Ready to dive into the world of stocks trading? You’ve come to the right place. Trading IC Markets stocks gives you direct access to some of the biggest companies on the planet. Forget limitations. Start exploring a universe of opportunities in equity trading from a single, powerful platform. We make it simple to get started and provide the tools you need to build your strategy and take control of your trading today.

Why should you consider trading stocks with us? It all comes down to access, power, and flexibility.

- Global Reach: Trade on major international exchanges like the NYSE, NASDAQ, and ASX. The world’s markets are open to you.

- Powerful Platforms: Use industry-leading platforms like MetaTrader 4, MetaTrader 5, and cTrader to analyze markets and execute trades.

- Low-Cost Trading: Benefit from tight spreads and some of the lowest commissions in the industry, helping you maximize your potential returns.

- Flexible Positions: Go long or short. You can profit from markets that are rising as well as those that are falling.

- Understanding Share CFDs

- Start Your Trading Journey in 4 Simple Steps

- What is IC Markets and Can You Trade Stocks?

- Exploring the Range of Stocks on IC Markets

- US Stocks (NYSE & NASDAQ)

- Australian Stocks (ASX)

- Key Advantages of Trading ASX Stocks:

- European and Asian Stock CFDs

- How to Start Trading Stocks: A Step-by-Step Guide

- Understanding the Costs: Spreads, Commissions, and Fees

- Trading Platforms for IC Markets Stocks: MT4 vs MT5 vs cTrader

- Are IC Markets Stocks Real Shares or CFDs?

- Leverage and Margin Requirements for Stock Trading

- Key Benefits of Trading Stocks with IC Markets

- Managing Risks When Trading Stock CFDs

- Your Core Risk Management Checklist

- IC Markets vs Competitors: A Stock Trading Comparison

- Essential Tools and Features for Stock Traders

- Technical Analysis Indicators

- Market Research and News Feeds

- Account Types for Optimal Stock Trading Conditions

- Deposits and Withdrawals for Your Trading Account

- Final Verdict: Is IC Markets a Good Broker for Stocks?

- Frequently Asked Questions

- Frequently Asked Questions

Understanding Share CFDs

We offer access to the stock market through share CFDs (Contracts for Difference). This is a popular way to trade on the price movements of company shares without actually owning them. You are simply speculating on whether the price will go up or down. This method provides leverage, which can amplify both your potential profits and losses, so it’s important to manage your risk carefully.

| Feature | Share CFDs | Traditional Share Investing |

|---|---|---|

| Ownership | No ownership of the underlying asset | Direct ownership of company shares |

| Leverage | Leverage is available | No leverage (you pay the full value) |

| Market Direction | Go long (buy) or short (sell) | Typically long positions only |

Unlock the potential of the world’s leading companies. Your journey into equity trading starts with the right tools and global access.

Start Your Trading Journey in 4 Simple Steps

Getting started is quick and straightforward. You can begin exploring opportunities in global markets in just a few minutes.

- Open Your Account: Complete our simple and secure online application form.

- Fund Your Account: Choose from a wide range of convenient funding options.

- Select Your Platform: Download your preferred trading platform—MT4, MT5, or cTrader.

- Start Trading: Access thousands of global company shares and begin your trading journey.

Whether you’re new to the markets or an experienced trader, the world of IC Markets stocks offers a dynamic environment to engage with global finance. Explore the potential, build your strategy, and take control of your trading today.

What is IC Markets and Can You Trade Stocks?

You’ve likely heard the name IC Markets mentioned in trading circles. It’s a globally recognized broker known for its fast execution speeds and tight spreads. Traders often choose it for its robust platform and access to deep liquidity. But what about trading company shares? The short answer is a resounding yes.

When it comes to IC Markets stocks, you gain access to the market in a modern and flexible way. Instead of buying and holding physical shares, you engage in stocks trading through an instrument called a Contract for Difference (CFD). This means you speculate on the price movement of top global equities without ever owning the underlying asset. It’s a popular method for active equity trading.

Trading share CFDs offers several unique advantages: Go Long or Short to profit from both rising and falling markets; use Leverage to control a larger position with a smaller initial deposit; access Global Markets from a single platform; and avoid Stamp Duty since you don’t own the physical share.

So, what does this mean for you? Trading share CFDs offers several unique advantages:

- Go Long or Short: You can profit from both rising and falling markets. If you believe a stock’s price will go up, you “go long” (buy). If you think it will fall, you “go short” (sell).

- Leverage: You can control a larger position with a smaller initial deposit. Leverage magnifies both potential profits and potential losses, so you must manage your risk carefully.

- Global Access: Trade shares from major international exchanges like the NYSE and NASDAQ, all from a single platform.

- No Stamp Duty: Since you don’t own the physical share, you typically don’t pay stamp duty on your trades.

CFD trading unlocks the potential of the stock market by focusing purely on price movement, offering a dynamic alternative to traditional investing.

To help you understand the difference, let’s compare traditional share dealing with share CFDs.

| Feature | Traditional Share Dealing | Share CFDs |

|---|---|---|

| Ownership | You own the company shares. | You do not own the underlying asset. |

| Market Direction | Primarily profit from rising prices. | Potential to profit from both rising and falling prices. |

| Leverage | Not typically available. | Leverage is a core feature. |

| Shareholder Rights | Receive dividends and voting rights. | Receive dividend adjustments, but no voting rights. |

This approach gives you a powerful way to interact with the world’s biggest companies. Whether you’re interested in tech giants or established blue-chip firms, IC Markets provides the tools to build a diverse trading strategy. It’s an exciting opportunity to explore the world of stocks trading with enhanced flexibility.

Exploring the Range of Stocks on IC Markets

Dive into a world of opportunity with direct access to global markets. We open the door for you to trade some of the biggest and most exciting companies listed today. Successful equity trading isn’t just about timing; it’s about having the right assets at your fingertips. The range of IC Markets Stocks gives you the flexibility to build a diverse and dynamic portfolio.

You gain exposure to a massive selection of international company shares. This means you are not limited to just one local market. Explore possibilities across different economies and sectors. Our offerings include:

- Major Global Exchanges: Trade well-known names from the NYSE, NASDAQ, and the Australian Stock Exchange (ASX).

- Diverse Industries: From fast-moving tech giants and innovative healthcare firms to stable financial institutions and resource powerhouses.

- Blue-Chip & Growth Stocks: Find opportunities in both established market leaders and emerging companies with high growth potential.

We provide access through share CFDs, a powerful tool for modern traders. This method allows you to speculate on the price movement of stocks without owning the underlying asset. This approach comes with its own set of unique characteristics.

| Advantages of Trading Share CFDs | Key Considerations |

|---|---|

| Go long (buy) or short (sell) to trade in any market direction. | Leverage can amplify both profits and losses. |

| Access global markets from a single, unified platform. | You do not have ownership rights in the company. |

“The sheer variety is a game-changer. Being able to act on news from Wall Street or Sydney without switching platforms has completely streamlined my stocks trading strategy.”

Whether you follow titans like Apple, monitor the banking sector, or track commodity-linked stocks, you’ll find a wealth of options. Your strategy dictates your choices, and we provide the vast marketplace to execute it. Discover the full list of available stocks and start your trading journey today.

US Stocks (NYSE & NASDAQ)

Dive into the heart of the global economy. The New York Stock Exchange (NYSE) and NASDAQ are home to the world’s most influential and innovative companies. This dynamic environment offers incredible opportunities for stocks trading, giving you direct access to household names and groundbreaking tech giants.

Why should you trade on the US markets?

- Unmatched Liquidity: Millions of shares change hands daily, ensuring you can enter and exit positions with ease.

- Global Impact: These companies drive worldwide trends, making them exciting to follow and trade.

- Diverse Opportunities: The sheer variety of sectors offers a vast landscape for your equity trading strategy.

We make accessing these powerful markets simple. Experience trading top IC Markets Stocks with the competitive conditions and robust tools you need. By trading share CFDs, you can speculate on the price movements of major US company shares without needing to own the underlying asset.

| Market Access | NYSE & NASDAQ listed companies |

| Commissions | Highly competitive and transparent |

| Platforms | Available on MT5 |

Step onto the world’s biggest stage. Trade the names that define the global market and unlock your potential.

Australian Stocks (ASX)

Dive into one of the world’s leading financial markets. The Australian Securities Exchange (ASX) is home to some of the biggest names in mining, banking, and technology. This vibrant hub offers a fantastic environment for dynamic equity trading, giving you access to a robust and well-regulated market.

Instead of purchasing assets outright, you can speculate on the price movements of Australia’s leading public companies. We provide access through share CFDs, allowing you to go long or short and seize opportunities in any market direction.

Key Advantages of Trading ASX Stocks:

- Access Blue-Chip Companies: Trade the company shares of internationally recognised corporations and industry leaders.

- Portfolio Diversification: Gain exposure to a diverse range of sectors, from raw materials and energy to finance and healthcare.

- High Liquidity: The ASX boasts significant trading volume, ensuring you can enter and exit positions with ease.

| Feature | Details |

|---|---|

| Instruments | Over 500+ ASX Share CFDs |

| Leverage | Up to 1:5 |

| Trading Hours | Follows ASX Market Hours |

Tap into the powerful trends shaping the Australian economy by trading the stocks that drive it forward.

Trading IC Markets Stocks from the ASX gives you a direct line to this exciting market. Whether you follow the big banks or the innovative tech firms, you can build a strategy around the companies you know. Get started with your stocks trading journey and explore the potential of the Australian market today.

European and Asian Stock CFDs

Expand your trading horizons beyond North America. The global economy offers a wealth of opportunities, and you can tap into them right here. We provide access to leading exchanges across Europe and Asia, allowing you to diversify your portfolio with some of the world’s most influential companies.

Trading international IC Markets Stocks as share CFDs means you can speculate on price movements without ever owning the underlying asset. This opens up a flexible and powerful way to engage with global markets.

Explore dynamic opportunities from two major economic powerhouses:

- Europe: Gain exposure to established giants listed on the FTSE, DAX, and CAC 40. Trade on the performance of luxury brands, automotive leaders, and financial institutions that shape the European economy. This is a fantastic way to engage in diverse equity trading.

- Asia: Tap into the fast-paced growth of Asian markets. Speculate on leading technology, manufacturing, and financial company shares from key exchanges in Japan and Hong Kong. Capture the volatility and innovation driving this dynamic region.

| Advantage | How It Helps You |

| Geographic Diversification | Reduce your reliance on a single economy and spread your risk. |

| Trade Different Time Zones | Find trading opportunities when the US markets are closed. |

| Access New Sectors | Engage with industries and companies not available domestically. |

The smartest traders don’t just follow one market; they follow the opportunities, wherever they appear in the world.

Are you ready to build a truly global portfolio? Start exploring European and Asian markets to find your next great trade. This is a new frontier for your stocks trading strategy. Join us and unlock the potential of international exchanges today.

How to Start Trading Stocks: A Step-by-Step Guide

Diving into the world of stocks trading can feel like a huge leap. But what if we told you it’s a straightforward process? You can start your journey into the financial markets today. Let’s break down the path to placing your first trade into simple, actionable steps. This guide makes equity trading accessible to everyone.

Follow these four steps to get started:

- Step 1: Open a Trading Account. The first thing you need is a gateway to the markets. Creating your account is fast and secure. This is your personal portal to the world of IC Markets Stocks, designed to be user-friendly and powerful. The entire application is online and takes just a few minutes.

- Step 2: Fund Your Account. Once your account is active, you need to add funds to trade with. We offer a variety of convenient and secure deposit methods. Choose the one that works best for you and make your initial deposit. Your capital is what you will use to buy and sell company shares.

- Step 3: Research and Select Your Stocks. Now for the exciting part! Decide which companies you want to trade. You can start by looking at brands you know and use every day. Or, you can analyze market trends to find new opportunities. Consider a company’s financial health, its industry position, and recent news before making a decision.

- Step 4: Execute Your First Trade. You’ve done your research and you’re ready to act. Placing a trade is simple. You just need to decide how many shares you want to trade and what type of order to use.

Understanding basic order types is key to controlling your trades. Here’s a quick look at two common ones:

| Order Type | What It Does |

| Market Order | Buys or sells immediately at the best available current price. It’s fast and simple. |

| Limit Order | Buys or sells at a specific price or better. You set the price, giving you more control. |

As you become more comfortable, you can explore different strategies and instruments, such as share CFDs, which allow you to speculate on price movements without owning the underlying asset. This flexibility opens up a new dimension to your trading.

The journey into the stock market begins with a single, informed step. Your journey starts now.

Getting started is easier than you think. By following these steps, you can confidently enter the market. The world of IC Markets Stocks is ready for you to explore. Take control of your financial future and begin today.

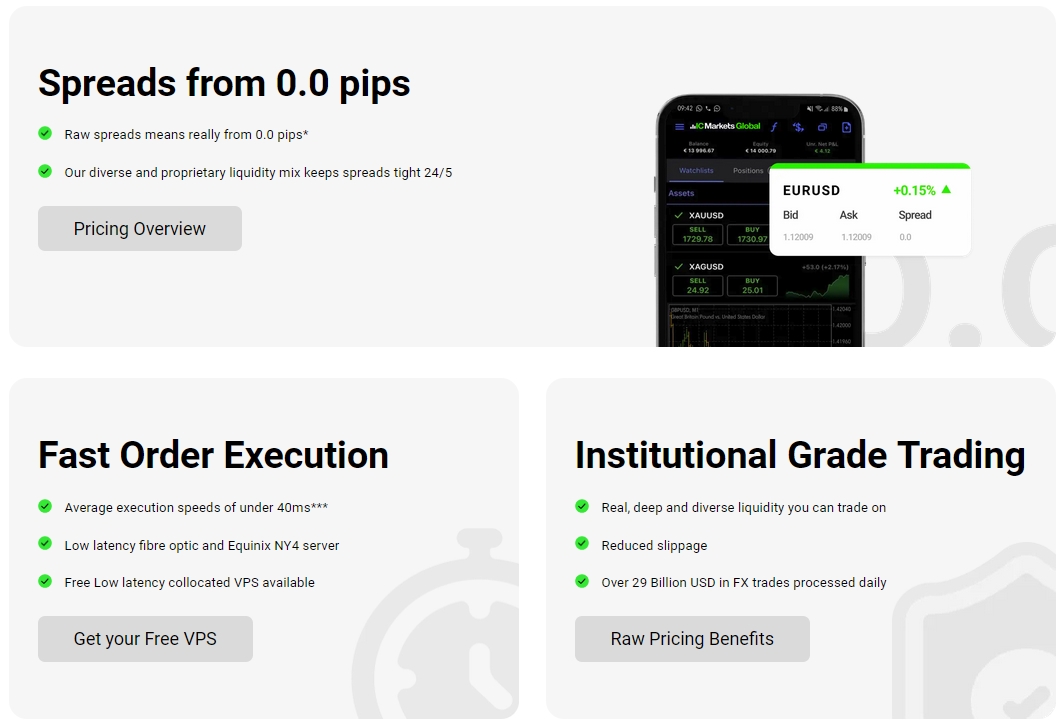

Understanding the Costs: Spreads, Commissions, and Fees

Diving into the world of stocks trading is exciting! But to succeed, you need to understand the costs involved. Transparent pricing is key to managing your strategy and maximizing potential returns. Let’s break down the common fees you’ll encounter so you can trade with confidence.

The two primary costs in most equity trading are the spread and the commission. Think of them as the service fees for executing your trades.

- The Spread: This is the small difference between the buying (ask) price and the selling (bid) price of a stock. It’s how brokers often make their money on commission-free trades. A tighter spread means a lower cost for you to enter and exit a position.

- The Commission: This is a fixed fee charged for buying or selling company shares. When trading share CFDs, a commission is a common part of the cost structure. It’s usually a small charge per share or a percentage of the trade’s total value.

Here’s a quick comparison to help you see the difference:

| Cost Type | How It Works | Best For |

|---|---|---|

| Spread | Difference between bid/ask price | Frequent, short-term traders |

| Commission | A set fee per trade/share | Larger volume, long-term investors |

Don’t forget about overnight financing, also known as swap fees. If you hold a leveraged position (like share CFDs) open overnight, you may incur a small fee. This charge reflects the cost of borrowing the capital to maintain your position.

“An expert is someone who has made all the mistakes which can be made, in a narrow field. For traders, ignoring costs is a rookie mistake you don’t want to make.”

When you trade IC Markets Stocks, we believe in full transparency. Our pricing structure is designed to be competitive and straightforward, helping you focus on what matters: your trading decisions. We combine tight spreads with low commissions to create a cost-effective environment for your equity trading journey.

Understanding these costs is the first step toward smart trading. By knowing exactly what you’re paying, you can better plan your strategy and manage your capital effectively. Ready to see how a low-cost environment can impact your trading?

Trading Platforms for IC Markets Stocks: MT4 vs MT5 vs cTrader

Choosing the right platform is the first step to mastering the markets. Your trading platform is your command center. It’s where you analyze, execute, and manage your trades. When it comes to trading IC Markets Stocks, you have three powerful options. Let’s break down MetaTrader 4, MetaTrader 5, and cTrader to find the perfect fit for your style.

MetaTrader 4 (MT4): The Industry Standard

Think of MT4 as the trusted workhorse of the trading world. For years, it has been the go-to platform for traders globally. Its simple interface makes it easy for beginners to start their journey in equity trading. Yet, it packs enough power for seasoned professionals. MT4 is especially famous for its massive community and the availability of custom tools.

- Unrivaled Automation: Access thousands of Expert Advisors (EAs) for automated trading strategies.

- User-Friendly: Its intuitive design lowers the learning curve, so you can focus on your strategy.

- Reliable & Stable: MT4 is known for its rock-solid performance and dependability.

MetaTrader 5 (MT5): The Multi-Asset Powerhouse

MT5 is the next-generation platform from the same creators as MT4. It takes everything great about its predecessor and adds more power. If you plan to dive deep into stocks trading, MT5 offers more analytical tools, timeframes, and order types. It was built from the ground up to handle a wider range of instruments, including company shares, with greater efficiency.

| Pros of MT5 | Cons to Consider |

|---|---|

| More technical indicators and timeframes | Fewer custom EAs available than MT4 |

| Advanced order types for complex strategies | Slightly steeper learning curve for beginners |

| Built-in economic calendar for fundamental analysis | Not all MT4 indicators are backward compatible |

cTrader: The Modern & Intuitive Choice

cTrader enters the scene with a fresh, clean, and modern interface. This platform focuses on providing an institutional-grade trading environment. It’s designed for speed and transparency, offering advanced Depth of Market (DoM) views. This makes it a fantastic tool for traders who want a deeper look into market liquidity when trading share CFDs.

cTrader is all about a clean user experience combined with advanced charting tools and order capabilities, putting the trader first.

Its powerful charting tools and intuitive layout make it a favorite for those who value aesthetics and cutting-edge functionality.

Which Platform Is Right for You? A Side-by-Side Comparison

The best platform is the one that aligns with your trading goals. We created a simple table to help you decide.

| Feature | MetaTrader 4 | MetaTrader 5 | cTrader |

|---|---|---|---|

| Best For | Beginners & EA enthusiasts | Multi-asset & advanced technical traders | Discretionary & speed-focused traders |

| Automated Trading | Largest library of EAs (MQL4) | More powerful strategy tester (MQL5) | Supports cBots (C#) |

| Charting Tools | Good (30 indicators, 9 timeframes) | Excellent (38 indicators, 21 timeframes) | Excellent (70+ indicators, 28 timeframes) |

| Market Depth | Basic | Level II Pricing | Advanced (Standard, Price, VWAP DoM) |

Ultimately, your choice depends on your personal preference. The best way to find your match is to experience them firsthand. Open a demo account and explore the platform that feels right for your approach to the markets. Your ideal tool for navigating IC Markets Stocks awaits.

Are IC Markets Stocks Real Shares or CFDs?

This is a fantastic question and a key distinction for every trader to understand. When you trade IC Markets Stocks, you are engaging with Contracts for Difference, more commonly known as share CFDs. You are not buying or taking ownership of the actual company shares themselves.

So, what does this mean for your stocks trading strategy? A CFD is an agreement to exchange the difference in the value of an asset from the time the contract is opened to when it is closed. This means you speculate on the price movement of the underlying stock without ever owning it. This method opens up a different world of equity trading opportunities.

Let’s break down the core differences in a simple table:

| Feature | Share CFDs | Real Company Shares |

|---|---|---|

| Ownership | No, you do not own the asset. | Yes, you own a piece of the company. |

| Leverage | Yes, you can control a larger position with less capital. | No (unless using a margin loan). |

| Ability to Go Short | Simple and straightforward. | Complex, requires borrowing stock. |

| Voting Rights | No shareholder voting rights. | Yes, you can vote on company matters. |

| Dividends | Receive a cash adjustment equivalent to the dividend. | Receive the actual dividend payment. |

With share CFDs, your focus shifts from long-term ownership to capitalizing on short to medium-term price movements, both up and down.

Choosing to trade CFDs on stocks comes with several powerful advantages that attract active traders. It’s a dynamic way to approach the markets.

- Enhanced Flexibility: You can profit from both rising and falling markets. If you believe a company’s share price will drop, you can open a ‘short’ position just as easily as you can open a ‘long’ position.

- Leverage: Use your capital more efficiently. Leverage allows you to open a larger position than your initial deposit would normally permit, amplifying potential profits (and losses).

- Broad Market Access: Gain exposure to a huge range of global company shares from major exchanges in the US, Europe, and Asia, all from a single platform.

Understanding this CFD model is the first step toward mastering your trading strategy. It’s a tool built for traders who value flexibility and want to act on market opportunities quickly. Are you ready to explore the potential of stocks trading without the limitations of traditional ownership?

Leverage and Margin Requirements for Stock Trading

Understanding leverage and margin is key to unlocking your potential in the world of stocks trading. Think of them as powerful tools that can amplify your market exposure. When you trade IC Markets Stocks, you can use these tools to control a large position with a relatively small amount of capital, opening up opportunities that might otherwise be out of reach.

Leverage essentially allows you to borrow capital to increase the size of your trade. It’s expressed as a ratio, like 5:1. This means for every dollar in your account, you can control five dollars’ worth of company shares. This can significantly magnify your results.

- Gain a larger market exposure than your initial deposit would normally allow.

- Open multiple positions across different assets without tying up all your capital.

- Potentially increase your returns on successful trades.

So, what’s margin? Margin is the deposit you need to open and maintain a leveraged position. It’s not a fee; it’s a portion of your account equity set aside as a good-faith deposit. This is the foundation of trading share CFDs, ensuring you have enough funds to cover potential losses.

Leverage and margin are two sides of the same coin. Leverage determines the size of the trade you can control, while margin is the capital you must have to open it. It is crucial to remember that while leverage can amplify profits, it also magnifies losses to the same degree.

Let’s see how this works in a practical equity trading scenario:

| Scenario | Your Capital (Margin) | Total Trade Value (Exposure) |

|---|---|---|

| Trading without Leverage | $1,000 | $1,000 |

| Trading with 5:1 Leverage | $1,000 | $5,000 |

While leverage boosts your trading power, it’s crucial to understand both sides of the story. It enhances both potential profits and potential losses.

| Pros of Using Leverage | Cons of Using Leverage |

|---|---|

| Capital Efficiency: Free up capital for other trades. | Amplified Losses: Losses are magnified just like profits. |

| Enhanced Exposure: Control a larger position in the market. | Margin Call Risk: If a trade moves against you, you may need to add funds to keep it open. |

We provide clear information on the margin requirements for each instrument, helping you manage your risk effectively. By understanding these concepts, you can build a smarter, more strategic approach to trading and make your capital work harder for you.

Key Benefits of Trading Stocks with IC Markets

Choosing the right partner for your trading journey is a game-changer. When it comes to IC Markets Stocks, you gain access to a powerful environment built for performance. We empower you to navigate the world’s stock markets with confidence. Let’s explore why so many traders choose us for their equity trading.

Unlock a world of opportunity with benefits designed for the modern trader:

- Access Global Markets Instantly

Dive into a vast pool of opportunities. We provide access to a massive range of company shares from major international exchanges like the NYSE, NASDAQ, and ASX. This diversity allows you to build a robust portfolio and react to global market trends as they happen.

- Experience Superior Trading Conditions

Your strategy deserves the best execution. We focus on providing tight spreads and low commissions to maximize your potential returns. Effective stocks trading is about precision, and our fast execution servers help you get in and out of the market at the price you want, minimizing slippage.

- Leverage Powerful Trading Platforms

Harness the power of world-class trading platforms like MetaTrader 4, MetaTrader 5, and cTrader. You get the professional-grade tools you need for success, including advanced charting, one-click trading, and full support for automated strategies.

- Gain Flexibility with Share CFDs

Our platform offers incredible flexibility through share CFDs. This allows you to speculate on the price movements of stocks without owning the underlying asset. You can potentially profit from both rising and falling markets, opening up a new dimension of trading strategies.

| Advantages | Considerations |

|---|---|

| Go long (buy) or short (sell) on markets | Leverage can amplify both gains and losses |

| Access markets with smaller capital outlay | Overnight financing fees may apply to positions |

| No stamp duty on profits in some regions | Complex instrument not suitable for all investors |

“The access to global markets and the speed of execution have fundamentally changed my approach to trading. It’s a professional-grade experience from start to finish.”

Ready to elevate your trading? The combination of extensive market access, competitive costs, and powerful technology makes IC Markets Stocks a premier choice for traders worldwide. Experience a better way to engage with the financial markets. Join a community of traders who demand more and get the edge you deserve.

Managing Risks When Trading Stock CFDs

The world of stocks trading is filled with opportunity. But the smartest traders know a secret: success isn’t just about picking winners. It’s about protecting what you have. Managing risk is the foundation of any strong equity trading strategy, especially when dealing with powerful tools like share CFDs.

Think of risk management as your trading superpower. It keeps you in the game long enough to find those winning trades. Two of the most essential tools in your arsenal are Stop-Loss and Take-Profit orders. A Stop-Loss automatically closes a trade at a predetermined price to limit your potential loss. A Take-Profit does the opposite, closing a trade to lock in your gains once it hits a target price. Using them removes emotion and enforces discipline.

Your Core Risk Management Checklist

- Know Your Leverage: Leverage can amplify your profits, but it also magnifies losses. Understand exactly how it works before you trade.

- Position Sizing Matters: Never risk too much of your capital on a single trade. A common rule is to risk no more than 1-2% of your account balance.

- Diversify Your Interests: Avoid putting all your eggs in one basket. Spreading your capital across different company shares and sectors can help cushion you from single-stock shocks.

- Stay Informed, Not Impulsive: Keep up with market news, but don’t let headlines cause you to make rash decisions. Stick to your trading plan.

When you trade share CFDs, you’re speculating on the price movements of company shares without owning them. This is made possible by leverage, a concept every trader must respect.

| Leverage: The Upside | Leverage: The Downside |

| Allows you to control a large position with a small amount of capital. | Losses are based on the full position size and can exceed your initial deposit. |

“The successful trader is a good loser. They know how to lose, how to accept a loss, and how to move on to the next trade.”

When you explore opportunities with IC Markets Stocks, our platform provides all the tools you need to implement these risk strategies effectively. We empower you to take control of your trading journey. Start with a plan, manage your risk, and trade with confidence.

IC Markets vs Competitors: A Stock Trading Comparison

Choosing the right broker can feel like navigating a maze. When it comes to stocks trading, every detail matters—from fees to the variety of shares available. Let’s see how IC Markets Stocks stack up against the competition and what makes them a compelling choice for modern traders.

To get a clear picture, we need to look at what truly impacts your trading experience. Here are the core areas where brokers often differ:

- Range of available company shares from global exchanges

- Commission structures and hidden fees

- Trading platform stability and features

- Order execution speed and overall reliability

Asset Diversity and Flexibility

Many brokers offer access to the stock market, but the quality of that access varies wildly. A key differentiator is the diversity of instruments. With IC Markets, you gain exposure to a vast selection of global equities through share CFDs. This instrument allows you to speculate on the price movements of major corporations without owning the underlying asset. It provides flexibility for both long and short positions, opening up more strategic possibilities in your equity trading.

| Feature | IC Markets | Typical Competitors |

|---|---|---|

| Asset Range | Extensive global share CFDs | Often limited to local markets |

| Commissions | Highly competitive, low fees | Can have higher or hidden costs |

| Platforms | MT4, MT5, cTrader | Often proprietary, less flexible |

The Cost of Trading: A Clear Advantage

Fees can eat into your profits. While some brokers lure you in with “zero commission” claims, they often hide costs in wide spreads or inactivity fees. Our approach is different. You get transparent, low-commission pricing. This straightforward model means you know exactly what you are paying, allowing for more precise planning and potentially better returns on your trading capital.

“I switched for the low commissions on stocks, but I stayed for the incredible execution speed. In equity trading, a split second can make all the difference, and I feel I have that edge here.” – An Active Day Trader

Ultimately, the right platform empowers your strategy instead of limiting it. When you compare the broad access to global company shares, the clear cost structure, and the powerful trading environment, the benefits become obvious. It is not just about offering stocks; it is about providing a superior ecosystem for your stocks trading journey. Discover an environment built for traders who demand more.

Essential Tools and Features for Stock Traders

Ready to elevate your stocks trading game? Success isn’t just about what you trade; it’s about how you trade. The right tools can transform your strategy, giving you a powerful edge in the market. We provide a suite of sophisticated features designed to empower every trader, from novice to expert.

Choose the platform that fits your style. We offer access to the world’s most popular trading environments, ensuring you have the best resources at your fingertips for trading company shares.

- MetaTrader 4 (MT4): A global favorite, known for its user-friendly interface and robust analytical capabilities.

- MetaTrader 5 (MT5): The next generation, offering more timeframes and indicators for comprehensive equity trading analysis.

- cTrader: A modern platform with an intuitive design, advanced order types, and impressively fast execution speeds.

Each platform is packed with features to give you a competitive advantage. See how they stack up:

| Feature | Description | Benefit for Traders |

|---|---|---|

| Advanced Charting | Access dozens of pre-installed indicators and graphical objects. | Make informed decisions with deep technical analysis. |

| One-Click Trading | Execute trades directly from the chart with a single click. | Seize market opportunities without delay. |

| Market Depth (DOM) | View the full range of executable prices from liquidity providers. | Gain transparency on liquidity for share CFDs. |

“The charting tools are a game-changer. I can analyze patterns and execute my plan with confidence, all in one place.”

Leveraging professional-grade tools comes with distinct advantages. Here’s a quick look at what you gain when you trade IC Markets Stocks with us:

- Pro: Enhanced Decision Making. Access real-time data and advanced analytics to build a smarter trading plan.

- Pro: Increased Efficiency. Automate parts of your strategy and execute trades faster than ever before.

- Con: Learning Curve. Sophisticated tools may require a bit of time to master, but the payoff is significant.

- Pro: Greater Market Insight. Get a clearer picture of market dynamics to inform your every move.

Ultimately, the best tools are the ones that fit your workflow and empower your strategy. Explore our feature-rich environment and discover how the right technology can support your journey in the world of stocks trading.

Technical Analysis Indicators

Gain a powerful edge in your trading with technical analysis indicators. These tools use mathematical formulas to analyze past price movements and predict future possibilities. They transform raw chart data into actionable insights, helping you make more informed decisions when analyzing IC Markets Stocks.

Our platform integrates dozens of popular indicators directly into your charts. Here are a few essential ones to get you started:

- Moving Averages (MA): These help you identify the direction of a market trend by smoothing out price fluctuations.

- Relative Strength Index (RSI): This momentum oscillator measures the speed and change of price movements, signaling potentially overbought or oversold conditions in specific company shares.

- Bollinger Bands: This tool measures volatility, providing a dynamic range for price action. The bands widen during high volatility and narrow during low volatility.

Using these indicators effectively is a cornerstone of successful equity trading. They help you spot entry and exit points, manage risk, and build a consistent strategy for trading share CFDs. Instead of reacting to the market, you can start anticipating its next move.

| Indicator Category | Primary Function |

|---|---|

| Oscillators (e.g., RSI) | Identify momentum and short-term overbought/oversold levels. |

| Trend-Following (e.g., MA) | Confirm the direction and strength of an existing trend. |

Ready to put theory into practice? Access a comprehensive suite of charting tools and technical indicators built for modern stocks trading when you join. Build your strategy, test your ideas, and trade with greater confidence.

Market Research and News Feeds

Knowledge is your greatest asset in the dynamic world of equity trading. Guesswork has no place in a successful strategy. That’s why we equip you with a powerful suite of integrated research tools and live news feeds, designed to help you make sharp, informed decisions when trading IC Markets Stocks.

Gain a competitive edge with direct access to vital market intelligence. Our platform integrates everything you need to stay ahead:

- Real-Time News Stream: Get breaking news from leading global sources delivered directly to your trading platform. Never miss an event that could impact your positions.

- Expert Market Analysis: Access daily technical and fundamental analysis from our team of seasoned experts. Uncover new opportunities in stocks trading with professional insights.

- Comprehensive Economic Calendar: Track key economic events, central bank announcements, and earnings reports that can move the markets for specific company shares.

- Advanced Charting Tools: Utilize a full array of technical indicators and drawing tools to perform your own in-depth analysis.

Stay ahead of the curve. Our integrated tools turn market noise into actionable signals, giving you the edge you need to trade with confidence.

Imagine spotting a trend before the rest of the market. Our tools are designed to help you do just that. Whether you are focused on long-term value or short-term movements in share CFDs, having the right information at the right time is crucial. We filter the noise and deliver the data that truly matters for your trading journey.

| Tool | Primary Benefit |

| Live News Feed | React instantly to market-moving information. |

| Market Sentiment | Gauge the overall mood of other traders. |

| Daily Analyst Reports | Leverage professional insights for your strategy. |

Stop trading in the dark. Arm yourself with the professional-grade research needed to navigate the world of IC Markets Stocks and build a smarter, more informed trading strategy today.

Account Types for Optimal Stock Trading Conditions

Choosing the right account is your first strategic move. Your trading style, frequency, and goals all play a part. We designed our account options to provide a superior environment for trading IC Markets Stocks, ensuring you have the tools you need to succeed.

Whether you are new to stocks trading or a seasoned professional, we have an account tailored for you. We offer distinct choices that cater to different needs, giving you control over your trading costs and execution. Let’s break down the key differences to help you find your perfect fit.

| Feature | Raw Spread Account | Standard Account |

|---|---|---|

| Best For | Active Traders & Scalpers | Beginners & Discretionary Traders |

| Pricing Model | Commission + Raw Spreads | All-in-One Spreads |

| Stock CFD Commissions | Low, fixed commission | Zero commission |

“The right account isn’t just a detail; it’s the foundation of your entire trading strategy.”

The Raw Spread Account is the choice for precision. It is perfect for high-volume traders and those using automated strategies. This account offers incredibly tight spreads directly from our liquidity providers. You pay a small, fixed commission per trade, a model that provides transparency and can significantly lower costs for active equity trading.

The Standard Account is ideal for simplicity and convenience. It features a straightforward, all-in-one pricing structure with no commissions on your trades. The cost is built directly into the spread, making it easy to calculate your potential profit and loss on share CFDs without extra math. This makes it a popular choice for those new to the markets.

No matter which you choose, you benefit from an environment built for performance. Here’s what you gain by selecting the right account:

- Cost-Effectiveness: Pick a pricing model that minimizes your costs based on how often you trade company shares.

- Total Flexibility: Match your account to your specific strategy and adapt as you grow.

- Unrestricted Trading: Use any trading style you prefer, from scalping to long-term investing.

- Powerful Platforms: Gain access to industry-leading trading platforms, regardless of your account type.

Your journey into the stock market deserves the best possible start. By carefully selecting your account, you set yourself up with optimal conditions from day one. Find your match and unlock your potential in the world of global markets.

Deposits and Withdrawals for Your Trading Account

Powering your trading account should be fast, simple, and secure. We designed our funding process to get you into the markets without delay. Manage your funds with confidence through a wide array of convenient payment options tailored for global traders.

We provide a variety of deposit methods to suit your needs. Fund your account and prepare for your stocks trading journey in just a few clicks. Explore some of our most popular choices:

| Payment Method | Processing Time | Our Fee |

|---|---|---|

| Credit & Debit Card | Instant | $0 |

| PayPal & E-Wallets | Instant | $0 |

| Bank Wire Transfer | 2-5 Business Days | $0 |

When it comes time to access your profits, our withdrawal process is just as streamlined. We pride ourselves on processing your requests quickly, so you can enjoy the returns from your share CFDs trades without unnecessary hold-ups.

Here’s what makes our funding experience stand out:

- Flexibility: Choose from over 10 funding options in multiple base currencies.

- Speed: Access instant deposit methods to capitalize on market movements right away.

- Security: Your transactions are protected with top-tier encryption and security protocols.

- No Hidden Costs: We charge no internal fees for deposits or withdrawals.

“The entire process was seamless. I funded my account and was set for my first equity trading session in minutes. It’s exactly what you want from a broker.”

A reliable funding system is the backbone of a great trading experience. It allows you to focus on analyzing company shares and executing your strategy. Prepare to trade IC Markets Stocks with a platform that makes managing your money effortless.

Final Verdict: Is IC Markets a Good Broker for Stocks?

So, what’s the bottom line? After a thorough look, we can confidently say that IC Markets Stocks offering is a powerful choice for a specific type of trader. If you value speed, low costs, and a professional-grade environment, this broker should be high on your list. It excels in providing the tools needed for serious trading, without unnecessary frills.

To help you decide, let’s weigh the most important factors.

What We Like:

- Competitive Costs: The broker is famous for its tight spreads and low commissions. This means more of your potential profit stays in your pocket, which is crucial for active trading.

- Powerful Platforms: You get access to the full MetaTrader suite (MT4 and MT5) and cTrader. These platforms are industry standards for a reason, offering advanced charting and tools for sophisticated equity trading.

- Global Market Access: You can trade a huge range of share CFDs from major global exchanges like the NYSE, NASDAQ, and ASX. This opens up opportunities far beyond your local market.

Potential Drawbacks:

- CFD-Focused Model: IC Markets specializes in Contracts for Difference (CFDs). This is great for leverage and short-selling but means you don’t own the underlying asset. This might not suit long-term, buy-and-hold investors.

- Lean on Fundamentals: The platform is built for technical traders. Those who rely heavily on deep fundamental company research might find the built-in tools a bit light.

For traders who prioritize execution speed and cost-efficiency above all else, IC Markets provides a truly professional-grade environment. It’s built for performance.

To make it even clearer, see who benefits the most from this platform:

| Trader Profile | Why It’s a Great Fit |

|---|---|

| Active Day Traders | Low latency and tight spreads are essential for frequent trading strategies. |

| Technical Analysts | Advanced charting tools on MT5 and cTrader provide a robust analytical edge. |

| Cost-Conscious Traders | The low-commission structure helps maximize returns on high-volume trading. |

In conclusion, if your approach to stocks trading involves active management, technical analysis, and a sharp focus on minimizing costs, IC Markets is an excellent choice. It delivers the tools and conditions necessary to effectively trade global company shares. For those ready to leverage a high-performance trading infrastructure, it’s time to get started.

Frequently Asked Questions

What kind of stocks can I access?

You can explore a vast range of global company shares. Our selection of IC Markets Stocks covers major exchanges from around the world. This allows you to build a diverse portfolio with leading names in technology, finance, and other key sectors.

Am I buying the actual company shares when I trade?

You are trading what are known as share CFDs. This popular method of stocks trading allows you to speculate on the price movements of stocks without taking ownership of the underlying asset. It provides great flexibility for your trading strategy.

What are the main benefits of this type of equity trading?

Trading share CFDs comes with several distinct advantages that can enhance your experience in the market.

- Leverage: You can open a larger position with a smaller amount of capital.

- Go Long or Short: You have the ability to profit from both rising and falling market prices.

- Global Access: Trade shares from numerous international markets all from a single, unified account.

- Potential Cost Savings: In many jurisdictions, you avoid the stamp duty that is typically associated with physical share purchases.

Which platforms can I use for stocks trading?

We provide our full suite of trading instruments on the world’s most popular and powerful platforms. You can choose the environment that best suits your needs, with full support for desktop, web, and mobile trading.

How do I get started?

Beginning your journey is a straightforward process. Simply open an account, complete the quick verification, and add funds. You can then immediately start exploring the exciting opportunities available in the world of stocks.

Frequently Asked Questions

When I trade stocks with IC Markets, am I buying real shares?

No, you are trading share CFDs (Contracts for Difference). This allows you to speculate on the price movements of company shares without actually owning the underlying asset.

What trading platforms are available for stock trading?

You can trade stocks on three powerful platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, all of which are available for desktop, web, and mobile devices.

Can I trade stocks from international exchanges?

Yes, IC Markets provides access to a wide range of global company shares from major exchanges like the NYSE, NASDAQ, ASX, as well as leading exchanges across Europe and Asia.

What are the primary costs associated with trading stock CFDs?

The main costs are the spread (the difference between the bid and ask price), commissions on certain account types, and overnight financing fees (swaps) if you hold a position open overnight.

What does it mean to trade with leverage?

Leverage allows you to control a large trading position with a relatively small amount of capital (margin). For example, with 5:1 leverage, every $1 of your margin controls $5 worth of shares. This magnifies both potential profits and potential losses.