Welcome to the definitive guide for traders in Indonesia. Are you ready to explore the dynamic world of forex and CFD trading? This journey requires a reliable partner. That partner could be IC Markets Indonesia. We will dive deep into every aspect of this popular broker, providing clear and honest insights. From account types and fees to platform choices and security, this guide covers it all. Whether you are new to Indonesia trading or an experienced professional, you will find valuable information here. Let’s uncover why so many choose IC Markets for their forex Indonesia adventures and help you decide if it is the right choice for you.

- What is IC Markets? An Overview for Traders

- Regulation and Security: Is IC Markets a Safe Choice?

- Trading Platforms on Offer: MT4, MT5, & cTrader

- A Deep Dive into IC Markets Account Types

- The Standard Account Explained

- Raw Spread Account for MetaTrader

- Raw Spread Account for cTrader

- Understanding Spreads, Commissions, and Fees

- Range of Tradable Financial Instruments

- Major, Minor, and Exotic Forex Pairs

- CFDs on Stocks, Indices, and Commodities

- Leverage and Margin Explained for Indonesian Traders

- Funding Your Account: Deposit Methods in Indonesia

- Withdrawing Your Profits: Process and Timelines

- Evaluating IC Markets Customer Support

- Educational Resources for Skill Development

- Top Advantages of Trading with IC Markets

- Potential Disadvantages to Be Aware Of

- Step-by-Step Guide: Opening Your Account from Indonesia

- Final Verdict: Is IC Markets the Right Broker for You?

- Frequently Asked Questions

What is IC Markets? An Overview for Traders

IC Markets is a globally recognized Forex and CFD broker, renowned for its exceptional trading environment. What sets it apart? It was built by traders, for traders. This means its core focus is on providing what active traders need most: speed, low costs, and reliability. The broker operates on a True ECN (Electronic Communication Network) model. This connects you directly to a deep pool of liquidity providers, ensuring your trades are executed at the best possible prices with minimal delay. This structure is especially beneficial for scalpers, day traders, and those who use automated trading systems. For anyone serious about Indonesia trading, understanding this foundation is key to appreciating the IC Markets difference.

Regulation and Security: Is IC Markets a Safe Choice?

Your capital’s safety is non-negotiable. With IC Markets, you can trade with peace of mind. The broker is regulated by several of the world’s most respected financial authorities. This oversight forces IC Markets to adhere to strict standards of conduct, transparency, and financial stability. What does this mean for you as a trader in Indonesia?

- Segregated Client Funds: Your money is kept in a separate trust account at a top-tier bank, completely isolated from the company’s operational funds.

- Robust Internal Controls: Regular audits and strict compliance procedures ensure the integrity of all financial operations.

- Negative Balance Protection: You can never lose more than your account balance, protecting you from extreme market volatility.

Choosing a well-regulated broker is the first step in responsible trading. IC Markets clearly demonstrates a strong commitment to providing a secure trading environment for its clients worldwide, including those in Indonesia.

Trading Platforms on Offer: MT4, MT5, & cTrader

IC Markets provides access to three of the most powerful and popular trading platforms in the industry. This choice ensures that every type of trader can find a platform that perfectly suits their style and strategy. Each platform is available on desktop, web, and mobile, giving you the flexibility to trade from anywhere.

| Platform | Best For | Key Feature |

|---|---|---|

| MetaTrader 4 (MT4) | Algorithmic & new traders | The world’s most popular platform, huge community, and vast library of Expert Advisors (EAs). |

| MetaTrader 5 (MT5) | Multi-asset traders | An advanced evolution of MT4 with more timeframes, technical indicators, and order types. |

| cTrader | Discretionary & ECN traders | A modern, intuitive interface with advanced charting and order capabilities designed for a True ECN environment. |

This powerful trio ensures that whether you’re focused on forex Indonesia or other global markets, you have the best tools at your fingertips.

A Deep Dive into IC Markets Account Types

Choosing the right account is crucial for aligning your trading strategy with the broker’s cost structure. IC Markets Indonesia offers distinct account types, each designed to cater to different trading needs. The primary difference lies in how trading costs are calculated—either through the spread alone or a combination of raw spreads and a fixed commission. This flexibility allows both beginners and high-volume professionals to find an option that optimizes their performance and minimizes their costs. Let’s break down each one.

The Standard Account Explained

The Standard Account is the ideal starting point for many traders. Its main appeal is simplicity. All trading costs are included within the spread you see on the platform. This means there are no separate commission fees to calculate, making it incredibly straightforward to figure out your potential profit or loss on any trade. Spreads on this account start from a competitive 0.6 pips. This account is perfect for discretionary traders and beginners who value a simple, all-in-one pricing structure without compromising on execution quality.

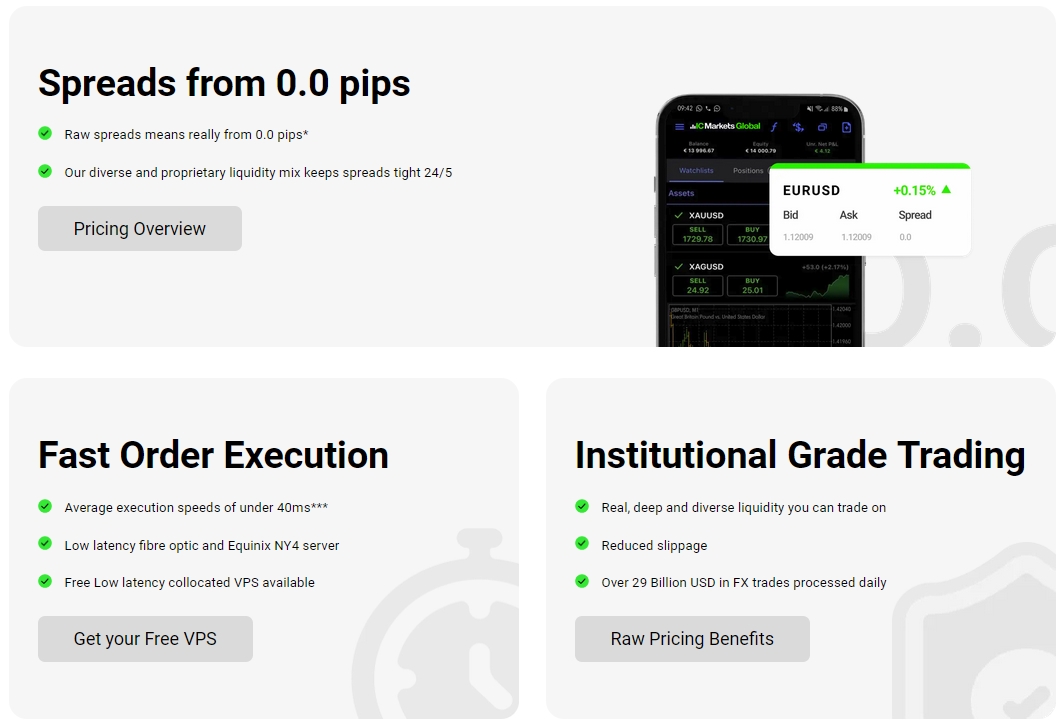

Raw Spread Account for MetaTrader

This account is the top choice for serious scalpers, algorithmic traders, and high-frequency traders using MetaTrader 4 or 5. The Raw Spread Account offers institutional-grade spreads starting from an incredible 0.0 pips. Because the spread is so tight, the broker charges a small, fixed commission per lot traded. This transparent structure allows for precise cost calculation and is designed for strategies that rely on entering and exiting the market quickly to capture small price movements. If peak performance on the MT4 or MT5 platform is your goal, this account is built for you.

Raw Spread Account for cTrader

Similar to its MetaTrader counterpart, the cTrader Raw Spread Account provides direct access to raw pricing with spreads from 0.0 pips. It is specifically designed for traders who prefer the advanced features and intuitive interface of the cTrader platform. The commission structure is slightly different, calculated based on the volume traded (e.g., a set amount per $100,000 USD traded). This account is favored by manual or discretionary traders who demand deep liquidity, transparent pricing, and the sophisticated order management tools that cTrader offers.

Understanding Spreads, Commissions, and Fees

Navigating trading costs is essential for profitability. At IC Markets, transparency is key. The primary costs are spreads and commissions, which vary by account type. It is vital to understand these to manage your trading effectively.

- Spread: This is the small difference between the buy (ask) price and the sell (bid) price of a financial instrument. A tighter spread means a lower cost to enter a trade.

- Commission: This is a fixed fee charged on Raw Spread accounts for opening and closing a trade. It is charged in exchange for receiving the raw, unfiltered spread from liquidity providers.

- Swap Fees: Also known as overnight financing, this is a fee you pay or earn for holding a position open overnight. It is an interest rate adjustment that depends on the instrument and trade direction.

IC Markets is committed to keeping these costs among the lowest in the industry, allowing you to keep more of your trading profits.

Range of Tradable Financial Instruments

A great broker opens the door to global markets, and IC Markets excels in this area. Traders in Indonesia gain access to a vast and diverse selection of financial instruments. This allows for excellent portfolio diversification and the ability to capitalize on opportunities across different sectors and economies. You are not limited to just one asset class; you can trade the markets that are moving right now. From the world’s most popular currency pairs to major global stock indices, the range is truly impressive and caters to nearly every trading strategy.

Major, Minor, and Exotic Forex Pairs

For the dedicated forex Indonesia trader, the selection is outstanding. IC Markets offers a comprehensive list of currency pairs, covering all corners of the globe. You can trade:

- Major Pairs: High-liquidity pairs like EUR/USD, GBP/USD, and USD/JPY, known for their tight spreads.

- Minor Pairs: Cross-currency pairs that do not involve the US dollar, such as EUR/GBP or AUD/NZD, offering unique trading opportunities.

- Exotic Pairs: Pairs involving the currency of an emerging economy, like USD/SGD or EUR/TRY, which can offer higher volatility.

This extensive range ensures you can always find a market that aligns with your analysis and trading style.

CFDs on Stocks, Indices, and Commodities

Beyond forex, IC Markets offers a rich selection of Contracts for Difference (CFDs). This allows you to speculate on the price movements of various assets without owning them. This is a powerful tool for diversification.

“Diversification is the only free lunch in finance.”

You can trade CFDs on:

- Indices: Get exposure to an entire stock market with popular indices like the S&P 500, NASDAQ 100, and DAX 40.

- Commodities: Trade precious metals like Gold and Silver, or energies like WTI and Brent Crude Oil.

- Stocks: Access shares of leading global companies from major stock exchanges.

This broad offering makes IC Markets a one-stop broker indonesia for multi-asset traders.

Leverage and Margin Explained for Indonesian Traders

Leverage is a powerful tool that allows you to control a large position in the market with a relatively small amount of capital. For example, with 100:1 leverage, you can control a $100,000 position with just $1,000 of your own money. This capital is known as the “margin.”

While leverage can significantly amplify your profits, it is crucial to remember that it also amplifies losses. It’s a double-edged sword that must be used with a solid risk management strategy.

Funding Your Account: Deposit Methods in Indonesia

Getting funds into your trading account should be fast, easy, and secure. IC Markets Indonesia provides a variety of convenient deposit methods to suit your preferences. The broker understands the needs of its Indonesian clients and offers several hassle-free options. Best of all, IC Markets does not charge any internal fees for deposits, helping you get more of your capital into the market.

Popular methods include:

- Local Online Bank Transfer

- Visa & MasterCard

- PayPal

- Neteller & Skrill

- Wire Transfer

Most of these methods provide instant funding, so you can seize trading opportunities as they arise without delay.

Withdrawing Your Profits: Process and Timelines

Withdrawing your hard-earned profits is a straightforward and secure process with IC Markets. To comply with anti-money laundering regulations, withdrawals are typically sent back to the same source you used for your deposit. The process is simple: you submit a withdrawal request from your secure client area. The internal finance team processes these requests promptly, usually within one business day. After processing, the time it takes for the funds to reach you depends on the method used—e-wallets are often instant, while bank transfers can take a few business days. This efficiency and reliability in handling client funds is a hallmark of a trustworthy broker.

Evaluating IC Markets Customer Support

When you need help, you need it fast. IC Markets offers award-winning customer support that is both responsive and knowledgeable. The support team is available 24 hours a day, 5 days a week, aligning with the major trading sessions. This ensures that no matter when you are trading from Indonesia, assistance is just a click or a call away. You can reach the team through several channels:

- Live Chat: The fastest way to get answers to quick questions, directly from their website.

- Email: Ideal for more detailed inquiries that may require investigation or attachments.

- Phone Support: For those who prefer to speak directly with a support agent.

The team is well-trained to handle everything from technical platform issues to account-related queries, providing a reliable backbone for your trading activities.

Educational Resources for Skill Development

IC Markets is committed to empowering its traders. While its primary focus is on providing an elite trading environment, it also offers a solid selection of educational resources to help you improve your skills. These materials are perfect for both new traders looking to learn the basics and experienced traders wanting to refine their strategies. The “Learn” section of their website includes a wealth of information, such as tutorials on technical analysis, fundamental analysis, risk management, and trading psychology. Additionally, you’ll find platform guides and a regularly updated market analysis blog, keeping you informed on key trends and events impacting the forex Indonesia market and beyond.

Top Advantages of Trading with IC Markets

When you weigh all the factors, IC Markets stands out for several compelling reasons. For traders in Indonesia, these advantages create a superior trading experience that can directly impact your bottom line.

- Unbeatable Low Costs: With some of the tightest spreads in the industry and low commissions, your trading costs are minimized.

- Lightning-Fast Execution: Trade execution speeds are incredibly fast, reducing slippage and ensuring you get the price you want.

- Superior Technology: A True ECN environment with deep liquidity provides stable and reliable pricing, even during volatile market conditions.

- Platform Choice: Freedom to choose between the world’s best platforms—MT4, MT5, and cTrader.

- Strong Regulation: Being regulated by top-tier authorities provides a high level of security and trust.

- Wide Market Access: Trade a huge range of instruments, from forex to stocks, all from a single account.

Potential Disadvantages to Be Aware Of

No broker is perfect for everyone. To provide a balanced view, it is important to acknowledge areas where IC Markets might not be the ideal fit for some traders.

- Advanced Focus: The platform and tools are geared towards serious traders. Absolute beginners might find the environment less hand-holding than some other brokers.

- Education Could Be Deeper: While the educational resources are good, they are not as comprehensive or structured as brokers that specialize solely in beginner education.

- No Proprietary Platform: IC Markets relies on the excellent MT4, MT5, and cTrader platforms, but does not offer its own unique, in-house platform.

These points are not necessarily weaknesses but rather characteristics of a broker that prioritizes a professional-grade trading infrastructure above all else.

Step-by-Step Guide: Opening Your Account from Indonesia

Getting started with IC Markets from Indonesia is a quick and digital process. You can be up and running in just a few simple steps. Follow this guide to open your live trading account seamlessly.

- Start the Application: Go to the IC Markets website and click on the “Create Live Account” button.

- Enter Your Details: Fill out the online form with your personal information, such as your name, email, and phone number.

- Configure Your Account: Choose your preferred trading platform (MT4, MT5, or cTrader) and select an account type (Standard or Raw Spread).

- Complete Verification: Upload a copy of your government-issued ID (like a KTP or passport) and a proof of residence document (like a utility bill) to verify your identity. This is a standard security procedure.

- Fund and Trade: Once your account is approved, make your first deposit using one of the convenient methods for Indonesia. You are now ready to start trading!

Final Verdict: Is IC Markets the Right Broker for You?

After a thorough review, the conclusion is clear. IC Markets Indonesia is an exceptional choice for traders who prioritize performance, low costs, and reliability. If you are a scalper, day trader, or use automated systems, the True ECN environment with raw spreads and fast execution is practically tailor-made for you. It is a professional-grade broker for those serious about their Indonesia trading journey.

If your goal is to trade in an environment with institutional-grade conditions without the high barriers to entry, IC Markets should be at the very top of your list.

For absolute beginners seeking extensive educational courses, other options might be more suitable. But for anyone ready to engage with the markets on a professional level, IC Markets provides the tools, technology, and transparent pricing structure to help you succeed. The choice is yours, but the evidence strongly suggests that this is a top-tier broker indonesia for the discerning trader.

Frequently Asked Questions

What account types does IC Markets offer in Indonesia?

IC Markets provides three main account types: the Standard Account, which includes costs in the spread, and two Raw Spread Accounts (for MetaTrader and cTrader) that offer spreads from 0.0 pips with a small, fixed commission. This caters to both beginners and high-volume traders.

Is IC Markets a safe and regulated broker?

Yes, IC Markets is considered a safe broker. It is regulated by top-tier financial authorities, keeps client funds in segregated accounts at major banks, and offers negative balance protection to ensure you cannot lose more than your initial deposit.

Which trading platforms can I use with IC Markets?

You can choose from three of the industry’s leading platforms: MetaTrader 4 (MT4), known for its vast library of trading robots; MetaTrader 5 (MT5), an advanced multi-asset platform; and cTrader, which features a modern interface designed for a True ECN environment.

What are the main costs involved when trading with IC Markets?

The primary trading costs consist of spreads (the difference between buy and sell prices), commissions (on Raw Spread accounts), and swap fees for holding positions overnight. IC Markets is known for keeping these costs highly competitive.

What can I trade with an IC Markets account?

IC Markets offers a wide range of financial instruments. You can trade major, minor, and exotic forex pairs, as well as CFDs on global indices like the S&P 500, commodities such as Gold and Oil, and stocks of leading international companies.