Embark on your journey into the dynamic world of financial markets with confidence and clarity. The path to accessing global trading opportunities starts with a streamlined registration, designed to get you connected quickly and efficiently. We invite you to explore a platform engineered for performance, offering robust tools and an environment where your trading ambitions can flourish.

Whether you are taking your first steps or seeking to enhance an established strategy, our commitment is to provide an accessible gateway to a diverse range of assets. Discover competitive advantages and dedicated support that empowers every trader. Your next significant market move is just a few clicks away.

- Why Choose IC Markets for Your Trading Journey?

- Your Step-by-Step Guide to the IC Markets Sign Up Process

- What You Need Before You Start Your Registration

- Quick Tips for a Seamless IC Markets Sign Up

- Why Choose IC Markets for Your Trading Journey?

- The IC Markets Sign Up Process: A Step-by-Step Walkthrough

- Initiating Your IC Markets Account Registration

- Personal Information Requirements for IC Markets Sign Up

- Choosing Your Account Type: Standard, Raw Spread, or cTrader?

- The Standard Account: Simplicity and Clarity

- The Raw Spread Account: Precision and Tight Spreads

- The cTrader Account: Advanced Tools and Unique Platform

- Making Your Choice: A Quick Comparison

- Comparing Key Features of IC Markets Account Types

- Standard Account

- Raw Spread Account

- cTrader Account

- Understanding Leverage and Margin with IC Markets

- What is Leverage?

- What is Margin?

- Leverage and Margin: A Crucial Relationship

- Pros and Cons of Using Leverage

- Verification Process: KYC and Document Submission

- What is KYC and Why Does it Matter?

- Required Documentation for Verification

- Submitting Your Documents

- What Happens Next?

- Acceptable Proof of Identity Documents

- Primary Proof of Identity

- Key Document Requirements

- Valid Proof of Residence Requirements

- Accepted Proof of Residence Documents:

- Funding Your IC Markets Trading Account

- Diverse Funding Options at Your Fingertips

- Key Considerations for Your Deposit

- How to Fund Your Account: A Simple Guide

- Available Deposit Methods for IC Markets Sign Up

- Popular Deposit Options Explained

- Choosing Your Best Deposit Method

- Selecting Your Trading Platform: MetaTrader 4, MetaTrader 5, or cTrader?

- MetaTrader 4 (MT4): The Forex Classic

- MetaTrader 5 (MT5): The Multi-Asset Evolution

- cTrader: The Modern ECN Experience

- Setting Up Your First Trade After IC Markets Sign Up

- Logging In and Funding Your Account

- Navigating Your Trading Platform

- Selecting Your Trading Instrument

- Placing Your First Trade – Step-by-Step

- Monitoring and Managing Your Trade

- Navigating the IC Markets Client Area

- Security Measures and Data Protection at IC Markets

- Regulatory Compliance: A Foundation of Trust

- Client Fund Segregation: Your Funds Are Yours

- Advanced Data Encryption: Protecting Your Privacy

- Secure Trading Environment: Beyond the Sign-Up

- Your Role in Security

- Common IC Markets Sign Up Issues and Troubleshooting

- Benefits of Trading with IC Markets: Spreads, Execution, and Support

- Getting Started with Demo Trading on IC Markets

- Why Practice with an IC Markets Demo Account?

- Your Path to Demo Trading: The IC Markets Sign Up Process

- Maximizing Your Demo Trading Experience

- Important Considerations Before You Sign Up with IC Markets

- Regulatory Oversight and Fund Security

- Understanding Account Types and Trading Conditions

- Trading Platforms and Tools

- Customer Support and Educational Resources

- Funding Methods and Withdrawal Policies

- Frequently Asked Questions

Why Choose IC Markets for Your Trading Journey?

Many traders choose IC Markets for compelling reasons that set us apart. We focus on providing an optimal trading environment that empowers our clients.

- Unmatched Execution: Experience ultra-low latency and swift trade execution, crucial for seizing market opportunities.

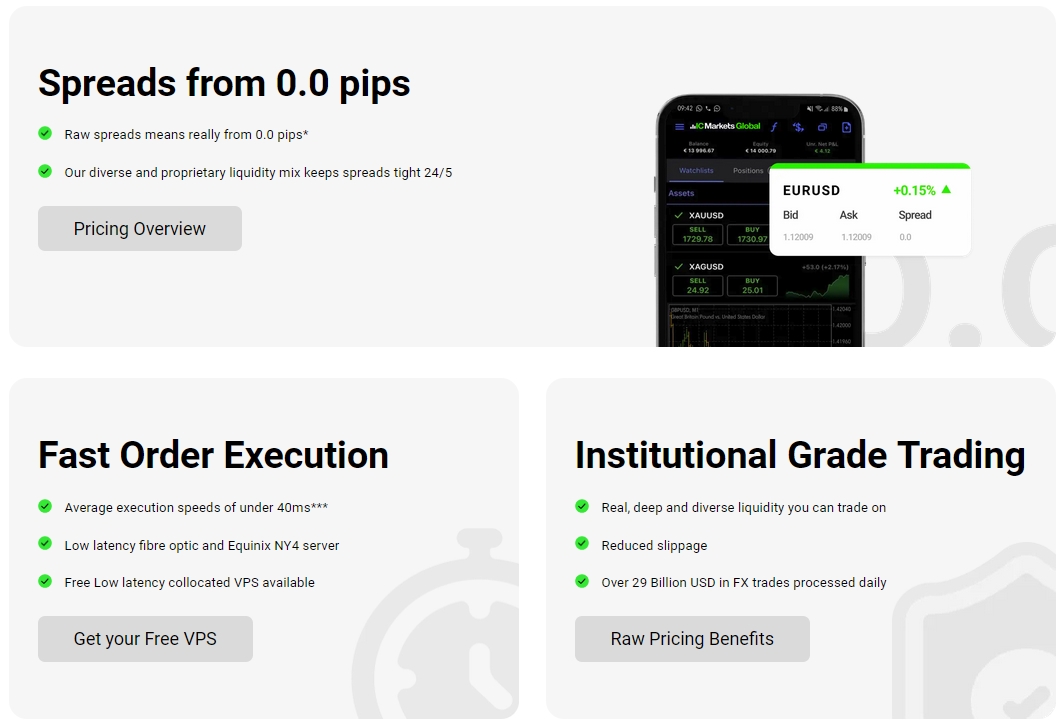

- Competitive Spreads: Access tight spreads starting from 0.0 pips on our Raw Spread accounts, minimizing your trading costs.

- Broad Market Access: Trade a vast array of instruments including Forex, Indices, Commodities, Stocks, and Cryptocurrencies.

- Flexible Platforms: Choose from industry-standard platforms like MetaTrader 4, MetaTrader 5, and cTrader, all equipped with advanced tools.

- Dedicated Support: Benefit from 24/7 customer support, ready to assist you whenever you need it.

Your Step-by-Step Guide to the IC Markets Sign Up Process

Getting started with IC Markets is a straightforward journey. Follow these simple steps to complete your registration and begin trading:

- Visit the Official Website: Navigate to the IC Markets homepage. Look for the “Open Account” button, usually prominently displayed.

- Complete the Application Form: You’ll enter basic personal details such as your name, email, country of residence, and phone number. This initial sign up takes just a few moments.

- Choose Your Account Type: Select the account that best fits your trading style and preferences. Options typically include Standard, Raw Spread, or cTrader accounts.

- Provide Financial Details: Answer questions about your trading experience and financial situation to help us understand your needs and ensure responsible trading.

- Verify Your Identity: Upload necessary documents for verification. This critical step ensures the security of your account and compliance with regulatory standards.

- Fund Your Account: Once verified, deposit funds using one of the many available payment methods. You are then ready to trade!

“The clarity and simplicity of the IC Markets sign up process made my decision to open an account easy. I appreciate how quickly I could move from registration to actively trading.”

What You Need Before You Start Your Registration

To ensure a smooth and quick registration, have these items ready. Preparing them beforehand will significantly speed up the process to open account.

| Document Type | Purpose | Acceptable Formats |

|---|---|---|

| Proof of Identity | Verifies your personal identity | Passport, National ID Card, Driver’s License |

| Proof of Residency | Confirms your residential address | Utility Bill, Bank Statement (issued within 3 months) |

Quick Tips for a Seamless IC Markets Sign Up

- Use Accurate Information: Ensure all details match your identification documents exactly to avoid delays.

- Clear Document Scans: Provide high-quality, readable images of your documents. Blurry photos can lead to rejections.

- Check Your Email: Monitor your inbox (and spam folder) for important updates and verification links during the sign up.

- Ask for Help: If you encounter any issues, don’t hesitate to contact IC Markets customer support. They are there to assist you on how to join.

Completing your IC Markets sign up is your first step towards a powerful trading journey. We’ve streamlined the registration to be as efficient as possible, allowing you to focus on what matters most: your trading strategy. Ready to open account and explore global markets? Start today and experience the difference.

Why Choose IC Markets for Your Trading Journey?

Embarking on a trading journey requires a broker that not only understands the market’s pulse but also empowers you with the tools and environment to succeed. IC Markets stands as a premier choice for countless traders worldwide, offering a robust platform designed for serious market participation. When you decide to open account with us, you unlock a world of opportunities supported by cutting-edge technology and unparalleled trading conditions.

We pride ourselves on providing an exceptional trading experience. Our commitment to low latency and high-speed execution ensures your trades are placed precisely when you intend, a critical factor in fast-moving markets. This translates directly into better pricing and reduced slippage, giving you a competitive edge.

- Ultra-Tight Spreads: Benefit from some of the industry’s lowest spreads, often starting from 0.0 pips on major currency pairs. This significantly reduces your trading costs.

- Superior Execution Speed: Strategic server placement ensures lightning-fast trade execution.

- Diverse Platform Choices: Trade with confidence on popular platforms like MetaTrader 4, MetaTrader 5, and cTrader, each offering unique features and customization options.

Access Extensive Global Markets

Your trading portfolio deserves diversity. IC Markets provides access to a vast array of financial instruments across global markets, allowing you to explore numerous strategies and seize varied opportunities.

Here’s a glimpse of what you can trade:

| Market Type | Examples |

|---|---|

| Forex | Major, Minor, and Exotic Pairs |

| Commodities | Gold, Silver, Oil, Natural Gas |

| Indices | S&P 500, Dow Jones, DAX 30 |

| Cryptocurrencies | Bitcoin, Ethereum, Ripple, Litecoin |

| Bonds & Futures | Government Bonds, Global Futures |

Built on Trust, Transparency, and Dedicated Support

Choosing a broker means placing your trust in their hands. IC Markets operates under stringent regulatory oversight, providing a secure and transparent trading environment. Your peace of mind is paramount.

We understand that support is crucial, especially for those new to the platform or exploring how to join. Our dedicated customer service team is available 24/7 to assist with any queries, from technical issues to guiding you through the IC Markets Sign Up process or explaining account features. We also offer extensive educational resources, including webinars, tutorials, and market analysis, empowering you to refine your trading skills and make informed decisions.

Ready to elevate your trading? The registration process is straightforward, designed to get you started quickly and efficiently. Complete your IC Markets Sign Up today and experience the difference a leading broker makes!

The IC Markets Sign Up Process: A Step-by-Step Walkthrough

Ready to elevate your trading experience with a trusted global broker? The IC Markets Sign Up process is remarkably streamlined, built for speed and clarity. We guide you through each stage, making it simple for you to open account and begin your trading journey with confidence.

Embarking on this path means you access a world of possibilities. A smooth registration ensures you move quickly from interest to active trading. Let’s walk through exactly what it takes to open account successfully.

- Start Your Registration: Navigate to the IC Markets website. Look for the ‘Create Account’ or ‘Register’ button – it’s typically prominent. Click it to initiate your registration. Here, you provide essential initial details: your country of residence, first name, last name, and email address.

- Input Personal Details and Configure Your Account: The next step involves providing more comprehensive personal information, such as your date of birth, phone number, and full residential address. This is also where you tailor your trading account. You select your preferred account type (like Standard or Raw Spread), your desired trading platform (MetaTrader 4, MetaTrader 5, or cTrader), and your base currency.

- Share Financial Information & Trading Experience: IC Markets gathers insights into your employment status, financial background, and trading experience. This crucial step helps the platform understand your needs better and adheres to important regulatory guidelines, ensuring responsible trading practices.

- Verify Your Identity: This is a vital security and compliance measure. You will upload specific documents to confirm both your identity and your place of residence.

- Proof of Identity: A clear, valid copy of your passport, national ID card, or driver’s license.

- Proof of Residency: A recent utility bill (gas, electricity, water), bank statement, or a government-issued document showing your current address, dated within the last three months.

Ensure all documents are sharp, valid, and show all four corners. This speeds up the verification process considerably.

- Fund Your Account & Begin Trading: Once IC Markets approves and verifies your account, you are ready to make your initial deposit. The platform supports a wide array of secure payment methods, ranging from bank transfers to popular e-wallets. After funding, simply download your chosen trading platform, log in, and you’re set to begin trading!

“The entire IC Markets sign up experience felt incredibly efficient. Every step was logical, making it easy to navigate and get my account ready.” – A Satisfied New Trader

A quick, efficient IC Markets sign up directly translates to more time focused on market analysis and less on paperwork. This foundational step is critical for building a confident start to your trading career.

| Requirement | Typical Document/Action |

|---|---|

| Identity Verification | Passport, ID Card, Driver’s License |

| Address Proof | Utility Bill, Bank Statement |

| Account Funding | Bank Transfer, Credit Card, E-Wallet |

Understanding how to join IC Markets demystifies the path to trading. Take that decisive step today. The world of financial markets awaits your strategy.

Complete your IC Markets sign up and unlock your trading potential!

Initiating Your IC Markets Account Registration

Ready to embark on your trading journey? Starting your IC Markets Sign Up is a clear and straightforward process, designed to get you trading with minimal fuss. We understand you’re eager to access the markets, and this initial step is streamlined for efficiency and ease.

The registration journey begins by locating the prominent “Open Account” button, typically found on the IC Markets homepage. Clicking this instantly transports you to the first stage of the sign up form. Here, you’ll provide some essential preliminary details that lay the groundwork for your new trading account.

This phase is swift, focusing on key information to get your profile started. Here’s a snapshot of what you might expect:

- Basic Personal Details: You’ll enter your name, email address, and phone number.

- Country of Residence: This helps IC Markets tailor services to your specific region and regulatory requirements.

- Password Creation: Choose a strong, secure password to protect your future account.

Understanding how to join IC Markets truly simplifies the process. This initial phase sets the foundation for your trading account without overwhelming you with too many details upfront. Our goal is to make the path to open account as smooth and secure as possible, ensuring you move quickly towards exploring the world of global markets.

Personal Information Requirements for IC Markets Sign Up

Embarking on your trading journey with IC Markets starts with a clear and straightforward IC Markets Sign Up process. A crucial part of this journey involves providing certain personal information. This isn’t just a formality; it’s a vital step to ensure your account security, comply with global financial regulations, and ultimately protect your investments.

When you decide to open account with IC Markets, you’ll find the registration process requires accurate details about who you are. This commitment to transparency helps create a safe and regulated trading environment for everyone. Let’s break down the core personal data points you’ll need to share:

- Full Legal Name: You will provide your complete name as it appears on official identification documents. This establishes your identity right from the start.

- Date of Birth: This confirms you meet the legal age requirements for trading and helps differentiate you from others with similar names.

- Residential Address: Your current proof of residence is essential for ‘Know Your Customer’ (KYC) and Anti-Money Laundering’ (AML) regulations. This helps verify your geographic location.

- Contact Information: Expect to provide a valid email address and phone number. IC Markets uses these to communicate important account updates, security alerts, and support.

- Citizenship/Nationality: This information is necessary for regulatory compliance, as different jurisdictions have varying financial regulations.

- Tax Identification Number (TIN): Depending on your country of residence, you might need to supply your TIN for tax reporting purposes, ensuring compliance with local and international financial authorities.

Understanding how to join IC Markets means recognizing that these requirements serve a clear purpose. Collecting this data enables IC Markets to verify your identity, prevent fraud, and adhere to strict regulatory standards enforced by financial bodies worldwide. This diligent approach safeguards both your funds and the integrity of the trading platform.

Rest assured, IC Markets treats your personal information with the highest level of confidentiality and security. They implement robust data protection measures to ensure your sensitive details remain private and protected throughout your trading tenure.

Choosing Your Account Type: Standard, Raw Spread, or cTrader?

Embarking on your trading journey starts with a crucial decision: selecting the account type that best aligns with your strategy and preferences. When you IC Markets Sign Up, you gain access to a selection of powerful accounts, each designed to cater to different trading styles and objectives. Understanding these options is vital for an optimal trading experience.

The Standard Account: Simplicity and Clarity

The Standard Account is an excellent choice for new traders or those who prefer a straightforward, all-inclusive pricing model. It offers competitive spreads with no commissions per lot, making cost calculation simple and transparent.

- Ideal For: Beginners, swing traders, those who prefer simplicity.

- Pricing Model: Spreads include the broker’s markup.

- Minimum Deposit: Accessible for most traders.

- Key Advantage: Predictable costs, no separate commission calculations to worry about.

“Simplicity in trading allows you to focus purely on market analysis, not complex fee structures.”

The Raw Spread Account: Precision and Tight Spreads

For experienced day traders, scalpers, and those employing expert advisors (EAs), the Raw Spread Account offers the ultimate in tight spreads, often starting from 0.0 pips. This account model is designed for traders who demand the lowest possible spreads and are comfortable with a small, fixed commission per lot.

- Ideal For: Scalpers, day traders, algorithmic traders, high-volume traders.

- Pricing Model: Ultra-low raw spreads with a small, fixed commission per standard lot.

- Execution: Often features superior execution speeds, critical for precise entries and exits.

- Key Advantage: Direct market pricing, allowing for minute profit margins on quick trades.

The cTrader Account: Advanced Tools and Unique Platform

If you value advanced charting capabilities, depth of market information, and a highly intuitive interface, the cTrader Account provides a distinct trading environment. This platform is renowned for its sleek design, sophisticated analytical tools, and fast order execution, appealing to a specific segment of the trading community.

- Ideal For: Advanced traders, those familiar with cTrader, automated trading enthusiasts.

- Pricing Model: Similar to Raw Spread with low spreads and commission per million USD traded.

- Platform Features: Customizable charts, advanced order types, Level II Depth of Market.

- Key Advantage: A unique, powerful platform experience with comprehensive trading features.

Making Your Choice: A Quick Comparison

Deciding which account is right for you before you open account is a critical step. Consider your trading frequency, preferred platform, and sensitivity to commissions versus spreads.

| Feature | Standard Account | Raw Spread Account | cTrader Account |

|---|---|---|---|

| Spreads | From 1.0 pip (no commission) | From 0.0 pips (plus commission) | From 0.0 pips (plus commission) |

| Commissions | None | Fixed per lot | Fixed per million USD traded |

| Best For | Beginners, swing traders | Scalpers, high-volume traders | Advanced traders, cTrader fans |

No matter your choice, the registration process is straightforward. Evaluating your trading needs thoroughly before you sign up ensures you start on the right foot. Understanding how to join the appropriate account type for your trading style empowers you to maximize your potential from day one.

Comparing Key Features of IC Markets Account Types

Choosing the ideal trading account sets the foundation for your success in the markets. IC Markets offers distinct account types, each tailored to different trading styles and preferences. Understanding these differences helps you make an informed decision before you open account and begin your trading journey. We break down the core features, empowering you to select the option that best aligns with your strategy and goals.

Consider what truly matters to your trading approach:

- Trading Costs: Are you sensitive to spreads, or do commissions impact your strategy more?

- Execution Speed: Do you require the fastest possible execution for high-frequency trading?

- Platform Preference: Do you have a preferred trading platform, such as MetaTrader or cTrader?

- Trading Style: Are you a scalper, a day trader, or a long-term position trader?

Let’s explore the primary account types offered by IC Markets:

Standard Account

The Standard Account is an excellent entry point, particularly if you are new to forex or prefer a straightforward pricing model. It features commission-free trading, with all costs integrated into a slightly wider spread. This account uses MetaTrader 4 (MT4) or MetaTrader 5 (MT5), making it familiar to many traders. It is suitable for those who value simplicity and want to avoid per-lot commissions.

Raw Spread Account

For traders seeking the absolute tightest spreads available, the Raw Spread Account is your choice. It boasts spreads starting from 0.0 pips, typically with a small, fixed commission per lot. This account offers lightning-fast execution and is ideal for scalpers, high-volume traders, and those who use Expert Advisors (EAs). You can access this account via MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

cTrader Account

Designed for sophisticated traders and algorithmic strategies, the cTrader Account combines incredibly tight spreads with competitive commission rates, similar to the Raw Spread option. However, it operates on the popular cTrader platform, known for its advanced order functionality, depth of market (DOM), and superior charting tools. If you appreciate a modern, intuitive interface and powerful analysis capabilities, this account is a strong contender.

Here’s a quick overview comparing the key features:

| Feature | Standard Account | Raw Spread Account | cTrader Account |

|---|---|---|---|

| Spreads (AUD/USD) | From 0.6 pips | From 0.0 pips | From 0.0 pips |

| Commissions | $0 per lot | $3.50 per lot per side | $3.00 per 100k traded |

| Trading Platforms | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5 | cTrader |

| Execution Model | No Dealing Desk (NDD) | No Dealing Desk (NDD) | No Dealing Desk (NDD) |

| Ideal For | Beginners, Swing Traders, Simplicity Seekers | Scalpers, EA Users, High-Volume Traders | Algorithmic Traders, Advanced Users, cTrader Fans |

| Minimum Deposit | $200 | $200 | $200 |

Each IC Markets account type offers competitive conditions and robust execution. The choice ultimately depends on your trading strategy, the platforms you prefer, and how you manage your trading costs. Once you’ve identified your ideal account, the IC Markets Sign Up process is swift and secure. Many ask how to join IC Markets; simply pick the account that fits you best and proceed with the easy online registration. Your journey into the world’s largest financial market starts with this crucial decision.

Understanding Leverage and Margin with IC Markets

Navigating the financial markets can feel complex, but mastering concepts like leverage and margin is key to smart trading. Before you complete your IC Markets Sign Up, understanding these powerful tools is absolutely essential. They define your trading potential and your risk exposure. Let’s break down how leverage and margin work, specifically with IC Markets, to help you make informed decisions.What is Leverage?

Leverage is essentially borrowed capital used to increase the potential return of an investment. Think of it as a financial magnifier. With IC Markets, you can control a much larger position in the market with a relatively small amount of your own capital. For example, if you have 1:500 leverage, you can open a trade worth $500,000 with just $1,000 of your own money.

This increased buying power allows traders to capitalize on smaller price movements, potentially generating significant profits. It’s a common feature for those looking to open account with various brokers, and IC Markets offers competitive leverage options designed to suit different trading styles.

What is Margin?

Margin is the actual amount of money required in your trading account to open and maintain a leveraged position. It’s not a transaction cost or a fee; rather, it’s a portion of your account equity set aside as collateral. When you use leverage, you’re only required to put up a fraction of the trade’s full value, and that fraction is your margin.

For instance, with 1:500 leverage, your margin requirement would be 0.2% of the total trade value. IC Markets calculates margin requirements in real-time, ensuring you always know the capital needed to support your open positions. This concept is fundamental to understanding your trading capacity after registration.

Leverage and Margin: A Crucial Relationship

Leverage and margin are two sides of the same coin. Higher leverage means a lower margin requirement, freeing up more capital in your account. Conversely, lower leverage demands a higher margin. While high leverage can amplify profits, it also significantly increases potential losses. Understanding this balance is critical for effective risk management.

IC Markets provides clear information on margin requirements for each instrument directly within the trading platform. This transparency helps you manage your risk exposure diligently. Before you learn how to join and place your first trade, ensure you’re comfortable with how these figures impact your overall strategy.

Pros and Cons of Using Leverage

Using leverage can be a powerful tool, but it comes with both advantages and disadvantages:

- Pros:

- Increased Capital Efficiency: Trade larger positions with less capital.

- Amplified Profits: Potentially generate higher returns from small market movements.

- Diversification: With less capital tied up per trade, you can diversify across more assets.

- Cons:

- Amplified Losses: Just as profits are magnified, so are losses.

- Margin Calls: If your account equity falls below the margin requirement, you may face a margin call, potentially leading to forced closure of positions.

- Increased Risk: Higher leverage naturally translates to higher trading risk.

IC Markets offers tools and resources to help you manage these risks effectively. They prioritize client education, encouraging responsible trading. Knowing this, taking the step to complete your IC Markets Sign Up feels like a well-informed decision.

Verification Process: KYC and Document Submission

Completing your IC Markets Sign Up goes beyond just filling in initial forms. A crucial step, vital for your security and regulatory compliance, is the verification process. This involves Know Your Customer (KYC) procedures and submitting essential documents. It ensures a safe trading environment for everyone and is a standard practice across reputable financial institutions.

What is KYC and Why Does it Matter?

KYC stands for Know Your Customer. It is a mandatory process that verifies the identity of clients. Regulators require it to prevent financial crimes like money laundering and terrorism financing. For you, it means peace of mind, knowing your funds and personal data are secure on a compliant platform.

Required Documentation for Verification

To successfully open account access, you will need to provide two main types of documents. These typically prove your identity and your residential address. Prepare clear, legible copies or photos of these documents before you start the upload process.

- Proof of Identity (PoI): This document confirms who you are.

- Government-issued national ID card (front and back)

- Passport (full photo page)

- Driver’s license (front and back)

Ensure your document is valid (not expired) and clearly shows your full name, date of birth, photo, and signature.

- Proof of Residence (PoR): This confirms where you live.

- Utility bill (electricity, water, gas, internet)

- Bank statement

- Credit card statement

- Government-issued tax invoice

The document must be dated within the last three to six months, show your full name, and your current residential address. P.O. Box addresses are generally not accepted.

Submitting Your Documents

The document submission process is straightforward and happens directly through your secure client area after your initial registration. Follow the on-screen prompts. You will typically upload digital copies of your chosen documents. The system guides you through each step, ensuring you provide everything needed to finalize your sign up.

| Document Type | Purpose | Key Information Needed |

|---|---|---|

| Proof of Identity | Confirms your legal identity | Full Name, DOB, Photo, Expiry Date |

| Proof of Residence | Confirms your residential address | Full Name, Residential Address, Issue Date (recent) |

What Happens Next?

After you submit your documents, the compliance team reviews them. This verification usually takes a short period, often within one business day. You will receive an email notification once your account is fully verified. If they need further information, they will contact you directly. Completing this step fully activates your account, allowing you to deposit funds and begin trading.

Do not let the verification process deter you; it is a critical safeguard. Understanding how to join and completing these steps ensures a smooth and secure experience from the moment you open account access. This thoroughness protects you and maintains the high standards of the platform, making your IC Markets Sign Up a truly reliable choice.

Acceptable Proof of Identity Documents

When you decide to open account with a trusted broker like IC Markets, verifying your identity is a crucial step. This safeguard ensures regulatory compliance and protects your financial activities. We streamline your IC Markets Sign Up process by providing clear guidelines on required documentation. To complete your registration smoothly, prepare one of these widely accepted identity proofs.

Primary Proof of Identity

To finalize your sign up, you’ll need to submit one valid, government-issued identification document. Here are the most common and readily accepted options:

- International Passport: This is a universally recognized form of ID. Ensure it is current and clearly displays your full name, photograph, date of birth, and signature.

- National Identity Card: A valid national ID card issued by your country’s government, such as an EU identity card, is highly suitable. Make sure all personal details are legible and the card is not expired.

- Driver’s License: Your valid driver’s license can also serve as proof of identity. Provide clear scans or photos of both the front and back, ensuring your photo, signature, and expiration date are visible.

Each document must be valid and unexpired. Provide a full image of the document, showing all four corners and clearly readable text. Blurred or partial images may delay your approval.

Key Document Requirements

Ensure your chosen document meets these essential criteria for swift approval:

| Requirement | Description |

|---|---|

| Validity | The document must not be expired. |

| Clarity | All text, photo, and security features must be sharp and readable. |

| Completeness | Upload a full image showing the entire document, including all edges. |

| Matching Details | The name on the document must match the name used during your registration. |

Gathering these documents beforehand significantly speeds up your sign up, letting you focus on what truly matters: your trading journey. This is how to join us with confidence and get your IC Markets Sign Up completed without delay.

Valid Proof of Residence Requirements

Ready to IC Markets sign up and dive into the markets? A crucial step in securing your trading account is providing valid proof of residence. This isn’t just a formality; it’s a regulatory requirement designed to protect your account and ensure a safe trading environment for everyone. Having the right documents prepared makes the entire registration process incredibly smooth.

To successfully open account with us, you will need to submit one document from the list below. These documents help us verify your current residential address, an essential part of our ‘Know Your Customer’ (KYC) compliance.

Accepted Proof of Residence Documents:

- Utility Bill: This includes electricity, water, gas, internet, or landline phone bills. It must be issued by a recognized service provider.

- Bank or Credit Card Statement: A statement from a reputable bank or financial institution showing your name and address.

- Government-Issued Residence Certificate: Official documents issued by a local government authority confirming your residential address.

- Tax Statement: An official tax assessment or statement from a government body.

- Rental Agreement: A valid, signed rental agreement or lease showing your name and address (must be recent and officially recognized).

For your document to be considered valid proof of residence, it must meet specific criteria:

- Recency: The document needs to be dated within the last six months. Old documents will not be accepted.

- Full Name Match: Your full name on the document must exactly match the name you used during the IC Markets sign up process.

- Clear Address: Your complete residential address must be clearly visible and match the address provided in your registration application.

- Issuing Authority: The document should clearly show the name or logo of the issuing authority (e.g., bank, utility company).

- Full Page Scan: Please ensure all four corners of the document are visible in the uploaded image or scan.

Understanding these requirements helps you streamline your account activation. Preparing these documents ahead of time ensures a quick and hassle-free registration. We want to make it as easy as possible for you to complete your sign up and begin your trading journey. Don’t let a simple document hold you back; knowing how to join quickly starts with correct preparation.

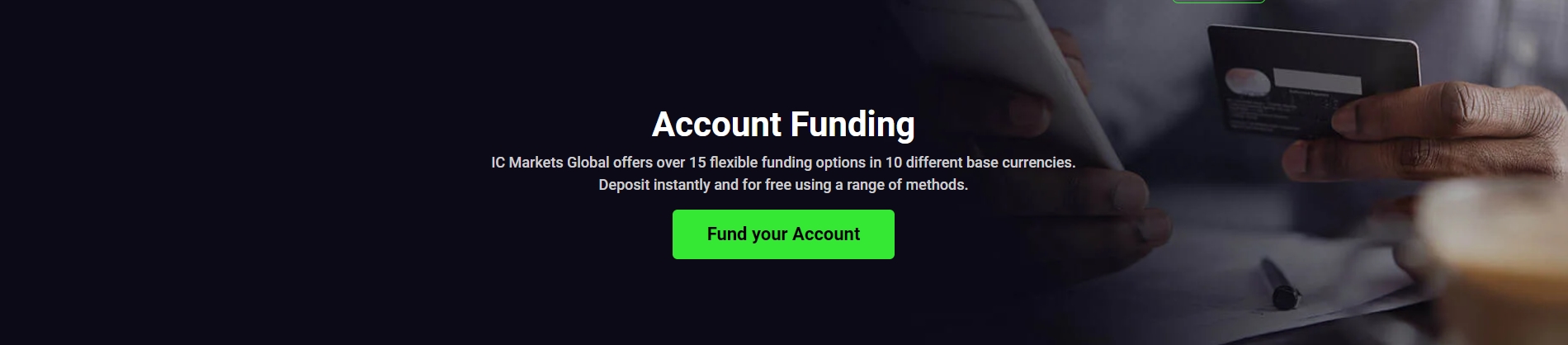

Funding Your IC Markets Trading Account

Once you’ve completed your IC Markets sign up and successfully opened your trading account, the next vital step is to fund it. This is where you prepare your account to seize market opportunities. Getting your capital ready doesn’t have to be a headache; IC Markets provides a robust and user-friendly system designed for speed and security. Whether you’re new to online trading or a seasoned professional, you’ll find the process straightforward and efficient.

Diverse Funding Options at Your Fingertips

IC Markets understands that traders have different preferences for managing their money. That’s why they offer an extensive array of deposit methods, ensuring you can choose the one that best suits your needs. Your initial registration paves the way for a seamless funding experience.

- Credit/Debit Cards: Visa and Mastercard are popular choices for instant deposits, allowing you to react quickly to market changes.

- Bank Transfers: Direct bank transfers, while sometimes taking a little longer, offer a secure way to move larger sums. Many local options are available depending on your region.

- e-Wallets: Solutions like PayPal, Skrill, and Neteller provide fast and secure transactions, often preferred for their convenience and privacy features.

- Broker-to-Broker Transfers: If you’re moving funds from another brokerage account, this option simplifies the process.

Key Considerations for Your Deposit

Before you add funds, it’s wise to consider a few critical aspects to ensure a smooth transaction. This helps you get started trading faster after you how to join the platform.

Minimum Deposit: IC Markets offers highly accessible minimum deposit requirements, making it easier for new traders to get started without a large initial capital outlay. This flexibility allows you to begin trading with an amount that aligns with your comfort level.

Processing Times:

The speed at which your funds appear in your trading account can vary significantly by method:

| Method | Typical Processing Time | Potential Fees |

|---|---|---|

| Credit/Debit Card | Instant | Generally Zero |

| e-Wallets (e.g., PayPal, Skrill) | Instant | Generally Zero |

| Bank Wire Transfer | 2-5 Business Days | Bank Fees May Apply |

Most electronic methods process deposits instantly, getting you into the market without delay. Bank transfers, on the other hand, typically take a few business days to clear.

Fees and Charges: IC Markets prides itself on offering fee-free deposits for most methods. However, always be aware that your bank or payment provider might impose their own charges for international transfers or currency conversions. Always check with your provider beforehand.

How to Fund Your Account: A Simple Guide

- Log in: Access your secure Client Area using your credentials.

- Navigate: Locate the “Deposit Funds” or “Funding” section within your dashboard.

- Choose Method: Select your preferred deposit method from the available options.

- Enter Details: Input the amount you wish to deposit and provide the necessary payment details (e.g., card number, e-wallet login).

- Confirm: Review your transaction details and confirm the deposit.

You’ll receive a confirmation once the transaction is successful, and your funds will reflect in your trading account according to the processing times.

“Security is paramount. IC Markets employs advanced encryption and regulatory compliance to protect your funds and personal information throughout the deposit and withdrawal process.”

Available Deposit Methods for IC Markets Sign Up

Getting started with your trading journey after you decide to complete your IC Markets Sign Up is an exciting step. A crucial part of this process involves funding your account quickly and securely. Fortunately, IC Markets provides a broad spectrum of deposit methods, ensuring flexibility and convenience for traders worldwide. We make it simple to deposit funds so you can focus on what matters most: your trading strategy.

When you open account, you’ll find options tailored for speed, low fees, and ease of use. This variety caters to different preferences, whether you prioritize instant funding or prefer traditional banking methods. Our goal is to make your initial deposit seamless, allowing you to move from registration to trading without unnecessary delays.

Popular Deposit Options Explained

Let’s look at some of the most frequently used methods and what you can expect:

| Method Type | Typical Processing Time | Key Benefit |

|---|---|---|

| Credit/Debit Cards (Visa/Mastercard) | Instant | Widely accepted, immediate access to funds. |

| e-Wallets (Skrill, Neteller, PayPal) | Instant | Fast, secure, and often preferred for online transactions. |

| Bank Wire Transfer | 2-5 Business Days | Ideal for larger deposits, highly secure. |

| Local Bank Transfers (Specific regions) | Same Day to 2 Business Days | Convenient for regional clients, often lower fees. |

Beyond these, IC Markets also supports a range of alternative payment solutions, depending on your geographic location. These can include various online banking portals and regional payment gateways, all designed to facilitate a smooth funding experience after your initial registration.

Choosing Your Best Deposit Method

When you’re ready to fund your account, consider these points to pick the right method:

- Speed: If you need to trade immediately, instant methods like credit/debit cards or e-wallets are your best bet.

- Fees: While IC Markets generally does not charge deposit fees, your bank or payment provider might. Always check their terms.

- Currency: Ensure your chosen method supports your preferred currency to avoid potential conversion fees.

- Withdrawal Matching: For security purposes, withdrawals often need to go back to the original deposit method. Keep this in mind.

We empower you with choices to make your how to join experience as efficient and user-friendly as possible. Select the method that best fits your needs and start trading with confidence after your IC Markets Sign Up.

Selecting Your Trading Platform: MetaTrader 4, MetaTrader 5, or cTrader?

Choosing the right trading platform is a pivotal step on your financial journey. It’s the cockpit from which you navigate the markets, execute trades, and analyze opportunities. At IC Markets, we empower you with a selection of industry-leading platforms, each designed to cater to different trading styles and preferences. Understanding their unique strengths helps you make an informed decision before you dive into the IC Markets Sign Up process.

Let’s explore the standout features of MetaTrader 4, MetaTrader 5, and cTrader so you can confidently pick the perfect environment for your trading endeavors.

MetaTrader 4 (MT4): The Forex Classic

- Intuitive Interface: Easy to navigate, even for beginners.

- Extensive Charting Tools: A wide array of indicators and analytical objects for deep market analysis.

- Expert Advisors (EAs): Seamless integration of automated trading strategies, making it a favorite for algorithmic traders.

- Large Community Support: Access to a vast network of developers and fellow traders for resources and tools.

MetaTrader 5 (MT5): The Multi-Asset Evolution

- Multi-Asset Trading: Trade forex, CFDs on stocks, indices, commodities, and more from a single platform.

- Enhanced Charting: More timeframes and additional built-in indicators compared to MT4.

- Depth of Market (DOM): Gain deeper insights into market liquidity and order flow.

- Integrated Economic Calendar: Stay on top of key economic events directly within the platform.

- Faster Processing: Improved performance for quicker trade execution.

cTrader: The Modern ECN Experience

- Sleek User Interface: A clean, contemporary design focused on user experience.

- Advanced Order Types: Access to a comprehensive suite of order types for precise trade management.

- Deep Liquidity & Transparent Pricing: Experience true market conditions with no dealing desk intervention.

- Detailed Trade Analytics: Understand your trading performance with in-depth statistics and reports.

- cAlgo for Algorithmic Trading: Build and run custom trading robots using C#.

A Quick Look at Key Differences:

| Feature | MetaTrader 4 | MetaTrader 5 | cTrader |

|---|---|---|---|

| Primary Focus | Forex | Multi-Asset | ECN Forex, CFDs |

| Programming Language | MQL4 | MQL5 | C# (cAlgo) |

| Depth of Market | No (Standard) | Yes | Yes |

| Interface Style | Classic, Functional | Updated Classic | Modern, Intuitive |

Ultimately, the best platform is the one that aligns perfectly with your trading strategy and comfort level. Consider your asset preferences, need for automation, and analytical requirements.

Ready to make your choice? We make it easy for you to open account and begin your trading journey. Once you decide, the registration process is straightforward. We are here to support you whether you are new to the markets or looking for an advanced platform. Take the next step and discover how to join our community of traders.

Setting Up Your First Trade After IC Markets Sign Up

You successfully completed your IC Markets sign up. Now the exciting part begins: placing your very first trade. This guide walks you through the essential steps, making it straightforward to start your trading journey with confidence. We focus on clarity and action, ensuring you feel prepared to navigate the markets.Logging In and Funding Your Account

Your first step after registration is to access your personalized client area. Use the credentials you set during your IC Markets sign up. * **Login**: Enter your username and password on the IC Markets website or through the dedicated client portal. * **Fund Your Account**: Before you can trade, you need funds. If you haven’t already, deposit capital into your trading account. IC Markets provides various secure payment methods, making this process quick and easy. This critical step ensures you have the necessary balance to open account positions.Navigating Your Trading Platform

IC Markets offers industry-leading platforms like MetaTrader 4, MetaTrader 5, and cTrader. Choose the one you prefer and launch it. * **Market Watch**: This window displays a list of available trading instruments (forex pairs, commodities, indices, etc.) and their current buy/sell prices. * **Navigator**: Here, you manage your accounts, access indicators, and Expert Advisors. * **Terminal/Toolbox**: This area shows your open trades, pending orders, account history, and journal. Familiarize yourself with these sections; they are your control panel.Selecting Your Trading Instrument

Now, choose what you want to trade. 1. **Browse Instruments**: In the Market Watch window, scroll through the list of instruments. You might see popular forex pairs like EUR/USD, commodities such as Gold, or major stock indices. 2. **Identify an Asset**: Pick an instrument you’ve researched or feel comfortable trading. 3. **Open Order Window**: Right-click on your chosen instrument and select “New Order” or simply double-click it. This brings up the order execution window.Placing Your First Trade – Step-by-Step

Inside the order window, you define the specifics of your trade. Pay close attention to each field.| Setting | Description |

|---|---|

| **Symbol** | Confirm the asset you are trading (e.g., EUR/USD). |

| **Volume** | This is your trade size, measured in lots. Start with a very small volume, especially for your initial trades, to manage risk effectively. |

| **Stop Loss (SL)** | Set a specific price level where your trade automatically closes if it moves against you. This limits potential losses and protects your capital. Always use a Stop Loss! |

| **Take Profit (TP)** | Define a specific price level where your trade automatically closes if it reaches your desired profit target. This helps lock in gains. |

| **Type** | Choose “Market Execution” for an instant trade at the current market price, or “Pending Order” if you want the trade to execute only when the price reaches a specific level in the future. |

Monitoring and Managing Your Trade

Once placed, your active trade appears in the “Trade” tab of your Terminal or Toolbox. * **Track Performance**: Watch your trade’s real-time profit/loss. * **Modify Orders**: You can adjust your Stop Loss or Take Profit levels at any time by right-clicking the trade and selecting “Modify or Delete Order.” * **Close Manually**: If you decide to exit the trade before it hits your SL or TP, right-click the trade and select “Close Order.” Remember, successful trading involves continuous learning and careful risk management. After your IC Markets sign up, take advantage of the educational resources available to refine your strategy and build your expertise. This methodical approach helps new traders learn how to join the markets effectively and responsibly.Navigating the IC Markets Client Area

The moment you complete your IC Markets Sign Up, you gain immediate access to your personalized Client Area. Think of it as your central command center for all trading activities. This intuitive platform puts you in complete control, helping you manage your funds, accounts, and tools with remarkable ease.

Once you open an account, the Client Area unlocks a suite of powerful features:

- Account Management: Effortlessly oversee all your trading accounts, including real and demo accounts. Monitor balances, equity, and margin levels at a glance.

- Fund Management: Initiate deposits and withdrawals securely and efficiently. Choose from various payment methods to fund your account or access your profits.

- Trading Tools & Resources: Discover a wealth of resources, including market analysis, educational materials, and access to premium trading tools to enhance your strategy.

- Profile Settings: Update personal details, manage security settings, and customize your preferences for a tailored experience.

- Support Access: Connect directly with customer support should you have any questions or require assistance with your registration or any other aspect of your trading journey.

A well-structured Client Area is crucial for a smooth trading experience. It streamlines processes, saves time, and gives you a clear overview of your financial standing. From the initial sign up to daily trading operations, this hub ensures you have everything you need at your fingertips.

Getting started is straightforward after your registration. Here’s a quick guide to some common actions you can take right after you sign up:

| Action | Description |

|---|---|

| Fund Your Account | Access the ‘Deposits’ section and select your preferred method. |

| Open a New Account | Navigate to ‘My Accounts’ and choose to open a new live or demo account. |

| Request Withdrawal | Go to ‘Withdrawals’, specify the amount, and choose your method. |

Understanding how to navigate this space is key to maximizing your trading potential. It’s where your trading journey truly begins, providing the essential foundation for successful market engagement. Take the time to explore its capabilities – it empowers you every step of the way.

Security Measures and Data Protection at IC Markets

Your financial safety and data privacy stand as our utmost priority. When you consider an IC Markets sign up, you’re not just choosing a trading platform; you’re opting for a secure environment crafted with industry-leading protection measures. We understand that trust is built on transparency and robust security protocols. That’s why we’ve implemented a multi-layered approach to safeguard your funds and personal information from the moment you decide to open account with us.

Regulatory Compliance: A Foundation of Trust

Our commitment to security begins with strict adherence to global regulatory standards. Being regulated by prominent financial authorities provides a robust framework that mandates stringent operational and security requirements. These bodies oversee our conduct, ensuring we operate with integrity and maintain the highest levels of client protection. This regulatory oversight forms the bedrock of our secure trading environment, giving you peace of mind.

Client Fund Segregation: Your Funds Are Yours

One of the most critical security measures we employ is the segregation of client funds. When you make a deposit, your money is held in separate trust accounts with top-tier global banks, entirely distinct from IC Markets’ operational capital. This means your funds are ring-fenced and protected, even in unforeseen circumstances. This segregation ensures your capital remains untouched and accessible only by you.

Advanced Data Encryption: Protecting Your Privacy

From the moment you begin your registration, your personal and financial data are shielded by state-of-the-art encryption technologies. We utilize Secure Socket Layer (SSL) encryption across all our platforms and during all data transfers. This technology creates an encrypted link between our servers and your browser, ensuring that all information – from your login credentials to deposit details – remains confidential and impenetrable to unauthorized access. Your privacy is non-negotiable.

Here are key aspects of our data protection strategy:

- SSL Encryption: Safeguards all data transmitted between you and our servers.

- Firewall Protection: Advanced firewalls guard our internal networks against external threats.

- Secure Servers: Our servers reside in highly secure data centers with physical and digital access controls.

- Regular Security Audits: Independent experts routinely test our systems for vulnerabilities.

- Strict Privacy Policy: We adhere to a comprehensive privacy policy, detailing how we collect, use, and protect your information, ensuring transparency throughout your journey, from registration to trading.

Secure Trading Environment: Beyond the Sign-Up

The security extends far beyond your initial sign up. Our trading platforms (MetaTrader 4, MetaTrader 5, and cTrader) are designed with security in mind, offering features like two-factor authentication (2FA) to add an extra layer of protection to your account access. This means even if your password is compromised, an unauthorized user cannot access your account without the second verification step.

Consider these proactive steps we take:

| Security Aspect | Our Commitment |

|---|---|

| Login Security | Optional Two-Factor Authentication (2FA) |

| Transaction Integrity | Encrypted payment gateways for deposits/withdrawals |

| System Monitoring | 24/7 real-time threat detection and response |

Your Role in Security

While we implement extensive security measures, you play a crucial role in protecting your account. We encourage you to use strong, unique passwords, enable 2FA, and remain vigilant against phishing attempts. Learning how to join a secure trading platform also means understanding your own responsibility in maintaining online safety. Together, we create an ironclad defense.

Rest assured, when you proceed with an IC Markets sign up, you’re choosing a broker that prioritizes your security as much as your trading success.

Common IC Markets Sign Up Issues and Troubleshooting

Embarking on your trading journey with IC Markets is an exciting step! While the IC Markets Sign Up process is generally straightforward, sometimes a small hurdle can slow things down. Don’t worry, even experienced traders hit a snag now and then. This guide addresses the most common issues users face when they try to open account with IC Markets and provides actionable solutions to get you trading faster.

Email Verification Glitches

- Check Your Spam/Junk Folder: Often, verification emails land here by mistake. Take a quick look!

- Verify Your Email Address: Did you type it correctly during the initial sign up? A small typo can cause big problems.

- Wait a Few Minutes: Sometimes, there’s a slight delay. Give it five to ten minutes before requesting a resend.

- Add to Safe Sender List: Add IC Markets to your email’s safe sender list to prevent future issues.

Document Upload Difficulties

Identity verification is vital for security and compliance. Issues with document uploads are quite common. When you’re asked for proof of identity and residency, make sure your documents meet the following criteria:

| Requirement | Details to Check |

|---|---|

| Clarity | Ensure images are clear, high-resolution, and readable. No blurriness! |

| Full Document Visible | All four corners of the document must be visible. |

| Validity | Documents must not be expired. Always use current IDs. |

| File Type & Size | Most platforms accept JPG, PNG, or PDF. Check the maximum file size limit. |

Troubleshooting Tip: If your upload consistently fails, try converting the document to a different accepted format or resizing the file. A smartphone camera often takes high-res photos that might exceed the size limit.

Personal Information Mismatches

Accuracy is key when you open account. Any discrepancy between the information you provide during registration and your uploaded documents can cause delays.

“Always double-check your name, date of birth, and address against your official documents before submitting your application. A small typo can flag your application for manual review.”

What to do: If you spot an error after submission, contact IC Markets support immediately. They can guide you on correcting the details.

Technical Hiccups During Application

Sometimes, the problem isn’t with your data but with the connection or browser.

- Internet Connection: Ensure you have a stable and strong internet connection.

- Browser Compatibility: Use a widely supported browser like Chrome, Firefox, Safari, or Edge. Update it to the latest version.

- Clear Cache and Cookies: Old browser data can sometimes interfere with forms. Clear your browser’s cache and cookies, then try again.

- Disable VPNs/Ad-Blockers: These can occasionally block essential elements of the IC Markets Sign Up form.

Delays in Account Activation

You’ve completed everything, but your account isn’t active yet. What gives?

While IC Markets strives for quick processing, reviewing applications takes time. Factors include:

- Volume of Applications: Peak periods can lead to slight delays.

- Complexity of Documents: If your documents require additional verification.

- Time Zones: If you’re applying outside of business hours in their operational region.

Action: If it’s been longer than the stated processing time, reach out to their customer support. They can provide an update on your how to join status.

By proactively addressing these common issues, your path to successful IC Markets Sign Up will be smooth and efficient. Remember, their support team is always ready to assist if you encounter anything unexpected during your journey to open account.

Benefits of Trading with IC Markets: Spreads, Execution, and Support

Ready to elevate your trading journey? Choosing the right broker makes all the difference, and IC Markets stands out for good reasons. When you consider an IC Markets Sign Up, you gain access to a platform built around performance, reliability, and robust support. Let’s dive into the core advantages that empower traders worldwide.

Cost-efficiency is paramount in trading, and IC Markets truly excels with its incredibly tight spreads. This means you keep more of your hard-earned profits. We connect you directly with top-tier liquidity providers, cutting out unnecessary markups and delivering genuine market pricing.

- Razor-Thin Pricing: Benefit from spreads starting from 0.0 pips on major currency pairs. This dramatically reduces your trading costs.

- Transparent Fees: Enjoy clear, commission-based pricing on raw spreads, ensuring full transparency in every trade.

- Optimal Conditions: Our competitive spreads provide an edge, especially for high-frequency traders and scalpers.

Here’s a glimpse at typical spreads on our True ECN account:

| Instrument | Typical Spread (pips) |

|---|---|

| EUR/USD | 0.0 – 0.1 |

| GBP/USD | 0.3 – 0.5 |

| AUD/USD | 0.1 – 0.2 |

In the fast-paced world of financial markets, every millisecond counts. IC Markets understands this, which is why we invest heavily in cutting-edge technology to ensure lightning-fast trade execution. Your orders process swiftly and reliably, minimizing slippage and maximizing opportunity.

We leverage:

- High-Speed Servers: Strategically located data centers near major financial hubs ensure minimal latency.

- Enterprise-Grade Hardware: Powerful infrastructure handles massive trading volumes with ease and precision.

- No Dealing Desk Intervention: Your trades go straight through, avoiding re-quotes and ensuring true market execution.

IC Markets prides itself on offering exceptional customer support, available whenever you need it. Our dedicated team is ready to help you navigate any challenge, ensuring your trading experience remains smooth and stress-free.

“From guiding you through the registration process to resolving complex trading queries, our support team is always here for you.”

Our support channels include:

- 24/7 Availability: Speak to a real person, day or night, across five trading days.

- Multilingual Team: Get assistance in your preferred language, ensuring clear communication.

- Comprehensive Resources: Access extensive educational materials and FAQs to enhance your knowledge.

When you combine ultra-tight spreads, unparalleled execution speed, and world-class customer support, you get a trading environment designed for success. Many traders open account with IC Markets to benefit from these core strengths. If you’re wondering how to join our community, the registration process is straightforward and quick. Take the next step towards optimized trading.

Getting Started with Demo Trading on IC Markets

Want to dive into the world of trading without risking a single penny? An IC Markets demo account offers the perfect playground. It is your ultimate training ground, a risk-free environment where you can sharpen your skills and build confidence before hitting the live markets. This is how you gain a significant edge.Why Practice with an IC Markets Demo Account?

Choosing the right platform for practice is crucial. IC Markets provides an unparalleled demo experience designed to mirror real market conditions. Here’s what makes it stand out:- Real Market Conditions: Experience true market volatility, pricing, and execution speeds without the pressure of live funds.

- Advanced Platforms: Get hands-on with MetaTrader 4, MetaTrader 5, or cTrader. Explore their full functionality, charting tools, and indicators.

- Substantial Virtual Funds: Trade with generous virtual capital, allowing you to practice various position sizes and strategies.

- No Time Limits: Practice at your own pace for as long as you need to feel truly ready for the live markets.

- Access to All Instruments: Test your strategies across a wide range of assets, including forex, commodities, indices, and cryptocurrencies.

Your Path to Demo Trading: The IC Markets Sign Up Process

Ready to begin your journey? The IC Markets Sign Up process for a demo account is remarkably straightforward. You will be trading in minutes. We have made it simple to get started.- Visit the Official IC Markets Website: Navigate directly to their homepage.

- Locate the Demo Account Option: You will typically find a prominent “Try Demo” or “Open Demo Account” button on the main page.

- Complete the Registration Form: Fill in your basic details. This swift registration asks for your name, email, and country. This is where you quickly sign up and begin your trading adventure.

- Choose Your Trading Platform: Select your preferred platform – MT4, MT5, or cTrader – based on your familiarity or learning goals.

- Set Your Virtual Capital: Decide how much virtual money you wish to start with. This allows you to simulate your desired account size.

- Access Your Account: You will receive your login details, and then you are ready to explore. It’s truly that simple to open account and start practicing. If you’re wondering how to join, these steps cover everything you need.

Maximizing Your Demo Trading Experience

Don’t just randomly trade. Treat your demo account like a real one to get the most out of it.- Set Clear Goals: Define what you want to achieve with your practice. Are you testing a new strategy, understanding a platform, or improving your discipline?

- Test Strategies Thoroughly: Experiment with different trading approaches under various market conditions. Document your results.

- Analyze Every Trade: Review your virtual trades to understand successes and failures. What went right? What went wrong? Learn from each outcome.

- Practice Risk Management: Even with virtual funds, implement good risk management principles. This builds habits crucial for live trading.

- Use Real-World News: Follow market news and economic calendars. Practice reacting to real-time events within your demo environment.

Important Considerations Before You Sign Up with IC Markets

Embarking on your trading journey with a new broker requires careful thought. Before you complete your IC Markets sign up, it’s crucial to evaluate several key areas. Making an informed decision ensures your trading experience aligns with your goals and expectations. Let’s explore what you need to consider.

Regulatory Oversight and Fund Security

One of the first things to check is the broker’s regulatory status. IC Markets operates under various reputable financial authorities globally, which provides a layer of protection for traders. Understanding which entity regulates your specific account offers peace of mind. Here’s why this matters:

- Investor Protection: Regulatory bodies often implement schemes to protect client funds.

- Operational Standards: Regulated brokers adhere to strict operational guidelines, promoting fairness and transparency.

- Segregated Accounts: Client funds are typically kept in separate bank accounts from the company’s operational capital, safeguarding your investment.

Before you open account, always verify the specific licenses and jurisdictions relevant to your region.

Understanding Account Types and Trading Conditions

IC Markets offers a range of account types, each designed to suit different trading styles and experience levels. Taking time to review these options will help you choose the best fit for your strategy. Think about these aspects:

- Spreads and Commissions: Compare the typical spreads on popular currency pairs and any associated commission fees. IC Markets is known for competitive pricing, especially on their Raw Spread accounts.

- Leverage Options: Understand the available leverage and how it impacts both potential profits and risks. Higher leverage means higher risk.

- Minimum Deposit: Check the initial deposit requirement for your chosen account type.

- Execution Speed: Fast execution is vital for traders, especially those employing strategies like scalping.

Knowing these details before you complete your registration helps manage expectations and plan your capital effectively.

Trading Platforms and Tools

The quality and features of the trading platform directly influence your ability to execute trades and analyze markets efficiently. IC Markets provides access to industry-standard platforms. Consider the following:

- Platform Choice: Are you comfortable with MetaTrader 4 (MT4), MetaTrader 5 (MT5), or cTrader? Each platform has unique features and interfaces.

- Mobile Trading: Ensure there are robust mobile applications available if you plan to trade on the go.

- Analytical Tools: Look for built-in indicators, charting tools, and access to market news or analysis that support your decision-making process.

- Automated Trading: If you use Expert Advisors (EAs) or other automated strategies, confirm the platform’s compatibility and reliability.

A user-friendly and feature-rich platform enhances your overall trading experience.

Customer Support and Educational Resources

Even experienced traders sometimes need assistance. Strong customer support and accessible educational materials are invaluable resources. When you consider how to join, evaluate:

- Availability: Is support available 24/5 or 24/7? What channels can you use (live chat, email, phone)?

- Language Support: Does the broker offer support in your preferred language?

- Responsiveness: How quickly do they typically respond to inquiries?

- Educational Content: Look for webinars, tutorials, articles, or guides that can help improve your trading knowledge and skills.

Reliable support can save you time and frustration should any issues arise.

Funding Methods and Withdrawal Policies

Depositing and withdrawing funds should be a straightforward process. Before you proceed with your IC Markets sign up, clarify these financial logistics:

| Aspect | Consideration |

|---|---|

| Deposit Options | Available methods (bank transfer, credit/debit cards, e-wallets), processing times, and any associated fees. |

| Withdrawal Process | How long do withdrawals typically take? Are there minimum withdrawal amounts or fees? |

| Currency Options | Does the broker support your preferred account base currency to avoid conversion fees? |

Understanding these details upfront prevents unexpected delays or costs.

By thoroughly reviewing these considerations, you will be well-prepared for your IC Markets sign up. Taking the time to do your due diligence ensures a smoother and more confident start to your trading journey with a clear understanding of what to expect.

Frequently Asked Questions

How do I begin the IC Markets sign-up process?

To start your journey, visit the official IC Markets website and locate the “Open Account” or “Register” button. Click this to begin the secure online registration form, where you’ll provide basic details like your name, email, and country of residence to create your initial profile.

What documents are required to verify my identity and residence?

For identity verification (KYC), you will need to upload a clear, valid copy of a government-issued photo ID, such as a passport, national ID card, or driver’s license. For proof of residence, a recent utility bill or bank statement (issued within the last three to six months) showing your current address is typically required.

What are the main trading account types offered by IC Markets?

IC Markets primarily offers three main account types: the Standard Account, the Raw Spread Account, and the cTrader Account. The Standard Account features commission-free trading with spreads included. The Raw Spread Account offers ultra-tight spreads with a small, fixed commission per lot. The cTrader Account provides similar low spreads and commissions on the advanced cTrader platform.

How can I fund my IC Markets trading account after registration?

After completing your registration and verification, you can fund your account through various secure methods. These typically include credit/debit cards (Visa/Mastercard) for instant deposits, bank wire transfers for larger amounts (2-5 business days), and popular e-wallets like PayPal, Skrill, or Neteller for fast and convenient transactions.

Which trading platforms can I use with IC Markets?

IC Markets supports industry-leading trading platforms to suit diverse trader needs. You can choose from MetaTrader 4 (MT4), known as the classic platform for forex trading and Expert Advisors; MetaTrader 5 (MT5), an advanced multi-asset platform with more tools and assets; or cTrader, which offers a modern interface, deep liquidity, and sophisticated order types for ECN trading.