Welcome to your definitive guide on IC Markets China. If you seek a top-tier trading experience with ultra-low costs and lightning-fast execution, you have arrived at the right place. We dive deep into every aspect of what makes this broker a preferred choice for thousands of traders. Discover how to leverage powerful platforms, access global markets, and start your Forex China journey with a trusted partner. This guide provides all the clear, direct answers you need to trade with confidence and skill. Let’s unlock your trading potential together.

- Is IC Markets Available and Regulated for Chinese Clients?

- Understanding Regulatory Oversight for Trader Safety

- Pros and Cons of Trading with IC Markets in China

- Account Types Offered to Traders in China

- The Raw Spread Account: For Scalpers and Day Traders

- The Standard Account: Simplicity and No Commissions

- Step-by-Step Guide: How to Open an Account from China

- Deposit and Withdrawal Methods for Chinese Users

- Navigating UnionPay and Bank Wire Transfers

- E-wallet and Crypto Funding Options

- Exploring Trading Platforms: MT4, MT5, and cTrader

- Spreads, Commissions, and Trading Costs Explained

- Leverage Options and Margin Requirements

- Full Range of Tradable Instruments

- Forex Pairs, Indices, and Commodities

- IC Markets Customer Support for Chinese Speakers

- Evaluating Trading Tools and Educational Resources

- How IC Markets Compares to Other Brokers in the Region

- Mobile Trading with the IC Markets App

- Security of Funds for Chinese Traders

- Frequently Asked Questions

Is IC Markets Available and Regulated for Chinese Clients?

Yes, IC Markets proudly accepts clients from China. You can open an account and access the global financial markets through its internationally regulated entities. This structure ensures that while you get access to favorable trading conditions, including high leverage, you are still protected by robust operational standards. The broker has a streamlined process specifically for Chinese clients, making it simple to get started. They understand the needs of the China trading community and provide a tailored experience. Choosing a globally recognized broker like IC Markets means you are partnering with a reliable and established firm.

Understanding Regulatory Oversight for Trader Safety

Your peace of mind is paramount. IC Markets operates under the supervision of respected financial authorities. This oversight mandates strict compliance with industry best practices, including the segregation of client funds. This means your capital is kept in separate trust accounts at top-tier banks, completely apart from the company’s operational funds. This critical measure ensures your money is protected, providing a secure trading environment. Regulatory compliance is a cornerstone of a trustworthy broker, and it forms the foundation of your safety as a trader.

Pros and Cons of Trading with IC Markets in China

Making an informed decision requires a balanced view. No broker is perfect for everyone, but IC Markets offers a compelling package for traders in China. We have broken down the key advantages and potential drawbacks to give you a clear picture.

| Feature | Pros (Advantages) | Cons (Considerations) |

|---|---|---|

| Spreads & Costs | Extremely low raw spreads from 0.0 pips, leading to lower trading costs. | The commission on Raw Spread accounts needs to be factored into profit calculations. |

| Execution Speed | Blazing-fast order execution with minimal slippage, ideal for scalping. | During extreme volatility, no broker can completely eliminate slippage. |

| Trading Platforms | Choice of three world-class platforms: MT4, MT5, and cTrader. | Does not offer a proprietary, custom-built platform for those who prefer them. |

| Client Support | Dedicated 24/7 support, including native Mandarin speakers. | Phone support may have wait times during peak trading hours. |

Account Types Offered to Traders in China

IC Markets offers a focused range of trading accounts designed to suit different trading styles and levels of experience. Whether you are a high-volume scalper or a long-term position trader, you will find an account that fits your strategy. The main distinction lies in the pricing structure: one combines costs into the spread, while the other offers raw spreads plus a small, fixed commission. Both provide access to the same deep liquidity and fast execution. Let’s explore which one is right for you.

The Raw Spread Account: For Scalpers and Day Traders

The Raw Spread account is built for performance. It is the top choice for active traders, scalpers, and those who use automated trading systems (EAs). By connecting you directly to institutional-grade liquidity, this account minimizes the spread, often down to 0.0 pips on major forex pairs. A small, transparent commission is charged per trade, making your total cost structure crystal clear.

- Spreads starting from 0.0 pips.

- Low, fixed commission per lot traded.

- Ideal for high-frequency trading and scalping strategies.

- Available on MT4, MT5, and cTrader platforms.

The Standard Account: Simplicity and No Commissions

The Standard account is perfect for traders who value simplicity. It offers an all-inclusive trading cost by building the commission into the spread. This means you will never have to calculate a separate commission fee. This account is an excellent starting point for new traders and a solid choice for discretionary traders who prefer a straightforward cost model. You still get access to fast execution and the full range of tradable instruments.

- Zero commission on all trades.

- Competitive spreads with costs all-in.

- Simple and easy-to-understand fee structure.

- A great option for beginner and discretionary traders.

Step-by-Step Guide: How to Open an Account from China

Getting started with IC Markets from China is a quick and secure process. The entire application is online and can be completed in just a few minutes. Follow these simple steps to open your live trading account and access the markets.

- Complete the Application Form: Navigate to the IC Markets website and fill out the secure online application. You will need to provide basic personal information and contact details.

- Configure Your Account: Choose your preferred trading platform (MT4, MT5, or cTrader), select your account type (Raw Spread or Standard), and set your base currency.

- Answer a Few Questions: Complete a brief questionnaire about your trading knowledge and experience. This helps ensure the products offered are appropriate for you.

- Verify Your Identity: Upload a copy of your government-issued ID (like a passport or national ID card) and a proof of residence (like a utility bill or bank statement) to verify your account.

- Fund and Trade: Once your account is approved, make your first deposit using one of the convenient funding methods. You are now ready to download the platform and start trading!

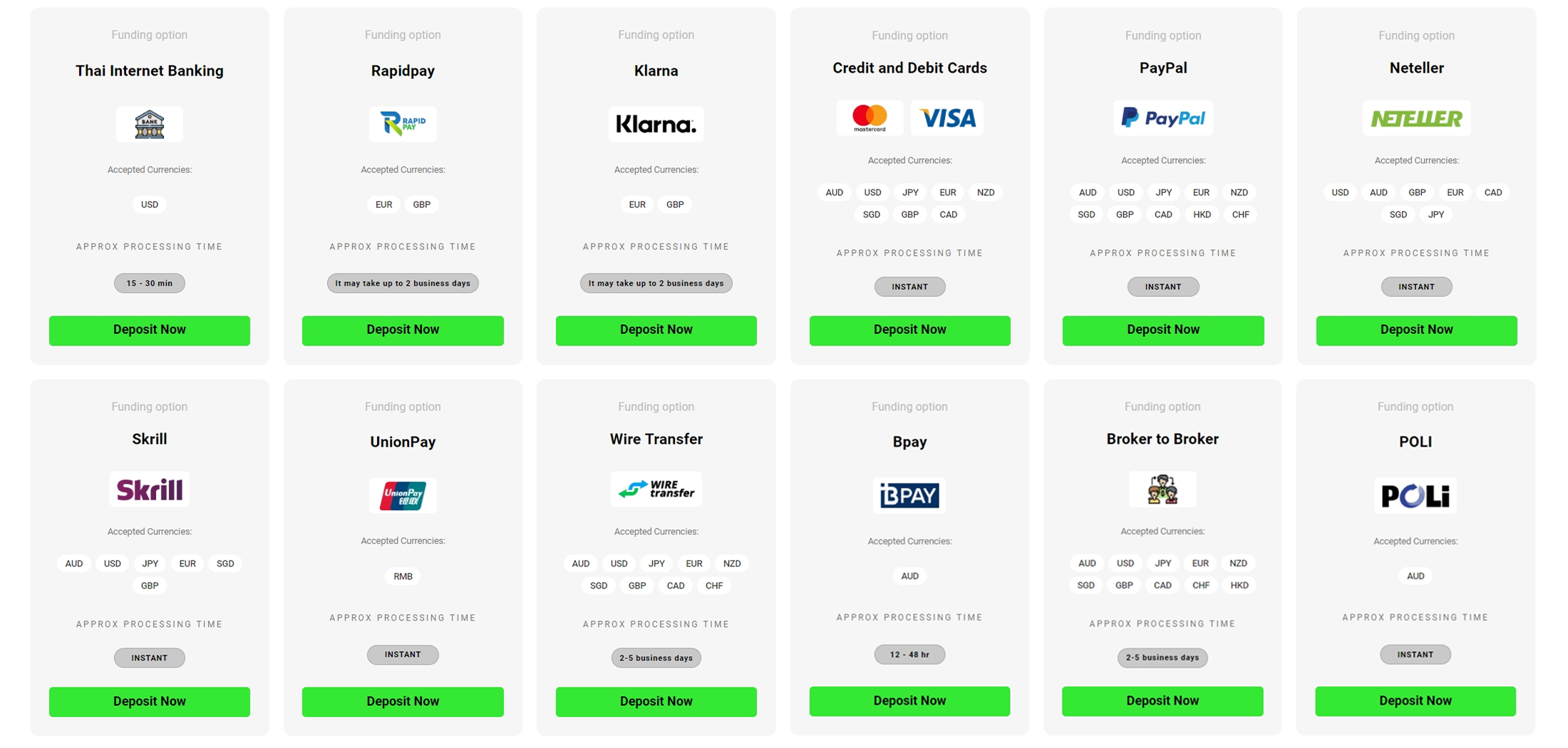

Deposit and Withdrawal Methods for Chinese Users

Funding your account should be fast, easy, and secure. IC Markets provides a variety of convenient payment solutions specifically for its clients in China. You can choose from traditional methods like bank transfers or modern solutions like e-wallets. The broker ensures that both depositing and withdrawing your funds is a seamless experience, with most methods incurring no fees from their side. This focus on accessibility makes managing your capital straightforward, letting you focus on your China trading activities.

Navigating UnionPay and Bank Wire Transfers

For traders who prefer traditional banking channels, IC Markets offers reliable options. China UnionPay is one of the most popular and efficient methods for clients in the region. It allows for instant deposits directly from your bank account, making it incredibly convenient. Alternatively, international bank wire transfers are available for larger transactions. While wires may take a few business days to process, they are a secure and trusted method for moving funds to and from your trading account.

E-wallet and Crypto Funding Options

Embracing modern technology, IC Markets also supports a range of digital payment methods. You can fund your account using popular e-wallets such as Skrill and Neteller, which offer quick and secure transactions. For those who utilize digital currencies, the broker also facilitates deposits via select cryptocurrencies like Bitcoin (BTC) and Tether (USDT). These options provide flexibility and speed, often processing deposits nearly instantly, allowing you to capitalize on market opportunities without delay.

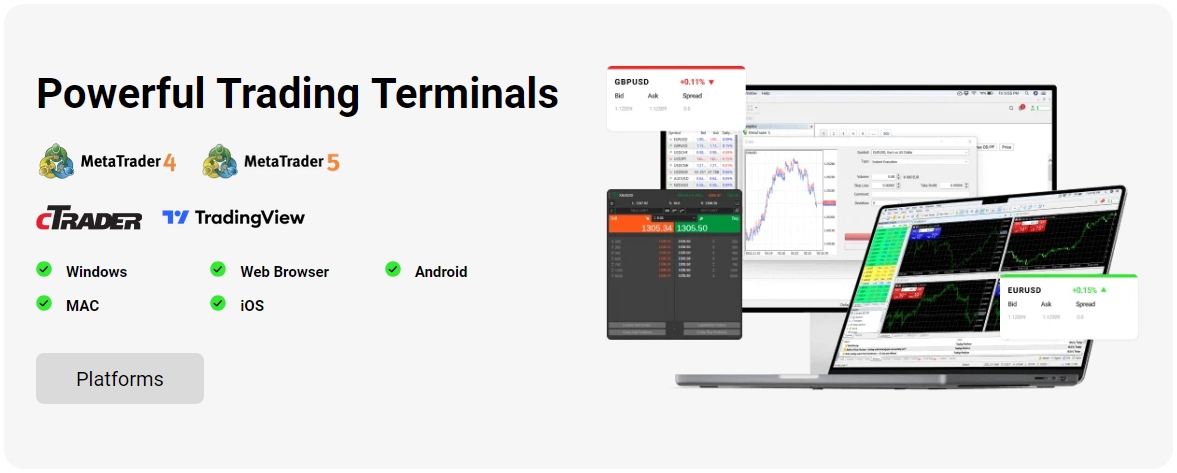

Exploring Trading Platforms: MT4, MT5, and cTrader

Your trading platform is your gateway to the markets. IC Markets empowers you with a choice of three industry-leading platforms, ensuring you have the right tools for your strategy. Each platform offers a unique set of features, but all deliver the core IC Markets promise of speed, stability, and deep liquidity.

MetaTrader 4 (MT4): The global standard. MT4 is famous for its user-friendly interface and vast ecosystem of custom indicators and Expert Advisors (EAs). It remains the top choice for forex traders who rely on automated strategies.

MetaTrader 5 (MT5): The powerful successor. MT5 offers everything traders love about MT4 but adds more timeframes, more built-in indicators, and access to a wider range of markets like stocks. It is a true multi-asset platform for the modern trader.

cTrader: The intuitive powerhouse. cTrader features a sleek, modern design and is packed with advanced charting tools and order types. It is a favorite among discretionary traders who value detailed market depth and a professional trading interface.

Spreads, Commissions, and Trading Costs Explained

One of the biggest advantages of trading with IC Markets is its commitment to low costs. Understanding how these costs work is key to maximizing your profitability. The two main components are the spread and the commission.

The spread is the small difference between the buy (ask) and sell (bid) price of an instrument. With IC Markets, you get access to raw spreads sourced directly from liquidity providers. On the Standard Account, this is your only trading cost.

A commission is a small, fixed fee charged on Raw Spread accounts. Because the spread on these accounts is virtually zero, the commission is charged separately. This model is transparent and often results in lower overall costs for active traders.

“Our mission is to provide traders with the lowest possible spreads in the market. By creating a transparent and low-cost trading environment, we empower our clients to succeed.”

Leverage Options and Margin Requirements

Leverage is a powerful tool that allows you to control a larger position in the market with a smaller amount of capital, known as margin. For example, with 100:1 leverage, you can control a $100,000 position with just $1,000 of margin. This can significantly amplify your potential profits from small market movements.

However, it is crucial to use leverage wisely. Just as it magnifies gains, it also magnifies potential losses. IC Markets offers flexible leverage options, allowing you to choose a level that matches your risk appetite. Always practice strong risk management, such as using stop-loss orders, to protect your capital when trading with leverage.

Full Range of Tradable Instruments

Diversification is a key principle of successful trading. IC Markets provides access to an extensive range of CFD instruments across multiple asset classes, all from a single platform. This allows you to seize opportunities wherever they appear, from the fast-paced forex market to global stock indices. Whether you want to trade short-term trends or build a long-term, diversified portfolio, you will find the markets you need. This variety makes it an excellent broker for China-based traders looking for global exposure.

Forex Pairs, Indices, and Commodities

Dive into the world’s largest financial markets with an incredible selection of instruments. IC Markets offers a comprehensive suite of products to fit any trading strategy.

- Forex: Trade over 60 currency pairs, including majors like EUR/USD, popular minors, and exotics such as USD/CNH. Experience the market with some of the tightest spreads available.

- Indices: Get exposure to the world’s largest stock markets by trading CFDs on over 25 global indices, including the S&P 500, Germany 30, and the Hang Seng Index (HK50).

- Commodities: Speculate on the price of hard and soft commodities. Trade popular markets like Gold, Silver, and WTI Crude Oil, as well as natural gas and agricultural products.

- Stocks & Bonds: Diversify further with CFDs on hundreds of top global stocks from the ASX, NYSE, and NASDAQ exchanges, plus a selection of government bonds.

IC Markets Customer Support for Chinese Speakers

Excellent customer service is essential for a smooth trading experience. IC Markets excels in this area by providing dedicated, 24/7 support from a global team. Crucially for clients from China, this includes fluent Mandarin-speaking support staff. You can get help whenever you need it via live chat, email, or phone. Whether you have a technical question about your platform or a query about your account, the knowledgeable and friendly team is ready to assist you promptly. This commitment to accessible support makes it a standout choice for Forex China traders.

Evaluating Trading Tools and Educational Resources

Beyond the platform, successful trading requires great tools and continuous learning. IC Markets provides a suite of resources to support your journey. You gain access to essential tools like a real-time economic calendar to track market-moving events and calculators for pips, margin, and swaps. The broker also offers valuable market analysis through its official blog, providing insights and commentary on key trends. For education, you can find platform tutorials and articles covering fundamental trading concepts, helping you build both your knowledge and your confidence in the markets.

How IC Markets Compares to Other Brokers in the Region

When choosing a broker in China, it is vital to compare your options. IC Markets consistently stands out from the competition due to its core focus on providing an institutional-grade trading environment for all clients. Here is a quick comparison against a typical regional broker.

| Feature | IC Markets | Typical Broker China |

|---|---|---|

| Average EUR/USD Spread | As low as 0.0-0.1 pips | 1.5 pips or higher |

| Execution Model | No Dealing Desk (NDD) | Often a Dealing Desk |

| Platform Choice | MT4, MT5, cTrader | Usually just MT4 |

| Funding Methods | UnionPay, Wire, E-wallets, Crypto | Limited local options |

Mobile Trading with the IC Markets App

In today’s fast-moving world, you need market access at your fingertips. IC Markets ensures you never miss a trading opportunity with powerful mobile solutions. The MetaTrader 4, MetaTrader 5, and cTrader platforms all come with free, full-featured mobile applications for both iOS and Android devices. You can analyze charts with technical indicators, place and manage trades, and monitor your account balance from anywhere with an internet connection. The apps are optimized for mobile screens, providing an intuitive and powerful China trading experience on the go.

Security of Funds for Chinese Traders

The safety of your capital is the highest priority. IC Markets adheres to strict financial standards to ensure your funds are protected at all times. All client money is held in segregated trust accounts at top-tier, AA-rated banking institutions. This is a critical security feature that legally separates your funds from the company’s own capital. It guarantees that your money cannot be used for any other purpose than to back your trading positions. This provides a secure and transparent environment, giving you the confidence to trade.

Frequently Asked Questions

Is IC Markets a suitable broker for traders in mainland China?

Yes, IC Markets accepts clients from mainland China. They provide a streamlined online application process and offer convenient funding methods like China UnionPay, making it easy for Chinese residents to open and manage a trading account.

What are the main differences between the Raw Spread and Standard accounts?

The Raw Spread account is designed for active traders and scalpers, offering spreads from 0.0 pips with a small, fixed commission per trade. The Standard account is simpler, with no separate commission, as all costs are included in the slightly wider spread, making it ideal for beginners.

Which trading platforms are available at IC Markets?

IC Markets offers three leading trading platforms: MetaTrader 4 (MT4), known for its vast ecosystem of automated trading tools; MetaTrader 5 (MT5), a powerful multi-asset successor to MT4; and cTrader, which features a modern interface and advanced charting capabilities.

How does IC Markets ensure the safety of client funds?

The broker prioritizes the security of funds by holding all client money in segregated trust accounts at top-tier, AA-rated banking institutions. This means your capital is kept completely separate from the company’s operational funds.

Can I trade on my mobile device with IC Markets?

Absolutely. All three platforms (MT4, MT5, and cTrader) come with full-featured mobile applications for both iOS and Android devices. This allows you to manage your account, analyze charts, and place trades from anywhere with an internet connection.