Are you a trader in Pakistan looking for a reliable broker? Navigating the world of forex can be challenging. You need a partner with fast execution, low costs, and trustworthy service. This is where IC Markets Pakistan enters the scene. This comprehensive review breaks down everything you need to know. We will explore platforms, account types, fees, and local payment methods. Discover why so many in the Pakistan trading community choose this broker for their journey in the financial markets.

- What is IC Markets and Is It Available in Pakistan?

- How to Open an IC Markets Account from Pakistan

- Step 1: Registration Process

- Step 2: Account Verification (KYC) for Pakistani Citizens

- Deposit and Withdrawal Methods for Pakistan

- Local Bank Transfers and E-wallets

- Cryptocurrency Funding Options

- Exploring IC Markets Trading Platforms

- MetaTrader 4 & 5

- cTrader

- Understanding Spreads, Commissions, and Fees

- Is IC Markets Regulated and Safe?

- IC Markets Account Types Explained

- Raw Spread vs. Standard Account

- Does IC Markets Offer an Islamic (Swap-Free) Account?

- Leverage and Margin Requirements

- Tradable Instruments: Forex, CFDs, and More

- Customer Support for Pakistani Traders

- Pros of Using IC Markets in Pakistan

- Cons and Potential Drawbacks

- IC Markets vs. Other Popular Brokers in the Region

- Frequently Asked Questions

What is IC Markets and Is It Available in Pakistan?

IC Markets is a globally recognized Forex and CFD broker, renowned for its True ECN trading environment. This means they connect traders directly to a deep pool of liquidity providers. The result is lightning-fast order execution and some of the tightest spreads in the industry. They offer a powerful trading experience for scalpers, day traders, and even automated trading systems.

So, the big question: can you use it here? Absolutely. IC Markets is available in Pakistan and actively welcomes clients from the region. They provide a seamless onboarding process for Pakistani citizens, making it a top-tier choice for anyone serious about Forex Pakistan trading.

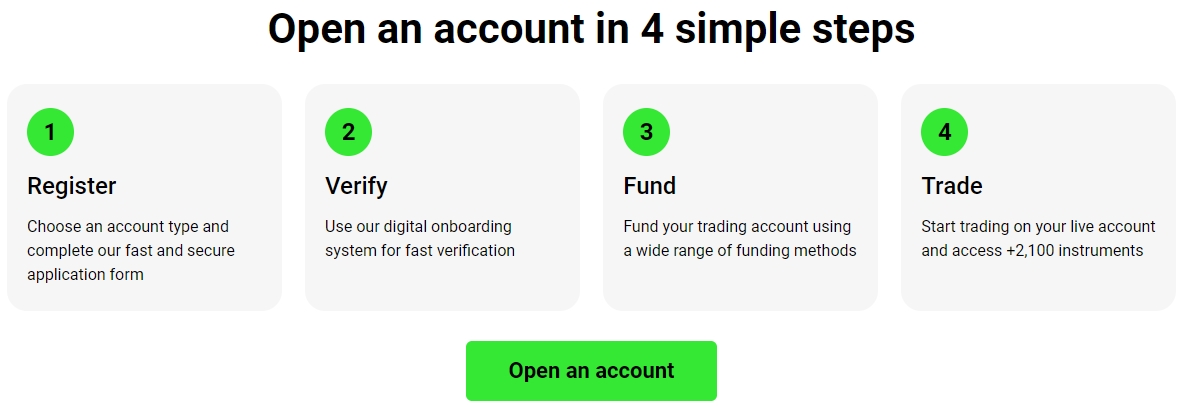

How to Open an IC Markets Account from Pakistan

Getting started with IC Markets from Pakistan is a simple and fully digital process. You can complete the entire setup from the comfort of your home in just a few minutes. The journey involves two main phases: an initial registration where you provide your details and choose your account, followed by a verification step to secure your account and comply with global standards. We’ll walk you through each step below.

Step 1: Registration Process

Your first move is to fill out the online application. This is a quick and intuitive form designed to get you set up without any hassle. Follow these simple steps:

- Visit the Official Website: Navigate to the IC Markets homepage and find the “Open an Account” button.

- Enter Personal Details: Fill in your name, email address, and phone number. Make sure this information is accurate as it will be used for verification.

- Configure Your Trading Account: This is where you choose your preferred trading platform (like MetaTrader 4 or 5), select your account type (e.g., Raw Spread or Standard), and set your account’s base currency (usually USD).

- Complete the Questionnaire: Answer a few brief questions about your trading experience. This is a standard regulatory requirement.

Step 2: Account Verification (KYC) for Pakistani Citizens

To fully activate your account for deposits and withdrawals, you must complete the Know Your Customer (KYC) process. This is a crucial security measure that protects both you and the broker. For citizens in Pakistan, the process is straightforward. You will need to upload clear digital copies of two types of documents:

- Proof of Identity (POI): A valid, government-issued photo ID.

- Your Computerized National Identity Card (CNIC)

- Your Passport

- Proof of Residence (POR): A document dated within the last few months that shows your full name and address.

- A recent utility bill (electricity, gas, water)

- A bank or credit card statement

Once you submit these documents through your secure client portal, the verification team typically reviews and approves them within one business day.

Deposit and Withdrawal Methods for Pakistan

One of the most critical factors for any trader is the ability to move funds easily and securely. IC Markets Pakistan offers a variety of convenient funding methods tailored to local needs. Whether you prefer traditional banking channels, modern e-wallets, or cutting-edge digital currencies, you can manage your capital efficiently. This flexibility ensures you can focus more on your trading and less on logistics.

Local Bank Transfers and E-wallets

For most traders in Pakistan, these methods offer the best balance of convenience and accessibility. IC Markets has streamlined the process to make it as smooth as possible. Here are the most popular options available:

| Method | Deposit Speed | Withdrawal Speed | Notes for Pakistani Users |

|---|---|---|---|

| Local Bank Transfer | Instant/Within hours | 1-3 Business Days | A very popular and reliable option for funding your account directly. |

| Skrill / Neteller | Instant | Instant/Same Day | Excellent for fast transactions. A top choice for active Forex Pakistan traders. |

| Visa / Mastercard | Instant | 1-3 Business Days | Check with your local bank for any restrictions on international transactions. |

Cryptocurrency Funding Options

Embracing modern financial technology, IC Markets allows clients to fund their trading accounts using popular cryptocurrencies. This method offers unparalleled speed and operates outside of traditional banking hours, providing a great alternative for tech-savvy traders. You can deposit and withdraw using several major digital assets, including:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

Crypto transactions are known for their efficiency, but always be mindful of network fees and the inherent price volatility of these assets when making a transfer.

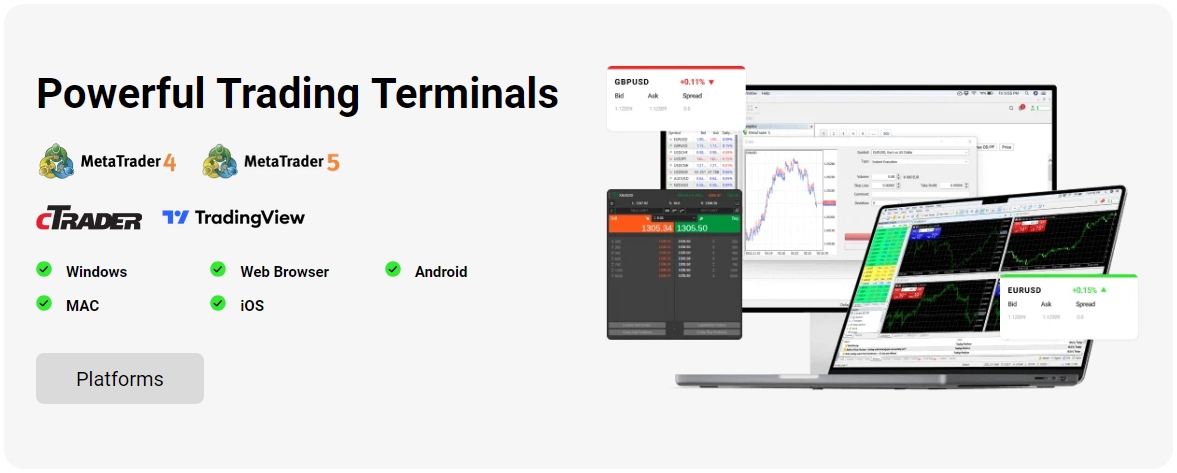

Exploring IC Markets Trading Platforms

Your trading platform is your gateway to the financial markets. It’s the software you use to analyze charts, place orders, and manage your positions. IC Markets doesn’t offer a one-size-fits-all solution. Instead, it provides a suite of the world’s most popular and powerful platforms, ensuring every type of trader, from a beginner to an algorithmic expert, finds the perfect tool for their strategy.

MetaTrader 4 & 5

MetaTrader is the undisputed king of forex trading platforms, and IC Markets offers both of its powerful versions.

- MetaTrader 4 (MT4): The global industry standard. MT4 is celebrated for its rock-solid stability, user-friendly interface, and massive ecosystem of custom indicators and automated trading robots (Expert Advisors or EAs). It remains the top choice for many forex purists.

- MetaTrader 5 (MT5): The next-generation successor. MT5 builds on MT4’s foundation with more technical indicators, additional timeframes, and access to a wider range of markets like stocks. It is the superior choice for multi-asset Pakistan trading.

cTrader

For those seeking a more modern and intuitive trading experience, cTrader is an outstanding alternative. It is designed with a clean, uncluttered interface that is especially appealing to discretionary traders who value advanced charting and order management tools.

cTrader’s key features include its advanced Depth of Market (DOM) view, detailed trade analysis reports, and a sleek design that works beautifully across desktop and mobile devices. It is an excellent platform for traders who want a sophisticated yet easy-to-navigate environment.

Understanding Spreads, Commissions, and Fees

Your trading costs directly impact your profitability. IC Markets built its reputation on providing a low-cost trading environment. The primary costs are spreads and commissions, which vary depending on your chosen account type.

What is a spread? It is the small difference between the buy (ask) and sell (bid) price of an asset. IC Markets is famous for its raw, razor-thin spreads that start from 0.0 pips on major currency pairs.

What is a commission? This is a small, fixed fee charged for opening and closing a trade. It is typically applied only on Raw Spread accounts in exchange for getting the absolute lowest spreads directly from liquidity providers. The Standard Account has zero commission, with the broker’s fee built into the slightly wider spread.

There are generally no hidden fees for deposits, but be aware of potential swap fees for holding positions overnight, unless you are using an Islamic account.

Is IC Markets Regulated and Safe?

Trust is non-negotiable when choosing a broker. IC Markets is widely considered a safe and reliable option because it is regulated by multiple top-tier financial authorities around the world, such as the Seychelles Financial Services Authority (FSA) and the Cyprus Securities and Exchange Commission (CySEC).

What does this mean for you as a trader in Pakistan?

- Segregated Client Funds: Your money is kept in a separate bank account from the company’s operational funds. This ensures it is protected.

- Strict Compliance: The broker must adhere to strict financial standards and conduct regular audits.

- Negative Balance Protection: You cannot lose more money than you have in your account, protecting you from extreme market volatility.

This strong regulatory framework provides peace of mind, making it a secure choice for your Pakistan trading activities.

IC Markets Account Types Explained

Choosing the right account type is essential as it aligns the broker’s cost structure with your trading style. IC Markets offers a focused range of accounts designed to cater to different needs, from beginners who prefer simplicity to high-volume traders who demand the lowest possible costs. The two primary options available to traders in Pakistan are the Raw Spread and the Standard account.

Raw Spread vs. Standard Account

The main difference between the two most popular accounts comes down to how trading costs are structured. One is not necessarily better than the other; the best choice depends entirely on your personal trading strategy. Here is a direct comparison to help you decide:

| Feature | Raw Spread Account | Standard Account |

|---|---|---|

| Spreads | Starts from 0.0 pips | Starts from 0.6 pips |

| Commissions | Yes, a small fixed fee per lot | Zero commission |

| Best For | Scalpers, algorithmic traders, and high-volume traders | Beginners and discretionary traders who prefer simplicity |

Does IC Markets Offer an Islamic (Swap-Free) Account?

Yes, IC Markets fully caters to traders of the Islamic faith by offering swap-free account options. An Islamic account operates in compliance with Sharia law, which prohibits the charging or earning of interest (Riba). On a standard trading account, this interest is applied as an overnight “swap” fee for positions held open past the market close.

With an IC Markets Islamic account, these swap fees are removed. Instead, a small flat-rate administration fee may be charged for positions held open for a certain number of nights. This ensures the trading conditions remain fair while respecting religious principles. To get a swap-free account, you simply open a standard or raw spread account and then request the conversion to an Islamic account through their customer support.

Leverage and Margin Requirements

Leverage is a powerful tool that allows you to control a large position in the market with a relatively small amount of capital. For example, with a leverage of 1:500, you can control a $50,000 position with just $100 from your account. This $100 is known as the “margin.” IC Markets offers flexible leverage up to 1:500 for traders in Pakistan.

While leverage can significantly amplify your potential profits, it is crucial to understand that it also amplifies your potential losses. It is a double-edged sword that must be used with a strong risk management strategy. Always start with lower leverage until you are comfortable with its effects and never risk more capital than you can afford to lose.

Tradable Instruments: Forex, CFDs, and More

A great broker provides access to a wide range of markets, allowing you to diversify your portfolio and seize opportunities wherever they appear. IC Markets excels in this area, offering a vast selection of tradable instruments through Contracts for Difference (CFDs). This means you can speculate on the price movements of assets without owning them outright. The available markets include:

- Forex: Over 60 currency pairs, including majors like EUR/USD, minors, and exotics.

- Indices: Trade the direction of major global stock markets like the S&P 500, NASDAQ, and DAX.

- Commodities: Speculate on popular markets like Gold (XAU/USD), Silver (XAG/USD), and WTI Oil.

- Stocks: Access CFDs on hundreds of top global companies from the US, EU, and Asian markets.

- Bonds: Trade on government debt instruments from around the world.

- Cryptocurrencies: Gain exposure to the most popular digital currencies, including Bitcoin and Ethereum.

Customer Support for Pakistani Traders

Reliable and accessible support is vital, especially when your money is on the line. IC Markets offers robust customer service that is well-suited for the needs of traders in Pakistan. Their support team is available 24 hours a day, 7 days a week, which is a major advantage given the time zone differences and the fact that forex markets run around the clock.

You can reach their knowledgeable and professional support staff through several channels:

- Live Chat: The fastest way to get answers to your questions, directly through their website.

- Email: Ideal for less urgent or more detailed inquiries.

- Phone: Direct phone support is also available for immediate assistance.

“The 24/7 live chat has been a lifesaver. No matter when I’m trading, I know I can get a quick and helpful response. It’s a key reason I stick with this broker Pakistan.”

Pros of Using IC Markets in Pakistan

When you put it all together, IC Markets presents a compelling case for traders in the region. Its core strengths align perfectly with what both new and experienced traders look for in a top-tier broker.

- Extremely Low Spreads: The Raw Spread accounts offer some of the tightest spreads in the industry, which can significantly lower your trading costs.

- Fast Execution Speed: Their True ECN infrastructure, with servers in major data centers, ensures minimal slippage and rapid order processing.

- Strong Regulation: Being regulated by multiple authorities provides a high level of security and trust for your funds.

- Excellent Platform Choice: Access to MT4, MT5, and cTrader means you can use the platform that best suits your trading style.

- Pakistan-Friendly Payments: A wide range of deposit and withdrawal methods, including local bank transfers, makes funding your account easy.

- Islamic Accounts Available: The provision of swap-free accounts is a crucial feature for a large portion of the local trading community.

Cons and Potential Drawbacks

No broker is perfect, and it’s important to have a balanced perspective. While IC Markets is an excellent choice, there are a few areas where it might not be the ideal fit for everyone.

- Limited Educational Content: Compared to some other brokers, their educational section is less extensive. It’s built more for traders who already have a foundational knowledge of the markets.

- No Proprietary Platform: IC Markets relies on industry-standard platforms like MetaTrader and cTrader. While these are excellent, some traders prefer brokers that develop their own unique, proprietary software.

- Minimum Deposit: The recommended minimum deposit of $200 USD might be a bit higher than some ultra-low-cost brokers who allow funding with just a few dollars.

IC Markets vs. Other Popular Brokers in the Region

How does IC Markets stack up against the competition in Pakistan? When you compare key features, its advantages become clear, particularly in the areas of cost and technology. Here is a brief look at how it compares to other typical brokers available to traders in the region.

| Feature | IC Markets | Typical Competitor A | Typical Competitor B |

|---|---|---|---|

| Average Spread (EUR/USD) | 0.1 pips (Raw) | 1.5 pips (Standard) | 1.2 pips (Standard) |

| Platforms | MT4, MT5, cTrader | MT4 Only | Proprietary, MT4 |

| Regulation | Top-Tier (e.g., CySEC, FSA) | Mid-Tier or Offshore | Varies |

| Execution Model | True ECN | Market Maker | Market Maker / STP |

As the table shows, IC Markets often leads the pack with its lower costs, superior platform selection, and strong regulatory standing, making it a highly competitive choice for any Forex Pakistan trader.

Frequently Asked Questions

What is the minimum deposit for IC Markets in Pakistan?

IC Markets recommends a minimum deposit of $200 USD. While you can open an account with less, this amount provides enough capital to open meaningful positions and manage risk effectively.

Is trading with IC Markets legal for Pakistani residents?

Yes, Pakistani residents can legally trade with internationally regulated online brokers. IC Markets holds licenses from several top-tier authorities, making it a legitimate and secure platform for traders in Pakistan.

Can I trade on my mobile phone?

Absolutely. All trading platforms offered by IC Markets—MetaTrader 4, MetaTrader 5, and cTrader—have fully-featured mobile apps for both Android and iOS devices, allowing you to trade and manage your account from anywhere.

How long do withdrawals take for traders in Pakistan?

Withdrawal times depend on the method used. E-wallets such as Skrill and Neteller are typically processed on the same day. For local bank transfers and credit/debit card withdrawals, it usually takes 1-3 business days for the funds to appear.

Does IC Markets offer an Islamic (swap-free) account?

Yes, IC Markets provides Islamic accounts that comply with Sharia law by not charging or earning swap fees on overnight positions. You can request to have your standard or raw spread account converted to a swap-free version.