Are you a trader in Brazil searching for a top-tier broker? This definitive guide explores everything you need to know about trading with IC Markets, one of the world’s leading providers. We will cover essential topics like account types, trading platforms, fees, and convenient local payment methods. We break down complex information to help you discover if this is the right broker to elevate your trading journey. Get ready to unlock your potential in the Brazilian market.

- What is IC Markets and Its Presence in Brazil?

- Is IC Markets a Safe and Regulated Broker for Brazilians?

- Account Types Offered to Brazilian Clients

- Standard Account Overview

- Raw Spread Account: Features and Benefits

- Exploring the cTrader Account

- Available Trading Platforms: MT4, MT5, and cTrader

- Understanding Spreads, Commissions, and Fees

- Step-by-Step Guide: Opening an Account from Brazil

- Deposit and Withdrawal Methods for Brazilian Traders

- Using PIX and Boleto with IC Markets

- Range of Tradable Instruments

- Leverage and Margin Explained

- Customer Support Quality for Portuguese Speakers

- Educational Resources and Trading Tools

- Key Advantages of Trading with IC Markets in Brazil

- Potential Disadvantages and Considerations

- How IC Markets Compares to Other Popular Brokers in Brazil

- Final Verdict: Is IC Markets a Good Choice for You?

- Frequently Asked Questions

What is IC Markets and Its Presence in Brazil?

IC Markets is a globally recognized broker, famous for its exceptional trading environment. It provides traders with access to the global financial markets. The broker built its reputation on offering tight spreads, lightning-fast execution speeds, and deep liquidity. For traders in Brazil, this means access to a professional-grade trading experience. The company understands the needs of the dynamic forex Brazil market, providing the tools and conditions necessary for both new and experienced traders to thrive. Its focus on technology ensures that your trades execute precisely when you need them to, which is a critical advantage in fast-moving markets.

Is IC Markets a Safe and Regulated Broker for Brazilians?

Safety is the number one concern for any trader. You can trade with confidence knowing IC Markets operates under strict regulatory oversight from multiple top-tier authorities around the world. These regulators enforce rules that protect you, the client. A key safety measure is the segregation of client funds. This means the broker holds your money in separate bank accounts, completely apart from its own operational funds. This practice ensures your capital is protected. The broker also employs robust security technology to safeguard your personal data and trading activity. For anyone searching for a trustworthy broker in Brazil, these measures provide essential peace of mind.

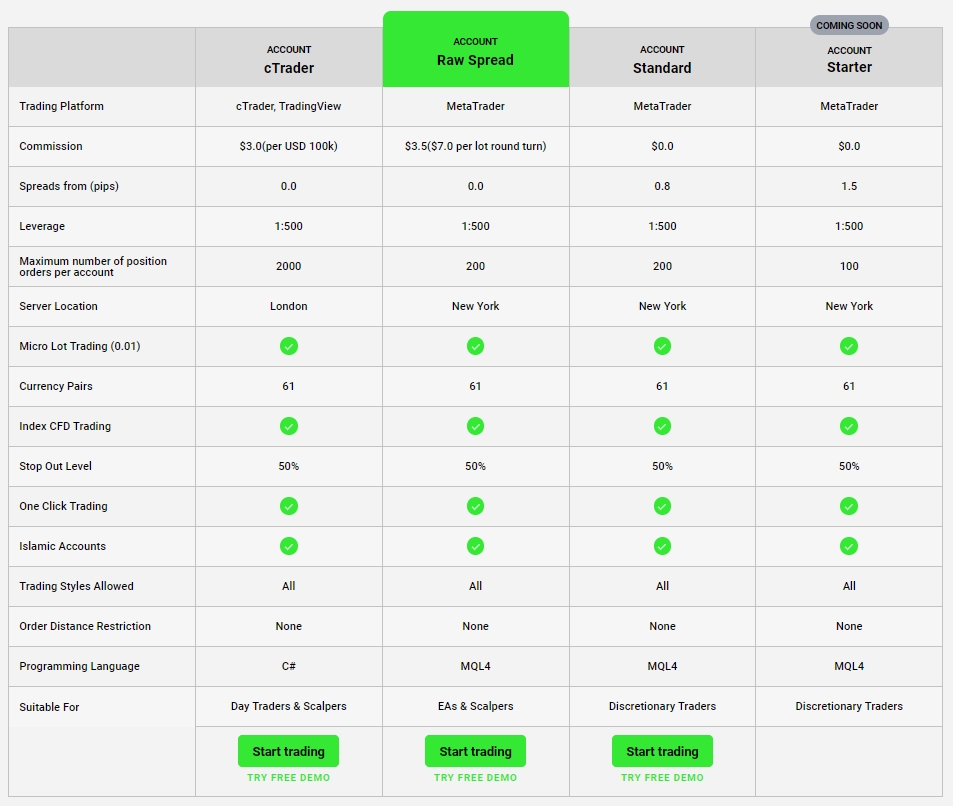

Account Types Offered to Brazilian Clients

Choosing the right account is a crucial first step. IC Markets offers several distinct account types designed to fit different trading styles and needs. Whether you are a beginner who prefers simplicity, an active day trader, or a scalper who relies on algorithms, there is an option tailored for you. Each account provides access to the same deep liquidity and wide range of instruments. The main differences lie in their pricing structure, specifically how spreads and commissions are handled. We will explore the Standard, Raw Spread, and cTrader accounts in detail to help you find your perfect match.

Standard Account Overview

The Standard Account is the perfect starting point for many traders. Its primary advantage is simplicity. All trading costs are included directly in the spread, which means you pay zero commission on your trades. This straightforward pricing model makes it easy to calculate your potential costs without any extra math. It is an excellent choice for discretionary traders and beginners who want a hassle-free experience.

- Commissions: $0 on all trades.

- Spreads: Competitive spreads starting from 0.6 pips.

- Best For: New traders and those who prefer an all-in-one cost structure.

- Platforms: Available on MetaTrader 4 and MetaTrader 5.

Raw Spread Account: Features and Benefits

“For traders who demand the lowest possible spreads, the Raw Spread account is the professional’s choice. It is built for speed and precision.”

The Raw Spread Account is the most popular choice at IC Markets, and for good reason. It gives you direct access to institutional-grade spreads, which can go as low as 0.0 pips on major currency pairs. Instead of a wider spread, you pay a small, fixed commission per lot traded. This structure is highly beneficial for scalpers, automated traders using Expert Advisors (EAs), and high-volume traders. The transparent pricing allows you to minimize your trading costs, especially during active market hours.

Exploring the cTrader Account

The cTrader Account combines the power of the cTrader platform with a low-cost trading environment. Similar to the Raw Spread account, it offers incredibly tight spreads sourced directly from liquidity providers. It also features a transparent, commission-based fee structure. The key difference is the platform itself. cTrader is known for its modern, intuitive interface and advanced risk management features. It provides enhanced charting tools and Level II Depth of Market (DOM) pricing, giving you deeper insight into market dynamics. This account is ideal for traders who appreciate cTrader’s unique features and transparent pricing.

Available Trading Platforms: MT4, MT5, and cTrader

IC Markets provides access to three of the most powerful and popular trading platforms in the industry. Each platform caters to different preferences and strategies, ensuring every trader in Brazil finds the right tool for the job. You can choose the one that best aligns with your trading style, whether you prioritize a vast ecosystem of automated tools or a sleek, modern user interface.

| Platform | Key Feature | Best For |

|---|---|---|

| MetaTrader 4 (MT4) | The global standard with a huge library of custom indicators and Expert Advisors (EAs). | Traders who rely on automated strategies and a familiar, robust interface. |

| MetaTrader 5 (MT5) | A modern multi-asset platform with more timeframes, indicators, and advanced tools. | Traders who want access to a wider range of markets and superior analytical tools. |

| cTrader | An intuitive platform with advanced charting, order types, and deep liquidity visibility. | Discretionary traders who value a clean design and advanced risk management features. |

Understanding Spreads, Commissions, and Fees

Keeping trading costs low is key to maximizing your profits. IC Markets excels with its transparent and highly competitive fee structure. The primary costs are spreads and commissions. The spread is the small difference between the buy and sell price of an asset. A commission is a fixed fee charged on certain account types for opening and closing a trade. IC Markets is known for having some of the tightest spreads in the industry. Beyond these, you should be aware of swap fees, which are charges for holding positions overnight. The broker maintains a clear policy with no hidden fees, ensuring you always know what you are paying for.

Step-by-Step Guide: Opening an Account from Brazil

Getting started with IC Markets from Brazil is a quick and straightforward process. You can have your account up and running in just a few simple steps. Follow this guide to begin your trading journey.

- Complete the Application Form: Visit the IC Markets website and fill out the secure online application. You will need to provide basic personal information and details about your trading experience.

- Provide Your Documents: To verify your identity, you will need to upload a copy of a valid government-issued ID (like your RG or CNH) and a proof of address (such as a recent utility bill or bank statement).

- Fund Your Account: Once your account is approved, choose from a variety of convenient deposit methods to add funds to your trading account. We will cover these in the next section.

- Start Trading: Download your chosen trading platform (MT4, MT5, or cTrader), log in with your new account details, and you are ready to enter the markets.

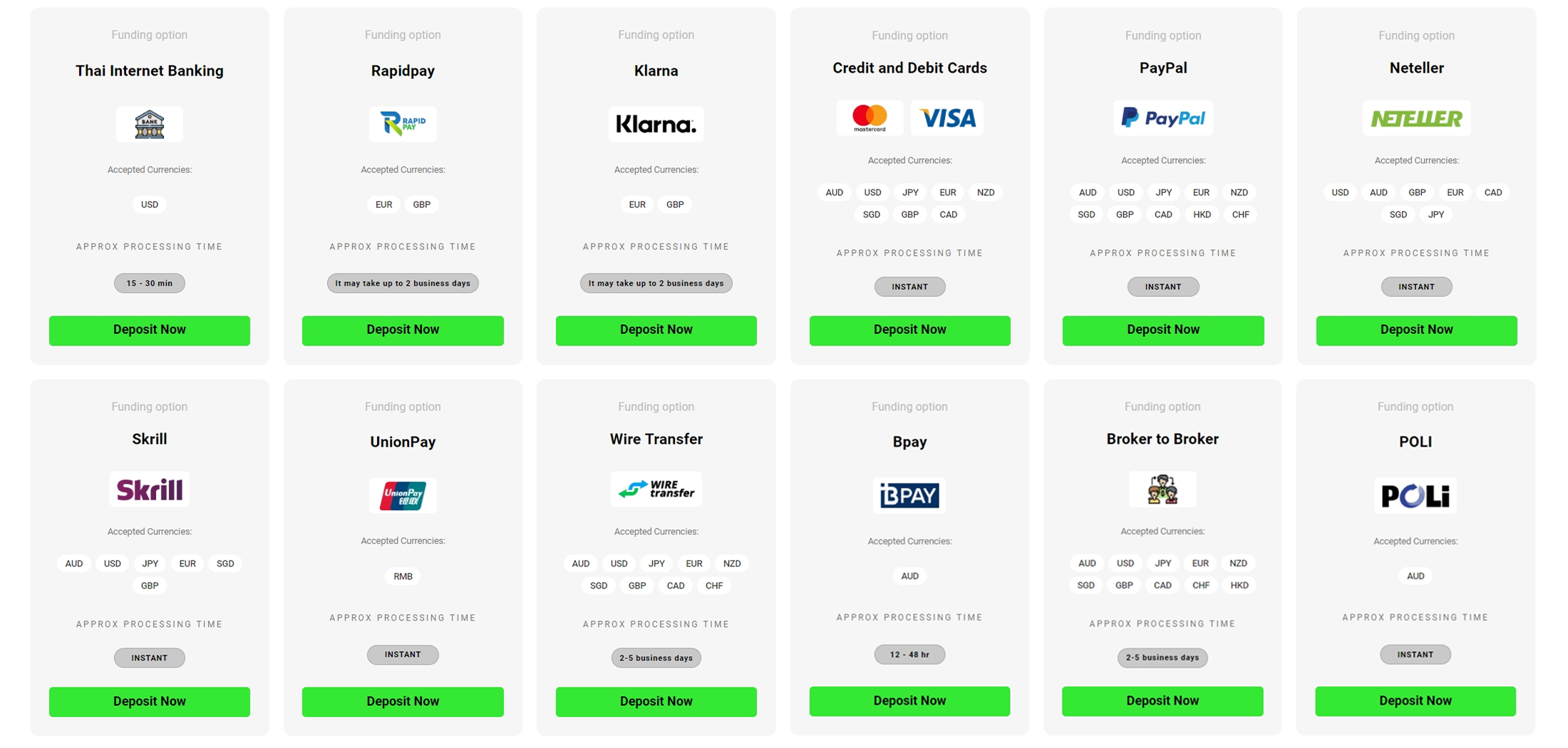

Deposit and Withdrawal Methods for Brazilian Traders

Funding your account and accessing your profits should be easy and efficient. IC Markets provides a wide array of payment options tailored to the needs of its clients in Brazil. You can choose from globally recognized methods that ensure fast and secure transactions. The broker processes most deposits instantly, so you can start trading without delay. Withdrawals are also handled promptly, ensuring you can access your funds when you need them. Available options typically include:

- Credit and Debit Cards (Visa, Mastercard)

- Bank Wire Transfer

- Popular E-wallets like Skrill and Neteller

- Broker to Broker Transfer

Using PIX and Boleto with IC Markets

Understanding the local financial landscape is crucial, and IC Markets demonstrates this by supporting popular Brazilian payment methods. The inclusion of PIX and Boleto Bancário makes funding your account incredibly convenient. PIX allows for instant, 24/7 deposits, so you never miss a trading opportunity due to funding delays. Boleto offers a reliable and widely used alternative for those who prefer to pay via a bank slip. These local options eliminate the need for complex international transfers and make managing your trading capital simple and efficient for anyone engaged in forex Brazil.

Range of Tradable Instruments

Variety is key to a diversified trading strategy. IC Markets offers an extensive selection of CFD instruments across several major asset classes. This allows Brazilian traders to access global markets from a single platform. Whether you want to trade the fast-paced forex market or speculate on the growth of global companies, you have the tools to do so. The wide range ensures you can find opportunities no matter the market conditions.

- Forex: Trade over 60 currency pairs, including majors, minors, and exotics.

- Indices: Access major global stock indices from Asia, Europe, and the Americas.

- Commodities: Trade popular commodities like Gold, Silver, and Oil.

- Stocks: Speculate on the price movements of leading global companies.

- Bonds: Diversify with government bonds from around the world.

- Cryptocurrencies: Access popular digital currencies like Bitcoin and Ethereum.

Leverage and Margin Explained

Leverage is a powerful tool that allows you to control a large position in the market with a relatively small amount of capital. For example, with 100:1 leverage, you can control a $10,000 position with just $100 from your account. This $100 is known as the margin. While leverage can significantly amplify your potential profits, it is vital to understand that it also magnifies your potential losses. IC Markets provides flexible leverage options, but you must always use it wisely. Effective risk management is essential when trading with leverage. Always start with a level you are comfortable with and never risk more than you can afford to lose.

Customer Support Quality for Portuguese Speakers

Excellent customer support can make a huge difference in your trading experience. IC Markets offers dedicated support for its Brazilian clients, including assistance in Portuguese. This ensures that you can get clear and helpful answers to your questions without any language barriers. The support team is available through multiple channels, including live chat, email, and a comprehensive help center. They are known for being responsive, knowledgeable, and professional, helping you resolve technical or account-related issues quickly so you can focus on your trading.

Educational Resources and Trading Tools

IC Markets supports your growth as a trader by providing a wealth of free educational materials and powerful trading tools. The educational section on their website features articles, tutorials, and videos covering a wide range of topics, from market basics to advanced trading strategies. They also offer valuable tools to enhance your analysis. The economic calendar helps you stay on top of important market-moving events, while market analysis blog posts provide expert insights. These resources are designed to help you make more informed trading decisions and continuously improve your skills.

Key Advantages of Trading with IC Markets in Brazil

When choosing a broker, the benefits must be clear and compelling. IC Markets stands out as a premier choice for Brazil trading for several key reasons. These advantages combine to create a superior trading environment where you can focus on executing your strategy effectively.

- Extremely Low Spreads: Access some of the tightest raw spreads in the industry, starting from 0.0 pips.

- Fast and Reliable Execution: Benefit from ultra-low latency and swift trade execution, crucial for active traders.

- Local Payment Methods: Easily deposit and withdraw funds using convenient options like PIX and Boleto.

- Wide Range of Markets: Trade thousands of instruments including Forex, indices, commodities, and stocks.

- Powerful Platforms: Choose between MT4, MT5, and cTrader to match your trading style.

- Strong Regulation: Trade with confidence under the oversight of top-tier global regulators.

Potential Disadvantages and Considerations

No broker is perfect for everyone. To provide a balanced view, it is important to consider some potential drawbacks. While IC Markets is an excellent choice for many, some traders might find certain aspects less suitable for their specific needs. For example, the educational resources are robust but may be geared more towards traders who already have a basic understanding of the markets rather than complete beginners. Additionally, the broker focuses on a low-cost, execution-only model. This means they do not provide personal trading signals or investment advice, which some traders might look for.

How IC Markets Compares to Other Popular Brokers in Brazil

Making an informed decision involves comparing your options. IC Markets consistently ranks as a top choice for serious traders due to its focus on providing institutional-grade trading conditions. Here is a quick comparison with other typical brokers available to traders in Brazil.

| Feature | IC Markets | Typical Broker A | Typical Broker B |

|---|---|---|---|

| EUR/USD Spread | From 0.0 pips + commission | Fixed at 1.8 pips | Variable from 1.2 pips |

| Platforms | MT4, MT5, cTrader | Proprietary Platform | MT4 Only |

| Local Payments (PIX) | Yes | No | Yes |

| Execution Model | ECN Pricing | Market Maker | Market Maker |

Final Verdict: Is IC Markets a Good Choice for You?

After a thorough review, the conclusion is clear. IC Markets Brazil is an outstanding choice for intermediate to advanced traders who prioritize low costs, fast execution, and a wide selection of trading instruments. If you are a scalper, day trader, or use automated systems, the Raw Spread and cTrader accounts offer one of the most competitive environments available. The support for local payment methods like PIX makes account management seamless. For those serious about their Brazil trading, IC Markets provides the professional tools and conditions needed to succeed. If you value performance and transparency, opening an account is a step in the right direction.

Frequently Asked Questions

Is IC Markets a safe broker for traders in Brazil?

Yes, IC Markets is considered a safe choice. It operates under strict oversight from multiple top-tier global regulators, ensures client funds are held in segregated bank accounts for protection, and uses robust security technology to safeguard personal data.

What types of trading accounts does IC Markets offer?

IC Markets provides three main account types to suit different needs: the Standard Account (commission-free), the Raw Spread Account (offering very low spreads with a small fixed commission), and the cTrader Account (which combines low-cost trading with the advanced features of the cTrader platform).

Can I use local Brazilian payment methods like PIX to fund my account?

Yes, IC Markets supports popular local payment methods for Brazilian traders, including PIX for instant deposits and Boleto Bancário. This makes funding your account fast, convenient, and efficient.

Which trading platforms can I use with IC Markets?

You can choose from three of the industry’s most popular trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Each platform offers unique features to cater to different trading strategies and preferences.

What are the main advantages of trading with IC Markets in Brazil?

The key advantages include access to extremely low spreads starting from 0.0 pips, fast trade execution, a wide range of tradable markets, the choice of powerful platforms (MT4, MT5, cTrader), strong global regulation, and the convenience of local payment options like PIX.