Navigating the vast world of online trading requires a partner that offers both diversity and reliability. IC Markets stands out by providing an extensive array of IC Markets Products designed to meet the unique demands of traders worldwide. Whether you are a seasoned investor or just starting your journey, understanding the breadth of their trading products is key to crafting a robust strategy.

We’ll explore the diverse markets offered, giving you a clear picture of the opportunities available. From major currency pairs to cutting-edge cryptocurrencies, IC Markets provides access to a multitude of financial instruments across various asset classes. Let’s dive into what makes their offerings so compelling.

- Forex Trading

- Commodities

- Indices

- Cryptocurrencies

- Stocks and Shares (CFDs)

- Understanding IC Markets: An Overview

- Brief History and Global Presence

- Core Trading Instruments Offered by IC Markets

- Forex

- Commodities

- Indices

- Cryptocurrencies

- Stocks

- Bonds

- Forex Trading with IC Markets Products

- Explore a World of Currency Pairs

- Major, Minor, and Exotic Pairs

- Major Pairs: The Core of Forex

- Minor Pairs: Unlocking Unique Dynamics

- Exotic Pairs: Higher Risk, Higher Reward

- Cryptocurrencies Available on IC Markets

- Stock CFDs and Indices: Expanding Your Portfolio

- Unlocking Opportunities with Stock CFDs

- Gaining Broad Exposure with Indices

- Why Choose IC Markets for These Financial Instruments?

- Global Stock Indices

- Individual Company Shares

- Commodities Trading: Energy and Metals

- Futures Contracts on IC Markets

- Why Trade Futures with IC Markets?

- Explore Diverse Futures Markets Offered

- Spreads and Commissions: What to Expect

- Understanding Spreads

- Unpacking Commissions

- Factors Influencing Your Costs

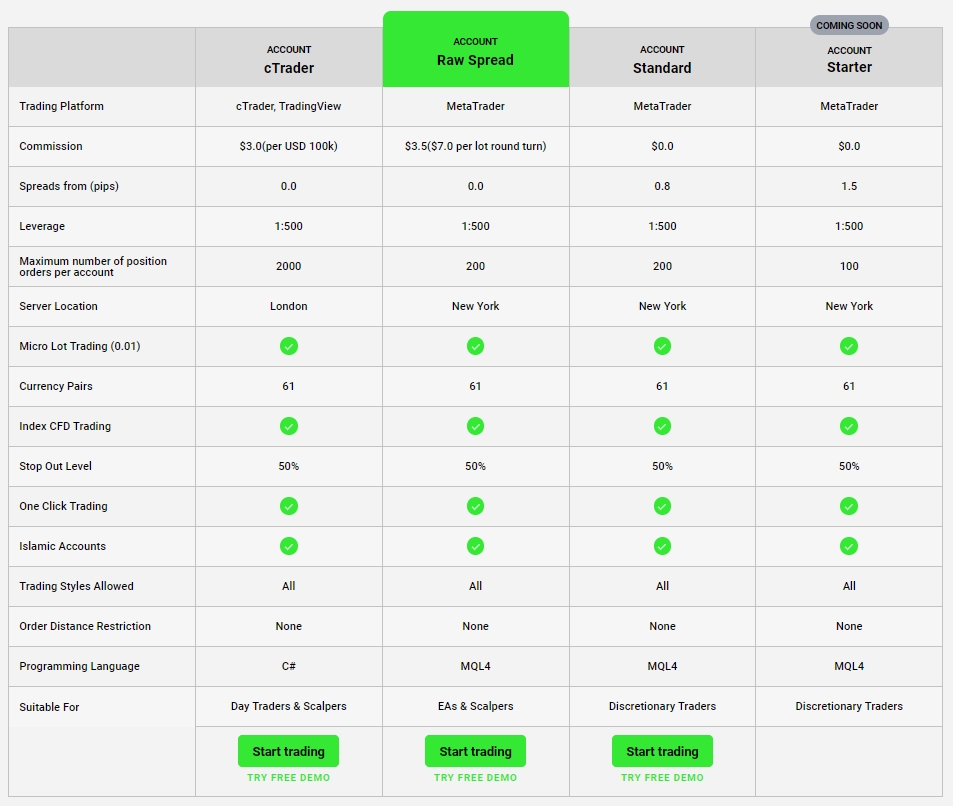

- Account Types at a Glance

- Trading Platforms Supporting IC Markets Products

- MetaTrader Suite

- MetaTrader 4: The Industry Standard

- MetaTrader 5: Expanded Possibilities

- Why Choose the MetaTrader Suite with IC Markets Products?

- cTrader Ecosystem

- Account Types for IC Markets Products

- Standard Account: Simplicity Meets Power

- Raw Spread Account: Precision Trading, Unbeatable Spreads

- Which Account is Right for You?

- Leverage and Margin Requirements: Key Considerations

- Customer Support and Educational Resources

- Unrivaled Customer Support at Your Fingertips

- Comprehensive Educational Resources for Every Trader

- Security and Regulation of IC Markets

- How to Get Started with IC Markets Products

- Open Your Trading Account

- Verify Your Identity

- Fund Your Account

- Select Your Trading Platform

- Explore the Markets Offered

- Practice with a Demo Account

- Account Opening Process

- Why Choose IC Markets for Your Trading Needs

- Unrivaled Access to Diverse Markets

- Superior Trading Conditions

- Advanced Technology and Support

- Frequently Asked Questions

Forex Trading

Forex remains a cornerstone of global financial markets, and IC Markets delivers an unparalleled experience.

You access competitive spreads and deep liquidity across a massive range of currency pairs.

- Major Pairs: EUR/USD, GBP/USD, USD/JPY, AUD/USD, etc.

- Minor Pairs: EUR/GBP, AUD/JPY, NZD/JPY, etc.

- Exotic Pairs: USD/TRY, EUR/NOK, AUD/SGD, etc.

Commodities

Diversify your portfolio by trading popular commodities. These raw materials often react to geopolitical events and supply-demand dynamics, offering distinct trading opportunities. IC Markets provides access to energy, metals, and agricultural products.

Key commodities you can trade include:

| Category | Examples |

|---|---|

| Precious Metals | Gold, Silver, Platinum |

| Energy | Crude Oil (WTI, Brent), Natural Gas |

| Soft Commodities | Coffee, Sugar, Cotton |

Indices

Trade the performance of entire economies or sectors through global stock market indices. These instruments allow you to speculate on the overall health of a market without needing to analyze individual company stocks. You gain exposure to major indices from North America, Europe, Asia, and Australia.

Popular indices include:

- S&P 500

- Dow Jones Industrial Average

- DAX 40

- FTSE 100

- Nikkei 225

Cryptocurrencies

Step into the exciting and volatile world of digital assets. IC Markets provides opportunities to trade CFDs on a selection of leading cryptocurrencies against fiat currencies. This allows you to speculate on price movements without owning the underlying asset, making it accessible and flexible.

Available crypto CFDs often include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Litecoin (LTC)

- Dogecoin (DOGE)

Stocks and Shares (CFDs)

Gain exposure to some of the world’s largest companies without the complexities of direct stock ownership. IC Markets offers Contracts for Difference (CFDs) on individual stocks from major exchanges. This gives you the flexibility to go long or short, capitalizing on both rising and falling markets.

You can trade CFDs on companies across various sectors, including technology, finance, and consumer goods, from markets like the US, UK, Europe, and Australia.

Choosing the right IC Markets Products aligns directly with your trading style and risk tolerance. Their broad selection of financial instruments across diverse asset classes ensures every trader finds suitable opportunities. Explore the markets offered and elevate your trading experience today!

Understanding IC Markets: An Overview

IC Markets stands as a premier global leader in online trading, consistently delivering outstanding trading conditions and unparalleled client support. Our core philosophy centers on empowering traders with robust tools and a vast selection of investment opportunities. We are dedicated to providing a transparent, fair, and accessible trading environment for everyone, from experienced market participants to those just beginning their journey in financial markets.

At its heart, IC Markets is committed to offering an extensive array of IC Markets Products, meticulously designed to cater to diverse trading strategies and individual preferences. Whether your aim is to capitalize on short-term market shifts or cultivate long-term portfolio growth, our versatile platform provides the flexibility and resources you require to pursue your financial goals.

We provide unfettered access to a broad spectrum of trading products across various global markets. Our clients can seamlessly engage with some of the most dynamic and liquid markets offered around the world. We prioritize giving you the freedom to diversify your investment portfolio effectively and explore multiple avenues for potential returns.

Our comprehensive selection of financial instruments includes a wide range of asset classes:

- Forex: Trade over 60 currency pairs, benefiting from competitive spreads and deep liquidity.

- Commodities: Gain exposure to major energy products, precious metals like gold and silver, and key agricultural commodities.

- Indices: Speculate on the performance of leading global stock markets without the need for direct equity ownership.

- Cryptocurrencies: Engage with popular digital assets, trading them against major fiat currencies.

- Stocks: Trade CFDs on individual shares from prominent global companies.

- Bonds: Incorporate government bonds into your trading strategy for strategic market diversification.

Traders consistently choose IC Markets for our cutting-edge technology, highly competitive pricing, and unwavering commitment to rapid execution speed. We deliver a seamless trading experience across multiple sophisticated platforms, ensuring you can manage your positions effectively and efficiently at all times.

| Key Asset Class | Primary Trader Advantage |

|---|---|

| Major & Minor Forex Pairs | Benefit from high liquidity, ultra-tight spreads, and 24/5 market access. |

| Global Stock Indices | Achieve broad market diversification and gain exposure to overall economic performance. |

| Precious Metals & Energy | Access safe-haven assets and capitalize on global supply and demand dynamics. |

We invite you to explore how IC Markets can significantly elevate your trading experience. Discover our intuitive platform and see firsthand why a vast community of traders trusts us to help realize their financial aspirations.

Brief History and Global Presence

IC Markets burst onto the scene in 2007 with a clear mission: to create the ultimate trading environment for retail and institutional clients alike. They quickly established a reputation for cutting-edge technology and transparent pricing. This dedication led to rapid growth, solidifying their position as a leading global broker. Their focus always remained on offering a vast selection of financial instruments and competitive conditions.

“Our founding vision was simple yet profound: empower traders with unparalleled access to global markets and superior tools.”

Today, IC Markets boasts an impressive global presence, serving hundreds of thousands of traders worldwide. This expansive reach isn’t just about numbers; it reflects their commitment to providing localized support and tailored trading products to a diverse clientele. Operating under robust regulatory frameworks across various jurisdictions, they ensure a secure and reliable trading experience, no matter where you are. This commitment to compliance underpins trust and security.

Their extensive global footprint empowers them to continuously enhance the IC Markets Products portfolio. Traders gain access to a broad array of asset classes and markets offered, reflecting the diverse needs of a worldwide client base. This global scale means more opportunities and greater flexibility for every trader.

Ready to explore a broker with a truly global vision? Discover how IC Markets’ history of innovation and widespread reach can elevate your trading journey. Join a community built on trust and unparalleled opportunity.

Core Trading Instruments Offered by IC Markets

Unlock a world of opportunity with the expansive range of IC Markets Products. We provide access to a truly diverse portfolio of financial instruments, ensuring every trader finds the markets that align with their strategy. Our commitment is to deliver a seamless trading experience across all major asset classes, empowering you to navigate global markets with confidence and precision.

Forex

Dive into the world’s largest and most liquid market. With IC Markets, you gain unparalleled access to over 60 currency pairs, from major pairs like EUR/USD and GBP/USD to a wide selection of minors and exotics. Experience ultra-low spreads and exceptional execution speeds, making Forex trading both dynamic and highly responsive to market movements. This extensive offering of trading products allows for sophisticated strategies in any market condition.

Commodities

Hedge against inflation, diversify your portfolio, or speculate on price movements with our robust commodities offering. We bring you direct access to some of the most vital global resources. Here’s what you can trade:

- Metals: Gold, Silver, Platinum, and Palladium, often seen as safe-haven assets.

- Energies: Crude Oil (WTI and Brent) and Natural Gas, reflecting global demand and supply dynamics.

- Agriculture: Coffee, Sugar, Corn, and Wheat, tracking essential food and industrial inputs.

Indices

Gain exposure to entire economies and sectors without buying individual stocks. Trade CFDs on major global stock market indices from the US, Europe, Asia, and Australia. These financial instruments allow you to capitalize on broad market trends, offering a powerful way to diversify your portfolio and manage risk across various regional markets.

Cryptocurrencies

Embrace the future of finance by trading CFDs on leading cryptocurrencies. Leverage the volatility and growth potential of digital assets like Bitcoin, Ethereum, Ripple, and Litecoin against the US Dollar. Our platform provides the tools to engage with this exciting and rapidly evolving asset class, offering robust execution for your crypto trading strategies.

Stocks

Access CFDs on hundreds of individual stocks from major exchanges worldwide, including the NYSE, NASDAQ, and ASX. Speculate on the price movements of prominent companies without owning the underlying shares. This gives you the flexibility to go long or short, capitalizing on both rising and falling markets across a vast selection of global equities.

Bonds

Add stability and interest rate sensitivity to your trading portfolio with CFDs on government bonds. These financial instruments offer a distinct way to diversify and manage risk, providing exposure to sovereign debt markets from key global economies.

Our commitment to providing a comprehensive suite of markets offered ensures you have the tools to construct a truly diversified and resilient trading portfolio. Explore the depth of IC Markets Products today and elevate your trading journey.

Forex Trading with IC Markets Products

Embarking on the dynamic world of forex trading requires a robust partner and a comprehensive suite of tools. IC Markets stands as a premier choice, offering an unparalleled environment for currency exchange. Dive into the heart of global finance with confidence, exploring the vast opportunities presented by IC Markets Products tailored specifically for forex traders.

We empower traders with competitive conditions designed for optimal performance. You gain access to some of the tightest spreads in the industry, rapid execution speeds, and deep liquidity, all crucial elements for navigating the volatile forex market effectively. Our commitment to transparency and fairness builds a foundation of trust, allowing you to focus purely on your trading strategies.

Explore a World of Currency Pairs

The core of forex trading revolves around currency pairs. IC Markets provides an extensive selection, ensuring you find the right financial instruments to match your market view and strategy. We categorize our offerings to help you easily identify opportunities within specific asset classes:

- Major Currency Pairs: These include the most heavily traded pairs globally, featuring currencies like the US Dollar, Euro, Japanese Yen, British Pound, Swiss Franc, Canadian Dollar, Australian Dollar, and New Zealand Dollar. Expect high liquidity and often lower spreads.

- Minor Currency Pairs: These pairs involve major currencies but exclude the US Dollar. They offer diverse trading opportunities with potentially higher volatility than majors.

- Exotic Currency Pairs: Combining a major currency with a currency from an emerging or smaller economy, exotics can present unique high-risk, high-reward scenarios.

Here is a snapshot of some popular forex instruments you can trade:

| Category | Example Pairs | Key Characteristics |

|---|---|---|

| Majors | EUR/USD, GBP/JPY | High liquidity, tight spreads |

| Minors | AUD/NZD, EUR/GBP | Good liquidity, diverse movements |

| Exotics | USD/ZAR, EUR/TRY | Higher volatility, wider spreads |

The breadth of trading products available ensures you can diversify your portfolio and capitalize on different market conditions. While our expertise shines brightly in forex, remember that the overall markets offered by IC Markets extend to other asset classes, providing a holistic trading experience if you choose to explore beyond currencies.

“Successful forex trading hinges on precision, speed, and access to a wide array of options. IC Markets delivers on all fronts, enabling you to capture opportunities confidently.”

We support your forex journey with industry-leading trading platforms such as MetaTrader 4, MetaTrader 5, and cTrader. These platforms offer advanced charting tools, sophisticated order types, and powerful analytical capabilities. You gain the power to execute trades seamlessly, manage risk effectively, and analyze market trends with precision. Choose IC Markets for a forex trading experience that truly empowers your financial aspirations.

Major, Minor, and Exotic Pairs

Diving into the world of forex trading requires a solid grasp of currency pairs. Among the diverse

IC Markets Products, currency pairs are fundamental. Each category offers distinct characteristics and opportunities, shaping your trading strategy and risk management approach.

Major Pairs: The Core of Forex

Major pairs form the backbone of global forex trading. These always involve the US Dollar paired with another major currency. They represent the largest economies and highest trading volumes worldwide.

- High Liquidity: You can enter and exit positions quickly and efficiently, even with large orders.

- Tight Spreads: The difference between the buy and sell price is minimal, reducing your transaction costs.

- Consistent Opportunities: High trading activity means frequent price movements and chances to profit throughout the day.

These powerful financial instruments include pairs like EUR/USD, GBP/USD, USD/JPY, and USD/CHF. Many traders build their core strategies around these highly liquid markets offered.

Minor Pairs: Unlocking Unique Dynamics

Also known as cross pairs, minor pairs exclude the US Dollar, instead matching two other major currencies against each other. They offer a different perspective and can provide diversification away from USD-centric movements.

- Good Liquidity: While not as high as majors, liquidity remains strong enough for effective trading.

- Slightly Wider Spreads: Expect spreads to be a bit broader compared to major pairs due to lower trading volumes.

- Distinct Drivers: These pairs often react more strongly to specific regional economic data or central bank announcements, creating unique patterns.

Consider trading products such as EUR/GBP, AUD/JPY, or CAD/CHF to explore these compelling dynamics and broaden your market exposure.

Exotic Pairs: Higher Risk, Higher Reward

Exotic pairs introduce a different level of excitement and potential. They combine a major currency with a currency from an emerging or smaller economy. This category presents both significant opportunities and increased risks.

- Lower Liquidity: Trading volumes are much smaller, which can lead to larger price jumps and slippage.

- Wider Spreads: Transaction costs are notably higher due to the lower liquidity.

- Increased Volatility: Price swings can be more dramatic, driven by local political events or economic shocks, making them attractive for high-risk, high-reward strategies.

These specific asset classes demand a keen eye on geopolitical news and local economic indicators. Examples include USD/TRY (US Dollar/Turkish Lira), EUR/ZAR (Euro/South African Rand), or GBP/MXN (British Pound/Mexican Peso). Approaching exotic pairs requires careful risk management and a deep understanding of the underlying economies.

Cryptocurrencies Available on IC Markets

Dive into the exciting world of digital assets with IC Markets. As a leading broker, we understand the surging interest in cryptocurrencies and provide robust platforms for you to capitalize on their volatility. Our suite of IC Markets Products includes an impressive array of crypto CFDs, allowing you to trade this dynamic asset class without owning the underlying coin.

We make crypto trading accessible and efficient. You gain the flexibility to go long or short, profiting from both rising and falling markets. Our competitive spreads and high liquidity ensure you get the best possible execution on your trades. Plus, enjoy 24/7 market access, mirroring the non-stop nature of the crypto space. These trading products offer unique opportunities distinct from traditional markets.

IC Markets offers a broad spectrum of the most popular cryptocurrencies, allowing you to diversify your portfolio. These markets offered cover major players and provide ample opportunities.

Here are some of the key digital financial instruments you can trade:

- Bitcoin (BTC): The original and largest cryptocurrency by market cap.

- Ethereum (ETH): Powering the decentralized finance (DeFi) ecosystem.

- Ripple (XRP): Known for its focus on fast, low-cost international payments.

- Litecoin (LTC): Often called the “silver to Bitcoin’s gold.”

- Bitcoin Cash (BCH): A fork of Bitcoin designed for faster transactions.

- Cardano (ADA): A blockchain platform for innovators and visionaries.

- Dogecoin (DOGE): The popular meme coin with a strong community.

- Solana (SOL): A high-performance blockchain known for speed.

Unlike buying actual coins on an exchange, trading crypto CFDs with IC Markets means you’re speculating on price movements. This method removes the complexities of wallet management and security concerns. You simply open and close positions, leveraging your capital to amplify potential returns. Explore these innovative financial instruments to expand your trading horizons.

Ready to explore the opportunities within this volatile asset class? Join the thousands of traders who are already capitalizing on these exciting markets offered by IC Markets.

Stock CFDs and Indices: Expanding Your Portfolio

Diversifying your investment strategy is key to long-term success, and exploring a wider range of financial instruments can unlock new opportunities. Stock CFDs and Indices stand out as powerful trading products, offering flexibility and broad market exposure. At IC Markets, we empower you to expand your portfolio with these dynamic asset classes, making them accessible to traders worldwide.

Unlocking Opportunities with Stock CFDs

Stock CFDs, or Contracts for Difference, allow you to speculate on the price movements of individual company shares without owning the underlying asset. This means you can profit from both rising and falling markets, adding a significant tactical advantage to your trading arsenal. Our IC Markets Products include an extensive selection of Stock CFDs, giving you access to major global exchanges.

Consider these benefits when integrating Stock CFDs into your strategy:

- Leverage Potential: Magnify your trading power, allowing you to control larger positions with a smaller capital outlay.

- Go Long or Short: Capitalize on upward price trends (going long) or benefit from downward movements (going short) with equal ease.

- Global Access: Trade shares from top companies across various international markets offered.

- No Physical Ownership: Avoid stamp duty or other taxes typically associated with direct stock ownership in certain jurisdictions.

Gaining Broad Exposure with Indices

Indices represent a basket of stocks, offering a snapshot of a particular market, sector, or economy. Trading indices provides a strategic way to gain exposure to an entire market’s performance, rather than betting on individual stocks. This approach can help mitigate risk by spreading your investment across multiple companies.

“Diversification through indices provides a robust foundation, while Stock CFDs offer precision targeting for specific growth areas.”

Our range of IC Markets Products includes many popular global indices, giving you a diverse selection of asset classes to choose from. You can track and trade benchmarks like the S&P 500, DAX, FTSE 100, and more, all from a single platform.

Key advantages of trading Indices:

- Market Diversification: Instantly diversify your portfolio across numerous companies within a sector or economy.

- Simplified Analysis: Focus on broader economic trends and market sentiment rather than intricate individual company reports.

- Lower Volatility (Generally): Compared to individual stocks, indices often exhibit smoother price movements due to their diversified nature.

Why Choose IC Markets for These Financial Instruments?

At IC Markets, we provide a robust and reliable platform for trading both Stock CFDs and Indices. We understand the nuances of these trading products and tailor our service to meet your needs. We deliver competitive spreads, deep liquidity, and rapid execution across all our markets offered, ensuring you can react swiftly to market opportunities.

| Feature | Stock CFDs | Indices |

|---|---|---|

| Exposure Type | Individual Company Shares | Broad Market/Sector |

| Diversification Level | Targeted | Built-in |

| Leverage Available | Yes | Yes |

| Short Selling | Yes | Yes |

Integrating Stock CFDs and Indices into your trading plan expands your potential for growth and offers powerful tools to navigate various market conditions. Explore these exciting IC Markets Products today and take control of your financial future.

Global Stock Indices

Ever wanted to tap into the pulse of the world’s leading economies? Global stock indices offer precisely that opportunity! These potent financial instruments represent a basket of top-performing companies within a specific country or sector. Trading them means you track the overall health and sentiment of major global markets, without needing to analyze individual stocks.

Among the diverse IC Markets Products, global stock indices stand out as popular trading products. They provide a streamlined way to gain exposure to the performance of entire market segments, from the tech-heavy US market to the industrial powerhouses of Europe and Asia. You can quickly react to geopolitical events, economic data releases, or sector-specific news, making them dynamic additions to any trading strategy.

We unlock access to a comprehensive range of these pivotal markets offered. You can diversify your portfolio and hedge existing positions, adding another crucial layer to your overall asset classes. Instead of buying individual shares, you speculate on the collective direction of an entire market, simplifying your decision-making process.

What makes trading global indices so compelling?

- Broad Market Exposure: Gain instant access to the performance of an entire national or regional economy.

- Diversification: Spread your risk across multiple companies within one trade, rather than relying on a single stock.

- Flexibility: Trade both rising and falling markets by going long or short on an index.

- Liquidity: Benefit from high liquidity, which often translates to tighter spreads and better execution.

Explore some of the prominent global stock indices available:

| Index Name | Represents |

|---|---|

| US 30 | 30 major US companies |

| Germany 40 | 40 largest German companies |

| Japan 225 | 225 leading Japanese stocks |

| UK 100 | 100 largest UK companies |

Trading global stock indices puts you right at the heart of the world economy. It’s an exciting way to engage with the markets and potentially capitalize on large-scale economic trends. Dive in and explore the power of these significant financial instruments.

Individual Company Shares

Diving into the world of individual company shares offers a direct route to participate in the success of specific corporations. As part of the comprehensive range of IC Markets Products, these allow you to gain direct exposure to some of the largest and most dynamic businesses across the globe.

Trading individual company shares means you are buying a small, defined portion of a company. It presents an exciting opportunity to invest in the brands you know and believe in, allowing your portfolio to reflect their performance. This distinct offering expands your access to various asset classes, moving beyond general market indices to target specific growth stories and industry leaders.

We provide access to an extensive selection of these powerful financial instruments, enabling you to diversify your portfolio and capitalize on individual company movements. Our diverse array of trading products ensures you have the tools to pinpoint opportunities across various sectors and regions.

Consider the compelling advantages of incorporating individual company shares into your trading strategy:

- Focused Exposure: Target specific companies based on your research and market outlook, aligning your investments with precise opportunities.

- Global Access: Tap into a broad range of markets offered from leading economies worldwide, including major stock exchanges across North America, Europe, and Asia.

- Portfolio Diversification: Blend different company shares to potentially mitigate risk and create a well-balanced portfolio that withstands market fluctuations.

- Leverage Potential: Utilize leverage to potentially amplify your returns from price movements (it is crucial to understand the inherent risks involved).

- Real-time Market Data: Make informed decisions with access to up-to-the-minute pricing and critical market insights, keeping you ahead of the curve.

Explore the potential of individual company shares and empower your trading journey with a focused approach to market participation. With our robust platform, you are equipped to uncover exciting prospects within this dynamic segment of the financial world.

Commodities Trading: Energy and Metals

Dive into the dynamic world of commodities trading, where global events often spark significant price movements. Energy and metals stand out as two of the most exciting and historically rich asset classes, drawing traders looking for diversification and unique opportunities. Understanding these essential financial instruments can unlock new dimensions in your trading strategy.

Energy commodities fuel the global economy, making them incredibly influential trading products. These markets are sensitive to geopolitical events, supply and demand dynamics, and even weather patterns.

Key energy instruments include:

- Crude Oil: Often dubbed ‘black gold,’ crude oil is a benchmark for global economic health. Supply disruptions, geopolitical tensions, and shifts in demand can create sharp, fast-moving trends.

- Natural Gas: A crucial energy source for heating and power generation, natural gas prices are highly sensitive to weather patterns, storage levels, and infrastructure developments. Traders often watch for seasonal shifts to identify opportunities.

Trading energy requires a keen eye on macroeconomic indicators and geopolitical landscapes.

Metals offer a different kind of commodity exposure. They range from safe-haven assets to crucial components in industrial growth.

Metal market highlights:

- Precious Metals (Gold & Silver): Gold often acts as a store of value and a hedge against inflation or economic uncertainty. Silver, while also precious, has significant industrial demand, adding another layer of price drivers. These traditional financial instruments remain popular.

- Industrial Metals (Copper, Platinum): Copper, known as ‘Dr. Copper’ for its predictive economic power, reflects global manufacturing activity. Platinum, another valuable metal, plays a vital role in automotive and jewelry industries. Their prices react strongly to economic health and supply chain stability.

The supply and demand dynamics, mining output, and global economic sentiment heavily influence metal prices.

Engaging with commodity markets through IC Markets Products provides access to a wide array of opportunities across these diverse asset classes. We understand the unique appeal of these trading products and tailor our offerings to support your goals.

“Commodities represent the raw heartbeat of the global economy. Understanding their pulse is key to unlocking robust trading strategies.” – An Experienced Trader

Consider the key characteristics of these markets:

| Commodity Type | Primary Drivers | Market Outlook |

|---|---|---|

| Energy (Oil, Gas) | Geopolitics, Supply/Demand, Weather | High volatility, macroeconomic sensitivity |

| Metals (Gold, Copper) | Economic health, Inflation, Industrial Demand | Safe-haven appeal, industrial growth indicator |

Our platform ensures you have access to a comprehensive range of these financial instruments, with competitive conditions across the energy and metal markets offered. Join us to explore these powerful opportunities.

Futures Contracts on IC Markets

Ready to unlock advanced trading opportunities? Futures contracts offer a dynamic way to speculate on price movements or hedge existing positions across various global markets. These powerful financial instruments allow traders to agree to buy or sell an asset at a predetermined price on a specified future date. It’s a strategic move for those looking to capitalize on market volatility or manage risk.

IC Markets provides access to a comprehensive suite of futures contracts, making them a significant part of our extensive range of IC Markets Products. You gain the ability to participate in some of the world’s most liquid and exciting markets. We empower you to take a position on future price direction with transparency and efficiency.

Why Trade Futures with IC Markets?

Trading futures contracts on our platform brings distinct advantages for both seasoned traders and those looking to expand their portfolio:

- Leverage Potential: Amplify your market exposure with relatively smaller capital outlays. This means greater potential returns, but also increased risk.

- Market Diversification: Access diverse asset classes, from commodities to equity indices, helping you spread risk and uncover new opportunities.

- Hedging Capabilities: Protect existing portfolios against adverse price movements by taking an opposing position in futures markets.

- Liquidity: Futures markets boast deep liquidity, ensuring efficient order execution and tighter spreads.

- Cost-Effective Trading: Enjoy competitive pricing and clear fee structures when you engage with these sophisticated trading products.

Explore Diverse Futures Markets Offered

IC Markets opens up a world of possibilities through its futures offerings. We connect you to major exchanges, providing access to a broad selection of futures across different categories. These are just some of the markets offered that you can explore:

| Futures Category | Description |

|---|---|

| Equity Index Futures | Trade on the performance of leading global stock market indices. |

| Commodity Futures | Speculate on essential raw materials like energy products, metals, and agricultural goods. |

| Currency Futures | Gain exposure to major currency pairs and manage foreign exchange risk. |

Our commitment is to provide you with the tools and access you need to navigate these complex yet rewarding markets. Futures contracts represent a powerful addition to your trading strategy, offering flexibility and potential for significant returns.

Ready to integrate futures into your trading toolkit? Discover the full scope of IC Markets Products and begin exploring these advanced financial instruments today. Take control of your trading future – join IC Markets and elevate your market participation.

Spreads and Commissions: What to Expect

Navigating the dynamic world of online trading means a clear understanding of the costs involved. Spreads and commissions are primary factors that directly impact your overall profitability. At IC Markets, we are committed to offering competitive and transparent pricing across our wide range of trading products. Let’s clarify what you can expect when you choose to trade with us.

Understanding Spreads

Spreads represent the difference between the bid and ask price of a financial instrument. We are renowned for our ultra-low spreads, particularly on our Raw Spread accounts. This means you gain access to raw market pricing directly from our diverse liquidity providers. Expect some of the tightest spreads in the industry, often starting from 0.0 pips on major currency pairs – a key differentiator among IC Markets Products. These tight spreads are crucial for active traders seeking to minimize transaction costs.

Unpacking Commissions

While spreads serve as our primary cost for many asset classes, commissions apply to specific account types, notably our Raw Spread accounts. These are typically charged per standard lot traded and remain highly competitive. For example, on forex pairs, you will find a clear, fixed commission per side. This transparent structure ensures you always know your exact transaction cost before you execute a trade across the various markets offered.

Factors Influencing Your Costs

Several elements can cause spreads to fluctuate or commissions to vary slightly:

- Liquidity: Highly liquid financial instruments generally feature tighter spreads.

- Market Volatility: During periods of high market volatility or major news events, spreads can temporarily widen.

- Time of Day: Spreads might appear wider outside of peak trading hours when overall market liquidity can be lower.

- Account Type: Your chosen account type significantly dictates whether you primarily pay through spreads or a combination of spreads and commissions.

Account Types at a Glance

| Account Type | Typical Spreads | Commissions | Best Suited For |

|---|---|---|---|

| Raw Spread Account | From 0.0 pips | Yes (per lot, very low) | Scalpers, high-frequency traders, Expert Advisors |

| Standard Account | From 0.6 pips | None | Discretionary traders, beginners, position traders |

“We believe in empowering our traders with transparent pricing and exceptional execution. Our commitment is to provide a trading environment where you can focus on your strategy, not hidden fees.”

By understanding the unique structure of our spreads and commissions, you can confidently select the account that best suits your trading style. This choice empowers you to optimize your cost efficiency across the diverse IC Markets Products available, ensuring you get the most out of all the markets offered.

Trading Platforms Supporting IC Markets Products

Choosing the right trading platform is paramount to success, acting as your essential gateway to the dynamic world of financial markets. At IC Markets, we understand this deeply, which is why we provide access to industry-leading platforms meticulously chosen to complement our extensive range of IC Markets Products. These platforms deliver stability, speed, and advanced tools, ensuring you can execute your strategies effectively across all asset classes.

MetaTrader 4 (MT4) remains the benchmark for forex trading platforms globally, revered by both novice and experienced traders. Its user-friendly interface and robust functionality make it an excellent choice for navigating the diverse financial instruments offered by IC Markets.

- Expert Advisors (EAs): Automate your trading strategies with a vast library of custom EAs, perfect for consistent execution.

- Advanced Charting Tools: Utilize numerous technical indicators and analytical objects to pinpoint market trends with precision.

- Customization: Personalize your trading environment to suit your unique style and preferences, enhancing your workflow.

- Reliability: Experience stable execution, a critical factor when trading fast-moving markets.

MT4 truly empowers traders to delve into the wide array of trading products, offering powerful features for detailed market analysis and swift order management.

Building on the solid foundation of MT4, MetaTrader 5 (MT5) offers an expanded feature set designed for multi-asset trading. If you are looking to broaden your horizons beyond just forex, MT5 provides enhanced tools to access an even wider range of markets offered.

- More Financial Instruments: Access additional asset classes, including stocks, futures, and cryptocurrencies, alongside traditional forex pairs.

- Greater Timeframes: Benefit from 21 timeframes for more granular market analysis, giving you deeper insights.

- Market Depth (DOM): Gain insight into market liquidity and order flow with the integrated Depth of Market feature.

- Improved Strategy Tester: Optimize your EAs with multi-threaded, faster backtesting capabilities, saving you valuable time.

MT5 is ideal for traders seeking a comprehensive solution to manage a diversified portfolio of IC Markets Products, offering unparalleled flexibility and advanced analytical power.

For traders who prioritize raw spreads, lightning-fast execution, and an intuitive, modern interface, cTrader stands out. This platform is specifically designed for ECN (Electronic Communication Network) trading, providing direct market access and unparalleled transparency.

| Feature | Benefit for Traders |

| Depth of Market (DOM) | Full market depth at multiple price levels, enhancing transparency. |

| Advanced Order Types | Utilize sophisticated order types like “Stop Loss & Take Profit on Entry” for precise control. |

| Sleek Interface | A modern, user-friendly design enhances the overall trading experience. |

| Fast Execution | Engineered for speed, crucial for high-frequency trading products and scalping strategies. |

cTrader’s robust features allow you to engage with various markets offered, from major currency pairs to commodities, with exceptional precision and control. It delivers a transparent and efficient environment for accessing IC Markets Products, catering to traders who demand an edge in execution and analysis.

No matter your trading style or the financial instruments you prefer, IC Markets provides a platform solution tailored to your needs. These powerful trading platforms ensure you have the tools to analyze, strategize, and execute trades across all our available trading products efficiently and reliably. Unlock your full trading potential by choosing the platform that best aligns with your goals and experience the difference firsthand.

MetaTrader Suite

Unlock your full trading potential with the powerful MetaTrader Suite, a cornerstone for many successful strategies. At IC Markets, we provide you access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), giving you the flexibility and tools to navigate diverse financial instruments across global markets.

MetaTrader 4: The Industry Standard

MetaTrader 4 remains the world’s most popular platform for good reason. It offers a robust and user-friendly environment, ideal for forex trading and beyond. You get advanced charting capabilities, a wide selection of technical indicators, and the flexibility to automate your strategies using Expert Advisors (EAs). Many traders find its stable performance and extensive community support invaluable when managing their trading products.

- Intuitive Interface: Easy for both beginners and experienced traders to master.

- Advanced Charting: Analyze price movements with precision using a variety of chart types and timeframes.

- Automated Trading: Deploy custom EAs to execute trades based on your predefined rules.

- Customization: Access thousands of custom indicators and scripts from a vast online community.

MetaTrader 5: Expanded Possibilities

Step up your game with MetaTrader 5, an evolution of the renowned MT4 platform. MT5 brings enhanced features and expanded market access, making it suitable for a broader range of asset classes. It offers more timeframes, additional analytical tools, a built-in economic calendar, and new order types. If you seek to diversify your portfolio across a wider array of markets offered, MT5 provides the advanced functionality you need.

| Feature | Benefit in MT5 |

|---|---|

| More Asset Classes | Trade stocks, indices, and commodities in addition to forex. |

| Increased Timeframes | Gain deeper market insights with 21 different timeframes. |

| Depth of Market (DOM) | View market liquidity and order book information. |

| Netting & Hedging Options | Manage your positions with greater flexibility. |

Why Choose the MetaTrader Suite with IC Markets Products?

Both MT4 and MT5 integrate seamlessly with IC Markets Products, giving you direct access to competitive spreads and lightning-fast execution. We ensure you have the best tools to implement your strategies effectively. Whether you prefer the classic reliability of MT4 or the advanced features of MT5, you are equipped with platforms built for performance and precision.

Ready to experience the power of the MetaTrader Suite? Dive into a world of diverse financial instruments and take control of your trading journey with confidence.

cTrader Ecosystem

The cTrader platform, a gem in the trading world, offers a sophisticated and intuitive environment. It stands out as a top choice for serious traders seeking speed, advanced charting, and transparent pricing. When you combine this powerful platform with the extensive offerings from IC Markets, you gain access to a truly exceptional trading experience. It’s an ecosystem built for precision and efficiency.

IC Markets leverages the cTrader platform to deliver an unparalleled array of trading products. This robust platform empowers you with deep liquidity and lightning-fast execution, making it ideal for scalpers and day traders. Its user-friendly interface does not compromise on functionality, providing a balance that appeals to both new and experienced market participants.

Here’s what makes the cTrader ecosystem shine:

- **Advanced Charting Tools:** Utilize a comprehensive suite of indicators and drawing tools for in-depth market analysis.

- **Level II Pricing:** See the full depth of the market with complete transparency, enabling smarter trading decisions.

- **Fast Order Execution:** Experience minimal latency, ensuring your trades execute at your desired prices without delay.

- **Customization:** Personalize your trading space with custom indicators and automated trading robots (cBots).

- **Diverse Markets:** Access a wide range of financial instruments, covering various asset classes.

Through the cTrader platform, you can explore the diverse markets offered by IC Markets with confidence. This includes major, minor, and exotic Forex pairs, along with various commodities, indices, and cryptocurrencies. The platform ensures you have the tools and access to capitalize on opportunities across these varied IC Markets Products.

We believe in providing you with superior technology. The cTrader ecosystem does exactly that, giving you an edge in the fast-paced world of trading. It’s a dynamic environment where clarity meets capability, allowing you to focus on your strategy and achieve your trading goals.

| Key Benefit | Trader Impact |

|---|---|

| Transparent Pricing | Better decision-making |

| High Performance | Reduced slippage |

| Analytical Depth | Enhanced strategy |

Account Types for IC Markets Products

Navigating the world of online trading begins with choosing the right foundation. At IC Markets, we understand that every trader has unique goals, strategies, and risk appetites. That’s why we offer distinct account types, each meticulously designed to optimize your experience across the extensive range of IC Markets Products. Selecting the perfect fit ensures you get the most out of our diverse financial instruments and the global markets offered.

Standard Account: Simplicity Meets Power

Our Standard Account is an excellent starting point, especially if you’re new to trading or prefer a straightforward, all-inclusive pricing structure. This account streamlines your costs, embedding them directly into a slightly wider spread.

- No Commissions: Trade without separate commission charges on your transactions.

- Competitive Spreads: Enjoy competitive spreads on popular trading products like Forex, Commodities, and Indices.

- Ideal For: Discretionary traders, those who prefer clarity on pricing without per-lot commissions, and anyone exploring various asset classes for the first time.

- Accessibility: Easy access to all IC Markets Products without additional complexities.

Raw Spread Account: Precision Trading, Unbeatable Spreads

For the serious, high-volume, or algorithmic trader, our Raw Spread Account (available on both MetaTrader and cTrader platforms) delivers truly institutional-grade pricing. We connect you directly to our deep liquidity pools, ensuring you receive some of the tightest spreads in the industry.

- Ultra-Tight Spreads: Experience spreads from 0.0 pips, particularly on major currency pairs.

- Transparent Commissions: A small, fixed commission applies per lot traded, ensuring full transparency.

- Ideal For: Scalpers, day traders, expert advisors (EAs), and anyone demanding the absolute lowest possible spreads to maximize their edge across all markets offered.

- Performance Focused: Engineered for optimal performance with automated strategies and high-frequency trading of diverse financial instruments.

Which Account is Right for You?

The choice largely depends on your trading style and priorities. Both accounts offer access to the full suite of IC Markets Products, but their cost structures cater to different preferences. Consider this quick comparison:

| Feature | Standard Account | Raw Spread Account |

|---|---|---|

| Spreads From | Typically from 0.6 pips | From 0.0 pips |

| Commissions | None | Low, per lot |

| Best For | Beginners, casual traders | Experienced, high-volume traders, EAs |

| Primary Cost | Wider spreads | Commissions + tight spreads |

No matter your experience level, choosing the correct account empowers you to trade confidently. Both options provide access to our vast selection of trading products, supported by excellent execution and client service. Unlock your trading potential by selecting the account that perfectly aligns with your strategy and journey with IC Markets.

Leverage and Margin Requirements: Key Considerations

Understanding leverage and margin is absolutely critical for anyone engaging with IC Markets Products. These powerful tools define your trading capacity and shape your risk exposure across all the markets offered. Get them right, and you unlock significant potential; misunderstand them, and you risk quick losses. Let’s demystify these core concepts.

Leverage essentially allows you to control a large position in the market with a relatively small amount of capital. Think of it as a loan provided by your broker to amplify your purchasing power. For instance, with 1:500 leverage, you can control a position worth $50,000 with just $100 of your own funds.

This amplification applies to both potential profits and potential losses, making it a double-edged sword when trading various financial instruments.

Margin is the actual amount of money required in your trading account to open and maintain a leveraged position. It’s not a fee, but rather a good-faith deposit that ensures you can cover potential losses. When you open a trade, a portion of your account balance is set aside as ‘initial margin’. If your trade moves against you, your account’s ‘free margin’ decreases. Should it fall below a certain level, you might face a ‘margin call’, prompting you to deposit more funds or close positions.

The leverage ratio directly impacts your margin requirements. A higher leverage ratio generally means a lower percentage of your total trade value is required as margin. However, this doesn’t reduce your overall market exposure or risk. It simply means you can open larger positions with less initial capital. It’s vital to remember that while the percentage might be small, the actual monetary value at risk can be substantial, especially across diverse asset classes.

Here’s why their interplay matters:

- Position Sizing: Leverage dictates how large a position you can take relative to your capital.

- Risk Management: Margin acts as a buffer against adverse price movements.

- Margin Calls: Insufficient margin can lead to forced closure of positions, protecting both you and the broker from deeper losses.

When exploring the wide range of IC Markets Products, from Forex to commodities and indices, you will encounter varying leverage and margin requirements. These differences are designed to reflect the inherent volatility and risk profile of each specific trading product.

Before you commit, ask yourself these questions:

| Consideration | Impact on Trading |

|---|---|

| Risk Tolerance | Does your chosen leverage align with your comfort level for potential losses? |

| Market Volatility | Highly volatile markets demand greater margin to withstand price swings. |

| Account Size | Ensure you have enough free margin to absorb drawdowns without a margin call. |

| Trading Strategy | Scalping often uses higher leverage, while long-term investing typically uses lower. |

Like any powerful tool, leverage and margin come with distinct advantages and disadvantages:

Pros:

- Increased Capital Efficiency: Trade larger positions with less initial capital.

- Amplified Profits: Magnify returns on successful trades.

- Diversification: Potentially open multiple positions across various markets offered.

Cons:

- Amplified Losses: Magnify losses on unsuccessful trades, potentially depleting your account quickly.

- Margin Calls: Risk of forced position closure if your account equity falls too low.

- Increased Stress: The amplified risk can lead to emotional decision-making.

Mastering leverage and margin is paramount for sustainable trading success with IC Markets Products. It’s about empowering your trades responsibly. We encourage you to thoroughly understand these concepts and practice robust risk management strategies. Ready to explore the possibilities? Join IC Markets today and apply these insights to a diverse selection of financial instruments.

Customer Support and Educational Resources

Navigating the exciting world of online trading can feel complex, especially when exploring the vast range of IC Markets Products. Whether you are just starting your journey or are a seasoned professional, reliable support and robust educational tools are crucial for sustained success. We commit to empowering every trader with confidence and clarity.

Unrivaled Customer Support at Your Fingertips

Imagine having a pressing question about your account or a specific financial instrument in the middle of a fast-moving market. Our award-winning customer support team stands ready to assist you around the clock, every day of the week. We offer multilingual support, ensuring you get help in a language you understand, eliminating barriers to effective communication.

You can reach our dedicated experts through various convenient channels:

- Live Chat: Get instant responses for urgent queries directly on our platform.

- Email Support: Send detailed inquiries or submit documentation with comprehensive responses in mind.

- Phone Assistance: Enjoy direct conversations with our team when you need immediate vocal guidance or in-depth explanations.

Our team helps with everything from platform navigation to technical troubleshooting, ensuring you can focus on mastering the diverse trading products available. We solve issues quickly, so you never miss an opportunity across the dynamic markets offered.

Comprehensive Educational Resources for Every Trader

Knowledge truly is power in the financial markets. We provide a comprehensive suite of educational resources designed to elevate your understanding and refine your trading skills. From beginner guides that lay the groundwork to advanced strategies that hone your edge, our materials cover it all, catering to all levels of experience.

Here’s what you can expect from our extensive library:

- Video Tutorials: Access step-by-step video guides on using our platforms effectively and executing various trades with precision.

- Live & Recorded Webinars: Participate in live sessions with expert analysts covering crucial topics like market analysis, trading psychology, and specific strategies for various financial instruments.

- In-Depth Articles & Guides: Read comprehensive explanations of market fundamentals, advanced technical analysis techniques, and essential risk management principles applicable across different asset classes.

- Trading Glossaries: Utilize clear, concise definitions of complex trading terminology, making even the most intricate concepts easy to grasp and understand.

These resources help you confidently explore the full spectrum of IC Markets Products. You learn how to analyze trends, manage risk effectively, and make informed decisions across the dynamic markets offered. They equip you to truly understand and capitalize on each of the trading products at your fingertips.

Our dedication to exceptional customer service and extensive educational content ensures you always have the backing you need to thrive. We empower you to grow as a trader, providing the tools and knowledge required to succeed in a competitive environment. Join us and discover a trading environment meticulously built with your success in mind.

Security and Regulation of IC Markets

Trust and security form the bedrock of any successful trading journey. At IC Markets, we prioritize your peace of mind above all else, embedding rigorous security protocols and adhering to stringent regulatory standards. We understand that knowing your investments are protected allows you to focus on what truly matters: your trading strategy.

A Foundation Built on Robust Regulatory Oversight

IC Markets operates under the watchful eyes of leading financial authorities across the globe. This multi-jurisdictional regulation demonstrates our commitment to transparency, accountability, and the highest standards of client protection. Each regulator sets strict guidelines we must follow, ensuring fair practices and secure operations across all our trading products.

Key Regulatory Bodies Protecting Our Clients:

- Australian Securities and Investments Commission (ASIC): Renowned for its stringent requirements, ASIC ensures IC Markets maintains robust capital adequacy, manages risk effectively, and upholds strong internal controls, safeguarding clients in Australia.

- Cyprus Securities and Exchange Commission (CySEC): For our European operations, CySEC provides a comprehensive regulatory framework, aligning with the Markets in Financial Instruments Directive (MiFID II). This means enhanced investor protection, transparent execution, and secure handling of funds for all asset classes.

- Financial Services Authority (FSA) Seychelles: Overseeing our global entity, the FSA Seychelles ensures we maintain a secure and compliant environment for international clients accessing the diverse markets offered.

Safeguarding Your Capital: Segregated Client Funds

One of the most critical security measures we implement is the complete segregation of client funds. All your deposits are held in separate trust accounts with top-tier banks, entirely distinct from IC Markets’ operational capital. This critical safeguard ensures that your money is secure and accessible, providing an essential layer of protection for every financial instrument you trade, regardless of market conditions.

Advanced Security Measures and Technology

Beyond regulatory compliance, we employ cutting-edge technology to fortify your trading environment. We protect your personal data and transactions with advanced encryption protocols, robust firewalls, and secure server infrastructure. Our commitment to data privacy is unwavering, preventing unauthorized access and maintaining the integrity of your sensitive information.

Why Our Security Framework Benefits Your Trading:

| Security Aspect | Direct Benefit to You |

|---|---|

| Regulatory Compliance | Ensures fair pricing, transparent execution, and clear dispute resolution across all IC Markets products. |

| Fund Segregation | Your capital is kept separate from company funds, offering peace of mind and security against unforeseen events. |

| Data Encryption | Protects your personal and financial information from cyber threats and unauthorized access. |

| Robust Infrastructure | Provides reliable trading platforms and uninterrupted access to the markets offered globally. |

Choosing IC Markets means partnering with a broker that places your security and trust at the forefront. We invite you to experience trading with confidence, knowing that a solid foundation of regulation and advanced security measures supports every step you take.

How to Get Started with IC Markets Products

Ready to explore the dynamic world of online trading? Getting started with IC Markets Products is straightforward and puts a vast array of global markets at your fingertips. We make the process simple, guiding you from setting up your account to placing your first trade with confidence.

Embarking on your trading journey with IC Markets involves a few clear steps, designed for efficiency and security. We prioritize a seamless onboarding experience so you can focus on what matters most: your trading strategy.

-

Open Your Trading Account

This is your first crucial step. Navigate to the IC Markets website and click ‘Open an Account’. You complete a quick registration form, providing basic personal details. We gather essential information to ensure compliance and create your secure trading profile.

-

Verify Your Identity

Regulatory compliance ensures a safe and transparent trading environment for everyone. Upload necessary identification documents, such as proof of identity and residence. Our dedicated team processes these swiftly, ensuring a smooth onboarding experience with minimal delay.

-

Fund Your Account

Choose from a wide range of secure deposit methods – including credit/debit cards, bank transfers, and various e-wallets. Funding your account is fast and convenient, enabling you to access IC Markets Products without unnecessary waiting. We support multiple currencies for your convenience.

-

Select Your Trading Platform

IC Markets offers industry-leading platforms like MetaTrader 4, MetaTrader 5, and cTrader. Each platform provides robust tools, advanced charting, and a user-friendly interface to manage your financial instruments. Explore them to find the platform that best suits your trading style and preferences.

-

Explore the Markets Offered

Once your account is funded and your platform is ready, you gain access to an incredible selection of trading products. Dive into Forex, commodities, indices, cryptocurrencies, and more. Understand the diverse markets offered across different asset classes before you begin to plan your trades.

-

Practice with a Demo Account

We strongly recommend starting with a free demo account. It allows you to practice trading strategies using virtual funds in a real-time market environment. This risk-free approach helps you build confidence and refine your skills before you commit real capital to the markets.

IC Markets offers competitive trading conditions, deep liquidity, and an unwavering commitment to customer support. Our comprehensive educational resources further empower you to navigate the complexities of global markets effectively.

Embark on your trading journey today. The expansive world of IC Markets Products awaits your exploration. Join our community and discover why traders globally trust us with their financial aspirations.

Account Opening Process

Ready to unlock a world of trading opportunities? Opening an account with us is a remarkably straightforward process, designed to get you trading with

IC Markets Products

swiftly and efficiently. We value your time, so we’ve streamlined every step.Here’s a simple breakdown of how you can gain access to our extensive range of

trading products

and start your journey:- Online Application: Begin by filling out our secure, user-friendly online application form. It requires basic personal details and typically takes only a few minutes to complete. We guide you through each section, making it easy to understand.

- Identity Verification: Upload the necessary identification and proof of residency documents. This crucial step ensures the security of your account and complies with regulatory standards. We process these documents quickly, often within hours.

- Fund Your Account: Once your account is verified, you can easily deposit funds using a variety of secure payment methods. Choose the option that best suits you to fund your account and prepare to explore diverse

financial instruments

. - Start Trading: With your account verified and funded, you gain immediate access to all the

markets offered

. You can then begin executing your trading strategies across variousasset classes

, from forex to commodities and more.

Our dedicated support team is always available to assist you if you have any questions or require guidance at any point during the account opening process. We are committed to providing a seamless experience from start to finish.

Why Choose IC Markets for Your Trading Needs

Making the right choice for your trading partner is critical for success in the dynamic financial markets. As an experienced SEO professional, I’ve seen countless platforms, but few truly stand out for their comprehensive offering and client-centric approach. IC Markets consistently earns its reputation as a leading broker, providing a robust environment for traders of all levels.

Here’s why many discerning traders place their trust in IC Markets:

Unrivaled Access to Diverse Markets

IC Markets offers an expansive selection of trading products, giving you the freedom to diversify your portfolio and capitalize on opportunities across various sectors. Whether you’re a seasoned pro or just starting, you will find an extensive suite of financial instruments at your fingertips.

The range of markets offered is truly impressive, spanning key asset classes. This broad access means you are not limited to just one or two options but can explore and execute strategies across a wide spectrum:

- Forex: Access over 60 currency pairs, benefiting from deep liquidity and competitive spreads.

- Indices: Trade CFDs on major global stock indices, allowing you to speculate on the performance of entire economies.

- Commodities: Engage with energy, metals, and agricultural products, diversifying your exposure to global resources.

- Cryptocurrencies: Tap into the exciting world of digital assets with CFDs on popular cryptocurrencies.

- Stocks: Execute trades on individual company shares from leading exchanges worldwide.

- Bonds: Trade government bonds from key economic regions, adding stability to your portfolio.

Superior Trading Conditions

IC Markets prioritizes optimal trading conditions designed to give you an edge. This commitment translates into several tangible benefits:

| Feature | Benefit to You |

|---|---|

| Ultra-Low Spreads | Significantly reduces your trading costs, enhancing potential profitability. |

| Fast Execution | Minimizes slippage and ensures your orders are filled promptly, crucial in volatile markets. |

| Deep Liquidity | Facilitates smooth execution of large orders without market disruption. |

| Flexible Leverage | Offers options to amplify your trading power responsibly. |

Advanced Technology and Support

We understand that powerful tools and reliable support are non-negotiable. IC Markets equips you with cutting-edge platforms and exceptional customer service:

“The right technology empowers traders, but responsive support builds lasting trust.”

- Industry-Leading Platforms: Choose from MetaTrader 4, MetaTrader 5, and cTrader, all renowned for their advanced charting tools, customizability, and automated trading capabilities.

- Seamless User Experience: These platforms provide intuitive interfaces, making analysis and trade execution straightforward.

- Responsive Customer Service: Access 24/7 multilingual support from a team ready to assist you with any query or issue.

In conclusion, when you evaluate your options, consider the robust array of IC Markets Products, the favorable trading conditions, and the strong technological backbone. It’s a compelling combination that empowers traders to pursue their financial goals with confidence.

Frequently Asked Questions

What types of financial instruments does IC Markets offer?

IC Markets provides a broad range of trading products across various asset classes, including Forex (major, minor, exotics), Commodities (metals, energy, agriculture), Global Stock Indices, Cryptocurrencies (CFDs), Stocks (CFDs on individual shares), and Government Bonds.

What trading platforms are available at IC Markets?

IC Markets supports industry-leading trading platforms such as MetaTrader 4 (MT4) for robust forex trading, MetaTrader 5 (MT5) for multi-asset trading with expanded features, and cTrader for ECN trading, known for raw spreads and fast execution.

What’s the difference between a Standard Account and a Raw Spread Account?

The Standard Account features no commissions with slightly wider spreads, suitable for beginners or casual traders. The Raw Spread Account offers ultra-tight spreads from 0.0 pips with a small, fixed commission per lot, ideal for scalpers, high-volume traders, and Expert Advisors.

How does leverage work at IC Markets and what are the risks?

Leverage allows you to control larger market positions with a smaller capital outlay, amplifying potential profits. However, it also magnifies potential losses, making robust risk management and a clear understanding of margin requirements crucial. Margin is the capital required to open and maintain leveraged positions.

How does IC Markets ensure the security of client funds?

IC Markets operates under the regulation of leading financial authorities like ASIC, CySEC, and FSA Seychelles. It ensures client funds are fully segregated in separate trust accounts with top-tier banks, distinct from the company’s operational capital, and employs advanced encryption for data protection.