Welcome to your essential guide for trading with IC Markets in Argentina. As the world of online forex and CFD trading grows, finding a reliable partner is your first step toward success. This comprehensive review offers a clear, honest look at what IC Markets provides for Argentinian traders, cutting through the confusing jargon. We will explore everything from account types and trading platforms to security measures and local payment methods. Our goal is to give you all the information needed to determine if IC Markets is the right choice for your financial journey.

- Is IC Markets Available and Legal in Argentina?

- Regulation and Security: How IC Markets Protects Your Funds

- Choosing Your IC Markets Account Type

- The Standard Account

- The Raw Spread Account

- The cTrader Account

- A Deep Dive into Trading Platforms

- MetaTrader 4 (MT4) for Argentinian Traders

- MetaTrader 5 (MT5) Features

- Exploring the cTrader Platform

- Understanding the Fee Structure: Spreads and Commissions

- Deposit and Withdrawal Methods for Clients in Argentina

- Tradable Instruments Available on the Platform

- How to Open an Account from Argentina: A Step-by-Step Guide

- Leverage Options for Forex and CFD Trading

- Customer Support Quality and Availability

- Educational Resources and Trading Tools

- IC Markets Mobile Trading App Review

- Pros and Cons of Using IC Markets

- Comparing IC Markets to Alternative Brokers

- Final Verdict: Is This the Right Broker for You?

- Frequently Asked Questions

Is IC Markets Available and Legal in Argentina?

Yes, absolutely. IC Markets accepts clients from Argentina, allowing you to access global financial markets directly from your home. You can open an account, deposit funds, and trade without any restrictions from the broker’s side.

The regulatory landscape for online forex in Argentina is unique. While international brokers like IC Markets are not locally regulated by the Comisión Nacional de Valores (CNV), Argentinian law permits residents to use the services of reputable, globally regulated firms. This freedom gives you the power to choose a broker based on its international standing, security, and trading conditions. By operating under respected international authorities, IC Markets provides a secure and transparent environment for all its clients, including those in Argentina.

Regulation and Security: How IC Markets Protects Your Funds

Your security is paramount when choosing a broker. IC Markets operates under multiple, top-tier regulatory bodies around the world. This global oversight ensures they adhere to strict standards of financial conduct and client protection. For traders in Argentina, this international regulation provides a strong layer of security for your capital.

Here’s how IC Markets actively protects your funds:

- Segregated Client Funds: The broker holds your money in separate trust accounts with top-tier banking institutions. This means your funds are never mixed with the company’s operational capital, protecting them in any eventuality.

- Negative Balance Protection: This crucial feature ensures you can never lose more money than you have deposited in your account. Your account balance will not go into the negative, even during extreme market volatility.

- Rigorous Audits: As a regulated entity, IC Markets is subject to regular external audits. These checks verify their financial operations and confirm compliance with strict regulatory requirements, ensuring transparency and integrity.

“Choosing a globally regulated broker is non-negotiable. It’s the foundation of secure Argentina trading.”

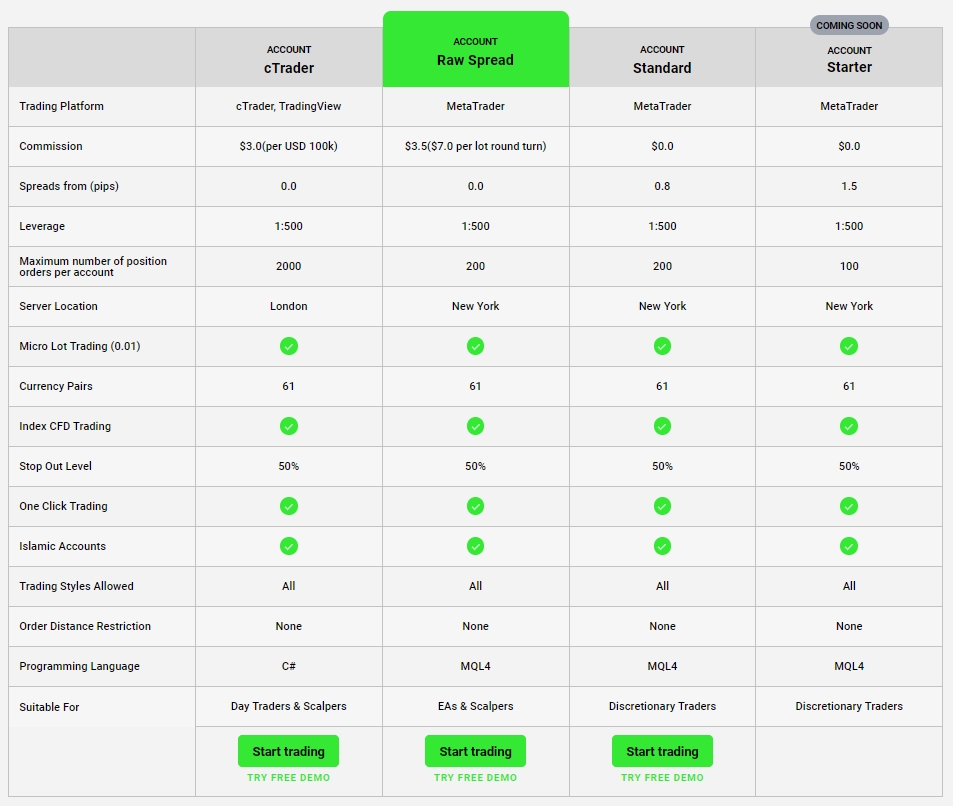

Choosing Your IC Markets Account Type

IC Markets understands that every trader is different. That’s why they offer three distinct account types, each designed to fit a specific trading style and preference. Your choice will depend on whether you prefer an all-in-one spread cost or a commission-based model with tighter spreads. All accounts provide access to deep liquidity and fast execution. Let’s explore which one is the perfect match for you.

The Standard Account

The Standard Account is an excellent choice for traders who value simplicity. It is perfect for beginners or discretionary traders who want straightforward cost calculations without worrying about separate commission fees. All trading costs are included in the spread, which starts from a competitive 0.6 pips.

Key features include:

- Zero Commission: You pay no extra commission on trades. The fee is built directly into the buy/sell price.

- User-Friendly: Its simple fee structure makes it easy to manage your trading costs.

- Platform Access: Fully available on the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

This account provides a hassle-free trading experience, allowing you to focus on your strategy.

The Raw Spread Account

The Raw Spread Account is the flagship offering from IC Markets, built for performance. It is the preferred choice for scalpers, high-volume traders, and those using automated trading systems (EAs). This account provides access to institutional-grade liquidity with some of the tightest spreads in the industry, starting from 0.0 pips.

Its structure is based on:

- Ultra-Low Spreads: Get direct access to raw pricing from liquidity providers.

- Fixed Commission: A small, transparent commission is charged per lot traded. This model often results in lower overall costs for active traders.

- Peak Performance: Ideal for strategies that require the tightest possible entry and exit prices. It’s available on both MT4 and MT5.

The cTrader Account

The cTrader Account offers the same low-cost trading environment as the Raw Spread account but is exclusively designed for the cTrader platform. It is perfect for traders who appreciate cTrader’s modern interface, advanced charting tools, and Depth of Market (DOM) features. Spreads are exceptionally tight, starting from 0.0 pips.

This account is distinguished by:

- cTrader Platform: Access a sophisticated platform known for its intuitive design and advanced order types.

- Transparent Commissions: Commissions are charged based on the trade volume, making it easy to calculate for any currency pair.

- Enhanced Trading: Ideal for discretionary traders who need detailed market insight and superior trade management tools.

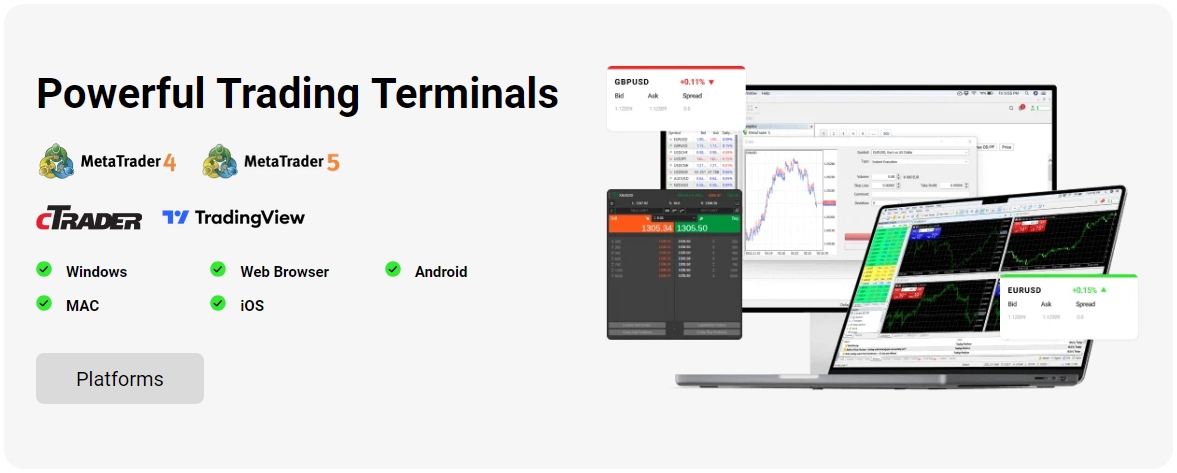

A Deep Dive into Trading Platforms

The trading platform is your gateway to the markets. It is the software you use to analyze charts, place orders, and manage your portfolio. IC Markets provides access to three of the world’s most powerful and popular trading platforms. This ensures that every trader in Argentina, from the complete novice to the seasoned professional, can find a platform that perfectly suits their needs and strategy.

MetaTrader 4 (MT4) for Argentinian Traders

MetaTrader 4 is the undisputed industry standard for forex trading. Renowned for its reliability, simplicity, and vast ecosystem, MT4 remains a favorite among millions of traders worldwide. It is especially powerful for those who rely on automated trading.

Why choose MT4?

- Rock-Solid Stability: A proven platform that performs consistently under pressure.

- Huge Customization: Access thousands of custom indicators, scripts, and Expert Advisors (EAs) from its massive online marketplace.

- User-Friendly Interface: Easy to learn for beginners, yet powerful enough for advanced chart analysis.

For traders focused on forex and leveraging a wealth of community-built tools, MT4 is a top-tier choice.

MetaTrader 5 (MT5) Features

MetaTrader 5 is the powerful successor to MT4. While it maintains a familiar interface, it offers significant upgrades under the hood. MT5 is a true multi-asset platform, making it the ideal choice for Argentinian traders who want to trade more than just forex from a single interface.

Key advantages of MT5 include:

- More Instruments: Natively supports trading CFDs on stocks, indices, and commodities alongside forex.

- Advanced Tools: Comes with more technical indicators, more timeframes, and an integrated economic calendar.

- Superior Strategy Tester: Offers a more sophisticated environment for backtesting and optimizing Expert Advisors.

Exploring the cTrader Platform

cTrader stands out with its sleek, modern design and focus on providing a premium user experience. It’s a powerful alternative for traders who want advanced features and a more intuitive interface. cTrader is built for speed and transparency, offering detailed market depth information.

What makes cTrader special?

- Intuitive Interface: A clean and visually appealing layout that is easy to navigate.

- Advanced Charting: Superior charting tools and a wide range of order types not found on other platforms.

- Level II Pricing: View the full Depth of Market (DOM) to see the executable prices directly from liquidity providers.

It’s the perfect platform for discretionary traders who value design and advanced trade management.

Understanding the Fee Structure: Spreads and Commissions

IC Markets is famous for its transparent and highly competitive fee structure. Low trading costs can significantly impact your profitability over time. The primary costs are spreads and commissions, which vary depending on your chosen account type. We’ve simplified it for you in the table below.

| Feature | Standard Account | Raw Spread Account | cTrader Account |

|---|---|---|---|

| Spreads From | 0.6 pips | 0.0 pips | 0.0 pips |

| Commission | $0 | From $3.50 per lot | From $3.00 per 100k |

Beyond these primary costs, you should also be aware of swap fees. These are small charges applied for holding positions overnight. The good news? IC Markets has a reputation for keeping these fees low and, importantly, charges no fees for deposits or account inactivity.

Deposit and Withdrawal Methods for Clients in Argentina

Funding your account and accessing your profits should be simple and fast. IC Markets provides a wide range of convenient deposit and withdrawal methods for clients in Argentina, ensuring you can manage your money with ease. A key advantage is that IC Markets does not charge any internal fees on deposits or withdrawals.

Popular options available include:

- Credit and Debit Cards: Instant deposits using Visa and MasterCard.

- E-Wallets: Fast and secure transactions with popular services like Skrill and Neteller.

- Bank Wire Transfer: A reliable method for larger transactions directly from your bank account.

- Local Payment Options: IC Markets often supports local bank transfer solutions, which can simplify the process and reduce conversion costs.

Most deposits are processed instantly, allowing you to start trading immediately. Withdrawals are typically processed on the same business day, making for a smooth and efficient banking experience.

Tradable Instruments Available on the Platform

Variety is key to a dynamic trading strategy. IC Markets provides Argentinian traders with access to an impressive range of financial instruments. This allows you to diversify your portfolio and seize opportunities across different global markets, all from a single account.

You can trade CFDs on the following asset classes:

- Forex: A huge selection of over 60 currency pairs, including majors, minors, and exotics.

- Indices: Trade on the performance of the world’s largest stock markets with over 25 major global indices.

- Commodities: Access popular energies like Oil and Natural Gas, as well as precious metals like Gold and Silver.

- Stocks: Trade CFDs on hundreds of top companies from the NYSE, NASDAQ, and other major exchanges.

- Bonds: Diversify with CFDs on government bonds from around the world.

- Cryptocurrencies: Trade on the price movements of popular digital currencies like Bitcoin, Ethereum, and Ripple.

How to Open an Account from Argentina: A Step-by-Step Guide

Getting started with IC Markets from Argentina is a quick and straightforward process. The entire application is online and takes just a few minutes to complete. Follow these simple steps to begin your trading journey.

- Complete the Application Form: Visit the IC Markets website and click “Open Live Account.” Fill in your basic information, such as your name, email, and phone number.

- Configure Your Trading Account: Select your preferred trading platform (MT4, MT5, or cTrader), choose an account type (Standard or Raw Spread), and set your account’s base currency.

- Provide Your Personal Details: Complete the secure questionnaire with details about your trading experience and financial background. This helps ensure the products are appropriate for you.

- Verify Your Identity (KYC): To comply with global security standards, you must upload two documents: a proof of identity (like your DNI or passport) and a proof of address (such as a recent utility bill or bank statement).

- Fund Your Account and Start Trading: Once your account is approved, make your first deposit using one of the many convenient methods available for Argentina. You are now ready to trade!

Leverage Options for Forex and CFD Trading

Leverage is a powerful tool that allows you to control a large position in the market with a relatively small amount of capital. It can significantly amplify your potential profits from small price movements. For instance, with 1:500 leverage, you can control a $50,000 position with just $100 of your own money.

However, it is crucial to understand that leverage is a double-edged sword. While it magnifies gains, it also magnifies potential losses. The international entity of IC Markets offers flexible leverage up to 1:500 for traders in Argentina. We strongly advise all traders, especially those new to the markets, to use leverage responsibly and implement proper risk management strategies, such as using stop-loss orders.

Customer Support Quality and Availability

Excellent customer support can make a huge difference in your trading experience, especially when you need a quick answer. IC Markets is widely recognized for its high-quality, responsive customer service. The support team is available 24 hours a day, 7 days a week, ensuring that help is always on hand, no matter your local time in Argentina.

You can reach the support team through multiple channels:

- Live Chat: The fastest way to get help, with agents responding in seconds directly from the website.

- Email: Ideal for detailed inquiries, with a dedicated team providing thorough responses.

- Phone: Speak directly with a support representative for immediate assistance.

The team is knowledgeable, professional, and equipped to handle a wide range of queries, from technical issues to account questions. Crucially, they offer support in multiple languages, including Spanish, which is a significant benefit for traders in Argentina.

Educational Resources and Trading Tools

IC Markets equips traders with a solid suite of tools and educational materials to help them navigate the markets. These resources are designed to support your decision-making process and enhance your trading skills, whether you are a beginner or a professional.

Available resources include:

- Market Analysis Blog: Get daily technical and fundamental analysis from market experts to stay on top of key trends.

- Economic Calendar: A vital tool for tracking important economic events that can cause market volatility.

- Platform Tutorials: A library of video guides and articles to help you master the features of MT4, MT5, and cTrader.

- Trading Calculators: Useful tools to help you calculate pips, margins, and potential trade outcomes.

- VPS Service: For algorithmic traders, IC Markets offers access to a Virtual Private Server (VPS) to ensure your EAs run 24/7 without interruption.

IC Markets Mobile Trading App Review

In today’s fast-paced world, trading on the go is essential. IC Markets ensures you never miss an opportunity with powerful mobile trading solutions. Instead of developing a proprietary app, they provide access to the industry-leading mobile versions of MetaTrader 4, MetaTrader 5, and cTrader. These apps are available for free on both iOS and Android devices.

With the mobile apps, you can:

- Manage Your Account: Access your full trading account from anywhere with an internet connection.

- Analyze Charts: Use a suite of technical indicators and drawing tools on interactive, real-time charts.

- Execute Trades: Open, manage, and close positions with just a few taps.

- Stay Updated: Receive price alerts and notifications to stay informed about market movements.

The apps are stable, fast, and intuitive, delivering a seamless desktop-to-mobile trading experience for every trader in Argentina.

Pros and Cons of Using IC Markets

To provide a fair and balanced view, it’s important to look at both the strengths and weaknesses. IC Markets is a top-tier broker, but no single broker is perfect for everyone. Here is a clear breakdown to help you decide.

| Pros | Cons |

|---|---|

| ✅ Exceptionally low spreads and commissions | ❌ Educational content is less structured for absolute beginners |

| ✅ Ultra-fast trade execution speeds | ❌ Does not offer direct stock investing (only CFDs) |

| ✅ Choice of powerful platforms (MT4, MT5, cTrader) | ❌ No proprietary trading platform |

| ✅ Strong regulation and security measures | |

| ✅ Wide range of tradable instruments | |

| ✅ Excellent 24/7 customer support in Spanish |

Comparing IC Markets to Alternative Brokers

How does IC Markets stack up against the competition? When choosing a broker in Argentina, it’s wise to compare key features. We’ve created a simple table to show how IC Markets typically compares to other ECN-style and market maker brokers available to Argentinian traders.

| Feature | IC Markets | Typical ECN Broker | Typical Market Maker |

|---|---|---|---|

| EUR/USD Spread | From 0.0 pips + Commission | Variable (often higher) | Fixed, from 1.5 pips+ |

| Execution Speed | Ultra-Fast (LD5 servers) | Fast | Standard (potential requotes) |

| Platforms | MT4, MT5, cTrader | Usually MT4/MT5 | Often a proprietary platform |

| Trading Model | True ECN | ECN/STP | Dealing Desk |

| Scalping Allowed | Yes, encouraged | Usually | Sometimes restricted |

As you can see, IC Markets consistently stands out in the areas most critical for serious traders: low costs and superior execution technology.

Final Verdict: Is This the Right Broker for You?

After a thorough review, our verdict is clear. IC Markets is an outstanding choice for traders in Argentina, particularly those who prioritize low costs, fast execution, and a choice of world-class platforms. Its commitment to providing a True ECN trading environment sets it apart from many competitors.

IC Markets is an excellent fit for:

- Scalpers and Day Traders: The raw spreads and rapid execution are ideal for high-frequency strategies.

- Algorithmic Traders: The robust MT4/MT5 infrastructure and VPS options are perfect for running Expert Advisors.

- Experienced Traders: Professionals who demand institutional-grade trading conditions will feel right at home.

You might consider other options if:

- You are an absolute beginner seeking a highly structured, step-by-step educational course.

- You are a long-term investor looking to buy and hold physical stocks rather than trade CFDs.

Ultimately, for any serious trader in Argentina looking for a competitive edge, IC Markets delivers the performance, security, and tools necessary to succeed. It is a top-tier broker that empowers you to take on the global markets with confidence.

Frequently Asked Questions

Can I legally use IC Markets in Argentina?

Yes, IC Markets accepts clients from Argentina. While the broker is not locally regulated by the CNV, Argentinian law allows residents to use the services of reputable, internationally regulated brokerage firms.

What types of trading accounts does IC Markets offer?

IC Markets provides three main account types to suit different trading styles: the Standard Account (commission-free with spreads from 0.6 pips), the Raw Spread Account (with spreads from 0.0 pips and a small commission), and the cTrader Account (similar to Raw Spread but on the cTrader platform).

What are the available payment methods for Argentinian traders?

Traders in Argentina can fund their accounts using various methods, including credit and debit cards (Visa, MasterCard), popular e-wallets like Skrill and Neteller, and traditional bank wire transfers. Local payment options may also be available.

Does IC Markets charge any fees for deposits or withdrawals?

No, a key advantage of IC Markets is that it does not charge any internal fees for either deposits or withdrawals. However, be aware that your own banking institution or payment provider may apply their own transaction fees.

Is customer support available in Spanish?

Yes, IC Markets offers 24/7 customer support in multiple languages, including Spanish. You can reach their knowledgeable team via live chat, email, or phone for assistance with any account or technical questions.