Are you searching for a trading partner that matches your ambition in the crowded world of online trading? Finding a broker that truly understands the needs of active traders is a game-changer. This in-depth review explores what makes this particular broker a top choice for high-volume traders, scalpers, and automated systems. They champion a True ECN trading environment, providing direct access to interbank liquidity for tighter spreads and faster execution. Unlike many competitors, their business model thrives on volume, not wider spreads, offering a professional-grade platform for your strategy.

What can you expect when you trade with them? Here’s a quick rundown of their core offerings:

- Powerful Trading Platforms: Choose from the globally recognized MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the feature-rich cTrader platform.

- Multiple Account Types: Whether you prefer the simplicity of a Standard account or the raw spreads of a Raw Spread account, they offer options to fit your trading style.

- Wide Range of Instruments: Go beyond forex. Trade CFDs on indices, commodities, stocks, and even cryptocurrencies.

- Fast Execution: Their server infrastructure is co-located in major data centers, aiming for ultra-low latency.

Every forex broker has its strengths and weaknesses. Let’s look at the balance sheet.

Pros:

- Extremely competitive spreads, starting from 0.0 pips on major pairs.

- Fast and reliable trade execution, ideal for automated trading and scalping.

- No restrictions on trading styles, including hedging and scalping.

- Strong regulatory oversight in multiple jurisdictions.

Cons:

- Educational resources are less extensive compared to some other brokers.

- The product range, while broad, may not include some niche or exotic assets.

Serious traders focus on the numbers. Here’s a snapshot of the trading environment:

| Feature | Details |

| Average Spread (EUR/USD) | As low as 0.1 pips (Raw Spread account) |

| Commissions | Competitive commissions on Raw accounts; zero on Standard |

| Execution Model | True ECN |

| Minimum Deposit | Typically around $200 |

“For my EAs, execution speed is everything. A delay of milliseconds can be the difference between profit and loss. This is where a broker built for performance really shines.”

So, is this the best forex broker for you? If you are a disciplined trader who values tight spreads, low latency, and a no-frills trading environment, the IC Markets Forex Broker deserves your serious consideration. Their focus isn’t on flashy bonuses but on providing a professional-grade platform. For those who let their strategy do the talking, it’s a compelling option in the world of online trading. Take the next step and see if their conditions align with your goals.

- Is IC Markets a Safe and Regulated Broker?

- The Pros and Cons of Trading with IC Markets

- IC Markets Account Types: Which One is Right for You?

- The Standard Account

- The Raw Spread Account

- The cTrader Raw Spread Account

- Account Comparison at a Glance

- Raw Spread Account (MetaTrader)

- Pros

- Cons

- Standard Account (MetaTrader)

- cTrader Raw Spread Account

- Account at a Glance

- Unpacking IC Markets Spreads, Commissions, and Fees

- Available Trading Platforms: MT4, MT5, and cTrader

- Range of Tradable Instruments Beyond Forex

- IC Markets Deposit and Withdrawal Methods

- Funding Your Trading Account

- Accessing Your Profits

- Pros and Cons of Funding

- What We Like

- What to Consider

- Leverage and Margin Requirements Explained

- Evaluating the Quality of Customer Support

- Support Channels at a Glance

- Pros & Cons of the Support Experience

- How to Open an Account with IC Markets: A Step-by-Step Guide

- Trading Tools and Educational Resources for Traders

- Mobile Trading with the IC Markets App

- Comparing IC Markets to Other Top Forex Brokers

- Who Should Trade with IC Markets?

- Final Verdict: Our Expert Opinion on this Forex Broker

- Who Benefits Most?

- Frequently Asked Questions

Is IC Markets a Safe and Regulated Broker?

When you enter the world of online trading, safety is everything. You need a partner you can trust with your hard-earned capital. This brings up a critical question: how secure is your investment with the IC Markets forex broker? Let’s cut through the noise and look at the facts.

A broker’s commitment to safety starts with regulation. Strong oversight from reputable financial authorities ensures the company adheres to strict standards. A thorough ic markets review shows supervision from multiple top-tier global bodies. This multi-jurisdictional approach provides a robust framework of protection for traders.

This broker operates under the watchful eye of several key regulators, including:

- The Australian Securities and Investments Commission (ASIC)

- The Cyprus Securities and Exchange Commission (CySEC)

- The Financial Services Authority (FSA) of Seychelles

- The Securities Commission of The Bahamas (SCB)

One of the most important protections is the segregation of client funds. IC Markets holds client money completely separate from its own company funds in trust accounts at leading banks. This crucial step protects your balance from being used for the company’s operational expenses.

Choosing a well-regulated forex broker is the first and most important step in protecting your investment capital.

To give you a balanced view, here is a quick summary of the security environment.

| Security Advantages | Points to Consider |

| Regulated across several major jurisdictions. | Protections can vary based on your region. |

| Client funds are held in segregated accounts. | Compensation schemes are not universal for all entities. |

| Offers negative balance protection in certain regions. | Always confirm the specific entity you are trading with. |

Ultimately, this commitment to regulatory compliance builds a strong foundation of trust. For many traders looking for the best forex broker, this level of security is non-negotiable. It signals a dedication to transparency and fair practices, which are essential for a successful online trading journey.

The Pros and Cons of Trading with IC Markets

Choosing a partner for your online trading journey is a big decision. To help you decide, let’s dive into a balanced look at the IC Markets Forex Broker. No platform is perfect for everyone. This breakdown covers the key strengths and potential drawbacks you should consider before you start.

What We Like About This Broker

- Ultra-Low Spreads: One of the biggest draws is access to raw pricing. This means you get some of the tightest spreads in the industry, which can significantly lower your trading costs over time.

- Fast Execution Speeds: The broker invests heavily in technology. This results in incredibly fast order execution, minimizing slippage and ensuring you get the price you want.

- Wide Platform Selection: You are not locked into one system. You can choose from the globally popular MetaTrader 4, MetaTrader 5, and the advanced cTrader platforms.

- Excellent for Algorithmic Trading: With fast execution and deep liquidity, this forex broker is a top choice for traders who use automated strategies and expert advisors (EAs).

Potential Drawbacks to Consider

- Limited Educational Content: While there are some resources, beginners might find the educational library less extensive compared to some other platforms that focus heavily on hand-holding new traders.

- Basic Market Analysis: The in-house market analysis and news are functional but may not be as deep or comprehensive as what you might find at a more research-focused brokerage.

- Support Isn’t 24/7: While the support is high-quality, it isn’t available around the clock on weekends, which could be a factor for some global traders.

Finding the best forex broker isn’t about finding a flawless one. It’s about finding the one whose strengths align with your personal trading style and goals.

Here’s a quick summary to help you weigh the options. This is a key part of any honest ic markets review.

| Advantages | Disadvantages |

|---|---|

| Very competitive spreads | Beginner education is limited |

| Superior execution speed | Market research could be deeper |

| Choice of powerful platforms (MT4/5, cTrader) | Customer support isn’t 24/7 |

| Ideal for automated and high-frequency trading | No unique proprietary trading software |

Ultimately, your experience will depend on what you value most in a forex broker. If low costs and high performance are your top priorities, the advantages here are compelling. If you need extensive educational support, you may want to weigh that against the platform’s other powerful features.

IC Markets Account Types: Which One is Right for You?

Choosing your account type is one of the most important decisions you’ll make on your trading journey. The right account fits your strategy like a glove. The IC Markets forex broker understands this, offering distinct options designed for different types of traders. Let’s break them down so you can pick the perfect one for your online trading goals.

The Standard Account

Think of the Standard account as the all-in-one, straightforward choice. It’s ideal for traders who prefer simplicity. Instead of a separate commission, the trading cost is built directly into the spread. This makes calculating your potential profit and loss incredibly easy.

- Commissions: $0. All costs are in the spread.

- Spreads: Start from a competitive 1.0 pips.

- Platforms: Available on MetaTrader 4 and MetaTrader 5.

Who is it for? This account is a fantastic starting point for new traders and discretionary traders who value a simple fee structure without complex commission calculations.

The Raw Spread Account

This is the most popular account type, and for good reason. Many an IC Markets review highlights this account for its incredibly tight spreads. It separates the spread from the commission, giving you direct access to institutional-grade pricing. You see the raw interbank spread and pay a small, fixed commission on top.

- Commissions: A small, fixed commission per lot traded.

- Spreads: Go as low as 0.0 pips.

- Platforms: Choose between MetaTrader 4 and MetaTrader 5.

Who is it for? This account shines for scalpers, high-volume day traders, and those using automated trading systems (EAs). If your strategy depends on the tightest spreads possible, this is your match.

The cTrader Raw Spread Account

This account offers the same excellent raw spread pricing but on a different platform: cTrader. cTrader is known for its modern interface and advanced order capabilities, making it a favorite among certain manual traders. The commission structure is slightly different, calculated based on the currency traded.

- Commissions: A low commission based on the trade volume.

- Spreads: Also starting from 0.0 pips.

- Platform: Exclusively on the cTrader platform.

Who is it for? Traders who love the cTrader platform’s features, such as advanced charting and Depth of Market (DOM) views, will feel right at home here.

“The best trading account isn’t the one with the lowest numbers; it’s the one that perfectly aligns with your trading strategy and style.”

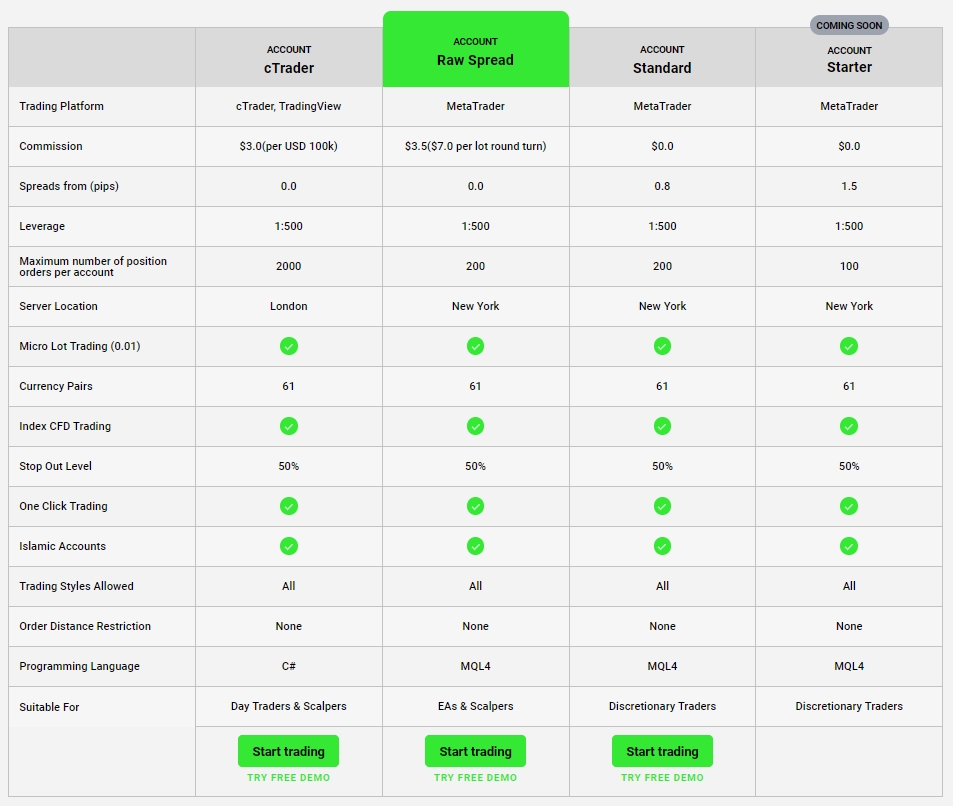

Account Comparison at a Glance

Here’s a simple breakdown to help you compare the key differences:

| Feature | Standard Account | Raw Spread Account | cTrader Raw Spread |

|---|---|---|---|

| Spreads From | 1.0 pips | 0.0 pips | 0.0 pips |

| Commission | $0 (in spread) | Small fixed fee | Small volume-based fee |

| Platforms | MT4, MT5 | MT4, MT5 | cTrader |

Ultimately, there is no single “best” account for everyone. The choice is yours. Consider your trading frequency, your strategy, and which platform you prefer. Finding the best forex broker often comes down to picking one that provides the tools and conditions that empower your personal trading style. Take a moment to reflect on your needs, and you’ll make a choice that sets you up for success.

Raw Spread Account (MetaTrader)

Enter the world of institutional-grade pricing with the Raw Spread Account. Many traders consider this the flagship offering from the IC Markets Forex Broker. We designed it for active traders and scalpers who demand the tightest possible spreads. If you use the popular MetaTrader 4 or 5 platforms, this account connects you directly to our deep liquidity pools.

This account structure separates the raw interbank spread from a small, fixed commission. This transparency gives you a clear view of your trading costs. It’s a favorite among professionals for a reason.

- Spreads starting from a razor-thin 0.0 pips on major pairs.

- Ultra-fast order execution with servers in the NY4 & LD5 data centers.

- Deep institutional liquidity, minimizing slippage.

- No restrictions on trading styles, perfect for scalping and EAs.

- The ideal choice for a powerful online trading experience.

This account is built for speed and precision, offering a professional-grade environment for serious traders.

The commission structure is simple and transparent. Here is a quick look at the baseline commissions per standard lot traded (round turn):

| Account Base Currency | Commission per 100k Lot |

| USD | $7.00 |

| EUR | €5.50 |

| GBP | £5.00 |

Many an ic markets review will highlight this account as a key advantage. It offers a distinct edge for specific trading strategies. Deciding if it’s right for you often comes down to your individual approach.

Pros

- Access to some of the tightest spreads available from any forex broker.

- Completely transparent cost structure.

- Excellent for high-volume traders and automated systems.

Cons

- Traders must factor the commission into their profit/loss calculations.

- May seem more complex for those brand new to trading.

Ultimately, if your goal is to reduce your spread cost to the absolute minimum, this account is a powerful tool. It’s a top contender for traders searching for the best forex broker to execute their high-frequency strategies effectively.

Standard Account (MetaTrader)

Ready to dive into online trading with a straightforward approach? The Standard Account is a popular choice for many traders. It simplifies the cost structure by building the trading fee directly into the spread. This means what you see is what you get, with no separate commission fees to calculate. It’s an ideal starting point for those new to the markets or for traders who prefer an all-in-one pricing model.

Here are the core features you get with this account:

- Zero Commissions: Trade without worrying about separate commission charges on each transaction.

- Competitive Spreads: Access institutional-grade spreads starting from just 0.6 pips.

- MetaTrader 4 & 5: Utilize the full power of the world’s most popular trading platforms.

- Fast Execution: Experience ultra-low latency, perfect for day traders and automated strategies.

- Flexible Deposits: Start with an amount that you feel comfortable with.

This account type shines for discretionary traders and beginners. If you value simplicity and want to focus purely on your trading strategy without calculating commissions, this is for you. Many traders writing an ic markets review often highlight this account as a great entry point into the world of forex.

| Pros | Cons |

|---|---|

| Simple, all-in-one pricing. | Spreads are wider than Raw Spread accounts. |

| No commission calculations needed. | May be less cost-effective for high-volume traders. |

| Excellent for new traders. | Not ideal for scalpers seeking the absolute tightest spreads. |

Ultimately, the Standard Account from this forex broker provides a powerful and accessible trading experience. The IC Markets Forex Broker designed this account to remove complexity, allowing you to focus on what truly matters: your next move in the market.

cTrader Raw Spread Account

Enter a powerful online trading environment designed for traders who demand precision. The cTrader Raw Spread account is the top choice for day traders and scalpers who love the sophisticated cTrader platform. It connects you directly to our deep liquidity pool for a transparent and competitive experience.

This account structure is what many traders seek from the best forex broker. It unbundles the spread and the commission, giving you a crystal-clear view of your trading costs. If you value institutional-grade conditions, this account delivers.

- Get raw spreads starting from 0.0 pips on major currency pairs.

- Benefit from ultra-fast order execution with servers in the LD5 Equinix data center.

- Access deep liquidity from top-tier providers, minimizing slippage.

- Utilize cTrader’s full suite of advanced tools, including cAlgo for automated trading.

In any comprehensive ic markets review, this account consistently stands out for its performance and transparency. It’s built for those who take their trading seriously.

Account at a Glance

| Feature | Details |

| Platform | cTrader |

| Spreads | From 0.0 Pips |

| Commission | $3.00 per lot per side |

“The cTrader Raw Spread account gives you the tools and pricing needed to execute your strategy with confidence. It’s a professional setup for the modern trader.”

Choosing this account with the IC Markets Forex Broker means you prioritize speed, low costs, and a top-tier trading platform. If you’re ready for a premium experience without the premium price tag, this is your solution.

Unpacking IC Markets Spreads, Commissions, and Fees

Let’s talk about the real cost of trading. Beyond the charts and strategies, your profitability hinges on the fees you pay. A detailed ic markets review must dissect these costs because they can make or break your performance. This is precisely where the IC Markets Forex Broker aims to provide a competitive edge. So, how does their fee structure truly work?

At the heart of their model are raw spreads. This means you can access incredibly tight pricing, often starting from 0.0 pips on major pairs. Why is this a game-changer for your online trading journey?

- Lower Costs Per Trade: Tighter spreads directly reduce the cost of entering and exiting a position.

- Enhanced Strategy Potential: This environment is ideal for scalpers and automated systems that rely on small price movements.

- Greater Transparency: You trade on prices closer to the true interbank market rate.

Of course, a broker needs to make money. With raw spreads, this forex broker charges a small, fixed commission per lot traded. This model is popular for its clarity. If you prefer a simpler approach, the Standard Account offers slightly wider spreads but with zero commission on forex trades. The choice is yours.

| Account Feature | Raw Spread Account | Standard Account |

|---|---|---|

| Spreads | From 0.0 pips | From 0.6 pips |

| Commission (Forex) | Small, fixed fee per side | Zero |

| Best For | Scalpers, EAs, experienced traders | Discretionary traders, beginners |

“A trader’s biggest enemy isn’t always the market; it’s often the cost of participation. Finding a broker with a fair and transparent fee structure is half the battle won.”

What about other fees that can catch you by surprise? Many traders worry about hidden charges for account maintenance or funding. Here’s a quick rundown of the IC Markets fee structure advantages and disadvantages:

Pros:

- Access to institutional-grade raw spreads.

- A clear and transparent commission structure.

- No charges for deposits or withdrawals from their side.

- No account inactivity fees, which is a major benefit.

Cons:

- The commission model can take some getting used to for brand new traders.

Ultimately, the pricing model offered by the IC Markets Forex Broker provides flexibility and an extremely competitive cost base. This focus on keeping trader costs low is a significant reason why many in the community consider it a top-tier choice and a contender for the best forex broker available. It empowers you to focus more on your trading and less on fees.

Available Trading Platforms: MT4, MT5, and cTrader

Your trading platform is your command center. It’s where you analyze markets, place trades, and manage your portfolio. The IC Markets forex broker understands this perfectly, offering a powerful suite of three industry-leading platforms. You get the freedom to choose the tool that fits your strategy like a glove, a key point often mentioned in any comprehensive ic markets review.

MetaTrader 4 (MT4): The Global Standard

MT4 is the most popular online trading platform for a reason. It’s robust, reliable, and incredibly versatile. Millions of traders trust its familiar interface and powerful capabilities every single day. It provides everything you need to start trading effectively.

- User-Friendly Interface: Perfect for beginners, yet powerful enough for pros.

- Advanced Charting: Access a full suite of analytical tools and indicators right out of the box.

- Expert Advisors (EAs): Tap into the world’s largest marketplace for automated trading robots.

- Unmatched Customization: Tailor the platform with thousands of free and paid custom indicators.

MetaTrader 5 (MT5): The Next-Generation Powerhouse

Think of MT5 as MT4 on steroids. It takes everything that made its predecessor great and adds more power, speed, and functionality. This platform opens up new possibilities for your technical analysis and trading execution, going beyond just forex.

| Feature | MT5 Advantage |

|---|---|

| Timeframes | 21 options (compared to MT4’s 9) |

| Indicators | 38 built-in technical indicators |

| Order Types | More pending order types, including stop-limit |

| Economic Calendar | Integrated directly into the platform |

cTrader: The Intuitive and Modern Choice

If you love sleek design and deep market insight, cTrader is for you. Built specifically for an ECN environment, it delivers institutional-grade features in a beautiful, easy-to-use package. This platform gives you a direct view of market liquidity.

cTrader is designed by traders, for traders. It focuses on clean execution and providing a transparent view of the market with its advanced Level II Pricing (Depth of Market).

It’s an excellent choice for discretionary traders who value advanced order capabilities and a sophisticated user interface. The platform’s layout is incredibly intuitive, making complex online trading feel simple.

Ultimately, the choice is yours. This forex broker empowers you with options. Whether you prefer the massive community of MT4, the raw power of MT5, or the modern design of cTrader, you have the right tool to succeed. This commitment to choice is a hallmark of what many consider the best forex broker experience.

Range of Tradable Instruments Beyond Forex

While the name IC Markets Forex Broker highlights its strength in currencies, your trading world can expand far beyond major and minor pairs. A truly dynamic online trading experience means having options. Diversifying your portfolio across different asset classes is a key strategy for managing risk and uncovering new opportunities. Let’s explore the rich variety of instruments you can access.

Many traders, when conducting an ic markets review, point to the extensive product range as a standout feature. This flexibility allows you to react to global economic events, whether they impact stocks, commodities, or digital currencies. The best forex broker platforms empower you to trade the entire market, not just a small slice of it.

- Indices: Trade the direction of an entire stock market. Instead of picking individual stocks, you can trade baskets of leading companies from major economies like the US, UK, and Germany.

- Commodities: Gain exposure to the raw materials that fuel the global economy. This includes precious metals like gold and silver, energies like oil, and agricultural products.

- Stocks: Access CFDs on hundreds of top global companies from the NYSE, NASDAQ, and other major exchanges. Take a position on household names like Apple, Amazon, and Tesla.

- Cryptocurrencies: Step into the world of digital finance. Trade some of the most popular cryptocurrencies, including Bitcoin and Ethereum, against major fiat currencies.

- Bonds & Futures: Diversify further with government-issued bonds and futures contracts, offering another layer of strategic depth to your trading.

“I came for the low forex spreads, but I stayed for the incredible range of markets. Being able to trade Gold and the S&P 500 from the same account is incredibly convenient and powerful.”

Having all these options under one roof with a single forex broker provides some distinct advantages. Consider how this impacts your trading strategy:

| Asset Class | Primary Driver | Example |

|---|---|---|

| Forex | Interest Rates, Geopolitics | EUR/USD |

| Indices | Corporate Earnings, Economic Health | S&P 500 |

| Commodities | Supply & Demand, Global Events | Crude Oil |

| Stocks | Company Performance, Industry Trends | AAPL |

This multi-asset environment allows you to build a robust and balanced portfolio. You can hedge your currency positions with commodities or capitalize on tech sector momentum through stock CFDs. It’s about giving you the tools to become a more versatile and adaptable trader. Ready to explore a universe of opportunities?

IC Markets Deposit and Withdrawal Methods

In the fast-paced world of online trading, you need swift, secure, and simple ways to manage your money. The IC Markets Forex Broker excels in this area, offering a wide array of funding options to suit traders globally. Let’s explore how you can fund your account and access your profits without any hassle.

Funding Your Trading Account

Getting started is quick and easy. IC Markets provides numerous fee-free deposit methods, ensuring your capital goes directly into your trading account. Most options offer instant funding, so you can seize market opportunities without delay.

- Credit & Debit Cards: Instantly fund your account using Visa or Mastercard.

- E-Wallets: Use popular services like PayPal, Neteller, and Skrill for fast and secure transactions.

- Bank Transfer: A reliable option for larger deposits directly from your bank account.

- Broker to Broker Transfer: Seamlessly move your funds from another forex broker.

Accessing Your Profits

Withdrawing your funds is just as straightforward. A common highlight in any honest ic markets review is the efficiency of its withdrawal process. The company processes all withdrawal requests on the same business day, which is a major advantage for traders.

| Withdrawal Method | Typical Processing Time | IC Markets Fee |

|---|---|---|

| Credit/Debit Card | 3-5 Business Days | Free |

| PayPal, Neteller, Skrill | Instant | Free |

| International Bank Transfer | 2-5 Business Days | Free |

Note: While IC Markets does not charge fees, your own banking institution or payment provider may apply charges.

“The ability to move capital quickly and without friction is a key feature traders look for when choosing the best forex broker. It reflects a platform’s commitment to its clients.”

Pros and Cons of Funding

What We Like

- Over 10 flexible funding options available.

- Zero fees on all deposits and withdrawals from IC Markets.

- Instant deposit options for immediate trading.

- Support for major global currencies, reducing conversion costs.

What to Consider

- Availability of certain methods can vary by country.

- Bank wire withdrawals can take several days to reflect in your account.

Overall, the payment system is designed for trader convenience, making it easy to manage your funds and focus on what truly matters: your trading strategy.

Leverage and Margin Requirements Explained

Leverage is one of the most powerful tools in online trading, yet it’s also one of the most misunderstood. Think of it as a loan provided by your forex broker. It allows you to control a much larger position in the market with a smaller amount of your own capital. This can magnify your potential profits, but it’s crucial to understand how it also increases your risk.

Working hand-in-hand with leverage is margin. Margin is not a fee; it’s the portion of your own funds set aside as a good-faith deposit to open and maintain a leveraged trading position. Let’s break down how the IC Markets Forex Broker handles these essential concepts.

- Leverage: This is the ratio of your funds to the size of the trade you can open. For example, with 100:1 leverage, you can control a $100,000 position with just $1,000 of your own money.

- Margin Requirement: This is the actual amount needed to open the trade, expressed as a percentage. For 100:1 leverage, the margin requirement is 1%.

- Used Margin: This is the total amount of your money that is currently locked up to keep your trades open.

- Free Margin: This is the money left in your account that you can use to open new positions.

Understanding the relationship between leverage and margin is vital. While high leverage can seem attractive, it requires careful risk management. Many an ic markets review points out the importance of starting with lower leverage until you are comfortable with your trading strategy.

Leverage is a double-edged sword. It can amplify your gains, but it can also magnify your losses. The key is to use it wisely and with a clear risk management plan.

Here’s a quick look at the dual nature of using leverage in your trading:

| Pros of High Leverage | Cons of High Leverage |

|---|---|

| Magnifies potential profits from small market movements. | Equally magnifies potential losses. |

| Allows you to control a large position with less capital. | Increases the risk of a margin call if the market moves against you. |

| Frees up capital for other trading opportunities. | Can encourage over-trading and taking on excessive risk. |

The best forex broker provides you with not only flexible leverage options but also the tools to manage your risk effectively. We offer negative balance protection and easy-to-use margin calculators. This helps you make informed decisions, ensuring you are always in control of your account. Mastering these concepts is your first step toward building a sustainable trading career.

Evaluating the Quality of Customer Support

In the fast-paced world of online trading, you need support you can count on. A quick and helpful response can make all the difference when you face a technical issue or have a question about your account. This is a critical factor in any comprehensive ic markets review. Great support shows that a broker truly values its clients.

The IC Markets Forex Broker team understands this need. They offer several ways for traders to get in touch. Let’s look at how accessible they are.

- Live Chat: Instantly connect with a support agent directly from their website for quick queries.

- Email: Ideal for less urgent or more detailed issues that require attachments or thorough explanations.

- Phone Support: Speak directly to a person for immediate and complex problem-solving.

But availability is just one part of the story. The quality of the assistance matters more. You want agents who are not only friendly but also knowledgeable. They should understand trading platforms, account types, and funding processes inside and out. The best forex broker will invest heavily in training their support staff to solve your problems on the first try.

Support Channels at a Glance

| Method | Availability | Best For |

|---|---|---|

| Live Chat | 24/7 | Quick questions & immediate help |

| 24/7 | Detailed inquiries & documentation | |

| Phone | 24/5 | Urgent and complex issues |

Pros & Cons of the Support Experience

- Multiple contact options

- 24/7 availability for key channels

- Knowledgeable and professional staff

- Support in various languages

- Phone support is not available on weekends

- Wait times can vary during peak trading hours

“I had an issue with a deposit not showing up. I used the live chat, and an agent named Alex solved it in under five minutes. That’s the kind of service you need from a forex broker when your money is on the line.”

Ultimately, strong customer support builds trust. It provides the peace of mind you need to focus on your trading, knowing that a capable team has your back if you ever need it.

How to Open an Account with IC Markets: A Step-by-Step Guide

Ready to start your journey into online trading? Getting set up with a top-tier forex broker should be simple, not complicated. We break down the account opening process into five easy steps. Follow this guide to get your account verified and funded in no time.

- Fill Out the Application Form

First, navigate to the broker’s website and begin the application. You will enter basic information like your name, email, and country of residence. This initial step is quick and secures your client portal access. - Configure Your Trading Account

This is where you tailor the account to your needs. You get to choose your preferred trading platform and account type. Many people search for the best forex broker based on these options alone. The IC Markets Forex Broker offers a great selection.Feature Raw Spread Account Standard Account Spreads From 0.0 pips From 0.6 pips Commission Yes No Best For Scalpers & EAs Discretionary Traders - Complete Your Profile

Next, you will provide more detailed personal information. This includes your address and financial background. You will also answer a few questions about your trading experience. This helps the broker understand your needs and ensure the products are suitable for you. - Verify Your Identity (KYC)

To comply with global regulations, all traders must verify their identity. This is a standard security measure. You will need to upload clear copies of a few documents.- Proof of Identity: A valid passport, national ID card, or driver’s license.

- Proof of Residence: A recent utility bill or bank statement showing your name and address.

- Fund Your Account and Start Trading

Once your account is verified, you are ready for the final step! Deposit funds using one of the many available methods, including bank transfer, credit/debit cards, or e-wallets. Your funds will appear in your account, and you can start trading.

“The onboarding was surprisingly fast. I submitted my documents and was approved the same day. This positive experience is often mentioned in any detailed ic markets review you find online.”

The process is designed for efficiency. By having your documents ready, you can move from application to active trading very quickly. Join a community of traders who chose a broker that values speed and simplicity.

Trading Tools and Educational Resources for Traders

Success in online trading demands more than just intuition. It requires sharp tools and continuous learning. A top-tier forex broker understands this, providing a complete ecosystem to help you navigate the markets with confidence. Explore how the right resources can elevate your trading journey.

The IC Markets Forex Broker platform equips you with a powerful suite of tools designed for precision and speed. Gain an edge with institutional-grade technology right at your fingertips.

- Advanced Charting Software: Analyze market trends with dozens of pre-installed indicators and graphical objects.

- MetaTrader 4 & 5: Access the world’s most popular trading platforms, renowned for their robust features.

- cTrader: Utilize a platform built for speed, transparency, and advanced order types.

- Trading Central & AutoChartist: Receive actionable trading signals and automated technical analysis to spot opportunities.

To help you decide which tool fits your style, here is a quick comparison:

| Feature | Trading Central | AutoChartist |

|---|---|---|

| Focus | Analyst-led research & signals | Automated chart pattern recognition |

| Best For | Confirming strategies with expert opinion | Scanning markets to find new setups |

Yet, powerful tools are only half the equation. Knowledge is your true competitive advantage. Many traders mention in their ic markets review that our educational content was a game-changer for their performance.

An investment in knowledge pays the best interest. We believe in empowering our clients to become smarter, more confident traders.

We provide a rich library of resources for traders at every level, from beginners finding their footing to experts refining their strategies.

- Daily Market Analysis: Stay ahead of market movements with expert commentary and insights.

- Video Tutorials: Master the platforms and learn new strategies at your own pace.

- Live Webinars: Engage directly with market professionals and ask questions in real-time.

- Educational Blog: Deepen your understanding of everything from basic concepts to complex market theories.

What sets the best forex broker apart is a genuine commitment to your growth. By combining cutting-edge technology with comprehensive education, you get the support you need to trade effectively. Explore these resources and discover the difference for yourself.

Mobile Trading with the IC Markets App

In the fast-moving world of online trading, you need the market at your fingertips. Your strategy doesn’t stop when you step away from your desk, and neither should your platform. The IC Markets app puts the full power of your trading account directly into your pocket, ensuring you never miss an opportunity.

We designed the app to be a complete trading solution. It’s more than just a place to check your open positions; it’s a command center for your entire trading journey. Many an ic markets review highlights the mobile experience as a standout feature, and for good reason. It delivers robust performance where it matters most.

- Full Account Control: Manage your funds with ease. Deposit, withdraw, and transfer between accounts in just a few taps.

- Seamless Platform Access: Switch effortlessly between MT4, MT5, and cTrader accounts without leaving the app.

- Advanced Charting Tools: Analyze price action on the go with a full suite of technical indicators and drawing tools.

- Instant Execution: Place trades with one-tap functionality, designed for speed and precision.

- Integrated Market Analysis: Stay informed with real-time news, economic calendars, and expert insights streamed directly to your device.

The best forex broker provides tools that feel intuitive for beginners yet powerful enough for professionals. The app’s clean interface and logical navigation make it easy to find what you need quickly. This focus on user experience is a core reason why the IC Markets Forex Broker remains a top choice for active traders who demand reliability.

| Advantages | Considerations |

|---|---|

| Trade from anywhere, anytime. | Screen size can limit complex analysis. |

| Receive instant push notifications for alerts. | Reliant on a stable mobile data or Wi-Fi connection. |

| Full functionality matches the desktop experience. | Potential for distraction in a mobile environment. |

“I used to be chained to my desktop. Now, I manage my entire portfolio from my phone during my commute. The app is fast, stable, and has every feature I need. It’s a game-changer.”

Ultimately, a superior mobile platform is a non-negotiable feature for a modern forex broker. It reflects a commitment to providing traders with flexibility and power. Take control of your trading and discover the freedom of a truly mobile-first platform. Download the app and experience the difference for yourself.

Comparing IC Markets to Other Top Forex Brokers

Choosing the right partner for your online trading journey is a critical first step. With so many options available, how do you know which forex broker truly stands out? Let’s dive into a direct comparison to see how the IC Markets Forex Broker measures up against other leading names in the industry. We’ll look at the features that matter most to traders.

| Feature | IC Markets | Typical ECN Broker | Typical Market Maker |

|---|---|---|---|

| Spreads | From 0.0 pips (Raw) | Low, from 0.1 pips | Wider, from 1.0 pips |

| Commissions | Yes (on Raw accounts) | Usually commission-based | Often zero commission |

| Execution Speed | Ultra-fast | Fast | Variable |

| Platforms | MT4, MT5, cTrader | MT4, MT5 | Proprietary, MT4 |

While tables provide a great overview, some advantages need a closer look. What truly sets IC Markets apart?

- Deep Liquidity: Access to a vast pool of liquidity providers means tighter spreads and better fills, even during volatile market conditions.

- No Trading Restrictions: They welcome all trading styles, including scalping and automated strategies, without limitations on stop-loss distances.

- Platform Diversity: Offering MetaTrader 4, MetaTrader 5, and cTrader gives you the flexibility to choose the platform that best fits your online trading style.

- Transparent Pricing: With raw spread accounts, you see the true market price and a clear, fixed commission. This transparency is a cornerstone of any good ic markets review.

“Serious traders don’t look for gimmicks. They look for speed, tight spreads, and reliability. That’s the foundation of a successful trading environment.”

Every forex broker has its strengths and weaknesses. To provide a balanced view, consider these points:

Pros:

- Extremely competitive spreads, keeping your costs low.

- Fast and reliable order execution.

- Wide range of trading instruments available.

- Excellent platform choices for all trader levels.

Cons:

- Educational resources are less extensive than some competitors.

- Customer support is primarily available online.

When searching for the best forex broker, the details make all the difference. The comparison highlights that the IC Markets Forex Broker focuses on delivering a professional-grade trading environment. Its core strengths in speed, cost, and technology cater directly to active and demanding traders. Ultimately, the right choice depends on your personal trading needs and priorities.

Who Should Trade with IC Markets?

Finding the right home for your trading activity is a personal journey. Every trader has unique needs, and not every forex broker fits every style. So, is the IC Markets Forex Broker the right partner for you? Let’s break down the ideal trader profiles to help you decide.

This platform truly shines for specific types of traders. If you recognize yourself in the descriptions below, you might have found your perfect match for online trading.

Scalpers and Day Traders

If you execute dozens or even hundreds of trades a day, you live and die by speed and cost. You need a broker that keeps up with your pace, not one that slows you down. IC Markets is built for this high-frequency environment. You’ll benefit from:

- Lightning-fast order execution to minimize slippage.

- Extremely tight spreads, often starting from 0.0 pips on major pairs.

- Deep liquidity sourced from top-tier providers.

- Powerful platforms like MetaTrader 4, MetaTrader 5, and cTrader that support rapid-fire trading.

Algorithmic and Automated Traders

Do you rely on Expert Advisors (EAs) or custom trading robots? Then you need a technical environment that is stable, fast, and flexible. The infrastructure here is a dream for automated strategies. The broker’s servers are co-located in major data centers, ensuring low latency and reliable connectivity for your algorithms to run smoothly around the clock.

Our in-depth ic markets review shows that traders who prioritize pure performance and a no-frills trading environment consistently rate this broker highly. It’s for the serious trader who knows what they need.

Cost-Conscious and High-Volume Traders

Whether you trade large volumes or are simply keen on keeping costs low, this broker’s pricing structure is a major advantage. The combination of low spreads and competitive commissions makes it a strong contender for the best forex broker when it comes to value. Your trading capital goes further when it isn’t being eroded by high fees on every transaction.

Here’s a quick summary of who fits best:

| Trader Profile | Why IC Markets is a Great Choice |

|---|---|

| Active Day Trader | Low spreads and fast execution. |

| EA/Algo Trader | Robust server infrastructure and platform support. |

| Experienced Trader | Focus on core trading conditions over extras. |

Conversely, if you are a brand new trader seeking extensive, in-house educational courses and a lot of hand-holding, you might find the offering a bit lean. The focus here is less on beginner education and more on providing a top-tier environment for those ready to trade.

Final Verdict: Our Expert Opinion on this Forex Broker

After a comprehensive analysis, our verdict is in. The IC Markets Forex Broker has firmly established itself as a top-tier platform, particularly for traders who demand high performance and low costs. It’s a powerhouse built on a foundation of speed, transparency, and deep liquidity. If you are serious about online trading, this is a platform that commands your attention.

So, who is this broker truly for? Let’s break down the key points.

Who Benefits Most?

- High-Volume Traders & Scalpers: The ultra-fast execution speeds and exceptionally low spreads are a perfect match for strategies that rely on small, frequent trades.

- Algorithmic Traders: Excellent support for EAs (Expert Advisors) and a robust server infrastructure make it a haven for automated trading systems.

- Cost-Conscious Traders: The raw spread account structure, combined with a competitive commission, offers one of the most cost-effective trading environments available.

Of course, no platform is perfect for everyone. While it excels in performance, beginners might find the advanced platform options a bit overwhelming initially. The focus is clearly on providing a professional-grade trading experience rather than extensive hand-holding.

| Trader Type | Our Rating |

|---|---|

| Beginner | Good |

| Intermediate | Excellent |

| Expert / Pro | Excellent |

For traders prioritizing execution speed and tight spreads above all else, this forex broker is incredibly hard to beat. The infrastructure is clearly built for performance.

– Lead Trading Analyst

In closing this ic markets review, we give a strong recommendation. It delivers on its promises of a true ECN environment with institutional-grade conditions. For active traders looking to optimize their costs and execution, it stands out as a strong candidate for the best forex broker in its class. If performance is your priority, opening an account is a logical next step to experience the difference firsthand.

Frequently Asked Questions

What types of trading accounts does IC Markets offer?

IC Markets offers three main account types: the Standard Account, which has spreads from 1.0 pips with zero commission; the Raw Spread Account, which offers spreads from 0.0 pips with a small fixed commission on MetaTrader; and the cTrader Raw Spread Account, which provides the same low spreads exclusively on the cTrader platform.

Is IC Markets a safe and regulated broker?

Yes, IC Markets is regulated by multiple top-tier authorities, including the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC). They also ensure safety by holding client funds in segregated trust accounts at leading banks, separate from company funds.

What trading platforms are available?

Traders can choose from three industry-leading platforms: MetaTrader 4 (MT4), known for its versatility and large community; MetaTrader 5 (MT5), an advanced version with more features; and cTrader, a modern platform designed for ECN environments with sophisticated order capabilities.

Who is the ideal trader for IC Markets?

IC Markets is particularly well-suited for active traders, including scalpers, day traders, and those using automated systems (EAs). Its environment of ultra-low spreads, fast execution, and deep liquidity is designed to meet the needs of high-volume and performance-focused traders.

Can I trade more than just Forex?

Absolutely. Beyond a wide range of forex pairs, you can trade CFDs on various other instruments, including indices, commodities like gold and oil, global stocks, popular cryptocurrencies, bonds, and futures, allowing for portfolio diversification.