Unlock your trading potential. The IC Markets Education hub is your launchpad into the world of financial markets. We designed these comprehensive trading lessons to transform you from a novice into a confident trader. Whether you want to learn to trade from scratch or sharpen your existing skills, our resources provide the clarity and depth you need. This is more than just a guide; it’s a structured path to mastering forex trading.

- What Are IC Markets’ Educational Resources?

- Who Can Benefit from This Learning Material?

- Getting Started: The Trading for Beginners Hub

- Setting Up Your First Trading Account

- Understanding Key Trading Terminology

- Deep Dive into Core Forex Trading Concepts

- Major, Minor, and Exotic Currency Pairs

- What are Pips, Lots, and Leverage?

- Understanding CFDs, Stocks, and Commodities

- Technical Analysis Explained by IC Markets Experts

- Mastering Fundamental Analysis for Smarter Trades

- How to Leverage Webinars for Interactive Learning

- Video Tutorials: Visual Guides for Complex Topics

- The IC Markets Blog: A Source of Daily Insights

- Using a Demo Account for Risk-Free Practice

- Navigating Trading Platforms: MetaTrader & cTrader

- Key Features of MT4 and MT5

- Exploring the cTrader Interface

- Exploring Advanced Trading Strategies

- Risk Management: A Core Pillar of Trading Education

- Frequently Asked Questions

What Are IC Markets’ Educational Resources?

We provide a complete toolkit to support your journey. Our forex education program is a rich ecosystem of learning materials tailored for every type of learner. You gain unlimited access to a diverse range of powerful tools. Forget searching all over the internet for trading courses; everything you need is right here.

- In-Depth Articles & Guides: Master foundational and advanced topics at your own pace.

- Video Tutorials: Watch experts break down complex subjects into simple, visual steps.

- Live Webinars: Engage directly with market analysts and ask your most pressing questions.

- Daily Market Analysis: Stay ahead of market movements with insights from our blog.

- Platform Walkthroughs: Learn to navigate MetaTrader and cTrader like a professional.

- Risk-Free Demo Account: Apply your knowledge and test strategies with virtual funds.

Who Can Benefit from This Learning Material?

Our educational content is built for everyone. We believe that access to high-quality trading lessons should be universal, regardless of your starting point. We have carefully crafted materials to meet you exactly where you are.

For the Absolute Beginner: If terms like ‘pip’ and ‘leverage’ sound like a foreign language, you are in the right place. We start with the absolute basics, building your knowledge brick by brick.

For the Intermediate Trader: You understand the fundamentals but want to refine your strategy and improve your analysis. Our advanced guides and technical breakdowns will help you level up.

For the Experienced Professional: Even seasoned traders need to stay sharp. Our market analysis, webinars, and strategy guides provide fresh perspectives to keep you at the top of your game.

Getting Started: The Trading for Beginners Hub

Your trading journey starts here. The Beginners Hub is the perfect first stop, designed to demystify the world of forex. We have organized everything you need into a logical, step-by-step pathway. You will progress from fundamental concepts to your first practice trades in a structured and supportive environment. This is the ultimate starting point to learn to trade with confidence.

Setting Up Your First Trading Account

Opening an account is a straightforward process. Follow these simple steps to get set up and ready to explore the markets. We guide you through each stage to ensure you are comfortable and prepared.

- Choose your preferred account type based on your trading style.

- Complete the secure online application form with your details.

- Verify your identity by uploading the required documents.

- Fund your account or start immediately with a risk-free demo account.

Understanding Key Trading Terminology

Speaking the language of the market is crucial for success. Our educational resources break down all the essential jargon you will encounter. Knowing these terms allows you to understand market analysis, follow trading news, and execute your strategy with precision. Here are just a few examples:

| Term | Simple Definition |

|---|---|

| Currency Pair | The two currencies being traded against each other (e.g., EUR/USD). |

| Bid/Ask Spread | The difference between the buying price (ask) and the selling price (bid). |

| Volatility | The degree of variation of a trading price series over time. |

Deep Dive into Core Forex Trading Concepts

Beyond the basic terminology, a successful trader must grasp the mechanics of the market. Our forex education program focuses on teaching you the core principles that govern every trade. We break down these vital concepts into easy-to-digest lessons, ensuring you build a solid foundation of knowledge. Understanding these pillars is non-negotiable for long-term success.

Major, Minor, and Exotic Currency Pairs

Not all currency pairs are created equal. Understanding the differences helps you choose the right instruments for your trading strategy. We teach you how to identify and trade each category.

- Major Pairs: These involve the US Dollar (USD) paired with another major currency like the Euro (EUR), Japanese Yen (JPY), or British Pound (GBP). They are the most liquid and widely traded pairs.

- Minor Pairs (Crosses): These pairs consist of two major currencies that do not include the US Dollar. Examples include EUR/GBP or AUD/JPY.

- Exotic Pairs: An exotic pair includes one major currency and one currency from an emerging economy, such as the South African Rand (ZAR) or the Mexican Peso (MXN). They typically have lower liquidity and higher spreads.

What are Pips, Lots, and Leverage?

These three terms are the building blocks of every single trade you will make. Grasping their meaning and interplay is essential for managing your risk and calculating potential profit or loss.

A Pip (Percentage in Point) is the smallest price move that a given exchange rate can make. A Lot refers to the size of your trade, or the number of currency units you are buying or selling. Leverage allows you to control a large position with a smaller amount of capital, amplifying both potential gains and losses.

Understanding CFDs, Stocks, and Commodities

Your trading opportunities extend far beyond forex. Our trading courses cover a wide array of financial instruments, allowing you to diversify your portfolio and explore different markets. We provide detailed education on Contracts for Difference (CFDs), which let you speculate on the price movements of various assets without owning them. Learn the unique characteristics of trading indices, popular stocks like Apple and Tesla, and essential commodities like Gold and Oil.

Technical Analysis Explained by IC Markets Experts

Learn to read the story the charts are telling. Technical analysis involves using historical price charts and market statistics to identify trading opportunities. Our expert-led trading lessons teach you how to spot patterns, use indicators, and analyze market trends. You will learn to make informed decisions based on price action rather than guesswork. Key topics include:

- Mastering Candlestick Patterns

- Using Moving Averages and RSI

- Identifying Support and Resistance Levels

- Understanding Chart Formations like Head and Shoulders

Mastering Fundamental Analysis for Smarter Trades

Trade the news, not the noise. Fundamental analysis looks beyond the price charts to evaluate an asset’s intrinsic value. This involves analyzing economic data, central bank policies, and geopolitical events that can impact currency and asset prices. Our forex education teaches you which economic indicators matter most, how to interpret news releases, and how to build a trading strategy around major economic events. This approach helps you understand the “why” behind market movements.

How to Leverage Webinars for Interactive Learning

Go beyond static articles and engage directly with market professionals. Our live webinars are a cornerstone of the IC Markets education experience. They offer a unique opportunity to learn in real-time from seasoned analysts. You can see strategies applied to live market conditions and, most importantly, ask questions and get instant answers. This interactive format accelerates your learning curve and connects you with a community of fellow traders.

Video Tutorials: Visual Guides for Complex Topics

Some concepts are best understood by seeing them in action. Our extensive library of video tutorials is perfect for visual learners. We break down everything from setting up your trading platform to executing advanced trading strategies into short, easy-to-follow videos. You can pause, rewind, and re-watch as many times as you need. These on-demand trading lessons make complex topics simple and accessible, whenever you are ready to learn.

The IC Markets Blog: A Source of Daily Insights

The market never sleeps, and neither does our analysis. The IC Markets Blog is your daily source for timely market commentary, trade ideas, and expert analysis. While our core trading courses build your foundational knowledge, the blog keeps you connected to the pulse of the market. Our team of analysts posts regular updates on key market movements, economic news, and potential trading setups, helping you apply your knowledge to what is happening right now.

Using a Demo Account for Risk-Free Practice

“The best way to learn to trade is by trading.”

But you do not have to risk your capital to get started. An IC Markets demo account is the perfect sandbox environment. It mirrors the live trading environment, using real market data, but with virtual funds. This allows you to:

- Practice executing trades without any financial pressure.

- Test the strategies you learn in our forex education courses.

- Familiarize yourself with the trading platform’s features.

- Build your confidence before you trade with real money.

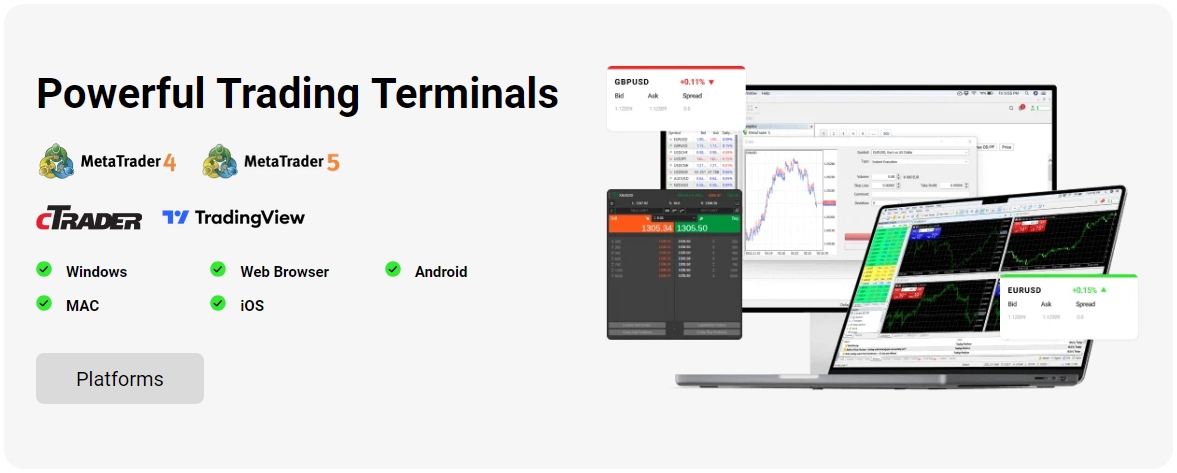

Navigating Trading Platforms: MetaTrader & cTrader

A powerful platform is a trader’s most important tool. We ensure you know how to use yours to its full potential. Our educational resources include comprehensive guides for the world’s most popular trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. We provide step-by-step tutorials to help you master everything from placing your first order to utilizing advanced charting tools and installing custom indicators.

Key Features of MT4 and MT5

MetaTrader platforms are the industry standard, known for their powerful features and robust performance. Our trading lessons will help you master their capabilities.

- Advanced Charting Tools: Access a huge suite of built-in indicators and graphical objects.

- Expert Advisors (EAs): Automate your trading strategies using powerful algorithms.

- Customizability: Tailor the platform to your needs with custom indicators and scripts.

- MQL Language: Develop your own trading robots and technical indicators.

- One-Click Trading: Execute trades swiftly and efficiently directly from the chart.

Exploring the cTrader Interface

cTrader is renowned for its sleek, user-friendly design and advanced order capabilities, making it a favorite among many traders. Our guides help you quickly get comfortable with its intuitive layout and powerful features.

Discover its clean charting interface, advanced risk management tools like cTrader Automate, and detailed market depth information. We show you how to leverage its unique features to get a clear view of the market and execute your trading plan with precision.

Exploring Advanced Trading Strategies

Once you have mastered the basics, it is time to explore more sophisticated techniques. Our educational content does not stop at the fundamentals. We provide deep dives into advanced trading strategies used by professional traders around the world. Learn the principles behind scalping, day trading, swing trading, and position trading. Discover how to combine different forms of analysis to create a robust and personalized trading system that fits your goals and risk tolerance.

Risk Management: A Core Pillar of Trading Education

Protecting your capital is the most important skill you can learn. Without proper risk management, even the best trading strategy can fail. This is why it is a central pillar of our entire forex education program. We dedicate significant resources to teaching you how to trade responsibly.

You will learn critical techniques like setting appropriate stop-loss orders, calculating correct position sizes, and understanding risk-to-reward ratios. Mastering these skills is essential for long-term survival and profitability in the markets.

Frequently Asked Questions

What types of educational materials does IC Markets offer?

IC Markets provides a comprehensive range of free educational resources, including in-depth articles, video tutorials, live webinars, daily market analysis, and platform walkthroughs to support traders at all levels.

Who can benefit from the IC Markets learning materials?

The educational content is designed for everyone, from absolute beginners who are new to terms like ‘pip’ and ‘leverage’ to intermediate traders looking to refine their strategies, and even experienced professionals seeking fresh market perspectives.

Can I practice trading without using real money?

Yes, you can use an IC Markets demo account to practice trading in a risk-free environment. The demo account mirrors live market conditions and uses virtual funds, allowing you to test strategies and familiarize yourself with the platform without financial pressure.

Which trading platforms are covered in the educational resources?

The educational guides provide comprehensive walkthroughs and tutorials for the world’s most popular trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

What is the difference between technical and fundamental analysis?

Technical analysis involves using historical price charts and market statistics to identify patterns and trading opportunities. In contrast, fundamental analysis evaluates an asset’s intrinsic value by analyzing economic data, central bank policies, and geopolitical events to understand the ‘why’ behind market movements.