Are you ready to explore the dynamic world of global stock markets? With IC Markets Indices, you gain unparalleled access to some of the most influential economies worldwide. This comprehensive guide empowers you to understand and navigate the exciting realm of indices trading, offering a clear path to potentially capitalize on market movements.

We provide a robust platform and competitive conditions for trading, making us a preferred choice for traders seeking exposure to major global indices. Discover how our offerings can enhance your trading strategy today.

- Why Trade Indices with IC Markets?

- Understanding Stock Indices and Index CFDs

- Key Advantages of Trading Index CFDs

- Explore the World’s Leading Global Indices

- Start Your Indices Trading Journey Today

- Understanding Stock Market Indices

- Why Stock Indices Matter for Traders

- What Are Indices and How Do They Work?

- Why Trade Indices in Today’s Market?

- Why Choose IC Markets for Index Trading?

- Unrivaled Access to Global Indices

- Superior Trading Conditions for Index CFDs

- Advanced Trading Platforms

- Trust and Dedicated Support

- A Closer Look at IC Markets Indices Offering

- Why Trade IC Markets Indices?

- Explore the Range of Global Indices

- Popular Global Indices Available

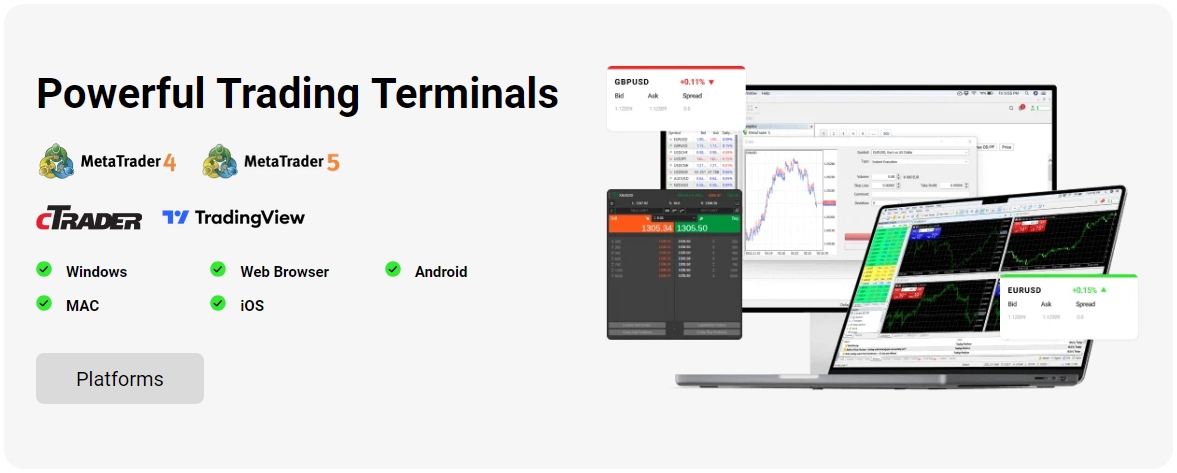

- Trading Platforms for IC Markets Indices

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- cTrader

- Choosing Your Ideal Platform

- MetaTrader 4 and 5 for Index Trading

- Unlock the Power of Indices Trading

- MetaTrader 4 vs. MetaTrader 5: What’s Best for Your Index Trading?

- cTrader’s Advanced Capabilities

- Precision Trading Tools

- Algorithmic Trading & Customization

- Advanced Order Management

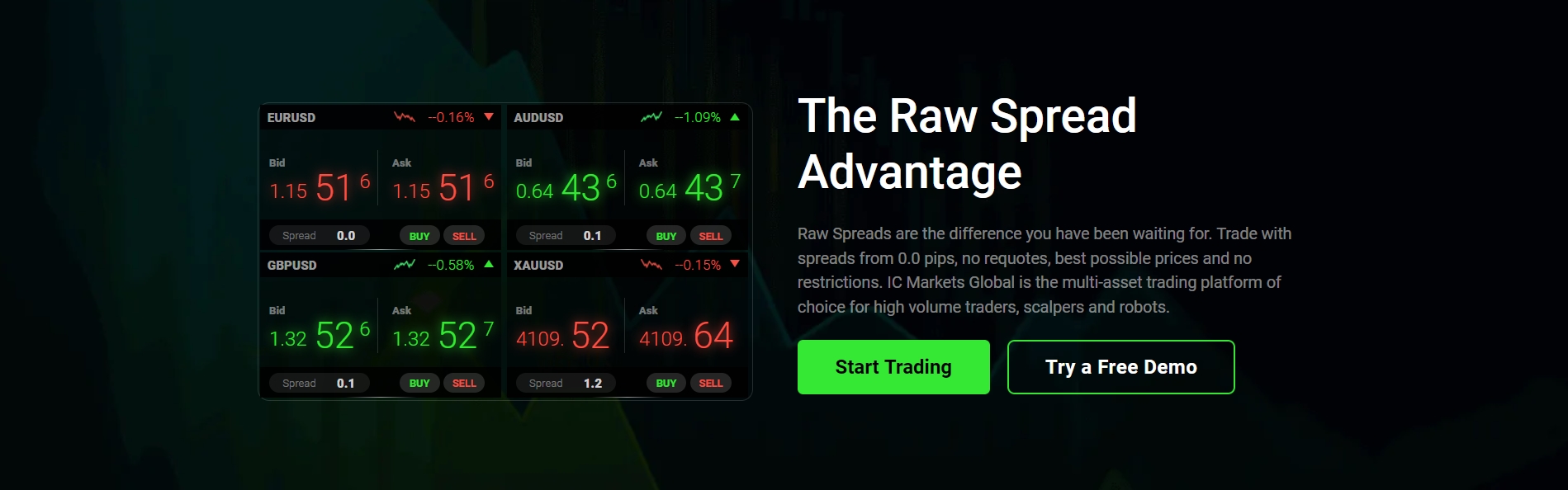

- Key Trading Conditions and Competitive Spreads

- Unrivaled Spreads for IC Markets Indices

- Superior Trading Conditions Engineered for Performance

- Lightning-Fast Execution

- Flexible Leverage Options

- Diverse Account Types

- Leverage and Margin Requirements Explained

- Unlocking Potential with Leverage

- Margin: Your Trading Safety Net

- Effective Strategies for Trading IC Markets Indices

- Mastering Trend Following

- Implementing Breakout Strategies

- Leveraging Range Trading Techniques

- Crucial Elements for Any Strategy

- Essential Risk Management When Trading Indices

- Mastering Your Trading Environment: Key Strategies

- Cultivating Emotional Discipline and Informed Decisions

- Practical Tools for Enhanced Risk Control

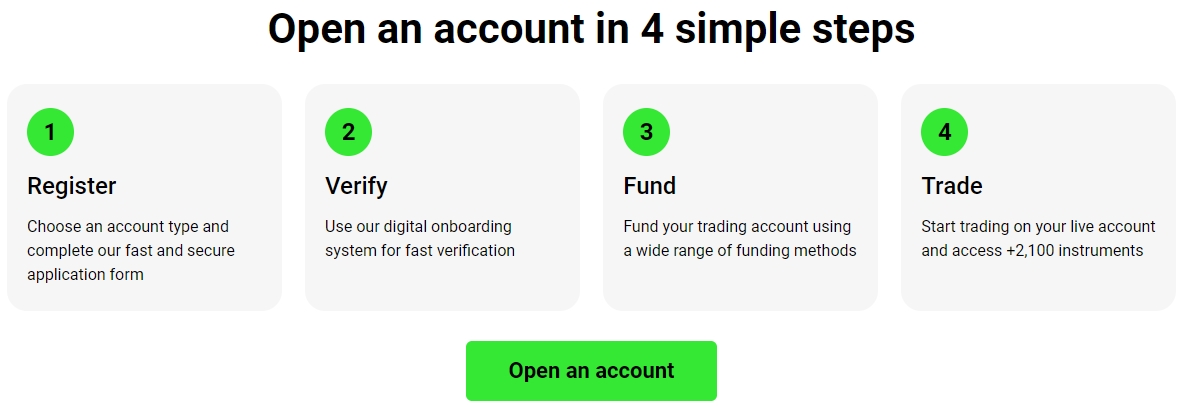

- How to Open an IC Markets Trading Account

- Your Step-by-Step Guide to Account Creation:

- Visit the Official Website

- Provide Personal Details

- Choose Your Account Type and Trading Platform

- Complete the Application Questions

- Verify Your Identity and Residence

- Fund Your Account

- Regulation and Security of Your Investments

- Comparing Indices with Other Asset Classes

- Indices vs. Individual Stocks

- Comparison Table: Indices vs. Individual Stocks

- Indices vs. Commodities

- Indices vs. Forex

- The Unique Appeal of Index Trading

- Advantages of Trading Indices with IC Markets

- Extensive Market Access and Diversification

- Flexible Trading with Leverage

- Competitive Pricing and Tight Spreads

- Advanced Trading Platforms

- Robust Regulation and Reliability

- Expert Support and Educational Resources

- Potential Disadvantages and Considerations

- Frequently Asked Questions About IC Markets Indices

- What are IC Markets Indices?

- Which global indices can I trade with IC Markets?

- What are the benefits of indices trading with IC Markets?

- Is indices trading suitable for beginners?

- How do I start trading IC Markets Indices?

- Maximizing Your Potential with IC Markets Indices

- Why Indices Trading Stands Out

- Your Advantage with IC Markets Indices

- Access a World of Global Indices

- Frequently Asked Questions

Why Trade Indices with IC Markets?

Trading stock indices provides a unique way to diversify your portfolio and react to macroeconomic news without focusing on individual company performance. IC Markets stands out as a premier broker for indices trading for several compelling reasons:

Trading stock indices provides a unique way to diversify your portfolio and react to macroeconomic news without focusing on individual company performance.

- Diverse Global Access: Explore a broad selection of global indices from North America, Europe, Asia, and Australia.

- Competitive Spreads: Benefit from tight spreads on all major index CFDs, reducing your trading costs.

- Flexible Leverage: Amplify your trading power with flexible leverage options, giving you greater market exposure.

- Advanced Trading Platforms: Trade seamlessly using industry-leading platforms like MetaTrader 4, MetaTrader 5, and cTrader.

- Reliable Execution: Experience fast and reliable order execution, crucial for volatile index markets.

Understanding Stock Indices and Index CFDs

A stock index acts as a barometer for a specific stock market or sector, representing the collective performance of a basket of top companies. For instance, the US 500 tracks the performance of 500 leading U.S. companies. Trading these as index CFDs allows you to speculate on their price movements without actually owning any shares.

With index CFDs, you can profit from both rising and falling markets. If you anticipate an index will climb, you can ‘buy’ (go long). If you expect it to fall, you can ‘sell’ (go short). This flexibility offers immense opportunities for traders to engage with global indices.

Key Advantages of Trading Index CFDs

Index CFDs offer distinct benefits compared to traditional stock trading. Here’s a quick overview:

| Advantage | Description |

|---|---|

| Leverage | Control a large position with a relatively small capital outlay. |

| Go Long or Short | Profit from both rising and falling markets. |

| Market Diversification | Gain exposure to an entire economy or sector with a single trade. |

| Lower Costs | Often involves lower transaction costs compared to buying individual stocks. |

Explore the World’s Leading Global Indices

IC Markets provides access to a wide array of global indices, allowing you to react to economic events and market trends across different continents. You can trade popular instruments reflecting the performance of major economies:

- North American Indices: Such as the Dow Jones Industrial Average (US30) or the S&P 500 (US500).

- European Indices: Including the German DAX (GER40) or the UK FTSE 100 (UK100).

- Asian & Oceanic Indices: Such as the Nikkei 225 (JP225) or the Australian ASX 200 (AUS200).

Our comprehensive selection ensures you find the IC Markets Indices that align with your trading goals, whether you focus on specific regions or seek broad market exposure.

Start Your Indices Trading Journey Today

Ready to leverage the power of IC Markets Indices and engage with the world’s most dynamic markets? Opening an account is straightforward and gives you immediate access to our advanced trading environment. Experience competitive pricing, powerful tools, and dedicated support.

Don’t miss out on the opportunities presented by global indices. Join thousands of traders who choose IC Markets for their indices trading needs. Your journey into the heart of global finance begins here.

Understanding Stock Market Indices

Stock market indices are like powerful barometers, offering a quick read on the health and direction of specific markets or entire economies. Imagine trying to track hundreds, even thousands, of individual companies daily. It becomes overwhelming fast. Stock indices simplify this, giving you a digestible snapshot of how a selected group of stocks performs. They represent a basket of securities, carefully chosen to reflect a particular sector, region, or even the broader global market. These indices function by tracking the collective performance of their constituent companies. When the prices of the companies within an index rise, the index typically increases in value, signaling optimism in that market segment. Conversely, a decline suggests a downturn. This movement provides a vital benchmark, allowing investors and traders to gauge market sentiment and assess portfolio performance against a recognized standard.Why Stock Indices Matter for Traders

- They act as a key performance benchmark for specific markets or economic sectors.

- Indices offer insights into broader economic health and investor confidence.

- They provide a practical tool for diversifying your trading strategies and portfolio exposure.

- Monitoring global indices helps traders identify emerging trends and opportunities worldwide.

“Stock indices offer a panoramic view of market dynamics, making complex movements comprehensible and actionable for traders.”Many traders explore the exciting possibilities offered by IC Markets Indices. They provide a direct pathway to participate in the movements of leading global markets. With instruments like index CFDs, you gain exposure to these popular indices without the need for direct stock ownership. This approach to indices trading offers flexibility and accessibility, making it a preferred choice for many seeking to capitalize on market fluctuations.

Benefits of Trading Index CFDs:

| Benefit | Description |

|---|---|

| Market Exposure | Access major global indices from a single platform. |

| Flexibility | Trade both rising and falling markets. |

| Diversification | Spread risk across an entire market rather than single stocks. |

What Are Indices and How Do They Work?

Ever wondered how to gauge the health of an entire economy or a specific industry with a single number? That’s precisely the power of an index. Think of it as a meticulously crafted barometer, measuring the collective performance of a select group of assets. It isn’t a physical asset you can hold, but rather a statistical measure, a benchmark that provides a clear snapshot of market sentiment and economic trends.

So, how does this sophisticated gauge operate? An index aggregates the price movements of multiple underlying components, typically stocks from a specific market or sector. Each component often carries a weighting, meaning larger companies or those with higher market capitalization might influence the index’s value more significantly. When the component prices rise, the index climbs; when they fall, the index declines. This mechanism offers a holistic view, letting you understand broader market direction without scrutinizing every single stock.

For traders, indices are invaluable. They serve as potent economic indicators, reflecting investor confidence and the overall market direction. Many of the most recognized indices are, in fact, stock indices, tracking the performance of leading companies on major exchanges worldwide. These global indices give you instant insight into various regional economies and sectors, from technology giants to energy producers.

You cannot buy an index directly, like you would a share in a company. Instead, you participate in indices trading through financial instruments designed to mirror their price movements. The most common way to do this is via index CFDs (Contracts for Difference). With CFDs, you speculate on whether the index’s price will rise or fall, without actually owning any of the underlying assets. This approach allows for flexibility and the potential to profit from both upward and downward market shifts.

Engaging with IC Markets Indices opens the door to a diverse range of these market benchmarks. This offers you the opportunity to diversify your trading portfolio and gain exposure to entire market sectors or national economies with a single position. It’s an efficient way to react to macroeconomic news and broader market shifts.

Consider these key advantages when exploring indices:

- Broad Market Exposure: Gain insight into an entire sector or economy, not just individual companies.

- Diversification Potential: Spread your risk across multiple assets within one trade.

- Liquidity: Major indices are highly liquid, often reflecting significant trading volumes.

- Economic Barometer: Use them as leading indicators for economic health and investor sentiment.

Understanding indices empowers you to make informed trading decisions, leveraging powerful tools to navigate the complexities of global financial markets.

Why Trade Indices in Today’s Market?

Today’s dynamic financial landscape offers unique opportunities for savvy traders. If you are looking to diversify your portfolio, gain broad market exposure, and capitalize on volatility, then indices trading deserves your attention. With platforms like IC Markets Indices, accessing these opportunities is straightforward and efficient.

Trading stock indices allows you to speculate on the performance of an entire economy or a specific sector rather than individual companies. This approach can simplify your market analysis and spread your risk. Here are compelling reasons to consider it now:

- Broad Market Exposure: Rather than picking individual stocks, you can gain exposure to a basket of leading companies through a single trade. This provides a snapshot of an entire market, like the FTSE 100 or the S&P 500.

- Diversification Benefits: Trading global indices helps spread your risk across different markets and economies. It offers a powerful way to diversify your investment strategy, potentially smoothing out returns and reducing the impact of negative performance from a single asset.

- Liquidity and Accessibility: Index CFDs are among the most liquid financial instruments available, ensuring you can enter and exit positions with ease. This high liquidity also often translates to tighter spreads, which benefits your overall trading costs.

- Capitalizing on Volatility: Market volatility, often seen as a challenge, presents significant opportunities for indices trading. Indices tend to react quickly to geopolitical events, economic data, and major news, offering frequent price movements that active traders can potentially leverage.

- Trading Flexibility: You can go long (buy) if you expect an index to rise, or go short (sell) if you anticipate a decline. This flexibility means you can potentially profit in both rising and falling markets, adding a crucial advantage in varying market conditions.

In a world of constant change, the ability to react quickly and access diverse markets is paramount. Trading IC Markets Indices positions you to take advantage of these shifts. It’s about making informed decisions with broad market instruments. Ready to explore how indices can fit into your trading strategy? Join us to discover the potential.

Why Choose IC Markets for Index Trading?

Want to dive into the dynamic world of indices trading? IC Markets offers a premier environment for traders looking to capitalize on market movements across the globe. Our platform provides robust access to IC Markets Indices, delivering a superior trading experience built on transparency and efficiency.

Unrivaled Access to Global Indices

IC Markets puts the world’s leading economies at your fingertips. You gain access to a diverse array of global indices, allowing you to speculate on the performance of entire stock markets rather than individual companies. From major stock indices in the US, Europe, and Asia, our selection ensures you can diversify your portfolio and seize opportunities wherever they emerge.

Here’s what you can expect:

- Trade popular indices representing key economic regions.

- Diversify your exposure beyond single stocks.

- Capitalize on broad market trends with ease.

Superior Trading Conditions for Index CFDs

When you engage in indices trading with IC Markets, you benefit from some of the most competitive conditions in the industry. Our commitment to tight spreads and rapid execution helps you maximize your potential returns on index CFDs.

| Feature | Benefit for You |

|---|---|

| Tight Spreads | Reduce your trading costs on index CFDs. |

| Deep Liquidity | Experience swift and reliable order execution. |

| Flexible Leverage | Manage your capital efficiently while accessing larger positions. |

Advanced Trading Platforms

Power your indices trading with cutting-edge technology. IC Markets provides access to industry-leading trading platforms, designed for speed, stability, and comprehensive analysis.

These platforms offer:

- Advanced charting tools for in-depth technical analysis.

- Real-time market data to keep you informed.

- Customizable interfaces to suit your trading style.

- Automated trading capabilities for strategic execution.

Whether you are a seasoned professional or just starting out with index CFDs, our platforms give you the edge you need.

Trust and Dedicated Support

Trading with peace of mind is paramount. IC Markets operates under robust regulatory oversight, ensuring a secure and transparent trading environment for your IC Markets Indices investments. Our dedicated customer support team is also available around the clock to assist you with any queries.

“Reliability and client support are the cornerstones of successful indices trading. At IC Markets, we build on these foundations, offering an experience you can trust.”

Ready to explore the possibilities with IC Markets Indices? Join a global community of traders who trust us for their index trading needs. Open an account today and experience the difference superior conditions and world-class service make.

A Closer Look at IC Markets Indices Offering

Ready to tap into the pulse of global economies? IC Markets brings you an exceptional opportunity to engage with leading markets through its comprehensive IC Markets Indices offering. We provide traders with direct access to a diverse selection of major stock indices, allowing you to participate in the movements of entire economies.

Our platform offers more than just numbers; it offers a gateway to some of the world’s most influential markets. Engaging in indices trading allows you to speculate on the performance of a group of shares without needing to buy each individual stock. This approach delivers incredible diversification and flexibility for your portfolio strategy.

Why Trade IC Markets Indices?

Choosing IC Markets for your indices trading journey comes with a host of advantages designed to empower your trading decisions:

- Broad Market Exposure: Access a vast selection of global indices, representing key economies and sectors across continents.

- Flexible Trading Hours: Trade major indices almost around the clock, aligning with the operational hours of different global markets.

- Competitive Spreads: We provide tight spreads on our index CFDs, helping you manage your trading costs effectively.

- Leverage Options: Amplify your potential trading power with competitive leverage, though remember it also magnifies risk.

- No Commissions: Focus purely on your strategy without incurring additional commission fees on index trades.

- Advanced Platforms: Utilize world-class trading platforms like MetaTrader 4, MetaTrader 5, and cTrader for superior execution and analysis.

Explore the Range of Global Indices

IC Markets connects you to a wide variety of global indices, allowing you to pinpoint opportunities wherever they emerge. Our offering includes major stock indices from leading economic regions.

| Index Category | Representative Markets | Trading Opportunities |

|---|---|---|

| US Equities | S&P 500, Dow Jones, NASDAQ 100 | Track technology, industrial, and broad market performance. |

| European Equities | DAX 40, FTSE 100, Euro Stoxx 50 | Engage with leading European economies and their top companies. |

| Asian Equities | Nikkei 225, Hang Seng Index | Access the dynamic growth and innovation of Asian markets. |

| Australian Equities | ASX 200 | Participate in the performance of Australia’s largest companies. |

Our extensive suite of index CFDs means you can react quickly to geopolitical events, economic data releases, and corporate news that influence market sentiment across the globe. We provide the tools for you to navigate these complex movements with precision.

Whether you are an experienced trader seeking diversification or just starting your journey into indices trading, IC Markets provides the robust environment you need. Take the next step today – join IC Markets and experience seamless access to the world’s most dynamic global indices. Unlock new potential in your portfolio with our premier IC Markets Indices offering.

Popular Global Indices Available

Diving into the world of financial markets means accessing diverse opportunities. With IC Markets Indices, you unlock direct access to some of the planet’s most influential economies. Our platform empowers you to engage in dynamic indices trading, letting you capitalize on the collective performance of top companies without needing to purchase individual stocks.

We provide a comprehensive selection of global indices, allowing you to diversify your portfolio and gain exposure to major market movements. Whether you’re interested in the tech giants of the US or the industrial powerhouses of Europe, our index CFDs offer a flexible way to participate.

Here are just a few of the widely traded stock indices you can find:

| Index Name | Represents |

|---|---|

| US 30 | 30 large companies listed on US exchanges |

| US 500 | 500 large US companies across various sectors |

| USTech 100 | 100 of the largest non-financial companies listed on NASDAQ |

| Germany 40 | 40 major German blue-chip companies |

| UK 100 | 100 companies with the highest market capitalization on the London Stock Exchange |

| Australia 200 | 200 largest eligible companies listed on the Australian Securities Exchange |

| Japan 225 | 225 largest companies on the Tokyo Stock Exchange |

Accessing these markets gives you unparalleled potential for strategic trading. Explore our robust platform and start your journey with these influential global indices today.

Trading Platforms for IC Markets Indices

Choosing the right trading platform is crucial for success, especially when you are engaged in active indices trading. IC Markets understands this, offering a selection of world-class platforms designed to give you precision, speed, and all the tools you need to navigate the exciting world of IC Markets Indices.

Each platform brings unique strengths to the table, catering to different trading styles and preferences. Let’s explore the powerful options available to you.

MetaTrader 4 (MT4)

MetaTrader 4 remains a dominant force in the online trading world. Its reputation for reliability and user-friendliness makes it a popular choice for traders looking to engage with stock indices. You will find robust charting capabilities and a vast array of technical indicators at your fingertips.

- Intuitive Interface: Easy to navigate, perfect for both beginners and experienced traders.

- Advanced Charting Tools: Customize charts with multiple timeframes and drawing tools to analyze market movements.

- Expert Advisors (EAs): Automate your indices trading strategies with custom EAs, executing trades based on predefined rules.

- High Performance: Known for its stable performance and efficient order execution.

MetaTrader 5 (MT5)

Building on the success of its predecessor, MetaTrader 5 offers an expanded set of features, providing an even more comprehensive trading experience. It’s ideal for traders who demand greater analytical depth and more market insights into global indices.

- More Timeframes: Access additional chart timeframes for granular analysis.

- Expanded Indicators: Enjoy a larger selection of built-in technical indicators and graphical objects.

- Market Depth: Gain insights into market liquidity with the Level II Market Depth feature.

- Hedging & Netting: Supports both hedging and netting order accounting systems, offering flexibility.

- Faster Processor: Optimized for quicker processing of market data and trade execution.

cTrader

For traders who prioritize ECN execution, a modern interface, and advanced order types, cTrader stands out as an excellent choice. It’s particularly well-suited for those actively trading index CFDs, offering a transparent and powerful environment.

- True ECN Environment: Experience raw spreads and fast execution, reflecting real market conditions.

- Sleek User Interface: A clean, intuitive design that enhances the trading experience.

- Advanced Order Types: Access sophisticated order types not always available on other platforms, giving you greater control.

- Algorithmic Trading: Develop and deploy custom trading robots and indicators using C#.

- Depth of Market: Provides full market depth, showcasing the full range of executable prices.

Choosing Your Ideal Platform

The best platform for your IC Markets Indices trading journey truly depends on your individual needs. Consider these factors:

| Feature | MT4 | MT5 | cTrader |

|---|---|---|---|

| User Friendliness | High | Medium-High | Medium |

| Advanced Analysis | Good | Excellent | Very Good |

| Automated Trading | Excellent (MQL4) | Excellent (MQL5) | Excellent (cAlgo) |

| ECN Experience | Yes (via broker) | Yes (via broker) | Native ECN |

Whether you prefer the robust automation of MetaTrader or the transparent ECN environment of cTrader, IC Markets provides the tools for intelligent indices trading. Explore these platforms and find the perfect match for your strategy to unlock your trading potential.

MetaTrader 4 and 5 for Index Trading

Ready to elevate your approach to global markets? MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are industry-leading platforms, offering robust tools perfect for trading IC Markets Indices. These platforms equip you with everything you need to navigate the exciting world of indices trading with precision and confidence.

Unlock the Power of Indices Trading

Both MT4 and MT5 provide a stable and feature-rich environment, making them ideal choices for monitoring and executing trades on various global indices and stock indices. You gain access to real-time market data, ensuring you always have the latest information at your fingertips.

Here’s why these platforms shine for index traders:

- Advanced Charting Tools: Visualize price movements of index CFDs with a wide array of charts and customizable indicators. Analyze trends and identify potential entry and exit points with clarity.

- Comprehensive Analytical Features: Dive deep into market analysis using a vast library of technical indicators. From moving averages to oscillators, you have the tools to develop robust trading strategies.

- Automated Trading Capabilities: Implement your strategies around the clock using Expert Advisors (EAs). This powerful feature allows for algorithmic indices trading, helping you capitalize on opportunities even when you are away from your screen.

- Flexible Order Management: Place various order types, including market orders, pending orders, stop losses, and take profits, giving you complete control over your risk management and trade execution.

- Mobile Access: Stay connected to the markets wherever you are. Both platforms offer excellent mobile applications, so you can manage your IC Markets Indices positions on the go.

MetaTrader 4 vs. MetaTrader 5: What’s Best for Your Index Trading?

While both platforms deliver exceptional performance, they do have distinct features that might influence your choice for indices trading. Let’s look at a quick comparison:

| Feature | MetaTrader 4 | MetaTrader 5 |

|---|---|---|

| Number of Timeframes | 9 standard timeframes | 21 timeframes |

| Depth of Market (DOM) | Not natively available | Integrated DOM for market depth visibility |

| Pending Order Types | 4 types (Buy Limit, Sell Limit, Buy Stop, Sell Stop) | 6 types (including Buy Stop Limit, Sell Stop Limit) |

| Economic Calendar | Via third-party plugins | Integrated into the platform |

Whether you prefer the simplicity and broad community support of MT4 or the enhanced analytical capabilities and additional features of MT5, both platforms offer a superior experience for trading IC Markets Indices. Choose the platform that aligns best with your trading style and start exploring the vast opportunities in global indices today!

cTrader’s Advanced Capabilities

cTrader is a platform designed for serious traders, offering a suite of advanced capabilities that elevate your trading experience, especially when navigating markets like IC Markets Indices. This platform stands out with its powerful tools, making it a preferred choice for those engaged in various forms of indices trading.

Precision Trading Tools

Unlock superior market analysis with cTrader’s extensive charting package. You gain access to a vast array of indicators and drawing tools, essential for spotting trends and patterns in stock indices. The depth of market (DOM) feature provides crucial transparency, showing you the full range of executable prices directly from liquidity providers. This level of detail empowers you to make informed decisions quickly.

“cTrader provides the sophisticated environment needed to truly understand and react to the dynamics of global indices.”

Algorithmic Trading & Customization

For traders seeking an edge, cTrader’s algorithmic capabilities are second to none. The platform supports automated trading through cBots, allowing you to develop and deploy custom strategies. You can backtest your ideas rigorously against historical data before risking capital. Furthermore, the ability to create custom indicators ensures your analysis perfectly aligns with your trading methodology for index CFDs. This level of customization ensures the platform adapts to you, not the other way around.

Advanced Order Management

Manage your positions with surgical precision using cTrader’s advanced order types. Beyond standard market and limit orders, you can utilize sophisticated tools like stop-limit orders and trailing stops. These features are vital for managing risk and securing profits across volatile global indices. The platform also offers flexible position management, allowing you to partially close positions or reverse them with ease.

Here’s a quick look at key benefits:

- Fast Execution: Enjoy lightning-fast order execution, critical for capitalizing on swift market movements.

- Transparent Pricing: Access raw spreads and level II pricing for clear insights into market depth.

- User-Friendly Interface: Despite its advanced features, cTrader maintains an intuitive interface, making it accessible to both new and experienced traders.

- Multi-Device Access: Trade seamlessly across desktop, web, and mobile, ensuring you never miss an opportunity.

Ultimately, cTrader’s robust architecture and extensive feature set provide a comprehensive environment for sophisticated indices trading. It’s a platform built to support your growth as a trader, offering the tools you need to analyze, execute, and manage your positions with confidence.

Key Trading Conditions and Competitive Spreads

When you delve into the dynamic world of indices trading, the quality of your trading conditions and the competitiveness of your spreads are paramount. At IC Markets, we recognize these as foundational pillars for your success, particularly when engaging with IC Markets Indices. We strive to provide an environment where every trade is executed under optimal circumstances, ensuring transparency and efficiency.

Unrivaled Spreads for IC Markets Indices

Our commitment to delivering some of the tightest spreads in the industry sets us apart. This focus means lower transaction costs for you, directly impacting your potential profitability across a wide spectrum of stock indices. Whether you are scalping short-term movements or holding positions longer, the advantage of competitive pricing is undeniable.

Benefits of our competitive spreads include:

- Reduced Trading Costs: More of your capital stays in your trading account, not in fees.

- Enhanced Profit Potential: Lower costs mean a quicker path to profit on winning trades.

- Better Entry and Exit Points: Tight spreads allow for more precise execution of your trading strategy.

- Increased Market Liquidity: Our deep liquidity pools contribute to consistently low spreads, even during volatile periods.

Superior Trading Conditions Engineered for Performance

Beyond attractive spreads, the overall trading conditions for IC Markets Indices are meticulously crafted to support high-performance trading. We understand that success in trading index CFDs hinges on more than just cost; it demands reliability, speed, and flexibility.

Lightning-Fast Execution

Our state-of-the-art infrastructure ensures ultra-fast trade execution. This minimizes slippage, which is crucial for capturing desired price points, especially when markets move quickly. You can trade with confidence, knowing your orders process swiftly and efficiently.

Flexible Leverage Options

We offer flexible leverage options, allowing you to optimize your exposure to the market based on your risk appetite and trading strategy. This empowers you to take advantage of opportunities across global indices while maintaining control over your capital. Always remember to manage leverage responsibly.

Diverse Account Types

IC Markets provides various account types designed to cater to different trading styles and experience levels. Each account benefits from our core competitive spreads and robust trading conditions, giving you the power to choose what best fits your needs for indices trading.

Here’s a quick overview of what you can expect:

| Condition Feature | Trader Benefit |

|---|---|

| Ultra-Low Spreads | Maximizes profit potential on every trade. |

| Rapid Execution | Minimizes slippage and ensures timely order fulfillment. |

| Flexible Leverage | Tailors market exposure to individual risk tolerance. |

| Deep Liquidity | Consistent pricing and reduced re-quotes. |

Experience the tangible difference that professional-grade trading conditions and highly competitive spreads make for your journey into IC Markets Indices. We equip you with the tools and environment you need to pursue your trading goals with confidence.

Leverage and Margin Requirements Explained

Understanding leverage and margin is absolutely crucial for anyone diving into indices trading, especially when exploring the vast opportunities with IC Markets Indices. These concepts are the bedrock of efficient capital use in trading, offering both immense potential and significant responsibility. Let’s demystify them so you can approach the markets with confidence.

Unlocking Potential with Leverage

Leverage essentially allows you to control a much larger trading position than your initial capital would otherwise permit. Think of it as a financial tool that amplifies your market exposure. For instance, with 1:100 leverage, a $1,000 capital can manage a $100,000 position in popular global indices. This means you can gain exposure to major stock indices around the world without tying up vast sums of money. It’s a powerful mechanism for maximizing potential returns from even small price movements in index CFDs.

While the prospect of magnified profits is appealing, it’s vital to recognize that leverage is a double-edged sword. It equally magnifies losses. A small adverse price movement can quickly erode your capital if not managed carefully.

- Increased Market Exposure: Access larger positions in stock indices with less capital.

- Capital Efficiency: Free up capital for diversification or other investment opportunities.

- Potential for Higher Returns: Amplify profits from favorable market movements.

Margin: Your Trading Safety Net

Margin is the actual amount of capital you must deposit and maintain in your trading account to open and hold a leveraged position. It acts as a good faith deposit, ensuring you can cover potential losses. Your broker holds this margin as collateral for the leveraged trade. When you engage in indices trading, the margin requirement directly relates to the leverage you employ.

Lower leverage means a higher margin percentage is required, reducing your overall market exposure for a given capital amount. Conversely, higher leverage translates to a lower margin percentage, allowing you to control a larger position with less upfront capital. It’s a critical component of risk management, as failing to maintain sufficient margin can lead to a margin call, where you’re asked to deposit more funds or face automatic closure of your positions.

| Leverage Ratio | Required Margin (%) |

|---|---|

| 1:30 | 3.33% |

| 1:100 | 1.00% |

| 1:200 | 0.50% |

| 1:500 | 0.20% |

Understanding the interplay between leverage and margin is paramount for strategic index CFDs trading. It enables you to make informed decisions about your risk appetite and position sizing when navigating the dynamic world of IC Markets Indices.

Effective Strategies for Trading IC Markets Indices

Diving into the world of financial markets offers exciting opportunities, and IC Markets Indices stand out as a dynamic asset class. Successful indices trading demands a well-thought-out approach, combining market understanding with robust strategies. Let us explore some highly effective methods to navigate these volatile, yet rewarding, markets.

Mastering Trend Following

One of the most straightforward and powerful strategies involves identifying and following market trends. Trends offer clear direction, whether upward or downward, allowing traders to align their positions with the prevailing momentum. Look for strong, sustained moves in global indices, such as the major stock indices, and aim to enter positions early in the trend’s development.

- Identify clear trends using moving averages or visual analysis.

- Confirm the trend strength with volume or other momentum indicators.

- Set stop-loss orders below a support level for uptrends or above resistance for downtrends.

Implementing Breakout Strategies

Breakout strategies capitalize on price movements that ‘break out’ of established ranges or patterns. Markets often consolidate for periods before making a significant move. Identifying these consolidation phases and anticipating a breakout can lead to substantial gains, particularly when trading index CFDs. A successful breakout typically occurs on higher volume, indicating strong conviction from market participants.

Here’s how to approach it:

- Pinpoint clear support and resistance levels.

- Wait for the price to decisively cross one of these levels.

- Enter a trade in the direction of the breakout, ensuring follow-through.

Leveraging Range Trading Techniques

Not all markets trend; many spend significant time moving sideways within a defined price range. Range trading involves buying at the support level and selling at the resistance level. This strategy thrives in less volatile conditions and requires keen observation of boundaries. However, always remain prepared for potential breakouts that could invalidate the range.

“Successful trading is about managing risk, not avoiding it. Strategies help define that management.”

Crucial Elements for Any Strategy

No strategy works in isolation. Integrate these vital components for enhanced success when dealing with IC Markets Indices:

| Element | Description |

|---|---|

| Risk Management | Always define your maximum risk per trade. Use stop-loss orders consistently to protect capital. |

| Technical Analysis | Utilize indicators like MACD, RSI, and Bollinger Bands to confirm signals and identify entry/exit points. |

| Fundamental Analysis | Stay informed about major economic news and events impacting global indices, as they often trigger significant moves. |

| Market Volatility | Adjust position sizes based on market volatility. Higher volatility often means smaller position sizes. |

Adopting effective strategies for indices trading at IC Markets Indices empowers you to approach the market with confidence and discipline. Consistency in execution, combined with ongoing learning, forms the bedrock of long-term trading success. Dive in, apply these insights, and enhance your trading journey.

Essential Risk Management When Trading Indices

Trading global indices offers exciting opportunities, but success hinges on smart risk management. The dynamic nature of stock indices means market shifts can be sudden. Your ability to navigate these fluctuations while protecting your capital is paramount. Without a robust risk management strategy, even the most promising indices trading ventures can face significant setbacks. Let’s explore the core principles that empower you to trade with confidence and control, especially when engaging with platforms like IC Markets Indices.Mastering Your Trading Environment: Key Strategies

* **Implement Stop-Loss Orders Religiously:** This is your first line of defense. A stop-loss order automatically closes your position when the market moves against you to a pre-defined level. It prevents small losses from snowballing into catastrophic ones. Define your maximum acceptable loss before you enter any trade. * **Optimal Position Sizing:** Never risk more than a small percentage of your total trading capital on any single trade. Determining the right position size for your index CFDs means balancing potential profit with acceptable loss. Calculate this carefully based on your account size and the volatility of the specific IC Markets Indices you are trading. * **Diversify Your Portfolio Wisely:** Don’t put all your eggs in one basket. Spreading your capital across different global indices can mitigate risk. If one market experiences a downturn, others might remain stable or even rise, helping to balance your overall portfolio performance. * **Understand Leverage Inside Out:** Leverage amplifies both gains and losses. While it allows you to control larger positions with less capital, it also magnifies your exposure. Always be aware of your margin requirements and understand the potential impact of leveraged trades on your account equity. Use leverage responsibly.“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett. Patience and discipline are your strongest allies in risk management.

Cultivating Emotional Discipline and Informed Decisions

Emotional control is a cornerstone of effective risk management in indices trading. Fear and greed often lead to impulsive decisions that bypass your carefully constructed strategies. Stick to your trading plan, even when market sentiment tries to sway you. A disciplined approach ensures you make objective choices rather than emotional ones. Before you execute any trade on IC Markets Indices, thorough market analysis is non-negotiable. Understand the economic factors influencing the global indices you target. Stay informed about news, economic reports, and geopolitical events that could impact market movements. Knowledge empowers you to make calculated decisions and avoid speculative gambles.Practical Tools for Enhanced Risk Control

| Risk Management Tool | How It Helps |

|---|---|

| **Trading Journal** | Record every trade, including your entry/exit points, rationale, and emotional state. This helps you learn from mistakes and refine your strategy. |

| **Risk-Reward Ratio** | Ensure potential profits outweigh potential losses. Aim for at least a 1:2 risk-reward ratio, meaning you stand to gain twice as much as you risk. |

| **Regular Review** | Periodically assess your risk management strategy. Markets evolve, and so should your approach. Adapt to new conditions and continuously improve. |

How to Open an IC Markets Trading Account

Ready to dive into the world of trading? Opening an IC Markets trading account is a straightforward process, designed to get you trading quickly and efficiently. Whether your interest lies in forex, commodities, or the exciting opportunities presented by IC Markets Indices, this guide walks you through each step. Get ready to explore the vast potential of indices trading and expand your portfolio.

IC Markets provides a robust platform for accessing a wide range of financial instruments, including global indices. Setting up your account paves the way for you to participate in dynamic markets, including those for major stock indices through index CFDs.

Your Step-by-Step Guide to Account Creation:

-

Visit the Official Website

Start by navigating to the official IC Markets website. Look for the “Open Account” or “Register” button, usually prominently displayed on the homepage. This action kicks off your application process.

-

Provide Personal Details

You’ll need to fill out a registration form with your basic personal information. This includes your full name, email address, phone number, and country of residence. Ensure all details are accurate to avoid any delays in the verification stage.

-

Choose Your Account Type and Trading Platform

IC Markets offers various account types, such as Standard, Raw Spread, and cTrader, each designed to suit different trading styles and preferences. Consider your trading volume and strategy when making this choice. You’ll also select your preferred trading platform – MetaTrader 4 (MT4), MetaTrader 5 (MT5), or cTrader. These platforms are excellent for managing your indices trading activities, offering advanced charting and analytical tools.

-

Complete the Application Questions

The platform will ask a few questions about your financial situation, trading experience, and knowledge of financial markets. This helps IC Markets assess your suitability for trading and ensures you understand the associated risks. Be honest and thorough in your responses.

-

Verify Your Identity and Residence

This is a crucial regulatory step. You must upload clear copies of identification documents and proof of residence. Common documents include a government-issued ID (passport or driver’s license) and a utility bill or bank statement (dated within the last three months). This process safeguards your account and complies with global financial regulations.

Required Documents:

- Proof of Identity: Passport, National ID Card, Driver’s License

- Proof of Residence: Utility Bill (electricity, gas, water), Bank Statement, Government-issued Tax Document

-

Fund Your Account

Once your account is verified, you can deposit funds. IC Markets supports a variety of funding methods, including bank transfers, credit/debit cards, and e-wallets. Choose the method most convenient for you. With funds in your account, you are ready to begin trading a wide selection of stock indices and other assets.

Congratulations! Following these steps will successfully open your IC Markets trading account. You’re now poised to explore the exciting markets, from major global indices to specific index CFDs, with a trusted broker.

Regulation and Security of Your Investments

Navigating the financial markets requires confidence, especially when considering instruments like IC Markets Indices. Your peace of mind is paramount, and understanding the robust regulatory framework safeguarding your capital is essential. We prioritize your security, ensuring a trustworthy environment for all your trading activities.

Operating under stringent oversight from respected financial authorities globally, we adhere to the highest standards of transparency and accountability. These regulations are not just formalities; they are the bedrock of our commitment to protecting your funds and ensuring fair trading practices across all our offerings, including indices trading.

Here’s how we secure your investments:

- Segregated Client Funds: Your money is held in separate trust accounts with top-tier banks, completely distinct from our operational funds. This ensures your capital remains safe and accessible, even in unforeseen circumstances.

- Regulatory Compliance: We are authorized and regulated by leading financial bodies, enforcing strict operational guidelines and capital adequacy requirements. This oversight provides a strong layer of protection for every trader, whether you’re dealing with stock indices or other assets.

- Negative Balance Protection: We provide automatic negative balance protection for all eligible retail clients. This means your account balance will never fall below zero, safeguarding you from unexpected market volatility.

- Robust Internal Controls: Beyond external regulations, we implement sophisticated internal risk management systems. These systems continuously monitor market exposure and operational integrity, offering an additional layer of security for those exploring global indices or index CFDs.

- Transparency and Clarity: We believe in clear communication regarding our services, fees, and terms. You always have a comprehensive understanding of your trading environment, free from hidden clauses.

Your financial safety is our absolute priority. We empower you to focus on your trading strategies with the assurance that your investments are protected by a world-class regulatory framework. This commitment to security builds the foundation for your successful journey in the dynamic world of financial markets.

Comparing Indices with Other Asset Classes

Understanding how IC Markets Indices stack up against other trading instruments is crucial for any savvy investor. While all asset classes offer unique opportunities, indices provide distinct advantages, particularly in terms of market exposure and risk management. Let’s delve into what sets indices apart and why many traders choose them for their portfolios.

Indices vs. Individual Stocks

When considering indices trading, many traders first compare it to investing in individual company stocks. Both give you exposure to the equity market, but their mechanisms differ significantly.

- Diversification: An index represents a basket of stocks, offering inherent diversification. This reduces the risk associated with a single company’s performance. If one company in the index falters, its impact on the overall index is usually diluted.

- Market Trends: Trading stock indices allows you to capitalize on broader economic trends rather than needing to pick individual winning companies. You’re betting on the overall health of an economy or a specific sector.

- Analysis Focus: With individual stocks, deep fundamental and technical analysis of a single company is paramount. For indices, the focus shifts to macroeconomic factors, geopolitical events, and sector-wide sentiment.

Comparison Table: Indices vs. Individual Stocks

| Feature | Indices (e.g., via Index CFDs) | Individual Stocks |

|---|---|---|

| Exposure | Broad market, sector, or economy | Single company |

| Risk | Diversified, lower single-entity risk | Concentrated, higher single-entity risk |

| Analysis | Macroeconomic & technical | Company-specific fundamental & technical |

| Volatility | Generally smoother than individual highly volatile stocks | Can be highly volatile based on company news |

Indices vs. Commodities

Commodities like gold, oil, or agricultural products often follow supply and demand dynamics, geopolitical tensions, and weather patterns. In contrast, global indices typically reflect the economic health, corporate earnings, and investor sentiment of a region or country. While commodities can offer portfolio diversification due to their low correlation with equities, indices provide a direct gauge of equity market performance, which can be a key component of a balanced trading strategy.

Indices vs. Forex

Forex trading involves speculating on the exchange rates between currency pairs, driven by interest rate differentials, economic data releases, and central bank policies. While similar in their response to macroeconomic news, index CFDs track the performance of equity markets. Forex focuses on the relative strength of two currencies, whereas indices capture the collective sentiment and performance of a nation’s leading companies. Both offer high liquidity and operate almost around the clock, but their underlying drivers and market dynamics are distinct.

The Unique Appeal of Index Trading

Ultimately, IC Markets Indices offer a compelling proposition. They provide a streamlined way to gain exposure to major equity markets around the world without needing to analyze hundreds of individual companies. This broad market access, combined with the leverage and flexibility of index CFDs, makes them an attractive asset class for both short-term speculation and longer-term strategic market participation. Traders appreciate the opportunity to diversify their portfolio and react to global economic shifts efficiently through indices trading.

Advantages of Trading Indices with IC Markets

Diving into the world of IC Markets Indices opens up a universe of opportunity for traders looking to diversify their portfolio and tap into major global economies. With IC Markets, you gain direct access to powerful instruments that track the performance of leading stock markets worldwide. It’s more than just trading; it’s about making smart strategic moves.

When you choose IC Markets for your indices trading journey, you unlock several key benefits designed to enhance your experience and potential:

Access a broad range of global indices, from the bustling markets of North America to the dynamic economies of Europe and Asia. This wide selection of index CFDs allows you to diversify your exposure across different geographical regions and economic sectors.

-

Extensive Market Access and Diversification

Access a broad range of global indices, from the bustling markets of North America to the dynamic economies of Europe and Asia. This wide selection of index CFDs allows you to diversify your exposure across different geographical regions and economic sectors. You can easily spread your risk and capitalize on various market trends, moving beyond single stock investments.

-

Flexible Trading with Leverage

IC Markets empowers you with flexible leverage options when trading index CFDs. This means you can control larger positions with a smaller capital outlay, potentially amplifying your returns from even minor price movements. Leverage offers significant capital efficiency, making the markets more accessible to a wider range of traders.

-

Competitive Pricing and Tight Spreads

Experience some of the most competitive pricing in the industry. IC Markets provides tight spreads on its range of global indices, helping to keep your trading costs down. Lower transaction costs contribute directly to your bottom line, making your indices trading more profitable.

-

Advanced Trading Platforms

Trade with confidence on industry-leading platforms like MetaTrader 4, MetaTrader 5, and cTrader. These platforms come equipped with advanced charting tools, technical indicators, and automated trading capabilities, giving you the analytical edge you need to make informed decisions across all stock indices.

-

Robust Regulation and Reliability

IC Markets operates under strict regulatory frameworks, ensuring a secure and transparent trading environment. Your peace of mind is paramount, knowing you are trading with a reputable broker committed to fair practices and reliable service. This commitment fosters a trustworthy space for your financial endeavors.

-

Expert Support and Educational Resources

Whether you are new to IC Markets Indices or an experienced trader, you benefit from dedicated customer support available around the clock. Additionally, a wealth of educational resources helps you continually refine your strategies and deepen your understanding of the markets, putting knowledge and support right at your fingertips.

Ready to explore these advantages firsthand? IC Markets offers a comprehensive and engaging platform for anyone serious about indices trading. Join us and discover a smarter way to interact with the world’s leading financial markets.

Potential Disadvantages and Considerations

Engaging with the financial markets always presents a degree of risk. Even with the advanced features and competitive spreads offered when trading IC Markets Indices, it is vital to understand the potential pitfalls. A truly professional approach involves acknowledging these challenges directly to ensure you make informed decisions.

Indices trading exposes you to broad market sentiment. For instance, global indices react sharply to major economic announcements, geopolitical shifts, and earnings reports from their constituent companies. This inherent sensitivity means rapid price movements are common. While such movements create ample opportunity, they also present significant risk, particularly with stock indices. Prices can swing suddenly and dramatically, demanding careful risk management.

- Leverage Magnification: Index CFDs often allow for substantial leverage. While leverage can significantly boost potential profits, it equally amplifies potential losses. A small market move against your position can result in a significant reduction in your capital if not managed properly.

- Spread and Commission Costs: Every trade incurs a cost, typically through spreads or commissions. During periods of high volatility or reduced liquidity, spreads on global indices can widen, increasing your transaction expenses. Always factor these into your overall trading strategy.

- Market Gaps and Slippage: Unexpected news or events can cause markets to ‘gap’ overnight or over a weekend. This means the price might jump significantly between closing and opening. Consequently, your stop-loss orders could execute at a less favorable price than intended, a phenomenon known as slippage.

- Overnight and Weekend Exposure: Holding positions in IC Markets Indices outside of regular trading hours exposes you to news and events that occur when the market is closed. These events can significantly impact the opening price on the next trading day or week.

To provide a quick overview, consider these key risk areas:

| Risk Category | Impact |

|---|---|

| Market Volatility | Rapid and unpredictable price swings |

| Leverage | Magnifies both potential profits and losses |

| Market Gaps | Stop-loss orders may be bypassed, causing slippage |

| Global Events | Sudden reactions to economic or geopolitical news |

Understanding these potential disadvantages does not mean you should avoid indices trading altogether. Instead, it empowers you to trade smarter. With IC Markets Indices, you gain access to diverse global markets, but prudent risk management, continuous education, and a well-defined trading plan remain your most valuable assets. Always trade responsibly and within your financial means.

Frequently Asked Questions About IC Markets Indices

Diving into the world of financial markets can spark many questions, especially when exploring new avenues like indices trading. Here, we tackle some of the most common inquiries about IC Markets Indices to help you understand how these powerful instruments can enhance your trading strategy. Let’s get straight to your questions!

What are IC Markets Indices?

IC Markets Indices are financial instruments that allow you to speculate on the performance of a group of shares from a specific stock exchange or industry sector. Instead of trading individual company stocks, you trade the overall market direction represented by the index. For example, you can trade the performance of major global markets without owning any underlying assets directly.

These are offered as index CFDs, enabling you to take a position on whether the value of the index will rise or fall. This provides flexibility and opportunity to capitalize on both upward and downward market movements.

Which global indices can I trade with IC Markets?

IC Markets offers a broad selection of global indices, giving you access to major economic regions around the world. Our platform lets you trade a wide array of stock indices, from the bustling markets of North America and Europe to the dynamic economies of Asia-Pacific.

You can access instruments representing diverse sectors and geographies, allowing for extensive portfolio diversification. Whether you are interested in technology giants, industrial leaders, or broader market health, our range of IC Markets Indices covers it.

What are the benefits of indices trading with IC Markets?

Trading index CFDs through IC Markets comes with several distinct advantages that appeal to both new and experienced traders:

- Diversification: Gain exposure to an entire market sector or economy with a single trade, reducing reliance on individual stock performance.

- Leverage: Amplify your trading power, allowing you to control larger positions with a smaller initial capital outlay.

- Competitive Spreads: We provide tight spreads on our IC Markets Indices, helping to minimize your trading costs.

- Flexibility: Trade long or short, profiting from rising or falling markets.

- Accessibility: Access markets around the clock, taking advantage of trading opportunities as they emerge across different time zones.

Is indices trading suitable for beginners?

Indices trading can be a great option for beginners due to its inherent diversification and the ability to trade market sentiment rather than individual company fundamentals. While it offers exciting opportunities, it also carries risks, like any form of trading. We encourage newcomers to start with our comprehensive educational resources and practice with a demo account.

IC Markets provides tools and support to help you understand market dynamics and develop effective risk management strategies. Learning the ropes with global indices can be a fulfilling journey for those willing to invest time in education.

How do I start trading IC Markets Indices?

Getting started with indices trading at IC Markets is a straightforward process:

- Open an Account: Register for a live trading account with IC Markets.

- Fund Your Account: Deposit funds using one of our convenient funding methods.

- Choose Your Platform: Select your preferred trading platform (MetaTrader 4, MetaTrader 5, or cTrader).

- Select Your Index: Browse the available IC Markets Indices and choose the one you wish to trade.

- Place Your Trade: Analyze the market, set your entry and exit points, and execute your trade.

Our platforms are intuitive, ensuring a smooth experience whether you are just starting or have years of experience with stock indices. We make it easy to access the markets you want.

Maximizing Your Potential with IC Markets Indices

Unlock dynamic market opportunities by exploring the vast world of IC Markets Indices. As a savvy trader, you understand the power of diversification and capitalizing on broader market movements. Indices trading offers exactly that – a direct gateway to the economic pulse of major regions worldwide without requiring you to buy individual stocks. Dive in and discover how IC Markets empowers you to navigate these exciting markets with confidence.

Why Indices Trading Stands Out

Indices represent a basket of stocks from a specific market, sector, or economy. Trading them offers unique advantages, providing a macroscopic view of market performance. Here’s why many experienced traders gravitate towards index CFDs:

- Broad Market Exposure: Gain instant exposure to entire economies or sectors with a single trade. This reflects general market sentiment rather than the fortunes of a single company.

- Diversification: Mitigate risk by not putting all your eggs in one stock. Stock indices naturally offer built-in diversification.

- Liquidity: Major global indices are among the most actively traded instruments, ensuring ample liquidity.

- Flexibility: Trade both rising and falling markets. You can go long or short on index CFDs, capitalizing on various market conditions.

Your Advantage with IC Markets Indices

Choosing the right broker makes all the difference in indices trading. IC Markets provides a robust platform engineered for serious traders. We combine competitive conditions with a comprehensive range of instruments, allowing you to focus on your strategy:

| Feature | Benefit to You |

|---|---|

| Competitive Spreads | Reduce your trading costs and improve potential profitability. |

| Fast Execution | Ensure your trades open and close at your desired prices, crucial in volatile markets. |

| Wide Selection | Access a diverse range of global indices from major economic powerhouses. |

| Robust Platforms | Trade seamlessly with MetaTrader 4, MetaTrader 5, or cTrader, renowned for their advanced tools. |

Access a World of Global Indices

With IC Markets, you are not limited to one region. We provide access to a comprehensive selection of global indices, allowing you to diversify your portfolio and seize opportunities across different time zones and economies. Whether you are interested in the established markets of North America and Europe or the growth potential of Asian indices, we offer the instruments you need. Think of the world’s most influential stock indices, and you will likely find them available as index CFDs through IC Markets.

“Successful indices trading requires keen market insight and a reliable trading partner. IC Markets provides both the tools and the access to help you execute your vision effectively.”

Embark on your journey to maximize your trading potential. Explore the opportunities presented by IC Markets Indices and position yourself for success in the dynamic world of financial markets.

Frequently Asked Questions

What are IC Markets Indices?

IC Markets Indices are financial instruments, typically offered as Contracts for Difference (CFDs), that allow you to speculate on the collective price movements of a basket of shares from a specific stock exchange or industry sector. They provide exposure to major global markets (like the S&P 500 or DAX) without requiring ownership of the underlying individual stocks.

Why should I consider trading indices with IC Markets?

IC Markets offers a premier trading environment for indices, featuring diverse global access, competitive spreads, flexible leverage options, and reliable execution. You can trade on advanced platforms like MetaTrader 4, MetaTrader 5, and cTrader, allowing for portfolio diversification and efficient reaction to macroeconomic events.

How does leverage and margin apply to indices trading?

Leverage allows you to control a larger trading position in global indices with a smaller initial capital outlay, amplifying potential profits from market movements. Margin is the capital you must maintain in your account as a deposit for these leveraged positions. While leverage offers capital efficiency, it also magnifies potential losses, necessitating careful risk management.

What trading platforms are available for IC Markets Indices?

IC Markets provides industry-leading platforms for indices trading: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Each platform offers advanced charting tools, technical indicators, and automated trading capabilities (Expert Advisors or cBots) to suit various trading styles and analytical needs.

What are the main risks involved in indices trading?

Key risks in indices trading include the magnification of losses due to leverage, rapid and unpredictable price swings from market volatility, potential market gaps and slippage (where stop-loss orders execute at a less favorable price), and exposure to sudden impacts from global economic or geopolitical events. Effective risk management, like using stop-loss orders and proper position sizing, is crucial.