Unlock the world of futures, one of the most dynamic financial markets available. This guide unpacks everything you need to know about trading futures with IC Markets, whether you’re a newcomer or an experienced professional. We’ll explore the core concepts, the powerful tools at your disposal, and how to get started on your trading journey. Dive in with us and discover the potential of trading on global exchanges with a market leader.

- What Exactly Are Futures Contracts?

- Why Choose IC Markets for Futures Trading?

- A Balanced View: The Pros and Cons

- Explore a Wide Range of Markets

- Ready to Begin Your Journey?

- What Are Futures and How Do They Work on IC Markets?

- Key Features of Trading Futures with IC Markets

- A Complete List of Available Futures Instruments

- Index Futures

- Energy and Commodity Futures

- Bond and Currency Futures

- Understanding IC Markets Futures Commissions and Fees

- Spreads and Margin Requirements

- Supported Trading Platforms for Futures

- MetaTrader 5 (MT5)

- cTrader

- MetaTrader 5 (MT5) for Futures Trading

- How to Open an IC Markets Futures Account: A Step-by-Step Guide

- Is IC Markets a Safe Broker for Futures Trading?

- The Advantages of Choosing IC Markets for Your Futures Strategy

- Potential Risks in Futures Trading and How to Mitigate Them

- Mastering Your Risk Management

- IC Markets Futures vs. CFDs: What’s the Difference?

- Leverage in Futures Trading Explained

- Funding Your Account: Deposit and Withdrawal Methods

- Customer Support for Futures Traders

- How IC Markets Compares to Other Futures Brokers

- Frequently Asked Questions

- Frequently Asked Questions

What Exactly Are Futures Contracts?

Think of futures as a binding agreement. You agree to buy or sell a specific asset at a predetermined price on a future date. These instruments are a type of derivatives, meaning their value comes from an underlying asset. Imagine locking in a price today for something you’ll receive later. That’s the core idea. This could be anything from indices and bonds to popular commodity futures like gold or oil.

Why Choose IC Markets for Futures Trading?

Making the right choice of broker is critical. Here’s why traders consistently turn to us for their futures trading journey:

- Global Market Access: Trade on major international exchanges from a single platform.

- Powerful Platforms: Utilize industry-leading software designed for speed and reliability.

- Deep Liquidity: Benefit from a large pool of buyers and sellers, ensuring your orders get filled at the prices you want.

- Competitive Conditions: Experience tight spreads and low commissions that help you keep more of your profits.

- 24-Hour Trading: Access key markets around the clock, five days a week, so you never miss an opportunity.

But what about your funds? IC Markets takes a critical step to protect your money by holding it in segregated accounts. These accounts are with top-tier banking institutions. This practice keeps your capital separate from the company’s operational funds, adding a crucial layer of security for your peace of mind.

“Success in trading comes from finding an edge. The right platform, tools, and market access can be that edge.”

A Balanced View: The Pros and Cons

Every trading style has its benefits and risks. Understanding both sides helps you make informed decisions.

| Pros | Cons |

|---|---|

| Potential for high leverage | Increased risk due to leverage |

| Ability to profit in rising or falling markets | Can be complex for absolute beginners |

| Highly liquid and transparent markets | Requires active market monitoring |

Explore a Wide Range of Markets

Diversification is key. We provide access to a broad selection of futures contracts across various asset classes, allowing you to build a robust trading strategy.

- Index Futures: Speculate on the direction of top global indices like the S&P 500, NASDAQ 100, and DAX 40.

- Commodity Futures: Trade popular hard and soft commodities, including Crude Oil, Natural Gas, Gold, Silver, and Soybeans.

- Bond Futures: Take positions on government debt instruments and interest rate movements.

Ready to Begin Your Journey?

Getting started with IC Markets Futures is a straightforward process. We designed it to get you into the markets quickly and efficiently. Whether you are funding an account or placing your first trade, our ecosystem supports your goals.

Join a community of traders who demand more. More access, better technology, and superior conditions. Take the next step and discover the power of trading futures with a true market leader.

What Are Futures and How Do They Work on IC Markets?

Ever wondered about futures? Let’s break it down. At its core, a future is a type of financial derivative. It’s a standardized agreement to buy or sell a specific asset at a set price on a future date. Think of it as locking in a price today for a transaction that will happen down the road.

This powerful tool is used by traders for two main reasons: hedging against price risk and speculating on market movements. Whether you’re looking at indices, energies, or popular commodity futures, you are essentially trading on the expected future value of that asset, not the asset itself.

The world of futures trading revolves around a few key principles. Here’s how it works:

- Standardized Contracts: Each futures contract has a set quantity, quality, and expiration date, which makes it easy to trade on an exchange.

- Leverage: You only need to put up a small fraction of the contract’s total value, known as margin, to open a position. This magnifies both potential profits and losses.

- Long vs. Short: You can go “long” if you believe the asset’s price will rise, or go “short” if you expect it to fall.

- Daily Settlement: Profits and losses on your position are calculated at the end of each trading day, a process known as “marking-to-market.”

When you explore IC Markets Futures, you gain access to a robust and dynamic trading environment. We provide direct access to major global exchanges, ensuring deep liquidity and competitive pricing. Our platforms are designed for speed and reliability, giving you the tools you need to effectively analyze markets and manage your positions. We simplify the complexities of trading futures contracts, so you can focus on your strategy.

“The key to successful trading is understanding your tools. Futures offer incredible opportunities, but they demand respect and a solid strategy.”

Getting familiar with the lingo is the first step. Here are a few terms you’ll encounter frequently:

| Term | Definition |

| Contract Size | The standardized amount of the underlying asset in one contract (e.g., 1,000 barrels of oil). |

| Expiration Date | The specific date when the contract becomes void and final settlement occurs. |

| Initial Margin | The amount of capital you must have in your account to open a new futures position. |

Imagine you believe the price of crude oil will rise over the next month. You could buy a crude oil futures contract today. If your prediction is correct and the price of oil increases before the contract expires, you can close your position for a profit. Conversely, if the price falls, you would incur a loss. This simple mechanism allows traders to act on market insights without ever needing to own the physical barrels of oil.

Ready to explore the potential of the futures market? Dive in with a platform built for performance and reliability. Join a community of traders who choose us for speed, transparency, and powerful tools.

Key Features of Trading Futures with IC Markets

Discover a better way to trade. When you choose IC Markets Futures, you unlock a world of powerful tools and global markets. We designed our platform to give you a competitive edge. Let’s dive into what makes our futures trading experience stand out from the rest.

- Lightning-Fast Execution: Experience minimal slippage with our ultra-low latency infrastructure, crucial for active traders who demand precision.

- Access to Global Exchanges: Trade a diverse range of futures contracts from leading international exchanges like CME, CBOT, and Eurex.

- Deep Liquidity: We connect you to a vast pool of liquidity providers. This ensures tight spreads and reliable order fulfillment, even in volatile markets.

- Powerful Trading Platforms: Utilize industry-leading platforms packed with advanced charting tools and analytical features to inform your strategy.

| Feature | Your Advantage |

|---|---|

| Competitive Margins | Maximize your capital efficiency and trading power. |

| Diverse Product Range | Trade everything from indices to energy and commodity futures. |

| Dedicated Support | Access our expert team 24 hours a day, 5 days a week. |

What You’ll Love

You gain direct access to a wide array of derivatives, from energy to equity indices. The low-cost structure means more of your potential returns stay with you. Our technology delivers the speed and reliability essential for serious futures trading.

What to Keep in Mind

Trading futures contracts carries a high level of risk and may not be suitable for all investors. Understanding the mechanics of these financial instruments is crucial before you begin.

“The platform’s speed and direct market access transformed my approach to trading. I can finally execute my strategy with the precision it requires.”

Ready to elevate your trading journey? With IC Markets Futures, you get the technology, access, and support needed to navigate the dynamic world of global futures. Explore the possibilities and see why thousands of traders choose us for their futures trading needs. Join a community of serious traders today.

A Complete List of Available Futures Instruments

Unlock the full potential of the global markets with our extensive selection of IC Markets Futures. We provide direct access to a diverse range of instruments, empowering you to build a sophisticated and well-rounded trading portfolio. Dive into different asset classes and discover new opportunities across the world’s most liquid exchanges. This variety is the cornerstone of dynamic futures trading.

Explore our main categories of futures contracts below:

- Stock Indices: Trade the direction of entire economies. Gain exposure to major global indices like the S&P 500 (ES), NASDAQ 100 (NQ), and the DAX 40 (FDAX). These derivatives are perfect for speculating on broad market movements.

- Energy: Access the world’s most crucial energy markets. Trade popular contracts like Crude Oil (CL) and Natural Gas (NG) to capitalize on shifts in global supply and demand.

- Metals: Hedge against inflation or trade on industrial trends with precious and base metals. We offer contracts for Gold (GC), Silver (SI), and Copper (HG).

- Soft Commodities: Engage with the agricultural markets through a variety of commodity futures. Trade contracts for products like Coffee, Sugar, and Cocoa.

- Bonds & Interest Rates: Take positions on government debt and interest rate fluctuations with instruments like the 10-Year T-Note (ZN).

- Cryptocurrencies: Participate in the digital asset revolution by trading futures on leading cryptocurrencies like Bitcoin (BTC) and Ether (ETH).

The ability to access everything from commodity futures to crypto derivatives on a single platform gives me the flexibility I need to react to market news instantly.

To help you see the breadth of our offerings at a glance, here is a simple breakdown of what you can access.

| Instrument Category | Popular Contracts | Primary Market Focus |

|---|---|---|

| Indices | E-mini S&P 500, Nikkei 225 | Global Equity Performance |

| Energies | WTI Crude Oil, Brent Crude | Global Energy Supply/Demand |

| Metals | Gold, Silver, Copper | Inflation & Industrial Health |

| Financials | T-Notes, Eurodollar | Interest Rates & Monetary Policy |

Having such a wide range of futures contracts available offers significant advantages for every trader. It allows you to diversify your strategies, hedge existing positions in other asset classes, and seize opportunities in markets you may not have previously considered. Explore the possibilities and start building your futures trading strategy today.

Index Futures

Ever wanted to trade the pulse of an entire economy with a single transaction? Welcome to the world of index futures. Instead of picking individual stocks, you can speculate on the direction of major market indices like the S&P 500, NASDAQ 100, or the DAX 40. This approach to futures trading offers a broad view of market sentiment and performance.

As powerful derivatives, these instruments track the expected future value of an index. This is quite different from commodity futures, which are tied to physical goods like oil or gold. With index futures, you are trading a number that represents the collective health of a country’s top companies.

Why should you consider adding index futures to your strategy?

- Broad Market Exposure: Gain access to an entire market segment without buying dozens of individual stocks.

- Go Long or Short: Profit from markets that are rising or falling. This flexibility is key for dynamic trading.

- Hedge Your Portfolio: Use index futures to offset potential losses in your existing stock holdings during uncertain times.

- High Liquidity: Major global indices are traded heavily, which means you can typically enter and exit positions with ease.

The IC Markets Futures platform gives you direct access to these exciting global markets. We provide the tools you need to analyze trends and execute your strategy on the world’s most popular indices.

Trade the entire market, not just a single stock. That’s the power of index futures.

Here’s a quick look at how they compare to traditional stock trading:

| Feature | Index Futures | Single Stocks |

|---|---|---|

| Exposure | Broad, diversified market | Specific company performance |

| Hedging | Efficiently hedge a whole portfolio | Complex and costly to hedge |

By understanding how these futures contracts work, you unlock a new way to interact with the financial markets. It’s a method favored by professionals for its efficiency and versatility. Dive in and explore the potential of trading the world’s leading economic benchmarks.

Energy and Commodity Futures

Tap into the markets that power our world. With IC Markets Futures, you gain direct access to the ebb and flow of global energy and precious metals. Trade the raw materials that drive economies and respond to real-world supply and demand. This is your chance to move beyond traditional markets and explore new opportunities.

We offer access to some of the most popular commodity futures:

- Crude Oil (WTI & Brent)

- Natural Gas

- Gold

- Silver

- Copper

- Palladium

This form of futures trading involves buying or selling standardized futures contracts for a specific commodity at a predetermined price for future delivery. These powerful derivatives allow you to speculate on price movements without ever owning the physical asset. It’s an efficient way to gain exposure to these vital markets.

| Feature | Benefit for Your Trading |

|---|---|

| Global Impact | Markets react directly to geopolitical and economic news, creating distinct trading events. |

| Portfolio Diversification | Add an asset class that often moves independently of stocks and bonds. |

| High Liquidity | Major energy and metal markets see huge daily volumes, enabling easier entry and exit. |

Trading commodities is like having a direct line to the world’s economic pulse. You see global events unfold in real-time on your charts.

Are you ready to explore the dynamic world of energy and resources? Discover the potential of these markets and find your next trading opportunity with us. Join a community of traders who look at the bigger picture.

Bond and Currency Futures

Move beyond the world of commodity futures and dive into the global financial system. Bond and currency futures trading opens up a new dimension of strategy. These powerful derivatives allow you to speculate on interest rate changes and shifts in global economic power.

Why trade government bond futures? They offer a direct way to act on your views about a country’s economic health.

- Trade on the future direction of interest rates.

- Hedge existing bond portfolios against market volatility.

- Gain exposure to government debt from major economies.

Currency futures contracts let you lock in an exchange rate for a future date. This is crucial for international businesses managing risk. It’s also a popular way for traders to capitalize on movements in the forex market, from the US Dollar to the Japanese Yen.

| Feature | Bond Futures | Currency Futures |

| Primary Influencer | Central Bank Policy | Economic Data & Geopolitics |

| Main Use Case | Hedging Interest Rate Risk | Managing Foreign Exchange Risk |

Understanding bond and currency derivatives is like having a map to the flow of global capital. It is an essential tool for the serious trader.

Whether you want to protect your portfolio or actively trade on macroeconomic trends, these instruments offer unique opportunities. Exploring the world of IC Markets Futures gives you direct access to these dynamic and influential markets.

Understanding IC Markets Futures Commissions and Fees

Let’s talk about one of the most important aspects of trading: the costs. A clear understanding of commissions and fees is vital for your success. We believe in transparency, so you know exactly what you’re paying for when you engage in futures trading with us. No surprises, just straightforward pricing to help you plan your strategy effectively.

With IC Markets Futures, our commission structure is designed to be competitive. We want to empower you to trade a wide range of futures contracts without worrying about excessive costs eating into your profits. Here’s how it works:

- Per-Side Commissions: You pay a small commission for both opening and closing a position.

- Volume-Based Tiers: Active traders can benefit from even lower commission rates. The more you trade, the more you save.

- All-Inclusive Pricing: Our commission includes various fees, making the cost structure simple to follow.

To give you a clearer picture, here is a breakdown of the typical costs you might encounter. Remember that fees can vary depending on the exchange and the specific instrument, like commodity futures or financial derivatives.

| Fee Type | Description |

| Commission | Our low, competitive fee for executing your trade. |

| Exchange & NFA Fees | Standard fees charged by the exchange (like CME or EUREX) and regulatory bodies. |

| Market Data Fees | A monthly fee for accessing real-time market data, often waived for active traders. |

“Transparent fees empower traders to focus on strategy, not hidden costs. That’s our commitment to you.”

We keep our fee structure for derivatives simple so you can concentrate on what matters most: your trading. By choosing IC Markets Futures, you’re opting for a partner that values clarity and provides the tools you need to navigate the markets confidently. Ready to experience a transparent trading environment? Join us and see the difference for yourself.

Spreads and Margin Requirements

Understanding your costs is crucial for smart trading. We focus on providing a transparent and competitive environment for IC Markets Futures. Let’s dive into what our spreads and margin requirements mean for your strategy.

The spread is the small difference between the buy and sell price of an asset. In futures trading, a tight spread is your best friend. It directly impacts your bottom line on every trade. We work hard to keep spreads low, which gives you several advantages:

- Lower your overall transaction costs.

- Improve your potential profit on each trade.

- Enter and exit positions with greater precision.

Margin is not a fee. Think of it as a good-faith deposit required to open and maintain a leveraged position. It’s a core feature of trading derivatives that allows you to control a large contract value with a smaller amount of capital. We use two main types of margin:

| Initial Margin | The amount of capital you need in your account to open a new position for one or more futures contracts. |

| Maintenance Margin | The minimum balance you must keep in your account to hold your positions open. |

Remember, leverage is a powerful tool. While it can magnify your profits, it can also amplify losses. Always practice responsible risk management, especially with products like commodity futures.

Our straightforward margin policies and competitive spreads create a robust trading framework. This empowers you to focus on market movements and opportunities, not on navigating complex or hidden costs.

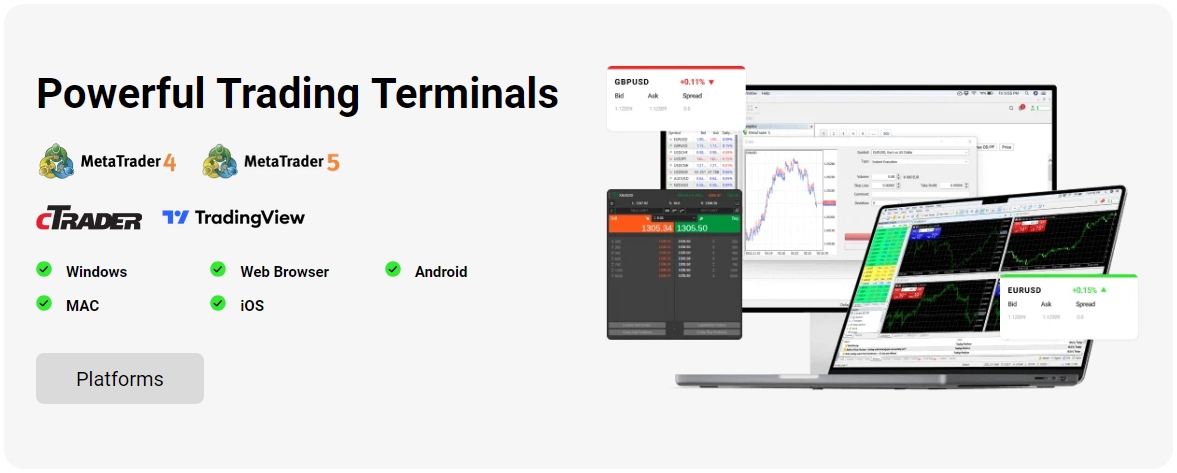

Supported Trading Platforms for Futures

Your success in futures trading depends heavily on the tools you use. The right platform gives you speed, powerful analytics, and reliable execution. We provide access to industry-leading platforms designed to elevate your trading experience. Discover the perfect environment for your strategy and unlock your full potential with IC Markets Futures.

MetaTrader 5 (MT5)

Step into a world of advanced trading with MetaTrader 5. This globally recognized platform is a powerhouse for traders focused on derivatives. It offers superior tools for comprehensive price analysis, algorithmic trading applications (Expert Advisors), and copy trading. MT5 empowers you to analyze futures contracts with exceptional precision and execute trades with confidence.

- Advanced Charting: Access dozens of analytical objects and technical indicators.

- Algorithmic Trading: Build, test, and deploy your own trading robots and scripts.

- Depth of Market (DOM): View market liquidity and make more informed trading decisions.

- Multi-Asset Terminal: Trade a variety of instruments, including commodity futures, from a single interface.

cTrader

Experience a platform built for performance. cTrader is renowned for its stunning user interface and focus on fast, transparent execution. It offers an institutional-grade trading environment perfect for discerning traders. If you value a clean layout, advanced order types, and detailed trade analysis, cTrader is an exceptional choice for your futures trading journey.

| Pros | Cons |

|---|---|

| Sleek, modern, and intuitive interface. | Fewer third-party custom indicators than MT5. |

| Advanced risk management and order types. | Smaller developer community for automated strategies. |

| Detailed trade analysis and performance reporting. | Can have a steeper learning curve for some features. |

“The best traders have an edge. More often than not, that edge comes from their tools and their discipline.”

Choosing your platform is a critical first step. Both MetaTrader 5 and cTrader offer robust features, but they cater to slightly different trading styles. We encourage you to explore both to see which one aligns with your approach to the markets. Your ideal platform awaits to help you navigate the world of futures contracts. Join us and gain access to these powerful tools today.

MetaTrader 5 (MT5) for Futures Trading

Unlock the full potential of your trading strategy with the MetaTrader 5 platform. MT5 is a powerhouse, specifically designed for traders who demand superior tools and flexibility. It gives you direct access to a dynamic world of futures trading, all from a single, intuitive interface. Say goodbye to limitations and hello to advanced trading capabilities.

Why do so many professional traders choose MT5? It comes down to its robust feature set built to handle complex instruments like futures contracts. Here’s what sets it apart:

- Advanced Charting Suite: Analyze market movements with dozens of technical indicators and graphical objects.

- Multiple Order Types: Execute precise strategies with market, pending, stop, and trailing stop orders.

- Depth of Market (DOM): Gain crucial insights into market liquidity and see buy and sell orders at different prices.

- Algorithmic Trading: Deploy Expert Advisors (EAs) to automate your trading and react to markets 24/7.

- Built-in Economic Calendar: Stay ahead of market-moving news and events without ever leaving the platform.

MT5 isn’t just a platform; it’s your command center for the global derivatives market. It provides the speed and analytics you need to act decisively.

With IC Markets Futures on MT5, you can access a diverse range of global markets. This allows you to build a diversified portfolio that includes various asset classes, from major indices to essential commodity futures.

| Asset Class | Examples of Available Contracts |

|---|---|

| Indices | ICE Dollar Index (DXY), CBOE VIX Index (VIX) |

| Energies | Brent Crude Oil, WTI Crude Oil, Natural Gas |

| Metals | Gold, Silver, Copper |

Ready to elevate your trading experience? Discover the power, precision, and performance of MT5. Join today and see why it’s the ultimate choice for ambitious traders engaging with IC Markets Futures.

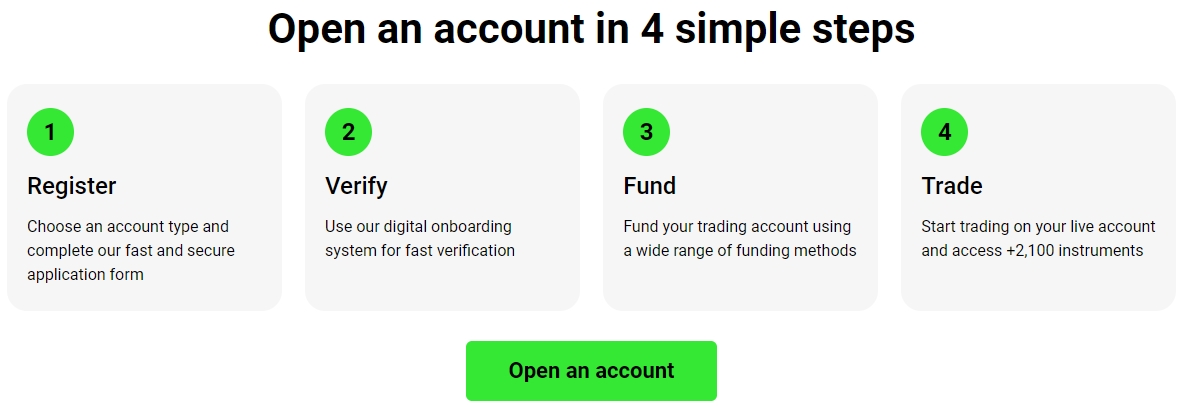

How to Open an IC Markets Futures Account: A Step-by-Step Guide

Ready to dive into the world of futures trading? Getting started is easier than you might think. This guide breaks down the simple process of opening your IC Markets Futures account. We will walk you through each step, so you can move from sign-up to your first trade with confidence. Let’s get you set up to trade a wide range of futures contracts.

To make the process even smoother, have these items ready:

| Requirement | Details |

|---|---|

| Personal Information | Your full name, date of birth, and current address. |

| Proof of Identity | A clear copy of a government-issued ID like a passport or driver’s license. |

| Proof of Residence | A recent utility bill or bank statement showing your name and address. |

Follow these four simple steps to activate your account:

- Complete the Application Form

First, you will fill out a quick online form. This involves providing your basic personal details. It is the initial step on your trading journey. - Verify Your Identity

Next, you need to secure your account. This involves uploading a couple of documents to confirm who you are. This standard procedure protects you and is a key requirement for trading financial derivatives. - Fund Your Account

Once your account is approved, it is time to add funds. Choose your preferred deposit method and transfer money into your trading wallet. This capital is what you will use to enter the market. - Access the Platform and Start Trading

With a funded account, you are ready to go! Log in to your trading platform and explore the markets. You can now analyze and trade various instruments, from index to commodity futures.

The journey into the financial markets begins with a single, simple step. Take that step today and unlock your trading potential.

Is IC Markets a Safe Broker for Futures Trading?

When you enter the world of futures trading, safety is your top priority. You need a broker you can trust with your capital. So, let’s get straight to the point. IC Markets has built a strong reputation, but what makes it a secure choice for trading complex derivatives?

A broker’s safety begins with its regulation. Strict oversight ensures they follow the rules designed to protect you, the trader. IC Markets operates under the watchful eye of several respected global financial authorities, which holds them to high standards of conduct and financial stability. This multi-jurisdictional regulation is a significant sign of a reliable broker.

Key regulatory oversight includes:

- Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

- The Financial Services Authority (FSA) of Seychelles

But what about your funds? IC Markets takes a critical step to protect your money by holding it in segregated accounts. These accounts are with top-tier banking institutions. This practice keeps your capital separate from the company’s operational funds, adding a crucial layer of security for your peace of mind.

Trust isn’t just a promise; it’s proven through action. Top-tier regulation and segregated client funds are the cornerstones of a broker you can rely on.

To give you a balanced view, let’s break down the key safety aspects for trading IC Markets futures contracts.

| Feature | Pro | Con |

|---|---|---|

| Regulation | Supervised by multiple reputable authorities. | Protections may differ based on your region. |

| Fund Security | Client money is kept in segregated accounts. | Does not heavily promote extra private insurance. |

| Platform Tech | Stable platforms reduce technical risk. | High leverage can increase risk if not managed well. |

In conclusion, the evidence points toward a secure environment for trading IC Markets futures. The combination of robust regulation, segregated client funds, and a transparent approach provides a solid foundation. Whether you are trading commodity futures or other financial instruments, you can focus on your strategy knowing that a strong safety net is in place.

The Advantages of Choosing IC Markets for Your Futures Strategy

When you engage in futures trading, every decision counts. Your choice of broker can be the single most important factor in your success. We built the IC Markets Futures offering to give serious traders a distinct competitive advantage. Forget about slow platforms and high costs; it’s time to experience a trading environment engineered for performance and precision.

Our core philosophy is simple: empower traders. We achieve this by focusing on the conditions that truly matter. By removing common trading barriers, we provide a clear path for you to execute your strategy effectively. Access institutional-grade trading conditions, no matter your account size.

Key Benefits at a Glance:

- Exceptional Pricing: Benefit from some of the tightest spreads and lowest commissions in the industry. Lower trading costs mean more of your profits stay with you.

- Superior Technology: Leverage our ultra-low latency infrastructure for rapid execution. In the fast-paced world of derivatives, speed is your ally.

- Unrivaled Market Access: Diversify your portfolio with a vast selection of global futures contracts. Don’t limit your opportunities.

- Robust Trading Platforms: Utilize world-renowned platforms like MetaTrader and cTrader, equipped with advanced charting tools and analytical capabilities.

We provide the professional tools and deep liquidity you need. You bring the strategy. Together, we can unlock your full trading potential.

Explore a diverse range of markets from a single account. Whether you focus on indices, energies, or commodity futures, our platform connects you to global opportunities. This flexibility allows you to adapt to changing market conditions and capitalize on volatility across different sectors.

| Instrument Category | Popular Examples |

|---|---|

| Global Indices | ICE Dollar Index, CBOE VIX Index |

| Energy Futures | Brent Crude Oil, WTI Crude Oil, Natural Gas |

| Precious Metals | Gold, Silver, Platinum |

Choosing the right partner for your futures trading journey is critical. With our combination of cutting-edge technology, low-cost execution, and extensive market access, you are better equipped to navigate the complexities of the market. Join a community of traders who demand more and experience the difference for yourself.

Potential Risks in Futures Trading and How to Mitigate Them

Diving into the world of futures trading opens up a dynamic landscape of opportunity. These powerful derivatives let you speculate on the future price of everything from indices to energy. But with great power comes the need for great strategy. Understanding the potential risks is the first step to becoming a more confident and prepared trader. Let’s break down the challenges and explore smart ways to manage them.

Every experienced trader knows that success isn’t just about picking winners; it’s about managing the trades that don’t go your way. The unique structure of futures contracts introduces specific risks you must be aware of before you begin.

The Power of Leverage: Leverage is a double-edged sword. It allows you to control a large contract value with a relatively small amount of capital, magnifying potential profits. However, it also magnifies potential losses just as quickly. A small market movement against your position can result in substantial losses.

- Market Volatility: The futures markets can be fast-paced and volatile. Sudden price swings, often driven by economic news or geopolitical events, can dramatically impact your position. This is especially true for popular markets like commodity futures.

- Liquidity Risk: In less common markets or during times of extreme stress, you might face liquidity risk. This happens when you can’t exit a trade at your desired price because there are not enough buyers or sellers available.

A smart trader worries about the downside; the upside will take care of itself.

Mastering Your Risk Management

Acknowledging risks is one thing; actively managing them is what sets successful traders apart. You have several tools and techniques at your disposal. Integrating these into your routine is crucial when engaging with IC Markets Futures and the broader market.

| Strategy | How It Helps |

| Use Stop-Loss Orders | This is your primary safety net. A stop-loss automatically closes your position if the market moves against you by a predetermined amount, limiting your potential loss on any single trade. |

| Control Position Size | Never risk more than a small percentage of your trading capital on a single idea. Proper position sizing ensures that one bad trade doesn’t wipe out your account. |

| Have a Trading Plan | Define your entry and exit points, risk tolerance, and profit targets before you enter a trade. A plan removes emotion and promotes discipline. |

Ultimately, knowledge and preparation are your greatest assets in futures trading. By respecting the risks and using a disciplined approach, you can navigate the markets with greater skill. Combining a solid strategy with the powerful tools available gives you a clear path to pursue your trading goals responsibly.

IC Markets Futures vs. CFDs: What’s the Difference?

Choosing the right trading instrument can feel like a major challenge. You see terms like futures and CFDs everywhere, but what really sets them apart? Both are powerful derivatives, yet they operate in very different ways. Let’s break down the key distinctions to help you decide which path is right for your trading journey.

First, let’s define futures. A futures contract is a standardized legal agreement. You agree to buy or sell a specific asset, like commodity futures or an index, at a predetermined price on a specific date. This type of trading happens on a centralized, public exchange, which ensures a high level of transparency for all participants.

On the other hand, a Contract for Difference (CFD) is an agreement between you and a broker. You agree to exchange the difference in an asset’s value from the point the contract is opened until it is closed. With CFDs, you never own the underlying asset; you simply speculate on its price movements.

To see these differences clearly, let’s put them side-by-side:

| Feature | Futures | CFDs |

|---|---|---|

| Marketplace | Traded on a centralized public exchange | Traded over-the-counter (OTC) with a broker |

| Contract Size | Standardized and generally larger | Flexible and can be much smaller (micro-lots) |

| Expiry Dates | Yes, contracts have a set expiration date | No, positions can be held open indefinitely |

| Primary Costs | Commission per trade | The spread and overnight financing fees |

To simplify it further, think about the practical advantages and disadvantages of each instrument.

Exploring Futures Trading:

- Pro: Full Transparency. Prices come directly from a central exchange, so everyone sees the same quotes and market depth.

- Pro: No Overnight Fees. Since contracts have a set lifespan, you do not pay daily financing charges for holding positions.

- Con: Higher Capital Needed. The standardized, larger sizes of futures contracts often require more significant initial capital.

- Con: Less Flexible. You must trade in whole contracts, which offers less precision for smaller account sizes.

Considering CFDs:

- Pro: Greater Accessibility. Trade with smaller contract sizes, making it easier to start with less capital.

- Pro: Go Long or Short Easily. You can speculate on both rising and falling markets without complex rules.

- Con: Costs Can Accumulate. The bid-ask spread and overnight financing fees (swaps) can add up on longer-term trades.

- Con: Less Price Transparency. Prices are set by the broker, which may include a markup on the spread.

“Understanding the instrument is the first step to mastering the market. Choose the tool that best fits your strategy and goals.”

So, which one is right for you? Your decision hinges on your trading style, risk tolerance, and available capital. If you prefer transparent pricing and plan to hold positions without incurring daily fees, IC Markets Futures could be an excellent fit, offering direct access to global exchanges. However, if you need more flexibility with smaller position sizes and want to get in and out of markets quickly, CFDs might be more your speed.

The key is to align your instrument with your objectives. By understanding these fundamental differences, you empower yourself to make smarter trading decisions. Ready to explore the dynamic world of futures trading and discover the opportunities waiting for you?

Leverage in Futures Trading Explained

Ever wondered how you can control a large market position with a relatively small amount of capital? Welcome to the world of leverage. In futures trading, leverage allows you to open a position that is much larger than the funds in your account. It’s a powerful tool that can significantly amplify your trading results.

Think of it like putting down a deposit on a house. You don’t pay the full price upfront; you pay a small fraction, but you get control of the entire asset. Similarly, when you trade futures contracts, you post a “good faith deposit,” known as margin, to control a contract with a much higher notional value. This capital efficiency is a core attraction for traders engaging with derivatives.

Leverage is a double-edged sword. It magnifies both your potential profits and your potential losses with equal force.

Understanding the dual nature of leverage is critical for success. It offers incredible opportunity but also comes with significant risk. Let’s break down the key advantages and disadvantages.

| Pros of Leverage | Cons of Leverage |

|---|---|

| Capital Efficiency: Control large positions with less capital, freeing up funds for other opportunities. | Amplified Losses: A small market move against you can result in substantial losses, even exceeding your initial margin. |

| Enhanced Potential Returns: Profits are calculated on the full position size, not just your margin, leading to higher potential ROI. | Margin Calls: If the market moves against you, you may need to deposit additional funds to keep your position open. |

Your margin is not a down payment but a security deposit held by the exchange. It ensures you can cover potential losses. Two types of margin are crucial to know:

- Initial Margin: The minimum amount of money you must deposit to open a futures position.

- Maintenance Margin: The minimum amount you must maintain in your account to keep your position open. If your account balance drops below this level, you will face a margin call.

Let’s consider a practical example with commodity futures. Imagine you want to control a crude oil futures contract with a total value of $50,000. Instead of needing the full amount, the exchange might only require a 5% margin, or $2,500. If the contract value increases by just 2% ($1,000), your return on your deposited margin is a massive 40%. However, a 2% drop would result in a 40% loss on your margin. This amplification effect is the essence of leverage.

Mastering leverage means mastering risk management. Using tools like stop-loss orders is not just wise; it’s essential. A solid trading plan helps you define your entry, exit, and risk tolerance before you ever place a trade. Understanding these concepts is your first step toward navigating the dynamic world of IC Markets Futures with confidence.

Funding Your Account: Deposit and Withdrawal Methods

Ready to dive into the world of IC Markets Futures? The first step is funding your account, and we make it simple, fast, and secure. We offer a wide range of payment options to ensure you can manage your capital with ease. A quick deposit means you can start your futures trading journey without delay and seize opportunities as they arise.

We provide a variety of convenient methods to get you started. Choose the one that works best for you:

- Credit & Debit Cards (Visa, Mastercard): Instant funding to start trading immediately.

- Bank Wire Transfer: A reliable option for larger deposits.

- E-wallets (PayPal, Skrill, Neteller): Enjoy the speed and convenience of popular online payment systems.

- And many more: We support over 10 flexible funding options to suit your location and preference.

Withdrawing your profits is just as straightforward. We understand that accessing your funds quickly is crucial when trading derivatives. Our streamlined process ensures you get your money efficiently. Whether you are trading index funds or commodity futures, you can trust our system to handle your transactions securely.

| Method | Processing Time | Notes |

|---|---|---|

| Credit/Debit Card | 1 Business Day | Funds are returned to the original card used for deposit. |

| Bank Wire | 2-5 Business Days | Ideal for larger withdrawals. Intermediary bank fees may apply. |

| E-wallets | Instant/Within 1 Day | Fastest way to access your funds. |

“Your capital is the lifeblood of your trading. That’s why we built a funding system that is not only robust and secure but also incredibly fast. Get in and out of the market on your terms.”

Choosing the right funding method is key to managing your strategy for trading futures contracts. Here are a few things to keep in mind:

- Speed: E-wallets and cards offer the fastest deposit times.

- No Deposit Fees: We do not charge any internal fees for deposits, regardless of the method you choose.

- Security: All transactions are protected with top-tier encryption to keep your funds safe.

- Currency Options: Fund your account in one of 10 base currencies to avoid conversion fees.

Join a platform that respects your time and money. Experience hassle-free deposits and withdrawals, and focus on what truly matters: your trading.

Customer Support for Futures Traders

The world of futures trading moves at lightning speed. When you have capital on the line, you need answers fast. That’s why the IC Markets Futures support experience is built around you, the trader. We provide an award-winning customer service team that understands the complexities of the market, giving you the confidence to trade effectively.

Our global team is always ready to assist you. We know that markets don’t sleep, and neither does our support. Get help whenever you need it, wherever you are.

- Expert Support Team: Speak with professionals who understand derivatives and the intricacies of futures contracts.

- 24/7 Availability: Reach out via live chat or email anytime. Our team is on standby around the clock.

- Multilingual Service: We provide assistance in multiple languages to support our global client base.

- Fast Resolutions: We work efficiently to solve your problems so you can get back to focusing on the markets.

“Knowing I can get a knowledgeable person on the line in minutes is a game-changer. It removes a huge layer of stress from my trading.”

We provide multiple channels for you to connect with us. Choose the one that best fits your needs at the moment. Whether you have a simple question about commodity futures or a complex account inquiry, we have you covered.

| Support Channel | Availability | Ideal For |

|---|---|---|

| Live Chat | 24/7 | Instant answers to quick questions |

| 24/7 | Detailed inquiries & document submission | |

| Phone | 24/5 | Urgent and complex issues |

Don’t let support issues disrupt your trading strategy. Our dedicated team is here to ensure your experience is smooth and seamless. Focus on what you do best—trading—and let us handle the rest. Experience the difference a truly supportive broker can make on your journey.

How IC Markets Compares to Other Futures Brokers

Choosing the right broker is a critical first step in your trading journey. When you look at IC Markets Futures, you’ll notice key differences that set it apart from the competition. We focus on providing the tools and conditions that serious traders demand, moving beyond the standard offerings you might find elsewhere.

So, what truly makes the difference? Let’s break it down.

- Ultra-Low Latency: Our servers are co-located in major data centers. This means your trades execute faster, which is vital in the fast-paced world of futures trading.

- Competitive Pricing: We connect you directly to a deep liquidity pool. This results in tight spreads and some of the lowest commissions in the industry, allowing you to keep more of your profits.

- Extensive Market Access: Gain exposure to a wide array of global exchanges. You can trade everything from index and energy futures contracts to various commodity futures, all from a single platform.

- Powerful Platforms: We offer industry-leading platforms like cTrader and MetaTrader. These are known for their advanced charting tools, stability, and support for automated trading strategies.

Here’s a quick look at how our typical offering stacks up against a standard broker:

| Feature | IC Markets | Typical Broker |

|---|---|---|

| Commission Per Side | From $0.50 | Often $1.50+ |

| Execution Speed | Ultra-fast, low latency | Standard execution |

| Platform Choice | cTrader, MT4, MT5 | Often proprietary or limited |

| Market Range | Global Indices, Commodities & More | Limited selection |

“With other brokers, I always felt like I was a step behind the market. The execution speed at IC Markets changed the game for me. It’s a tangible difference you can feel with every trade.”

Our commitment goes beyond just numbers. We built an infrastructure designed for high-frequency and algorithmic traders who work with complex derivatives. The entire ecosystem is optimized for performance, ensuring stability when market volatility is high. Many brokers simply cannot offer this level of technical sophistication.

Ultimately, the choice depends on what you value as a trader. If you prioritize speed, low costs, and access to a diverse range of futures contracts, the advantages become clear. We empower you to execute your strategy with precision and confidence.

Frequently Asked Questions

Got questions about futures trading? You’re in the right place! We’ve gathered the most common queries to help you get started with confidence.

What exactly are IC Markets Futures?

IC Markets Futures provide direct access to global futures exchanges. This allows you to trade a wide range of futures contracts on a powerful platform. Think of it as your gateway to speculating on the future price of various assets, from major indices to essential energies.

How do futures contracts work?

A futures contract is a standardized legal agreement. It locks in a price to buy or sell an asset on a specific future date. Instead of owning the asset now, you trade on its expected value. This core concept in futures trading allows you to potentially profit from both rising and falling markets.

What types of assets can I trade?

You gain access to a diverse world of financial derivatives. We offer markets across several key categories, giving you plenty of opportunities:

- Indices: Trade on the direction of major global stock indices.

- Energies: Speculate on the price movements of oil and natural gas.

- Commodities: Access popular commodity futures like gold and silver.

- Bonds: Take positions on government debt instruments from around the world.

What are the key advantages of trading futures?

Trading these powerful instruments comes with several distinct benefits. Here’s a quick look at why traders choose them.

| Advantage | Description |

|---|---|

| Centralised Trading | All trades occur on transparent, regulated exchanges. |

| High Liquidity | Major futures markets have high daily trading volumes. |

| Trade Long or Short | Profit from markets moving in either direction easily. |

Is this type of trading suitable for beginners?

While all trading involves risk, our platform provides the tools and educational resources to help you learn. We strongly recommend starting with a demo account to practice your strategies. Understanding the market and managing risk are crucial steps for anyone new to the world of futures. Ready to take the next step? Join us today and unlock your trading potential.

Frequently Asked Questions

What is a futures contract?

A futures contract is a standardized agreement to buy or sell a specific asset at a predetermined price on a future date. It’s a type of derivative whose value is based on an underlying asset like an index, commodity, or bond. Traders use them to speculate on price movements or to hedge against risk.

Why trade futures with IC Markets?

IC Markets offers several advantages for futures traders, including access to major global exchanges, deep liquidity for reliable order fills, powerful platforms like MT5 and cTrader, and competitive conditions with tight spreads and low commissions. This provides a robust environment for executing your trading strategy.

What trading platforms are available for futures?

You can trade futures on industry-leading platforms such as MetaTrader 5 (MT5) and cTrader. Both offer advanced charting tools, algorithmic trading capabilities, and reliable execution, but they cater to slightly different trading styles and preferences.

What are the primary risks associated with futures trading?

The main risks include leverage, market volatility, and liquidity risk. Leverage magnifies both profits and losses, so a small adverse market move can lead to significant losses. Volatility can cause rapid price swings, while liquidity risk may make it difficult to exit a trade at a desired price.

How are futures different from CFDs?

The key differences lie in the marketplace and contract structure. Futures are traded on a centralized, public exchange with standardized contract sizes and expiry dates. CFDs are traded over-the-counter (OTC) with a broker, offering more flexible contract sizes and no expiry dates, but their primary costs are the spread and overnight financing fees.