Discover your ultimate guide to IC Markets, specifically tailored for traders in the Kingdom of Saudi Arabia. As the interest in forex and CFD trading continues to expand across KSA, selecting a trustworthy and efficient broker is paramount. IC Markets has established itself as a global industry leader, celebrated for its minimal costs, rapid execution speeds, and robust trading platforms. This comprehensive review provides the clear, essential information you need to make an informed decision. We will delve into every facet of the IC Markets offering in Saudi Arabia, from its regulatory framework and Sharia-compliant Islamic accounts to a detailed analysis of its trading platforms. Whether you’re just starting out in Riyadh or are a seasoned trader in Jeddah, this guide will help determine if IC Markets is the right partner for your trading ambitions.

- Is IC Markets Regulated and Safe for Saudi Arabian Clients?

- Islamic Account Options: Sharia-Compliant Trading

- Key Features of IC Markets Swap-Free Accounts

- Trading Platforms Available in KSA: MT4, MT5, and cTrader

- Choosing the Right Platform for Your Strategy

- A Deep Dive into IC Markets Account Types

- Raw Spread vs. Standard Account

- Spreads and Commissions: How Low are the Fees?

- Available Trading Instruments for Saudi Traders

- Deposit and Withdrawal Methods in Saudi Arabia

- Local Bank Transfers and E-Wallets Supported

- How to Open an IC Markets Account from Saudi Arabia

- Step-by-Step Registration and Verification Process

- Customer Support for the MENA Region

- Leverage and Margin Requirements

- IC Markets vs. Other Popular Brokers in KSA

- Pros and Cons of Trading with IC Markets in KSA

- Educational Resources and Tools for Beginners

- Security of Client Funds

- Frequently Asked Questions by Saudi Traders

- Is Forex Trading Legal in Saudi Arabia?

- Does IC Markets Offer a Demo Account?

- Frequently Asked Questions

Is IC Markets Regulated and Safe for Saudi Arabian Clients?

Trust is the foundation of trading. When you deposit your funds with a broker, you need absolute confidence that your money is safe. IC Markets operates under the oversight of some of the world’s most respected financial regulators. These include the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), among others.

For a trader in Saudi Arabia, this international regulation provides a powerful layer of security. It means IC Markets must adhere to strict standards regarding capital adequacy, client fund segregation, and fair trading practices. They are regularly audited and must maintain transparent operations. Choosing a globally regulated broker like IC Markets is a critical step in protecting yourself and ensuring you are trading in a fair and secure environment.

Islamic Account Options: Sharia-Compliant Trading

For traders of the Islamic faith in Saudi Arabia, trading in a way that aligns with Sharia law is essential. IC Markets understands and respects this need by offering dedicated Islamic, or swap-free, accounts. These accounts are designed to eliminate ‘Riba’ (interest), which is prohibited in Islam.

With an Islamic account, you can hold positions open overnight without incurring or earning any swap or rollover interest charges. This feature is available across all account types and platforms, ensuring that you do not have to compromise on trading conditions to uphold your faith. It makes IC Markets an accessible and principled choice for the Forex Saudi Arabia trading community.

Key Features of IC Markets Swap-Free Accounts

The Islamic account option at IC Markets is more than just a label; it comes with specific features designed for Sharia-compliant trading. Understanding these benefits is key for any trader in KSA considering this option.

- No Swap or Rollover Fees: The core feature is the complete removal of overnight interest fees. You can hold positions for multiple days without any Riba.

- Access to All Instruments: You are not limited. Islamic account holders can trade the full range of instruments, including forex, indices, and commodities.

- Identical Spreads: You receive the same ultra-low, raw spreads as traders on standard accounts, ensuring your costs remain competitive.

- Available on All Platforms: Whether you prefer MetaTrader 4, MetaTrader 5, or cTrader, the swap-free option is available.

- Transparent Administration Fees: To maintain fairness, a small daily administration fee is charged for holding certain positions open for an extended period. This is not interest but a fee for maintaining the open trade.

Trading Platforms Available in KSA: MT4, MT5, and cTrader

A trader’s platform is their primary tool. IC Markets provides an exceptional range of options, catering to every style and experience level. Clients in Saudi Arabia can choose from three of the most powerful platforms in the industry: MetaTrader 4, MetaTrader 5, and cTrader.

MetaTrader 4 (MT4) is the global standard, famous for its reliability, user-friendly interface, and vast ecosystem of automated trading robots (Expert Advisors). MetaTrader 5 (MT5) is its successor, offering more technical indicators, timeframes, and access to a wider range of markets. cTrader is a modern platform known for its sleek design, advanced charting capabilities, and features designed specifically for a True ECN trading environment.

Choosing the Right Platform for Your Strategy

Selecting the best platform depends entirely on your personal trading style and needs. Each platform excels in different areas. This table helps break down which one might be the best fit for your Saudi Arabia trading activities.

| Platform | Best For | Key Feature |

|---|---|---|

| MetaTrader 4 | Beginners & Algo Traders | Largest library of EAs and custom indicators. |

| MetaTrader 5 | Multi-Asset & Advanced Traders | More built-in tools, timeframes, and order types. |

| cTrader | Discretionary & ECN Traders | Modern interface with advanced charting and order execution. |

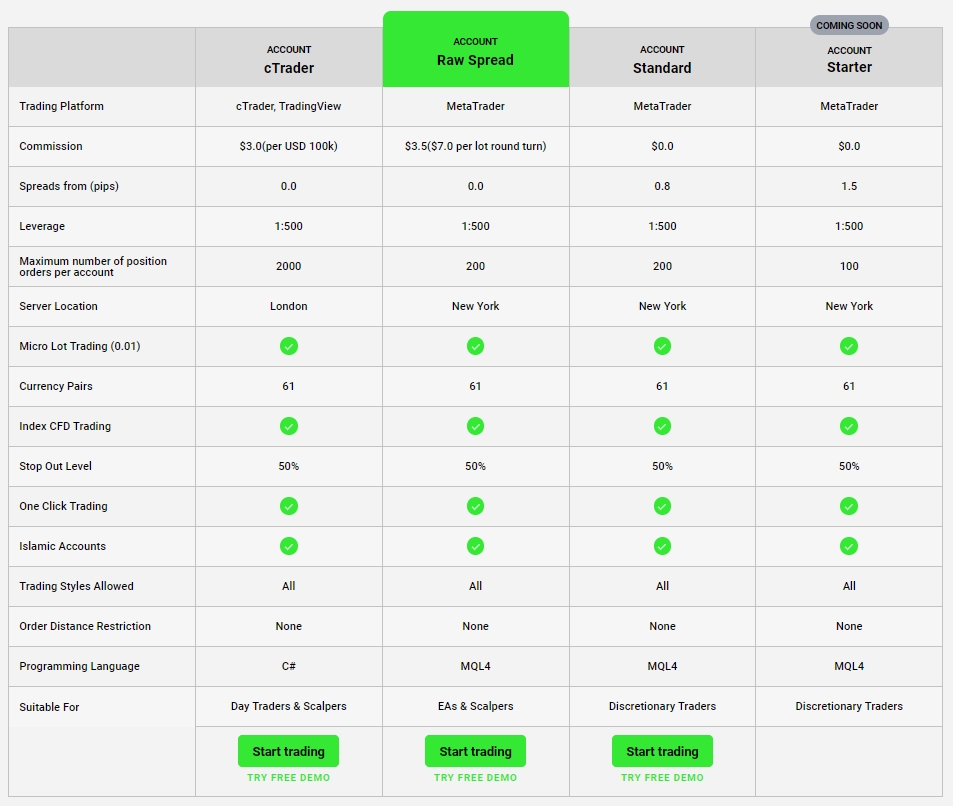

A Deep Dive into IC Markets Account Types

IC Markets simplifies its account offerings to focus on what matters most: trading costs and execution. The primary choice for traders in Saudi Arabia is between a commission-free account and a commission-based account with lower spreads. This structure provides clarity and allows you to select an account that perfectly matches your trading strategy.

The main account types are the Standard Account and the Raw Spread Account. The Raw Spread Account is further available on both the MetaTrader and cTrader platforms, with slightly different commission structures. All accounts offer access to the same deep liquidity and fast execution, ensuring a high-quality trading experience regardless of your choice.

Raw Spread vs. Standard Account

Understanding the difference between these two primary accounts is crucial for optimizing your trading costs. Your decision will likely depend on your trading frequency and preference for cost structure.

“The choice is simple: do you prefer all costs built into the spread, or do you want the raw spread plus a fixed commission? Both are highly competitive.”

Standard Account:

- Pricing: Spreads start from 0.6 pips with $0 commission.

- Best for: Discretionary traders and beginners who prefer a simple cost structure where all fees are included in the spread.

Raw Spread Account:

- Pricing: Spreads start from 0.0 pips with a small, fixed commission per lot traded.

- Best for: Scalpers, algorithmic traders, and high-volume traders who benefit from the tightest possible spreads.

Spreads and Commissions: How Low are the Fees?

One of the main reasons IC Markets is a popular broker in Saudi Arabia is its commitment to low trading costs. The broker operates on a True ECN (Electronic Communication Network) model, which means it sources pricing from a deep pool of liquidity providers. This results in some of the tightest spreads available in the retail forex market.

On the Raw Spread account, you can regularly see spreads of 0.0 pips on major pairs like EUR/USD. The commission is a fixed, transparent fee, typically around $3.50 per lot per side. For the Standard account, there is no separate commission, as the cost is built into a slightly wider spread.

This transparent and highly competitive fee structure means more of your trading profits stay with you.

Available Trading Instruments for Saudi Traders

Variety is key to a dynamic trading strategy. IC Markets provides traders in Saudi Arabia with access to a vast and diverse range of global markets from a single account. This allows you to diversify your portfolio and seize opportunities across different asset classes.

You can trade a wide array of instruments, including:

- Forex: Over 60 currency pairs, including majors, minors, and exotics.

- Indices: Access to 25+ major global stock indices from Asia, Europe, and the Americas.

- Commodities: Trade popular markets like Crude Oil, Brent, and Natural Gas, as well as precious metals like Gold and Silver.

- Stocks: Trade CFDs on over 1800 of the largest companies from the ASX, NASDAQ, and NYSE.

- Bonds: Diversify with government bonds from around the world.

- Cryptocurrencies: Trade popular digital currencies like Bitcoin, Ethereum, and Ripple.

–

–

–

–

Deposit and Withdrawal Methods in Saudi Arabia

Managing your funds should be fast, easy, and secure. IC Markets offers a wide range of convenient payment methods for clients in Saudi Arabia, ensuring you can fund your account and access your profits with minimal hassle. The broker prides itself on fast processing times, with many deposit methods being instant.

Importantly, IC Markets does not charge any internal fees for deposits or withdrawals. While your bank or payment provider may charge a fee, IC Markets keeps its side of the transaction free. This commitment to cost-effective fund management is another reason it is a preferred broker for Saudi Arabia trading.

Local Bank Transfers and E-Wallets Supported

To cater specifically to the needs of traders in the KSA, IC Markets supports a variety of popular and accessible payment options. This ensures you can find a method that is both familiar and efficient for you.

Supported methods include:

- Credit and Debit Cards (Visa, Mastercard)

- Bank Wire Transfer

- PayPal

- Neteller

- Skrill

- FasaPay

This mix of traditional banking and modern e-wallets provides flexibility, allowing you to manage your trading capital in the way that suits you best.

How to Open an IC Markets Account from Saudi Arabia

Getting started with IC Markets from Saudi Arabia is a straightforward and fully digital process. You can complete the entire application from the comfort of your home in just a few minutes. The platform is designed to be user-friendly, guiding you through each step efficiently.

Before you begin, it’s helpful to have your identification documents ready. You will typically need a valid government-issued ID and a recent proof of address to complete the verification process. This is a standard requirement from regulated brokers to ensure account security and comply with international financial regulations.

Step-by-Step Registration and Verification Process

Follow these simple steps to open and verify your live trading account. The process is designed to be quick so you can start trading as soon as possible.

- Complete the Online Form: Visit the IC Markets website and fill out the secure application form with your personal details.

- Configure Your Account: Choose your preferred trading platform (MT4, MT5, or cTrader), account type (Standard or Raw Spread), and base currency.

- Submit Your Documents: Upload a clear copy of your passport or Saudi National ID for identity verification.

- Verify Your Address: Upload a recent utility bill or bank statement (less than 3 months old) that clearly shows your name and address.

- Fund and Trade: Once your account is approved, you will receive your login details. You can then make your first deposit and begin trading.

Customer Support for the MENA Region

Excellent customer service is vital, especially when you need help quickly. IC Markets provides comprehensive, 24/7 customer support to assist traders from the MENA region, including Saudi Arabia. Their global support team is known for being responsive, knowledgeable, and professional.

You can reach the support team through multiple channels, ensuring help is always available when the markets are open. This level of accessibility provides peace of mind, knowing that a dedicated team is ready to assist with any technical or account-related questions you may have. For traders in KSA, having access to multilingual support, including Arabic, is a significant advantage.

Leverage and Margin Requirements

Leverage allows you to control a larger position in the market with a smaller amount of capital. IC Markets offers flexible leverage up to 1:500 for clients in Saudi Arabia. This can be a powerful tool for amplifying potential profits from small price movements in the forex market.

However, it is crucial to understand that leverage is a double-edged sword; it also magnifies potential losses.

Margin is the amount of your own capital required to open and maintain a leveraged trade. Responsible use of leverage is a key part of risk management, and traders should always use a level they are comfortable with.

IC Markets vs. Other Popular Brokers in KSA

When choosing a broker in Saudi Arabia, it’s helpful to see how IC Markets compares to the competition. The table below provides a snapshot of how it stacks up against other popular brokers on key features.

| Feature | IC Markets | Typical Competitor |

|---|---|---|

| EUR/USD Spread | From 0.0 pips + Commission | From 1.0 pips (commission-free) |

| Platforms | MT4, MT5, cTrader | Mainly MT4/MT5 |

| Execution Model | True ECN | Market Maker / STP |

| Islamic Account | Yes, on all accounts | Yes, often with limitations |

Pros and Cons of Trading with IC Markets in KSA

To provide a balanced view, it’s important to look at both the strengths and potential weaknesses. Here is a summary of the pros and cons for traders in Saudi Arabia considering IC Markets.

Pros:

- Extremely Low Costs: Industry-leading raw spreads and low commissions make it ideal for cost-conscious traders.

- Superior Platform Selection: Offers the choice of MT4, MT5, and cTrader to suit all trading styles.

- Strong Regulation: Regulated by top-tier authorities, ensuring a high level of security and trust.

- True ECN Environment: Fast execution with no dealing desk intervention, perfect for scalping and automated strategies.

- Full-Featured Islamic Accounts: Sharia-compliant options are available without compromising on core trading conditions.

Cons:

- Limited Educational Content: While some resources exist, absolute beginners might seek more structured educational material elsewhere.

- No Local Physical Office: Support is provided online and by phone, with no physical branch in Saudi Arabia.

Educational Resources and Tools for Beginners

While IC Markets is often favored by experienced traders, it also provides valuable resources for those new to the markets. For traders in KSA just starting their journey, these tools can help build a strong foundation of knowledge.

The broker offers a regularly updated blog with market analysis and trading insights. You can access webinars and video tutorials that cover platform usage and basic trading concepts. Furthermore, an integrated economic calendar helps you stay on top of important financial events. The most powerful educational tool, however, is the unlimited demo account, which allows you to practice trading with virtual money in a real market environment.

Security of Client Funds

The safety of your capital is a non-negotiable priority. IC Markets takes multiple steps to ensure that client funds are protected at all times. As a regulated broker, it is required to hold client money in segregated trust accounts with top-tier international banks.

This means your funds are kept completely separate from the company’s own operational finances. In the highly unlikely event of the broker’s insolvency, your money cannot be used to pay creditors. This segregation of funds is a cornerstone of financial regulation and provides traders in Saudi Arabia with critical protection and peace of mind.

Frequently Asked Questions by Saudi Traders

Here we answer some of the most common questions that traders from the Kingdom of Saudi Arabia have about trading forex and using the IC Markets platform.

Is Forex Trading Legal in Saudi Arabia?

Yes, forex trading is permitted for individuals in Saudi Arabia. While the local Capital Market Authority (CMA) regulates financial activities within the Kingdom, residents are free to open accounts and trade with internationally regulated online brokers like IC Markets. The key is to choose a reputable broker that is regulated in a major financial jurisdiction, which ensures a framework of safety and fairness for your trading activities.

Does IC Markets Offer a Demo Account?

Absolutely. IC Markets offers a free and unlimited demo account for all its platforms (MT4, MT5, and cTrader). This is an invaluable tool for both new and experienced traders in Saudi Arabia. It allows you to practice your trading strategies, become familiar with the platform’s features, and experience IC Markets’ execution speed and spreads using virtual funds, all without any financial risk.

Frequently Asked Questions

Is IC Markets safe for traders in Saudi Arabia?

Yes, IC Markets is considered safe as it operates under the oversight of top-tier financial regulators like ASIC and CySEC. This ensures that the broker adheres to strict standards, including the segregation of client funds, which provides a powerful layer of security for Saudi Arabian traders.

Can I trade according to Sharia law with IC Markets?

Yes, IC Markets offers dedicated Islamic (swap-free) accounts that are fully compliant with Sharia law. These accounts eliminate ‘Riba’ (interest) on positions held overnight and are available across all account types and trading platforms without compromising on trading conditions.

What is the difference between a Standard and a Raw Spread account?

The Standard Account includes all costs in the spread, which starts from 0.6 pips, and has no commission, making it simpler for beginners. The Raw Spread Account offers tighter spreads starting from 0.0 pips but includes a small, fixed commission, which is generally more cost-effective for high-volume traders and scalpers.

Which trading platforms can I use with IC Markets in KSA?

Traders in Saudi Arabia can choose from three industry-leading platforms: MetaTrader 4 (MT4), known for its vast ecosystem of automated tools; MetaTrader 5 (MT5), which offers more advanced features; and cTrader, a modern platform designed for a True ECN trading environment.

How can I deposit and withdraw funds from Saudi Arabia?

IC Markets provides a variety of convenient payment methods for Saudi clients, including credit/debit cards (Visa, Mastercard), bank wire transfers, and popular e-wallets like PayPal, Neteller, and Skrill. The broker does not charge any internal fees for deposits or withdrawals.