Are you a forex trader constantly battling high transaction costs that eat into your profits? Imagine an environment where you can trade with spreads that are virtually non-existent, giving your strategies the edge they deserve. Welcome to the world of IC Markets Raw Spread, a game-changer for serious traders seeking unparalleled value and efficiency.

Our commitment to providing a genuine raw spread offering means you gain direct access to market pricing without unnecessary markups. This isn’t just about a low spread; it’s about minimizing your trading expenses to empower your financial growth.

Our commitment to providing a genuine raw spread offering means you gain direct access to market pricing without unnecessary markups.

The True ECN Advantage Behind Raw Spread

What exactly enables such an incredibly tight raw spread? It all comes down to our robust ECN trading model. IC Markets connects you directly to a vast network of over 50 different liquidity providers, including major banks and dark pool liquidity sources. This direct connection ensures you receive the best available bid and ask prices from multiple institutions in real-time.

In an ECN environment, there’s no dealing desk intervention. Your orders execute swiftly and transparently at market prices, reflecting true supply and demand. This setup is crucial for delivering the ultra-competitive pricing that defines our IC Markets Raw Spread account.

Efficiency in execution and transparency in pricing are the cornerstones of profitable trading. Our raw spread offering embodies both.

**Transform Your Trading with Ultra-Low Costs**

Choosing an account with a raw spread profoundly impacts your trading experience and profitability. Here are some of the direct benefits you unlock:

- Significant Cost Reduction: Experience some of the lowest spread values available, often averaging 0.1 pips on EUR/USD. This translates directly into more money staying in your pocket.

- Enhanced Strategy Performance: Scalpers, high-frequency traders, and automated systems thrive in a low spread environment. Your entry and exit points become more precise, improving the viability of strategies that rely on small price movements.

- Fair and Transparent Pricing: See the actual market price. Our raw spread reflects the true cost of accessing liquidity, free from artificial widenings.

- Access to Zero Spread Opportunities: During periods of high market liquidity, you might frequently see spreads of 0.0 pips – a true zero spread – on major currency pairs. This exceptional condition offers unparalleled trading value.

During periods of high market liquidity, you might frequently see spreads of 0.0 pips – a true zero spread – on major currency pairs. This exceptional condition offers unparalleled trading value.

**Raw Spread vs. Standard Spread: A Quick Look**

Understanding the difference is key to appreciating the value. While a standard spread account bundles a broker’s markup into the spread, our raw spread offers the interbank rate, with only a small, fixed commission per lot traded.

| Feature | IC Markets Raw Spread | Typical Standard Spread |

|---|---|---|

| Spread | Interbank, often near zero | Broker-marked up, wider |

| Commission | Small fixed per lot | Included in spread (hidden) |

| Transparency | High | Lower |

When you opt for IC Markets Raw Spread, you gain access to an environment built for performance. Expect average spreads on EUR/USD as low as 0.1 pips, complemented by a transparent commission structure designed to keep your overall trading costs minimal. This setup is ideal for traders who execute a high volume of trades or those who demand the tightest possible market access for their precision strategies.

Don’t let high trading costs hold back your potential. Explore the genuine benefits of an ultra-low spread environment and discover how IC Markets Raw Spread can empower your journey toward trading success. Join a community that values fairness, transparency, and superior trading conditions.

- What is the IC Markets Raw Spread Account?

- Key Features of the Raw Spread Account

- Raw Spread vs. Standard Account Spreads

- Advantages of Choosing a Raw Spread Account

- Comparing Raw Spread vs. Standard Account Offerings

- Understanding the Raw Spread Account

- Exploring the Standard Account

- Key Differences at a Glance

- Which Account Suits Your Trading Style?

- Key Differences in Cost Structure

- Suitability for Different Trading Styles

- The Core Benefits of Trading with Raw Spreads

- Understanding IC Markets Raw Spread Commission Details

- Calculating Your Trading Costs Accurately

- Demystifying Spreads: Your Primary Cost

- Beyond the Spread: Unpacking Other Trading Fees

- The Advantage of True Cost Transparency

- Factors Affecting Commission Rates

- How IC Markets Achieves Consistently Tight Spreads

- Trading Instruments Available on Raw Spread Accounts

- Forex Pairs: Experience Ultra-Tight Spreads

- Commodities: Trade Precious Metals and Energies

- Indices: Global Market Exposure with Minimal Costs

- Cryptocurrencies: Innovative Trading with Reduced Spreads

- Minimum Deposit Requirements for IC Markets Raw Spread

- Leverage Options for Raw Spread Account Holders

- Execution Speed and Minimizing Slippage on Raw Spreads

- The Crucial Role of Execution Speed

- Understanding and Combating Slippage

- IC Markets’ Commitment to Ultra-Fast Execution

- Minimizing Slippage with IC Markets Raw Spread

- Is the IC Markets Raw Spread Account Right for Your Strategy?

- Understanding the Raw Spread Advantage

- Matching the Account to Your Trading Style

- Key Considerations: Spreads vs. Commissions

- Is It for You? A Quick Assessment

- Step-by-Step Guide to Setting Up Your IC Markets Raw Spread Account

- 1. Initiate Your Journey: Start Registration

- 2. Select Your Trading Account Type

- 3. Complete Personal Information and Verification

- 4. Fund Your Account and Begin Trading

- Why Choose an IC Markets Raw Spread Account?

- Customer Support for IC Markets Raw Spread Traders

- Security, Regulation, and Trust in IC Markets

- A Foundation Built on Strong Regulation

- Protecting Your Capital and Data

- Transparency: The Cornerstone of Trust

- Advanced Trading Tools and Platforms for Raw Spread Users

- Unleashing Potential with Superior Platforms

- Key Tools That Give You the Edge

- Real-World Trader Experiences with IC Markets Raw Spreads

- Testimonials and Performance Reviews

- What Our Traders Highlight

- The Raw Spread Advantage: A Closer Look

- Voices from Our Community

- Frequently Asked Questions

What is the IC Markets Raw Spread Account?

The IC Markets Raw Spread Account offers a truly competitive edge for serious traders. It’s an account type specifically designed to provide you with the tightest possible pricing directly from liquidity providers. When you choose this account, you experience the market in its purest form, minimizing your trading costs and maximizing your potential.

Key Features of the Raw Spread Account

- Direct Market Access: You get direct access to bid and ask prices without any added markup from the broker.

- Ultra-Low Spreads: We provide incredibly low spread values, often starting from 0.0 pips on major currency pairs. This truly reflects the interbank market.

- Transparent Commission Structure: Instead of a hidden markup in the spread, you pay a small, fixed commission per standard lot traded. This makes your trading costs clear and predictable.

- ECN Trading Environment: This account operates within a genuine ECN trading environment, ensuring deep liquidity and fast execution.

The core concept behind the IC Markets Raw Spread Account is simple: give traders the real price. Many brokers build their profit into a wider spread. With a raw spread account, you see the actual bid and ask prices from our pool of liquidity providers. This means you often encounter spreads that are exceptionally tight, sometimes even approaching zero spread during peak liquidity periods.

“Experience genuine market pricing with the IC Markets Raw Spread Account – where transparency and low costs drive your trading.”

This approach benefits high-volume traders, scalpers, and those employing automated strategies. Every pip matters in these trading styles, and the IC Markets Raw Spread Account helps you keep more of your profits.

Raw Spread vs. Standard Account Spreads

Understanding the difference helps clarify why the Raw Spread Account stands out:

| Feature | Raw Spread Account | Standard Account (Example) |

|---|---|---|

| Spread Model | Raw interbank spreads, often from 0.0 pips | Wider spreads (broker markup included) |

| Commission | Small, fixed commission per lot | Typically no commission |

| Pricing Transparency | High; costs are split (spread + commission) | Lower; costs are embedded in the spread |

Advantages of Choosing a Raw Spread Account

- Reduced Trading Costs: Benefit from the narrowest spreads available, making your trades more cost-effective.

- Enhanced Execution: The ECN trading model helps ensure quick order execution with minimal slippage in liquid markets.

- Optimal for Advanced Strategies: Ideal for traders who rely on precise entry and exit points, such as scalpers and high-frequency traders.

- Greater Control: You have a clearer picture of your trading costs, allowing for better risk management and strategy optimization.

Ultimately, the IC Markets Raw Spread Account empowers you with a trading environment built on speed, precision, and ultra-low spread costs. It’s for traders who demand the best possible market conditions to execute their strategies effectively.

Comparing Raw Spread vs. Standard Account Offerings

Navigating the world of online trading means making crucial decisions, and your choice of account type stands as one of the most significant. It directly impacts your trading costs and overall strategy. Today, we break down two primary offerings: the Raw Spread account and the Standard account, helping you understand which path aligns best with your trading aspirations.

Understanding the Raw Spread Account

The Raw Spread account is designed for serious traders seeking the tightest possible market pricing. With this account type, you access spreads directly from liquidity providers, often seeing them as low as 0.0 pips. This means the spread, the difference between the bid and ask price, can effectively be a zero spread on major currency pairs during active market hours. This transparent pricing model, characteristic of ECN trading environments, allows you to enter and exit trades with minimal slippage and direct market access.

While the raw spread itself is ultra-low, a small, fixed commission applies per standard lot traded. This structure appeals to those who prioritize precise cost calculation and seek to minimize the spread component of their transaction costs. If you are a high-volume trader or employ strategies like scalping, the benefits of a consistently low spread can significantly impact your profitability.

Exploring the Standard Account

In contrast, the Standard account offers a simpler cost structure, especially appealing to newer traders or those who prefer an all-inclusive pricing model. With a Standard account, the broker’s compensation is built directly into the spread. This means you won’t pay a separate commission fee per trade.

The spreads on a Standard account are typically wider than those you’d find on a Raw Spread account, but they are still competitive and provide a straightforward trading experience. For swing traders or those holding positions for longer periods, the slight difference in spread often becomes less critical than the absence of recurring commission fees. It simplifies budgeting and makes the trading process more intuitive without needing to factor in additional costs per lot.

Key Differences at a Glance

Let’s put these two account types side-by-side to highlight their distinguishing features:

| Feature | Raw Spread Account | Standard Account |

|---|---|---|

| Spread | Ultra-low (often near zero spread) | Typically wider, all-inclusive |

| Commission | Fixed commission per lot traded | No separate commission |

| Cost Structure | Spread + Commission | Spread only |

| Ideal For | Scalpers, HFT, ECN trading enthusiasts | Newer traders, swing traders, simplicity |

| Transparency | Direct market pricing, high transparency | Simpler, spread integrated |

Which Account Suits Your Trading Style?

Choosing between a raw spread and a Standard account boils down to your individual trading strategy, frequency, and preference for cost structure. If you demand the absolute lowest spread possible, even if it means paying a small commission, then an IC Markets Raw Spread account is likely your best fit. It empowers strategies that thrive on minimal price differences and high trade volumes. You get direct access to institutional-grade liquidity, which is the hallmark of true ECN trading.

However, if you prefer a simpler fee structure without separate commissions, and your strategy isn’t hyper-sensitive to microscopic spread differences, the Standard account offers an excellent, hassle-free experience. Both options provide robust trading environments; the ultimate choice empowers you to optimize your trading costs and execution to match your unique objectives.

Ready to make an informed decision? Explore the detailed specifications of each account type to see which one perfectly aligns with your trading goals and helps you maximize your potential.

Key Differences in Cost Structure

Understanding trading costs is crucial for every successful trader. The “spread” represents the difference between a currency pair’s buy and sell price, a fundamental cost in forex trading. Not all spreads are created equal, and recognizing the distinct cost structures offered by brokers can significantly impact your profitability.

Most brokers offer a standard spread account. Here, the broker typically adds a markup to the interbank rate. This means the spread you see already includes their fee. While seemingly simpler, these spreads are often wider, especially during volatile market conditions. This model can make precise entry and exit points more challenging to gauge.

However, an alternative model, often found with ECN brokers, provides a far more transparent approach: the raw spread. With IC Markets Raw Spread accounts, you access spreads directly from top-tier liquidity providers. This means you get the interbank spread without the typical broker markup. The result is an incredibly low spread, sometimes as tight as 0.0 pips on major pairs, though 0.1 or 0.2 pips are more common.

The key distinction lies in how the broker earns revenue. When you trade with a raw spread account, a small, fixed commission applies per lot traded. This structure ensures that your actual trading cost remains highly transparent and competitive. Contrast this with standard accounts where the broker’s compensation is baked directly into that wider spread.

Consider these fundamental differences:

| Feature | Standard Spread | Raw Spread (e.g., IC Markets) |

|---|---|---|

| Spread Width | Wider, includes broker markup | Extremely tight, direct from liquidity providers |

| Broker Revenue | Built into the wider spread | Fixed commission per lot traded |

| Transparency | Less direct cost visibility | High, clear distinction between spread and commission |

| Trading Environment | Often market maker model | Typically ECN trading environment |

Choosing an account with a raw spread, like the one offered by IC Markets, gives you access to an ECN trading environment designed for execution speed and minimal slippage. This model brings you closer to what many consider the ideal of zero spread trading, by presenting the market’s true cost and separating the broker’s fee into a clear, predictable commission. Understanding these differences empowers you to select a cost structure that best aligns with your trading strategy and financial goals.

Suitability for Different Trading Styles

Your unique approach to the markets dictates the tools you need to succeed. Different trading styles demand different conditions, and understanding these nuances helps you choose the right environment. We built the IC Markets Raw Spread account with this diversity in mind, ensuring it caters to a wide spectrum of strategies.

For traders who execute frequent entries and exits, minimizing transaction costs becomes paramount. This is where a truly competitive offering shines.

- Scalpers and High-Frequency Traders: If you’re a scalper, every pip counts. Your strategy relies on capturing small price movements many times a day. Our incredibly tight raw spread, often hitting near zero spread during peak liquidity, gives you the edge you need. This direct access to the interbank market via our ECN trading model drastically reduces your costs per trade, making your high-volume strategy more viable and potentially more profitable.

- Day Traders: As a day trader, you open and close positions within the same trading day, navigating intraday volatility. You might not trade as frequently as a scalper, but a low spread still significantly impacts your bottom line across multiple daily trades. The consistently low spread environment helps keep your trading expenses down, allowing more of your successful trades to translate into actual gains.

- Swing and Position Traders: Even if you hold positions for days or weeks, transaction costs add up over time. While not as critical as for scalpers, the benefits of a low spread remain substantial. It improves your entry and exit points and reduces the overall cost burden, leaving more room for your long-term strategies to flourish without being eroded by hefty trading fees.

The IC Markets Raw Spread account empowers traders across the board. Whether you’re chasing fleeting pips or building long-term positions, our commitment to providing a genuine raw spread environment ensures you get an edge. Experience the difference minimal trading costs can make for your preferred trading style.

The Core Benefits of Trading with Raw Spreads

In the dynamic world of financial markets, every edge counts. Savvy traders constantly seek ways to optimize their strategies and maximize potential returns. One of the most significant factors influencing your profitability is the spread—the difference between the buy and sell price of an asset. For those serious about their trading, understanding the power of a raw spread can truly revolutionize their approach.

Trading with an incredibly low spread isn’t just a minor advantage; it’s a fundamental shift that directly impacts your bottom line. It means less of your capital goes towards transaction costs and more stays in your pocket, ready for your next strategic move. This approach offers a clear path to greater efficiency and enhanced potential earnings.

Unlocking Superior Cost Efficiency. The primary draw of a raw spread environment is its unparalleled cost efficiency. Unlike standard accounts where brokers often add a markup to the interbank spread, raw spread accounts pass on spreads directly from liquidity providers. This means you’re seeing the true market price, often hovering near zero spread during peak liquidity, especially on major currency pairs.

Consider the cumulative impact: every trade you make, big or small, incurs a cost. When these costs are minimized, your breakeven point is lower, and your potential for profit increases significantly. This is especially critical for scalpers or high-frequency traders who execute numerous trades daily, where even tiny differences in spread can add up to substantial savings over time.

Direct Market Access and Transparency with ECN Trading. A key aspect intertwined with raw spreads is the underlying execution model: ECN trading (Electronic Communication Network). When you trade with an ECN broker offering raw spreads, you gain direct access to a pool of liquidity providers. This cuts out the middleman, ensuring you receive the best available bid and ask prices from multiple sources.

This transparent model provides several advantages:

- Authentic Pricing: You see real-time market prices without broker intervention or requotes.

- Reduced Conflicts of Interest: The broker profits from commissions, not from your losses, aligning their interests with yours.

- Faster Execution: ECN environments often boast lightning-fast execution speeds, crucial for entering and exiting volatile markets precisely.

Enhanced Strategy Predictability. For traders who rely on technical analysis and precise entry/exit points, the predictability offered by a raw spread is invaluable. Wide or fluctuating spreads can introduce unexpected slippage, making it difficult to execute strategies as planned. With a consistent, tight raw spread, you can:

- Backtest with Accuracy: Your historical data analysis will more closely mirror live trading conditions.

- Improve Live Execution: Enter and exit trades closer to your intended price, reducing unforeseen costs.

- Manage Risk Better: More predictable trading costs lead to more accurate risk-reward calculations.

For example, comparing spread costs across different models:

| Spread Type | Broker Markup | Typical Cost Structure |

|---|---|---|

| Standard Account | Included in spread | Wider variable spread |

| Raw Spread Account | Separate commission | Ultra-low spread + fixed commission |

Embracing a platform that prioritizes a genuine IC Markets Raw Spread offering means you’re choosing a trading environment built on fairness, efficiency, and transparency. It empowers you to navigate the markets with a powerful advantage, ensuring more of your hard-earned capital works for you, not against you.

Understanding IC Markets Raw Spread Commission Details

When you navigate the fast-paced world of financial markets, every pip counts. Smart traders know that trading costs significantly impact profitability. This is where the IC Markets Raw Spread offering truly stands out, presenting a clear, transparent pricing model that appeals to both scalpers and long-term position traders alike.

Simply put, a raw spread represents the true market spread you receive directly from liquidity providers, with no artificial mark-up. Imagine getting rates straight from the interbank market. This means you experience incredibly low spread values, often just a few tenths of a pip, during active market hours. Traders choose this model specifically for its unparalleled transparency and competitive pricing, aiming to minimize the difference between the bid and ask prices.

Unlike some brokers who embed their costs into a wider spread, IC Markets utilizes a transparent commission structure alongside its raw spread. This approach means you always see the actual market price, and the brokerage fee is separate and clearly defined.

Here’s a breakdown of the typical commission applied to forex trading:

- Per Lot, Per Side: Commissions are typically charged per standard lot (100,000 units of base currency) traded.

- Round Turn: This means a commission is charged when you open a trade and again when you close it, effectively a ’round turn’ fee.

- Standard Rate: For standard forex pairs, the commission is typically around $3.50 per lot per side, totaling $7.00 for a round turn.

This model ensures you always know exactly what you’re paying.

The design behind the IC Markets Raw Spread and commission model aligns perfectly with the principles of ECN trading. ECN (Electronic Communication Network) brokers connect traders directly to liquidity providers, bypassing dealing desks. This setup fosters a competitive environment, driving spreads down. By separating the commission, IC Markets offers a true ecn trading experience. You get unadulterated market prices, allowing for precise entry and exit strategies, crucial for successful trading.

Adopting the IC Markets Raw Spread model offers distinct advantages for active traders:

- Unbeatable Low Spread: Access spreads that are often close to zero spread on major pairs during peak liquidity.

- Transparent Costing: Clearly understand your trading costs, as commissions are separate from the market spread.

- Precision Trading: Execute trades at precise market prices without hidden mark-ups, vital for strategies like scalping.

- Reduced Slippage Potential: With tighter spreads and deep liquidity, the potential for significant slippage can be reduced, especially in fast markets.

- ECN Trading Advantage: Benefit from genuine interbank pricing and execution, putting you on a level playing field with institutional traders.

Understanding the IC Markets Raw Spread commission details empowers you to make informed trading decisions. This model isn’t just about low cost; it’s about unparalleled transparency and a direct connection to the market. For those seeking a truly competitive and fair trading environment, exploring the IC Markets Raw Spread accounts is a wise move.

Calculating Your Trading Costs Accurately

Understanding your trading costs is not just an accounting exercise; it’s fundamental to your profitability. Every pip, every dollar, directly impacts your bottom line. Successful traders know their true expenses before they even open a position. This precision helps you craft effective strategies and make informed decisions.

Demystifying Spreads: Your Primary Cost

The spread is often the most significant cost in forex trading. It represents the difference between the bid and ask price of a currency pair. Different brokers offer various spread models. A key model many savvy traders seek is the raw spread. This type of spread is directly reflective of the market price, often starting from 0.0 pips. This means you get the most accurate, unfiltered pricing available.

For instance, the IC Markets Raw Spread model provides access to interbank pricing, which results in remarkably low spread conditions. You gain transparency, seeing the true cost without significant markups hidden within the spread itself.

Beyond the Spread: Unpacking Other Trading Fees

While spreads are crucial, they are not your only cost. Smart traders also consider these:

- Commissions: Often charged per lot traded, especially in environments offering raw spread or zero spread accounts. Commissions are a transparent, fixed fee that complements the raw market price.

- Swap Rates: These are interest charges or credits for holding positions overnight. They vary by currency pair and can significantly impact long-term trades.

- Slippage: The difference between your expected trade price and the actual executed price. While not a direct fee, slippage impacts your total cost and profitability, especially during volatile market conditions.

The Advantage of True Cost Transparency

Trading with a broker that offers genuine raw spread and clear commission structures gives you a distinct edge. This model is characteristic of ECN trading environments, where orders are matched directly with liquidity providers, minimizing intermediaries.

“Knowing your exact cost per trade allows for precise risk management and profit targeting. It separates guesswork from strategic execution.”

Here’s why accurate cost calculation matters:

| Benefit | Impact on Trading |

|---|---|

| Better Strategy | Incorporate exact costs into profit targets and stop-loss levels. |

| Improved Profitability | Minimize expenses to maximize net gains from successful trades. |

| Fair Comparison | Evaluate brokers based on total effective cost, not just advertised numbers. |

| Reduced Surprises | No hidden fees mean you always know your potential outlay. |

By focusing on brokers like those providing the IC Markets Raw Spread, you empower yourself with the clarity needed to navigate the markets effectively and build a truly profitable trading journey.

Factors Affecting Commission Rates

Understanding the elements that shape commission rates is crucial for any trader aiming to optimize their trading costs. These rates are not arbitrary; rather, they reflect a complex interplay of market dynamics, broker models, and your trading habits. Let’s break down the key factors influencing what you pay.

The type of trading account you choose often dictates its commission structure. For instance, ECN accounts are synonymous with raw spread environments. With ECN trading, you typically access interbank market prices directly from liquidity providers. This means you often see incredibly tight spreads, sometimes even close to zero spread during highly liquid times. However, in exchange for these low spread offerings, brokers usually charge a transparent, fixed commission per lot traded. This model, exemplified by platforms offering IC Markets Raw Spread options, provides clarity on both the spread and the commission component.

- Standard Accounts: These often feature wider spreads but carry no explicit commission. The broker’s profit is built directly into the spread you pay.

- ECN/Raw Spread Accounts: They offer extremely tight raw spread prices directly from liquidity, paired with a small, transparent commission per trade.

- Zero Spread Accounts (Hybrid): While they advertise “zero spread,” these models often compensate through slightly higher commissions or other hidden fees. Always scrutinize the full cost structure.

Your trading activity significantly impacts potential commission rates. Brokers often incentivize higher-volume traders with tiered commission structures. The more you trade, the lower your per-lot commission might become. This tiered approach rewards active participation, making a low spread environment even more cost-effective for frequent traders.

| Monthly Volume (Lots) | Typical Commission per Lot (Round Turn) |

|---|---|

| Under 50 | $7.00 |

| 50 – 199 | $6.50 |

| 200 – 499 | $6.00 |

| 500+ | Negotiable (Often Lower) |

Not all instruments are created equal when it comes to commissions. Forex pairs generally have lower commissions compared to, say, CFDs on individual stocks or certain cryptocurrencies. Volatility and liquidity also play a role. During periods of high market volatility or low liquidity, even a raw spread might temporarily widen, potentially affecting the overall cost perception, though the commission component usually remains fixed.

“Understanding your broker’s pricing model, especially regarding raw spread and commission, is key to managing your trading expenses effectively.”

A broker’s ability to source deep liquidity directly impacts the tightness of their raw spread offerings. Brokers with strong relationships with multiple top-tier liquidity providers can offer more competitive spreads and, consequently, more attractive commission rates. Their technological infrastructure also matters; efficient execution technology ensures that you get the best available prices, minimizing slippage and optimizing your overall transaction costs.

How IC Markets Achieves Consistently Tight Spreads

You want to maximize your trading potential, right? Every dollar saved on transaction costs goes directly into your pocket. That’s why consistently tight spreads are a game-changer for serious traders. IC Markets understands this deeply, and their commitment to providing a superior trading environment is evident in their exceptionally low spread offerings.

At the core of IC Markets’ ability to deliver such competitive pricing lies its true ECN (Electronic Communication Network) trading model. Forget about dealing desks or re-quotes. With true ECN trading, you gain direct access to an aggregated pool of liquidity. This means you trade directly against prices provided by the world’s leading financial institutions, ensuring transparency and fairness in every transaction.

Imagine a bustling marketplace where countless sellers compete fiercely for your business. IC Markets cultivates an extensive network of over 50 different liquidity providers, including major banks and dark pool liquidity sources. This intense competition among providers directly translates into a tighter raw spread for you. More participants mean more aggressive pricing, constantly pushing bid and ask prices closer together.

- Diverse Pool: Over 50 top-tier banks and dark pool liquidity sources contribute to robust liquidity.

- Real-time Bidding: Continuous, aggressive competition drives prices lower.

- Best Available Price: The system automatically selects the most favorable prices from all providers.

This powerful aggregation ensures that regardless of market conditions, you often encounter very appealing conditions. During highly liquid periods, spreads can even approach a zero spread. This commitment to delivering a true ECN experience directly benefits every trader looking for cost-effective execution.

Exceptional spreads are not just about liquidity; they’re also about speed and efficiency. IC Markets invests heavily in state-of-the-art trading infrastructure. Ultra-low latency connectivity to their liquidity providers and powerful servers, strategically located near major financial data centers, minimize execution delays. This technical prowess ensures that the tight prices you see are the prices you get, with minimal slippage.

Their advanced pricing engine constantly scans and aggregates quotes, presenting you with the tightest available bid-ask prices in real time. This technological edge is fundamental to offering the IC Markets Raw Spread account, which is renowned for its incredible value and competitive edge.

| Key Element | Impact on Spreads |

|---|---|

| Multiple Liquidity Providers | Drives intense competition, resulting in lower bid/ask spreads. |

| ECN Technology | Provides direct market access, eliminating dealer intervention. |

| High Trading Volume | Allows IC Markets to negotiate better rates from liquidity providers, passing savings to you. |

By combining deep liquidity with superior technology, IC Markets consistently achieves what many other brokers cannot: a genuinely competitive and low spread environment. This means more effective trading and reduced costs, empowering you to execute your strategies with confidence. If you’re serious about minimizing trading costs, understanding the mechanics behind IC Markets’ raw spread offering is crucial. It sets a new standard for efficient and cost-effective trading.

Ready to experience the difference for yourself?

Trading Instruments Available on Raw Spread Accounts

Unlock the full potential of your trading strategy with the diverse range of instruments available on IC Markets Raw Spread accounts. We provide a premier trading environment designed for serious traders seeking the absolute lowest possible costs. Our commitment to offering a true raw spread ensures you get spreads from 0.0 pips, coupled with a small, transparent commission. This setup is ideal for scalpers, high-volume traders, and anyone aiming for precision in their execution.

Forex Pairs: Experience Ultra-Tight Spreads

The cornerstone of any great trading platform, our Forex offering truly shines on a raw spread account. You gain access to over 60 currency pairs, from major pairs like EUR/USD and GBP/USD to exotic and minor crosses. The advantage here is significant: you experience incredibly low spread values, often starting from 0.0 pips. This means the market price dictates your entry and exit points with minimal broker markup, reflecting a genuine ECN trading environment where liquidity providers compete to offer the best prices.

Commodities: Trade Precious Metals and Energies

Diversify your portfolio by trading a wide array of commodities. Our raw spread accounts give you access to popular assets such as Gold, Silver, Crude Oil, and Natural Gas. With these instruments, you benefit from highly competitive low spread offerings, allowing you to capitalize on market movements with greater efficiency. Whether you’re speculating on global economic trends or hedging existing positions, the cost-effectiveness of our spreads enhances your profit potential.

Indices: Global Market Exposure with Minimal Costs

Tap into the performance of leading global economies by trading major stock indices. Our raw spread accounts offer access to key indices like the S&P 500, Dow Jones Industrial Average, DAX 40, and FTSE 100. When trading these instruments, the ultra-tight spreads become a distinct advantage, especially for day traders and those employing high-frequency strategies. You achieve broader market exposure without absorbing unnecessary costs, which can significantly impact your bottom line over time.

Cryptocurrencies: Innovative Trading with Reduced Spreads

Engage with the dynamic world of cryptocurrencies through our raw spread accounts. We offer popular digital assets such as Bitcoin, Ethereum, Litecoin, and Ripple against the USD. While cryptocurrency markets can exhibit higher volatility, our commitment to providing a raw spread helps mitigate your trading costs. This ensures you can react quickly to market shifts, with the spread reflecting the true underlying market conditions rather than an inflated broker markup. It’s a prime example of how an ECN trading model benefits even emerging asset classes.

Here’s a quick overview of instrument categories and their benefits on raw spread accounts:

| Instrument Type | Key Raw Spread Benefit |

|---|---|

| Forex | Spreads from 0.0 pips, ideal for precision trading |

| Commodities | Highly competitive low spread for Gold, Oil, etc. |

| Indices | Access global markets with reduced entry/exit costs |

| Cryptocurrencies | Minimize trading costs on volatile digital assets |

Minimum Deposit Requirements for IC Markets Raw Spread

Are you ready to experience trading with the market’s true pulse? Trading with IC Markets Raw Spread accounts offers unmatched transparency and incredibly tight pricing directly from top-tier liquidity providers. Many aspiring traders wonder about the entry point for such a powerful setup. Let’s get straight to the facts about getting started.

To open an IC Markets Raw Spread account and access direct interbank pricing, you need a minimum deposit of $200 USD. This initial commitment ensures you can fully leverage the advanced trading environment and benefit from the highly competitive spreads that define ECN trading.

This minimum deposit acts as your gateway to a trading experience designed for precision and cost-efficiency. Here’s what this threshold unlocks:

- True Raw Spread Access: You connect directly to institutional-grade liquidity, seeing the genuine bid and ask prices with minimal markup.

- Exceptional Value: For this investment, you gain access to an environment where spreads can often be 0.0 pips on major currency pairs, especially during peak market hours. Our goal is to provide the lowest possible spread.

- ECN Trading Advantage: You participate in a true ECN trading model, which means faster execution and no dealing desk intervention. This transparency is crucial for serious traders.

- Competitive Cost Structure: Instead of wider spreads, you pay a small, fixed commission per lot, making your trading costs predictable and often significantly lower overall. Many clients seek a near zero spread experience, and this structure helps achieve that.

We understand that every dollar counts. That’s why we ensure this minimum deposit delivers immense value, providing a professional trading platform for those serious about optimizing their strategies. Join IC Markets today and discover the difference a genuinely low spread trading environment makes to your success.

Leverage Options for Raw Spread Account Holders

Unlocking the full potential of your trading journey begins with smart decisions, and for those holding an IC Markets Raw Spread account, understanding leverage is paramount. This powerful tool amplifies your market exposure, letting you capitalize significantly on even the smallest price movements. When you combine carefully selected leverage with the incredibly tight raw spread available, you position yourself to maximize every trading opportunity. We empower you to make informed choices that align with your trading strategy and risk appetite.

Simply put, leverage allows you to control a larger position in the market with a relatively small amount of capital. It’s essentially a temporary loan provided by your broker. For instance, with 1:500 leverage, a $1,000 deposit can control a $500,000 position. This magnifying effect is particularly appealing to those seeking to optimize the inherent advantages of a low spread environment.

Traders opting for an IC Markets Raw Spread account often do so to benefit from highly competitive pricing, with typical average spreads being exceptionally low – sometimes even near zero spread during active market conditions thanks to deep liquidity providers in an ECN trading environment. Leverage takes this advantage and intensifies it. Imagine securing a profitable trade with a minimal raw spread. With leverage, the absolute profit on that trade can be substantially larger, turning tiny market fluctuations into meaningful gains.

However, the choice of leverage is not one-size-fits-all. Several key factors determine the maximum leverage available and the optimal level for your trading style:

- Regulatory Requirements: Different jurisdictions have varying rules on the maximum leverage brokers can offer. These regulations aim to protect traders.

- Trading Instrument: Forex majors often allow for higher leverage compared to commodities, indices, or cryptocurrencies, which tend to have lower caps due to their volatility.

- Account Balance: In some cases, very large account balances might have slightly adjusted maximum leverage options.

- Individual Risk Tolerance: Ultimately, the most crucial factor is your personal comfort level with risk. Higher leverage means higher potential gains, but also higher potential losses.

Higher leverage means higher potential gains, but also higher potential losses.

We provide flexible leverage options, allowing you to choose a level that suits your experience and strategy. While the allure of high leverage is strong, responsible risk management is crucial. Always consider the potential impact on your margin requirements and utilize protective measures like stop-loss orders to safeguard your capital. Our goal is to equip you with the tools to trade confidently, making the most of the low spread environment.

Here’s a general overview of how leverage might vary across different asset classes:

| Asset Class | Typical Maximum Leverage | Considerations |

| Forex Majors | Up to 1:500 (or higher, depending on regulation) | High liquidity, frequent trading. Ideal for capitalizing on raw spread. |

| Indices | Up to 1:200 | Reflects broader market movements. Volatility can vary. |

| Commodities | Up to 1:100 | Influenced by global supply/demand. Can experience significant price swings. |

| Cryptocurrencies | Up to 1:20 (or lower) | Highly volatile, often regulated with much lower leverage caps. |

Embrace the power of leverage to elevate your trading experience with an IC Markets Raw Spread account. Understand its mechanics, choose your levels wisely, and always pair it with robust risk management. It’s your path to unlocking enhanced potential within the dynamic world of ECN trading.

Execution Speed and Minimizing Slippage on Raw Spreads

In the lightning-fast world of online trading, every millisecond can impact your bottom line. For traders who meticulously plan their strategies around tight pricing, superior execution speed and the ability to minimize slippage are not just preferences—they are necessities. This becomes even more critical when pursuing the competitive advantage offered by an IC Markets Raw Spread account.

The Crucial Role of Execution Speed

Think of execution speed as the bridge between your trading decision and the actual market action. When you place a trade, you expect it to open or close at a specific price. Fast execution ensures that your order reaches the market and gets filled almost instantaneously. This precision is vital for strategies like scalping or high-frequency trading, where even a tiny delay can turn a profitable setup into a missed opportunity or a losing trade. Rapid execution allows you to capitalize on fleeting market conditions, making the most of every price fluctuation.

Understanding and Combating Slippage

Slippage occurs when your trade order is executed at a different price than you requested. While sometimes beneficial, negative slippage—where the fill price is worse than expected—can erode profits, especially when you are aiming for a very low spread. It frequently arises during periods of high volatility, rapid price movements, or when market liquidity is thin. For traders focused on capturing the benefits of a raw spread, managing slippage effectively is paramount. You want your chosen low spread to remain exactly that, not be eaten away by unforeseen price deviations.

IC Markets’ Commitment to Ultra-Fast Execution

We understand that speed translates directly into opportunity. Our infrastructure is engineered for peak performance, providing an unparalleled trading environment. Here’s how we achieve some of the fastest execution speeds in the industry:

- State-of-the-Art Technology: Our trading servers are strategically located in key financial data centers, ensuring minimal latency between your platform and our liquidity providers.

- Deep Liquidity Pools: We aggregate pricing from over 25 distinct institutional liquidity providers. This deep pool ensures competitive prices and the capacity to fill large orders quickly, even under challenging market conditions.

- ECN Trading Environment: Our true ECN trading model means your orders go straight to the market, without re-quotes or dealing desk intervention. This direct access facilitates rapid matching and execution.

Minimizing Slippage with IC Markets Raw Spread

Our dedication to speed extends directly to mitigating slippage. When you trade with an IC Markets Raw Spread, you gain access to raw market prices directly from our liquidity providers. This transparency, combined with our robust execution technology, helps keep slippage to an absolute minimum.

Key factors in our slippage reduction strategy:

- Direct Market Access: Orders are routed directly to the liquidity providers, bypassing unnecessary intermediaries.

- Advanced Order Routing: Our systems intelligently route your orders to the best available prices, even when volatility spikes.

- High Volume Capability: Our infrastructure handles massive trading volumes with ease, ensuring stability and efficient order processing even during major news events.

Traders often seek a near zero spread experience, and while a true zero spread is rare, minimizing slippage ensures that the raw spread you see is the raw spread you largely get. This precision empowers you to execute your strategies with greater confidence, knowing that your entry and exit points are as close to your intentions as possible.

Choosing a broker with a proven track record in execution speed and slippage control, especially for a raw spread offering, gives you a significant edge. It allows you to focus on your trading strategy, rather than worrying about the underlying mechanics of your trade execution.

Is the IC Markets Raw Spread Account Right for Your Strategy?

Making informed choices about your trading account is paramount to your success. It directly impacts your profitability and execution quality. The **IC Markets Raw Spread** account stands out as a popular option, but does it truly align with your specific trading strategy? Let’s dive in and see if this account fits your needs.

Understanding the Raw Spread Advantage

What exactly does “raw spread” mean for a trader? Essentially, you receive pricing directly from liquidity providers with minimal to no markup added by the broker. This approach provides incredibly **low spread** values, often just a few tenths of a pip, sometimes even reaching what many refer to as a **zero spread** on major currency pairs during high liquidity periods. This model operates within an **ECN trading** environment, ensuring deep liquidity and transparent pricing.

The benefits are clear:

- Unmatched Transparency: You see the true market bid and ask prices without hidden markups.

- Reduced Trading Costs: Minimizing spreads can significantly lower your cost per trade, boosting potential profitability on tight margins.

- Faster Execution: ECN environments often mean rapid order processing, crucial for time-sensitive strategies.

- Precision Trading: Optimal for strategies requiring exact entry and exit points due to minimal price distortion.

Matching the Account to Your Trading Style

Your trading style dictates the best account type. Consider these points:

- Scalpers: If you thrive on quick, small profits from minor price fluctuations, the **IC Markets Raw Spread** account is a strong contender. The exceptionally **low spread** minimizes your hurdle for profitability on each trade.

- Day Traders: For those executing multiple trades within a single day, the cumulative savings from tight spreads can be substantial, directly improving your daily net profit.

- Algorithmic Traders: Automated systems demand consistent and precise execution. The direct market access and minimal spread environment of a **raw spread** account provide an ideal foundation for high-frequency or algorithmic strategies.

- News Traders: During volatile news events, spreads can widen dramatically. While no account can eliminate this entirely, a **raw spread** account generally offers the tightest possible spreads even during these periods.

Key Considerations: Spreads vs. Commissions

It’s important to understand the full cost structure. The **IC Markets Raw Spread** account offers fantastic **raw spread** values but charges a small, fixed commission per lot traded. This is standard practice in an **ECN trading** setup.

| Benefit | Consideration |

|---|---|

| Access highly competitive raw spread pricing. | A small commission applies per lot traded. |

| Transparent execution from liquidity providers. | You must account for both spread and commission in your trading plan. |

| Excellent for high-volume, short-term strategies. | May not offer significant cost advantages for very long-term position traders compared to standard accounts without commissions. |

Is It for You? A Quick Assessment

Ask yourself these questions:

- Do you prioritize the absolute lowest possible spread over a commission-free model?

- Does your strategy involve frequent trades or targeting small price movements?

- Are you keen on transparent pricing and direct market access?

- Do you trade major currency pairs or other highly liquid instruments?

If you answered yes to most of these, the **IC Markets Raw Spread** account likely offers a significant edge for your trading strategy. It empowers traders who demand precision, transparency, and superior cost efficiency in fast-moving markets. It’s a powerful tool for those who understand how to leverage minimal spreads to their advantage.

Step-by-Step Guide to Setting Up Your IC Markets Raw Spread Account

Ready to experience trading with ultra-tight spreads and true market access? Setting up your IC Markets Raw Spread account is a straightforward process that opens the door to institutional-grade conditions. This guide walks you through each step, ensuring a smooth start to your journey with potentially zero spread opportunities.

1. Initiate Your Journey: Start Registration

Your first move is to visit the IC Markets website. Look for the prominent “Open Live Account” button – it’s typically easy to spot. This is where your journey into advanced ECN trading begins.

- Navigate to the official IC Markets website.

- Click on “Open Live Account” or “Register.”

- Provide your basic personal details: full name, email address, and country of residence.

2. Select Your Trading Account Type

This is a pivotal step. To truly benefit from the tightest pricing available, you must explicitly choose the Raw Spread account. This selection is key to accessing direct interbank pricing, often resulting in an incredibly low spread.

- Choose your entity type: “Individual” or “Corporate.”

- Under “Account Type,” specifically select “Raw Spread.” This is critical for getting the most competitive pricing.

- Pick your preferred trading platform (MetaTrader 4, MetaTrader 5, or cTrader) and your base currency.

3. Complete Personal Information and Verification

To ensure security and regulatory compliance, you will need to complete a detailed application and verify your identity. IC Markets makes this process efficient, getting you closer to actual ECN trading.

- Fill in additional personal details: address, employment status, and trading experience.

- Upload necessary documents for verification:

- Proof of Identity: A valid passport or driver’s license.

- Proof of Residency: A recent utility bill or bank statement (issued within the last three months).

- IC Markets processes verification swiftly, allowing you to access your account without undue delay.

4. Fund Your Account and Begin Trading

Once your account receives verification, you are ready to make a deposit and start trading. IC Markets offers a range of convenient funding options, ensuring you can quickly capitalize on the advantages of your IC Markets Raw Spread account.

- Log into your secure client area.

- Select your preferred deposit method from a wide array of options (e.g., bank transfer, credit/debit card, various e-wallets).

- Deposit funds into your account. Always consider your trading strategy and the minimum deposit required to fully leverage the benefits of raw spread conditions.

Why Choose an IC Markets Raw Spread Account?

Opting for the IC Markets Raw Spread account offers distinct advantages for serious traders. It’s not just about setting up; it’s about trading with confidence and optimal conditions.

| Key Benefit | Impact on Your Trading |

|---|---|

| Ultra-Low Spreads | Significantly reduces transaction costs, boosting your potential profitability. |

| True ECN Access | Direct market access with no dealing desk intervention, ensuring fair pricing. |

| Zero Spread Potential | During periods of high liquidity, spreads on major pairs can go as low as 0.0 pips. |

| Superior Execution Speed | Experience lightning-fast order execution, crucial for high-frequency strategies. |

Customer Support for IC Markets Raw Spread Traders

Trading with IC Markets Raw Spread demands precision and swift action. Every moment counts, and when you need assistance, it should be just as precise and swift. We understand this fundamental need, providing robust customer support designed specifically for traders who prioritize the tightest possible trading conditions.

Your trading journey deserves uninterrupted focus. That’s why we ensure you access dedicated, knowledgeable assistance whenever you need it. Our support channels are available around the clock, globally, ensuring you receive immediate help regardless of your time zone or the urgency of your query.

We empower your trading with comprehensive support through:

- 24/7 Live Chat: Connect instantly with a support agent. This is your go-to for urgent questions about platform navigation, account funding, or any technical hiccup you encounter within your ECN trading environment.

- Email Support: For more detailed inquiries or when you need a written record, our email support delivers thorough, well-explained responses. We address your concerns about specific orders, account statements, or the nuances of achieving the lowest possible raw spread.

- Phone Support: Prefer a direct conversation? Our phone lines put you in touch with experienced representatives who possess deep knowledge of our systems and the fast-paced nature of the markets. They expertly guide you through complex issues, helping you understand how to maximize the benefits of our low spread offering, even exploring possibilities that verge on zero spread in certain market conditions.

Our support specialists are not just generalists; they are market-aware professionals with a deep understanding of what matters to raw spread traders. They grasp the importance of speed, cost-efficiency, and transparent execution. You benefit directly from their expertise, ensuring quick resolutions and accurate information every time.

Do not let technical questions or account inquiries slow down your momentum. With unparalleled customer support, your focus remains firmly on identifying opportunities and executing your strategies with confidence. Experience the difference of support that genuinely empowers your success with IC Markets Raw Spread.

Security, Regulation, and Trust in IC Markets

Choosing a broker for your financial journey demands absolute confidence. You need peace of mind knowing your funds are secure, your data is protected, and your trading environment is fair. At IC Markets, we prioritize these core principles, establishing a robust framework of security, stringent regulation, and unwavering trust that sets us apart. We believe this foundation is crucial for any trader, whether you’re just starting or you’re a seasoned professional seeking optimal conditions like the IC Markets Raw Spread.

A Foundation Built on Strong Regulation

Regulation isn’t just a compliance formality; it’s a bedrock of trust. We operate under the watchful eyes of several leading financial authorities worldwide. This multi-jurisdictional oversight ensures we adhere to the highest standards of financial conduct, transparency, and operational integrity.

Our regulatory compliance means:

- Client Fund Segregation: Your funds are held in separate trust accounts with top-tier banks, completely distinct from our operational capital. This ensures your capital is protected, even in unforeseen circumstances.

- Regular Audits: Independent auditors meticulously review our financial statements and operational processes, confirming our adherence to regulatory requirements and best practices.

- Investor Protection: Operating within regulated frameworks often provides certain protections for eligible clients, adding an extra layer of security to your trading experience.

Protecting Your Capital and Data

We understand that protecting your investments goes beyond regulatory checks. It’s about implementing practical measures that safeguard your capital and personal information around the clock.

| Security Measure | Benefit to You |

|---|---|

| Negative Balance Protection | Ensures your account balance can never fall below zero, protecting you from losing more than your initial deposit. |

| Advanced Encryption | Your personal data and transactions are protected using sophisticated SSL encryption technology, preventing unauthorized access. |

| Secure Trading Infrastructure | Our global server network is built for resilience and speed, ensuring reliable execution, especially critical for traders leveraging low spread conditions. |

Transparency: The Cornerstone of Trust

Trust isn’t given; it’s earned through consistent transparency and reliable service. We are committed to providing a clear, honest, and equitable trading environment. This commitment extends to our pricing model, where you can access genuine `raw spread` opportunities, often seeing `zero spread` during peak liquidity. This direct access to market pricing is fundamental to an `ECN trading` environment, fostering fairness and reducing conflicts of interest.

Our dedication to transparency means:

- Clear Pricing: We offer highly competitive spreads and commissions, with no hidden fees or charges. What you see is what you get.

- Fair Execution: Our technology ensures ultra-fast order execution, helping you capitalize on market movements without unnecessary slippage.

- Dedicated Support: Our multilingual client support team is available 24/7 to assist you, offering prompt and professional help whenever you need it.

We invite you to experience the difference that a secure, regulated, and trusted broker makes. Join IC Markets and trade with confidence, knowing you’re backed by a broker committed to your success and peace of mind.

Advanced Trading Tools and Platforms for Raw Spread Users

Unlocking the full potential of market opportunities demands more than just exceptional pricing; it requires a sophisticated toolkit. For traders focused on achieving the tightest possible entry and exit points, the right technology makes all the difference. When you pursue the highly competitive IC Markets Raw Spread, your trading platform becomes your command center, essential for capitalizing on every market nuance.

Our advanced trading tools and platforms are specifically designed to empower users who prioritize a raw spread environment. We understand that in such conditions, execution speed, analytical depth, and automation are not luxuries, but necessities. We provide robust solutions to help you navigate volatile markets and execute strategies with precision.

Unleashing Potential with Superior Platforms

Experience industry-leading platforms engineered for peak performance. These sophisticated environments are crucial for anyone leveraging a low spread account. They deliver the stability, speed, and feature set required to make informed decisions and act decisively.

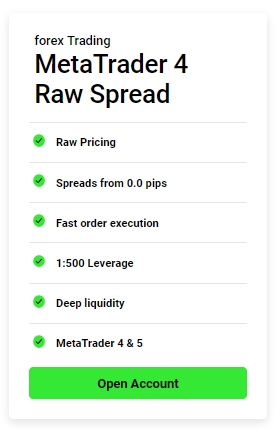

- MetaTrader 4 & 5: Renowned for their extensive charting capabilities, customizable indicators, and support for Expert Advisors (EAs). Perfect for automated trading strategies that thrive in an ecn trading setup.

- cTrader: A modern platform celebrated for its intuitive interface, fast execution speeds, and comprehensive Depth of Market (DOM) visibility. It’s a favorite among those who demand transparency and precision for their raw spread trades.

Key Tools That Give You the Edge

Beyond the core platforms, specific features truly enhance your ability to trade effectively with a raw spread. These tools are built to give you a distinct advantage:

| Feature | Direct Benefit for Raw Spread Users |

|---|---|

| Depth of Market (DOM) | Gain real-time insight into market liquidity and order books. Identify areas of support and resistance, crucial for precise entry and exit points, especially when seeking a zero spread opportunity. |

| One-Click Trading | Execute trades instantaneously. This speed is vital for scalpers and day traders looking to seize fleeting market movements and capitalize on razor-thin margins. |

| Algorithmic Trading | Deploy Expert Advisors (EAs) or cBots to automate your strategies. Optimize your trading around specific conditions, ensuring consistent execution without emotional bias. |

| Advanced Charting Tools | Access a vast array of indicators, drawing tools, and multiple timeframes. Analyze market trends and patterns with unparalleled clarity, helping you spot the best opportunities within your raw spread trading. |

These powerful tools directly support your goal of minimizing costs and maximizing efficiency. They reduce the impact of slippage, enhance your analytical capabilities, and streamline your trading process. By combining the exceptional pricing of IC Markets Raw Spread with these cutting-edge platforms and tools, you gain a significant competitive edge in the fast-paced world of financial markets.

Real-World Trader Experiences with IC Markets Raw Spreads

Understanding the actual impact of trading conditions goes beyond just numbers on a website. It’s about how those conditions translate into daily profits and smoother strategies for real traders. When it comes to the highly competitive world of forex and CFD trading, the IC Markets Raw Spread truly stands out. Traders consistently share their positive experiences, highlighting the difference it makes in their bottom line.

For many active traders, especially those who execute numerous trades, even tiny differences in costs add up quickly. This is where a genuinely low spread becomes a game-changer. Imagine entering and exiting positions with minimal friction – that’s the reality for those trading with raw spreads. It allows for tighter stop-losses and more precise profit targets, crucial elements for successful trading strategies.

Here’s what traders frequently emphasize about their experience with IC Markets’ tight spreads:

- Precision Trading: Scalpers and day traders praise the ability to enter and exit trades with incredible accuracy, maximizing small price movements. The tight raw spread ensures that the cost of execution doesn’t erode their potential gains.

- Reduced Slippage: Many report less slippage during volatile market conditions compared to platforms with wider spreads, especially during news events. This translates to better execution prices and more predictable outcomes.

- Strategy Viability: Certain high-frequency or arbitrage strategies only become profitable or even possible in environments offering genuinely low spreads, an advantage IC Markets consistently provides.

- Cost Efficiency: Over hundreds or thousands of trades, the cumulative savings from consistent raw spreads are substantial, directly improving overall profitability.

The concept of raw spread is intrinsically linked to true ECN trading environments. In such a setup, traders access liquidity providers directly, bypassing dealing desk intervention. This structure ensures that the spreads offered are the absolute market spreads, with only a small, transparent commission per lot traded. This transparency and direct market access are core reasons traders choose IC Markets, appreciating the genuine market pricing.

“With IC Markets, what you see is truly what you get. The raw spread means fewer surprises and a more predictable trading cost. It’s essential for anyone serious about high-volume trading.”

While the goal of achieving a true zero spread is often aspirational in retail trading, raw spreads offered by IC Markets come remarkably close. Traders appreciate this near-zero difference between bid and ask prices, recognizing it as the closest practical alternative to pure market pricing, giving them a significant edge.

Based on widespread feedback, the advantages are clear. However, traders also offer insights into managing expectations:

| Pros of IC Markets Raw Spreads | Considerations for Traders |

|---|---|

| Extremely tight spreads, often 0.0 pips. | A small, fixed commission per lot applies. |

| Ideal for scalping and automated strategies. | Requires robust risk management for high-frequency trading. |

| Transparent ECN trading environment with direct market access. | Execution speed is crucial; a fast internet connection helps. |

| Significant cost reduction over time for active traders. | Understanding market depth and liquidity is beneficial. |

In conclusion, real-world traders consistently validate the value proposition of the IC Markets Raw Spread. They experience firsthand how these ultra-tight spreads, combined with an authentic ECN trading model, create a superior trading environment. If you’re looking to optimize your trading costs and elevate your strategy execution, exploring what IC Markets offers could be your next smart move.

Testimonials and Performance Reviews

Understanding a broker’s true value often comes from the people who trade with them every day. We believe transparency and direct feedback are paramount. That’s why we’re proud to share what our global community says about their experience and the tangible performance benefits they achieve.

What Our Traders Highlight

Across various independent review platforms and direct feedback channels, common themes emerge. Traders consistently praise several key aspects that define their trading journey with us:

- **Exceptional Trading Conditions:** Many point to the incredibly competitive IC Markets Raw Spread as a significant advantage. This allows for precise entry and exit points, a critical factor for many strategies.

- **Reliable Execution:** Speed and accuracy in order execution frequently come up in discussions. Minimizing slippage, especially during volatile market conditions, offers peace of mind.

- **Robust Platform Stability:** Traders value a platform that performs flawlessly, offering uninterrupted access to markets and essential tools.

- **Responsive Customer Support:** Knowing that help is readily available makes a big difference. Our support team receives consistent praise for their professionalism and efficiency.

The Raw Spread Advantage: A Closer Look

The concept of a low spread, particularly a true raw spread, is a cornerstone of our offering. Traders in an ECN trading environment often see spreads that reflect the true market conditions, rather than marked-up rates. This means the costs of trading are minimized, directly impacting profitability.

We’ve seen numerous reviews where traders specifically mention how the IC Markets Raw Spread has optimized their strategies, especially for scalping or high-frequency trading. While a true zero spread is rare, our competitive model often sees spreads drop to near-zero levels during peak liquidity, a testament to our commitment to fair pricing.

Here’s a snapshot of performance aspects frequently lauded:

| Performance Aspect | Trader Feedback Summary |

|---|---|

| **Spreads** | “Unbeatable raw spread, truly competitive.” |

| **Execution** | “Lightning-fast, minimal slippage.” |

| **Support** | “Quick, knowledgeable, always helpful.” |

| **Platform** | “Stable, robust, never an issue.” |

Voices from Our Community

“The IC Markets Raw Spread has transformed my trading. I can finally implement my strategies with confidence, knowing my costs are minimal. It’s a game-changer for serious traders.”

— A. Patel, Professional Trader

“In my years of trading, I’ve never experienced such consistently low spread conditions. Coupled with their reliable ECN trading environment, it’s a powerful combination.”

— S. Kim, Forex Enthusiast

These performance reviews underscore our dedication to providing an unparalleled trading experience. We empower our traders with tools and conditions that truly make a difference, helping them achieve their financial goals in a transparent and efficient market environment.

Frequently Asked Questions

What is the IC Markets Raw Spread account?

The IC Markets Raw Spread Account is designed for serious traders, offering the tightest possible pricing directly from liquidity providers with ultra-low spreads, often from 0.0 pips, and a small, fixed commission per lot in a genuine ECN trading environment.

How does the Raw Spread account differ from a Standard account?

A Raw Spread account offers interbank spreads (often near zero) with a small fixed commission per lot, providing high transparency. A Standard account has wider spreads with the broker’s markup included, typically with no separate commission, offering a simpler cost structure.

What are the main benefits of trading with IC Markets Raw Spreads?

Key benefits include significant cost reduction, enhanced strategy performance (especially for scalpers and HFT), fair and transparent pricing, access to zero spread opportunities, and superior execution speeds through an ECN model.

What trading instruments can I access with a Raw Spread account?

Raw Spread accounts allow trading in over 60 Forex pairs with ultra-tight spreads, various Commodities (Gold, Silver, Oil), major Global Indices (S&P 500, DAX 40), and popular Cryptocurrencies (Bitcoin, Ethereum), all with competitive low spread offerings.

What is the minimum deposit required to open an IC Markets Raw Spread account?

To open an IC Markets Raw Spread account and gain access to direct interbank pricing and the ECN trading environment, a minimum deposit of $200 USD is required.