Embarking on the journey of online trading requires a solid foundation, and choosing the right trading account is your first crucial step. With IC Markets, you gain access to a world of possibilities, designed to fit every trading style and ambition. Our carefully crafted accounts provide competitive conditions, cutting-edge platforms, and unwavering support, empowering you to navigate global financial markets with confidence. Discover how the ideal account can significantly enhance your trading performance and help you achieve your financial aspirations.

- Why Your Account Choice Matters

- Explore the Core IC Markets Trading Accounts

- Comparing Your IC Markets Account Types

- Making Your Choice Among Broker Accounts

- Ready to Start Trading?

- Understanding IC Markets Trading Accounts

- Explore Our Primary Account Types

- Why Our Forex Accounts Stand Out

- Raw Spread Account: Key Features and Benefits

- Unmatched Market Spreads and Transparent Costs

- Key Features That Empower Your Trading:

- Who Thrives with a Raw Spread Account?

- Making the Smart Choice Among Broker Accounts

- Spreads and Commissions on the Raw Spread Account

- Understanding the Raw Spreads

- The Commission Structure

- Minimum Deposit for Raw Spread Accounts

- Standard Account: Simplicity and Straightforward Trading

- Key Advantages of the Standard Account

- Spreads on the Standard Account

- Islamic Account (Swap-Free): Catering to Specific Needs

- Comparing IC Markets Trading Account Types

- Opening an IC Markets Account: A Step-by-Step Guide

- Understanding Your Trading Account Options

- The Step-by-Step Account Opening Process

- Considerations for Choosing Your IC Markets Trading Account

- Funding Your IC Markets Trading Account

- Flexible Deposit Methods at Your Fingertips

- Multiple Currencies, No Hassle

- Unwavering Security and Support

- Withdrawal Process and Options

- Leverage and Margin Requirements Across Account Types

- What is Margin?

- Leverage Across Different Account Types

- Margin Requirements Across Account Types

- Key Factors Influencing Leverage and Margin

- Trading Platforms Available with IC Markets Accounts

- MetaTrader 4 (MT4): The Industry Standard

- MetaTrader 5 (MT5): The Next Generation

- cTrader: For Advanced Traders and Scalpers

- Which Platform Suits Your Trading Accounts?

- MetaTrader 4 (MT4) for IC Markets

- Why Traders Choose MT4 with IC Markets:

- MetaTrader 5 (MT5) for IC Markets

- cTrader for IC Markets

- Why Traders Choose cTrader with IC Markets:

- Regulatory Compliance and Security for Your Funds

- Who Regulates IC Markets?

- Customer Support for IC Markets Trading Accounts

- Always Within Reach: Our Multichannel Support

- Expertise You Can Trust

- A Partner in Your Trading Journey

- Educational Resources for Traders

- Pros and Cons of IC Markets Trading Accounts

- Frequently Asked Questions about IC Markets Accounts

- Frequently Asked Questions

Why Your Account Choice Matters

Your chosen trading account is more than just a gateway to the markets; it dictates your trading costs, execution speed, and available features. A carefully selected account optimizes your trading conditions, whether you are a scalper, swing trader, or long-term investor. IC Markets provides robust options among their broker accounts, ensuring you find a fit for your specific objectives.

Explore the Core IC Markets Trading Accounts

IC Markets offers distinct account types, each crafted to serve different trading styles. Understanding these distinctions is key to making an informed decision. Let’s delve into the most popular forex accounts available.

The Standard Account

Ideal for new traders or those who prefer simpler commission structures, the Standard Account offers straightforward pricing. It bundles a small mark-up directly into the spread, meaning you pay no separate commission per trade. This simplifies cost calculation and is often preferred by discretionary traders.

- Pricing Structure: Spreads typically start from 1.0 pips, with no additional commission.

- Execution: Experience lightning-fast execution with ECN-style connectivity.

- Minimum Deposit: An accessible entry point for new traders.

- Best For: Traders prioritizing simplicity and convenience, especially those new to active trading.

The Raw Spread Account (MetaTrader)

The Raw Spread Account caters to experienced traders, algorithmic traders, and scalpers who demand the tightest possible spreads.

It offers institutional-grade spreads directly from liquidity providers with a small, fixed commission per lot traded. This structure delivers incredible cost efficiency for high-volume traders.

- Pricing Structure: Spreads often start from 0.0 pips, plus a small commission per lot traded.

- Execution: Ultra-low latency, deep liquidity access.

- Ideal For: Scalpers, high-frequency traders, and EAs (Expert Advisors) looking for minimal spreads.

The cTrader Account

For traders who value advanced charting, sophisticated order types, and a unique interface, the cTrader Account presents an excellent option. It offers similar raw spreads to the MetaTrader Raw Spread account but operates on the cTrader platform, known for its sleek design and advanced analytical tools. This account is another type of raw spread offering but with a different platform experience.

- Platform: cTrader, renowned for its advanced features and user-friendly interface.

- Pricing Structure: Raw spreads often start from 0.0 pips, plus a commission per lot.

- Unique Tools: Depth of Market (DOM), advanced order management, and customizable workspace.

- Best For: Traders seeking a robust alternative to MetaTrader with powerful analytical capabilities.

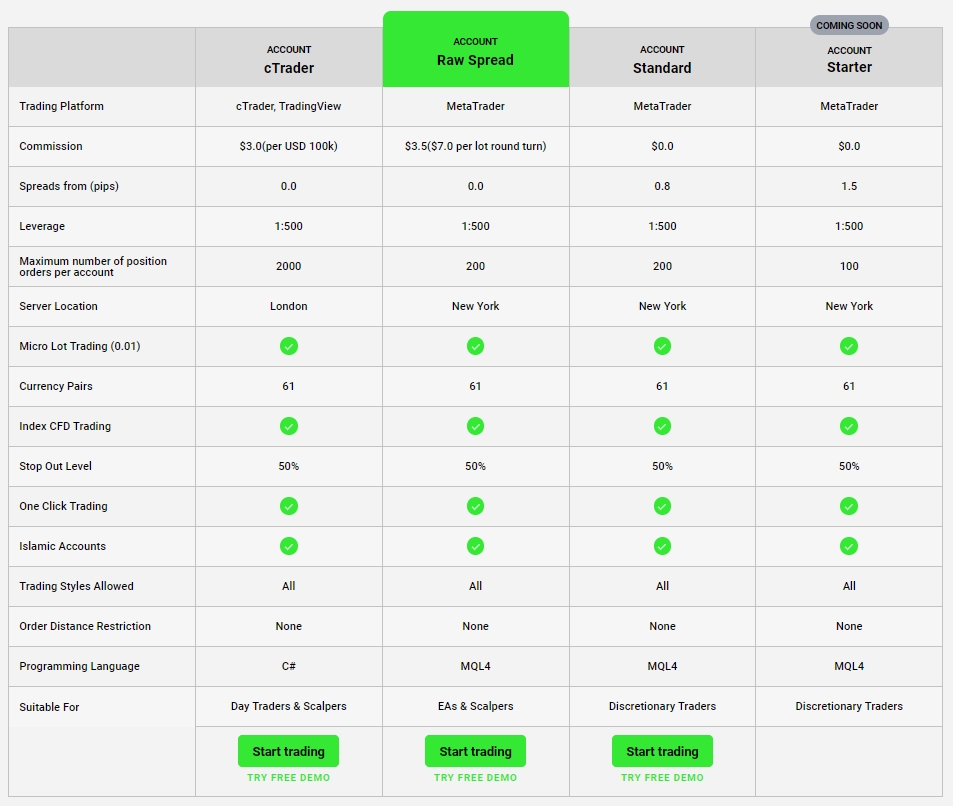

Comparing Your IC Markets Account Types

To help visualize the differences between these powerful trading accounts, here is a quick comparison:

| Feature | Standard Account | Raw Spread Account (MetaTrader) | cTrader Account |

|---|---|---|---|

| Spreads From | 1.0 pips | 0.0 pips | 0.0 pips |

| Commission | None | Low per lot | Low per lot |

| Ideal For | New/Discretionary Traders | Scalpers/High-Volume Traders | Advanced cTrader Users |

| Platform Options | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5 | cTrader |

Making Your Choice Among Broker Accounts

Choosing the right IC Markets trading account boils down to understanding your trading style and priorities. Consider these factors:

- Trading Volume: High-volume traders often benefit from raw spread forex accounts due to lower effective costs per trade.

- Trading Strategy: Scalpers and high-frequency traders absolutely need the tightest spreads. Swing traders might find the Standard Account sufficient.

- Platform Preference: Are you comfortable with MetaTrader, or do you prefer the advanced features and unique interface of cTrader?

- Cost Structure: Do you prefer commissions bundled into spreads or separate commissions with raw spreads for greater transparency?

No matter your experience level, IC Markets offers a robust solution among their various account types. These carefully designed options ensure you can execute your strategy effectively and capitalize on market opportunities.

Ready to Start Trading?

With a clear understanding of the IC Markets trading accounts, you are now equipped to make an informed decision. Explore each option further to identify the perfect fit for your financial goals. Your ideal platform for optimal trading awaits. Join thousands of successful traders who trust IC Markets for their trading journey.

Understanding IC Markets Trading Accounts

Choosing the right trading account is a critical first step on your journey to financial markets. IC Markets offers a range of sophisticated trading accounts designed to meet the diverse needs of both new and experienced traders. We empower you with competitive conditions and robust platforms, ensuring you find the perfect fit among our various account types.

Explore Our Primary Account Types

We understand that every trader has unique priorities, whether it’s razor-thin spreads or commission-free trading. Our main IC Markets Trading Accounts are tailored to provide optimal conditions for different strategies. Let’s look at the core differences:

| Feature | Raw Spread Accounts | Standard Accounts |

|---|---|---|

| Spreads | From 0.0 pips | From 0.6 pips |

| Commissions | Per lot, per side | None |

| Execution | ECN style, ultra-fast | No re-quotes |

| Ideal For | Scalpers, high-volume traders, EAs | Discretionary traders, beginners |

Why Our Forex Accounts Stand Out

Our commitment to providing superior trading conditions makes our forex accounts highly sought after. With IC Markets, you access deep liquidity, allowing for minimal slippage and rapid order execution. This is vital for traders who demand precision and speed, especially during volatile market movements. Our infrastructure supports high-frequency trading and expert advisors seamlessly, making us a top choice among broker accounts.

Here’s what makes our IC Markets Trading Accounts a preferred option for many:

- Competitive Pricing: Enjoy some of the lowest spreads and commissions in the industry.

- Flexible Leverage: Manage your capital effectively with adjustable leverage options.

- Advanced Platforms: Trade on industry-leading platforms like MetaTrader 4, MetaTrader 5, and cTrader.

- Superior Execution: Benefit from lightning-fast order execution with no dealing desk intervention.

- Client Support: Our dedicated support team is available around the clock to assist you.

Selecting the right one from our available trading accounts is crucial for maximizing your potential. We invite you to explore each option further and choose the account type that best aligns with your trading style and goals. Unlock your trading journey with IC Markets.

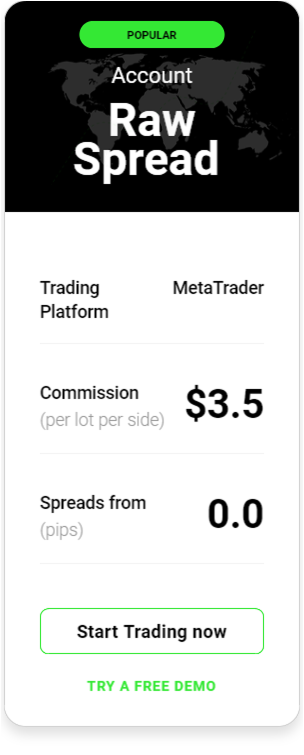

Raw Spread Account: Key Features and Benefits

Ready to elevate your trading game? The Raw Spread Account is a standout among the IC Markets Trading Accounts, specifically engineered for traders who demand the sharpest pricing and exceptional execution. If you value transparency and efficiency above all else, this particular account type delivers a professional-grade environment where every pip truly counts.

Unmatched Market Spreads and Transparent Costs

The core promise of the Raw Spread Account is simple: you gain access to raw, interbank spreads. This means you see pricing directly from over 50 different liquidity providers, often as low as 0.0 pips on major currency pairs. Such tight spreads are a critical advantage for active traders in the dynamic world of forex accounts.

While the spreads are incredibly low, there’s a small, fixed commission per standard lot traded. This transparent fee structure ensures that you understand your trading costs upfront, making it easier to manage your strategy and calculate potential profitability. It’s a straightforward approach designed for serious market participants.

Key Features That Empower Your Trading:

- Ultra-Tight Spreads: Experience spreads starting from 0.0 pips on popular pairs, reflecting genuine market conditions.

- Competitive Commissions: A clear, low commission per lot keeps your overall trading expenses predictable and manageable.

- Rapid Execution Speed: Our advanced trading infrastructure ensures your orders execute with minimal latency, crucial for precision entry and exit points.

- Deep Liquidity Pool: Benefit from aggregated pricing from numerous global financial institutions, leading to better fill prices and reduced slippage.

- Flexible Leverage Options: Customize your market exposure with leverage settings that suit your risk tolerance and trading methodology.

Who Thrives with a Raw Spread Account?

This robust account type provides significant advantages for specific trading styles. If any of these describe you, the Raw Spread Account offers a compelling solution:

| Trader Profile | Why It’s Ideal |

|---|---|

| Scalpers | Profit from tiny price movements with minimal spread friction. |

| High-Volume Traders | Achieve significant cost savings over many trades due to low base spreads. |

| Algorithmic Traders | Consistent, predictable pricing optimizes the performance of automated strategies. |

| Day Traders | React quickly to intraday market swings without excessive overheads. |

Making the Smart Choice Among Broker Accounts

Selecting the right trading accounts is a pivotal decision for any trader. The Raw Spread Account stands out by offering a genuinely competitive pricing model combined with superior execution quality. It puts you closer to the real market, allowing for more precise entries, better exits, and ultimately, greater control over your trading outcomes. It’s one of the most sought-after account types for a reason.

Ready to experience the difference a truly raw spread can make? Explore the Raw Spread Account today and take the next step in your trading journey.

Spreads and Commissions on the Raw Spread Account

Ready to unlock precision trading with minimal friction? The Raw Spread Account stands as a premier choice among IC Markets Trading Accounts, engineered for traders who prioritize razor-thin spreads and transparent pricing. This specific offering is one of the most popular forex accounts because it delivers true interbank market spreads directly to you, making it ideal for high-volume strategies and algorithmic trading.

Understanding the Raw Spreads

On the Raw Spread Account, you will experience spreads starting from an incredibly low 0.0 pips. What does this mean for your trading? It means you access bids and asks at their rawest form, without any artificial markups. This transparency allows for tighter entry and exit points, giving you a competitive edge in volatile markets. We pull liquidity from over 50 different providers, ensuring you consistently receive the deepest liquidity and most competitive spreads available.

This approach differentiates our Raw Spread option from many other trading accounts, where spreads might include a hidden markup. With us, you get exactly what the market offers.

The Commission Structure

To balance the exceptional spreads, a small, fixed commission applies to each trade on this particular account type. We keep our commission structure straightforward and transparent:

- For standard MetaTrader 4 and MetaTrader 5 platforms, the commission is $3.50 per standard lot per side. This means a round trip (opening and closing a trade) will incur $7.00 per standard lot.

- If you prefer cTrader, the commission is slightly different at $3.00 per $100,000 traded per side. This translates to $6.00 per $100,000 round trip.

This fixed commission model ensures you always know your trading costs upfront, making it easier to calculate your potential profitability. Many broker accounts adopt this model for their low-spread offerings, and ours is designed to be highly competitive, especially for active traders.

| Platform | Commission (Per Standard Lot, Per Side) |

|---|---|

| MetaTrader 4/5 | $3.50 |

| cTrader | $3.00 (per $100,000 traded) |

Combining raw spreads with a clear, fixed commission creates a highly cost-effective environment for serious traders. It’s a structure built for those who execute frequently and demand the utmost in pricing efficiency.

Minimum Deposit for Raw Spread Accounts

You crave lightning-fast execution and some of the tightest spreads in the industry, right? That’s precisely what our Raw Spread trading accounts deliver. Many traders, especially those keen on minimizing costs, often ask about the financial commitment to access such premium conditions. We believe top-tier trading shouldn’t be out of reach.

To open a Raw Spread account, we set a clear, accessible minimum deposit. You only need to deposit $200 USD (or the equivalent in another base currency) to get started. This entry point allows you to immediately tap into institutional-grade liquidity and incredibly low average spreads.

Here is what this accessible minimum deposit means for your trading journey:

- Competitive Entry: Compare this with other forex accounts; our $200 threshold makes high-performance trading attainable for a wider range of participants.

- Access to Excellence: It quickly places you within an environment designed for serious traders, offering you access to Raw Spreads, often as low as 0.0 pips, with a commission per lot.

- Flexibility Across Account Types: This deposit level applies across our main Raw Spread account types, ensuring consistency when considering our various IC Markets Trading Accounts.

- Gateway to Opportunity: It’s a straightforward path to exploring advanced trading strategies without a prohibitive initial investment, making our broker accounts highly attractive.

This manageable minimum deposit empowers you to dive into the market with confidence, knowing you’re utilizing one of the most cost-effective and efficient trading accounts available. It truly positions our Raw Spread offering among the leading account types in the industry for serious traders.

Standard Account: Simplicity and Straightforward Trading

Are you seeking a hassle-free entry into the dynamic world of online trading? Our Standard Account at IC Markets is meticulously designed for those who value clarity and simplicity. This popular choice among our various IC Markets Trading Accounts provides a direct, easy-to-understand trading environment, perfect for both new traders and experienced participants who prefer straightforward conditions.

We understand that navigating different trading accounts can feel overwhelming. That’s why the Standard Account cuts through the complexity, offering a familiar trading structure without sacrificing performance or access to our robust platforms.

Key Advantages of the Standard Account

- Commission-Free Trading: Enjoy transparent trading costs with zero commissions on trades. All charges are included in the spread, making it simple to calculate your potential expenses.

- Competitive Spreads: We provide highly competitive spreads, starting from 1.0 pips, ensuring you get excellent value as you execute your trades across a wide range of instruments.

- Broad Market Access: Trade on major, minor, and exotic forex pairs, commodities, indices, and cryptocurrencies. This account offers extensive market access, empowering you to diversify your portfolio.

- Flexible Leverage: Utilize flexible leverage options to suit your risk appetite and trading strategy. Manage your capital effectively with the freedom to adapt.

This particular offering among our account types is ideal if you’re just starting your journey or if you prefer a ‘what you see is what you get’ approach to your trading. It’s a fantastic option for those who want to focus purely on market analysis and trade execution without worrying about additional commission structures. Many traders find this one of the most user-friendly forex accounts available.

“Our Standard Account is built on the principle of transparency. We empower you to trade with confidence, knowing exactly what to expect from your costs and conditions.”

When comparing different broker accounts, the IC Markets Standard Account truly shines for its no-fuss nature. It delivers a powerful trading experience with the simplicity you appreciate, allowing you to concentrate on spotting opportunities and executing your strategy. Take the step towards simplified trading today and discover why so many choose this dependable option.

Spreads on the Standard Account

Understanding spreads is absolutely critical when you evaluate various trading accounts. For the IC Markets Standard Account, you gain access to spreads that reflect the real market conditions. This particular offering is one of the most popular account types for good reason, providing transparency and competitive pricing.

A spread represents the difference between the bid and ask price of a currency pair or other financial instrument. It’s essentially the cost of entering a trade. On the Standard Account, you will experience variable spreads. This means they fluctuate based on market volatility, liquidity, and the time of day. During peak market hours, you often see the tightest spreads, while off-peak times might show slightly wider figures.

IC Markets aims to provide some of the lowest average spreads in the industry for this specific account. Many traders, especially those actively involved in forex, choose this option for its straightforward pricing model. It’s a key consideration for anyone looking into forex accounts where execution costs play a significant role in overall profitability.

Here’s a snapshot of typical average spreads you might encounter on the Standard Account for some major pairs:

| Instrument | Average Spread (Pips) |

| EUR/USD | 0.6 – 1.2 |

| GBP/USD | 0.9 – 1.5 |

| AUD/USD | 0.6 – 1.2 |

| USD/JPY | 0.7 – 1.3 |

These figures are illustrative and can change, but they give you a clear idea of what to expect. This spread structure makes the Standard Account an attractive option, often setting it apart from many other broker accounts by balancing ease of use with favorable trading conditions.

Islamic Account (Swap-Free): Catering to Specific Needs

Are you seeking trading solutions that align with Sharia law? IC Markets understands diverse trader requirements, offering a specialized Islamic Account. This unique option is one of the distinct IC Markets Trading Accounts, meticulously designed for ethical compliance without compromising your trading potential.

At its core, the Islamic Account operates on a ‘swap-free’ basis. This means you incur no overnight interest or rollover fees on positions held open for extended periods. Sharia principles strictly prohibit earning or paying interest (riba), making traditional forex accounts unsuitable for many Muslim traders. Our commitment to a swap-free policy ensures your trading activities remain fully compliant with Islamic finance principles.

This dedicated account offers several compelling advantages for traders:

- Sharia Compliance: Trade with peace of mind, knowing your activities strictly adhere to Islamic law.

- No Overnight Interest: Hold positions for as long as your strategy dictates without worrying about swap charges, providing stability from a Sharia perspective.

- Comprehensive Market Access: Enjoy full access to our extensive range of instruments, just like our other standard broker accounts.

- Transparent Structure: We maintain full transparency regarding any administrative fees that may apply after a specified number of days, ensuring clarity in your trading costs without involving interest.

This specific offering among our various account types is ideal for Muslim traders globally, empowering them to participate actively in the financial markets without compromising their faith. It also appeals to non-Muslim traders who prefer trading accounts that do not involve overnight financing charges for their specific strategies.

Choosing the right broker accounts is a pivotal decision. We invite you to explore the details of our Islamic Account further. Discover how it perfectly aligns with both your ethical considerations and your trading strategy. IC Markets is dedicated to providing inclusive, accessible market opportunities for every trader.

Comparing IC Markets Trading Account Types

Selecting the right trading account is fundamental to your success in the financial markets. IC Markets offers a range of top-tier IC Markets Trading Accounts designed to cater to diverse trading styles and experience levels. Understanding the nuances of each option empowers you to make an informed choice.

Let’s dive into the core account types available, ensuring you pick the perfect fit for your trading journey.

The Raw Spread Account: For Precision Traders

This account is specifically for those who demand the absolute tightest spreads available. If you are an experienced trader, a scalper, or someone who relies on expert advisors (EAs) for high-frequency trading, this option speaks directly to your needs.

- Key Features: You gain access to market-leading spreads, frequently starting from 0.0 pips on major currency pairs. The cost structure involves a small, fixed commission charged per lot traded.

- Benefits: Experience ultra-low latency execution and highly competitive pricing. This account stands out as a professional choice among forex accounts for serious market participants where every pip counts.

The Standard Account: Simplicity and Ease

For traders who prefer a straightforward approach without separate commissions, the Standard Account delivers. It’s an excellent starting point for beginners, discretionary traders, and anyone seeking a clear, predictable cost model.

- Key Features: Enjoy commission-free trading. The spreads are slightly wider than the Raw Spread account, with the trading cost built directly into the spread itself. This simplifies your cost calculation.

- Benefits: Ideal for getting started in the markets without the added complexity of per-trade commissions. Its transparent pricing makes it a popular choice among various broker accounts, offering peace of mind.

cTrader Raw Account: Advanced Platform, Raw Spreads

This account combines the benefits of raw spreads with the advanced capabilities of the cTrader platform. It caters to traders who appreciate sophisticated tools and an intuitive interface.

- Key Features: Access advanced charting, diverse order types, and unique automated trading capabilities found only on cTrader. You still benefit from ultra-low spreads and a commission structure similar to the MetaTrader Raw Spread account.

- Benefits: A powerful combination for those seeking both cutting-edge technology and cost-efficiency in their trading environment.

To help you visualize the differences, here’s a quick comparison:

| Account Type | Spreads | Commissions | Ideal For |

|---|---|---|---|

| Raw Spread (MT4/MT5) | From 0.0 pips | Yes (fixed per lot) | Scalpers, EAs, experienced traders |

| Standard (MT4/MT5) | From 0.6 pips | No | New traders, discretionary traders |

| cTrader Raw | From 0.0 pips | Yes (fixed per lot) | cTrader platform fans, precision traders |

Making Your Choice: Key Factors

When deciding between these excellent IC Markets Trading Accounts, consider these important questions:

- Your Trading Style: Are you a high-frequency scalper, a swing trader, or a long-term position holder?

- Capital: What is your initial trading capital?

- Experience Level: Do you prefer simplicity in cost structures or are you comfortable with more granular commission models?

- Platform Preference: Do you have a favorite trading platform (MetaTrader 4/5 or cTrader)?

Each of these trading accounts offers distinct advantages tailored to different trading philosophies. Your goal is to align an account with your unique trading strategy and personal preferences. Explore each option thoroughly, understand its cost structure, and envision how it fits with your personal trading approach. Ready to take the next step? Choose the best fit for you and join thousands of successful traders making informed decisions.

Opening an IC Markets Account: A Step-by-Step Guide

Dive into the world of online trading with IC Markets, a leading broker renowned for its competitive conditions and robust platforms. Setting up your very own IC Markets Trading Accounts opens doors to diverse markets, from forex to commodities and indices. This guide walks you through the entire process, ensuring a smooth start to your trading journey.

Before we jump into the “how,” let’s quickly touch on the “why.”

- Tight spreads and low commissions

- Fast execution speeds

- Access to cutting-edge trading platforms

- Extensive range of tradable instruments

- Strong regulatory compliance

Understanding Your Trading Account Options

IC Markets offers various account types designed to suit different trading styles and experience levels. Whether you are a seasoned pro or just starting, you will find a fit. Most commonly, traders gravitate towards their Raw Spread or Standard accounts. These are designed for diverse needs, catering to various forex accounts and other market instruments.

The Step-by-Step Account Opening Process

Embarking on your trading journey with IC Markets is straightforward. Follow these simple steps:

-

1. Start Your Registration Online: Visit the official IC Markets website. Look for the “Open an Account” button, usually prominently displayed. You’ll fill out a quick online form with your basic personal details, including your name, email address, country of residence, and phone number. Choose your preferred trading platform (MetaTrader 4, MetaTrader 5, or cTrader) and select your desired currency for your trading accounts.

-

2. Complete Your Application: After the initial registration, you’ll be prompted to provide more detailed information. This typically includes your date of birth, address, and employment details. You will also answer a few questions about your trading experience and financial situation. This helps the broker understand your suitability for trading. Remember, honesty is key.

-

3. Verify Your Identity and Residence: This crucial step ensures the security of your broker accounts and complies with regulatory requirements. You’ll need to upload clear copies of:

- Proof of Identity: A government-issued ID like a passport or driver’s license.

- Proof of Residence: A utility bill or bank statement issued within the last three months, showing your name and address.

Ensure the documents are clear, current, and all four corners are visible.

-

4. Fund Your Account: Once your documents are verified and your account is approved, it’s time to fund your trading account. IC Markets supports a wide range of deposit methods, including bank transfers, credit/debit cards, and various e-wallets. Choose the method that best suits you. The minimum deposit requirement varies by account type.

-

5. Start Trading: With your account funded, you are ready to explore the markets. Download your chosen trading platform, log in with your credentials, and begin placing trades. Take advantage of demo accounts first if you wish to practice without real capital.

Considerations for Choosing Your IC Markets Trading Account

Selecting the right account type is crucial for your trading style. Here’s a quick comparison to help you decide:

| Feature | Standard Account | Raw Spread Account |

|---|---|---|

| Spreads | Wider, no commission | Very tight, commission per lot |

| Execution | Fast | Ultra-fast |

| Ideal For | New traders, those preferring all-inclusive spreads | Scalpers, high-volume traders, EAs |

No matter which of the IC Markets Trading Accounts you choose, you gain access to powerful tools and robust support.

Opening an IC Markets account is a seamless process, setting you up for potential success in the dynamic financial markets. Ready to take control of your financial future? Join the thousands of traders who trust IC Markets for their trading needs.

Funding Your IC Markets Trading Account

Ready to unlock your trading potential? Getting started with your IC Markets Trading Account is incredibly straightforward. We understand that quick, secure, and flexible funding is crucial for traders, which is why we’ve streamlined the process for all our trading accounts. Whether you’re opening one of our many account types or managing existing forex accounts, funding your journey has never been easier.

Flexible Deposit Methods at Your Fingertips

We offer a diverse range of deposit options to suit traders worldwide, ensuring you can fund your broker accounts with ultimate convenience. Our goal is to make sure you spend less time on administration and more time focusing on the markets.

| Method | Description | Typical Processing Time |

|---|---|---|

| Credit/Debit Cards | Visa and MasterCard accepted globally. A fast and secure way to deposit directly from your card. | Instant |

| Bank Transfer | Direct bank transfers from your financial institution. Ideal for larger deposits or specific banking preferences. | 2-5 Business Days (may vary by bank) |

| e-Wallets | Popular options like Neteller, Skrill, and PayPal provide an efficient and secure digital wallet experience. | Instant |

| Other Local Payment Solutions | We integrate various regional payment methods to offer localized convenience for traders in specific areas. | Varies (often Instant) |

Multiple Currencies, No Hassle

Fund your IC Markets Trading Account in a variety of major global currencies. This flexibility helps you avoid unnecessary currency conversion fees and simplifies your financial management, especially if you deal with international transactions regularly. Choose the base currency that best suits your needs and keeps your trading costs transparent.

Unwavering Security and Support

Your financial security is our top priority. We employ advanced encryption and robust security protocols for all transactions, protecting your funds and personal information every step of the way. Funding your trading accounts is not just easy; it’s also incredibly safe. Should you have any questions or require assistance during the deposit process, our dedicated support team is always ready to provide expert guidance.

With IC Markets, quick and reliable funding means you can seize market opportunities as they arise. Choose your preferred method, make a deposit, and power up your IC Markets Trading Account today!

Withdrawal Process and Options

A seamless withdrawal process is crucial for any trader. You need full confidence that accessing your funds is straightforward and efficient. At IC Markets, we prioritize transparency and speed, ensuring you can manage your capital with ease across all your trading accounts. Our aim is to make fund management as simple as opening your initial forex accounts.

Initiating a withdrawal is a straightforward process. You simply log into your secure Client Area, navigate to the ‘Withdraw Funds’ section, and select your preferred method. We guide you through each step, ensuring a smooth experience from start to finish. You can easily manage funds from your various trading accounts directly from this portal.

We offer a wide array of withdrawal options designed for your convenience. Whether you’re managing standard or raw spread account types, you’ll find a method that suits your needs. Here are some of the popular choices available for your broker accounts:

- Bank Wire Transfer: A reliable option for larger amounts, supporting transfers to virtually any bank worldwide.

- Credit/Debit Cards: For quick and easy transfers back to your Visa or MasterCard, often matching the initial deposit method.

- E-Wallets: Popular digital payment solutions like Neteller, Skrill, PayPal, and others provide fast processing times, ideal for active traders.

- Broker to Broker Transfer: For transferring funds directly between your existing brokerage accounts.

Each method comes with specific processing times. Typically, e-wallet withdrawals are the fastest, often processed within the same business day. Bank wire transfers, due to international banking protocols, may take several business days to complete. We strive to process all requests promptly from our end, ensuring minimal delay to your IC Markets Trading Accounts funds.

Transparency is key. While IC Markets does not charge internal fees for most withdrawal methods, your bank or payment provider might apply their own transaction fees. It’s always a good practice to check with your financial institution regarding any potential charges for incoming funds. We ensure clarity on any fees displayed in your Client Area before you confirm your request.

Security is paramount throughout the entire process. We employ advanced encryption and verification procedures to protect your funds and personal information. You can rest assured that your capital, whether in your live trading accounts or demo accounts, is handled with the utmost care. This robust security applies to all account types, giving you peace of mind when managing your forex accounts.

Experience the ease and reliability of managing your funds with IC Markets. Our dedicated support team is also available to assist with any questions you may have regarding your withdrawal process, ensuring a hassle-free experience from start to finish. Join us and discover a trading environment built on trust and efficiency.

Leverage and Margin Requirements Across Account Types

Understanding leverage and margin is absolutely crucial for anyone engaging with IC Markets Trading Accounts. These powerful tools define your trading capacity and risk exposure.

Leverage essentially lets you control larger positions in the market with a smaller initial capital. Think of it as a financial amplifier. It significantly magnifies both potential profits and, importantly, potential losses.

What is Margin?

Margin is the amount of money you must deposit to open and maintain a leveraged position. It serves as a security deposit, ensuring you can cover adverse market movements. Your margin requirement directly links to the leverage you employ. Higher leverage often translates to a lower margin requirement, but it also elevates your overall risk.

Leverage Across Different Account Types

Different IC Markets Trading Accounts offer varying leverage options. The account types you choose directly influence the maximum leverage available to you. Some broker accounts, designed for experienced traders, might provide very high leverage. Other account types, perhaps tailored for beginners, could have more conservative limits. Regulatory restrictions frequently dictate these maximums, differing based on your geographic location and the specific asset class you intend to trade.

Margin Requirements Across Account Types

Just as leverage varies, so do the precise margin requirements across our range of trading accounts. Certain account types might have distinct margin percentages compared to others. Comprehending these differences is vital for effective risk management. We provide transparent margin tables for all our forex accounts, detailing the initial margin needed to open a trade and the maintenance margin required to keep it active.

Your selected leverage and margin settings profoundly influence your trading strategy. Aggressive use of high leverage can accelerate gains but also amplify drawdowns rapidly. Prudent traders often choose lower leverage to manage risk more effectively across their portfolio of forex accounts.

Key Factors Influencing Leverage and Margin

Several factors can influence the leverage and margin requirements for your broker accounts:

- Regulatory Environment: Different jurisdictions impose varying maximum leverage limits to protect traders.

- Asset Class: Major currency pairs, for instance, typically allow higher leverage than exotic pairs or certain commodities.

- Account Types: The specific trading accounts you select with IC Markets will have their own predefined settings for leverage and margin.

Carefully reviewing leverage and margin for your chosen IC Markets Trading Accounts empowers you to make informed decisions. We encourage you to explore the specifics for each of our available account types to find the perfect fit for your individual trading style and goals.

Trading Platforms Available with IC Markets Accounts

Your trading platform is your command center, the critical interface where strategy meets the market. Selecting the right one for your IC Markets Trading Accounts is a pivotal decision that directly impacts your trading success. We understand this deeply, which is why we offer a suite of industry-leading platforms designed to cater to diverse trading styles and preferences. Each platform integrates seamlessly with our account types, providing robust tools and unparalleled execution.

MetaTrader 4 (MT4): The Industry Standard

MetaTrader 4 remains a dominant force in the online trading world, especially for forex accounts. It’s renowned for its stability, user-friendly interface, and powerful charting capabilities. Millions of traders worldwide trust MT4 for their daily operations, and our IC Markets broker accounts give you full access to its extensive features.

- Extensive Charting Tools: Utilize numerous timeframes and analytical objects for in-depth market analysis.

- Expert Advisors (EAs): Automate your trading strategies with a vast library of custom indicators and EAs.

- Customizable Interface: Tailor your workspace to fit your specific needs and preferences.

- Mobile Trading: Stay connected to the markets and manage your trades on the go with dedicated mobile apps.

MetaTrader 5 (MT5): The Next Generation

Building on the success of MT4, MetaTrader 5 offers an expanded feature set and multi-asset capabilities. If you’re looking to diversify beyond forex, MT5 for your trading accounts opens up new possibilities, including stocks, indices, and commodities. It’s an ideal choice for traders seeking enhanced analytical tools and broader market access.

- More Timeframes & Indicators: Access additional charting options for even deeper analysis.

- Depth of Market (DOM): View real-time market depth to gauge liquidity and price levels.

- Expanded Order Types: Execute more complex trading strategies with additional pending order types.

- Built-in Economic Calendar: Keep track of important economic events directly within the platform.

cTrader: For Advanced Traders and Scalpers

cTrader is a modern, sophisticated platform designed for traders who demand exceptional speed, transparent pricing, and advanced order execution. It’s particularly favored by those employing scalping or high-frequency strategies, offering a true ECN (Electronic Communication Network) environment for your IC Markets Trading Accounts. Experience true market depth and ultra-low latency with your broker accounts.

- True ECN Environment: Trade directly with interbank prices and minimal slippage.

- Advanced Order Types: Utilize sophisticated order management features, including cTrader Automate for algorithmic trading.

- Level II Pricing: Gain full visibility into market depth, showing all available liquidity.

- Sleek User Interface: Enjoy a clean, intuitive design focused on efficiency and speed.

Which Platform Suits Your Trading Accounts?

Choosing the right platform for your IC Markets Trading Accounts depends on your individual needs and trading goals. Here’s a quick overview to guide your decision:

| Platform | Key Strength | Ideal Trader Profile |

|---|---|---|

| MetaTrader 4 | Forex trading, EA compatibility, wide community support | New to forex, automated trading enthusiasts, steady forex traders |

| MetaTrader 5 | Multi-asset trading, enhanced tools, broader market access | Diversified traders, advanced analysts, those needing more asset classes |

| cTrader | ECN environment, speed, depth of market, algorithmic trading | Scalpers, high-frequency traders, algorithmic developers, ECN transparency seekers |

Each of these robust platforms seamlessly integrates with various account types, ensuring you have the optimal tools for your trading journey. We encourage you to explore them and discover which one perfectly aligns with your trading style and ambition. Your success is our priority, and having the right platform for your IC Markets Trading Accounts is a significant step in that direction.

MetaTrader 4 (MT4) for IC Markets

MetaTrader 4, widely known as MT4, remains the gold standard for traders around the globe. When you connect MT4 with IC Markets, you unlock a powerful, reliable trading environment. This platform offers a perfect blend of robust functionality and user-friendliness, making it an ideal choice for new and experienced traders accessing IC Markets Trading Accounts.

MT4 provides an unparalleled suite of tools designed to elevate your trading strategy. You gain access to a highly customizable interface, allowing you to tailor your workspace precisely to your preferences. Its intuitive design ensures you spend less time navigating and more time executing informed trades.

Why Traders Choose MT4 with IC Markets:

- Advanced Charting Tools: Perform in-depth technical analysis with a wide range of timeframes and analytical objects.

- Expert Advisors (EAs): Automate your trading strategies around the clock, leveraging pre-programmed algorithms.

- Comprehensive Indicators: Access dozens of built-in indicators and thousands of custom ones to identify market trends and signals.

- One-Click Trading: Execute trades quickly and efficiently directly from the charts.

- Flexible Order Types: Utilize market, pending, stop, and trailing stop orders to manage your risk effectively.

This powerful platform seamlessly integrates with your chosen IC Markets Trading Accounts. Whether you opt for a Raw Spread or Standard account, MT4 handles your trades with precision. It is especially favored by forex accounts holders, giving you direct market access and competitive pricing through IC Markets.

MT4 offers incredible flexibility, allowing you to trade on desktop, through your web browser, or on mobile devices. This means you maintain full control over your broker accounts wherever you are, never missing a crucial market move. Experience the difference a top-tier platform makes for your trading journey with IC Markets.

MetaTrader 5 (MT5) for IC Markets

Step into the next generation of trading with MetaTrader 5 (MT5), a cutting-edge platform available through IC Markets. This powerful platform provides an unparalleled trading experience, offering advanced tools and functionalities beyond its predecessor. Traders seeking sophisticated analysis and diverse market access find MT5 an indispensable ally for their IC Markets Trading Accounts.

MT5 empowers you with a comprehensive suite of features, perfect for navigating various financial markets. You get access to an extended range of instruments, including forex, indices, commodities, and cryptocurrencies, all from a single interface. Its multi-threaded strategy tester is a game-changer for algorithmic traders, allowing robust backtesting and optimization of Expert Advisors (EAs).

Discover the enhanced capabilities that MT5 brings to your trading journey:

- More Timeframes: Analyze market movements with 21 distinct timeframes, offering deeper insights.

- Advanced Pending Orders: Utilize eight types of pending orders for greater control over your entry and exit strategies.

- Integrated Economic Calendar: Stay ahead of market-moving events directly within the platform.

- Market Depth: Gain transparency with real-time market depth, helping you understand liquidity.

- Superior Charting Tools: Leverage advanced analytical objects and indicators for precise technical analysis.

Whether you are managing complex strategies or simply looking for a more versatile platform, MT5 integrates seamlessly with our range of trading accounts. This flexibility ensures your broker accounts are perfectly suited to harness the full potential of the financial markets, including specialized forex accounts. No matter your preferred account types, MT5 delivers a premium trading environment. Upgrade your trading experience and explore the robust capabilities of MT5 with IC Markets today.

cTrader for IC Markets

Seeking a trading platform that combines sophisticated tools with raw speed? cTrader, offered by IC Markets, is a standout choice for serious traders. It’s renowned for its sleek interface, advanced charting capabilities, and exceptionally fast order execution. For those who demand precision and transparency, cTrader delivers a premium trading experience.

IC Markets integrates seamlessly with cTrader, providing direct market access and deep liquidity. This powerful combination ensures you can capitalize on market movements with minimal latency. Whether you’re a scalper, day trader, or long-term investor, cTrader on IC Markets provides the robust environment you need to execute your strategies effectively across a variety of asset classes.

Why Traders Choose cTrader with IC Markets:

- Advanced Charting: Explore a vast array of chart types, indicators, and drawing tools for in-depth technical analysis.

- Algorithmic Trading: Utilize cBots to automate your trading strategies and execute trades around the clock.

- Transparent Pricing: Experience true ECN pricing with competitive spreads, crucial for many forex accounts.

- Fast Execution: Benefit from rapid order processing, essential for high-frequency trading and minimizing slippage.

- Depth of Market (DOM): Gain full visibility into market depth, allowing for more informed trading decisions.

The synergy between IC Markets’ superior brokerage services and cTrader’s innovative platform creates an unparalleled offering. You get access to some of the most competitive conditions in the market, making your chosen IC Markets Trading Accounts even more powerful. This platform perfectly complements our commitment to offering transparent and efficient broker accounts, ensuring you always have the edge.

We understand that traders have diverse needs, which is why we offer various account types that pair perfectly with cTrader. This flexibility allows you to tailor your trading environment to your specific style and goals. Unlock the full potential of your trading with cTrader through IC Markets, where technology meets performance.

Regulatory Compliance and Security for Your Funds

Choosing a broker for your financial journey means entrusting them with your capital. At IC Markets, we understand this profound responsibility. That’s why regulatory compliance and the ironclad security of your funds stand as the bedrock of our operations. We actively work to earn and maintain your confidence, ensuring peace of mind for every trader.

Our commitment begins with robust regulatory oversight. We operate under stringent licensing conditions from some of the most respected financial authorities globally. This adherence isn’t just a formality; it dictates our operational standards, transparency, and accountability, providing a secure environment for all our client trading accounts.

Here’s how we prioritize the safety of your investment:

-

Your capital is held in separate bank accounts from the company’s operational funds. This critical measure ensures that your money is protected and cannot be used for IC Markets’ business expenses. It’s a fundamental safeguard for all our client broker accounts.

- Top-Tier Banking Relationships: We partner with major, reputable financial institutions to hold client funds. These banks are known for their stability and reliability, adding another layer of security to your deposits.

- Negative Balance Protection: For many of our global clients, we offer negative balance protection. This means you cannot lose more than the funds you have deposited in your IC Markets trading accounts. It’s a vital safety net, especially when trading volatile markets like forex.

- Data Security and Privacy: Protecting your personal and financial information is paramount. We employ advanced encryption technologies and strict data protection protocols to secure all transactions and personal data across all account types. Your privacy is respected and protected with the utmost diligence.

Transparency is a cornerstone of our client relationships. We believe you should always know how your funds are managed and protected. Our regulatory frameworks demand detailed reporting and regular audits, ensuring consistent compliance and financial integrity. This commitment extends across all our offerings, from standard to more specialized forex accounts.

When you consider IC Markets trading accounts, you’re not just choosing a platform; you’re opting for a brokerage where the security of your capital is woven into every aspect of our service. We empower you to trade with confidence, knowing that your funds are handled with the highest degree of care and regulatory diligence.

Who Regulates IC Markets?

Understanding the regulatory landscape of your chosen broker is absolutely critical. It’s the cornerstone of trust and security in your trading journey. IC Markets understands this deeply, operating under the strict oversight of several prominent financial authorities worldwide. This robust regulatory framework protects clients and ensures fair, transparent trading conditions for all their trading accounts.

You want peace of mind when managing your forex accounts, right? Well-regulated broker accounts offer just that. IC Markets is authorized and regulated by reputable bodies, which means they adhere to stringent financial standards and operational guidelines. This commitment to compliance is a major advantage for anyone considering their various account types.

IC Markets maintains a strong global regulatory presence. Key entities providing oversight include:

- Australian Securities and Investments Commission (ASIC): For clients trading under their Australian entity, ASIC provides robust consumer protection and market integrity oversight.

- Cyprus Securities and Exchange Commission (CySEC): Serving clients in the European Economic Area, CySEC ensures compliance with MiFID II directives, offering significant investor safeguards.

- Financial Services Authority (FSA) Seychelles: This offshore regulator oversees their global entity, providing international clients with access to their trading services.

- Securities Commission of the Bahamas (SCB): Another international regulator for certain global operations, ensuring adherence to financial services laws.

Why does this matter to you and your IC Markets Trading Accounts? Regulation enforces best practices, mandates segregated client funds, and establishes clear dispute resolution mechanisms. It means your funds are held separately from the company’s operational capital, adding an essential layer of security. This regulatory environment directly impacts the integrity and reliability of all available trading accounts, giving you confidence as you execute trades.

Choosing a broker with strong regulatory backing is not just a recommendation; it’s a necessity. It ensures that regardless of which of their account types you choose, you’re trading with a firm committed to maintaining high standards of financial conduct and client protection. It helps safeguard your investment and promotes an equitable trading experience across all their offerings, including specialized forex accounts.

Customer Support for IC Markets Trading Accounts

Navigating the dynamic world of online trading demands reliable support, especially when managing your IC Markets Trading Accounts. We understand that quick, expert assistance is not just a convenience; it’s a critical component of a successful trading journey. Our dedicated customer support team stands ready to empower you with the help you need, ensuring your trading experience remains smooth and efficient.

Always Within Reach: Our Multichannel Support

We provide multiple avenues for you to connect with our support specialists, tailored to suit your needs and urgency. Whether you have a quick question about specific account types or need in-depth assistance with your forex accounts, we make reaching us effortless.

Here’s how you can get in touch:

- 24/7 Live Chat: For immediate queries, our live chat feature connects you directly with a support agent anytime, day or night. This is perfect for quick troubleshooting or information about your trading accounts.

- Email Support: If your query requires detailed explanations or involves documentation, our email support team provides comprehensive and clear responses, ensuring all aspects of your inquiry are addressed thoroughly.

- Phone Support: For urgent matters or if you simply prefer a direct conversation, our phone lines are open. Speak directly with an expert who can guide you through any challenge related to your broker accounts.

Expertise You Can Trust

Our support team comprises highly trained professionals with extensive knowledge of the financial markets and our platform. They possess the deep understanding necessary to address a wide range of topics, from technical issues and platform navigation to specific queries about funding or withdrawals for your IC Markets Trading Accounts. We pride ourselves on providing precise, actionable advice, helping you make informed decisions.

You benefit from:

| Support Aspect | Our Commitment to You |

|---|---|

| Responsiveness | We prioritize fast response times across all channels. |

| Knowledge | Our team holds in-depth expertise on all trading accounts and services. |

| Clarity | We communicate solutions clearly, avoiding jargon. |

| Multilingual | Support available in multiple languages to assist a global client base. |

A Partner in Your Trading Journey

We view our customer support as an extension of your trading tools. It is designed to be a reliable resource, helping you confidently manage your IC Markets Trading Accounts. Whether you’re configuring new account types, navigating the complexities of forex accounts, or resolving an issue with your broker accounts, our team is here to ensure you feel supported every step of the way. Experience truly professional and client-focused assistance that empowers your trading decisions.

Educational Resources for Traders

Navigating the financial markets requires more than just opening *IC Markets Trading Accounts*; it demands knowledge, skill, and continuous learning. We believe in empowering our traders through robust educational resources, helping you build a solid foundation and refine your strategies. Success in trading is a journey of ongoing education, and we provide the tools to guide you every step of the way.

We offer a comprehensive suite of learning materials designed for every level, from beginners exploring their first *trading accounts* to seasoned professionals seeking advanced insights. Our goal is to demystify complex concepts, giving you the confidence to make informed decisions about various *account types* and market opportunities. You gain access to a rich library of content crafted by industry experts, always accessible when you need it most.

Discover our diverse educational offerings:

- In-Depth Tutorials: Master core trading concepts, technical analysis, and risk management with our structured guides. These resources help you understand the functionality and benefits of different *broker accounts* before you commit.

- Live Webinars & Workshops: Participate in interactive sessions with professional traders. Ask questions, learn new strategies, and gain real-time market perspectives, particularly valuable for optimizing your *forex accounts*.

- Video Library: Watch concise, easy-to-understand videos that break down complex topics into digestible segments. Visual learning makes understanding market dynamics and platform features simpler.

- Market Analysis & Research: Stay ahead with daily market reports, expert forecasts, and deep dives into economic events. This crucial information equips you to anticipate trends and manage your trades effectively.

- Glossary & FAQs: Quickly look up financial terms and get answers to common questions about our platform or various *trading accounts*. Clear definitions enhance your understanding.

By leveraging these educational assets, you not only improve your trading proficiency but also gain a deeper understanding of how to maximize the potential of your chosen *IC Markets Trading Accounts*. We equip you with the insights necessary to approach the markets with confidence and make strategic decisions for your financial future. Start learning today and transform your trading experience.

Pros and Cons of IC Markets Trading Accounts

Considering your options for a robust trading platform? Diving into the world of IC Markets offers distinct advantages and a few points to consider. We believe making an informed decision about your brokerage is paramount, and understanding the nuances of their IC Markets Trading Accounts is crucial for any serious trader. Let’s break down what makes these broker accounts stand out, and where they might not be the perfect fit for everyone.

The Upside: What You’ll Love About IC Markets

IC Markets consistently attracts traders with compelling features designed to enhance your trading experience. Their various account types cater to different strategies and preferences.

- Competitive Spreads and Low Commissions: Enjoy some of the tightest raw spreads in the industry, especially on popular currency pairs. The True ECN account, for example, offers spreads starting from 0.0 pips with a transparent, low commission structure. This is a significant draw for active traders looking to minimize costs.

- Superior Execution Speed: Experience lightning-fast order execution. IC Markets leverages advanced technology to ensure minimal slippage and efficient trade processing, which is critical for scalpers and day traders.

- Wide Range of Instruments: Access a comprehensive selection of assets including forex accounts (over 60 currency pairs), commodities, indices, cryptocurrencies, and futures. This diversity allows you to explore multiple markets from a single platform.

- Flexible Trading Platforms: Choose from industry-leading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Each platform offers unique tools, charting capabilities, and automated trading options to suit your specific needs.

- Excellent Customer Support: Receive reliable 24/7 multilingual customer service. Responsive support is invaluable when navigating the markets, ensuring you get help whenever you need it.

- Strong Regulation: Trade with confidence knowing IC Markets operates under strict regulatory oversight, providing a secure and transparent trading environment.

The Downside: Points to Consider Before Opening an Account

While the benefits are clear, it’s equally important to examine potential drawbacks. No broker is perfect for every single trader, and IC Markets is no exception when evaluating all their trading accounts.

- Limited Non-Forex Offerings: While their forex accounts are extensive, traders primarily interested in a very broad range of individual stocks or a deeper selection of exotic derivatives might find the equity offering somewhat less comprehensive compared to some multi-asset brokers.

- Minimum Deposit Requirements: Some account types or specific features might require a higher initial deposit, which could be a barrier for new traders starting with very limited capital. Ensure you check the requirements for your preferred account types.

- Geographic Restrictions: Due to regulatory constraints, IC Markets’ services are not available in all countries. Potential clients should verify their eligibility based on their residency.

- Focus on Active Traders: The fee structure and features, particularly the raw spreads and commission model, are highly optimized for high-volume or active traders. Casual or very infrequent traders might find the overall value proposition less impactful compared to commission-free models offered elsewhere for smaller trading volumes.

Ultimately, the choice of your IC Markets Trading Accounts depends on your individual trading style, capital, and market focus. We encourage you to weigh these points carefully and explore the detailed information available. Ready to experience top-tier trading? Open one of their leading broker accounts today and elevate your trading journey!

Frequently Asked Questions about IC Markets Accounts

Navigating the world of online trading brings many questions, especially when choosing the right broker. Here, we tackle some of the most common inquiries about IC Markets trading accounts. Our goal is to provide clarity and help you make informed decisions about your trading journey.

What types of IC Markets Trading Accounts are available for traders?

IC Markets offers a selection of account types designed to cater to various trading strategies and preferences. You can choose from popular options like the Standard Account and the Raw Spread Account. Each provides a unique set of benefits, ensuring you find a fit for your specific trading style.

How do the different IC Markets account types compare?

Understanding the distinctions between the available IC Markets trading accounts is crucial. Here is a quick overview highlighting the main differences:

| Account Type | Spreads | Commissions | Ideal For |

|---|---|---|---|

| Standard Account | From 0.6 pips | $0 per lot | Discretionary traders, beginners |

| Raw Spread Account | From 0.0 pips | $3.50 per side/per lot | Scalpers, EAs, high-volume traders |

The choice between these broker accounts often comes down to your preferred cost structure and trading volume.

What is the minimum deposit required to open an IC Markets account?

To begin trading with IC Markets, a minimum initial deposit is typically required. This amount makes IC Markets accessible to a wide range of traders looking to engage with the market. Always check the official website for the most current deposit requirements.

Can I open a demo account with IC Markets before committing real capital?

Absolutely! IC Markets encourages new traders and those testing strategies to utilize their free demo account. This allows you to practice trading in a risk-free environment, using virtual funds to explore the platforms and features without any financial commitment. It’s an excellent way to familiarize yourself with the platform before opening live forex accounts.

Is it possible to open multiple forex accounts under one IC Markets profile?

Yes, many traders find it beneficial to open multiple IC Markets trading accounts. This flexibility allows you to implement different strategies, manage various currency pairs separately, or test new approaches without affecting your main trading activity. For instance, you might use one account for long-term investments and another for short-term day trading.

Does IC Markets offer Islamic or swap-free trading accounts?

IC Markets provides Islamic accounts for traders who adhere to Sharia law. These accounts operate on a swap-free basis, meaning no interest is charged or credited on overnight positions. You can typically convert your existing trading accounts to an Islamic account or request one during the signup process.

Frequently Asked Questions

What are the main types of trading accounts offered by IC Markets?

IC Markets primarily offers the Standard Account and the Raw Spread Account (available on MetaTrader and cTrader platforms), each designed for different trading styles and priorities. An Islamic (swap-free) Account is also available.

What is the key difference between the Standard Account and the Raw Spread Account?

The Standard Account offers commission-free trading with spreads typically starting from 0.6 pips. The Raw Spread Account provides institutional-grade spreads starting from 0.0 pips, with a small, fixed commission per lot traded.

What is the minimum deposit required to open a Raw Spread Account with IC Markets?

To open a Raw Spread account, a minimum deposit of $200 USD (or equivalent in another base currency) is required, providing accessible entry to institutional-grade liquidity.

Which trading platforms are compatible with IC Markets trading accounts?

IC Markets supports industry-leading platforms including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, allowing traders to choose the interface and tools that best suit their strategy.

How does IC Markets ensure the security of client funds?

IC Markets prioritizes fund security through segregated client funds held in top-tier banks, negative balance protection for many clients, and robust regulatory oversight from authorities like ASIC, CySEC, FSA Seychelles, and SCB.