The world of raw material trading offers exciting opportunities for diversification and potential profit. Imagine tapping into markets driven by fundamental global supply and demand. With IC Markets Commodities, you gain direct access to these powerful forces, transforming how you approach global raw material trading. We empower traders like you to navigate the dynamic landscape of commodities trading. Whether you are looking to diversify your portfolio or capitalize on price movements, our platform provides a robust environment. It’s time to explore markets that often move independently of traditional stock and bond markets, connecting you to global raw material trading with ease.

IC Markets offers a broad spectrum of commodity instruments. You can engage with energy products, agricultural goods, and crucially, precious metals. Our comprehensive offering ensures you find the markets that align with your trading strategy.

- Energy Commodities: Powering Your Portfolio

- Precious Metals: The Ultimate Safe Haven

- Agricultural Commodities: Feeding the World, Fueling Your Trades

- Why Choose IC Markets for Commodities Trading?

- Start Your Commodities Journey Today

- Why Trade Commodities with IC Markets?

- Unrivaled Access and Opportunity

- Key Benefits for Your Trading Journey

- Focus on Specific Commodity Markets

- Competitive Spreads on Key Commodities

- Regulatory Compliance and Fund Security

- Types of Commodities Available at IC Markets

- Key Commodity Categories We Offer:

- A Snapshot of Available Commodities:

- Energy Commodities (Oil, Gas)

- Precious Metals (Gold, Silver, Platinum)

- Gold Trading: The Ultimate Safe Haven

- Silver: The Dual-Purpose Metal

- Platinum: The Industrial Powerhouse

- Agricultural Products (Corn, Wheat, Coffee)

- Understanding IC Markets Commodity Spreads and Fees

- Leveraging CFD Trading for IC Markets Commodities

- The Benefits of Low Latency Trading for Commodities

- How to Open an IC Markets Account for Commodity Trading

- Your Step-by-Step Guide to Account Opening

- Why Choose IC Markets for Commodities?

- Tips for New Commodity Traders

- Funding Your IC Markets Commodities Trading Account

- Deposit Methods at a Glance

- Choosing Your Best Funding Option

- Advanced Trading Platforms for IC Markets Commodities

- MetaTrader 4 (MT4): The Industry Standard

- MetaTrader 5 (MT5): Next-Generation Trading

- cTrader: Designed for Deep Liquidity

- Key Features You Can Expect

- Platform Feature Snapshot

- Risk Management Strategies for Commodity Trading

- Understand Your Exposure: Position Sizing

- Protect Your Capital with Stop-Loss Orders

- Diversify Your Portfolio: Spread the Risk

- Leverage: A Double-Edged Sword

- Continuous Market Monitoring and Adjustment

- Develop a Robust Trading Plan

- Analyzing Market Trends in Commodity Futures

- Key Drivers Shaping Commodity Trends

- Approaches to Market Trend Analysis

- The Role of Economic Indicators in Commodity Prices

- Customer Support and Resources for IC Markets Traders

- Dedicated Customer Support Channels

- Empowering Educational Resources

- Robust Market Analysis Tools

- Comparing IC Markets with Other Commodity Brokers

- Market Access and Instrument Variety

- Spreads, Commissions, and Costs

- Trading Platforms and Tools

- Regulation and Trader Security

- Customer Support and Educational Resources

- Mobile Trading Options for IC Markets Commodities

- Expanding Your Portfolio with IC Markets Commodity CFDs

- Diversifying with IC Markets Commodities

- Frequently Asked Questions

Energy Commodities: Powering Your Portfolio

Dive into the energy sector with confidence. We provide robust options for oil trading, allowing you to react to geopolitical events and economic shifts that impact crude oil prices. This market segment provides some of the most consistent volatility and liquidity, making it a favorite for many traders seeking dynamic opportunities.

Precious Metals: The Ultimate Safe Haven

For centuries, precious metals have served as a store of value. Now, you can participate directly in this enduring market. Our platform facilitates gold trading, silver, and other sought-after metals. These assets often act as a hedge against inflation and economic uncertainty, offering unique portfolio benefits in times of market flux.

Agricultural Commodities: Feeding the World, Fueling Your Trades

From grains to soft commodities, our platform connects you to the heartbeat of global agriculture. These markets are influenced by weather patterns, crop yields, and global consumption trends, presenting distinct trading scenarios for those who understand their drivers.

Why Choose IC Markets for Commodities Trading?

Making the right choice in a trading partner is critical. We stand out by offering superior conditions and dedicated support. Our commitment to low latency and tight spreads creates an optimal trading environment for all our clients.

| Feature | Benefit to You |

|---|---|

| Competitive Spreads | Reduce your trading costs and maximize potential returns on every trade. |

| High Liquidity | Execute trades swiftly and efficiently, even in volatile conditions. |

| Advanced Platforms | Utilize industry-leading MetaTrader 4 & 5 for powerful analysis and precise execution. |

| Deep Market Access | Connect directly to global raw material trading venues, ensuring fair pricing. |

“Commodities trading provides a unique opportunity to interact with the foundational elements of the global economy. IC Markets simplifies this access, making it achievable for a wide range of traders.”

Start Your Commodities Journey Today

Ready to explore the vast potential of global raw material trading? IC Markets Commodities offers the tools, access, and conditions you need to succeed. Open an account and begin your journey into the world of oil trading, gold trading, and much more. Diversify your portfolio and harness the power of fundamental market movements with a trusted partner.

Why Trade Commodities with IC Markets?

Embarking on commodities trading requires a partner you can trust, one that combines advanced technology with market access and robust support. IC Markets stands out as a premier destination for traders seeking to capitalize on global price movements. Our focus is on empowering you with the tools and environment to succeed, offering an exceptional gateway to the world of IC Markets Commodities.

Our commitment to low latency and tight spreads creates an optimal trading environment for all our clients.

When you choose to engage with IC Markets Commodities, you are tapping into a trading experience crafted with your needs in mind. We provide direct access to a diverse range of instruments, ensuring you have ample opportunity to diversify your portfolio and react swiftly to market shifts.

Unrivaled Access and Opportunity

We believe in offering a broad spectrum of choices for your commodities trading strategies. You gain exposure to a vast array of assets, from essential energy products to critical agricultural resources and highly sought-after precious metals. This extensive selection allows you to find trading opportunities across different market conditions.

- Diverse Market Range: Trade major commodities including energies, soft commodities, and metals.

- Competitive Pricing: Experience tight spreads and low commissions, designed to keep your trading costs down.

- High Liquidity: Benefit from deep liquidity pools, ensuring fast execution and minimal slippage.

- Flexible Leverage: Tailor your trading approach with flexible leverage options, managing risk according to your strategy.

Key Benefits for Your Trading Journey

Your success is our priority. We continuously refine our offerings to provide an optimal trading environment. Here’s what makes us a preferred choice for commodities traders:

| Feature | Benefit to You |

|---|---|

| Advanced Platforms | Utilize industry-leading platforms like MetaTrader 4, MetaTrader 5, and cTrader for superior charting, analysis, and execution capabilities. |

| Transparent Execution | Enjoy ultra-fast order execution with no dealing desk intervention, ensuring fairness and transparency in every trade. |

| Comprehensive Support | Access 24/7 customer support from a dedicated team ready to assist you with any query or challenge. |

| Educational Resources | Enhance your trading knowledge with a wealth of educational materials, webinars, and market analysis. |

Enjoy ultra-fast order execution with no dealing desk intervention, ensuring fairness and transparency in every trade.

Focus on Specific Commodity Markets

Whether your interest lies in the volatile energy sector or the steady allure of physical assets, we have you covered. For instance, our platform offers excellent conditions for oil trading, allowing you to speculate on crude oil prices with precision and efficiency. Similarly, gold trading provides a classic hedge against inflation and market uncertainty, and we deliver competitive spreads for this vital precious metal.

Engage in the dynamic world of commodities trading with a broker that understands your needs and provides the infrastructure for success. IC Markets offers a comprehensive and robust environment for you to explore, analyze, and execute your trades confidently.

Competitive Spreads on Key Commodities

In the fast-paced world of commodities trading, every pip counts. That’s why securing the most competitive spreads is not just an advantage; it’s a necessity for serious traders. At IC Markets Commodities, we understand this fundamental truth. We meticulously work to bring you ultra-low spreads across a comprehensive range of key instruments, empowering your trading strategy.

Our commitment to competitive pricing means you experience significantly reduced transaction costs. This direct benefit allows you to retain more of your potential profits from each trade. Whether you are engaging in high-volume commodities trading or carefully timing strategic entries and exits, our tight spreads provide a noticeable edge.

Focus your attention on market analysis, knowing that you’re trading with some of the best conditions available. We cover the most sought-after commodities, from energy products like `oil trading` to the timeless value of `precious metals`. When it comes to `gold trading`, for instance, our spreads are engineered to give you maximum efficiency and opportunity.

What do competitive spreads on IC Markets Commodities mean for your trading?

- Increased Profit Potential: Lower costs per trade directly translate to better returns when your positions move in the right direction.

- Enhanced Trading Flexibility: Tight spreads make it easier to enter and exit trades more frequently, capturing smaller market movements.

- Better Risk Management: Reduced costs allow for more precise position sizing and stop-loss placements, helping you manage your capital effectively.

- True Market Reflection: Our spreads aim to reflect underlying market conditions accurately, giving you a transparent trading environment.

Experience the difference that genuine competitive spreads can make to your commodities portfolio. It’s a critical component for success, and we deliver it consistently.

Regulatory Compliance and Fund Security

When you venture into commodities trading, knowing your funds are safe and your broker operates under strict rules gives you immense peace of mind. At IC Markets, regulatory compliance is not just a checkbox; it’s the foundation of trust we build with every client. We empower your trading journey with robust oversight and unwavering dedication to safeguarding your capital.

IC Markets operates under the watchful eye of leading financial authorities globally. These stringent regulatory bodies ensure transparency, fair trading practices, and robust operational standards. This oversight means you engage in commodities trading within a secure and monitored environment, whether you are interested in oil trading or the nuanced world of gold trading. It’s about ensuring a level playing field for all participants.

Protecting your capital is our highest priority. We safeguard client funds through segregated bank accounts. This crucial measure keeps your money separate from the company’s operational funds. In the unlikely event of any financial issues for the company, your funds remain secure and accessible. This segregation is a cornerstone of our commitment, offering peace of mind for those trading IC Markets Commodities, including precious metals.

| Benefit of Strong Regulation | What It Means for Your Trading |

|---|---|

| Enhanced Transparency | Clear, fair pricing and execution in every trade. |

| Fund Segregation | Your capital is always safe and separate from company funds. |

| Independent Dispute Resolution | Access to impartial channels for fairness if issues arise. |

| Operational Integrity | Broker operates under strict ethical and financial standards. |

“Your security is not just a feature; it is our promise. We empower your commodities trading journey with unwavering regulatory adherence and robust fund protection.”

Choosing a broker with impeccable regulatory standing is a non-negotiable step for serious traders. With IC Markets, you gain access to a world of commodities trading, from precious metals to energy, all underpinned by an unshakeable commitment to your security and compliance. Focus on your trading strategies, knowing your investments are in safe hands.

Types of Commodities Available at IC Markets

Diversifying your trading portfolio is a smart move, and IC Markets offers an extensive selection of commodities to help you achieve just that. We provide access to some of the world’s most dynamic markets, allowing you to capitalize on global economic shifts, supply and demand dynamics, and geopolitical events. Explore the exciting opportunities within IC Markets Commodities and expand your trading horizons.

Key Commodity Categories We Offer:

- Energy Commodities: Dive into the crucial energy markets that power the global economy. You can engage in oil trading, for instance, speculating on price movements influenced by supply disruptions, economic growth, and even weather patterns. These markets offer significant volatility and liquidity, attracting traders worldwide.

- Precious Metals: Often seen as safe-haven assets during times of economic uncertainty, precious metals are a vital component of many trading strategies. We facilitate focused gold trading, alongside other valuable precious metals. These markets react sharply to interest rate changes, inflation data, and geopolitical tensions, providing unique trading opportunities.

- Soft Commodities: Engage with markets driven by agriculture, climate, and consumer trends. This category includes popular products like coffee, sugar, and cotton. Understanding global harvest cycles and consumption patterns becomes key to successful trading in these dynamic markets.

- Agricultural Commodities: Beyond soft commodities, we offer broader access to essential agricultural products. These markets allow traders to speculate on the prices of staple foods and industrial crops, influenced by factors such as weather, government policies, and global demand.

Our comprehensive commodities trading options mean you can build a strategy that aligns with your market outlook. Whether you are hedging against inflation, speculating on price direction, or diversifying your overall portfolio, IC Markets provides the instruments and platform you need.

A Snapshot of Available Commodities:

| Commodity Type | Examples | Market Drivers |

|---|---|---|

| Energy | Crude Oil, Natural Gas | Geopolitics, OPEC decisions, global demand, weather |

| Precious Metals | Gold, Silver | Interest rates, inflation fears, economic data, safe-haven demand |

| Softs | Coffee, Sugar | Weather patterns, harvest reports, consumer tastes, global supply |

| Agriculture | Wheat, Corn | Weather forecasts, crop yields, government subsidies, global consumption |

We empower you to take an active role in these essential markets. Explore the diverse world of IC Markets Commodities and find the right fit for your trading journey.

Energy Commodities (Oil, Gas)

The energy sector pulsates with constant movement, offering significant opportunities for astute traders. When you engage in commodities trading, you tap into markets that power industries and nations. IC Markets Commodities provides a robust platform for navigating these dynamic assets, particularly crude oil and natural gas.

Crude oil, the world’s most traded commodity, often dictates global economic trends. Its price shifts reflect geopolitical tensions, supply and demand dynamics, and the health of industrial output. Engaging in oil trading means staying alert to a complex web of factors:

- Global supply fluctuations from major producers.

- Demand changes influenced by economic growth or slowdowns.

- Inventory levels reported by key energy agencies.

- Geopolitical events impacting oil-producing regions.

Natural gas, while often overshadowed by oil, presents its own unique trading landscape. This essential fuel experiences strong seasonal demand, particularly with weather patterns influencing heating and cooling needs. Infrastructure developments, storage levels, and shifts towards cleaner energy sources also heavily sway its price. Understanding these specific drivers gives you a clear edge.

Consider the distinct characteristics of trading these powerful assets:

| Commodity | Primary Market Drivers | Volatility Profile |

|---|---|---|

| Crude Oil | Geopolitical events, global demand, OPEC+ decisions | Often high, influenced by world events |

| Natural Gas | Weather forecasts, storage levels, regional supply/demand | Significant seasonal fluctuations |

Leveraging the advanced tools and competitive conditions available through IC Markets Commodities lets you participate effectively in these critical markets. You gain the power to capitalize on price movements, diversifying your trading portfolio and exploring new avenues for growth.

Precious Metals (Gold, Silver, Platinum)

Diving into the world of commodities trading offers diverse opportunities, and among the most compelling are the precious metals. These assets, including gold, silver, and platinum, have captivated investors and traders for centuries, serving as a benchmark for wealth and a hedge against economic uncertainty. At IC Markets Commodities, you gain access to these fascinating markets, each with its unique drivers and trading characteristics.

Gold Trading: The Ultimate Safe Haven

Gold stands as the quintessential safe-haven asset. For many, engaging in gold trading means navigating a market heavily influenced by geopolitical tensions, interest rate expectations, and inflation concerns. When global markets face turmoil, gold often shines, offering a reliable store of value. Its deep liquidity and global acceptance make it a highly sought-after commodity.

Gold’s enduring appeal lies in its perceived stability and its role as a counter-cyclical asset, often performing well when other investments struggle.

Silver: The Dual-Purpose Metal

Silver, often called ‘poor man’s gold’, boasts a unique dual identity. It functions both as an industrial metal, vital for electronics, solar panels, and medical applications, and as a monetary asset similar to gold. This dual role makes silver’s price movements inherently more volatile and dynamic than its golden counterpart. Its industrial demand links it closely to economic growth, while its investment demand mirrors broader market sentiment for precious metals.

Platinum: The Industrial Powerhouse

Platinum holds significant industrial importance, particularly in the automotive sector where it’s a key component in catalytic converters. Beyond vehicles, it finds uses in jewelry, medical devices, and chemical processes. Supply for platinum is notably scarcer than gold or silver, making its price sensitive to mining disruptions and changes in industrial demand. Traders often analyze global manufacturing data and automotive sales to gauge potential movements in platinum prices.

While markets like those for oil trading focus on energy supply and demand, precious metals offer distinct advantages within a balanced commodities trading portfolio. Consider these benefits:

- Diversification: Adding gold, silver, or platinum can help diversify a portfolio, as their price movements often correlate differently to traditional assets like stocks.

- Inflation Hedge: They historically maintain purchasing power during periods of rising inflation.

- Liquidity: These markets are generally very liquid, allowing for efficient entry and exit points.

Agricultural Products (Corn, Wheat, Coffee)

Dive into the vibrant world of agricultural commodities, a crucial sector influencing global economies and daily lives. Trading products like corn, wheat, and coffee offers unique opportunities to diversify your portfolio and engage with markets driven by fundamental supply and demand.

Agricultural markets provide a fascinating landscape for commodities trading. Unlike industrial metals or energy, these assets respond directly to factors such as weather patterns, harvest reports, and geopolitical developments. This dynamic interplay can create significant price movements, presenting potential for keen traders.

Consider the distinct drivers for these essential goods:

- Corn: A primary feed grain and biofuel source, its price often reacts to planting intentions, yield forecasts, and global demand from livestock and ethanol industries.

- Wheat: A staple food commodity, global supply and regional weather conditions in major producing areas like the US, Europe, and Russia heavily influence its value.

- Coffee: Dependent on specific growing climates, frost scares in Brazil or excessive rains in Vietnam can trigger sharp movements, capturing the attention of traders worldwide.

Engaging with these markets means understanding the global narratives shaping them. IC Markets Commodities offers access to these vital instruments, allowing you to participate in the pricing of our planet’s food and beverage staples. While many traders explore the volatility of oil trading or the traditional safety of precious metals, agricultural products offer a distinct market flavor and a different set of catalysts.

Expand your trading horizons beyond popular assets like gold trading. Explore the intricate connection between climate, consumption, and capital within the agricultural sector. It’s an opportunity to connect with the raw materials that fuel our world, offering depth and diversity to your overall trading strategy.

Understanding IC Markets Commodity Spreads and Fees

Diving into the world of IC Markets Commodities means exploring exciting opportunities across various markets. But like any savvy investor, you know that understanding the costs involved is paramount. Transparent pricing directly impacts your bottom line, and at IC Markets, we make sure you have a clear picture of commodity spreads and any associated fees.

What Spreads Mean for Your Commodities Trading

Think of a spread as the primary cost of executing a trade. It’s simply the difference between the buying price (ask) and the selling price (bid) of an asset. For commodities trading, this spread is your entry ticket. We operate with variable spreads, meaning they fluctuate based on market volatility, liquidity, and supply and demand. This dynamic approach often results in tighter spreads during peak market hours, reflecting true market conditions.

IC Markets Commodity Spreads: A Closer Look

IC Markets is renowned for providing some of the most competitive spreads in the industry. We connect you to deep liquidity pools from top-tier providers, which translates into minimal price discrepancies and efficient trade execution. Whether your interest lies in oil trading, exploring the market for precious metals, or focusing on gold trading, you will find our pricing structure designed to support your profitability.

Here’s a glimpse at how competitive spreads can look on popular IC Markets Commodities:

| Commodity | Typical Spread (pips) | Market Type |

|---|---|---|

| Crude Oil (WTI) | 0.03 – 0.05 | Energy |

| Gold (XAU/USD) | 0.15 – 0.25 | Precious Metal |

| Silver (XAG/USD) | 0.015 – 0.025 | Precious Metal |

| Natural Gas | 0.003 – 0.005 | Energy |

Please note: These are typical spreads and can vary based on market conditions and liquidity.

Beyond Spreads: Essential Fees to Consider

While spreads form the core of your trading costs, smart traders always consider other potential fees. IC Markets maintains a transparent approach, ensuring you know exactly what to expect:

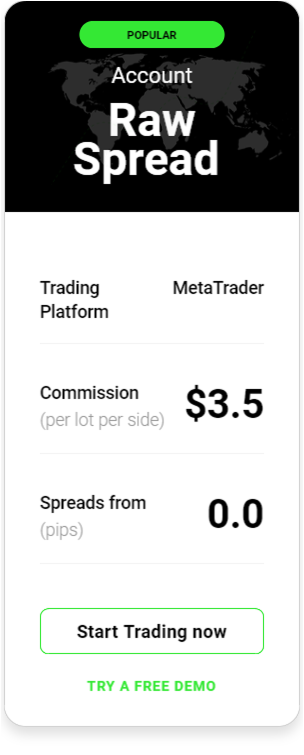

- Commissions: For Raw Spread accounts, a small commission per lot applies. Our Standard accounts, however, are commission-free, with slightly wider spreads built-in.

- Swap Rates (Overnight Financing): If you hold a position open past the daily market close (typically 5 PM New York time), a small interest charge or credit, known as a swap, applies. This reflects the interest rate differential between the two currencies in a pair.

- Deposit/Withdrawal Fees: We offer a wide range of free deposit options. For withdrawals, most methods are free, though some international bank transfers might incur a fee from intermediary banks, not from IC Markets.

Why Transparent Costs Supercharge Your Trading

Understanding and managing your trading costs is a cornerstone of successful commodities trading. Every pip saved on a spread, every avoided fee, directly contributes to your potential profits. This transparency empowers you to calculate your potential returns and risks more accurately, refine your strategy, and make confident decisions in the fast-paced commodity markets.

Ready to experience competitive pricing and transparent fees? Explore the full range of IC Markets Commodities and elevate your trading journey today!

Leveraging CFD Trading for IC Markets Commodities

Unlock dynamic market opportunities with Contracts for Difference (CFDs) when exploring IC Markets Commodities. This powerful trading instrument allows you to speculate on price movements without owning the underlying asset. It offers remarkable flexibility and direct access to a diverse range of global markets, making it a compelling choice for traders seeking to capitalize on commodity price fluctuations.

Engaging in commodities trading through CFDs provides several distinct advantages over traditional methods:

- Trade Both Ways: Gain the ability to trade both rising and falling markets by going long or short, opening up opportunities regardless of market direction.

- Leverage Potential: Utilize leverage to control larger positions with a smaller capital outlay, potentially amplifying returns (while also increasing risk, so manage it wisely).

- Global Access: Access a wide array of global commodity markets around the clock, providing extensive trading hours.

- Cost-Efficiency: Often involves lower transaction costs compared to buying physical assets, making entry and exit more efficient.

IC Markets offers a comprehensive selection within its commodities portfolio, allowing you to diversify your strategy across various sectors. For instance, you can dive into the volatile world of energy markets. Many traders engage in oil trading, responding quickly to geopolitical events and supply-demand shifts. This is a fast-paced environment for those who closely follow global economic indicators.

Discover the stability and allure of precious metals. Here, gold trading often attracts attention, frequently seen as a safe-haven asset, alongside silver and platinum. These markets present distinct opportunities, driven by factors like economic uncertainty, inflation concerns, and industrial demand. Beyond metals and energy, you can also explore soft commodities, from agricultural products like coffee and sugar to various grains, where price movements are influenced by weather patterns, crop yields, and global consumption trends.

Choosing IC Markets for your commodities CFD trading provides a robust and reliable environment. Benefit from competitive spreads and ultra-fast execution speeds, which are crucial for navigating dynamic commodity markets effectively. Our advanced trading platforms equip you with the tools needed for comprehensive market analysis and proficient risk management. Experience a seamless trading journey designed to empower your strategies and help you make informed decisions.

Ready to explore the exciting potential of IC Markets Commodities? Start your journey today and tap into the global marketplace with confidence.

The Benefits of Low Latency Trading for Commodities

In the dynamic world of financial markets, speed is king, especially when it comes to commodities trading. Low latency trading refers to the incredibly fast execution of trades, minimizing the time between when you place an order and when it gets filled. This rapid-fire execution delivers a crucial edge for anyone looking to navigate the often-volatile commodities market.

For traders dealing with IC Markets Commodities, understanding and leveraging low latency capabilities can significantly impact your bottom line and overall trading experience. Here are some compelling benefits:

- Precision Trade Execution: Low latency systems ensure your trade orders reach the exchange and get filled at lightning speed. This precision helps you secure prices very close to your intended entry or exit points, minimizing slippage that can erode profits, especially in fast-moving markets.

- Capture Fleeting Opportunities: The commodities market, particularly for assets like oil trading or gold trading, reacts instantly to global news and economic data. With low latency, you gain the ability to react just as quickly. You can capitalize on sudden price movements, entering or exiting positions with unparalleled swiftness before market conditions shift again.

- Superior Risk Management: Effective risk management is non-negotiable. Fast execution means your stop-loss orders trigger and fill with minimal delay, protecting your capital when the market moves against you. This immediate response capacity is vital for managing exposure, particularly with highly volatile instruments like precious metals.

- Enhanced Market Insight: Low latency isn’t just about order execution; it also applies to receiving market data. Faster data feeds mean you see price changes and market depth updates sooner. This clearer, real-time picture allows you to make more informed decisions, giving you an analytical advantage over those with slower connections.

- Competitive Advantage: Ultimately, low latency provides a significant competitive edge. It allows you to operate with institutional-grade speed and reliability, ensuring your strategies are implemented exactly when intended. This technological sophistication empowers you to perform at your peak in the demanding commodities trading arena.

Embracing low latency trading technology transforms how you engage with the commodities market, offering greater control, speed, and precision in every trade you make.

How to Open an IC Markets Account for Commodity Trading

Ready to explore the dynamic world of commodities trading? Opening an account with IC Markets is your direct gateway to markets spanning energies, metals, and agricultural products. Setting up your IC Markets Commodities account is a smooth, efficient process designed to get you trading quickly. We guide you through each step, ensuring you understand exactly how to begin your journey.

Your Step-by-Step Guide to Account Opening

Getting started with IC Markets for commodities trading is simpler than you think. Follow these clear steps to set up your account and prepare for market action:

- Start Your Registration: Visit the official IC Markets website. Locate the "Open Live Account" button and click it. You'll provide basic information like your email address and create a secure password.

- Input Your Personal Details: Complete the application form with your personal information. This includes your name, date of birth, country of residence, and contact number. Ensure all details match your identification documents for a seamless verification process.

- Select Your Account & Platform: IC Markets offers various account types tailored to different trading styles. For commodities trading, you might consider an account that aligns with your volume and strategy. Also, choose your preferred trading platform, such as MetaTrader 4, MetaTrader 5, or cTrader. Each offers robust tools for market analysis and execution, perfect for tracking precious metals or managing oil trading positions.

- Trading Experience & Knowledge: The platform will ask about your trading experience and financial knowledge. This helps IC Markets provide services suitable for your expertise level, upholding regulatory requirements. Be honest in your responses.

- Verify Your Identity: This is a crucial step for compliance and security. You will need to upload copies of identification documents, typically a government-issued ID (like a passport or driver's license) and a proof of residence (such as a utility bill or bank statement). Make sure these documents are clear and valid.

- Fund Your Account: Once your account is verified, you can deposit funds. IC Markets supports a wide range of secure funding methods, including bank transfers, credit/debit cards, and various e-wallets. Choose the method most convenient for you to start gold trading or enter other commodity markets.

Why Choose IC Markets for Commodities?

IC Markets stands out as a premier broker for those interested in commodities. Here's why:

| Feature | Benefit for Commodity Traders |

|---|---|

| Competitive Spreads | Lower costs mean more potential profit on your trades. |

| Deep Liquidity | Fast execution and minimal slippage, even in volatile markets. |

| Diverse Instruments | Trade a broad spectrum of IC Markets Commodities, including precious metals, energies, and soft commodities. |

| Advanced Platforms | Utilize sophisticated tools for analysis and strategy development, enhancing your oil trading or gold trading experience. |

You gain access to a powerful environment for navigating the commodity markets. Whether your interest lies in precious metals like gold and silver, or energy commodities such as Crude Oil, IC Markets provides the tools and conditions you need.

Tips for New Commodity Traders

As you prepare to open your IC Markets account and dive into commodities, consider these practical tips:

- Educate Yourself: Understand the factors influencing commodity prices. Geopolitical events, supply and demand shifts, and economic data all play a role.

- Start Small: Begin with smaller position sizes as you gain experience. This helps manage risk effectively while you learn the market dynamics.

- Risk Management: Always implement stop-loss orders. Protecting your capital is paramount in the often-volatile commodities market.

- Stay Informed: Keep an eye on global news and economic calendars. Events can quickly impact the prices of IC Markets Commodities, from oil trading to agricultural products.

Opening your IC Markets account for commodity trading is your first step toward seizing opportunities in these exciting markets. Take action today and set yourself up for success!

Funding Your IC Markets Commodities Trading Account

Getting started with IC Markets Commodities is straightforward, and the first crucial step is funding your trading account. We understand that quick, secure, and flexible deposit options are vital for serious traders. Whether you’re looking to dive into commodities trading, explore precious metals, or engage in oil trading, having your funds ready ensures you never miss a market opportunity.

Your journey to accessing a diverse range of global commodities begins with a simple deposit. We’ve optimized our process to make it as seamless as possible, allowing you to focus on your trading strategies, not on administrative hurdles.

Deposit Methods at a Glance

IC Markets offers a wide array of funding solutions designed to suit traders worldwide. Here’s a quick overview of popular methods:

| Method | Description | Typical Processing Time |

|---|---|---|

| Credit/Debit Card | Instant deposits using Visa or Mastercard. | Instant |

| Bank Wire Transfer | Direct transfer from your bank account. Ideal for larger sums. | 2-5 Business Days |

| Neteller / Skrill | Popular e-wallet solutions for quick and secure transfers. | Instant |

| PayPal | A widely recognized digital payment platform. | Instant |

| Local Bank Transfers | Available in various regions, often offering faster local processing. | Instant to 1 Business Day |

Choosing Your Best Funding Option

Selecting the right deposit method for your IC Markets Commodities account involves a few considerations. Think about what works best for your specific needs:

- Speed: If you need immediate access to the market for gold trading or other fast-moving commodities, instant deposit methods like credit cards or e-wallets are your best bet.

- Fees: While IC Markets aims to keep fees low, some payment providers may charge their own transaction fees. Always check these details.

- Convenience: Opt for a method you already use and trust, making the funding process familiar and stress-free.

- Currency: Ensure your chosen method supports your preferred base currency to minimize conversion costs.

Once your account is funded, you’re ready to explore the exciting world of IC Markets Commodities. Prepare to engage with global markets and trade with confidence.

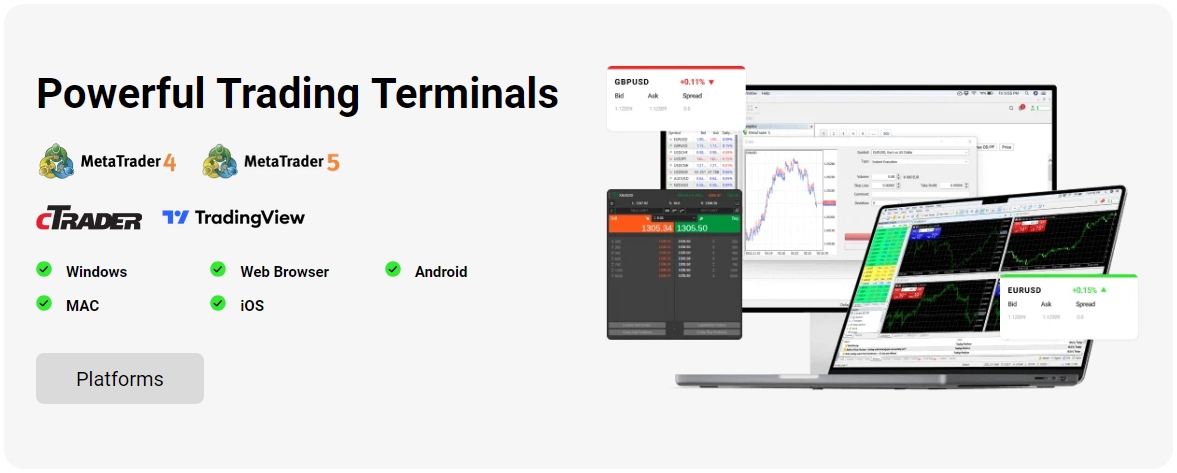

Advanced Trading Platforms for IC Markets Commodities

Unlocking your potential in `commodities trading` demands more than just market access; it requires sophisticated tools. `IC Markets Commodities` provides a powerful suite of advanced trading platforms designed to give you precision, speed, and control. We understand that every trader has unique needs, which is why we offer industry-leading options that empower you to navigate volatile markets with confidence.

Our platforms are engineered for high performance, ensuring seamless execution whether you are focused on `oil trading`, `gold trading`, or other `precious metals`. They come packed with analytical tools, customizable interfaces, and features that cater to both new and experienced traders.

MetaTrader 4 (MT4): The Industry Standard

MetaTrader 4 remains a global favorite for a reason. It is robust, reliable, and incredibly user-friendly, making it an excellent choice for anyone stepping into the world of `commodities trading`. MT4 offers comprehensive charting capabilities, a wide array of technical indicators, and support for automated trading through Expert Advisors (EAs). You gain direct market access and execute trades swiftly, whether you are scalping or engaging in longer-term strategies. Its intuitive design means less time learning the software and more time focusing on your trades.

MetaTrader 5 (MT5): Next-Generation Trading

For traders seeking even more power and flexibility, MetaTrader 5 delivers. Building upon the success of MT4, MT5 introduces additional timeframes, a deeper market depth, and an expanded set of technical indicators and graphical objects. It supports more asset classes, providing a versatile environment for `IC Markets Commodities` and other markets. MT5’s multi-threaded strategy tester is a game-changer for backtesting EAs, offering faster and more accurate results. This platform is perfect for those who demand cutting-edge features and advanced analytical tools.

cTrader: Designed for Deep Liquidity

cTrader stands out with its modern interface and direct market access through an ECN (Electronic Communication Network) environment. It prioritizes transparency and lightning-fast execution, making it an ideal choice for serious `commodities trading`. With cTrader, you get advanced order types, customizable charts, and Level II pricing. Its unique features, like advanced take profit and stop loss, provide unparalleled control over your positions. Traders who value deep liquidity and precise order management often gravitate towards cTrader for their `precious metals` and energy market endeavors.

Key Features You Can Expect

- Advanced Charting Tools: Utilize a vast selection of indicators, drawing tools, and multiple timeframes to analyze market trends effectively.

- Automated Trading: Deploy Expert Advisors (EAs) to automate your strategies and capitalize on market movements around the clock.

- Real-time Market Data: Access live pricing and market depth information to make informed decisions for your `IC Markets Commodities` trades.

- Customization Options: Personalize your trading environment, from chart layouts to hotkeys, optimizing your workflow.

- Mobile Trading: Stay connected and manage your positions on the go with powerful mobile applications available for iOS and Android.

Platform Feature Snapshot

| Feature | MetaTrader 4 | MetaTrader 5 | cTrader |

|---|---|---|---|

| Interface | Classic, Functional | Modern, Enhanced | Sleek, Intuitive |

| Timeframes | 9 | 21 | 26 |

| Order Types | Basic | Advanced, Expanded | Custom, ECN Specific |

| Market Depth | Basic (Level 1) | Advanced (Level 2) | Full (Level 2) |

Each platform offers distinct advantages, catering to different trading styles and preferences within `IC Markets Commodities`. We encourage you to explore them and find the perfect fit that complements your `commodities trading` strategy.

Risk Management Strategies for Commodity Trading

Navigating the dynamic world of commodities trading offers exciting opportunities, but it also comes with inherent risks. Mastering risk management is not just a suggestion; it’s essential for long-term success. With IC Markets Commodities, you gain access to a powerful platform, but your approach to managing potential downside is what truly sets you apart. Let’s explore robust strategies to protect your capital and maximize your potential.

Understand Your Exposure: Position Sizing

Never risk more than a small percentage of your total trading account on one trade.

Before placing any trade, define how much capital you are willing to risk on a single position. This foundational principle prevents a few losing trades from significantly depleting your capital. Consider your account size and the volatility of the specific commodity you are trading. For instance, oil trading can experience rapid price swings, requiring careful calculation of your position size.

Protect Your Capital with Stop-Loss Orders

Stop-loss orders are your best friend in the commodities trading arena. They automatically close your trade if the price moves against you to a predetermined level. This limits your potential loss and removes emotional decision-making during volatile market conditions. Set your stop-loss based on technical analysis, support and resistance levels, or a percentage of your maximum acceptable loss per trade. Always place them; never second-guess this crucial step.

Diversify Your Portfolio: Spread the Risk

Don’t put all your eggs in one basket. Diversification means spreading your investments across different types of commodities. Instead of focusing solely on energy, consider adding precious metals like gold trading, or perhaps agricultural products. If one commodity sector experiences a downturn, others in your diversified portfolio might remain stable or even increase, buffering your overall results. This strategy smooths out equity curves and reduces the impact of unforeseen events in a single market.

Leverage: A Double-Edged Sword

IC Markets Commodities offers leverage, which can amplify your profits with a relatively small initial outlay. However, leverage also magnifies losses. Use it judiciously. Understand the margin requirements for each commodity and trade within your comfortable risk tolerance. Over-leveraging is a common pitfall that can quickly erode your account. Always be aware of your margin usage and available equity.

Continuous Market Monitoring and Adjustment

Markets are ever-changing. What works today might not work tomorrow. Stay informed about global economic news, geopolitical events, and supply-demand dynamics impacting your chosen commodities. Regularly review your open positions and adjust your stop-loss levels or take-profit targets as market conditions evolve. Flexibility and adaptability are hallmarks of successful traders.

Here’s a quick overview of key risk management tools:

| Strategy | Benefit | Action |

|---|---|---|

| Position Sizing | Limits per-trade loss | Trade small, defined amounts |

| Stop-Loss Orders | Automates loss limitation | Always place them |

| Diversification | Spreads overall risk | Trade various commodities |

Develop a Robust Trading Plan

A comprehensive trading plan is your roadmap. It outlines your entry and exit criteria, risk-per-trade rules, preferred markets (like precious metals or energy), and your overall trading goals. Stick to your plan, and only deviate if your analysis strongly warrants it. Emotional trading often leads to poor decisions. IC Markets Commodities provides the tools; your disciplined execution of a well-defined plan drives your success.

“The key to long-term success in trading is not about avoiding losses entirely, but about managing them effectively when they occur.”

By implementing these robust risk management strategies, you set yourself up for a more controlled and potentially more profitable experience in commodities trading. Take control of your trading journey; learn more about the tools and resources available for effective risk management at IC Markets Commodities today!

Analyzing Market Trends in Commodity Futures

Understanding the pulse of the market is paramount for any successful trading strategy. When it comes to commodities trading, meticulous market trend analysis is not just a recommendation; it’s a necessity. At IC Markets Commodities, we empower traders to navigate these dynamic markets with clarity and confidence, offering access to a wide range of instruments.

Market trends in commodity futures are influenced by a complex web of factors. Keeping an eye on these drivers helps you anticipate price movements and make informed decisions. It’s about spotting opportunities before they become obvious to everyone else.

Key Drivers Shaping Commodity Trends

- Supply and Demand Dynamics: This is the bedrock. Geopolitical events, weather patterns, and global economic shifts directly impact the availability and consumption of raw materials.

- Economic Indicators: Data like inflation rates, industrial output, and interest rate decisions can signal broader economic health, which in turn affects demand for industrial and energy commodities.

- Geopolitical Events: Conflicts, trade agreements, and political instability in major producing or consuming regions often trigger significant price volatility, especially in crucial sectors like oil trading.

- Currency Fluctuations: Since many commodities are priced in USD, a stronger or weaker dollar can make commodities more or less expensive for international buyers, influencing demand and prices.

- Technological Advancements: New extraction methods or renewable energy innovations can alter supply landscapes and demand patterns over time.

Consider the volatility often seen in energy markets. A sudden shift in global supply or demand can send ripples through oil prices. Similarly, for precious metals like gold, economic uncertainty or geopolitical tensions frequently drive investors toward these safe-haven assets, boosting gold trading activity.

Approaches to Market Trend Analysis

Successful traders often blend various analytical techniques to get a comprehensive view:

| Analysis Type | Focus | Key Questions |

|---|---|---|

| Fundamental Analysis | Underlying economic forces, supply/demand | What factors are *driving* the price? |

| Technical Analysis | Price action, chart patterns, indicators | What does the *market history* suggest? |

Combining these approaches provides a robust framework. For instance, fundamental analysis might highlight a potential supply crunch in crude oil, while technical analysis could pinpoint optimal entry and exit points for your commodities trading strategy.

“Understanding the narrative behind the numbers is what truly unlocks insight in commodity markets.”

Embarking on your journey with IC Markets Commodities means accessing a platform built for sophisticated analysis and seamless execution. We believe that with the right tools and a keen eye on market trends, you can position yourself for success. Ready to elevate your trading?

The Role of Economic Indicators in Commodity Prices

Understanding economic indicators is not just an advantage; it’s a necessity for anyone engaging in commodities trading. These vital data points act as the pulse of the global economy, directly influencing supply and demand dynamics, and consequently, the price movements of everything from crude oil to precious metals. Mastering their interpretation empowers you to make informed decisions and navigate the volatile landscape of the commodity markets with greater confidence.

Economic indicators provide invaluable insights into the health and direction of the global economy. They signal shifts in industrial production, consumer spending, inflation, and interest rates – all factors that directly impact commodity valuations. For instance, robust economic growth typically fuels demand for raw materials, while inflationary pressures often steer investors toward safe-haven assets like gold trading.

Consider these key indicators and their influence:

- Gross Domestic Product (GDP): A primary measure of economic activity. Strong GDP growth often translates to increased industrial output and higher demand for energy and industrial metals, positively impacting oil trading and other base commodities.

- Inflation Data (CPI, PPI): Consumer Price Index and Producer Price Index reveal inflationary trends. Rising inflation can erode purchasing power, leading investors to seek refuge in tangible assets such as precious metals, boosting their appeal.

- Interest Rates: Central bank decisions on interest rates significantly affect the cost of borrowing and the strength of a currency. Higher rates can strengthen the currency, making dollar-denominated commodities more expensive for international buyers, potentially dampening demand.

- Employment Reports: Data like Non-Farm Payrolls and unemployment rates reflect consumer confidence and spending power. A strong job market can indicate robust economic activity, indirectly supporting demand for various commodities.

- Industrial Production: This indicator directly measures the output of the manufacturing, mining, and utility sectors. An uptick here signals increased demand for raw materials used in production.

The relationship between economic indicators and commodity prices is dynamic and often intricate. For example, a surge in manufacturing activity (reflected in industrial production data) typically drives up the price of base metals and energy. Conversely, a weakening economy might see a flight to safety, where investors pivot towards gold trading, often perceived as a hedge against economic uncertainty.

| Indicator Signal | Potential Commodity Impact |

|---|---|

| Strong GDP Growth | Increased demand for industrial commodities, energy (oil trading) |

| High Inflation | Increased demand for precious metals (gold trading) as a hedge |

| Rising Interest Rates | Stronger currency, potentially higher cost for international buyers of commodities |

Successful commodities trading hinges on your ability to synthesize these economic signals and anticipate market reactions. It is not just about knowing what the indicators are, but understanding their forward-looking implications. For example, if manufacturing PMI data points to an expansion, you might anticipate increased demand for industrial inputs. Keeping a close watch on these developments allows you to position yourself strategically within various markets, including those offered by IC Markets Commodities.

Ready to apply these insights and elevate your commodities trading strategy? By understanding the crucial role of economic indicators, you gain a powerful lens through which to view market opportunities. Join us to access the tools and resources you need to trade a diverse range of commodities effectively.

Customer Support and Resources for IC Markets Traders

Navigating the dynamic world of financial markets requires solid support. Whether you are a novice or an experienced professional, having access to excellent customer service and rich educational materials makes a significant difference in your trading journey. IC Markets understands this critical need, providing comprehensive support and resources designed to empower every trader. This commitment extends across all instruments, including those interested in IC Markets Commodities.

Dedicated Customer Support Channels

Getting help when you need it is paramount. IC Markets delivers responsive and accessible support through multiple channels, ensuring you always have a way to connect with a knowledgeable team member. They prioritize quick resolutions and clear communication.

- 24/7 Live Chat: Instant messaging connects you directly with support staff, perfect for urgent queries or quick assistance anytime, day or night.

- Email Support: For detailed inquiries or documentation, email provides a reliable channel. Expect prompt and thorough responses addressing your specific concerns.

- Phone Support: Prefer to speak with someone directly? Phone lines are available around the clock, offering personalized assistance and immediate troubleshooting.

This multi-channel approach ensures that whether you have a question about account management, platform functionality, or specific aspects of commodities trading, help is readily available.

Empowering Educational Resources

Knowledge is power in trading. IC Markets invests heavily in providing a wealth of educational content, helping traders sharpen their skills and understand market mechanics better. From foundational concepts to advanced strategies, their resources cover a broad spectrum.

- Trading Guides & Tutorials: Access an extensive library of articles and step-by-step guides. Learn about market analysis, risk management, and how to execute trades effectively.

- Video Library: Visual learners benefit from a collection of video tutorials explaining platform features, market insights, and trading techniques. This includes specific content on various asset classes.

- Webinars & Seminars: Participate in live sessions led by market experts. These interactive events offer invaluable insights into current market trends and provide opportunities to ask questions directly.

- Glossaries & FAQs: Quickly find definitions for industry terms and answers to frequently asked questions about account settings, funding, and trading conditions.

These resources are particularly beneficial for those delving into commodities trading. You can find specialized content covering everything from the intricacies of oil trading and gold trading to broader market dynamics influencing precious metals. Understanding these nuances helps you make informed decisions.

Robust Market Analysis Tools

Beyond direct support and education, IC Markets equips traders with powerful analytical tools and up-to-date market information. These resources help you monitor market movements, identify opportunities, and refine your strategies.

| Resource Type | Benefit to Traders |

|---|---|

| Economic Calendar | Track upcoming economic events and announcements that impact market volatility. |

| Market News & Analysis | Stay informed with real-time news feeds and expert commentary on global markets. |

| Advanced Charting Tools | Utilize sophisticated charts with numerous indicators for in-depth technical analysis. |

By leveraging these analytical tools, traders gain a clearer perspective on market conditions, whether they are focusing on major forex pairs or actively participating in the IC Markets Commodities market. This holistic approach to support and resources truly helps traders succeed.

Comparing IC Markets with Other Commodity Brokers

Choosing the right broker is a pivotal step for success in commodities trading. With countless options available, understanding where a broker like IC Markets stands against its competitors is crucial. We empower you to make an informed decision by highlighting key differentiators and shared industry standards. IC Markets Commodities offers a robust environment for traders, but let’s dive into the specifics of how it truly compares.

When evaluating brokers for your commodities trading needs, several factors come into play. These range from the sheer breadth of assets offered to the underlying costs and technological infrastructure. Your trading experience hinges on these critical elements.

Market Access and Instrument Variety

One primary area of comparison is the range of markets and instruments available. Many brokers offer basic access to major commodities. However, IC Markets stands out with its extensive selection. You gain access to popular energy products for oil trading, a wide array of precious metals for those interested in gold trading and silver, along with agricultural commodities and softs. This broad offering allows for greater diversification and more strategic trading opportunities.

- IC Markets: Offers a comprehensive suite including energies, metals, and softs, catering to diverse commodities trading strategies. Their selection of precious metals is particularly strong.

- Competitors: Often focus on a narrower range, typically major crude oil contracts and perhaps gold, but may lack depth in other areas.

Spreads, Commissions, and Costs

Cost efficiency is paramount for any trader. Lower spreads and transparent commissions directly impact your profitability. Here’s a quick look at how IC Markets generally stacks up:

| Cost Factor | IC Markets (Typical) | Other Brokers (Average) |

|---|---|---|

| Raw Spreads | From 0.0 pips | From 0.8 pips |

| Commission (per lot) | Low, flat fee | Variable, sometimes hidden |

| Overnight Fees | Clearly disclosed | Can vary widely |

IC Markets is well-known for its competitive raw spreads, particularly on their True ECN accounts. This means you often get closer to the interbank market prices, which can make a significant difference in your long-term trading costs, especially for active traders in oil trading or gold trading.

Trading Platforms and Tools

The quality and reliability of trading platforms are non-negotiable. IC Markets offers industry-leading platforms such as MetaTrader 4, MetaTrader 5, and cTrader. These platforms provide advanced charting tools, expert advisor capabilities, and fast execution speeds. While many brokers offer MT4, not all provide the full suite of options or the same level of seamless integration and robust server infrastructure.

“Fast, reliable execution is not just a luxury; it’s a necessity in volatile commodity markets. Our technology ensures minimal slippage, giving traders an edge,” states one of our lead market analysts.

Regulation and Trader Security

The security of your funds and data is critical. IC Markets operates under regulation from multiple reputable financial authorities. This multi-jurisdictional regulation provides a higher level of oversight and protection for clients. Always ensure any broker you consider has robust regulatory compliance. While many brokers are regulated, the strength and reputation of their regulators can differ significantly.

Customer Support and Educational Resources

Effective customer support and comprehensive educational materials enhance your trading journey. IC Markets provides 24/7 multilingual customer support, ensuring you get assistance whenever you need it. They also offer various educational resources, helping both new and experienced traders refine their skills in commodities trading. Some competitors may offer limited support hours or less extensive educational content, impacting your ability to resolve issues or learn effectively.

Mobile Trading Options for IC Markets Commodities

The world of financial markets never stops, and neither should your ability to trade. For anyone engaged in IC Markets Commodities, staying connected on the go is not just a luxury; it’s a necessity. Modern technology empowers you to manage your positions, analyze market movements, and execute trades right from your pocket. This ensures you never miss a critical opportunity, whether you are dealing with traditional commodities trading or specialized markets.

IC Markets understands this need, offering robust mobile trading solutions designed for performance and ease of use. You can access the comprehensive suite of commodities through the industry-leading MetaTrader 4 (MT4) and MetaTrader 5 (MT5) mobile applications. These platforms are available on both iOS and Android devices, bringing the full power of desktop trading to your smartphone or tablet.

What can you expect from these mobile platforms when trading IC Markets Commodities? Plenty of features streamline your experience:

- Real-time Market Data: Get instant quotes for all available commodities, including vital information for oil trading and gold trading, ensuring you always have the latest prices.

- Advanced Charting Tools: Utilize a wide array of technical indicators and chart types to perform in-depth analysis directly on your device. Spot trends and make informed decisions about your precious metals positions.

- Full Account Management: Deposit funds, withdraw profits, and review your trading history with just a few taps.

- Multiple Order Types: Place market, limit, stop, and trailing stop orders with ease, managing risk and executing your strategy effectively.

- Customizable Interface: Tailor your watchlists, charts, and news feeds to focus on the commodities that matter most to your trading strategy.

These mobile applications deliver a seamless and intuitive interface, making them perfect for both new and experienced traders. You gain the flexibility to react to global events, manage open positions, and plan future trades for IC Markets Commodities from any location with an internet connection. Imagine analyzing a sudden shift in the oil market or a price movement in precious metals while commuting – that’s the power mobile trading offers. Take control of your commodities trading experience and ensure you are always ahead of the curve.

Expanding Your Portfolio with IC Markets Commodity CFDs

Ready to add a new dimension to your investment strategy? Exploring IC Markets Commodities offers a powerful way to diversify your portfolio beyond traditional assets. Engaging in commodities trading allows you to capitalize on market movements of essential global resources, providing unique opportunities for growth and risk management. With IC Markets, you gain direct access to a wide array of commodity CFDs, making it simple to expand your trading horizons.

Commodities have always played a critical role in the global economy. They represent tangible assets that can offer a hedge against inflation or provide speculative opportunities based on supply and demand dynamics. Whether you are looking to balance your existing holdings or seek new avenues for potential profit, IC Markets provides the tools and environment to make informed trading decisions.

Our comprehensive offering includes a vast selection of IC Markets Commodities. Dive into the world of precious metals, where gold trading offers a classic safe-haven asset, alongside silver, platinum, and palladium. Beyond metals, you can engage in energy markets with opportunities in oil trading, natural gas, and more. Agricultural commodities like coffee, sugar, and cotton also present intriguing possibilities. This diverse selection ensures you can find the markets that best align with your strategy and risk appetite.

Here’s why trading commodity CFDs with IC Markets stands out:

- Broad Market Access: Trade a wide range of commodities from a single account, including energy, metals, and agriculture.

- Competitive Spreads: Benefit from tight spreads and low commissions, enhancing your potential profitability.

- Flexible Leverage: Utilize leverage to maximize your exposure and potential returns, understanding the associated risks.

- Advanced Platforms: Access industry-leading trading platforms like MetaTrader 4, MetaTrader 5, and cTrader, equipped with powerful analysis tools.

- Reliable Execution: Experience ultra-fast trade execution, ensuring you can enter and exit positions precisely when you intend.

A look at some popular IC Markets Commodity CFD categories:

| Commodity Type | Examples | Market Drivers |

|---|---|---|

| Precious Metals | Gold, Silver, Platinum | Geopolitical events, inflation, interest rates |

| Energy | Crude Oil, Natural Gas | Supply disruptions, global demand, OPEC decisions |

| Agriculture | Coffee, Sugar, Wheat | Weather patterns, harvest reports, consumption trends |

Expanding your portfolio with IC Markets Commodity CFDs offers an exciting pathway to explore new market dynamics and potentially enhance your financial outcomes. Take control of your investment future and discover the vast potential of commodities trading today. We empower you with the resources and reliability you need to succeed.

Diversifying with IC Markets Commodities

Smart investors always seek ways to spread risk and seize new opportunities. Adding diverse assets to your portfolio builds resilience and opens doors to different market drivers. Think beyond traditional stocks and forex. IC Markets Commodities offers a powerful avenue for achieving precisely that.

Engaging in commodities trading provides a unique hedging mechanism against inflation and geopolitical events. These markets often move independently of equity markets, offering a valuable counterbalance. This distinction enhances your portfolio’s stability, giving you exposure to fundamental global economic forces.

With IC Markets Commodities, you access a broad spectrum of global markets. Consider the inherent stability offered by precious metals. Many traders look to gold trading as a safe haven during uncertain times, or they capitalize on energy market dynamics through oil trading. These instruments react to different global indicators than equities, providing true diversification.

Here are just a few commodity types available through IC Markets:

| Commodity Type | Market Examples |

|---|---|

| Metals | Gold, Silver, Platinum |

| Energies | Crude Oil, Natural Gas |

| Softs | Coffee, Sugar, Cotton |

Choosing IC Markets Commodities means you trade with competitive conditions and robust execution. Their platform ensures you can manage your diversified portfolio effectively. It’s about having the tools and access to truly broaden your market exposure and implement sophisticated diversification strategies.

Ready to explore a world beyond conventional assets? Unlock new potential and strengthen your financial future by diversifying with IC Markets Commodities today.

Frequently Asked Questions

What are IC Markets Commodities?

IC Markets Commodities provide traders access to a wide range of raw material markets, including energy products (like oil and natural gas), precious metals (gold, silver, platinum), and agricultural goods (corn, wheat, coffee), allowing diversification and speculation on global supply and demand.

What types of commodities can I trade with IC Markets?

You can trade various types of commodities, including Energy Commodities (Crude Oil, Natural Gas), Precious Metals (Gold, Silver, Platinum), Soft Commodities (Coffee, Sugar), and other Agricultural Products (Wheat, Corn), enabling diverse trading strategies.

How do IC Markets ensure competitive pricing for commodities?

IC Markets is known for offering ultra-low, competitive spreads across its commodity instruments, especially on Raw Spread accounts. They connect to deep liquidity pools from top-tier providers, reducing transaction costs and aiming for efficient trade execution.

What advanced trading platforms does IC Markets offer for commodities trading?

IC Markets provides industry-leading platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These platforms are equipped with advanced charting tools, automated trading capabilities, real-time market data, and mobile access to facilitate precise and efficient commodities trading.

Why is risk management crucial when trading commodities with IC Markets?

Risk management is essential in commodities trading due to inherent market volatility. Strategies like proper position sizing, using stop-loss orders, diversifying portfolios, and judiciously using leverage are critical to protect capital and maximize potential, supported by IC Markets’ tools and transparent environment.