Welcome to your essential guide for trading with IC Markets in Bangladesh. As more traders seek a reliable partner to navigate global markets, this guide provides a clear roadmap. We’ll explore everything from account types and platforms to fees and security measures. Discover how to start your trading journey, fund your account, and practice your strategies risk-free. Let’s unlock your trading potential together.

- What is IC Markets and Why is it Popular in Bangladesh?

- Is IC Markets a Safe and Regulated Broker for Bangladeshi Traders?

- A Deep Dive into IC Markets Account Types

- Raw Spread Account: For ECN and Scalping

- Standard Account: Commission-Free Trading

- Choosing Your Trading Platform: MT4, MT5, or cTrader?

- Range of Tradable Instruments Available

- Understanding Spreads, Commissions, and Other Fees

- How to Open a Live Trading Account from Bangladesh

- Depositing Funds: Easy Methods for Bangladeshi Clients

- Local Bank Transfers and Digital Wallets

- Withdrawing Your Profits: A Step-by-Step Guide

- Practice Risk-Free with an IC Markets Demo Account

- Leverage and Margin Requirements Explained

- Accessing Customer Support for Local Traders

- IC Markets vs. Other Brokers: A Comparative Analysis

- Pros and Cons of Trading with IC Markets in Bangladesh

- Pros:

- Cons:

- Final Verdict: Is IC Markets the Right Choice for You?

- Frequently Asked Questions

What is IC Markets and Why is it Popular in Bangladesh?

IC Markets is a world-renowned forex and CFD broker, celebrated for its exceptional trading environment. For traders in Bangladesh, its popularity stems from a simple promise: to provide institutional-grade trading conditions to everyone. This isn’t just another broker; it’s a gateway to the True ECN (Electronic Communication Network) market.

What does this mean for you? It means direct access to deep liquidity, resulting in lightning-fast execution and some of the tightest spreads available. This commitment to performance makes it a top broker in Bangladesh. Key reasons for its popularity include:

- Ultra-Low Spreads: Get access to raw pricing from liquidity providers, minimizing your trading costs.

- Fast Execution Speed: Orders are executed in milliseconds, which is critical for scalping and news trading.

- Advanced Technology: Servers are co-located in major data centers, ensuring low latency and stable connections.

- Transparency: A clear fee structure and a commitment to a fair trading environment build immense trust.

Is IC Markets a Safe and Regulated Broker for Bangladeshi Traders?

Your capital’s safety is non-negotiable. With IC Markets, you can trade with peace of mind. The broker operates under the oversight of some of the world’s most respected financial regulatory bodies. This multi-regulator framework ensures they adhere to strict standards of conduct and financial transparency.

For a trader from Bangladesh, this regulation provides crucial layers of protection:

- Segregated Client Funds: Your money is kept in separate trust accounts with top-tier banking institutions. This means the broker cannot use your funds for its operational expenses.

- Negative Balance Protection: You can never lose more than your account balance. This feature protects you from extreme market volatility.

- Regular Audits: The company undergoes frequent audits to ensure compliance with financial regulations and operational integrity.

Choosing a well-regulated broker like IC Markets is the first and most important step in securing your forex Bangladesh trading career.

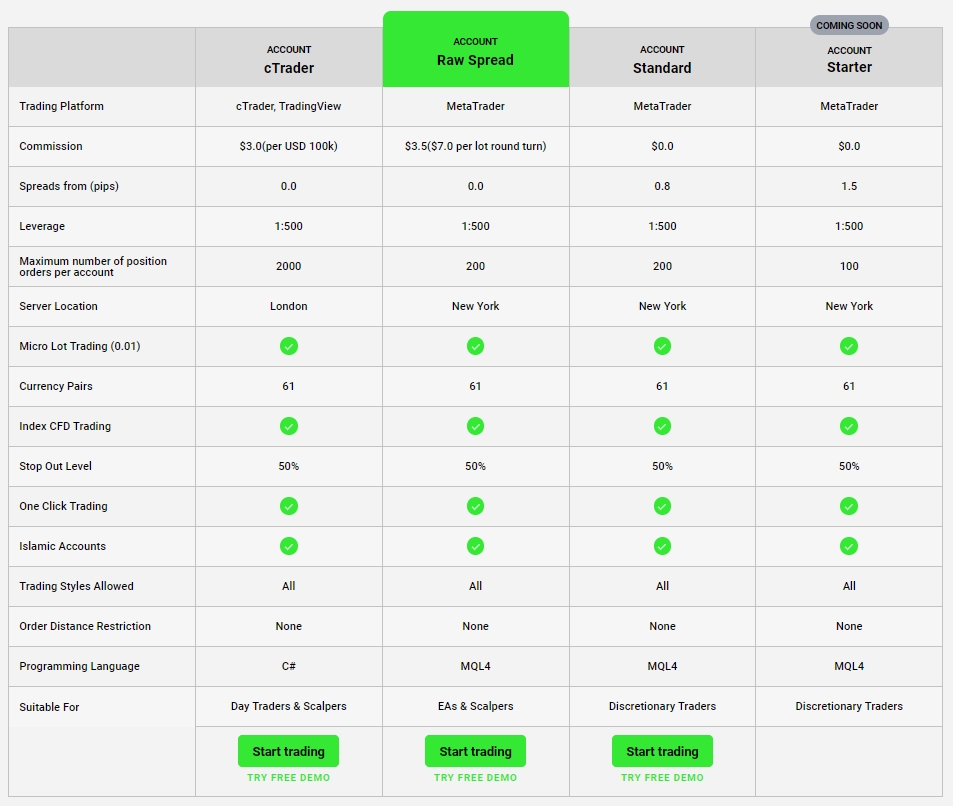

A Deep Dive into IC Markets Account Types

IC Markets understands that one size does not fit all in the world of trading. That’s why they offer a focused range of account types, each designed to cater to a specific trading style. Whether you are a high-frequency scalper or a long-term position trader, you will find an account that aligns perfectly with your strategy.

The primary choice for traders in Bangladesh is between two main live account types, with an Islamic (swap-free) option available for both. The core difference lies in their pricing structure—how spreads and commissions are handled. We will explore each one in detail to help you make the best decision for your Bangladesh trading goals.

Raw Spread Account: For ECN and Scalping

The Raw Spread account is the flagship offering from IC Markets and the top choice for serious traders. This account connects you directly to the broker’s pool of liquidity providers, giving you access to institutional-grade, “raw” spreads. Spreads on major pairs like EUR/USD can go as low as 0.0 pips.

In exchange for these incredibly tight spreads, you pay a small, fixed commission per trade. This transparent model is ideal for:

- Scalpers: Getting in and out of trades quickly requires the lowest possible entry cost.

- Algorithmic Traders: Automated strategies and Expert Advisors (EAs) perform best in a low-spread, fast-execution environment.

- High-Volume Traders: The fixed commission structure becomes highly cost-effective as trading volume increases.

Standard Account: Commission-Free Trading

The Standard account offers a simpler trading experience, making it an excellent starting point for new traders. With this account, there are no separate commission fees. The broker’s compensation is built into the spread, which is slightly wider but still highly competitive, starting from 1.0 pip.

This “all-in-one” pricing makes calculating your potential costs straightforward. You simply focus on the spread. This account is perfect for:

- Discretionary Traders: If you place fewer, more considered trades, the simplicity of a commission-free model is very appealing.

- Beginners: Newcomers to forex Bangladesh can benefit from the easy-to-understand cost structure.

- Fundamental Traders: Those who hold positions for longer periods are less sensitive to minor spread variations and appreciate the simplicity.

Choosing Your Trading Platform: MT4, MT5, or cTrader?

Your trading platform is your command center. IC Markets Bangladesh offers three of the most powerful and popular platforms in the industry. Each one provides a unique set of tools and features, allowing you to choose the one that best fits your trading personality. The choice is yours, and all platforms are available for every account type.

| Platform | Best For | Key Features |

|---|---|---|

| MetaTrader 4 (MT4) | Algorithmic Traders & Beginners | Industry standard, huge library of EAs and custom indicators, user-friendly interface. |

| MetaTrader 5 (MT5) | Multi-Asset Traders | More timeframes, advanced charting tools, Depth of Market (DOM), allows trading stocks. |

| cTrader | Discretionary & ECN Traders | Modern and intuitive design, advanced order types, detailed trade analysis, built for ECN conditions. |

Range of Tradable Instruments Available

Diversification is key to managing risk and uncovering new opportunities. With IC Markets, traders in Bangladesh gain access to a vast and diverse range of global financial markets from a single account. This allows you to build a comprehensive trading portfolio and adapt your strategy to changing market conditions.

You can trade a wide variety of CFDs (Contracts for Difference) across several asset classes:

- Forex: Over 60 currency pairs, including majors, minors, and exotics.

- Indices: Access 25+ of the world’s most popular stock indices from Asia, Europe, and America.

- Commodities: Trade energies like Oil and Gas, as well as precious metals like Gold and Silver.

- Stocks: Buy and sell CFDs on over 1800+ top companies from exchanges like the NYSE and NASDAQ.

- Cryptocurrencies: Trade over 20 of the most popular cryptocurrencies against the US Dollar, 24/7.

- Bonds & Futures: Diversify with government bonds and futures contracts like the CBOE VIX Index.

Understanding Spreads, Commissions, and Other Fees

Transparency in trading costs is a hallmark of a trustworthy broker. At IC Markets, the fee structure is straightforward, ensuring you always know what you are paying. The primary costs are the spread and, depending on your account, a commission.

“Your success as a trader often depends on managing costs. Low, transparent fees give you a crucial edge in the competitive forex market.”

Here’s a simple breakdown:

- Spread: This is the small difference between the buy (ask) and sell (bid) price of an asset. IC Markets offers variable spreads that tighten or widen based on market liquidity. The Raw Spread account offers the tightest possible spreads.

- Commission: This is a fixed fee charged only on the Raw Spread account for opening and closing a trade. It is calculated based on trade volume and is completely transparent.

- Swaps: Also known as an overnight financing fee, a swap is charged or credited to your account if you hold a position open overnight. Islamic accounts are swap-free.

IC Markets proudly charges no fees for deposits or withdrawals, and there are no account inactivity fees, making it a truly cost-effective broker for Bangladesh trading.

How to Open a Live Trading Account from Bangladesh

Getting started with IC Markets from Bangladesh is a quick and secure process. The entire application is online and can be completed in just a few minutes. Follow these simple steps to begin your trading journey.

- Complete the Online Application: Visit the official IC Markets website and fill out the registration form with your basic personal information, such as your name, email, and phone number.

- Configure Your Account: Choose your preferred trading platform (MT4, MT5, or cTrader) and select the account type that suits your style (Raw Spread or Standard).

- Verify Your Identity (KYC): To comply with global financial regulations, you need to verify your account. Simply upload a clear copy of your government-issued ID (like a National ID card or passport) and a proof of address (like a recent utility bill or bank statement).

- Fund and Trade: Once your account is verified, you can make your first deposit using one of the many convenient methods available for clients in Bangladesh. Then, you are ready to enter the markets!

Depositing Funds: Easy Methods for Bangladeshi Clients

Funding your trading account should be simple, fast, and secure. IC Markets Bangladesh provides a variety of deposit methods designed to be convenient for local traders. The broker ensures that you can move your capital into your trading account efficiently, allowing you to seize market opportunities without delay.

All deposits are processed securely, and IC Markets does not charge any internal fees for funding your account. Popular methods include:

- International Bank Wire Transfers

- Credit and Debit Cards (Visa, Mastercard)

- A wide range of global Digital Wallets

- Local Bank Transfer solutions

This flexibility ensures every trader can find a method that works for them, making the forex Bangladesh experience smooth from the very beginning.

Local Bank Transfers and Digital Wallets

For traders in Bangladesh, convenience is paramount. IC Markets excels by offering payment solutions that are perfectly suited to the local financial landscape. The availability of local bank transfer options is a significant advantage, as it allows you to fund your account directly from your Bangladeshi bank account, often with faster processing times and lower costs than traditional international wires.

In addition to local transfers, IC Markets supports a variety of popular digital wallets. These e-wallets provide an extra layer of security and speed for both deposits and withdrawals. Supported options often include:

- Skrill

- Neteller

- FasaPay

These methods make managing your funds for Bangladesh trading incredibly straightforward and user-friendly.

Withdrawing Your Profits: A Step-by-Step Guide

Accessing your profits should be as easy as earning them. IC Markets ensures a transparent and efficient withdrawal process. To maintain security, funds must be returned to the same source from which they were deposited. Here is how you can withdraw your money from your trading account.

- Log in to Your Client Area: Access your secure IC Markets account portal using your login credentials.

- Select “Withdraw Funds”: Navigate to the transactions section and choose the withdrawal option.

- Choose Your Method: Select the withdrawal method you wish to use. Due to anti-money laundering policies, you will typically withdraw via the same method you used to deposit.

- Submit Your Request: Enter the amount you wish to withdraw and confirm your request.

Withdrawal requests are processed quickly by the IC Markets team, usually within one business day, ensuring you receive your funds in a timely manner.

Practice Risk-Free with an IC Markets Demo Account

Want to test the waters before diving in? The IC Markets demo account is the perfect tool. It provides a risk-free, simulated trading environment where you can practice your strategies, familiarize yourself with the platform, and experience the broker’s ECN conditions firsthand. All of this is done using virtual money, so your real capital is never at risk.

The demo account is ideal for:

- Beginners: Learn the fundamentals of forex trading and how to use the MT4, MT5, or cTrader platforms.

- Experienced Traders: Test new trading strategies, expert advisors (EAs), or custom indicators without financial risk.

- Platform Evaluation: Directly compare the features of different platforms to see which one you prefer.

Opening a demo account is free and takes only a minute. It is the smartest way for anyone interested in forex Bangladesh to start their journey with confidence.

Leverage and Margin Requirements Explained

Leverage is a powerful feature in forex trading that allows you to control a large position in the market with a relatively small amount of capital. Think of it as a loan from your broker. For example, with 1:500 leverage, you can control a $50,000 position with just $100 of your own money.

While leverage can significantly amplify your potential profits, it is crucial to understand that it also magnifies your potential losses. This is where margin comes in. Margin is the amount of your own capital required to open and maintain a leveraged trade. It acts as a good-faith deposit.

IC Markets offers flexible leverage options, but it is vital for traders in Bangladesh to use it wisely. Always implement strong risk management techniques, such as using stop-loss orders, to protect your capital when engaging in Bangladesh trading with leverage.

Accessing Customer Support for Local Traders

When you need assistance, quick and reliable support is essential. IC Markets provides award-winning, multilingual customer support that is available 24 hours a day, 7 days a week. This round-the-clock availability is perfect for forex traders, as the market operates across different time zones.

Traders from Bangladesh can easily reach the support team through various channels:

- Live Chat: Get instant answers to your questions directly through the website. This is the fastest way to get help.

- Email: For more detailed inquiries, you can send an email to the dedicated support team and expect a prompt and thorough response.

- Help Center: A comprehensive online FAQ section covers a wide range of common questions about accounts, platforms, and trading.

This commitment to excellent service ensures that help is always just a click away, providing a supportive environment for your trading activities.

IC Markets vs. Other Brokers: A Comparative Analysis

When choosing a broker in Bangladesh, it helps to see how the competition stacks up. IC Markets consistently stands out from the crowd by focusing on what serious traders value most: performance, cost, and technology. Here is a brief comparison of how it compares to a typical broker.

| Feature | IC Markets | A Typical Broker |

|---|---|---|

| Spreads | From 0.0 pips on Raw Spread | Often wider, starting from 1.5 – 2.0 pips |

| Execution Model | True ECN with no requotes | Market Maker model with potential conflicts of interest |

| Execution Speed | Ultra-fast, measured in milliseconds | Slower, which can lead to slippage |

| Platform Options | MT4, MT5, and cTrader | Often limited to just MT4 or a proprietary platform |

| Regulation | Top-tier global regulation | May have weaker or offshore regulation |

Pros and Cons of Trading with IC Markets in Bangladesh

Every broker has its strengths and weaknesses. To provide a balanced view, here is an honest look at the pros and cons of choosing IC Markets for your Bangladesh trading needs. This will help you make a fully informed decision that aligns with your personal trading goals.

Pros:

- Exceptional Trading Conditions: Industry-leading low spreads and fast execution are ideal for all trading styles.

- Strong Regulation: Top-tier regulation provides a high level of security and trust.

- Choice of Powerful Platforms: Access to MT4, MT5, and cTrader caters to every preference.

- Wide Range of Instruments: Diversify your portfolio across forex, indices, crypto, and more.

- No Restrictions on Trading: Scalping, hedging, and automated trading are fully supported and encouraged.

Cons:

- Limited Educational Content: The platform is geared more towards traders who already have a basic understanding of the markets.

- No Bonuses or Promotions: The focus is purely on providing the best trading environment, not on deposit bonuses.

Final Verdict: Is IC Markets the Right Choice for You?

After a thorough review, the verdict is clear. For any serious individual looking to engage in forex Bangladesh, IC Markets presents a compelling and professional choice. This broker prioritizes what truly matters: superior technology, low trading costs, and a secure, regulated environment. It strips away the gimmicks and focuses on delivering a high-performance trading experience.

“If you are a trader in Bangladesh who values speed, reliability, and cost-efficiency above all else, IC Markets is not just a good choice—it is arguably one of the best available.”

Whether you are a scalper chasing pips, an automated trader running EAs, or a discretionary trader who demands flawless execution, this broker provides the tools and conditions you need to succeed. The combination of True ECN conditions and a client-first approach makes IC Markets Bangladesh a top-tier broker. The best way to be sure? Open a free demo account and experience the difference for yourself.

Frequently Asked Questions

What types of trading accounts does IC Markets offer in Bangladesh?

IC Markets offers two main account types: the Raw Spread account, ideal for scalpers and algorithmic traders with spreads from 0.0 pips and a small commission, and the Standard account, which is commission-free with slightly wider spreads, making it great for beginners and discretionary traders.

Is IC Markets a safe broker for traders in Bangladesh?

Yes, IC Markets is considered a safe broker as it is regulated by top-tier financial authorities. It ensures client safety through measures like segregated client funds, negative balance protection, and regular audits.

What trading platforms can I use with IC Markets?

You can choose from three powerful platforms: MetaTrader 4 (MT4), the industry standard; MetaTrader 5 (MT5), for multi-asset trading; and cTrader, known for its modern interface and advanced order types.

How can I deposit funds into my IC Markets account from Bangladesh?

IC Markets offers several convenient deposit methods for Bangladeshi clients, including international bank transfers, credit/debit cards (Visa, Mastercard), various digital wallets like Skrill and Neteller, and local bank transfer solutions.

Can I practice trading before using real money?

Absolutely. IC Markets provides a free demo account that allows you to practice trading strategies in a simulated, risk-free environment using virtual funds. It’s a great way to familiarize yourself with the platforms and market conditions.