Unlock the power of the crowd and transform your trading journey. Welcome to the world of IC Markets IC Social, a revolutionary platform designed to connect you with a global community of traders. Forget spending years learning the markets from scratch. With social trading, you can tap into the expertise of seasoned professionals and mirror their strategies in your own account. This comprehensive guide will show you how IC Social elevates the concept of copy trading, providing you with the tools, insights, and community support to navigate the financial markets with confidence. Whether you are taking your first steps in trading or you’re a veteran looking for a new edge, prepare to discover a smarter way to trade.

- What Is IC Markets IC Social?

- How IC Social Works: A Step-by-Step Breakdown

- Key Features of the IC Social Platform

- Real-Time Trade Replication

- In-Depth Performance Analytics

- Community Interaction and Insights

- Getting Started with IC Social: Your Quick-Start Guide

- Setting Up Your IC Markets Account

- Linking Your Trading Account to IC Social

- Why IC Social is a Game-Changer for Beginner Traders

- Leveraging IC Social as an Experienced Trader

- How to Find and Select Top-Performing Traders to Copy

- Analyzing Trader Profiles and Statistics

- Diversifying Your Copied Portfolio

- Mastering Risk Management on IC Social

- IC Social vs. Other Copy Trading Platforms

- IC Social on MT4 & MT5: What You Need to Know

- Trading on the Go: The IC Social Mobile App Experience

- Understanding the Fees and Costs of IC Social

- Becoming a Strategy Provider on IC Social

- Common Pitfalls to Avoid When Copy Trading

- Is IC Markets IC Social Right for You?

- Frequently Asked Questions

What Is IC Markets IC Social?

IC Markets IC Social is a cutting-edge social trading application built exclusively for IC Markets clients. Think of it as a dynamic financial network where traders connect, share, and learn from one another. At its core, the platform allows you to automatically copy the trades of successful strategy providers. It bridges the gap between those who lack time or experience and those who have a proven track record. This isn’t just about blindly following others; it’s a powerful tool for community trading. You gain full transparency into the performance, risk profile, and trading style of every provider, empowering you to build a portfolio based on real data and shared knowledge.

How IC Social Works: A Step-by-Step Breakdown

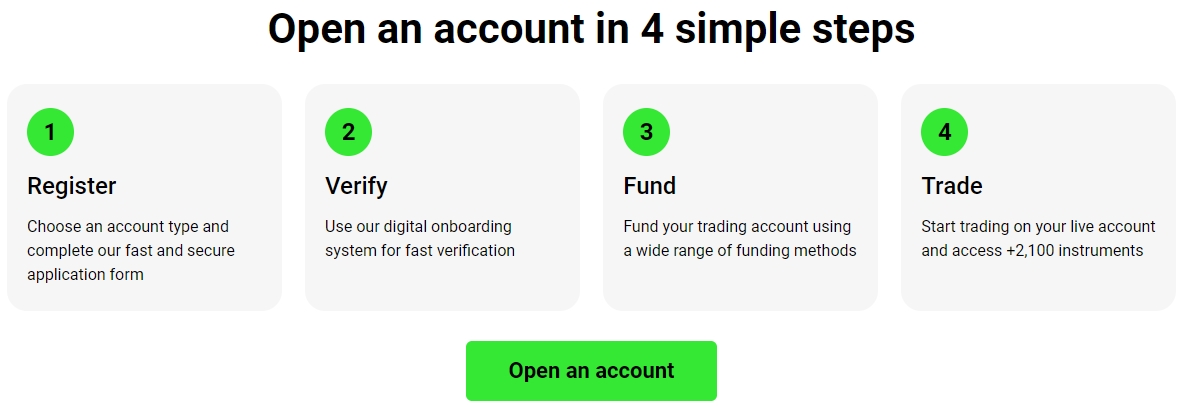

The beauty of the IC Social platform lies in its simplicity and efficiency. It strips away the complexities of trading, allowing you to get started in just a few logical steps. Here’s how you can go from a complete beginner to an active copy trader:

- Join the Community: The first step is to create your IC Markets account and link it seamlessly to the IC Social app. This gives you instant access to the entire network of traders.

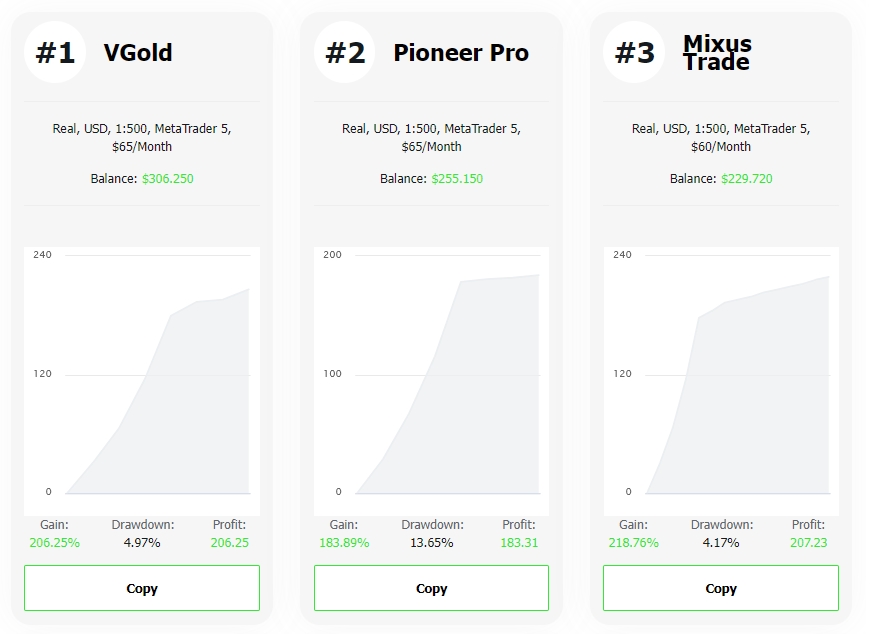

- Discover Top Traders: Use powerful search and filter tools to browse through a list of strategy providers. You can sort them by performance, risk level, assets traded, and more to find a perfect match for your goals.

- Analyze Performance: Dive deep into the detailed statistics of any trader. Review their historical returns, maximum drawdown, and complete trade history before you commit to copying.

- Allocate and Copy: Once you’ve chosen a provider, decide how much of your capital you want to allocate to their strategy. With a single tap, you can begin automatically replicating their trades in real-time.

- Monitor and Adjust: Keep track of your portfolio’s performance through the intuitive dashboard. You have full control to pause, stop copying, or add new traders at any time.

Key Features of the IC Social Platform

The IC Social platform is more than just a copy trading service; it’s an entire ecosystem packed with powerful features designed for your success. Every tool is built to provide transparency, control, and a seamless user experience. You get access to lightning-fast trade replication, ensuring you never miss an opportunity. The platform also offers incredibly detailed performance analytics, turning complex data into easy-to-understand insights. Finally, it fosters a vibrant environment for community interaction, allowing you to connect with and learn from your peers. These core pillars work together to create an unparalleled social trading experience.

Real-Time Trade Replication

Speed is everything in the financial markets. IC Social is built on a high-performance infrastructure that executes copied trades almost instantaneously. When a strategy provider opens, modifies, or closes a position, the exact same action is replicated in your account without delay. This ensures you get the same entry and exit prices, minimizing slippage and maximizing your potential to achieve similar results. This powerful technology works behind the scenes, so you can be confident that you are always in sync with your chosen experts.

In-Depth Performance Analytics

Making informed decisions is crucial for success. IC Social provides a transparent and comprehensive suite of analytical tools to help you evaluate every strategy provider. You are no longer relying on guesswork. Instead, you can access critical data points to build a clear picture of a trader’s performance and risk appetite.

- Return on Investment (ROI): See the trader’s total profitability over different timeframes.

- Maximum Drawdown: Understand the biggest peak-to-trough decline in their account equity.

- Risk Score: A simple, proprietary score that helps you quickly assess a trader’s risk level.

- Win Rate: View the percentage of trades that were closed in profit.

- Full Trade History: Scrutinize every single trade a provider has ever made on the platform.

Community Interaction and Insights

IC Social truly lives up to its name by fostering a collaborative trading environment. It’s a place to engage, share ideas, and grow as a trader. You can follow your favorite strategy providers and receive updates directly in your news feed. See their market commentary, analyze their rationale, and interact with their posts. This community trading aspect adds a valuable layer of qualitative insight to the hard data, helping you understand the “why” behind the trades you copy.

“Being able to see other traders’ thoughts on a market move before I commit capital is a huge advantage. The community feed on IC Social is my secret weapon.”

Getting Started with IC Social: Your Quick-Start Guide

Jumping into the world of social trading with IC Social is a straightforward and rapid process. We’ve designed the onboarding experience to be as smooth as possible, removing barriers so you can start exploring the platform right away. In just two simple stages—setting up your main trading account and then linking it to the social app—you’ll be ready to discover and copy top-performing traders from around the globe. Follow the steps below to begin your journey.

Setting Up Your IC Markets Account

Before you can join the IC Social community, you need a live trading account with IC Markets. This is your foundation. The process is fully digital and takes only a few minutes. You’ll need to provide some basic information, choose your preferred trading platform (like MT4 or MT5), and complete a simple identity verification step. Once approved, you can fund your account using a variety of convenient methods, preparing you for the next step of linking to the IC Social network.

Linking Your Trading Account to IC Social

With your IC Markets account ready, connecting to the IC Social platform is a breeze. Simply download the IC Social app or access it via the web. You will be prompted to log in using your IC Markets trading account credentials. The system automatically and securely links your account, making it available for copy trading. There’s no complex software to install or configure. This seamless integration means your account is now part of the social trading ecosystem, ready to mirror the strategies you choose.

Why IC Social is a Game-Changer for Beginner Traders

For those new to the markets, the learning curve can be steep and intimidating. IC Social completely changes this dynamic. It provides a unique opportunity to participate in the markets and learn simultaneously, without the pressure of having to develop a profitable strategy from day one. It’s the ultimate tool for accelerating your trading education.

- Learn by Doing: Observe how experienced traders manage their positions, set stop losses, and take profits in real market conditions.

- Access Expertise Instantly: You don’t need to be an expert to trade like one. Leverage the skills and research of professionals immediately.

- Build Confidence: Start with a smaller investment and gain confidence as you see how copy trading works, reducing the fear that often holds back new traders.

- Save Time: Bypass the hundreds of hours required to learn technical and fundamental analysis. You can start participating from your first day.

Leveraging IC Social as an Experienced Trader

IC Social isn’t just for beginners. Seasoned traders find immense value in the platform’s capabilities, using it as a sophisticated tool to enhance their existing strategies. If you already know how to trade, IC Social can help you trade smarter, not harder.

You can use it to diversify your portfolio by copying traders who specialize in markets or strategies outside of your own expertise, such as commodities or indices. It’s also a powerful time-saver.

By automating a portion of your portfolio through copy trading, you can free up valuable time to focus on your core manual trading strategy or conduct deeper market research.

How to Find and Select Top-Performing Traders to Copy

The key to success in copy trading is choosing the right people to follow. The IC Social platform provides a robust set of tools to help you sift through the community and identify strategy providers who align with your financial goals and risk tolerance. It’s not about picking the trader with the highest returns; it’s about conducting smart due diligence. A methodical approach involves analyzing a trader’s complete profile and statistics, and then carefully building a diversified portfolio of copied traders to spread your risk.

Analyzing Trader Profiles and Statistics

A trader’s profile is your window into their strategy and discipline. Go beyond the headline return figure and look for consistency and sound risk management. The platform organizes key metrics in an easy-to-digest format, allowing you to perform a thorough analysis before you allocate any funds.

| Metric to Check | What It Tells You |

|---|---|

| Historical Performance | Look for steady, consistent growth over a long period, not just a recent lucky streak. |

| Maximum Drawdown | A low drawdown indicates the trader protects their capital well and avoids catastrophic losses. |

| Average Trade Duration | Helps you understand their trading style—are they a short-term scalper or a long-term swing trader? |

| Assets Traded | Check if they focus on specific pairs like EUR/USD or trade a wide range of instruments. |

Diversifying Your Copied Portfolio

Never put all your eggs in one basket. Relying on a single strategy provider, no matter how good they are, exposes you to unnecessary risk.

A smarter approach is to diversify by copying several different traders. This spreads your risk and smooths out your equity curve. Consider combining traders with different styles; for example, you could copy one who focuses on major forex pairs with a long-term view, and another who is a short-term trader specializing in stock indices. This creates a more balanced and resilient copy trading portfolio.

Mastering Risk Management on IC Social

IC Social puts you in the driver’s seat of your risk exposure. While you are copying the trades of others, you retain ultimate control over your capital. The platform includes several powerful, user-friendly risk management tools that allow you to define your limits clearly. Effective risk management is the line between speculative gambling and strategic investing. Use these features wisely to protect your account and ensure your copy trading activities align with your personal risk tolerance.

- Set a Copy Stop-Loss: You can define a specific loss level for your entire copy trading relationship with a provider. If your allocated capital drops to this level, the platform will automatically close all copied trades and stop copying them.

- Control Your Allocation: Only invest a fraction of your total capital into copy trading. Experts recommend allocating only a small percentage to any single strategy provider.

- Regularly Review Performance: Don’t just “set it and forget it.” Schedule regular check-ins to review the performance of the traders you are copying and ensure they still meet your criteria.

- Adjust on the Fly: You can increase or decrease your allocated funds, or stop copying a trader entirely, with just a few clicks at any time.

IC Social vs. Other Copy Trading Platforms

Not all social trading platforms are created equal. Many third-party solutions are disconnected from the broker’s core infrastructure, leading to delays and inferior trade execution. IC Social is different. As a proprietary platform developed by IC Markets, it offers a deeply integrated and optimized experience that generic platforms simply cannot match.

| Feature | IC Markets IC Social | Generic Platforms |

|---|---|---|

| Execution Speed | Direct integration with IC Markets servers for ultra-low latency. | Relies on third-party connections (APIs), which can add delays. |

| Account Integration | Seamless connection with your IC Markets MT4/MT5 account. | Often requires complex setup with EAs or master/slave account configurations. |

| Cost Structure | Free to use the platform; pay only the performance fees set by providers. | May involve monthly subscription fees in addition to performance fees. |

| Support | Fully supported by the award-winning IC Markets customer service team. | Support is split between the platform provider and the broker. |

IC Social on MT4 & MT5: What You Need to Know

A common question is how IC Social interacts with the world’s most popular trading platforms, MetaTrader 4 and MetaTrader 5. The integration is both simple and powerful. When you link your IC Markets MT4 or MT5 account to IC Social, the copy trading technology works at the server level. This is a significant advantage. It means you do not need to install any Expert Advisors (EAs) or other plugins on your trading terminal. You don’t even need to have your MT4 or MT5 platform running on your computer or a VPS. The trade replication is handled entirely by our secure servers, ensuring reliability, speed, and freeing you from any technical maintenance.

Trading on the Go: The IC Social Mobile App Experience

The financial markets never sleep, and neither should your ability to manage your portfolio. The IC Social mobile app for iOS and Android puts the full power of the platform in the palm of your hand. Whether you’re commuting, on a lunch break, or traveling, you are always connected. The app features a clean, intuitive interface that makes it easy to discover new traders, monitor your active copy trading performance in real-time, and view your complete trade history. You can adjust risk settings, allocate more funds, or stop copying a trader with just a few taps. It’s complete control and peace of mind, wherever you are.

Understanding the Fees and Costs of IC Social

Transparency is a core principle at IC Markets, and that extends to the costs associated with the IC Social platform. Using the platform itself is completely free. There are no monthly subscriptions, sign-up fees, or hidden charges for accessing the network. The only cost involved is the performance fee charged by the strategy providers you choose to copy. Each provider sets their own fee, which is clearly displayed on their profile. This fee is typically a percentage of the profits they generate for you. This performance-based model is fair and motivating: providers only earn money when you make money.

Becoming a Strategy Provider on IC Social

If you are a talented and consistently profitable trader, IC Social offers you an incredible opportunity to be rewarded for your skills. By becoming a strategy provider, you can allow other members of the community to copy your trades. In return, you earn a performance fee on the profits you generate for your copiers. This creates a powerful secondary income stream based on the strategies you are already trading. To become a provider, you must demonstrate a solid trading history and a commitment to responsible risk management. It’s a fantastic way to build your reputation, grow a follower base, and monetize your market expertise.

Common Pitfalls to Avoid When Copy Trading

Copy trading is a powerful tool, but it’s not a guaranteed path to riches. Like any form of investing, it carries risks. Being aware of common mistakes can help you navigate the platform more effectively and protect your capital. Here are a few key pitfalls to avoid:

- Chasing Past Performance: Don’t just pick a trader because they had a phenomenal last month. Look for long-term consistency and a stable performance history.

- Ignoring Risk Metrics: Focusing only on returns while ignoring drawdown and risk scores is a recipe for disaster. A high-return trader might be taking excessive risks that don’t align with your profile.

- Over-Allocating Capital: Never risk more than you can comfortably afford to lose. Start small and only increase your allocation as you gain confidence in the platform and the providers you copy.

- Failing to Diversify: As mentioned before, copying only one trader is a high-risk strategy. Always spread your investment across multiple providers with different styles.

Is IC Markets IC Social Right for You?

Deciding if IC Social fits your needs comes down to your personal trading goals. Are you new to the markets and looking for a way to learn while you participate? Do you lack the time to perform daily market analysis but still want to be invested? Or are you an experienced trader seeking to diversify your strategies and save time? If you answered yes to any of these questions, then IC Social is designed for you. It democratizes access to trading strategies, fosters a supportive community, and provides a transparent, powerful platform for achieving your financial objectives. The best way to know for sure is to explore it for yourself. Join the IC Markets IC Social community today and discover a new world of trading possibilities.

Frequently Asked Questions

What is IC Markets IC Social?

IC Markets IC Social is a social trading application for IC Markets clients that allows users to connect with other traders and automatically copy the trades of successful strategy providers. It provides a platform for community trading, sharing insights, and learning from experienced professionals.

How do I start copy trading on IC Social?

To start, you need to create and fund a live IC Markets trading account. Then, you link this account to the IC Social app. From there, you can browse and analyze strategy providers, allocate funds to the ones you choose, and begin automatically copying their trades in real-time.

Are there any fees for using the IC Social platform?

Using the IC Social platform itself is free, with no monthly subscriptions or sign-up fees. The only cost is a performance fee set by the strategy providers you copy, which is a percentage of the profits they generate for your account.

Can I use IC Social on my mobile device?

Yes, there is a dedicated IC Social mobile app for both iOS and Android devices. The app provides full functionality, allowing you to discover traders, monitor performance, adjust risk settings, and manage your portfolio on the go.

Is IC Social only for beginner traders?

No, while it is an excellent tool for beginners to learn and participate in the markets, experienced traders also use IC Social to diversify their portfolios, copy experts in different markets, and save time by automating a portion of their trading.