Welcome to the essential guide for anyone interested in forex and CFD trading in Thailand. If you seek lightning-fast execution, razor-thin spreads, and a world-class trading environment, you are in the right place. This guide explores everything you need to know about IC Markets Thailand. We break down account types, platforms, fees, and security. Discover why so many Thai traders choose this broker for their journey into the global financial markets. Get ready to unlock your trading potential.

- What is IC Markets and Is It Available in Thailand?

- Regulation and Security: Is Your Money Safe?

- A Closer Look at IC Markets Account Types

- The Raw Spread Account (cTrader & MetaTrader)

- The Standard Account

- Trading Platforms: MT4, MT5, and cTrader Explored

- Understanding Spreads, Commissions, and Other Fees

- Deposit and Withdrawal Options for Thai Traders

- Local Bank Transfers in Thai Baht (THB)

- International and E-Wallet Methods

- What Can You Trade with IC Markets?

- Forex Pairs

- Commodities, Indices, and Stocks

- How to Open an Account with IC Markets from Thailand

- Leverage and Margin Requirements

- Customer Support for the Thai Market

- Advanced Trading Tools and Features

- Mobile Trading with the IC Markets App

- Pros and Cons of Using IC Markets in Thailand

- IC Markets vs. Other Popular Brokers in Thailand

- Frequently Asked Questions

What is IC Markets and Is It Available in Thailand?

IC Markets is a globally recognized forex and CFD broker. It built its reputation on a simple mission: to provide the best possible trading conditions for retail and institutional clients alike. This means offering access to true institutional-grade liquidity, which results in incredibly tight spreads and fast order execution. And yes, the great news is that IC Markets proudly serves clients in Thailand. They offer a fully localized experience, including dedicated support and seamless funding options for the Thai trading community. This broker is not just available; it is fully optimized for traders in Thailand.

Regulation and Security: Is Your Money Safe?

Your capital’s safety is the most important factor when choosing a broker. IC Markets understands this and operates under the oversight of multiple top-tier financial regulators around the world. These bodies enforce strict rules to protect clients.

A key safety measure is the segregation of client funds. This means your money is kept in a separate trust account at a major bank, completely apart from the company’s operational funds. This ensures that your investment is protected. With robust security protocols and a commitment to regulatory compliance, you can focus on your trading with peace of mind.

A Closer Look at IC Markets Account Types

Choosing the right account is crucial for your trading strategy. IC Markets offers several options tailored to different needs, whether you are a high-frequency scalper or a long-term investor. The primary distinction lies in the pricing structure and the trading platform compatibility. We will explore the most popular choices below, helping you find the perfect fit for your forex trading journey in Thailand. Each account provides access to the same deep liquidity and fast execution speeds.

The Raw Spread Account (cTrader & MetaTrader)

The Raw Spread account is the flagship offering, built for serious traders who demand the lowest possible spreads. It is the preferred choice for scalpers, day traders, and those using automated trading systems (Expert Advisors).

- Ultra-Low Spreads: Get access to institutional-grade spreads starting from 0.0 pips on major currency pairs.

- Transparent Commission: You pay a small, fixed commission per lot traded. This transparent structure makes it easy to calculate your trading costs.

- Deep Liquidity: Benefit from a diverse pool of liquidity providers, ensuring minimal slippage.

- Platform Choice: This account is available on all platforms: MetaTrader 4, MetaTrader 5, and cTrader.

The Standard Account

The Standard account is perfect for traders who prefer simplicity and a straightforward cost structure. It is an excellent starting point for new traders and for discretionary traders who value convenience over the absolute lowest spreads.

- Zero Commission: There are no separate commission fees on your trades. All costs are built directly into the spread.

- Simplicity: The all-inclusive spread makes it incredibly easy to see your potential trading costs at a glance.

- User-Friendly: It provides a hassle-free trading experience, ideal for those who are just starting their journey in forex Thailand.

- Platform Availability: This account type is available on the popular MetaTrader 4 and MetaTrader 5 platforms.

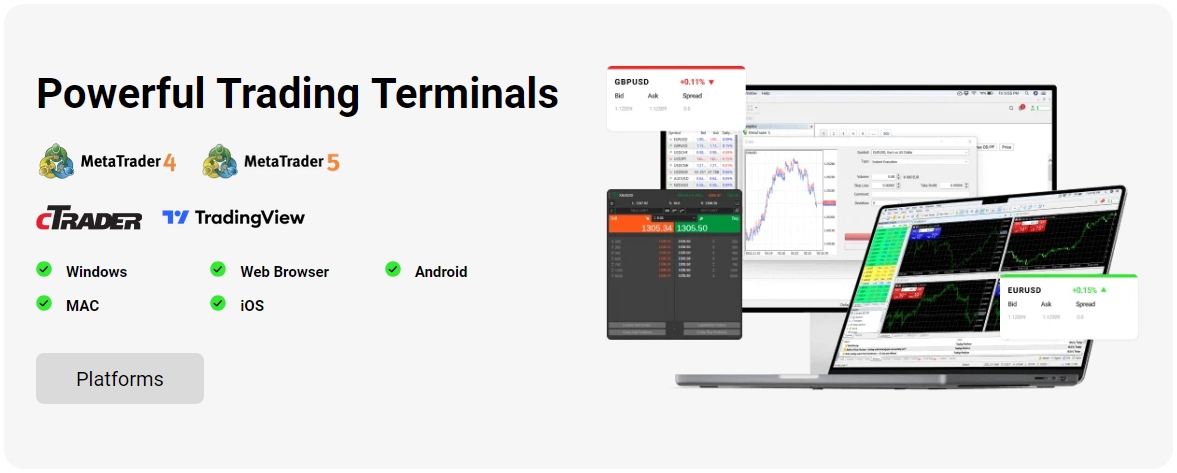

Trading Platforms: MT4, MT5, and cTrader Explored

IC Markets provides access to three of the most powerful and popular trading platforms in the world. Each platform caters to slightly different trading styles, but all offer robust charting tools, fast execution, and a stable environment for your Thailand trading activities. You have the freedom to choose the one that best aligns with your strategy.

| Platform | Best For | Key Feature |

|---|---|---|

| MetaTrader 4 (MT4) | Forex traders and users of automated systems (EAs). | The undisputed industry standard with a massive library of custom indicators and EAs. |

| MetaTrader 5 (MT5) | Traders wanting access to a wider range of markets. | A multi-asset platform with more timeframes, indicators, and access to stock CFDs. |

| cTrader | Day traders and scalpers seeking an advanced interface. | A modern platform with advanced order types and an intuitive, clean user interface. |

Understanding Spreads, Commissions, and Other Fees

Trading costs can significantly impact your profitability. IC Markets is known for its transparent and highly competitive fee structure. The two main costs are spreads and commissions. The spread is the small difference between the buy and sell price of an asset. The commission is a fixed fee charged on Raw Spread accounts for opening and closing a trade.

Choosing between a Standard account (spread-only) and a Raw Spread account (spread + commission) depends entirely on your trading style. High-volume traders often find the Raw Spread model more cost-effective.

Beyond these, you should be aware of swap fees, which are charges for holding positions overnight. On a positive note, a major benefit of using this broker in Thailand is that IC Markets charges no fees for deposits or withdrawals, helping you keep more of your money.

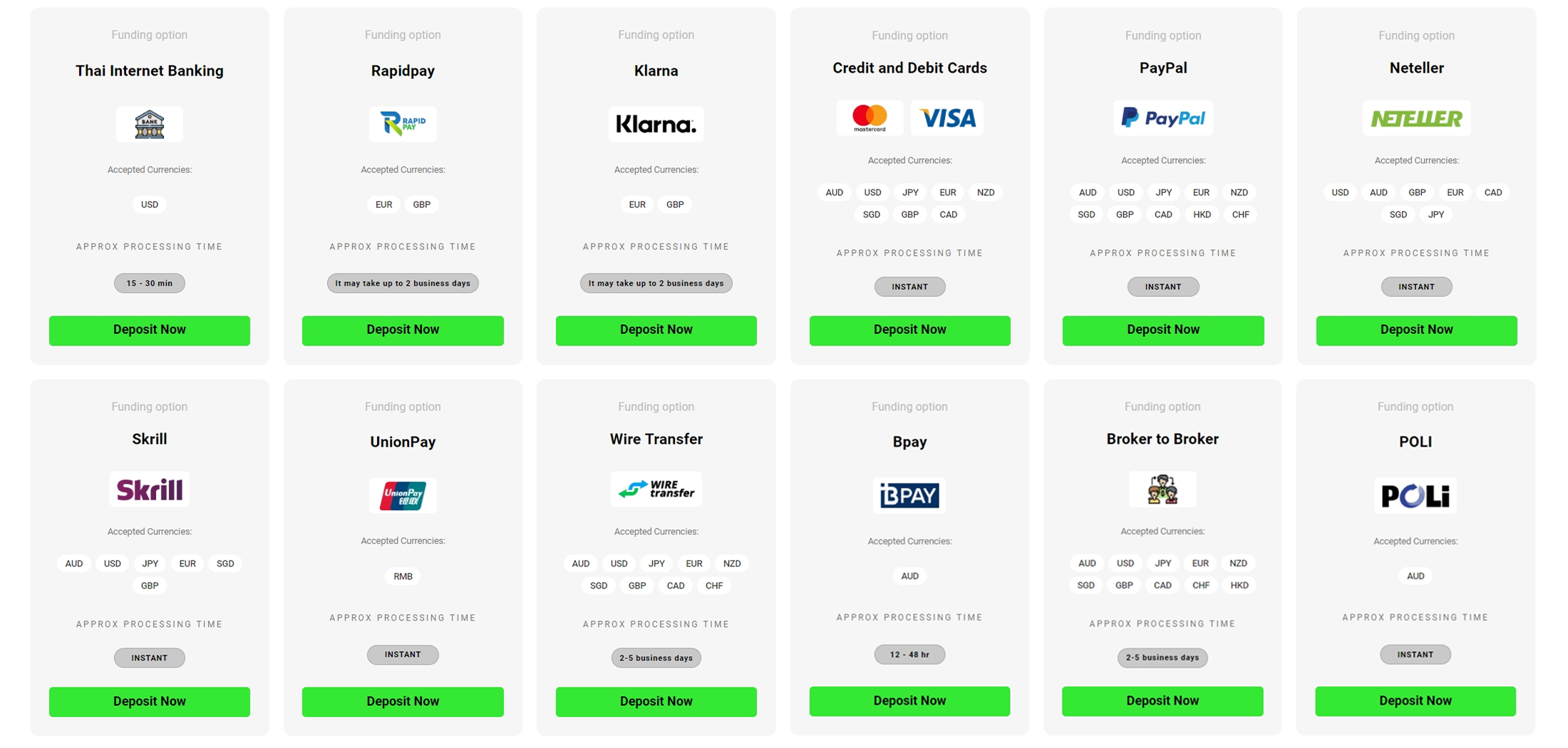

Deposit and Withdrawal Options for Thai Traders

Funding your trading account and accessing your profits should be fast, simple, and secure. IC Markets excels in this area by offering a wide range of payment methods designed to be convenient for traders in Thailand. You can choose from local solutions that use Thai Baht or opt for popular international methods. This flexibility ensures you can manage your funds efficiently and get back to focusing on the markets.

Local Bank Transfers in Thai Baht (THB)

This is a game-changer for the Thailand trading community. IC Markets allows you to deposit and withdraw funds directly through major Thai banks using local bank transfers. This is a huge advantage.

- Trade in Your Local Currency: Fund your account directly with Thai Baht (THB), avoiding costly and unpredictable currency conversion fees.

- Fast and Convenient: Use your familiar online banking service for quick and easy transactions. Withdrawals are processed swiftly back to your Thai bank account.

- Increased Accessibility: This method removes a significant barrier for many traders, making it easier than ever to get started with a global broker.

International and E-Wallet Methods

In addition to local options, IC Markets supports a full suite of globally recognized payment methods. This provides ultimate flexibility for traders who manage finances across different platforms or currencies.

- Credit/Debit Cards: Instant deposits using Visa and Mastercard are available.

- E-Wallets: Popular services like Skrill and Neteller offer fast and secure transactions.

- Wire Transfers: Traditional international bank wire transfers are also supported for larger transaction amounts.

What Can You Trade with IC Markets?

Variety is key to a diversified trading portfolio. With IC Markets, you gain access to a vast selection of financial instruments across global markets. This allows you to trade your favorite assets and explore new opportunities all from a single platform. Whether you are passionate about currency movements or global stock markets, this broker has you covered.

Forex Pairs

Forex is the heart of IC Markets’ offering. You can trade over 60 different currency pairs, including all the majors like EUR/USD and USD/JPY, minors, and a wide range of exotic pairs. The broker’s deep liquidity ensures that you get tight spreads and reliable execution, which is critical for successful forex trading.

Commodities, Indices, and Stocks

Go beyond forex and diversify your trading with a huge range of CFDs. You can trade popular hard and soft commodities like Gold, Silver, and Oil. Access the world’s largest stock markets by trading major indices like the S&P 500, NASDAQ, and FTSE. Additionally, you can trade CFDs on hundreds of leading global stocks from the US, European, and Asian markets, plus bonds and cryptocurrencies.

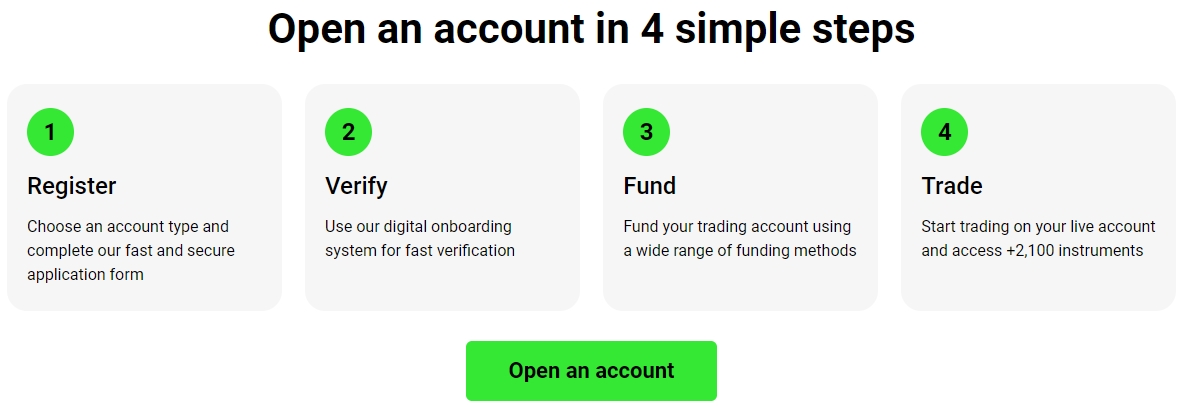

How to Open an Account with IC Markets from Thailand

Getting started is a quick and straightforward process. You can have your trading account set up and ready to go in just a few simple steps. The entire process is done online for your convenience.

- Complete the Application: Visit the IC Markets website and fill out the simple online application form. This takes only a few minutes.

- Verify Your Identity: To comply with financial regulations, you need to submit proof of identity (like a passport or national ID card) and proof of address (like a utility bill or bank statement).

- Fund Your Account: Once your account is approved, choose your preferred deposit method, like a local Thai bank transfer, to add funds.

- Start Trading: Download your chosen platform (MT4, MT5, or cTrader) and begin your trading journey!

Leverage and Margin Requirements

Leverage is a powerful tool that allows you to control a large position in the market with a relatively small amount of capital. For example, with 100:1 leverage, you can control a $10,000 position with just $100 of your own money, known as margin. IC Markets offers flexible leverage options, which can amplify both your potential profits and your potential losses. It is crucial to use leverage wisely and implement a solid risk management strategy. Always understand the margin requirements for the instruments you trade to avoid a margin call, where the broker may close your positions automatically if your account equity falls too low.

Customer Support for the Thai Market

Reliable and accessible customer support is essential. IC Markets provides award-winning support that you can count on. The global support team is available 24 hours a day, 7 days a week, ensuring that help is always available, no matter when the markets are open. Traders from Thailand can reach the team through several convenient channels:

- Live Chat: Get instant answers to your questions directly through the website.

- Email: For more detailed inquiries, you can send an email and expect a prompt and helpful response.

- Phone Support: Speak directly with a support representative for urgent matters.

The comprehensive help center and FAQ section also provide answers to a wide range of common questions about accounts, platforms, and trading.

Advanced Trading Tools and Features

IC Markets empowers traders with a suite of professional-grade tools that enhance the trading experience. These features go beyond the standard platform offerings and give you a competitive edge. For automated traders, the broker provides access to Virtual Private Server (VPS) hosting. This ensures your EAs run 24/7 in a secure, high-speed environment, even when your personal computer is off. Additionally, you can benefit from advanced trading tools for MetaTrader, which include a package of over 20 exclusive apps. These apps provide sophisticated order management, trade execution, and market analysis capabilities right inside your platform.

Mobile Trading with the IC Markets App

In today’s fast-paced world, you need to manage your trades from anywhere. IC Markets ensures you never miss an opportunity with powerful mobile trading solutions. You can download the MT4, MT5, and cTrader apps directly to your iOS or Android device. These are not just stripped-down versions; they are fully-featured mobile platforms. You can conduct in-depth chart analysis with dozens of indicators, place and manage orders with a few taps, and monitor your account portfolio in real-time. Whether you are commuting or away from your desk, the entire market is in the palm of your hand.

Pros and Cons of Using IC Markets in Thailand

Every broker has its strengths and weaknesses. To give you a balanced view, here is a straightforward summary of what makes IC Markets a great choice for Thai traders, along with areas where it could improve.

| Pros | Cons |

|---|---|

|

|

IC Markets vs. Other Popular Brokers in Thailand

How does IC Markets stack up against the competition? The choice of a broker often comes down to what a trader values most. For those focused on low costs, fast execution, and platform choice, IC Markets is a clear leader. Here is a brief comparison:

| Feature | IC Markets | Typical Competitor A | Typical Competitor B |

|---|---|---|---|

| Spreads | From 0.0 pips + Commission | From 0.6 pips (Commission-Free) | Fixed spreads, often wider |

| Platforms | MT4, MT5, cTrader | MT4, MT5 | Proprietary Platform, MT4 |

| Execution Speed | Excellent (Low Latency) | Standard | Varies (Market Maker Model) |

| Thai Baht (THB) Funding | Yes, via Local Banks | Limited or Not Available | Yes, but with fees |

Frequently Asked Questions

What is the minimum deposit for IC Markets in Thailand?

The recommended minimum deposit is $200 USD or the equivalent in Thai Baht. This allows you to open an account and start trading, although the amount you deposit should align with your trading strategy and risk management plan.

Is IC Markets a good broker for beginners?

Yes, it can be. While its professional-grade tools appeal to experts, the Standard account is very beginner-friendly with its simple, commission-free structure. The availability of a demo account also allows new traders to practice without risking real money.

Can I have an account denominated in Thai Baht (THB)?

While you can deposit and withdraw in THB, the trading account’s base currency is typically one of the major global currencies like USD, EUR, or AUD. The seamless local bank transfer system minimizes conversion costs.

How long do withdrawals to a Thai bank take?

Withdrawals to Thai bank accounts are processed very quickly. Once approved by IC Markets, the funds typically arrive in your account within 1-3 business days.

Does IC Markets offer a demo account?

Absolutely. You can open a free, unlimited demo account to test the platforms, practice your strategies, and experience the broker’s trading conditions with virtual funds before committing any real capital.