- Why IC Markets Forex Stands Apart

- Explore a Universe of Currency Pairs

- Key Features at a Glance

- Ready to Join the Ranks of Elite Traders?

- Why Choose IC Markets for Forex Trading?

- Unrivaled Trading Conditions

- Powerful & Flexible Trading Platforms

- Commitment to Transparency and Security

- Diverse Range of Currency Pairs

- Exceptional Customer Support & Resources

- Understanding IC Markets’ Regulatory Compliance and Safety

- Forex Trading Platforms Offered by IC Markets

- MetaTrader 4 (MT4): The Industry Standard

- MetaTrader 5 (MT5): The Next Generation

- cTrader: Designed for True ECN Trading

- MetaTrader 4 (MT4) Experience with IC Markets

- Why IC Markets’ MT4 Platform Shines

- Your Trading Arsenal on MT4 with IC Markets

- MetaTrader 5 (MT5) Benefits for Forex Traders

- cTrader for Advanced IC Markets Forex Trading

- Why Serious Traders Choose cTrader:

- Spreads and Commissions with IC Markets Forex

- Raw Spread Account vs. Standard Account Comparison

- Understanding the Raw Spread Account

- Understanding the Standard Account

- Key Differences at a Glance

- Leverage Options for IC Markets Forex Traders

- Deposits and Withdrawals at IC Markets

- Effortless Deposits to Fuel Your Trading

- Secure and Prompt Withdrawals of Your Profits

- Typical Processing Times for Key Methods:

- Available Currency Pairs and Market Access on IC Markets

- Unrivaled Selection of Currency Pairs

- Seamless Market Access and Superior Execution

- Key Advantages of Our Market Access:

- IC Markets Customer Support and Resources

- Dedicated Customer Support Channels

- Comprehensive Educational Resources

- Advanced Trading Tools and Platform Support

- Educational Tools for Forex Traders at IC Markets

- Master Your Trading Skills with Our Resources

- Why Education is Your Edge

- Unique Features of IC Markets for Serious Forex Traders

- Unbeatable Spreads and Ultra-Low Commissions

- Lightning-Fast Execution Speed

- Advanced Trading Platforms for Every Style

- An Extensive Range of Currency Pairs

- Deep Liquidity for Stable Trading Conditions

- Comparing IC Markets Forex Account Types

- The IC Markets Standard Account

- The IC Markets Raw Spread Account

- The IC Markets cTrader Account

- Account Type Overview

- Risk Management Strategies for IC Markets Forex Trading

- Mastering Stop-Loss Orders

- Implementing Take-Profit Orders

- Strategic Position Sizing

- Defining Your Risk-Reward Ratio

- Diversification Across Currency Pairs

- Is IC Markets Right for Beginner Forex Traders?

- The Beginner’s Edge with IC Markets

- Navigating the World of Currency Pairs

- Is There a Catch for Novices?

- Advanced Trading Tools and Integrations with IC Markets

- Unleash Powerful Platforms and Features

- Key Advanced Tools for Strategic Trading

- Seamless Integrations for a Customised Experience

- The Future of Forex Trading with IC Markets

- Frequently Asked Questions

Why IC Markets Forex Stands Apart

Choosing the right partner for currency trading is crucial. IC Markets Forex provides a distinct advantage, built on transparency, reliability, and performance.

- Unmatched Spreads: We offer some of the tightest raw spreads in the industry, starting from 0.0 pips on major currency pairs. This means more of your potential profits stay with you.

- Lightning-Fast Execution: Our robust infrastructure, co-located servers, and deep liquidity pools ensure your trades execute at incredible speeds, minimizing slippage and maximizing precision.

- Powerful Trading Platforms: Access the world’s most popular platforms, including MetaTrader 4, MetaTrader 5, and cTrader. Each is packed with advanced tools, charting capabilities, and customization options to suit your strategy.

- Extensive Range of Instruments: Beyond an impressive selection of currency pairs, diversify your portfolio with commodities, indices, cryptocurrencies, and more.

- Exceptional Customer Support: Our dedicated, multilingual support team is available 24/7 to assist you, ensuring a smooth and uninterrupted trading experience.

Explore a Universe of Currency Pairs

With IC Markets Forex, you gain access to an extensive array of currency pairs. Whether you focus on the stability of major pairs like EUR/USD and GBP/JPY, explore the volatility of minor pairs, or seek opportunities in exotic markets, our platform offers the depth you need. This wide selection allows you to implement diverse strategies and react to global economic events with agility.

“Success in forex trading starts with the right environment. IC Markets Forex delivers precisely that – speed, precision, and unparalleled market access.”

Key Features at a Glance

We pride ourselves on providing an environment that fosters trading excellence. Here’s a quick overview of what you can expect:

| Feature | Benefit to You |

|---|---|

| Deep Liquidity | Consistent pricing and minimal requotes. |

| Flexible Leverage | Manage your risk and maximize potential gains effectively. |

| Advanced Order Types | Execute complex strategies with precision. |

| Educational Resources | Enhance your trading knowledge and skills. |

Ready to Join the Ranks of Elite Traders?

IC Markets Forex is more than just a forex broker; we are a partner in your trading journey. We provide the tools, the technology, and the support so you can focus on what matters most: making informed decisions in the dynamic world of currency trading. Open an account today and discover the difference that a truly professional trading environment can make for your forex trading aspirations.

Don’t just trade; excel with IC Markets Forex. Your ultimate guide to trading excellence begins here.

We empower traders with exceptional conditions and comprehensive support, making your journey into currency trading both efficient and rewarding.

Why Choose IC Markets for Forex Trading?

Navigating the dynamic world of online forex trading demands a partner you can truly trust. For countless traders seeking an edge, IC Markets Forex emerges as a premier choice, offering a robust and reliable environment built for success. We empower traders with exceptional conditions and comprehensive support, making your journey into currency trading both efficient and rewarding.

Unrivaled Trading Conditions

Experience the difference with trading conditions designed to put you ahead. IC Markets provides some of the tightest spreads in the industry, starting from 0.0 pips on major currency pairs. Our deep liquidity from top-tier providers ensures minimal slippage and lightning-fast execution speeds, critical for high-frequency trading strategies. This commitment to superior conditions gives you the real advantage every time you place a trade.

- Raw Spreads: Access institutional-grade pricing with spreads from 0.0 pips.

- Ultra-Fast Execution: Benefit from an average execution speed of less than 40ms.

- Deep Liquidity: Trade with confidence, even during volatile market conditions.

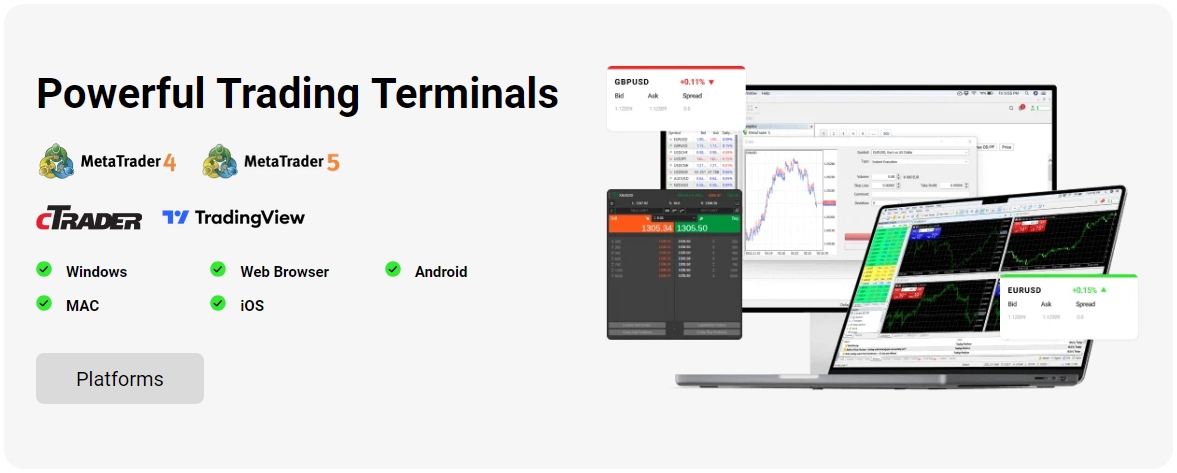

Powerful & Flexible Trading Platforms

Your trading tools should adapt to your style, not the other way around. As a leading forex broker, IC Markets offers a suite of industry-standard platforms, providing flexibility and advanced features whether you are a novice or a seasoned professional.

| Platform | Key Features |

|---|---|

| MetaTrader 4 (MT4) | User-friendly interface, extensive charting tools, Expert Advisors (EAs). |

| MetaTrader 5 (MT5) | Advanced analytical tools, more timeframes, built-in economic calendar, depth of market. |

| cTrader | ECN trading environment, advanced order types, algorithmic trading capabilities (cBots). |

Each platform offers a seamless experience across desktop, web, and mobile, ensuring you can manage your positions and react to market movements from anywhere.

Commitment to Transparency and Security

Security and integrity form the bedrock of our operations. IC Markets operates under stringent regulatory oversight, providing a transparent and secure trading environment. We segregate client funds with top-tier banks, offering you peace of mind that your capital remains protected. Our dedication to compliance ensures we maintain the highest standards of operation and client protection.

“Choosing a forex broker with a strong regulatory framework is paramount. IC Markets delivers confidence through its transparent practices and robust security measures.”

Diverse Range of Currency Pairs

Expand your horizons beyond just major currency pairs. IC Markets offers an extensive selection of instruments for currency trading, including majors, minors, and exotics. This broad offering allows you to diversify your portfolio and capitalize on opportunities across various global markets. Whether you prefer the stability of EUR/USD or the unique movements of emerging market currencies, you will find ample choices here.

Exceptional Customer Support & Resources

We believe in empowering our traders through excellent support and valuable educational resources. Our dedicated customer service team provides 24/7 assistance, ready to answer your questions and resolve any issues promptly. Beyond support, we offer a wealth of educational materials, market analysis, and webinars to help you refine your skills and stay informed about the latest trends in forex trading.

Choosing IC Markets for your forex trading means opting for an environment built on competitive conditions, advanced technology, security, and unwavering support. Join us and experience the difference a truly professional forex broker makes to your trading success.

Understanding IC Markets’ Regulatory Compliance and Safety

Embarking on the world of online financial markets demands trust. Choosing a reliable forex broker is paramount. When it comes to IC Markets Forex, transparency and client protection stand at the core of their operations. We know you seek peace of mind, especially when navigating the dynamic landscape of forex trading.

IC Markets takes its regulatory responsibilities seriously. This commitment ensures a secure trading environment for all participants. They operate under strict oversight from multiple global financial authorities. These bodies enforce rigorous standards for capital adequacy, client fund protection, and fair business practices.

IC Markets’ global presence means they adhere to various stringent regulatory frameworks. This robust compliance structure offers traders confidence:

| Regulatory Authority | Key Focus / Region |

|---|---|

| Australian Securities and Investments Commission (ASIC) | Strict consumer protection, Australia |

| Cyprus Securities and Exchange Commission (CySEC) | EU operations, MiFID II compliance |

| The Securities Commission of the Bahamas (SCB) | International operations, strong financial services framework |

| Financial Services Authority (FSA) of Seychelles | Global outreach, consumer protection, market integrity |

Each regulatory body performs regular audits and monitors the broker’s activities. This constant scrutiny ensures IC Markets maintains high standards in all aspects of its service, from trading execution to handling client complaints. Your engagement in currency trading, whether with major or exotic currency pairs, happens under a secure umbrella.

Let’s talk about fund safety. One of the most critical aspects of choosing a forex broker is how they protect your money. IC Markets actively segregates all client funds. This means:

- IC Markets holds your funds in separate bank accounts, distinct from the company’s operational capital.

- This separation ensures your capital remains safe and accessible, even in the unlikely event of company insolvency.

- IC Markets partners with top-tier banks for these segregated accounts, adding an extra layer of security.

Choosing IC Markets for your forex trading journey means partnering with a broker that prioritizes your security. Their commitment to regulatory compliance and client fund safety lets you focus on your trading strategies with confidence. Experience reliable, regulated trading – join IC Markets today.

Forex Trading Platforms Offered by IC Markets

Navigating the dynamic world of forex trading requires not only skill and strategy but also the right tools. At IC Markets, we understand this deeply, which is why we provide a suite of industry-leading forex trading platforms designed to empower your currency trading journey. As a premier forex broker, we ensure you have access to robust, reliable, and feature-rich environments to execute your trades and manage your investments efficiently. Discover how our platform offerings can enhance your IC Markets Forex experience.

MetaTrader 4 (MT4): The Industry Standard

For many traders, MetaTrader 4 remains the gold standard in online forex trading. Its intuitive interface and powerful charting tools have made it a global favorite. IC Markets provides an optimized MT4 experience, ensuring lightning-fast execution and a stable trading environment.

- User-Friendly Interface: Easy to navigate, even for beginners.

- Advanced Charting: Utilize numerous timeframes and analytical objects to pinpoint market trends.

- Expert Advisors (EAs): Automate your trading strategies with custom-built robots.

- Extensive Indicator Library: Access a vast collection of technical indicators to refine your analysis.

- Mobile Trading: Stay connected to the markets and manage your currency pairs on the go with dedicated mobile apps.

MetaTrader 5 (MT5): The Next Generation

Building on the legacy of MT4, MetaTrader 5 offers enhanced capabilities and additional features for an even more comprehensive trading experience. If you are seeking expanded functionalities, MT5 provides the power you need, making it an excellent choice for advanced traders and those exploring a wider range of markets beyond just forex.

- More Timeframes: Gain deeper insights with more charting options.

- Additional Indicators and Objects: Expand your analytical toolkit further.

- New Order Types: Execute more complex trading strategies with greater flexibility.

- Depth of Market (DOM): View real-time market depth to understand liquidity.

- Multi-Asset Trading: While primarily known for forex trading, MT5 also facilitates trading other asset classes, offering a broader scope.

cTrader: Designed for True ECN Trading

For traders who prioritize pure ECN execution, cTrader stands out. This platform is specifically built to offer a transparent and direct market access experience, ideal for scalpers and day traders focusing on precise entry and exit points across various currency pairs. It provides a distinct feel and powerful tools tailored for serious currency trading.

Here’s why many choose cTrader for their IC Markets Forex activities:

| Feature | Benefit |

|---|---|

| True ECN Environment | Direct access to interbank liquidity, tight spreads. |

| Advanced Order Types | Precision in execution with sophisticated order management. |

| Algo Trading with cAlgo | Develop and backtest custom trading robots and indicators using C#. |

| Detailed Trade Analysis | Comprehensive breakdown of your trading performance. |

| Clean, Modern Interface | Intuitive and aesthetically pleasing, enhancing user experience. |

Choosing the right platform is a crucial step in your forex trading journey. Whether you prefer the familiarity of MT4, the enhanced features of MT5, or the specialized ECN environment of cTrader, IC Markets ensures you have top-tier options. Each platform offers unique strengths, designed to cater to different trading styles and preferences within the IC Markets Forex ecosystem. Explore them all and find the perfect fit to elevate your trading!

MetaTrader 4 (MT4) Experience with IC Markets

Ready to elevate your trading journey? MetaTrader 4, universally known as MT4, stands as the industry benchmark for online trading platforms. When you combine this powerful software with a top-tier forex broker like IC Markets, you unlock an unparalleled environment for serious

forex trading

.We provide a seamless and robust MT4 experience, giving you the tools to navigate the dynamic world of currency markets with confidence. It is a platform renowned for its user-friendly interface and advanced functionalities, making it ideal for both new and seasoned traders.

Why IC Markets’ MT4 Platform Shines

Our commitment to providing an exceptional trading experience truly comes to life through MT4. Here’s what sets it apart:

- Ultra-Fast Execution: Experience lightning-quick order execution, essential for capitalizing on fast-moving markets. Our direct access to deep liquidity ensures minimal slippage and optimal pricing, vital for successful

IC Markets Forex

operations. - Advanced Charting Tools: Dive deep into market analysis with a comprehensive suite of charting tools. Utilize multiple timeframes, drawing objects, and technical indicators to identify trends and make informed decisions on various

currency pairs

. - Expert Advisors (EAs) Support: Automate your trading strategies effortlessly. MT4 fully supports Expert Advisors, allowing you to implement sophisticated algorithms and trade around the clock without constant manual intervention. This feature is a game-changer for many engaged in modern

currency trading

. - Customizable Interface: Tailor your trading environment to match your preferences. Arrange charts, watchlists, and tools exactly how you like them, creating a workspace optimized for your personal trading style.

Your Trading Arsenal on MT4 with IC Markets

Beyond the core features, IC Markets enhances your MT4 experience with resources designed to empower your decisions:

| Feature | Benefit to Trader |

|---|---|

| Depth of Market (DoM) | Gain insight into liquidity and market sentiment. |

| One-Click Trading | Execute trades instantly, minimizing delays. |

| Historical Data Access | Backtest strategies with extensive past market data. |

Choosing IC Markets as your

forex broker

means leveraging MT4 with superior connectivity and support. We ensure your platform runs smoothly, allowing you to focus purely on your strategy and execution across a wide range of assets. Take control of your financial future by experiencing the professional edge that IC Markets and MT4 deliver.MetaTrader 5 (MT5) Benefits for Forex Traders

Ready to elevate your trading experience? MetaTrader 5 (MT5) offers a significant leap forward for those engaged in serious forex trading. This powerful platform builds on the success of its predecessor, delivering an even more robust and versatile environment for analyzing markets and executing trades. If you are serious about currency trading, understanding MT5’s advantages is crucial for your success.

MT5 empowers you with an unparalleled suite of tools for in-depth market analysis. You gain access to a wider array of technical indicators and graphical objects, helping you spot trends and make informed decisions across various currency pairs. The platform provides:

- Expanded Timeframes: Analyze market movements across 21 distinct timeframes, from one-minute charts to monthly, for a comprehensive perspective.

- Integrated Economic Calendar: Stay ahead of market-moving news and events directly within the platform, without needing external resources.

- Depth of Market (DOM): View real-time market depth to gauge liquidity and potential price action, an invaluable tool for precision trading, especially with dynamic IC Markets Forex offerings.

Beyond analysis, MT5 significantly streamlines your trading operations, offering flexibility and efficiency vital for the fast-paced forex market. It brings advanced functionality right to your fingertips:

| Feature | MT5 Advantage for Traders |

|---|---|

| Order Types | Access to more pending order types, including Buy Stop Limit and Sell Stop Limit, for incredibly precise entry and exit strategies. |

| Hedging & Netting | The platform supports both hedging (multiple positions for the same instrument) and netting (consolidating positions), giving you complete control over your strategy. |

| Execution Speed | Experience faster processing of orders, a critical factor when dealing with volatile forex markets. |

For traders who leverage automation, MT5’s MQL5 programming language provides a powerful foundation. You can develop and deploy sophisticated Expert Advisors (EAs) and custom indicators with greater efficiency and functionality than ever before. This advanced environment fosters innovation, allowing you to tailor your trading approach precisely to your needs.

“MT5 transforms how you engage with the market, offering tools not just to react, but to truly understand and anticipate movements. It’s a strategic advantage for any serious forex trader.”

Choosing a forex broker that offers MetaTrader 5 ensures you have access to these cutting-edge features. Experience the difference a next-generation platform makes in your pursuit of successful currency trading. Unlock a world of advanced opportunities for your forex trading journey.

cTrader for Advanced IC Markets Forex Trading

Ready to elevate your approach to IC Markets Forex? For traders who demand precision, advanced tools, and deep market insight, cTrader stands out as a powerful platform. It is a premium choice for those serious about their forex trading journey, offering a sophisticated environment designed to meet the needs of experienced market participants.

cTrader is more than just a trading interface; it’s an ecosystem built for performance. This platform empowers you with unparalleled control over your trades and a transparent view of market dynamics. It’s truly for those who want to execute complex strategies and meticulously analyze market behavior.

Why Serious Traders Choose cTrader:

- Algorithmic Trading Capabilities: Utilize cAlgo to develop, backtest, and optimize your custom trading robots and indicators. This feature allows for automated strategies that execute trades based on your precise rules, freeing up your time for deeper analysis.

- Superior Charting Tools: Dive into comprehensive charting with multiple chart types, timeframes, and a vast array of technical indicators. Visualizing market trends across various currency pairs becomes intuitive and highly effective.

- Advanced Order Types: Gain flexibility with a wide range of order types, including market orders, limit orders, stop orders, and advanced bracket orders. You maintain full control over entry and exit points, managing risk with greater precision.

- Level II Pricing (Depth of Market): Experience true market transparency with full depth of market visibility. You see the complete range of executable prices directly from liquidity providers, giving you a clearer picture of market liquidity.

- Customizable Interface: Tailor the platform to your exact preferences. Arrange workspaces, detach charts, and personalize your layout to create an optimal currency trading environment that suits your individual style.

When you combine cTrader’s advanced functionalities with the robust infrastructure of IC Markets Forex, you unlock a formidable trading experience. IC Markets, a leading forex broker, provides ultra-low latency execution, competitive spreads, and deep liquidity, all crucial elements that complement cTrader’s precision-focused design. This synergy ensures your sophisticated strategies are executed exactly as intended, without compromise.

“Precision, transparency, and advanced control define the cTrader experience. It’s a platform built for those who refuse to settle for anything less than the best in their trading.”

If you are looking to push the boundaries of your online trading and leverage tools trusted by professional traders worldwide, exploring cTrader with IC Markets is your next logical step. Discover how this powerful combination can transform your approach to the markets.

Spreads and Commissions with IC Markets Forex

Navigating the costs associated with your forex trading journey is a critical skill for any successful trader. With IC Markets Forex, you discover a transparent and highly competitive fee structure designed to maximize your trading potential. We champion clarity, ensuring you always understand the true cost of executing your trades across various currency pairs.

Experience the Power of Raw Spreads: IC Markets Forex distinguishes itself by offering genuine raw spreads. This means you gain direct access to institutional-grade pricing, often seeing spreads as low as 0.0 pips on some of the most liquid currency pairs. This commitment to tight spreads is a significant benefit, reducing your entry barriers and improving your potential profitability across a wide range of currency trading instruments.

“Transparent costs empower confident trading. IC Markets Forex delivers clarity from the start.”

Unpacking Our Commission Structure: While our raw spreads are remarkably low, trading with an IC Markets Forex Raw Spread account involves a small, fixed commission per standard lot. This model is straightforward and predictable, allowing you to accurately calculate your trading expenses before you even open a position. This structure particularly appeals to high-volume traders and those employing strategies that benefit from minimal market impact costs. It’s a core part of how we, as a leading forex broker, facilitate efficient currency trading.

Here’s a simplified breakdown of the core cost components:

| Cost Component | Description |

|---|---|

| Spreads | The difference between the bid and ask price, often raw and exceptionally tight on major currency pairs. |

| Commissions | A fixed fee per lot traded, primarily applicable to Raw Spread accounts, ensuring transparency. |

The combination of ultra-low spreads and clear, fixed commissions creates a powerful proposition for serious forex traders. This efficient pricing model makes a real difference, especially for strategies involving frequent trades or large volumes across various currency pairs. It ensures more of your trading profits stay in your account, supporting your overall success in the dynamic world of currency trading.

Raw Spread Account vs. Standard Account Comparison

Choosing the right account type is crucial for your success in the dynamic world of forex trading. At IC Markets Forex, we understand that every trader has unique needs and strategies. That is why we offer two primary account types: the Raw Spread Account and the Standard Account. Each is designed to cater to different trading styles, ensuring you find the perfect fit for your currency trading journey.

Understanding the Raw Spread Account

The Raw Spread Account is a favorite among professional traders, scalpers, and those employing Expert Advisors (EAs). This account type offers incredibly tight spreads, often starting from 0.0 pips, across major currency pairs. You get direct access to institutional-grade spreads, which means you see the raw interbank market prices.

- Ultra-Tight Spreads: Experience some of the lowest spreads available in the market.

- Commission-Based: A small, fixed commission is charged per lot traded, typically on a round-turn basis. This clear fee structure makes calculating costs straightforward.

- Ideal For: High-frequency traders, algorithmic traders, and those who prioritize minimal spread costs above all else.

Understanding the Standard Account

The Standard Account, on the other hand, is an excellent choice for new traders, those who prefer simplicity, or anyone who values an all-inclusive pricing model. With this account, you trade commission-free. Instead, the cost of trading is incorporated into a slightly wider, fixed spread.

- Commission-Free Trading: No separate commission charges, simplifying your trade calculations.

- Wider Spreads: Spreads are slightly wider compared to the Raw Spread Account, but they are transparent and easy to understand.

- Ideal For: Discretionary traders, beginners, and those who prefer a single, upfront cost integrated into the spread without additional commissions.

Key Differences at a Glance

To help you make an informed decision, here’s a direct comparison of the key features of both account types:

| Feature | Raw Spread Account | Standard Account |

| Spreads | Ultra-tight, often from 0.0 pips | Slightly wider, commission-free |

| Commissions | Charged per lot traded (round turn) | None (integrated into the spread) |

| Pricing Model | Spread + Commission | All-inclusive spread |

| Target Trader | High-volume, scalpers, EAs | Beginners, discretionary traders |

| Cost Transparency | Clear, separate spread and commission | Simple, single spread cost |

Ultimately, the best account for your IC Markets Forex trading depends on your individual preferences, trading frequency, and overall strategy. If you frequently trade large volumes or employ strategies sensitive to tight spreads, the Raw Spread Account may offer a significant edge. Conversely, if you value simplicity and prefer a single, integrated cost for your currency pairs, the Standard Account provides a straightforward and user-friendly experience.

Take time to consider your trading style and goals. Choose the account that aligns perfectly with how you approach the markets, and you’ll set yourself up for a more effective and profitable forex trading journey with a leading forex broker.

Leverage Options for IC Markets Forex Traders

Leverage stands as a cornerstone of modern `forex trading`, offering traders the ability to control larger positions than their account balance would typically allow. It acts like a loan from your broker, significantly amplifying both potential gains and losses. For those engaging in `currency trading` with `IC Markets Forex`, understanding these leverage options is crucial for effective risk management and strategic market participation. As a leading `forex broker`, IC Markets offers flexible leverage ratios, though the specific maximums depend heavily on the regulatory entity overseeing your account and the particular financial instrument you are trading. This means traders in different regions will experience different caps on available leverage, primarily due to varying regulatory requirements designed to protect retail investors. Here’s how leverage typically works and what you might expect with `IC Markets Forex`:- **Amplified Market Exposure:** Leverage allows you to open trades with a much larger notional value using a relatively small margin. For instance, with 1:500 leverage, a $100 deposit can control a $50,000 position in `currency pairs`.

- **Regulatory Impact:** Maximum leverage can vary significantly. Traders under ASIC (Australia) or CySEC (Europe) regulations will find lower caps, often around 1:30 for major `currency pairs`, in line with ESMA guidelines. In contrast, IC Markets entities regulated elsewhere might offer much higher ratios, sometimes up to 1:500 or even more, depending on the asset class.

- **Instrument-Specific Leverage:** Leverage ratios are not universal across all assets. While major `currency pairs` usually have the highest available leverage, commodities, indices, and cryptocurrencies often come with lower maximums due to their inherent volatility or market structure.

- **Margin Requirements:** Your account’s margin requirement directly correlates with the leverage you use. Higher leverage means lower margin needed to open a position, but it also increases the risk of a margin call if the market moves against you.

While the allure of higher leverage is undeniable, particularly for magnifying returns in forex trading, it demands a disciplined approach. Responsible use of leverage is paramount; it’s a double-edged sword that can quickly deplete an account if market analysis proves incorrect or proper risk controls are absent.

“Leverage empowers you to seize opportunities, but true mastery lies in knowing when and how much to apply, always prioritizing capital preservation.”

Many professional traders choose to use significantly lower leverage than the maximum available, focusing instead on consistent strategy execution and robust risk management. This cautious stance often leads to more sustainable results in the long run.

Deposits and Withdrawals at IC Markets

Seamless financial transactions are the backbone of successful online trading. At IC Markets, we understand that getting your funds in and out quickly and securely is paramount for every trader. As a leading forex broker, we prioritize efficient, transparent processes for both deposits and withdrawals, ensuring you can focus on your forex trading strategies without unnecessary delays.

We pride ourselves on providing a wide array of convenient funding options designed to cater to our diverse global clientele. Our goal is to make your experience with IC Markets Forex as smooth as possible from the very first deposit.

Effortless Deposits to Fuel Your Trading

Funding your IC Markets account is straightforward and fast. We offer numerous methods, ensuring you can choose the option that best suits your needs and location. Most deposit methods are instant, allowing you to jump straight into trading currency pairs without waiting.

- Credit/Debit Card: Instant processing for immediate access to funds.

- Neteller/Skrill: Popular e-wallet solutions, typically instant.

- PayPal: A widely recognized, secure, and instant funding method.

- Bank Transfer: Direct bank transfers are secure, though processing times can vary depending on your bank and location.

- Broker to Broker Transfer: A convenient option for transferring funds directly from another broker.

With such a comprehensive selection, you can confidently deposit and begin your currency trading journey, knowing your funds are handled with utmost care and speed.

Secure and Prompt Withdrawals of Your Profits

When it comes to withdrawing your hard-earned profits, IC Markets maintains the same high standards of efficiency and security. We believe that accessing your funds should be as hassle-free as depositing them. Our streamlined withdrawal process ensures that your requests are handled promptly, allowing you to manage your finances effectively.

Withdrawal requests are typically processed within one business day, though the time it takes for the funds to appear in your account can vary based on the chosen method and your banking institution. We work tirelessly to ensure a swift and reliable transfer of your funds.

Typical Processing Times for Key Methods:

| Method | Deposit Time | Withdrawal Time (After Processing) |

|---|---|---|

| Credit/Debit Card | Instant | 3-5 Business Days |

| Neteller/Skrill/PayPal | Instant | Instant to 1 Business Day |

| Bank Transfer | 2-5 Business Days | 3-5 Business Days |

Experience the difference with a broker committed to your financial convenience. Our dedicated support team is always ready to assist with any queries regarding your transactions, ensuring a smooth flow of funds. Join IC Markets today and empower your trading with unparalleled financial flexibility.

Available Currency Pairs and Market Access on IC Markets

Exploring the world of currency trading demands a platform offering both breadth and depth. At IC Markets, we understand this critical need, providing extensive access to global financial markets. Our commitment ensures traders can capitalize on diverse opportunities across a vast selection of currency pairs.

When you choose to engage in IC Markets Forex, you gain entry to a comprehensive range of instruments. This broad offering allows you to craft robust trading strategies and diversify your portfolio effectively. We connect you directly to the markets, ensuring optimal conditions for your currency trading endeavors.

Unrivaled Selection of Currency Pairs

Our platform boasts an impressive array of currency pairs, catering to every type of forex trader, from those focused on stability to those seeking higher volatility. This diverse selection forms the backbone of your trading strategy, offering flexibility and choice.

- Major Pairs: These are the most frequently traded currency pairs, featuring highly liquid markets and tight spreads. Think EUR/USD, GBP/USD, USD/JPY, and AUD/USD. They represent the backbone of global forex trading and offer consistent opportunities.

- Minor Pairs: Also known as cross-currency pairs, these involve two major currencies but exclude the US Dollar. Examples include EUR/GBP, EUR/JPY, and AUD/NZD. They provide different volatility profiles and market dynamics for strategic engagement.

- Exotic Pairs: Combining a major currency with the currency of a developing or smaller economy, exotic pairs offer unique market characteristics. While they often present wider spreads and lower liquidity, they can unlock high-impact opportunities for savvy traders.

Seamless Market Access and Superior Execution

Beyond the sheer number of currency pairs, the quality of market access defines your trading experience. As a leading forex broker, IC Markets provides an unparalleled environment for your trades. We focus on delivering deep liquidity, competitive pricing, and ultra-fast execution speeds, creating ideal conditions for traders globally.

“Access to diverse markets with razor-thin spreads and lightning-fast execution is the cornerstone of successful forex trading. IC Markets consistently delivers on this promise.”

We operate on an Electronic Communication Network (ECN) model. This means your trades bypass a dealing desk, connecting you directly to a pool of liquidity providers. This transparent approach ensures genuine market prices and minimizes requotes, providing a fair and efficient trading environment for every IC Markets Forex participant.

Key Advantages of Our Market Access:

- Deep Liquidity: Benefit from aggregated pricing from over 25 different liquidity providers. This depth means better prices and minimal slippage, even for large orders.

- Ultra-Low Spreads: Our ECN model allows us to offer some of the industry’s tightest spreads, starting from 0.0 pips on major currency pairs, directly translating into lower trading costs for you.

- Lightning-Fast Execution: Trade with confidence, knowing your orders execute swiftly. Our advanced infrastructure and co-location with liquidity providers ensure minimal latency, crucial for high-frequency trading and scalping strategies.

- No Restrictions: We place no restrictions on trading styles. Whether you employ expert advisors, scalping, or hedging, our environment supports your strategy without interference.

IC Markets empowers you with the tools and access necessary to navigate the dynamic world of currency trading successfully. Join us and experience the difference that a truly market-leading forex broker can make to your trading journey.

IC Markets Customer Support and Resources

Navigating the dynamic world of forex trading demands robust support and readily available resources. At IC Markets Forex, we understand this crucial need. We empower our traders with an exceptional support system and a wealth of educational materials, ensuring you always feel confident and informed. Our goal is to provide a seamless trading experience, backed by expertise and comprehensive tools.

Dedicated Customer Support Channels

Your trading journey deserves reliable assistance around the clock. IC Markets offers multi-channel customer support designed to address your queries promptly and efficiently. Our team stands ready to help, no matter your location or time zone. Expect clear, concise answers that help you get back to focusing on your currency trading strategies.

- 24/7 Live Chat: Get instant answers to your pressing questions directly from our website. Our support agents are always online, ready to assist.

- Email Support: For more detailed inquiries or documentation, our email support team provides thorough and timely responses.

- Phone Support: Prefer to speak with someone? Our global phone lines connect you directly with experienced professionals who can guide you through any challenge.

- Multilingual Team: We offer support in multiple languages, ensuring you can communicate comfortably and effectively.

Comprehensive Educational Resources

Knowledge is power in the markets. IC Markets equips you with an extensive library of educational content, perfect for both novice and seasoned traders. Dive deep into market analysis, strategies, and platform guides to refine your skills and make informed decisions.

You gain access to a variety of learning tools:

- Trading Guides & Tutorials: Step-by-step instructions on various aspects of forex trading, from basic concepts to advanced strategies.

- Webinars & Seminars: Participate in live sessions led by industry experts, covering market insights, technical analysis, and risk management. Learn directly from the pros.

- Market Analysis: Stay ahead with daily market commentary, economic calendars, and expert analysis on key currency pairs. Understand the forces shaping the market.

- Glossary: Demystify complex trading terminology with our comprehensive glossary, making currency trading accessible to everyone.

Advanced Trading Tools and Platform Support

Beyond direct assistance, IC Markets Forex provides a suite of advanced tools that serve as invaluable resources for your trading. These features are integrated into our platforms, designed to enhance your analytical capabilities and execution speed.

| Resource Type | Benefit |

|---|---|

| Economic Calendar | Track major economic events that impact currency pairs. |

| Market Analysis Tools | Utilize integrated tools for in-depth chart analysis and trend identification. |

| Trading Calculators | Manage risk and calculate margins effectively before placing trades. |

| Platform Tutorials | Master MetaTrader 4, MetaTrader 5, and cTrader with detailed guides. |

We ensure that whether you are just starting with IC Markets as your forex broker or you are a veteran trader, you have all the necessary support and resources to thrive in the forex market.

Educational Tools for Forex Traders at IC Markets

Navigating the dynamic world of forex trading demands constant learning. A robust educational foundation is not just an advantage; it’s a necessity for sustained success. At IC Markets Forex, we understand this critical need, providing a comprehensive suite of resources designed to empower traders at every stage of their journey.

Whether you’re taking your first steps into currency trading or seeking to refine advanced strategies, our curated educational materials equip you with practical knowledge and insights. We believe that an informed trader makes better decisions, which is why we invest heavily in accessible, high-quality learning tools.

Master Your Trading Skills with Our Resources

Our commitment to trader education goes beyond basic definitions. We offer a multi-faceted approach, catering to different learning styles and experience levels. Here’s a glimpse into the valuable resources available:

- Expert Webinars & Seminars: Participate in live sessions led by industry professionals. These interactive events cover market analysis, technical strategies, risk management, and deep dives into specific currency pairs. You can ask questions in real-time and gain direct insights.

- Extensive Article Library: Our comprehensive collection of articles breaks down complex topics into digestible explanations. Learn about market fundamentals, trading psychology, economic indicators, and advanced analytical techniques. This library serves as an excellent reference point for ongoing study.

- Video Tutorials: Visual learners will appreciate our library of video tutorials. These step-by-step guides demonstrate how to use trading platforms, execute trades, interpret charts, and apply various indicators. They make learning practical and engaging.

- Trading Guides & eBooks: Downloadable guides provide in-depth explorations of specific trading concepts. From beginner’s guides to advanced strategy handbooks, these resources offer structured learning paths.

- Glossary of Terms: Quickly look up any unfamiliar terms with our comprehensive forex glossary. Understanding the jargon is crucial for clear communication and effective learning.

- Market Analysis & News: Stay ahead of market movements with our daily and weekly analysis. Learn how to interpret news events and their potential impact on various currency pairs. This practical application of knowledge is a powerful learning tool.

Why Education is Your Edge

Engaging with these educational tools transforms your potential. As a leading forex broker, we see firsthand how informed traders approach the markets with greater confidence and strategic foresight. You gain the ability to:

“An educated trader is an empowered trader. Our tools provide the compass to navigate the complex forex landscape effectively.”

We encourage you to explore these resources and integrate them into your daily trading routine. Embrace the journey of continuous learning with IC Markets Forex and unlock your full trading potential.

Unique Features of IC Markets for Serious Forex Traders

Serious forex traders demand more than just a basic trading account; they seek a partner that provides a competitive edge. IC Markets Forex stands out as a leading choice, offering a suite of unique features designed to empower professional and aspiring traders alike. When your goal is consistent profitability in currency trading, the right forex broker makes all the difference. Let’s explore what makes IC Markets a preferred platform.Unbeatable Spreads and Ultra-Low Commissions

One of the most critical factors for active forex trading is the cost of transactions. IC Markets excels here, providing some of the industry’s tightest raw spreads directly from top-tier liquidity providers. This means you’re trading closer to the actual market price.- Average EUR/USD spread often near 0.0 pips.

- Transparent, low commission structure per standard lot.

- Significant cost savings, especially for high-volume traders and scalpers.

Lightning-Fast Execution Speed

In the fast-paced world of currency trading, milliseconds matter. IC Markets has invested heavily in robust infrastructure to ensure rapid order execution.Their servers, strategically located near major financial hubs, minimize latency. This gives traders a crucial advantage, particularly when executing trades based on market volatility or high-frequency strategies. Slippage is dramatically reduced, helping you enter and exit positions precisely.

Advanced Trading Platforms for Every Style

IC Markets understands that traders have diverse needs. They offer a comprehensive range of industry-leading platforms, each packed with powerful tools for analysis and execution. Whether you’re a beginner or a seasoned professional, you’ll find a platform that suits your strategy.

| Platform | Key Benefit | Ideal For |

|---|---|---|

| MetaTrader 4 (MT4) | Extensive EAs & Custom Indicators | Algorithmic Traders, Chartists |

| MetaTrader 5 (MT5) | More Indicators, Timeframes, Depth of Market | Advanced Analysis, Futures Trading |

| cTrader | Raw Spreads, Superior UI, Advanced Order Types | ECN Trading, Scalpers, Manual Traders |

An Extensive Range of Currency Pairs

Diversification is key in forex trading. IC Markets provides access to an incredibly broad selection of currency pairs, ensuring traders can always find opportunities across major, minor, and exotic markets. This extensive offering allows traders to capitalize on various global economic trends and market conditions.

This wide selection means you’re not limited to just the popular pairs. You can explore less correlated assets, manage risk effectively, and uncover unique trading setups.

Deep Liquidity for Stable Trading Conditions

Serious traders need confidence that their large orders won’t significantly impact market prices. IC Markets connects directly to multiple top-tier liquidity providers, creating a deep pool of liquidity. This ensures that even substantial trade sizes are executed smoothly and efficiently, with minimal market disruption.

“Deep liquidity at IC Markets provides a stable environment, even during volatile news events, giving traders peace of mind when placing significant trades.”

This commitment to deep liquidity is invaluable, offering stable pricing and reliable execution, which is crucial for managing risk and maximizing potential returns in forex trading.

Comparing IC Markets Forex Account Types

Choosing the right account type for your `forex trading` journey with `IC Markets Forex` sets the stage for your success. We know one size does not fit all. `IC Markets` offers tailored options designed to meet various trading styles, experience levels, and capital commitments. Understanding these differences empowers you to select the best fit for your unique objectives in the dynamic `currency trading` market.Consider these essential factors before making your choice:

- Your Trading Strategy: Are you a scalper, day trader, or long-term position holder?

- Budget: How much capital do you plan to invest?

- Experience Level: Are you new to the markets or a seasoned professional?

- Platform Preference: Do you prefer MetaTrader 4/5 or cTrader?

- Cost Sensitivity: Are you more concerned about spreads or commissions?

The IC Markets Standard Account

The Standard Account is a popular choice, particularly for those new to `forex trading` or traders who prefer a straightforward cost structure. It operates on a spread-only model, meaning no commissions on trades. This account integrates all costs directly into the spread, making it easy to calculate your overall transaction expenses.

- Key Features: Spreads from 0.6 pips, no commissions, available on MetaTrader 4 & 5.

- Best For: Discretionary traders, those who prefer simple pricing, beginners.

Pros:

- Easy to understand cost structure.

- No separate commission charges.

- Often seen as less complex for new traders.

Cons:

- Wider spreads compared to raw spread accounts.

- Can be less cost-effective for high-volume traders over time.

The IC Markets Raw Spread Account

For serious traders seeking the tightest possible spreads and lightning-fast execution, the Raw Spread Account stands out. This account offers true ECN pricing, reflecting interbank rates directly. You pay a small commission per lot traded, but in return, you access spreads as low as 0.0 pips on major `currency pairs` during peak liquidity. It’s built for precision and cost-efficiency at scale.

- Key Features: Spreads from 0.0 pips, low commission per standard lot, available on MetaTrader 4 & 5.

- Best For: High-volume traders, scalpers, algo traders, experienced professionals seeking minimal spreads.

Pros:

- Extremely tight spreads, often zero for significant pairs.

- Potentially lower overall trading costs for active traders.

- True ECN environment for transparent pricing.

Cons:

- Involves a separate commission charge per trade.

- May seem more complex for beginners initially.

The IC Markets cTrader Account

The cTrader Account is another excellent option for those prioritizing raw spreads and superior execution, but with a different platform. It mirrors the Raw Spread Account’s pricing model, offering incredibly tight spreads coupled with a commission. The key differentiator is the cTrader platform itself, celebrated for its advanced charting tools, sophisticated order types, and intuitive interface, especially favored by algorithmic traders.

- Key Features: Spreads from 0.0 pips, competitive commission, powered by the cTrader platform.

- Best For: Advanced traders, algo traders, those who prefer cTrader’s unique features, high-frequency strategies.

Pros:

- Access to the advanced cTrader platform.

- Ultra-tight spreads with transparent commission.

- Excellent for detailed technical analysis and automated strategies.

Cons:

- Requires familiarity with the cTrader platform.

- Also involves a separate commission charge.

Account Type Overview

Here’s a quick comparison of the main features across the `IC Markets Forex` account types:

| Feature | Standard Account | Raw Spread Account (MT4/MT5) | cTrader Account |

|---|---|---|---|

| Spreads From | 0.6 pips | 0.0 pips | 0.0 pips |

| Commissions | None | Low per lot | Low per lot |

| Platform | MetaTrader 4/5 | MetaTrader 4/5 | cTrader |

| Target User | Beginner, Discretionary | Active, Scalper, Algo | Advanced, Algo, cTrader fans |

Your choice of `IC Markets` account directly impacts your trading experience and potential profitability. Whether you value simplicity with the Standard Account or demand razor-thin spreads with a Raw Spread or cTrader Account, `IC Markets` provides robust options. We encourage you to weigh the benefits against your personal trading style and objectives to make an informed decision and start your journey with a leading `forex broker` today.

Risk Management Strategies for IC Markets Forex Trading

Navigating the dynamic world of IC Markets Forex trading demands more than just identifying profitable opportunities. It requires an ironclad approach to risk management. As an experienced forex trader, I can tell you that protecting your capital is paramount. Without solid risk management strategies, even the most promising trades can quickly erode your account. Let’s explore how you can safeguard your investments and elevate your overall currency trading experience.

Mastering Stop-Loss Orders

A stop-loss order is your first line of defense in the volatile forex market. It’s an instruction to close a trade automatically when the price reaches a specified level, limiting potential losses. Setting stop-loss orders effectively is crucial for every IC Markets Forex participant.

- Defined Risk: You know your maximum potential loss before entering a trade.

- Emotional Control: It removes emotion from the decision-making process during market downturns.

- Capital Protection: Preserves your trading capital, allowing you to participate in future opportunities.

Implementing Take-Profit Orders

While stop-loss orders protect against downside, take-profit orders secure your gains. These orders automatically close a trade when the price reaches a predetermined profit level. It ensures you lock in profits and avoid watching winning trades reverse.

“Discipline in both cutting losses and taking profits defines long-term success in currency trading.”

Setting realistic take-profit levels, often based on technical analysis or expected market movements, complements your stop-loss strategy for a balanced approach.

Strategic Position Sizing

Perhaps the most critical aspect of risk management for IC Markets Forex traders is position sizing. This strategy determines how much capital you allocate to each trade. It’s not about how many currency pairs you trade, but how much you risk per trade.

A common rule is to risk only a small percentage (e.g., 1-2%) of your total trading capital on any single trade. Here’s why:

- Longevity: Small losses are recoverable, while large ones can be debilitating.

- Compounding: Consistent small gains, even with occasional losses, allow your capital to grow steadily.

- Stress Reduction: Trading with manageable risk reduces psychological pressure.

Consider this simple comparison:

| Risk Type | Description | Impact on Trading |

|---|---|---|

| Fixed Risk | Always risk the same dollar amount. | Simpler, but doesn’t adjust to account growth. |

| Percentage Risk | Risk a fixed percentage of your current capital. | Adjusts dynamically, promoting sustainable growth. |

Defining Your Risk-Reward Ratio

Before you even open a trade on IC Markets Forex, you must determine your risk-reward ratio. This ratio assesses the potential profit of a trade relative to its potential loss. Aim for trades where the potential reward significantly outweighs the potential risk (e.g., 1:2 or 1:3). This means you aim to make at least twice or thrice what you stand to lose.

A favorable risk-reward ratio allows you to be wrong on more trades than you are right, yet still come out profitable overall. It’s a powerful concept for long-term consistency in forex trading.

Diversification Across Currency Pairs

While the forex market often moves in correlated ways, diversifying your trades across different currency pairs can spread risk. Avoid overexposure to a single currency or region. For example, simultaneously trading highly correlated pairs like EUR/USD and GBP/USD might not offer true diversification if both are reacting to similar economic news. Instead, consider pairing a major with an exotic, or different majors that have low correlation.

This approach, carefully implemented, can mitigate the impact of unexpected news or events affecting a specific region or economy. A professional forex broker like IC Markets provides access to a vast array of currency pairs, enabling you to build a diversified portfolio.

Effective risk management is not just a suggestion; it’s the bedrock of sustainable success in IC Markets Forex trading. Implement these strategies diligently to protect your capital, manage your emotions, and position yourself for consistent growth. Master these principles, and you’ll significantly enhance your longevity and profitability in the competitive world of currency trading. Ready to deepen your understanding and refine your trading approach? Connect with us for more insights.

Is IC Markets Right for Beginner Forex Traders?

Embarking on your journey into the world of financial markets can feel daunting, especially when considering `forex trading`. Many new traders wonder which platform offers the best starting point. Let’s dive into whether `IC Markets Forex` stands out as a suitable choice for beginners looking to venture into `currency trading`.

As a leading global `forex broker`, IC Markets provides a robust trading environment. Yet, for those just starting out, the key lies in accessibility, learning support, and a transparent trading experience.

The Beginner’s Edge with IC Markets

New traders need a platform that balances powerful tools with ease of use. IC Markets offers several features that can benefit those new to the market:

- Demo Accounts: A crucial tool for any beginner. IC Markets allows you to practice your strategies with virtual funds in a real-market environment. This lets you get comfortable with the platform and understand market dynamics without risking capital.

- Educational Resources: While not as extensive as some dedicated educational platforms, IC Markets does provide a range of articles and tutorials. These cover trading basics, platform guides, and market analysis insights, helping you grasp fundamental concepts.

- Low Spreads and Fast Execution: For beginners, transaction costs matter. IC Markets is known for its competitive spreads. Faster execution means your trades open and close closer to your desired price, which is vital when learning to manage risk.

- Wide Range of Platforms: You get access to popular platforms like MetaTrader 4, MetaTrader 5, and cTrader. These platforms are industry standards, offering comprehensive charting tools and customizable interfaces, ideal for developing your trading skills.

Navigating the World of Currency Pairs

One of the attractions of `forex trading` is the sheer volume of `currency pairs` available. IC Markets offers a comprehensive selection, from major pairs like EUR/USD to various minors and exotics. For a beginner, starting with major pairs is often recommended due to their higher liquidity and typically lower volatility, making them easier to analyze and trade.

Consider the following aspects when you begin your `currency trading` journey with IC Markets:

| Aspect | Benefit for Beginners |

|---|---|

| Regulation | Operates under reputable regulatory bodies, offering a layer of security and trust for your funds. |

| Customer Support | Provides 24/7 multilingual support, which is invaluable when you encounter questions or technical issues, especially outside of standard business hours. |

| Leverage Options | Offers flexible leverage. While leverage can amplify profits, beginners must use it cautiously. IC Markets allows you to choose appropriate levels. |

Is There a Catch for Novices?

While `IC Markets Forex` provides an excellent environment, the inherent complexity of `forex trading` itself remains. No broker can completely simplify the market. You must commit to learning and developing a disciplined approach. Beginners should be mindful of:

- Market Volatility: Currencies can move rapidly. Understanding market news and economic indicators is crucial.

- Risk Management: Leverage can magnify losses as well as gains. Always start with small position sizes and implement stop-loss orders.

- Emotional Control: Trading success often hinges on managing emotions and sticking to a plan, even during losing streaks.

In conclusion, `IC Markets Forex` offers a highly capable and well-supported platform for new `forex trading` enthusiasts. With their strong regulatory standing, competitive conditions, and access to essential tools like demo accounts, beginners have a solid foundation to explore `currency trading`. Remember, success comes from combining a reliable platform with continuous education and prudent risk management.

Advanced Trading Tools and Integrations with IC Markets

Elevate your forex trading journey with IC Markets’ sophisticated suite of advanced tools and seamless integrations. As a leading forex broker, IC Markets empowers you with everything needed to navigate the dynamic market, from real-time analysis to automated strategies. We understand that success in currency trading hinges on having the right resources at your fingertips, and our offerings are designed to give you a definitive edge.

Unleash Powerful Platforms and Features

IC Markets provides access to industry-standard platforms, each packed with advanced functionalities for serious traders:

- MetaTrader 4 (MT4): A timeless favorite, MT4 offers robust charting capabilities, a vast array of technical indicators, and support for Expert Advisors (EAs). It’s the go-to platform for many looking to automate their strategies in various currency pairs.

- MetaTrader 5 (MT5): Stepping up from MT4, MT5 delivers even more advanced features, including additional timeframes, more analytical objects, and an expanded range of order types. It provides deeper market depth data and supports trading across a wider range of asset classes.

- cTrader: For those seeking a modern interface with raw pricing and lightning-fast execution, cTrader is an excellent choice. It boasts advanced order types, Level II pricing, and a customisable trading environment perfect for high-frequency traders.

Key Advanced Tools for Strategic Trading

Beyond the core platforms, we equip you with specialized tools designed to enhance your decision-making and operational efficiency:

- Advanced Charting Packages: Utilise a comprehensive suite of charting tools with multiple chart types, drawing objects, and timeframes to pinpoint market trends and entry/exit points with precision.

- Economic Calendar: Stay ahead of market-moving news and events with our integrated economic calendar, helping you anticipate volatility and adjust your strategies accordingly.

- Trading Central Insights: Access professional market analysis and actionable trading ideas directly within your platform, providing expert perspectives on key currency pairs and other instruments.

- VPS Services: Ensure your automated trading strategies run without interruption, even when your computer is off, with our Virtual Private Server (VPS) solutions. This guarantees optimal uptime for your Expert Advisors.

Seamless Integrations for a Customised Experience

The strength of IC Markets Forex lies not just in its individual tools but also in its capacity for integration, allowing you to tailor your trading environment to your exact specifications:

| Integration Type | Benefit to You |

|---|---|

| Expert Advisors (EAs) | Automate your strategies on MT4/MT5 for round-the-clock trading without manual intervention. |

| Custom Indicators | Implement your unique analytical tools to gain deeper insights into market movements. |

| API Access (FIX, OpenAPI) | Develop bespoke trading solutions and connect directly to our liquidity for maximum control and flexibility. |

We empower you to connect your preferred third-party software, custom scripts, and analytical models, creating a truly personal and powerful trading ecosystem. This flexibility ensures that whether you’re a manual trader relying on advanced charts or an algorithmic trader needing robust integration, IC Markets provides the framework for your success.

The Future of Forex Trading with IC Markets

The global financial landscape evolves rapidly, and forex trading stands at its dynamic core. Looking ahead, IC Markets Forex is not just observing these changes; we are actively shaping them. We believe the future holds more precision, greater accessibility, and an even more empowering experience for every trader. Get ready to explore a world where innovation drives your trading success.

Expect a future where cutting-edge technology transforms your currency trading decisions. IC Markets actively integrates advanced algorithms and artificial intelligence, providing lightning-fast execution speeds and real-time data insights. Our focus remains on equipping you with tools that give you an edge, ensuring you can react decisively to market movements.

Traders will also gain even broader access to an extensive array of currency pairs. From the well-known majors to exciting exotics, we empower you with diverse trading opportunities across global markets. This expanded reach allows for more sophisticated strategies and greater portfolio diversification, all within a robust and reliable environment.

As a premier forex broker, IC Markets commits to delivering an unparalleled trading experience. We continually enhance our platforms, making them more intuitive, responsive, and packed with features designed for both novice and experienced traders. Imagine tools that anticipate your needs, providing actionable insights before you even ask for them.

What does this mean for you?

- Smarter Decisions: Leverage AI-driven analytics to refine your strategies.

- Faster Execution: Benefit from ultra-low latency and quick trade processing.

- Wider Reach: Explore an expanded selection of currency pairs and global markets.

- Enhanced Reliability: Trade with confidence on a stable and secure platform.

Join us at IC Markets and be part of the future of forex trading. We are constantly innovating to ensure you have the best possible environment to achieve your financial goals. Your journey into advanced currency trading begins here.

| Future Focus Area | IC Markets’ Approach |

|---|---|

| Technology Integration | AI-driven insights, ultra-low latency execution |

| Market Accessibility | Expanded range of currency pairs, global reach |

| Trader Empowerment | Intuitive platforms, advanced analytical tools |

| Reliability & Support | Robust infrastructure, dedicated client service |

Frequently Asked Questions

What makes IC Markets Forex a preferred choice for traders?

IC Markets Forex is distinguished by its ultra-low raw spreads (starting from 0.0 pips), lightning-fast execution, powerful trading platforms (MT4, MT5, cTrader), an extensive range of instruments including diverse currency pairs, and exceptional 24/7 customer support.

Which trading platforms does IC Markets offer?

IC Markets offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Each platform provides advanced tools, charting capabilities, and customization options to suit various trading styles, from beginner to experienced.

How does IC Markets ensure the safety of client funds?

IC Markets prioritizes client fund safety by segregating all client funds in separate bank accounts with top-tier banks, distinct from the company’s operational capital. This ensures funds are safe and accessible, even in the unlikely event of company insolvency.

What are the main differences between IC Markets’ Raw Spread and Standard accounts?

The Raw Spread Account offers ultra-tight spreads (from 0.0 pips) with a small, fixed commission per lot traded, ideal for high-frequency and algorithmic traders. The Standard Account is commission-free, with costs integrated into slightly wider spreads, suitable for new or discretionary traders who prefer simpler pricing.

What risk management tools are essential for forex trading with IC Markets?

Essential risk management tools include mastering stop-loss orders to limit potential losses, implementing take-profit orders to secure gains, strategic position sizing to control capital allocation per trade, defining a favorable risk-reward ratio, and diversifying trades across various currency pairs to mitigate overexposure.