Ever wished you could trade the markets like a seasoned professional? Imagine harnessing the expertise of successful traders and having their strategies automatically replicated in your own account. Welcome to the world of IC Markets cTrader Copy Trading, a revolutionary approach to social trading. This guide will show you how to tap into a global network of signal providers, analyze their performance, and start mirroring their success. Your journey to smarter, automated trading starts right here.

- What Exactly is cTrader Copy Trading?

- Why Choose IC Markets for Your Copy Trading Journey?

- Benefit from Raw Spreads and Ultra-Fast Execution

- Trade in a Secure and Regulated Environment

- How Does the cTrader Copy System Function?

- A Step-by-Step Guide to Getting Started

- Setting Up and Funding Your IC Markets cTrader Account

- Navigating the cTrader Copy Platform Interface

- Key Features and Tools for Investors

- How to Find and Evaluate Top-Performing Strategy Providers

- Analyzing Key Performance Metrics (ROI, Drawdown, etc.)

- Starting Your First Copy Trading Investment

- Managing Your Portfolio and Monitoring Performance

- Understanding the Fee Structure: Commissions and Charges Explained

- Risks Involved in Copy Trading and How to Mitigate Them

- IC Markets cTrader Copy vs. Other Social Trading Platforms

- Advanced Tips for Maximizing Your Returns

- Is cTrader Copy Trading with IC Markets Suitable for Beginners?

- Common Pitfalls to Avoid When Copy Trading

- Frequently Asked Questions

What Exactly is cTrader Copy Trading?

Think of cTrader Copy Trading as a sophisticated form of social trading. It is a system that directly connects your trading account to the account of an experienced trader, known as a Strategy Provider. When they execute a trade, the cTrader platform instantly copies that same trade in your account, adjusted for your investment size. It’s not just about getting trade ideas or signals; it’s fully automated trade replication. This allows you to leverage the skills and strategies of others without needing to watch the charts all day. You choose the provider, set your risk limits, and the technology handles the rest, creating a powerful synergy between expert traders and investors.

Why Choose IC Markets for Your Copy Trading Journey?

Selecting the right broker is the foundation of a successful copy trading experience. The platform and trading conditions directly impact your results. IC Markets stands out as a premier choice for cTrader Copy Trading, offering a powerful combination of technology, speed, and security. We provide the ideal ecosystem for both new and experienced investors to thrive. By pairing the innovative cTrader Copy platform with our institutional-grade trading environment, you gain a significant edge. Let’s explore the specific benefits that make IC Markets the smart choice for your social trading ambitions.

Benefit from Raw Spreads and Ultra-Fast Execution

In copy trading, every fraction of a second and every fraction of a pip matters. Your results depend on mirroring the Strategy Provider’s trades as closely as possible. IC Markets delivers this with our Raw Spreads pricing model. This means you get access to some of the tightest spreads available, minimizing your trading costs on every single trade. We couple this with ultra-fast, low-latency execution. This high-speed environment drastically reduces slippage—the difference between the expected price and the actual execution price—ensuring your account copies strategies with precision and efficiency.

Trade in a Secure and Regulated Environment

Your capital’s safety is our top priority. IC Markets operates under the oversight of some of the world’s most respected financial regulators. This commitment to regulation provides you with a secure trading environment built on trust and transparency. We adhere to strict capital requirements and implement robust internal procedures for risk management, staff training, and accounting. Trading with a regulated broker means your funds are held in segregated client trust accounts with top-tier banking institutions. You can focus on choosing the best copy strategies, confident that your investment is protected by a framework of global standards.

How Does the cTrader Copy System Function?

The cTrader Copy system is built on a simple yet powerful principle: connecting two types of users in a transparent ecosystem. On one side, you have the Strategy Providers. These are experienced traders who allow others to follow their trading strategies in exchange for a fee. On the other side, you have Investors like you, who search for and allocate funds to copy these providers.

The process works in real-time:

- A Strategy Provider opens, modifies, or closes a trade in their cTrader account.

- The cTrader Copy system instantly broadcasts this action to all their Investors.

- The Investor’s account automatically executes the exact same action, proportionally scaled to their allocated capital.

This entire mechanism is automated, removing the need for manual intervention and ensuring that you never miss a trade from your chosen signal providers.

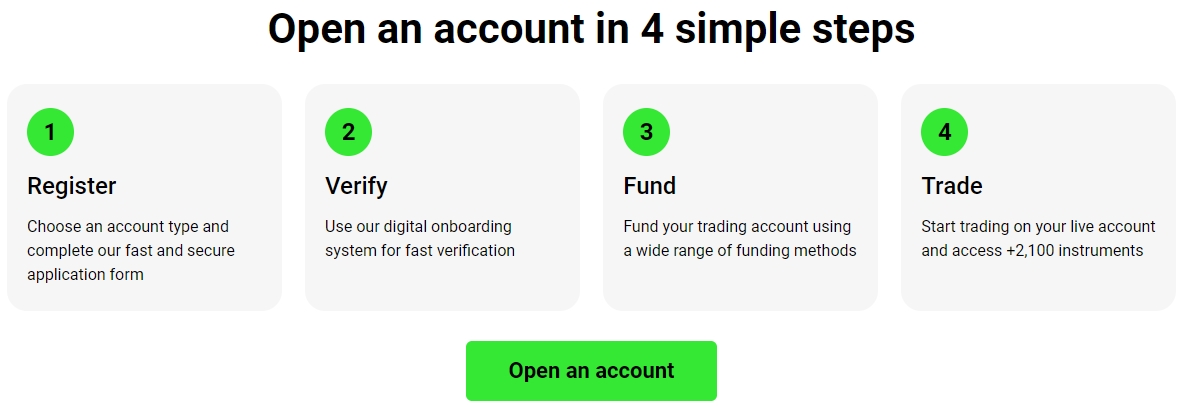

A Step-by-Step Guide to Getting Started

Embarking on your IC Markets cTrader Copy Trading journey is a straightforward process. We have designed the system to be intuitive, allowing you to go from registration to copying your first strategy in just a few simple steps. This high-level overview will walk you through the entire path, ensuring you have a clear roadmap to follow. Think of it as your launch sequence for entering the exciting world of social trading.

- Step 1: Create and verify your IC Markets live trading account.

- Step 2: Fund your account using one of our many convenient methods.

- Step 3: Access the cTrader platform and navigate to the “Copy” section.

- Step 4: Discover and analyze potential Strategy Providers.

- Step 5: Allocate funds and begin copying your chosen strategy.

Setting Up and Funding Your IC Markets cTrader Account

Your first step is to establish your trading hub. The registration process is quick and digital. You will need to provide some basic information and complete the standard identity verification (KYC) process by uploading a proof of identity and address. This is a crucial regulatory step that protects your account. Once your account is approved, you can fund it. IC Markets offers a wide variety of deposit options, including bank transfer, credit/debit cards, and popular e-wallets. Choose the method that works best for you, transfer your initial investment, and you’ll be ready to access the cTrader Copy platform.

Navigating the cTrader Copy Platform Interface

Once you log in to the cTrader platform and select the “Copy” feature, you’ll find a clean and user-friendly interface. The main screen presents a list of available Strategy Providers, which you can sort and filter using various criteria. Each provider has a dedicated profile page where you can see detailed performance statistics, charts, and their fee structure. A separate tab shows your own portfolio, allowing you to monitor your active copy strategies, track your profit and loss in real-time, and manage your investments. Familiarize yourself with these sections to make informed decisions with ease.

Key Features and Tools for Investors

The cTrader Copy platform is packed with powerful tools designed to give you maximum control and insight over your investments. These features go beyond simple copying and allow you to implement sophisticated risk management.

| Feature | Benefit |

|---|---|

| Equity Stop Loss | Set a “safety net” for your entire investment with a specific provider. If your equity drops to this level, the system automatically stops copying and closes all trades. |

| Detailed Strategy Profiles | Go beyond ROI. Access in-depth charts and historical data for every provider, giving you a complete picture of their trading style and risk profile. |

| Volume Scaling Options | Choose how your trade size is calculated. You can mirror the provider’s risk level, set a fixed trade size, or customize other advanced scaling models. |

| Transparent Fee Calculation | See exactly how and when fees are calculated and deducted. There are no hidden charges, ensuring complete transparency for your investment. |

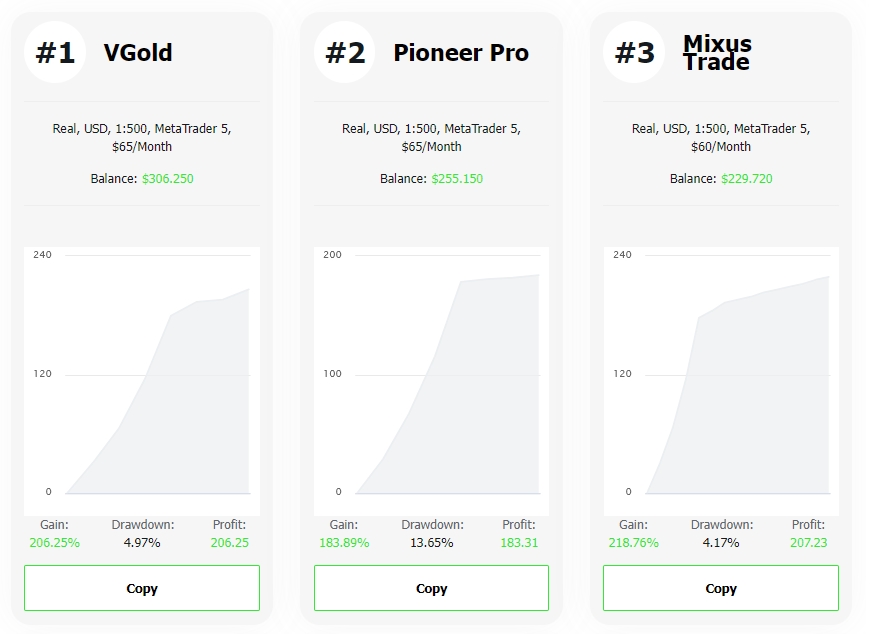

How to Find and Evaluate Top-Performing Strategy Providers

The heart of successful copy trading lies in your ability to select the right signal providers. The cTrader Copy platform provides powerful filtering and sorting tools to help you discover strategies that match your goals. Don’t just focus on the highest return on investment (ROI). A truly great strategy is about consistency and risk management. Start by filtering providers based on criteria like the age of the strategy, the total number of copiers, and the assets they trade. This narrows the field, allowing you to focus your attention on a shortlist of credible candidates for a more detailed analysis.

Analyzing Key Performance Metrics (ROI, Drawdown, etc.)

Once you have a shortlist of providers, it’s time to dig into their stats. Understanding these key metrics is non-negotiable for making smart investment choices.

- Return on Investment (ROI)

- This shows the strategy’s total profitability over time. While important, look for a smooth, upward-sloping equity curve rather than one with extreme spikes and dips.

- Max Drawdown

- This is one of the most critical risk metrics. It reveals the largest peak-to-trough decline the strategy has experienced. A lower drawdown indicates better risk management by the provider.

- Number of Copiers

- A large number of copiers can be a sign of trust and consistent performance, as other investors have already vetted and invested in the strategy.

- Live vs. Demo

- Always prioritize providers who are trading with their own live funds. This demonstrates they have real skin in the game and are confident in their own strategy.

Starting Your First Copy Trading Investment

You have done your research and chosen a promising Strategy Provider. Now it’s time to put your capital to work. The process is designed to be simple and secure. Navigate to the provider’s profile page and click the “Start Copying” button. A new window will appear where you define the parameters of your investment. You will enter the amount of capital you wish to allocate to this specific strategy. This is also where you will configure your mandatory Equity Stop Loss, which acts as your ultimate safety net. Double-check your settings, confirm your decision, and that’s it! Your account will immediately begin mirroring the provider’s trades.

Managing Your Portfolio and Monitoring Performance

Copy trading is not a “set it and forget it” activity. Active monitoring is key to long-term success. Make it a habit to regularly check your cTrader Copy portfolio dashboard. Here you can see a consolidated view of all your active copy strategies. Track their real-time profit and loss, review the open positions, and analyze the overall performance of your investment. This regular review allows you to stay informed and make timely decisions, such as increasing your allocation to a consistently performing strategy or stopping the copy of one that is underperforming or has changed its trading style.

Understanding the Fee Structure: Commissions and Charges Explained

Transparency is a core principle of the cTrader Copy platform. Strategy Providers are compensated for their expertise, and they can choose from several fee structures. It is crucial to understand these before you invest.

- Performance Fee: This is a percentage of the net profit generated for you, the investor. It is only charged on new profits, using a high-water mark model. This means the provider only earns a fee if your investment value exceeds its previous peak.

- Management Fee: This is a small annual percentage calculated on your total equity invested with the provider. It is charged on a daily basis.

- Volume Fee: This is a commission paid to the provider based on the volume of the trades copied in your account, often stated as a certain amount per million USD traded.

Each Strategy Provider clearly displays their chosen fee structure on their profile page, so you always know exactly what to expect before you commit.

Risks Involved in Copy Trading and How to Mitigate Them

While IC Markets cTrader Copy Trading offers incredible opportunities, it’s essential to acknowledge and manage the inherent risks. All trading involves the risk of loss, and past performance is not a guarantee of future results. However, you can take proactive steps to protect your capital.

“The essence of investment management is the management of risks, not the management of returns.” – Benjamin Graham

Here’s how you can trade smarter:

- Diversify Your Portfolio: Never allocate all your funds to a single Strategy Provider. By copying several providers with different trading styles and instruments, you spread your risk.

- Use the Equity Stop Loss: This tool is your most important defense. Set a realistic Equity Stop Loss for every strategy you copy to define your maximum acceptable loss.

- Conduct Thorough Research: Do not blindly follow high ROI figures. Invest time in analyzing a provider’s drawdown, history, and trading consistency.

* Start Small: When you’re new to the platform or copying a new provider, begin with a smaller investment. You can always increase your allocation later as you build confidence in the strategy.

IC Markets cTrader Copy vs. Other Social Trading Platforms

The social trading landscape is diverse, but the combination of IC Markets and cTrader Copy offers a distinct advantage. Many platforms are closed ecosystems or operate more like social networks than serious investment tools. We provide an environment built for performance.

| Feature | IC Markets cTrader Copy | Typical Social Trading Platforms |

|---|---|---|

| Spreads & Costs | Institutional-grade Raw Spreads, leading to lower trading costs and more precise copying. | Often have wider, fixed spreads which can erode profits over time. |

| Analytics | Advanced, in-depth performance metrics and charts for comprehensive provider analysis. | Basic metrics, often focused solely on ROI without sufficient risk data. |

| Transparency | Clear, upfront fee structures (Performance, Management, Volume) chosen by the provider. | Fees can be hidden within wider spreads or complex terms. |

| Risk Management | Mandatory Equity Stop Loss on every investment, giving you granular control. | Risk management tools can be less robust or optional. |

Advanced Tips for Maximizing Your Returns

Once you are comfortable with the basics, you can apply more sophisticated tactics to enhance your copy trading portfolio. Moving beyond simple selection can significantly impact your long-term success.

- Analyze the “Sharpe Ratio”: While not always displayed directly, you can get a feel for it. Look for providers with smooth, steady equity growth (high return) and low drawdown (low risk). This indicates a strong risk-adjusted return.

- Match Strategy to Market Conditions: Some providers excel in trending markets, while others thrive in ranging conditions. Having a mix in your portfolio can help you perform well in various market environments.

- Review Periodically, Not Daily: Avoid the temptation to micromanage your investments based on daily fluctuations. Instead, schedule a weekly or monthly review to assess performance against your goals and make strategic adjustments.

- Look Beyond Forex: Many top Strategy Providers on IC Markets trade a diverse range of instruments, including indices and commodities. Diversifying across asset classes can further reduce risk.

Is cTrader Copy Trading with IC Markets Suitable for Beginners?

Absolutely. IC Markets cTrader Copy Trading is one of the most accessible ways for a beginner to engage with the financial markets. It effectively lowers the barrier to entry. Instead of needing to master complex technical and fundamental analysis, you can leverage the hard-won experience of successful traders from day one. The platform provides a unique opportunity to “earn while you learn.” By observing the trades taken by professionals in your own account, you gain practical insight into real market strategies and risk management principles. However, it is crucial for beginners to start with a modest investment and dedicate time to understanding the platform’s features and the importance of provider selection.

Common Pitfalls to Avoid When Copy Trading

Navigating the world of social trading can be highly rewarding, but new investors often make avoidable mistakes. Being aware of these common pitfalls is the first step toward building a sustainable and profitable copy trading portfolio.

Chasing “Get Rich Quick” Strategies: Be wary of providers showing astronomical returns in a very short time. These strategies are often extremely high-risk and can lead to rapid losses. Look for steady, long-term growth.

- Ignoring Drawdown: Focusing only on profit is a classic error. A strategy with a 50% drawdown means it lost half its value at some point. This is a critical indicator of the real risk involved.

- Over-Allocating Capital: Never invest more than you are prepared to lose. Start with a small portion of your investment capital and only increase your exposure once you are comfortable and confident.

- Emotional Decision-Making: Don’t stop copying a good, long-term strategy just because it has a few losing trades or a single bad week. All professional traders experience drawdowns. Trust your initial research.

Frequently Asked Questions

What is IC Markets cTrader Copy Trading?

It’s a fully automated social trading system that allows your account to directly replicate the trades of experienced traders, known as Strategy Providers, whom you choose to follow.

Why are low spreads and fast execution important for copy trading?

They are crucial for minimizing your trading costs and reducing slippage (the difference between the expected and actual trade price). This ensures your account mirrors the provider’s trades as accurately as possible, leading to better results.

What are the most important metrics when evaluating a Strategy Provider?

Beyond Return on Investment (ROI), you must analyze their maximum drawdown to understand risk, the number of other copiers as a sign of trust, and always prioritize providers who are using their own live funds.

What is an Equity Stop Loss and why is it important?

An Equity Stop Loss is your main risk management tool. It’s a safety net you set for each strategy, which automatically stops the copying process and closes all trades if your investment equity falls to that predetermined level, protecting you from further losses.

Does my computer need to be on 24/7 for copy trading to work?

No. The cTrader Copy platform is hosted on servers. Once you allocate funds to a strategy, it will continue to copy all trades automatically, even when your computer or mobile device is turned off.