- What Defines the cTrader Raw Spread Advantage?

- Why Opt for IC Markets for Your cTrader Account?

- Understanding Our cTrader Pricing Model

- Ready to Experience the Difference?

- What is IC Markets and Its Global Reputation?

- Diving Deep into the cTrader Platform Experience

- Raw Spread Advantage with IC Markets cTrader

- Key Features and User Interface of cTrader

- Comparing cTrader to Other Popular Trading Platforms

- A Closer Look at Execution and Spreads

- Feature Showdown: cTrader vs. The Rest

- Demystifying the Concept of Raw Spreads in Forex

- How Raw Spreads Offer True Market Pricing

- Why Choose IC Markets for Your cTrader Raw Spread Account?

- Experience True Raw Spreads

- Unleash the Power of the cTrader Platform

- Superior Execution and Deep Liquidity

- Dedicated Support for Your Trading Journey

- The Core Benefits of Trading with IC Markets cTrader Raw Spread

- Cost Analysis: Understanding Commissions with Raw Spreads

- Decoding Raw Spreads and Commissions

- How Commissions Work with Your cTrader Account

- The Advantage of a Commission-Based Model

- Calculating Your Potential Costs

- Ready for Transparent Trading?

- Setting Up Your IC Markets cTrader Raw Spread Account

- Why Choose the IC Markets cTrader Raw Spread?

- Setting Up Your cTrader Account: A Simple Path

- Understanding Your cTrader Pricing Advantage

- Ready to Trade?

- Available Trading Instruments on IC Markets cTrader

- Advanced Tools and Indicators for cTrader Raw Spread Traders

- Customize Your Edge with Bespoke Indicators

- Harness the Power of Algorithmic Trading with cBots

- Deep Dive with Advanced Charting and Analytical Features

- Uncover Market Nuances with Order Flow and Sentiment Tools

- Optimize Risk with Specialized Management Utilities

- Automated Trading with cBots on IC Markets cTrader

- What Exactly Are cBots?

- The Advantages of Using cBots

- Maximizing Performance with IC Markets cTrader Raw Spread

- Getting Started with Your cTrader Account

- Why IC Markets is the Ideal Partner for Automated Trading

- Deposit and Withdrawal Methods at IC Markets

- Effortless Deposits to Power Your Trading

- Secure Withdrawals: Accessing Your Profits

- Key Aspects of Our Funding System

- IC Markets’ Commitment to Regulatory Compliance and Security

- Exceptional Customer Support for IC Markets cTrader Users

- Unparalleled Support at Your Fingertips

- What Our Support Team Handles

- Ideal Trading Styles for IC Markets cTrader Raw Spread Accounts

- Scalping Strategies

- Day Trading

- Algorithmic & High-Frequency Trading (HFT)

- News Trading

- Maximizing Profitability with Optimal IC Markets cTrader Raw Spread Conditions

- What Defines a Raw Spread?

- The IC Markets cTrader Raw Spread Advantage

- Seamless Experience with cTrader

- Take Control of Your Trading Costs

- Frequently Asked Questions

What Defines the cTrader Raw Spread Advantage?

The core of our cTrader Raw Spread offering lies in its commitment to minimal cost and maximum efficiency. We aggregate quotes from over 50 different liquidity providers, ensuring you always access the best bid and ask prices available. This robust infrastructure guarantees deep liquidity and exceptional price stability, even during volatile market conditions.

When you choose our cTrader Raw Spread account, you benefit from direct market access. This means no dealing desk intervention, no re-quotes, and no price manipulation. Your orders go straight to the market, executed swiftly and precisely. It’s the ultimate environment for those who demand integrity and speed from their broker.

Why Opt for IC Markets for Your cTrader Account?

Choosing IC Markets for your cTrader account means aligning with a broker committed to your success. Our dedication to superior trading conditions translates into tangible benefits for you.

- Unmatched Spreads: Experience consistently low spread cTrader conditions, often starting from 0.0 pips on major currency pairs.

- Rapid Execution: Our state-of-the-art infrastructure ensures orders are processed in milliseconds, crucial for strategies like scalping.

- Transparent cTrader Pricing: We believe in clarity. You get raw spreads plus a fixed, low commission per lot, with no hidden fees.

- Deep Liquidity: Access to a vast pool of liquidity providers minimizes slippage and ensures competitive pricing across all assets.

- Advanced cTrader Platform: Leverage the powerful features of cTrader, known for its intuitive interface, advanced charting tools, and algorithmic trading capabilities.

Traders worldwide trust IC Markets to provide a fair and high-performance trading environment. Our commitment to technology and client satisfaction makes us a leading choice for a low spread cTrader experience.

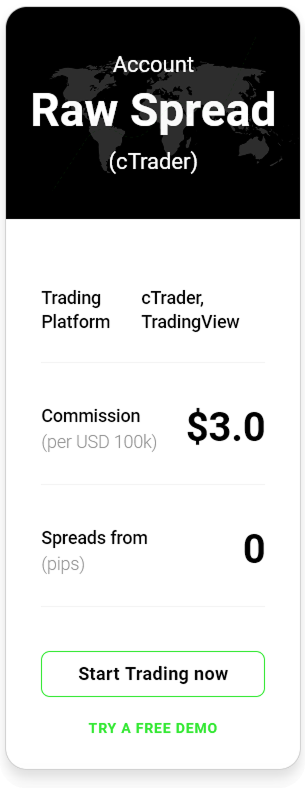

Understanding Our cTrader Pricing Model

Transparency is key to building trust. With the IC Markets cTrader Raw Spread account, you pay a small, fixed commission per standard lot traded, per side. This simple, upfront fee, combined with the raw market spread, constitutes your total cTrader pricing. This model ensures you always know exactly what you are paying, empowering you to manage your trading costs effectively.

| Account Type | Average EURUSD Spread | Commission (per standard lot, per side) |

|---|---|---|

| cTrader Raw Spread | 0.0 – 0.1 pips | $3.00 USD (or equivalent) |

This clear structure ensures that the IC Markets cTrader Raw Spread remains one of the most competitive options available to active traders. You get institutional spreads, combined with a predictable and fair commission.

Ready to Experience the Difference?

Unlock the full potential of your trading strategy with the IC Markets cTrader Raw Spread account. Gain access to superior execution, exceptional pricing, and a robust platform designed for performance. If you demand precision and transparency, this is the environment you need.

“Trading with IC Markets cTrader Raw Spread truly transformed my approach. The consistent low spreads and rapid execution provide an undeniable edge.”

Don’t settle for less. Open your cTrader account today and join the ranks of informed traders who benefit from genuine raw spreads and a world-class trading experience. Your journey towards ultra-tight trading conditions begins with IC Markets.

What is IC Markets and Its Global Reputation?

IC Markets stands as a prominent name in the online trading world, widely recognized as a leading global Forex and CFD broker. Established with a vision to provide the best possible trading conditions for retail and institutional traders, it has carved out a significant niche since its inception.

The company prides itself on offering deep liquidity, advanced trading platforms, and exceptional customer service. This dedication to quality has allowed them to attract a vast global client base, making them a go-to choice for traders worldwide seeking robust and reliable market access. Their commitment to technological innovation means traders experience seamless execution and a diverse range of instruments.

IC Markets’ global reputation is built on several key pillars, earning trust and loyalty across continents:

- Competitive Spreads: They are particularly renowned for their IC Markets cTrader Raw Spread offering. This feature provides exceptionally tight spreads, often starting from 0.0 pips, allowing traders to execute strategies with minimal trading costs.

- Regulatory Compliance: Operating under strict regulatory frameworks in multiple jurisdictions, IC Markets ensures a secure and transparent trading environment. This adherence to global standards fosters significant trust among its diverse clientele.

- Advanced Platforms: Beyond the standard, their support for a cTrader account provides access to one of the most sophisticated trading terminals available. This platform is celebrated for its advanced charting, fast execution, and algorithmic trading capabilities, further enhanced by their attractive cTrader pricing structure.

- Customer-Centric Approach: With multilingual support and a focus on trader education, IC Markets empowers its users, from novices to seasoned professionals, to navigate the markets effectively.

Traders often choose IC Markets specifically for the unparalleled benefits of a cTrader raw spread account, appreciating the clear advantage it provides in high-frequency trading and scalping strategies. This commitment to offering low spread cTrader options underlines their understanding of what serious traders truly value.

“IC Markets continually strives to deliver an unparalleled trading experience. Our focus remains on providing transparent pricing, ultra-low latency execution, and innovative platforms, empowering traders to achieve their financial goals.”

Ready to experience a truly superior trading environment? Discover why so many traders trust IC Markets for their market access and advanced trading needs.

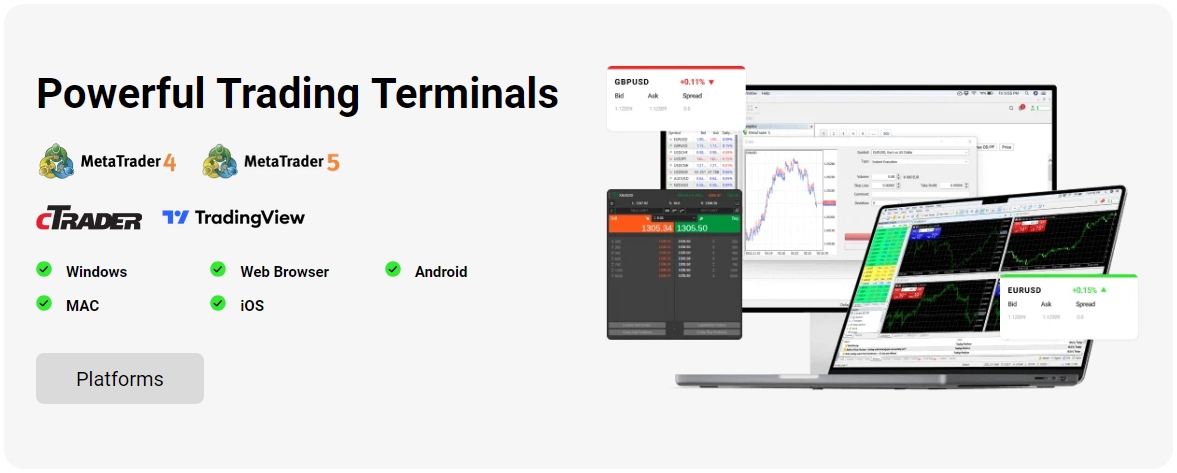

Diving Deep into the cTrader Platform Experience

For discerning traders, the choice of platform is paramount. It dictates your precision, speed, and ultimately, your profitability. We believe the cTrader platform, especially when paired with IC Markets, offers an unparalleled trading environment. This isn’t just another platform; it’s a sophisticated ecosystem designed for serious market participants seeking transparency and powerful tools.

cTrader stands out with its clean, intuitive interface that still packs advanced features. It’s built for efficient trading, offering a seamless user experience whether you are executing trades, analyzing market data, or developing automated strategies. You gain access to a full suite of technical analysis tools, customizable charts, and a rich array of indicators, all designed to give you an edge.

Here’s what makes the cTrader experience so compelling:

- Precision Charting and Analysis: Utilize multiple chart types, timeframes, and advanced drawing tools. Spot trends and make informed decisions with confidence.

- Advanced Order Types: Execute trades with sophisticated order management capabilities, including stop limits, take profits, and trailing stops, all ensuring optimal entry and exit points.

- Algorithmic Trading (cBots): Develop, test, and deploy automated trading strategies using cAlgo. This feature empowers you to automate your trading logic and backtest historical data with ease.

- Market Depth (Level II Pricing): View the full range of executable prices directly from liquidity providers. This transparency provides a clear picture of market supply and demand.

Now, combine this robust platform with the IC Markets cTrader Raw Spread offering, and you unlock a truly game-changing proposition. This isn’t just about accessing cTrader; it’s about experiencing the platform at its peak performance. IC Markets commits to delivering true ECN pricing, meaning you trade on spreads starting from 0.0 pips.

The IC Markets cTrader Raw Spread account gives you direct access to deep institutional liquidity. This means tighter spreads, faster execution, and a truly transparent trading environment free from dealing desk intervention. You benefit from extremely competitive cTrader pricing, making every trade potentially more efficient.

Raw Spread Advantage with IC Markets cTrader

| Feature | Benefit to You |

|---|---|

| Direct Market Access | Access the tightest possible spreads, often starting at 0.0 pips. |

| No Dealing Desk | Experience transparent execution without any re-quotes or manual intervention. |

| Deep Liquidity | Ensure reliable pricing and minimal slippage, even during volatile periods. |

Opening a cTrader account with IC Markets is straightforward, opening doors to this powerful combination. You get the innovative features of the cTrader platform alongside the extremely low spread cTrader conditions that IC Markets is renowned for. This means lower trading costs and more accurate pricing across major currency pairs, indices, and commodities.

Experience the difference a true ECN environment makes when powered by an intuitive and feature-rich platform. We encourage you to explore the benefits of the IC Markets cTrader Raw Spread offering. It’s a compelling choice for traders who value speed, transparency, and extremely competitive trading conditions, helping you maximize your trading potential.

Key Features and User Interface of cTrader

Embark on a superior trading journey with cTrader, a platform meticulously crafted for active traders. Its robust features and intuitive design stand out, offering a compelling environment especially for those seeking the advantages of an IC Markets cTrader Raw Spread account. We delve into what makes cTrader a preferred choice, from its powerful analytical capabilities to its user-friendly interface.

Powerful Trading Features at Your Fingertips

cTrader is not merely a trading terminal; it is a comprehensive ecosystem designed to empower traders with precision and control. Its rich feature set ensures you have every tool necessary for informed decision-making and efficient execution:

- Advanced Charting and Analysis: Dive deep into market dynamics with sophisticated charting tools. You get multiple chart types, custom timeframes, and a vast library of technical indicators. Tailor your charts to match your analytical style perfectly, providing clear insights into price action.

- Superior Order Management: Experience unparalleled control over your trades. cTrader offers various order types—market, limit, stop—with swift and reliable execution. For those prioritizing cost, the inherent benefits of a ctrader raw spread environment mean competitive entry and exit points.

- Full Depth of Market (DoM): Gain transparent insight into market liquidity. See the exact buy and sell volumes at different price levels, empowering you to understand true supply and demand. This feature is invaluable for traders utilizing a ctrader raw spread strategy.

- Algorithmic Trading with cBots: Automate your strategies with cBots. Develop your own trading robots using C#, or explore an extensive marketplace of existing solutions. This allows for disciplined, emotion-free trading around the clock.

- Integrated Copy Trading: Discover and follow successful traders directly within the platform. The copy trading feature enables you to mirror the strategies of experienced peers, offering a unique avenue for learning and portfolio diversification.

Navigating cTrader’s Intuitive User Interface

A powerful platform delivers its true potential when it is easy to navigate. cTrader excels here, offering a user interface (UI) designed with clarity and efficiency as top priorities. Its thoughtful layout ensures you spend less time learning the platform and more time capitalizing on market opportunities. Every aspect of the UI enhances your experience, regardless of your specific ctrader account setup.

| UI Aspect | Trader Benefit |

|---|---|

| Clean, Uncluttered Design | Reduces visual noise, allowing sharp focus on critical market data and order management. |

| Highly Customizable Workspaces | Arrange charts, watchlists, and order panels exactly to your preference. Tailor your environment to suit your unique trading style and workflow. |

| Multi-Device Accessibility | Access your ctrader account from desktop, web, or mobile devices seamlessly. Maintain control over your trades whether you are at your desk or on the go. |

| Intuitive Navigation | Easily locate tools and features through a logical menu structure and quick access shortcuts. This ensures a fluid and productive trading journey. |

This commitment to a user-friendly design perfectly complements the platform’s core advantages, like its transparent ctrader pricing model. It makes cTrader an exceptionally attractive choice for those seeking a low spread ctrader experience without compromising on powerful analytical and execution tools. Experience firsthand how the IC Markets cTrader Raw Spread offering truly marries high performance with exceptional usability.

Comparing cTrader to Other Popular Trading Platforms

Choosing the right trading platform is like selecting the perfect co-pilot for your financial journey. It dictates your experience, execution speed, and ultimately, your potential for success. While many platforms vie for your attention, cTrader consistently stands out for its unique blend of features and a focus on transparency. Let’s look at how it measures up against some of its popular counterparts.

A Closer Look at Execution and Spreads

When you’re comparing trading platforms, execution speed and spread transparency are paramount. Many traders find the IC Markets cTrader Raw Spread offering particularly compelling. Unlike some platforms that might have varying markups or less transparent pricing structures, cTrader, especially with a raw spread model, aims to give you direct market access with minimal intermediaries. This means you often encounter the tightest possible spreads available in the market.

Here’s how cTrader distinguishes itself in key areas:

- Pricing Transparency: cTrader is built on a “No Dealing Desk” model, often providing direct access to interbank liquidity. This architecture makes ctrader pricing incredibly transparent, ensuring you see the true market price and benefit from genuine low spread ctrader conditions.

- Order Execution: Speed matters. cTrader typically offers ultra-fast order execution. This is critical for strategies like scalping or high-frequency trading where milliseconds can impact profitability. Other platforms, depending on their broker integration, might introduce slight delays.

- Advanced Tools: Beyond basic charting, cTrader comes packed with sophisticated tools like advanced order types, depth of market (DOM) visibility, and a robust algorithmic trading environment (cAlgo). While competitors offer some of these, cTrader integrates them seamlessly for a more intuitive experience.

Feature Showdown: cTrader vs. The Rest

To give you a clearer picture, here’s a quick comparison of cTrader against other widely used platforms, highlighting what makes a ctrader account a strong choice:

| Feature | cTrader | MetaTrader 4/5 (MT4/MT5) | Proprietary Platforms |

|---|---|---|---|

| Spreads & Pricing | Often offers raw spread ctrader with transparent, low commissions. Excellent for low spread ctrader needs. | Spreads can vary widely by broker; often includes markup. | Pricing varies greatly; may be competitive but sometimes less transparent. |

| User Interface (UI) | Modern, intuitive, and highly customizable. | Functional but often considered dated. MT5 is an improvement. | Design quality varies significantly, from basic to highly advanced. |

| Algorithmic Trading | Robust cAlgo platform with C# for advanced bot development. | MQL4/MQL5 languages for Expert Advisors (EAs); huge community. | Capabilities vary; some offer custom scripting, others do not. |

| Depth of Market (DOM) | Full depth of market, crucial for understanding liquidity. | Limited DOM in MT4, more comprehensive in MT5. | Often restricted or unavailable. |

The choice ultimately depends on your trading style and priorities. However, if you prioritize transparent ctrader pricing, lightning-fast execution, and access to a genuine ctrader raw spread environment, cTrader offers a compelling advantage that empowers sophisticated traders. Explore an IC Markets cTrader Raw Spread account and experience the difference yourself.

Demystifying the Concept of Raw Spreads in Forex

Ever wondered what truly drives your trading costs in the dynamic forex market? Understanding the concept of raw spreads is crucial for any serious trader. At its core, a raw spread represents the unfiltered difference between the bid and ask prices received directly from liquidity providers. Unlike standard spreads, which often include a broker’s markup, raw spreads aim to offer you the purest market prices available.

Think of it this way: when you trade, there’s always a slight difference between the price you can buy an asset (ask) and the price you can sell it (bid). This tiny gap is the spread. Most brokers add a small fee or markup on top of this true market spread. However, with a true raw spread model, that markup is removed. This means you gain access to significantly tighter prices, often as low as zero pips on major currency pairs during liquid market conditions.

Why Raw Spreads Matter for Your Trading Edge

Accessing genuine market spreads can be a game-changer for your profitability, especially for high-frequency traders or those employing scalping strategies. Here’s why a low spread cTrader environment is often preferred:

- Lower Trading Costs: Without the added markup, your transaction costs per trade decrease. This directly impacts your bottom line over time.

- Improved Entry & Exit Prices: Tighter spreads mean less slippage and more precise execution, allowing you to enter and exit trades closer to your desired price.

- Transparency: You see the real market price. The broker’s remuneration comes from a small, fixed commission per lot traded, making the ctrader pricing model very clear.

- Competitive Advantage: Trading with minimal friction allows for more consistent profit capture, especially in volatile markets.

When you opt for an IC Markets cTrader Raw Spread account, you’re choosing a path designed for efficiency. This approach to ctrader raw spread offerings means the broker charges a very competitive commission, typically a few dollars per lot per side, instead of widening the spread. This clear structure provides peace of mind, knowing exactly what you’re paying for each transaction.

Raw Spreads vs. Standard Spreads: A Quick Look

To further illustrate the difference, consider this simple comparison:

| Feature | Raw Spreads | Standard Spreads |

|---|---|---|

| Spread Width | Often near zero on majors | Includes broker markup |

| Broker Compensation | Fixed commission per lot | Markup within the spread |

| Transparency | High; clear fees | Less transparent fee structure |

| Ideal For | Scalpers, EAs, high-volume traders | Beginners, less active traders |

Choosing a ctrader account with raw spread capabilities empowers you to trade with institutional-grade conditions. It’s an ideal choice for traders who prioritize execution quality and want to minimize their overall trading expenses. Ready to experience the difference for yourself? Dive into the world of truly raw spreads and elevate your trading journey.

How Raw Spreads Offer True Market Pricing

Ever wondered if you’re truly getting the best deal when you trade? Many brokers add a hidden markup to the prices you see, directly impacting your potential profits. This is where the concept of raw spreads becomes a game-changer for serious traders. It’s about full transparency and direct access to the market’s true cost.

A raw spread means you bypass the typical broker markup. Instead of a higher, fixed spread, you receive the direct bid and ask prices from liquidity providers. This offers genuine, interbank market pricing right to your fingertips. You only pay a small, fixed commission per lot, making your trading costs crystal clear and highly competitive.

Why does this matter for your trading strategy? True market pricing offers several distinct advantages:

- Unmatched Transparency: You see the exact prices from the liquidity pool. No hidden fees or inflated spreads muddy the waters.

- Reduced Trading Costs: Over time, a low spread cTrader offering significantly reduces your overall expenses, potentially boosting your profitability.

- Enhanced Execution: Accessing raw spreads often comes with superior execution speeds, crucial for high-frequency or scalping strategies.

- Fairer Environment: You operate on a level playing field, with the market’s real pulse driving your decisions, not an artificial layer of broker-added cost.

When you choose an IC Markets cTrader Raw Spread account, you unlock this direct pricing power. It transforms your trading experience by putting you closer to the actual market, eliminating many common frustrations with inflated costs. This focused approach on the ctrader raw spread empowers you with incredibly precise ctrader pricing, giving you an edge.

Consider the difference:

| Feature | Standard Spread Account | Raw Spread Account |

|---|---|---|

| Spread Value | Includes broker markup | Zero or near-zero spread |

| Cost Structure | Spread is your primary cost | Small, fixed commission per lot |

| Transparency | Less direct | High, direct market pricing |

Opening a ctrader account with IC Markets means you’re not just trading; you’re gaining access to an environment built for efficiency and fairness. Experience the profound difference true market pricing makes for your trading journey.

Why Choose IC Markets for Your cTrader Raw Spread Account?

For serious traders seeking an unparalleled advantage, an IC Markets cTrader Raw Spread account is the definitive choice. We provide a premium trading environment where performance, low costs, and advanced technology converge to empower your strategies.

Experience True Raw Spreads

When it comes to competitive trading costs, our commitment to a genuine ctrader raw spread sets us apart. We understand that tight spreads are crucial for profitability, especially for high-frequency or scalping strategies. Our ctrader pricing model gives you direct access to interbank spreads, ensuring transparency and fairness.

- **Ultra-Low Spreads:** Benefit from spreads starting at 0.0 pips on major currency pairs.

- **Transparent Pricing:** We avoid hidden markups, giving you clear insights into your trading costs.

- **Significant Savings:** Reduce your overall trading expenses with our exceptionally low spread ctrader conditions.

An IC Markets cTrader Raw Spread account means you trade on real market conditions, reflecting genuine supply and demand from our top-tier liquidity providers.

Unleash the Power of the cTrader Platform

Your ctrader account with IC Markets grants you access to one of the industry’s most respected platforms. cTrader is built for speed, precision, and advanced analysis, making it an ideal choice for traders who demand more.

Key features of the cTrader platform include:

| Feature | Benefit to You |

|---|---|

| **Advanced Charting Tools** | Dozens of indicators and customizable chart types for in-depth technical analysis. |

| **Level II Depth of Market** | View full market depth and liquidity directly from price providers. |

| **Automated Trading with cBots** | Develop, backtest, and deploy custom trading robots for algorithmic strategies. |

| **Intuitive Interface** | A clean, user-friendly design that makes execution and management straightforward. |

This powerful platform perfectly complements the competitive ctrader raw spread we offer, giving you both the tools and the conditions to succeed.

Superior Execution and Deep Liquidity

Speed is critical in trading, and we pride ourselves on lightning-fast order execution. Our state-of-the-art infrastructure and extensive network of liquidity providers ensure your trades are processed with minimal latency, significantly reducing the risk of slippage.

“IC Markets delivers a world-class trading environment. Our IC Markets cTrader Raw Spread account combines exceptional pricing with robust technology for truly empowered trading.”

We connect to over 25 distinct liquidity providers, including major banks and financial institutions. This ensures deep market depth across all instruments, allowing for larger order sizes to be filled without impacting market prices. This commitment to execution quality enhances the overall value of your low spread ctrader experience.

Dedicated Support for Your Trading Journey

When you choose an IC Markets ctrader account, you join a community supported by a global team. Our dedicated client support is available around the clock to assist you with any queries or technical needs. We believe in providing comprehensive resources and reliable service to ensure your trading journey is smooth and successful.

Ready to experience the difference? Choose IC Markets for your IC Markets cTrader Raw Spread account today. Unlock competitive ctrader pricing, ultra-fast execution, and a powerful platform designed to help you achieve your trading goals.

The Core Benefits of Trading with IC Markets cTrader Raw Spread

Ready to unlock a trading experience defined by precision, speed, and exceptional value? The IC Markets cTrader Raw Spread account isn’t just another option; it’s a strategic advantage designed for serious traders. We’ve meticulously crafted this offering to give you unparalleled access to market conditions, empowering your decisions and optimizing your potential.

A primary draw for traders to our IC Markets cTrader Raw Spread offering is the incredibly tight pricing. We connect you directly to institutional liquidity providers, bypassing markups often found with standard accounts. This means you trade on spreads that start from 0.0 pips, reflecting true market dynamics.

- Direct Market Access: Benefit from live, executable prices from multiple top-tier liquidity providers.

- Minimal Cost: Our commitment to a low spread cTrader environment ensures your trading costs are among the lowest in the industry.

- Consistent Performance: Experience reliable spreads, even during volatile market conditions.

In the world of online trading, milliseconds can make all the difference. The cTrader platform, combined with IC Markets’ robust infrastructure, delivers execution speeds designed to capture market movements precisely as you intend.

“Every trade, executed with precision. That’s the power of a streamlined trading environment.”

Our servers are strategically located in key financial hubs, minimizing latency and ensuring your orders are processed almost instantaneously. This rapid execution is crucial for scalpers, high-frequency traders, and anyone looking to capitalize on fleeting opportunities.

Understanding your trading costs should always be straightforward. With an IC Markets cTrader account, you’ll find complete transparency. Instead of inflated spreads, we operate on a simple, competitive commission model.

| Feature | IC Markets cTrader Raw Spread | Typical Standard Account |

|---|---|---|

| Spreads From | 0.0 Pips | Often 1.0 Pips+ |

| Commission | Fixed per lot/side | Usually spread into price |

| Pricing Model | ECN/STP | Market Maker/Standard |

This clear approach to cTrader pricing ensures you always know what you’re paying, allowing for more accurate risk management and profit calculations.

Beyond the superior pricing, your IC Markets cTrader Raw Spread account gives you access to the full power of the cTrader platform. It’s renowned for its intuitive interface, sophisticated charting tools, and advanced order types.

You gain access to:

- Detailed market analysis tools and indicators.

- Algorithmic trading capabilities with cBots.

- Depth of Market (DOM) visibility for a clearer market picture.

- A customizable workspace tailored to your trading style.

Choosing IC Markets cTrader Raw Spread means opting for a comprehensive trading solution that empowers you with low spreads, rapid execution, and a powerful platform. It’s time to experience the difference a truly professional trading environment can make.

Cost Analysis: Understanding Commissions with Raw Spreads

When you dive into the world of trading, particularly with platforms offering true market access, understanding your costs is paramount. This section uncovers the crucial aspect of commissions when trading with raw spreads, a hallmark of the IC Markets cTrader Raw Spread offering. We’ll break down how this model works, ensuring you grasp the total cost of your trades with clarity.

Decoding Raw Spreads and Commissions

A raw spread represents the narrowest possible difference between the bid and ask prices, often very close to zero, reflecting the actual interbank market rate. Unlike brokers who widen the spread to generate revenue, providers offering a ctrader raw spread typically earn their income through a transparent commission structure.

Here’s what that means for your trading:

- Pure Market Pricing: You see virtually the true market price, free from hidden markups in the spread. This offers unmatched transparency.

- Direct Cost Visibility: Your trading costs come in two distinct parts: the tiny raw spread and a clear, per-lot commission fee. You always know what you are paying.

How Commissions Work with Your cTrader Account

For an IC Markets cTrader account, commissions are a straightforward fee charged per standard lot traded, typically on each side of the trade (when you open and close a position). This method ensures that the brokerage generates revenue while offering you access to highly competitive, low spread ctrader conditions.

Consider these points regarding ctrader pricing and commissions:

- Volume-Based: The more you trade, the more commission you pay. Conversely, smaller trades incur smaller commission fees.

- Fixed Rate: Often, the commission rate is a fixed amount per standard lot for specific currency pairs, making it easy to calculate your costs upfront.

- Transparency: This model champions transparency. You receive access to direct market spreads, and the commission is always clearly stated.

The Advantage of a Commission-Based Model

Many experienced traders prefer a commission-based structure with raw spreads. Why? It offers several distinct advantages:

“Knowing your exact trading cost upfront simplifies your strategy and helps you manage your budget more effectively.”

- Predictability: You can accurately forecast your trading costs, which is invaluable for risk management and strategy development.

- Fairness: You pay for the service you use, without hidden costs baked into wider spreads.

- Tight Spreads: Accessing spreads as low as 0.0 pips frequently means greater potential for profitable trades, especially for scalpers and high-volume traders.

Calculating Your Potential Costs

Let’s look at a simplified example of how commissions might apply to your trades on a ctrader raw spread account. Remember, actual rates can vary slightly based on currency pair or asset class, but the principle remains consistent.

Assuming a commission of $3.00 per side per standard lot (total $6.00 round turn for 1 standard lot):

| Trade Size (Lots) | Commission per Side | Total Round Turn Commission |

| 0.1 (Mini Lot) | $0.30 | $0.60 |

| 1.0 (Standard Lot) | $3.00 | $6.00 |

| 5.0 (Standard Lots) | $15.00 | $30.00 |

This table illustrates how the commission scales with your trade volume, providing a clear picture of your trading expenses beyond the nearly non-existent raw spread.

Ready for Transparent Trading?

Understanding the cost structure is a critical step towards informed trading decisions. With an IC Markets cTrader Raw Spread account, you gain access to transparent ctrader pricing and the benefits of low spreads, complemented by a clear commission model. It’s a straightforward approach designed for serious traders. Explore the difference true market conditions can make for your trading strategy.

Setting Up Your IC Markets cTrader Raw Spread Account

Ready to experience unparalleled precision in your trading journey? Opening an IC Markets cTrader Raw Spread account positions you at the forefront of market execution, offering some of the tightest spreads available. This guide will walk you through each step, empowering you to quickly access an environment built for serious traders.

Why Choose the IC Markets cTrader Raw Spread?

When market conditions demand accuracy, having a true ctrader raw spread can make all the difference to your bottom line. IC Markets provides direct access to interbank liquidity, meaning you benefit from razor-thin spreads that often start from 0.0 pips. This ensures a low spread ctrader environment, allowing your strategies to perform optimally without significant costs eroding your profits. You gain transparency and efficiency, which are crucial for consistent trading.

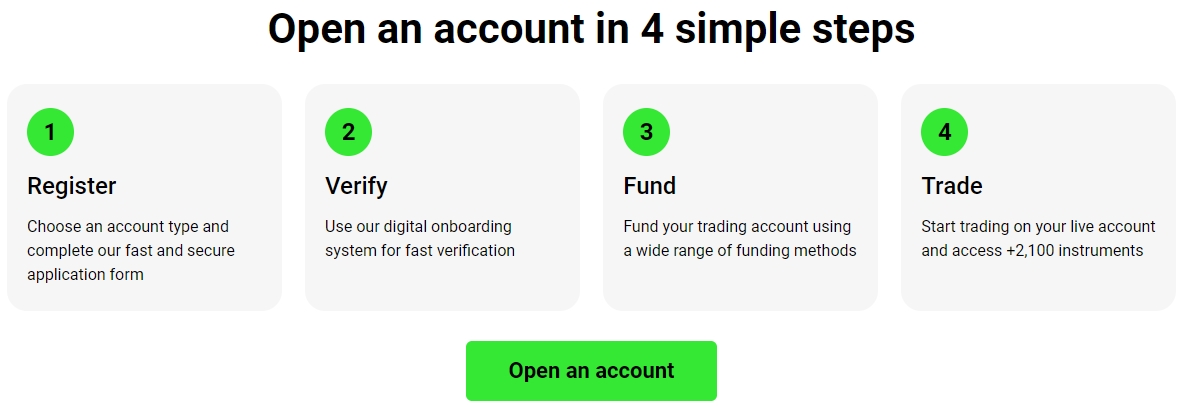

Setting Up Your cTrader Account: A Simple Path

Opening your IC Markets ctrader account is a straightforward process. We designed it for speed and clarity, getting you closer to the markets without unnecessary delays. Follow these easy steps to begin:

- Step 1: Start Your Application

Visit the IC Markets website and navigate to the “Open Live Account” section. This initiates your trading journey. - Step 2: Provide Your Personal Details

Accurately fill in your personal information. This includes your name, email address, and country of residence. We ensure your data remains secure throughout the process. - Step 3: Select Your Account Type

Crucially, choose “cTrader” as your preferred trading platform and “Raw Spread” as your account type. This selection grants you access to our most competitive pricing. - Step 4: Complete Your Profile

Answer a few questions about your trading experience and financial standing. This helps us tailor our services responsibly and ensures you trade within suitable parameters. - Step 5: Verify Your Identity

Upload the required identification documents, such as proof of identity and residency. Our compliance team processes these promptly, often within minutes. - Step 6: Fund Your Account

Once your account receives verification, deposit funds using one of our many convenient funding methods. You are now ready to place your first trade!

Understanding Your cTrader Pricing Advantage

The ctrader pricing model within the Raw Spread account is incredibly transparent and built for efficiency. You pay a small, fixed commission per lot traded, but in exchange, you gain access to spreads that typically start from 0.0 pips on major currency pairs. This clear cost structure empowers you to manage your trading costs effectively and implement your strategies with confidence, knowing exactly what you pay for each transaction.

Ready to Trade?

Don’t let higher trading costs limit your potential. Set up your IC Markets cTrader Raw Spread account today and unlock a world of precise trading opportunities. Join a global community of traders who value fair execution and transparent pricing. Your journey towards more efficient trading starts here.

Available Trading Instruments on IC Markets cTrader

Unlocking your trading potential starts with having a wide spectrum of instruments at your fingertips. At IC Markets, our cTrader platform delivers an extensive selection, empowering you to build a diverse portfolio and react swiftly to global market dynamics. A robust ctrader account with us provides direct access to these markets, all while benefiting from the competitive IC Markets cTrader Raw Spread.

We carefully curate our offerings to give you maximum flexibility and transparent ctrader pricing, making your trading journey both efficient and rewarding. Explore a world of opportunity:

- Forex: Immerse yourself in the largest financial market. We offer over 60 currency pairs, from major pairs like EUR/USD and USD/JPY to exotic crosses. Capitalize on currency fluctuations with exceptional liquidity and a genuinely low spread ctrader environment.

- Indices: Gain broad market exposure without focusing on individual stocks. Trade popular global indices such as the S&P 500, DAX 40, and FTSE 100. These instruments offer a bird’s-eye view of economic health and market sentiment.

- Commodities: Tap into the foundational elements of the world economy. Our commodity selection includes precious metals like Gold and Silver, crucial energy products such as Crude Oil and Natural Gas, and various soft commodities.

- Cryptocurrencies: Embrace the future of finance with a growing range of digital assets. Trade popular cryptocurrencies like Bitcoin, Ethereum, and Ripple against the US Dollar, harnessing their inherent volatility.

- Futures: Expand your strategies with various futures contracts on underlying assets, providing additional avenues for advanced traders.

Choosing IC Markets cTrader means you trade with confidence. We offer some of the tightest spreads available in the industry. Our ctrader raw spread model ensures you receive direct market access with minimal markups, which is essential for maximizing profitability across all these diverse instruments.

| Instrument Category | Typical Examples | Market Dynamics |

|---|---|---|

| Forex | EUR/USD, GBP/JPY | Interest rate differentials, economic news |

| Global Indices | S&P 500, DAX 40 | Overall economic health, corporate earnings |

| Commodities | Gold, Crude Oil | Supply and demand, geopolitical events |

| Cryptocurrencies | BTC/USD, ETH/USD | Adoption rates, technological developments |

Ready to diversify your portfolio and experience truly competitive trading conditions? Open your ctrader account today and discover the unparalleled range of trading instruments available with the IC Markets cTrader Raw Spread. Unlock your potential with our superior execution and transparent ctrader pricing.

Advanced Tools and Indicators for cTrader Raw Spread Traders

Unlocking your full trading potential demands more than just a great platform; it requires the right arsenal of advanced tools and indicators. For traders seeking the sharpest edge, especially within an IC Markets cTrader Raw Spread environment, mastering these sophisticated features is absolutely essential. They transform raw market data into actionable insights, helping you navigate volatile markets with confidence and precision.Customize Your Edge with Bespoke Indicators

The beauty of cTrader lies in its flexibility. While the platform offers a robust suite of built-in indicators, serious traders often seek more. Custom indicators, developed through the cAlgo API, allow you to implement unique strategies or visualize market data in ways that perfectly align with your trading philosophy. This level of personalization is a game-changer, giving you a distinct advantage over those relying solely on standard setups. Every serious trader with a ctrader account understands the power of tailored analysis.

- Proprietary Signals: Develop and deploy indicators that generate unique buy/sell signals based on your specific rules.

- Enhanced Visualizations: Create custom overlays or sub-windows to monitor multiple conditions simultaneously.

- Backtesting Synergy: Seamlessly integrate your custom indicators into cTrader’s powerful backtesting engine to validate their effectiveness.

Harness the Power of Algorithmic Trading with cBots

Emotional decisions can derail even the most well-planned strategies. This is where cBots, cTrader’s algorithmic trading systems, step in. They execute trades automatically based on predefined rules, removing human emotion from the equation and ensuring disciplined execution around the clock. Leveraging cBots within a ctrader raw spread setting means you can capitalize on fleeting market opportunities without constant manual intervention, securing optimal entry and exit points.

“Automation isn’t about replacing the trader; it’s about empowering them to operate with unparalleled speed and unwavering discipline.”

Deep Dive with Advanced Charting and Analytical Features

Beyond custom tools, cTrader’s native charting package is exceptionally powerful. It goes far beyond basic candlesticks, offering a comprehensive suite of charting types, drawing tools, and timeframes. These fundamental yet sophisticated features allow for meticulous technical analysis. Understanding ctrader pricing becomes clearer when you can visually dissect price action across various market conditions, making informed decisions easier.

Explore some of the advanced charting capabilities:

| Feature | Benefit for Traders |

| Tick Charts | Precise analysis of every price movement, ideal for scalping. |

| Renko Charts | Filters out time and minor price movements, highlighting significant trends. |

| Depth of Market (DoM) | Visibility into market liquidity and potential support/resistance levels. |

Uncover Market Nuances with Order Flow and Sentiment Tools

To truly gain an edge, you need to understand the forces driving the market. Advanced order flow tools and market sentiment indicators provide a look beyond the price chart. They reveal where institutional money is moving, the cumulative delta, and the overall bullish or bearish bias in the market. For traders focused on low spread ctrader opportunities, this insight is invaluable, helping them anticipate price movements rather than just react to them. This precision is vital when leveraging the IC Markets cTrader Raw Spread environment.

Optimize Risk with Specialized Management Utilities

Advanced tools aren’t just for finding trades; they are equally crucial for managing risk effectively. Position sizing calculators, automated stop-loss and take-profit modifications, and equity protection cBots help safeguard your capital. These tools ensure your risk-reward profile remains optimal, even during fast-moving markets. They contribute significantly to maintaining consistency and longevity in your trading journey with your ctrader account.

Pair these powerful tools and indicators with the exceptional trading conditions of an IC Markets cTrader Raw Spread account. You gain access to razor-thin spreads and lightning-fast execution, creating an unparalleled trading environment designed for serious traders. Explore how these advanced capabilities can elevate your strategy and performance.

Automated Trading with cBots on IC Markets cTrader

Unlock the full potential of your trading strategy with cBots on IC Markets cTrader. Imagine a trading assistant that works tirelessly, executes trades with precision, and never lets emotions dictate decisions. That’s the power of automated trading, and cBots are your key to harnessing it within the advanced cTrader platform provided by IC Markets.What Exactly Are cBots?

cBots are sophisticated algorithmic robots specifically designed for the cTrader platform. They allow you to automate your trading strategies by following a predefined set of rules. From simple indicators to complex multi-layered systems, cBots can analyze market data, identify opportunities, and execute trades without any manual intervention. They remove human error and emotional bias from the trading equation, ensuring consistent strategy application.The Advantages of Using cBots

Embracing automated trading with cBots brings a host of benefits that can significantly transform your trading experience:- 24/7 Market Monitoring: cBots never sleep. They monitor markets around the clock, ready to act on opportunities even when you’re away from your screen.

- Emotion-Free Decisions: Human emotions like fear and greed often lead to irrational trading. cBots stick to your predefined logic, ensuring discipline in every trade.

- Flawless Execution: Complex strategies involving multiple conditions can be executed perfectly by cBots, eliminating the risk of manual errors or missed signals.

- Backtesting & Optimization: You can thoroughly test your cBots against historical data to refine and optimize your strategies, ensuring they perform optimally in various market conditions.

Maximizing Performance with IC Markets cTrader Raw Spread

The real magic happens when you combine the power of cBots with the superior trading conditions offered by IC Markets. Our exceptionally tight IC Markets cTrader Raw Spread is a game-changer for automated strategies. cBots thrive on precision and minimal costs. A low spread cTrader environment means your entry and exit points are executed with virtually no slippage, preserving the profitability of your meticulously crafted algorithms. This genuine ctrader raw spread makes high-frequency trading and scalping strategies not just possible, but highly efficient.Getting Started with Your cTrader Account

Ready to experience the future of trading? Setting up a ctrader account with IC Markets is a seamless process. Our platform provides a robust and reliable environment perfect for deploying and managing your cBots. Whether you choose to develop your own cBot using C# or prefer to utilize ready-made solutions from the cTrader community, our infrastructure supports your automated aspirations.Why IC Markets is the Ideal Partner for Automated Trading

IC Markets stands out as a premier choice for traders employing cBots due to several key factors:| Feature | Benefit for cBots |

|---|---|

| Raw Spreads & Deep Liquidity | Ensures optimal execution for cBots, maximizing profitability and minimizing trading costs with transparent ctrader pricing. |

| Ultra-Fast Execution | Orders from your cBots are processed in milliseconds, crucial for strategies sensitive to market fluctuations. |

| Reliable Infrastructure | Minimizes downtime, providing continuous operation for your automated strategies. |

| No Restrictions on Trading Style | cBots can implement any strategy, including scalping and high-frequency trading, without limitations. |

Deposit and Withdrawal Methods at IC Markets

Navigating your finances should be the least of your worries when focusing on trading. At IC Markets, we understand this completely. That is why we provide a robust and secure range of deposit and withdrawal methods, ensuring your funds move efficiently and safely. We prioritize your convenience, so you can focus on executing your trading strategies, whether on a standard account or an IC Markets cTrader Raw Spread account.

Effortless Deposits to Power Your Trading

Getting funds into your IC Markets trading account is straightforward and often instantaneous. We offer a diverse selection of payment options tailored for traders worldwide. This flexibility means you can choose the method that best suits your needs, ensuring you quickly access the markets and leverage the benefits of a low spread cTrader environment.

- Credit/Debit Cards: Fund your account instantly using Visa or Mastercard. It’s a quick, globally recognized option.

- Bank Wire Transfer: Ideal for larger deposits, though processing times may vary slightly.

- E-Wallets: Popular choices like Neteller, Skrill, PayPal, and others offer immediate funding and enhanced security.

- Local Payment Solutions: Depending on your region, you might find specific local bank transfers or payment gateways for added convenience.

Each method offers seamless integration, allowing you to fund your ctrader account without hassle and begin exploring the competitive ctrader pricing we offer.

Secure Withdrawals: Accessing Your Profits

When it is time to withdraw your profits, we make the process just as smooth and secure as your deposits. Our policy generally dictates that withdrawals should be processed back to the original deposit method, a standard security measure designed to protect your funds.

Here is what you can expect:

- Same Method Rule: Funds typically return to the source of your deposit (e.g., if you deposit via Skrill, your withdrawal will go back to your Skrill account).

- Verification Process: For your security, a standard account verification process is often required before your first withdrawal. This protects you and ensures only authorized individuals can access your funds.

- Processing Times: While we process withdrawals swiftly, the time it takes for funds to appear in your account can vary based on the method chosen and your bank or payment provider. E-wallets are usually the fastest, followed by credit/debit cards, and then bank transfers.

“We believe in transparency and efficiency. Our goal is to ensure your funds are always accessible and secure, reflecting our commitment to your trading success.”

For your security, a standard account verification process is often required before your first withdrawal. This protects you and ensures only authorized individuals can access your funds.

Key Aspects of Our Funding System

Understanding the core aspects of our deposit and withdrawal system helps you manage your trading capital effectively. We strive for a transparent and fair approach.

| Feature | Details |

|---|---|

| Fees | IC Markets typically charges no internal fees for deposits or withdrawals, though your bank or payment provider might apply their own charges. |

| Processing Speed | Deposits are often instant, especially for e-wallets and cards. Withdrawals are processed by our team usually within one business day, with external processing times varying. |

| Supported Currencies | We support various base currencies for your account, reducing conversion fees. |

| Security | All transactions are secured with advanced encryption and robust protocols to safeguard your financial information. |

We work hard to provide a seamless financial experience, allowing you to focus on capitalizing on market opportunities with your IC Markets cTrader Raw Spread account. Explore our funding options today and join a community that values efficiency, transparency, and competitive ctrader pricing.

IC Markets’ Commitment to Regulatory Compliance and Security

At IC Markets, your security and trust form the absolute bedrock of your trading experience. We understand that peace of mind is invaluable, especially when navigating dynamic financial markets. That’s why we embed regulatory compliance and robust security measures into every facet of our operations.

We actively operate under the vigilant oversight of several leading financial authorities worldwide. This stringent adherence ensures a transparent, fair, and secure trading environment for every client. Our commitment means consistently meeting capital adequacy requirements, adhering to strict operational standards, and upholding ethical practices.

When you choose to trade with IC Markets, especially when pursuing the competitive IC Markets cTrader Raw Spread, you’re not just gaining access to superior trading conditions. You are also benefiting from a framework designed to protect your interests and ensure integrity at every step.

Protecting your capital is our highest priority. We meticulously segregate all client funds from our company’s operational capital. These funds reside in separate trust accounts with highly reputable, top-tier financial institutions. This critical separation ensures your funds are always accessible and cannot be used for company expenses, providing an essential layer of security.

- Segregated Client Funds: Your capital is held in separate trust accounts, distinct from IC Markets’ operational funds.

- Top-Tier Banking: We partner with leading global banks to safeguard client deposits.

- Financial Reporting: Regular audits and financial disclosures maintain transparency and accountability.

Your personal and trading data remains fiercely protected through advanced security protocols. We employ state-of-the-art encryption technologies and robust cybersecurity measures to shield your sensitive information from unauthorized access. This dedication extends across all our platforms, ensuring your cTrader account, and every transaction within it, operates within a secure digital fortress.

Our unwavering commitment to compliance also brings unparalleled transparency to your trading. You can trust the integrity of our execution and the clarity of our ctrader pricing. We strive to offer not just a low spread cTrader environment but one built on a foundation of honesty and reliability. This holistic approach ensures you can focus on your trading strategy, confident in the knowledge that your assets and information are safe with us.

Exceptional Customer Support for IC Markets cTrader Users

Navigating the dynamic world of online trading demands more than just a powerful platform; it requires unwavering support. At IC Markets, we understand this crucial need, especially for our traders leveraging the sophisticated cTrader platform. We stand ready to assist you, ensuring a seamless and confident trading experience from the moment you open your ctrader account.

Our commitment to your success shines through our dedicated support services. Whether you are exploring the advantages of IC Markets cTrader Raw Spread or need assistance with a technical query, our expert team is here to help. We build confidence, one interaction at a time.

Unparalleled Support at Your Fingertips

We pride ourselves on providing accessible, knowledgeable, and proactive customer support. Our team understands the intricacies of cTrader, ensuring you receive relevant and timely assistance.

- 24/7 Global Reach: Our support desk operates around the clock, five days a week, ensuring assistance is available whenever the markets are open. Traders across all time zones receive prompt attention.

- Multi-Channel Accessibility: Connect with us through various convenient channels. Whether you prefer instant chat, detailed email correspondence, or direct phone conversations, we provide the option that suits you best.

- Dedicated cTrader Experts: Our support specialists possess in-depth knowledge of the cTrader platform. They expertly guide you through platform features, troubleshoot technical issues, and explain specific trading conditions like ctrader raw spread or our competitive ctrader pricing.

- Multilingual Assistance: We cater to our diverse global community with support available in multiple languages, breaking down communication barriers.

What Our Support Team Handles

Our goal is to empower you to focus on your trading strategies. We efficiently resolve common issues and offer guidance on platform functionalities.

| Support Area | Typical Assistance Provided |

|---|---|

| Account Management | Help with ctrader account setup, funding, withdrawals, and profile updates. |

| Platform Navigation | Guidance on using cTrader’s advanced features, indicators, and charting tools. |

| Technical Support | Troubleshooting connectivity issues, platform glitches, and installation queries. |

| Trading Conditions | Clarification on spreads, commissions, and how to maximize your low spread ctrader experience. |

“Exceptional support transforms a good trading platform into an outstanding trading experience. We equip our IC Markets cTrader users with the confidence to trade effectively.”

Ultimately, our exceptional customer support ensures you have a reliable partner throughout your trading journey with IC Markets. We empower you to harness the full potential of your IC Markets cTrader Raw Spread account, knowing expert assistance is always just a click or call away. Experience the difference true support makes.

Ideal Trading Styles for IC Markets cTrader Raw Spread Accounts

Are you a trader who demands razor-thin spreads and lightning-fast execution? Then the IC Markets cTrader Raw Spread account is likely your perfect match. This account type caters specifically to strategies where every pip counts, offering unparalleled market access with true institutional-grade spreads from 0.0 pips. We’re talking about direct market pricing, typically with a small, transparent commission. Let’s explore which trading styles truly thrive in this environment, making the most of the exceptional ctrader raw spread conditions.

Scalping Strategies

Scalpers live by tiny price movements, opening and closing trades within seconds or minutes to snatch small profits. For this high-volume, quick-turnaround approach, transaction costs are paramount. The tighter the spread, the less ground you need to cover just to break even on each trade. This makes the IC Markets cTrader Raw Spread offering a dream come true for scalpers.

- Reduced Break-Even Point: A low spread ctrader environment means you reach profitability faster on each micro-trade.

- Increased Opportunities: Even the smallest price fluctuations become viable profit opportunities.

- Commission-Based Transparency: With a fixed commission per lot, you know your costs upfront, removing variable spread unpredictability.

Day Trading

Day traders open and close positions within the same trading day, avoiding overnight holding risks. While they aim for larger moves than scalpers, they still execute multiple trades daily. The cumulative effect of wider spreads across many trades can significantly erode profits. The IC Markets cTrader Raw Spread account offers a distinct advantage here, ensuring your trading costs remain minimal.

You benefit from superior ctrader pricing, which allows for more aggressive entry and exit points, maximizing your potential gains. This account empowers day traders to capture intraday volatility efficiently, knowing that their cost per trade is optimized.

Algorithmic & High-Frequency Trading (HFT)

Automated trading systems, including Expert Advisors (EAs) and High-Frequency Trading algorithms, operate on strict parameters and often execute a massive number of trades. These systems critically depend on consistent, low-latency execution and minimal trading costs to maintain their edge. The IC Markets cTrader Raw Spread environment is engineered for this exact purpose.

Here’s why a ctrader account with raw spreads is superior for automated strategies:

| Benefit | Impact on Algo/HFT |

|---|---|

| Ultra-Low Spreads | Maximizes profit margins on high-volume, rapid trades. |

| Deep Liquidity | Ensures reliable execution, even for large order sizes, reducing slippage. |

| Fast Execution | Critical for algorithms that react to market changes in milliseconds. |

| Transparent Pricing | Predictable costs allow for more accurate backtesting and strategy optimization. |

Algorithms performing statistical arbitrage or market making greatly benefit from the tight spreads and exceptional speed, allowing them to exploit minute price discrepancies effectively.

News Trading

News traders capitalize on the sharp, rapid price movements that occur immediately after significant economic or geopolitical news releases. These events often bring extreme volatility and can lead to wider spreads across many brokers. However, with the IC Markets cTrader Raw Spread account, you access the raw market spread, which, even during volatile times, remains highly competitive compared to standard accounts.

This provides an edge, as you can enter and exit positions closer to the market price, capturing more of the move rather than losing a significant portion to spread costs. A low spread ctrader setup can be a game-changer when seconds and pips determine success.

Ultimately, if your trading style demands precision, minimal costs, and direct market access, the IC Markets cTrader Raw Spread account stands out. It’s built for serious traders who understand that superior execution and transparent ctrader pricing are fundamental pillars of sustained profitability.

Maximizing Profitability with Optimal IC Markets cTrader Raw Spread Conditions

Unlocking your full trading potential often hinges on the conditions under which you operate. For astute traders seeking a significant edge, the IC Markets cTrader Raw Spread offers just that – a direct path to enhanced profitability. We understand that every pip counts, and minimizing trading costs directly impacts your bottom line.What Defines a Raw Spread?

A raw spread environment means you trade on prices directly sourced from top-tier liquidity providers, with no additional markups from IC Markets. Instead of a wider, all-inclusive spread, you receive the raw, tight interbank rates plus a small, fixed commission per lot. This approach provides unprecedented transparency and typically results in significantly lower overall trading costs compared to standard spread models. It’s about getting closer to the true market price, making your analysis and execution more precise.The IC Markets cTrader Raw Spread Advantage

Choosing the IC Markets cTrader Raw Spread isn’t just a technical preference; it’s a strategic decision for serious traders. Here’s why it stands out:- Unmatched Transparency: You see the real market prices directly, allowing for clearer decision-making. This openness in ctrader pricing builds confidence.

- Lower Trading Costs: Experience some of the tightest spreads in the industry. For many, this translates into a truly low spread ctrader experience, reducing the barrier to entry for frequent trades.

- Faster Execution: Benefit from lightning-fast order execution. The direct connection to liquidity removes unnecessary delays, crucial for volatile markets.

- Ideal for Diverse Strategies: Whether you’re a scalper, day trader, or employ automated strategies, the tight ctrader raw spread conditions are perfectly suited to capitalize on small price movements.

- No Re-quotes: Trade with confidence, knowing your orders will be filled at the price you click, especially beneficial during busy market hours.

Seamless Experience with cTrader

The cTrader platform itself complements these raw spread conditions beautifully. Known for its advanced charting tools, sophisticated order types, and intuitive interface, cTrader empowers traders to execute their strategies with precision. Combining a powerful platform with IC Markets’ competitive raw spread offering creates a robust trading environment designed for efficiency and success. Opening a ctrader account with these conditions means you’re equipped with a leading edge.Take Control of Your Trading Costs

Maximizing profitability isn’t solely about winning trades; it’s also about minimizing expenses. The IC Markets cTrader Raw Spread model is engineered to help you achieve exactly that. By offering direct access to market pricing and charging a clear commission, we empower you to take greater control over your trading costs, making every trade potentially more lucrative. Discover how these optimal conditions can redefine your trading journey.Frequently Asked Questions

What defines the IC Markets cTrader Raw Spread account?

The IC Markets cTrader Raw Spread account is designed for minimal cost and maximum efficiency, offering ultra-low spreads (often starting from 0.0 pips) sourced directly from over 50 liquidity providers. This ensures direct market access, no dealing desk intervention, and rapid, precise order execution.

How does the cTrader Raw Spread pricing model work with commissions?

With the cTrader Raw Spread account, you pay a small, fixed commission per standard lot traded per side (e.g., $3.00 USD), in addition to the raw market spread. This transparent model allows you to clearly understand and manage your total trading costs effectively.

What advanced features does the cTrader platform offer?

The cTrader platform provides precision charting and analysis tools, advanced order types, algorithmic trading capabilities through cBots, and full Market Depth (Level II Pricing) for transparent insights into market liquidity and supply/demand dynamics.

What is the difference between raw spreads and standard spreads?

Raw spreads represent the purest market prices, often near zero, with the broker’s compensation coming from a fixed, per-lot commission. Standard spreads, conversely, typically include a broker’s markup within the spread itself, making the fee structure less direct and potentially higher.

Which trading styles are most suitable for the IC Markets cTrader Raw Spread account?

The IC Markets cTrader Raw Spread account is ideally suited for trading styles that demand precision and low costs, such as scalping, day trading, algorithmic trading (HFT), and news trading. Its razor-thin spreads and fast execution optimize profitability for these high-frequency and sensitive strategies.