Ready to start trading? The first step is funding your account. This guide breaks down every aspect of the IC Markets deposit process. We make it simple and clear, so you can move from funding to trading with confidence. Discover the various deposit methods, understand processing times, and learn essential tips for a hassle-free experience. Whether you are making your first fund deposit or are an experienced trader, this information will ensure your capital is transferred securely and efficiently. Let’s get your account ready for the markets.

- Key Information Before You Make a Deposit

- Step-by-Step: How to Fund Your IC Markets Account

- Exploring All Available IC Markets Deposit Methods

- Credit & Debit Cards (Visa, Mastercard)

- E-Wallet Solutions (PayPal, Skrill, Neteller)

- Bank Wire & Local Bank Transfers

- Other Global & Regional Funding Options

- What is the Minimum Deposit Requirement?

- Understanding IC Markets Deposit Fees and Charges

- How Long Do Deposits Take to Process?

- Accepted Deposit Currencies for Your Account

- Funding Different Account Types: Standard vs. Raw Spread

- Depositing Funds via the IC Markets Mobile App

- Is It Safe to Deposit Money with IC Markets?

- Troubleshooting Common Deposit Problems

- What to Do If Your Deposit is Declined

- Funds Not Appearing in Your Trading Account

- Information on IC Markets Deposit Bonuses

- Comparing Deposit Methods: Which is Best for You?

- Withdrawing Your Funds: What Comes After the Deposit?

- Final Tips for a Smooth Funding Experience

- Frequently Asked Questions

Key Information Before You Make a Deposit

Before you transfer your funds, a little preparation goes a long way. Taking a moment to review these key points ensures your IC Markets deposit is smooth and successful from the very start. Keep these essentials in mind:

- Account Verification: Ensure your trading account is fully verified. You cannot deposit funds until your identity and address documents are approved. This is a standard security measure.

- Matching Names: You must make all deposits from an account or card that is in your own name. IC Markets does not accept third-party payments. The name on your payment source must match the name on your trading account exactly.

- Base Currency: Be mindful of your account’s base currency. Depositing in the same currency (e.g., funding a USD account with USD) helps you avoid potential currency conversion fees charged by your bank or payment provider.

- Check Payment Method Limits: Some payment options have daily or transactional limits. Verify these with your provider to avoid a declined transaction, especially for larger deposits.

Step-by-Step: How to Fund Your IC Markets Account

Making an IC Markets deposit is a straightforward process. We designed the client portal to be intuitive and fast. Follow these simple steps to add funds and get ready to trade. This is exactly how to deposit into your account in just a few minutes.

- Log In to Your Secure Client Area: Access your account by entering your email and password on the official IC Markets website.

- Navigate to the ‘Deposit’ Section: Once logged in, find the “Transfers” menu item. Click on “Deposit Funds” from the dropdown menu.

- Choose Your Trading Account: If you have multiple trading accounts, select the specific one you wish to fund from the list.

- Select a Deposit Method: You will see a list of all available payment options for your region. Click on your preferred method, such as a credit card, PayPal, or bank transfer.

- Enter the Deposit Amount: Type in the amount of money you want to add to your account. Double-check the currency to ensure it is correct.

- Complete the Transaction: Follow the on-screen prompts to finalize the payment. This may involve entering card details or logging into your e-wallet service. Once confirmed, you will receive a notification.

Exploring All Available IC Markets Deposit Methods

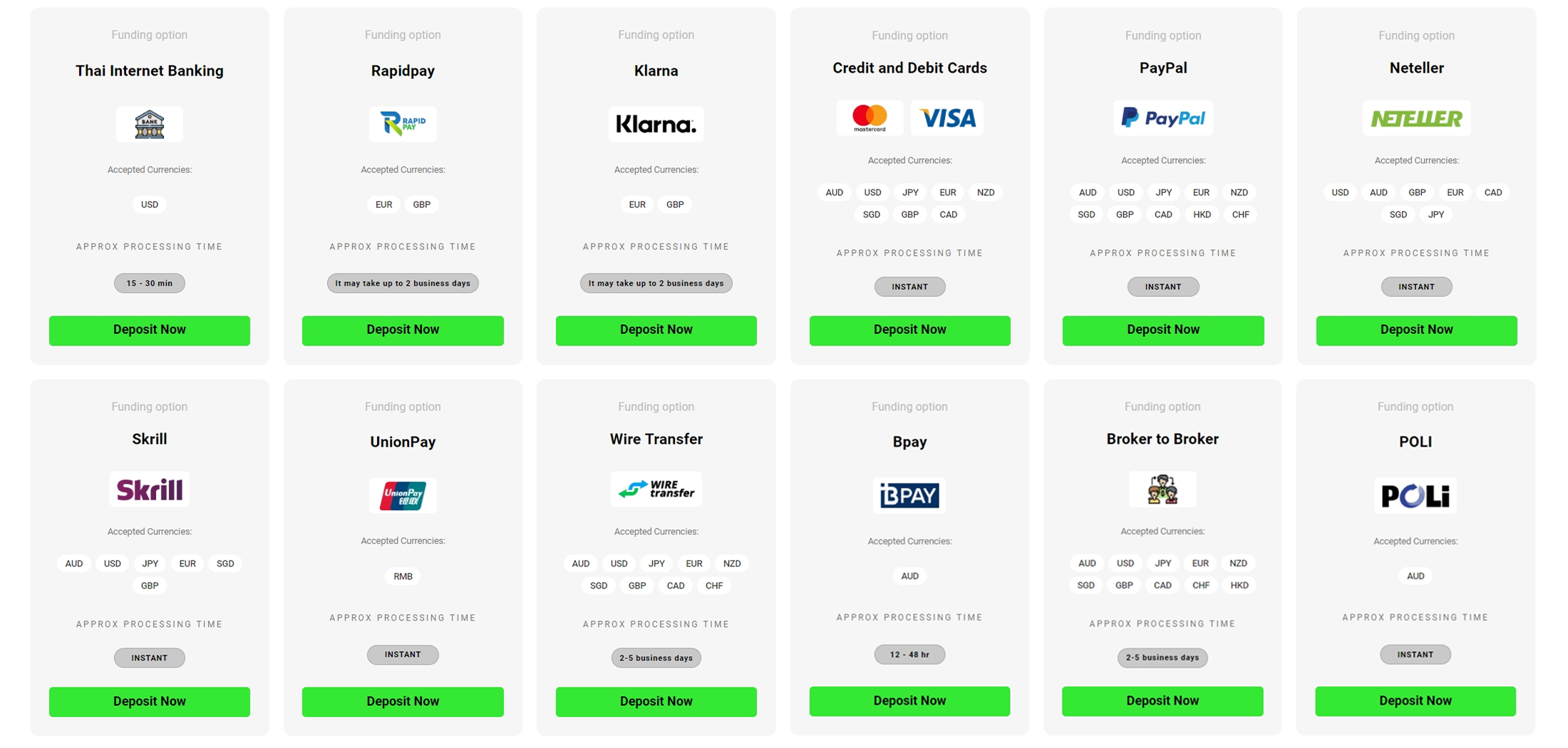

We believe in providing flexibility and choice. That is why we offer a wide range of IC Markets deposit methods to suit traders from all over the world. Your goal is to fund your account quickly and securely, and our diverse payment options are here to make that happen. From instant funding via cards and e-wallets to traditional bank wires for larger amounts, you can select the method that best fits your needs. Each option is integrated directly into our secure client area for a seamless experience. Below, we detail the most popular categories of payment options available to you.

Credit & Debit Cards (Visa, Mastercard)

Using a credit or debit card is one of the fastest and most popular ways to make an IC Markets deposit. We accept both Visa and Mastercard, providing you with instant access to your trading funds. Once you complete the transaction, the money typically appears in your trading account immediately, allowing you to seize market opportunities without delay. This method is perfect for traders who value speed and convenience. Just enter your card details in our secure portal, specify the amount, and confirm. It’s that simple.

E-Wallet Solutions (PayPal, Skrill, Neteller)

E-wallets offer a fantastic blend of speed, security, and convenience. We support leading global providers like PayPal, Skrill, and Neteller. Funding your account with an e-wallet is an excellent choice if you prefer not to share your card or bank details directly. Transactions are processed almost instantly, meaning your funds are ready for trading in moments. This method is highly favored by traders who manage their finances across multiple online platforms and appreciate the extra layer of security these services provide.

Bank Wire & Local Bank Transfers

For traders looking to make a substantial fund deposit, bank wire transfers are a reliable and secure option. While not as fast as cards or e-wallets, they are ideal for moving larger sums of capital. We also facilitate local bank transfers in many regions, which can be faster and more cost-effective than international wires. This traditional method remains a trusted choice for its security and high transaction limits. Simply get our bank details from the client portal and instruct your bank to make the transfer.

Other Global & Regional Funding Options

We cater to a global client base, which is why we support a variety of other payment options tailored to specific regions. Depending on your location, you may have access to methods like:

- Rapidpay: A secure bank transfer service.

- Klarna: A popular online banking payment solution.

- UnionPay: A leading card scheme for clients in Asia.

- Bpay & POLi: Convenient options for our Australian clients.

Log in to your client area to see the full list of payment options available to you. We are always working to expand our offerings to make funding your account as easy as possible, no matter where you are.

What is the Minimum Deposit Requirement?

Getting started with IC Markets is accessible to everyone. The minimum deposit required to activate your live trading account is $200 USD or the equivalent in your chosen currency. This initial fund deposit allows you to open either a Standard or Raw Spread account and begin trading across our full range of instruments. We set this requirement to ensure you have sufficient capital to open meaningful positions while still keeping the barrier to entry low. This approach makes it possible for new traders to enter the markets without a massive initial investment, while experienced traders can start with this amount and add more funds as they see fit.

Understanding IC Markets Deposit Fees and Charges

Transparency is a core value at IC Markets. We want to be clear about any potential costs.

Here is the great news: IC Markets does not charge any internal fees for deposits, regardless of the method you choose. We absorb the costs on our end to make your funding experience better.

However, it is important to be aware of potential external charges. Your own financial institution or payment provider may impose fees.

Here are some examples:

- International Bank Wires: Your bank will likely charge a fee for sending an international wire transfer, which can range from $15 to $50.

- Currency Conversion: If you deposit in a currency different from your account’s base currency, your bank or card provider will perform a currency conversion and may charge a fee for this service.

- E-Wallet Fees: Some e-wallets might charge a small fee for sending money, so check their terms and conditions.

To avoid unexpected charges, we recommend funding your account in its base currency whenever possible.

How Long Do Deposits Take to Process?

The time it takes for your funds to reflect in your trading account depends entirely on the deposit method you select. We process most payments instantly to get you into the markets faster. Below is a quick guide to our typical processing times.

| Deposit Method | Average Processing Time |

|---|---|

| Credit / Debit Card (Visa, Mastercard) | Instant |

| PayPal, Skrill, Neteller | Instant |

| Rapidpay, Klarna | Instant |

| Broker to Broker Transfer | 2-5 Business Days |

| Bank Wire Transfer | 2-5 Business Days |

| Local Bank Transfer | 1-2 Business Days |

Please note that “Instant” means the funds are typically available within minutes, but on rare occasions, it can take up to an hour. Bank-related methods are subject to banking hours and processing schedules.

Accepted Deposit Currencies for Your Account

To provide a truly global trading experience, we offer you the flexibility to fund your account in a variety of major currencies. This helps you manage your capital more effectively and can help you avoid unwanted currency conversion fees. When you open your account, you can select a base currency that suits you.

We proudly accept deposits in the following 10 base currencies:

- Australian Dollar (AUD)

- United States Dollar (USD)

- Euro (EUR)

- Great British Pound (GBP)

- Singapore Dollar (SGD)

- New Zealand Dollar (NZD)

- Japanese Yen (JPY)

- Swiss Franc (CHF)

- Hong Kong Dollar (HKD)

- Canadian Dollar (CAD)

For the most cost-effective transaction, always try to make your IC Markets deposit using the same currency as your trading account’s base currency.

Funding Different Account Types: Standard vs. Raw Spread

A common question is whether the deposit process changes based on your account type. The answer is simple: it does not. The method for your fund deposit is identical whether you operate a Standard Account, a Raw Spread Account, or a cTrader Raw Spread Account.

Your funds are deposited into your secure IC Markets wallet, which acts as a central hub for your money. From this wallet, you can then perform instant internal transfers to any of your trading accounts. This system gives you incredible flexibility. For example, you can deposit a lump sum into your wallet and then allocate smaller amounts to different trading accounts to test various strategies. The process remains the same: choose a deposit method, fund your wallet, and then distribute the capital as you see fit.

Depositing Funds via the IC Markets Mobile App

Trade and manage your account from anywhere with the IC Markets mobile app. We’ve made it just as easy to deposit funds on the go as it is on your desktop. The app provides full access to your client wallet, allowing you to make a secure fund deposit in just a few taps. The process is streamlined for mobile use without sacrificing security or functionality.

- Open the IC Markets app and log in.

- Tap on the menu and select “Deposit”.

- Choose your preferred payment option from the available list.

- Enter the amount you wish to deposit.

- Follow the prompts to securely complete the payment.

Your funds will be credited according to the standard processing time for your chosen method. It’s the perfect way to top up your account quickly to react to market movements.

Is It Safe to Deposit Money with IC Markets?

Absolutely. The security of your funds is our highest priority. When you make an IC Markets deposit, you can be confident that your money and personal data are protected by industry-leading security protocols. We are a highly regulated broker, and we adhere to strict financial standards to ensure your peace of mind.

- Top-Tier Regulation: We are regulated by multiple reputable authorities, including the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC).

- Segregated Client Funds: Your money is held in segregated client trust accounts at top-tier banking institutions. This means your funds are kept completely separate from our company’s operational funds.

- Secure Connections: Our website and client portal are secured with SSL (Secure Sockets Layer) encryption. This technology scrambles your data during transmission, making it unreadable to any unauthorized parties.

- Robust Data Protection: We employ advanced security measures to protect your personal and financial information around the clock.

We are committed to providing a secure trading environment, starting from the moment you deposit your funds.

Troubleshooting Common Deposit Problems

While the vast majority of deposits go through without a hitch, occasionally you might encounter an issue. This is often due to a simple error or a misunderstanding of the process. Most problems can be resolved quickly by checking a few key details. Common issues include declined transactions, where the payment is not authorized, or a delay in the funds appearing in your account. Below, we cover the two most frequent scenarios and provide clear, actionable steps you can take to resolve them swiftly and get back to focusing on the markets.

What to Do If Your Deposit is Declined

A declined transaction can be frustrating, but it is usually easy to fix. The rejection almost always originates from your bank or payment provider, not from IC Markets. If your deposit attempt fails, here is a checklist to run through before trying again:

- Verify Your Details: Double-check that all the information you entered is correct. This includes your card number, expiration date, CVV code, and billing address. A small typo is the most common culprit.

- Check Available Funds: Ensure you have sufficient funds or credit available in the account you are using.

- Review Transaction Limits: Contact your bank to see if you have daily or single-transaction limits that might be blocking the payment. This is common for international transactions.

- Use a Different Method: If the problem persists, simply try one of the other available IC Markets deposit methods. An e-wallet or a different card may work without issue.

- Contact Your Bank: If none of the above work, call your bank’s fraud or security department. Sometimes, they block transactions to new international merchants as a security precaution and can unblock it for you.

Funds Not Appearing in Your Trading Account

You have made a deposit and received a success confirmation, but the funds are not yet visible in your trading account. Do not panic. This is almost always related to standard processing times. Here is what to consider:

- Review Processing Times: Check the expected processing time for your chosen method. While cards and e-wallets are usually instant, bank wires can take several business days. Bank holidays or weekends can also cause delays.

- Check Your Email: Look for any confirmation emails from both IC Markets and your payment provider. These may contain important information or a transaction ID.

- Wait Patiently (For a Bit): If you used a method like a bank wire, allow the full estimated time to pass. For “instant” methods, wait at least one hour before taking further action.

- Contact Support with Details: If the funds still have not arrived after a reasonable period, contact our customer support team. Be ready to provide your trading account number, the deposit amount and currency, the date, and a proof of payment (like a bank receipt or transaction screenshot). This will help us trace the payment for you quickly.

Information on IC Markets Deposit Bonuses

Many traders ask if we offer deposit bonuses. At IC Markets, our business model is built on providing the best possible trading conditions, not on temporary promotions. Therefore, we do not offer deposit bonuses or any form of trading credits.

Why do we take this approach? Our focus is on offering you:

- Extremely Tight Spreads: We provide some of the lowest spreads in the industry, starting from 0.0 pips.

- Fast Execution: Our servers are located in leading data centers to ensure ultra-low latency.

- Deep Liquidity: We get our pricing from a diverse pool of liquidity providers.

Instead of complex bonus schemes with restrictive terms and conditions, we believe in giving you direct, sustainable value through a superior trading environment. This transparent approach ensures that the capital in your account is entirely your own, free from complicated withdrawal restrictions tied to bonus promotions.

Comparing Deposit Methods: Which is Best for You?

Choosing the right IC Markets deposit method depends on your personal priorities. Do you value speed above all else? Or are you making a large deposit where security and low costs are paramount? Use this table to compare the most popular payment options at a glance.

| Feature | Credit / Debit Card | E-Wallets (PayPal, etc.) | Bank Wire Transfer |

|---|---|---|---|

| Speed | Instant | Instant | Slow (2-5 Business Days) |

| Convenience | Very High | High (Requires e-wallet account) | Low (Requires bank visit/login) |

| IC Markets Fee | None | None | None |

| Potential 3rd-Party Fee | Possible currency conversion fee | Possible e-wallet sending fee | Likely bank sending fee |

| Best For | Quick, small-to-medium deposits | Fast, secure deposits of any size | Large, secure deposits |

Consider what matters most to you. For most traders, cards and e-wallets offer the best balance of speed and ease of use. For significant capital injections, a bank wire remains a trusted and reliable choice.

Withdrawing Your Funds: What Comes After the Deposit?

Understanding the full capital cycle is important. After you successfully fund your account and trade, you will eventually want to withdraw your profits. The withdrawal process at IC Markets is just as secure and straightforward as making a deposit.

A key rule to remember is that withdrawals must be sent back to the original source of the funds. This is a standard anti-money laundering (AML) requirement.

- If you deposited $500 via a credit card, the first $500 you withdraw must go back to that same credit card.

- If you funded your account using Skrill, your withdrawals will be processed back to your Skrill account.

Any profits made beyond your initial deposit amount can then be withdrawn via a different method, typically a bank wire transfer to an account in your name. Planning your deposit method with this in mind can help ensure a smooth withdrawal process later on.

Final Tips for a Smooth Funding Experience

You are now equipped with all the knowledge needed to make your IC Markets deposit. To ensure every transaction is perfect, keep these final tips in mind. Think of this as your pre-flight checklist for funding your trading account.

- Use a Secure Connection: Always make deposits when connected to a secure, private Wi-Fi network. Avoid using public Wi-Fi at cafes or airports for financial transactions.

- Double-Check Everything: Before you hit the ‘Confirm’ button, take a second to review the deposit amount, the currency, and the trading account number. A small mistake can cause unnecessary delays.

- Keep Records: For your own records, take a screenshot of the transaction confirmation page or save the confirmation email. This is useful if you ever need to contact support.

- Start Small: If it’s your first time depositing, consider starting with the minimum amount to familiarize yourself with the process. You can always add more funds later.

Following these simple guidelines will help guarantee that your funding experience is as fast, secure, and efficient as our trading environment. It’s time to fund your account and join the markets!

Frequently Asked Questions

What is the minimum deposit required at IC Markets?

The minimum deposit to activate a live trading account is $200 USD or the equivalent in your account’s base currency. This applies to both Standard and Raw Spread accounts.

Are there any fees for depositing funds?

IC Markets does not charge any internal fees for deposits. However, you should be aware that your bank, card issuer, or e-wallet provider may charge external fees for transactions or currency conversions.

How quickly are deposits processed?

Processing times vary by method. Deposits made via Credit/Debit Cards, PayPal, Skrill, Neteller, Rapidpay, and Klarna are typically instant. Bank wire transfers and broker-to-broker transfers can take between 2 to 5 business days.

Is it safe to deposit money with IC Markets?

Yes, it is very safe. IC Markets is regulated by top-tier authorities like ASIC and CySEC. All client funds are held in segregated trust accounts, and the website uses SSL encryption to protect your data.

What payment methods can I use to fund my account?

IC Markets offers a wide range of deposit methods, including major Credit and Debit Cards (Visa, Mastercard), popular e-wallets (PayPal, Skrill, Neteller), Bank Wire Transfers, and various regional options like Klarna, UnionPay, and Rapidpay.