Dive into the exciting world of global finance directly from Nigeria. With IC Markets, you gain robust access to a diverse array of trading opportunities, from currency pairs to commodities and indices. We are dedicated to empowering Nigerian traders with a potent mix of competitive conditions, cutting-edge technology, and unwavering support. Experience a trading environment crafted for efficiency and designed to help you achieve your financial goals. Whether you’re taking your first step or expanding your portfolio, discover why astute investors choose us for their trading journey. Unlock your potential and engage with the markets today!

- Why IC Markets for Nigerian Traders?

- Key Benefits for Nigerian Market Participants

- Understanding IC Markets’ Regulatory Compliance

- Forex Trading with IC Markets in Nigeria

- Cryptocurrency Trading Options

- Leverage and Margin Requirements Explained

- Account Types Available for Nigerian Clients

- Comparing Standard and Raw Spread Accounts

- Funding and Withdrawal Methods in Nigeria

- Efficient Deposit and Payout Solutions

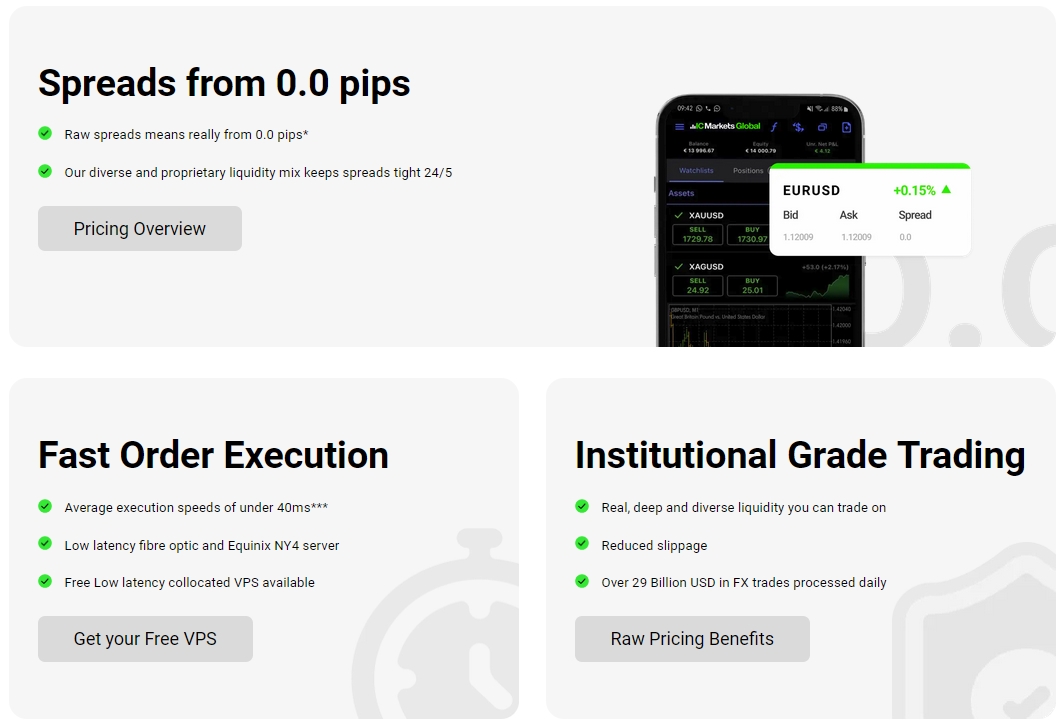

- Spreads, Commissions, and Trading Costs

- Trading Platforms: MetaTrader 4, MetaTrader 5, cTrader

- Choosing the Best Platform for Your Style

- Educational Resources for New Traders

- Learning Tools and Market Analysis

- Customer Support and Local Assistance

- Risk Management Strategies for Nigerian Traders

- IC Markets’ Commitment to the Nigerian Market

- Supporting the Local Trading Community

- Getting Started: Opening an IC Markets Nigeria Account

- A Step-by-Step Guide

- Conclusion: Is IC Markets Right for You?

- Frequently Asked Questions

Why IC Markets for Nigerian Traders?

Choosing the right broker makes all the difference in the vibrant forex nigeria landscape. IC Markets stands out by prioritizing the unique needs of Nigerian traders. We understand the local market dynamics and deliver a trading environment built for success.

Here’s why we are a top choice:

- Competitive Edge: Access industry-leading spreads and lightning-fast execution speeds.

- Reliability: Trade with confidence, knowing you partner with a globally recognized and well-regarded broker nigeria.

- Diverse Instruments: Explore a broad spectrum of assets beyond just currency pairs.

- Cutting-Edge Technology: Utilize advanced trading platforms designed for precision and performance.

Experience a broker committed to empowering your financial aspirations in Nigeria.

Key Benefits for Nigerian Market Participants

Nigerian traders find distinct advantages with IC Markets. Our focus remains on delivering a superior experience, fostering growth and opportunity. We understand the specific demands of the nigeria trading environment.

Here are some of the critical benefits you gain:

- Ultra-Low Spreads: Minimize your trading costs with some of the tightest spreads available in the market. This directly impacts your profitability.

- Superior Execution Speed: Experience almost instantaneous order execution. This means less slippage and better entry/exit prices, crucial for volatile markets.

- Extensive Asset Selection: Diversify your portfolio effortlessly. Trade major, minor, and exotic currency pairs, alongside a wide range of commodities, indices, and cryptocurrencies.

- Dedicated Support: Access responsive customer service ready to assist with any queries, ensuring smooth operations for our IC Markets Nigeria clients.

- Flexible Leverage: Manage your capital effectively with competitive leverage options, allowing you to amplify your trading power responsibly.

Minimize your trading costs with some of the tightest spreads available in the market. This directly impacts your profitability.

Experience almost instantaneous order execution. This means less slippage and better entry/exit prices, crucial for volatile markets.

These benefits combine to create an optimal trading ecosystem for every Nigerian market participant.

Understanding IC Markets’ Regulatory Compliance

Trader safety and security are paramount. IC Markets Nigeria operates with a strong foundation of regulatory compliance, offering peace of mind to our clients. We adhere to strict international standards set by reputable financial authorities.

What does this mean for you, a trader in Nigeria?

- Client Fund Segregation: Your funds remain held in separate bank accounts from the company’s operational capital. This ensures your money is always accessible and protected.

- Financial Stability: Regulatory oversight mandates specific capital requirements, ensuring the broker maintains robust financial health.

- Operational Transparency: We operate with openness and integrity, providing clear information about our services and terms.

- Fair Trading Practices: Compliance ensures we uphold fair and ethical trading conditions for all clients.

Choosing a regulated broker nigeria like IC Markets means you engage in trading with confidence, knowing your investments are handled with the utmost care and security.

Forex Trading with IC Markets in Nigeria

Engage in the world’s largest financial market directly from Nigeria. Forex trading with IC Markets in Nigeria offers an unparalleled experience, merging global liquidity with local accessibility. We provide a robust platform for you to trade currency pairs with precision and efficiency.

Here’s what makes our forex nigeria offering stand out:

- Vast Currency Pair Selection: Access over 60 currency pairs, from major pairs like EUR/USD and GBP/USD to exotic ones, giving you extensive trading opportunities.

- Deep Liquidity: Benefit from connections to multiple top-tier liquidity providers, ensuring tight spreads and minimal requotes even during volatile market conditions.

- Fast Execution: Our infrastructure guarantees rapid order processing, crucial for high-frequency strategies and taking advantage of fleeting market movements.

- Flexible Lot Sizes: Trade micro, mini, or standard lots, allowing you to manage risk effectively and scale your positions according to your capital and strategy.

Experience professional-grade forex nigeria trading designed to meet the demands of serious traders.

Cryptocurrency Trading Options

Embrace the future of finance with IC Markets Nigeria. We empower you to trade a dynamic range of cryptocurrencies, offering exposure to this exciting and rapidly evolving market. Diversify your nigeria trading portfolio beyond traditional assets.

Our cryptocurrency offering includes:

- Popular Cryptos: Trade major digital assets like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and many more against the USD.

- Leveraged Trading: Amplify your potential returns with leverage, allowing you to control larger positions with a smaller capital outlay. Remember, leverage also increases risk.

- No Wallet Needed: Trade crypto CFDs without the need for a crypto wallet, simplifying the process and enhancing security by avoiding direct coin ownership.

- Extended Trading Hours: Access the crypto markets virtually 24/7, capitalizing on opportunities that arise outside traditional market hours.

Step into the digital asset space with confidence and leverage the advanced tools and liquidity provided by IC Markets.

Leverage and Margin Requirements Explained

Understanding leverage and margin is crucial for any trader, especially within IC Markets Nigeria. These concepts allow you to control larger positions than your account balance typically permits, significantly impacting your potential gains and losses in forex nigeria.

What is Leverage?

Leverage is a powerful tool where a broker lends you capital to increase your trading exposure. For example, 1:500 leverage means for every $1 of your own capital, you can control $500 worth of assets. This amplifies both potential profits and potential losses.

What is Margin?

Margin is the actual amount of your capital required to open and maintain a leveraged position. It acts as a security deposit, not a transaction cost. If you use 1:500 leverage, your margin requirement for a $100,000 position would be $200 (0.2%). Your available margin dictates how many positions you can open.

Managing Risk:

- Leverage increases risk; use it wisely.

- Monitor your margin level closely to avoid margin calls.

- IC Markets provides tools to help you manage your exposure effectively.

Always consider your risk tolerance when utilizing leverage in your forex nigeria trading strategy.

Account Types Available for Nigerian Clients

IC Markets Nigeria understands that every trader has unique needs and preferences. We offer a selection of account types designed to cater to various trading styles, experience levels, and capital sizes. Our goal is to provide flexibility and optimal conditions for every Nigerian client.

We provide choices that allow you to:

- Optimize your trading costs, whether you prefer raw spreads or commission-free trading.

- Select a platform that aligns with your analytical and execution requirements.

- Access the full suite of trading instruments available to our global clientele.

Whether you’re a high-volume trader or just starting your journey as a broker nigeria participant, you’ll find an account perfectly suited for your ambitions.

Comparing Standard and Raw Spread Accounts

Choosing between a Standard Account and a Raw Spread Account is a key decision for IC Markets Nigeria clients. Both offer excellent trading conditions, but they cater to different preferences for cost structures in forex nigeria.

| Feature | Standard Account | Raw Spread Account |

|---|---|---|

| Spreads | Wider spreads (starting from 0.6 pips) | Ultra-low spreads (starting from 0.0 pips) |

| Commissions | No commissions per lot | Small commission per lot traded |

| Target Trader | Ideal for beginners and those who prefer all costs in the spread. | Best for high-volume traders, scalpers, and EAs seeking the tightest possible spreads. |

| Pricing Model | Integrated cost | Separated cost (spread + commission) |

Consider your trading volume, strategy, and cost preference to select the best account type for your forex nigeria trading.

Funding and Withdrawal Methods in Nigeria

Seamless and secure financial transactions are essential for effective nigeria trading. IC Markets Nigeria offers a range of convenient funding and withdrawal methods specifically chosen to accommodate our Nigerian clients. We prioritize both speed and reliability in all your transactions.

Our commitment ensures you can:

- Deposit funds quickly to capitalize on market opportunities.

- Withdraw your profits efficiently and securely when you need them.

- Utilize payment solutions familiar and trusted within the Nigerian market.

We continuously work to optimize our payment gateways, providing a smooth financial experience that complements your trading activities.

Efficient Deposit and Payout Solutions

Accessing your funds and profits with IC Markets Nigeria is designed to be straightforward and secure. We offer several popular and efficient solutions for both deposits and payouts, ensuring that our broker nigeria clients experience minimal hassle.

Here are some of the reliable methods available:

- Local Bank Transfers: Deposit and withdraw directly via Nigerian banks, offering familiarity and security for many traders.

- E-Wallets: Utilize popular e-payment solutions for fast and convenient transactions, often with instant processing for deposits.

- Credit/Debit Cards: Fund your account instantly using major card providers (Visa, MasterCard), providing a quick way to get started.

- Other Global Solutions: Access a variety of international payment processors, giving you diverse choices based on your preference.

IC Markets aims for quick processing times on both deposits and withdrawals, ensuring you can manage your capital effectively without unnecessary delays.

Spreads, Commissions, and Trading Costs

Understanding the total cost of trading is vital for profitability, especially in the competitive landscape of forex nigeria. IC Markets Nigeria maintains a transparent approach to spreads, commissions, and other trading costs, ensuring you always know where you stand.

Our commitment to low trading costs stems from:

- Ultra-Tight Spreads: We source liquidity from numerous top-tier banks and financial institutions. This allows us to offer some of the tightest spreads in the industry, often starting from 0.0 pips on Raw Spread accounts.

- Competitive Commissions: For Raw Spread accounts, a small, fixed commission per standard lot traded applies. This structure provides direct market pricing with minimal markup. Standard Accounts, however, feature zero commissions, with all costs integrated into a slightly wider spread.

- No Hidden Fees: You won’t encounter unexpected charges for account maintenance, deposits, or withdrawals (though third-party payment provider fees may apply).

- Swap Rates: Be aware of overnight financing costs (swaps) for positions held open beyond the trading day. These rates are clearly displayed within your trading platform.

We empower you to choose a cost structure that best suits your trading strategy and volume, maximizing your potential in IC Markets Nigeria.

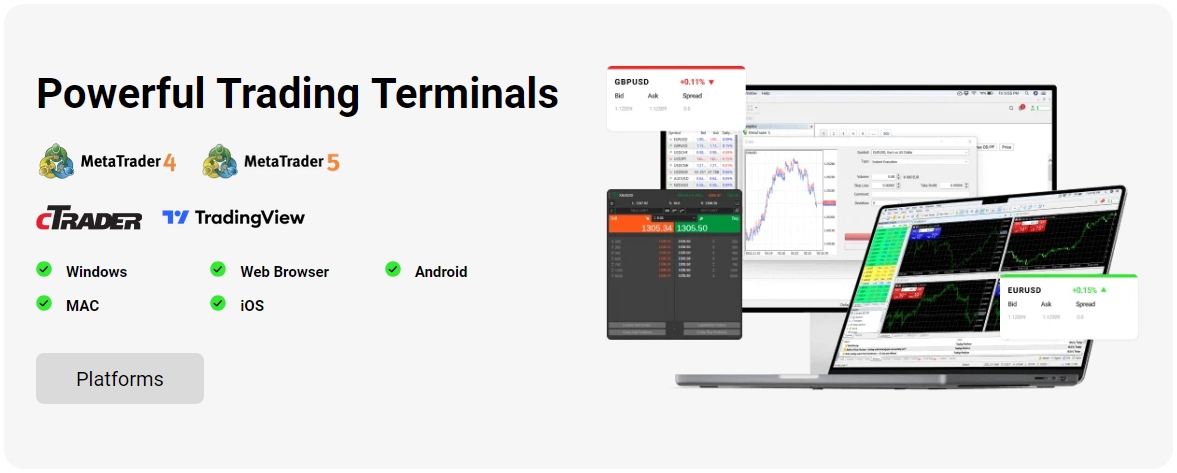

Trading Platforms: MetaTrader 4, MetaTrader 5, cTrader

Your choice of trading platform profoundly impacts your execution, analysis, and overall experience. IC Markets Nigeria offers the industry’s most popular and powerful platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Each platform provides a robust environment for forex nigeria and other market trading.

- MetaTrader 4 (MT4): Renowned for its user-friendly interface and extensive charting tools. MT4 remains a favorite for forex traders globally, offering a vast array of custom indicators and Expert Advisors (EAs).

- MetaTrader 5 (MT5): An upgraded version of MT4, MT5 expands on its predecessor’s capabilities. It provides access to more asset classes, advanced charting features, and enhanced analytical tools, making it suitable for multi-asset traders.

- cTrader: Known for its intuitive design and advanced order types. cTrader offers an ECN-like trading experience, deep liquidity, and a clean, modern interface, appealing to traders who prioritize speed and transparent pricing.

These platforms are available across desktop, web, and mobile, ensuring you can trade anytime, anywhere within the IC Markets Nigeria ecosystem.

Choosing the Best Platform for Your Style

Selecting the ideal trading platform from MT4, MT5, or cTrader truly depends on your individual nigeria trading style and priorities. Each platform offers distinct advantages for various types of traders and strategies within IC Markets Nigeria.

- For the Forex Purist & EA Enthusiast (MetaTrader 4): If you primarily focus on forex, value stability, and extensively use Expert Advisors or custom indicators, MT4 remains an industry benchmark. Its vast community support means endless resources for customisation.

- For the Multi-Asset Trader & Advanced Analyst (MetaTrader 5): If your portfolio includes more than just forex – like stocks or indices – or if you crave deeper analytical tools, more timeframes, and a broader range of pending order types, MT5 is your upgrade. It offers enhanced backtesting capabilities too.

- For the ECN Trader & Modern Interface Lover (cTrader): If you prioritize a sleek, intuitive interface, direct market access (ECN), advanced order types like ‘cTID’, and highly transparent pricing, cTrader will resonate with your style. It’s often favored by those seeking sophisticated execution.

Experiment with demo accounts on each platform to discover which one perfectly aligns with your trading objectives and enhances your overall experience.

Educational Resources for New Traders

Embarking on your forex nigeria journey with IC Markets Nigeria is an exciting step, and we ensure you’re well-equipped. We believe that informed traders make better decisions. That’s why we provide a comprehensive suite of educational resources, designed to empower both beginners and those looking to refine their skills.

Our commitment to your growth means offering a foundational understanding of the markets and advanced techniques. You’ll find tools to:

- Grasp core trading concepts.

- Understand market dynamics and terminology.

- Develop effective trading strategies.

- Improve your risk management skills.

Learning is an ongoing process, and we are here to support every step of your nigeria trading education.

Learning Tools and Market Analysis

IC Markets Nigeria goes beyond just providing a platform; we equip you with vital learning tools and cutting-edge market analysis to sharpen your nigeria trading acumen. Knowledge is power in the financial markets.

Our comprehensive resources include:

- Trading Guides & Tutorials: Step-by-step guides covering everything from ‘Forex for Beginners’ to advanced technical analysis, helping you navigate complex topics with ease.

- Video Library: Engaging video tutorials explain intricate concepts, platform functionalities, and trading strategies in an accessible format.

- Webinars: Participate in live online sessions hosted by industry experts. These interactive sessions often cover current market events, fundamental analysis, and practical trading tips.

- Economic Calendar: Stay ahead of key economic events and data releases that impact market movements. Plan your trades around high-impact news with this essential tool.

- Daily Market Analysis: Receive insightful commentary and technical analysis from our team of experts, identifying potential trading opportunities and market trends.

Leverage these tools to continuously evolve as a trader and make more informed decisions in the Nigerian market.

Customer Support and Local Assistance

Exceptional customer support is a cornerstone of a reliable broker nigeria. IC Markets Nigeria is dedicated to providing responsive, knowledgeable, and multilingual assistance to all our clients. We understand that quick and effective solutions are crucial when you’re navigating fast-moving markets.

You can connect with our support team through multiple convenient channels:

- 24/7 Live Chat: Get instant answers to your queries around the clock, directly from our website or trading platform.

- Email Support: For more detailed inquiries or documentation, our email support team provides thorough and timely responses.

- Phone Support: Speak directly with a support agent for immediate assistance.

Our team is well-versed in our products and services, ensuring you receive accurate and helpful guidance. Your smooth trading experience with IC Markets Nigeria is our priority.

Risk Management Strategies for Nigerian Traders

Effective risk management is not just a suggestion; it’s a necessity for sustainable success in forex nigeria. IC Markets Nigeria empowers you with the tools and knowledge to protect your capital and navigate the inherent volatility of the financial markets. Developing a solid risk management plan is crucial for every nigeria trading participant.

Consider these vital strategies:

- Define Your Risk Per Trade: Never risk more than a small percentage (e.g., 1-2%) of your total capital on any single trade. This protects you from significant losses if a trade moves against you.

- Utilize Stop-Loss Orders: Always place a stop-loss order to automatically close a position if the market moves unfavorably to a predetermined level. This limits potential downside.

- Implement Take-Profit Orders: Set a take-profit order to automatically close a profitable position when it reaches your target price. This secures gains and prevents greed from eroding profits.

- Understand Position Sizing: Calculate your position size based on your risk tolerance and account balance. Avoid over-leveraging.

- Diversify Your Portfolio: Don’t put all your capital into one asset. Spread your risk across different currency pairs, commodities, or indices.

Mastering these strategies will help you preserve capital and build a resilient forex nigeria trading career.

IC Markets’ Commitment to the Nigerian Market

IC Markets Nigeria is more than just a global broker; we are a dedicated partner committed to the growth and prosperity of the Nigerian trading community. We recognize the immense potential within the nigeria trading sector and actively work to support its development.

Our commitment extends to:

- Tailored Solutions: Developing services and features that directly address the specific needs and challenges faced by Nigerian traders.

- Accessibility: Ensuring easy access to our platforms, educational resources, and support, regardless of location within Nigeria.

- Building Trust: Upholding the highest standards of transparency and integrity, fostering long-term relationships with our clients.

We are investing in the future of nigeria trading, creating an environment where local traders can thrive on a global stage.

Supporting the Local Trading Community

IC Markets Nigeria actively fosters a vibrant and informed nigeria trading community. Our commitment goes beyond just providing trading services; we aim to be a valuable resource for local participants, helping them navigate the complexities of the global markets.

We support the community through initiatives such as:

- Localized Content: Providing educational materials and market insights that resonate with the local context and address specific questions relevant to Nigerian traders.

- Responsive Localized Support: Ensuring our customer support understands the unique challenges and payment methods pertinent to Nigeria, offering efficient and empathetic assistance.

- Community Engagement: Potentially participating in local events, seminars, or webinars to connect directly with traders, share expertise, and gather feedback to improve our offerings.

By empowering traders with knowledge and reliable tools, IC Markets Nigeria contributes to a stronger, more informed, and successful trading ecosystem in the region.

Getting Started: Opening an IC Markets Nigeria Account

Ready to unlock your trading potential with IC Markets Nigeria? Opening an account is a streamlined and secure process designed for your convenience. We make it simple to begin your journey into the global financial markets, whether you’re interested in forex nigeria or other asset classes.

Embark on your trading adventure today by taking the first step. Our intuitive account opening procedure ensures you can get set up quickly and efficiently, allowing you to focus on what matters most: your trading strategy.

Experience the seamless onboarding process that welcomes you to a world of opportunity. It’s time to join a leading broker nigeria.

A Step-by-Step Guide

Opening your IC Markets Nigeria account is straightforward and takes just a few minutes. Follow these simple steps to begin your forex nigeria journey with a trusted broker nigeria:

- Visit Our Website: Navigate to the IC Markets Nigeria section.

- Click “Open Account”: Locate the “Open Account” or “Register” button, usually prominent on the homepage.

- Fill in Your Details: Complete the online registration form with your personal information, including your name, email, phone number, and country of residence (Nigeria).

- Choose Your Account Type: Select your preferred trading account (Standard or Raw Spread) and your desired trading platform (MT4, MT5, or cTrader).

- Complete Identity Verification: Upload the necessary documents for identity (e.g., national ID, international passport) and residency (e.g., utility bill, bank statement) verification. This is a standard regulatory requirement.

- Fund Your Account: Once your account is verified, deposit funds using one of the secure and convenient local payment methods available.

- Start Trading: Download your chosen platform, log in with your credentials, and begin trading the global markets!

Our support team is always available to assist you if you encounter any questions during the process.

Conclusion: Is IC Markets Right for You?

After exploring the comprehensive offerings of IC Markets Nigeria, you likely have a clear picture of our dedication to providing an exceptional trading experience. For those in nigeria trading, we combine globally competitive conditions with a deep understanding of local needs.

We offer:

- Unmatched Trading Conditions: Ultra-low spreads and lightning-fast execution across a broad range of instruments.

- Advanced Platforms: Choice of MT4, MT5, and cTrader to suit every trading style.

- Robust Security: Regulatory compliance and segregated client funds ensure your peace of mind.

- Dedicated Support: Accessible and knowledgeable customer service.

- Empowering Resources: Extensive educational tools to foster your growth as a trader.

If you prioritize transparent pricing, superior technology, and a secure trading environment for your forex nigeria activities, then IC Markets stands as an optimal choice. We invite you to experience the difference with a leading broker nigeria.

Frequently Asked Questions

Why should Nigerian traders choose IC Markets?

IC Markets offers Nigerian traders competitive spreads, fast execution, a diverse range of trading instruments including Forex and cryptocurrencies, and cutting-edge trading platforms. It provides a reliable and secure environment with a focus on local market dynamics to empower traders.

How does IC Markets ensure the safety of funds for Nigerian clients?

IC Markets operates with strong regulatory compliance, adhering to international standards. This commitment includes segregating client funds in separate bank accounts from the company’s operational capital, ensuring financial stability, and maintaining operational transparency for peace of mind.

What trading platforms are available for IC Markets Nigeria clients?

IC Markets Nigeria provides access to three of the industry’s most popular and powerful platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Each platform offers unique features tailored to different trading styles, from extensive charting tools to advanced order types and multi-asset capabilities.

What is the difference between Standard and Raw Spread accounts at IC Markets Nigeria?

The primary distinction lies in the cost structure. Standard accounts feature wider spreads with no commissions per lot, suitable for beginners. Raw Spread accounts, conversely, offer ultra-low spreads (starting from 0.0 pips) combined with a small commission per lot traded, ideal for high-volume traders and scalpers seeking the tightest pricing.

How can I deposit and withdraw funds from my IC Markets Nigeria account?

IC Markets Nigeria offers a range of efficient and secure funding and withdrawal methods, including local bank transfers, popular e-wallets, and credit/debit cards. The broker prioritizes quick processing times for both deposits and payouts, ensuring a smooth financial experience for its Nigerian clients.