Welcome to the definitive guide for traders in the Emirates. If you are searching for a top-tier broker, this IC Markets UAE review covers everything you need to know. We dive deep into the platform, exploring why it has become a go-to choice for both new and professional traders across the region. Known for its lightning-fast execution speeds and incredibly low spreads, IC Markets provides the tools necessary to navigate the dynamic world of forex and CFD trading. We will explore its robust platform options, transparent fee structures, and commitment to providing a superior trading environment. This is your starting point for exceptional UAE trading.

- Is IC Markets a Good Broker for UAE Residents?

- Understanding IC Markets Regulation in the UAE

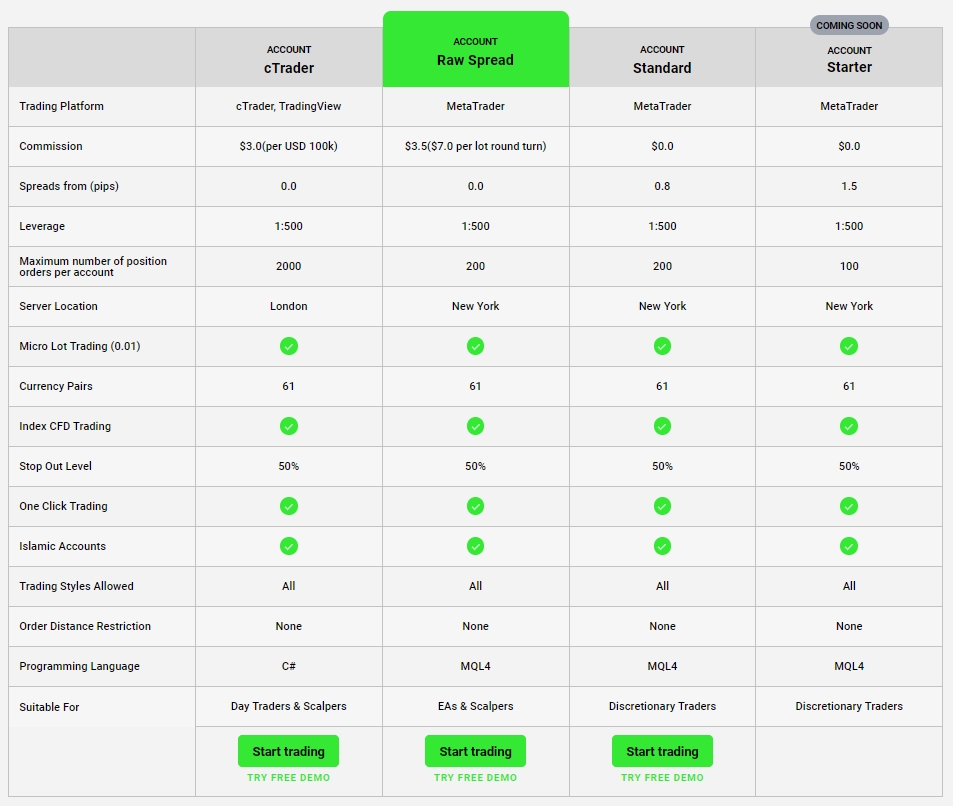

- Account Types Explained: Raw Spread vs. Standard

- Raw Spread Account Features

- Standard Account Features

- A Deep Dive into IC Markets Spreads and Commissions

- Forex Trading Fees

- CFD Trading Costs

- Non-Trading Fees to Be Aware Of

- Trading Platforms: MetaTrader 4, MetaTrader 5, and cTrader

- Key Features of MT4/MT5

- Exploring the cTrader Platform

- How to Open an IC Markets Account from the UAE

- Funding and Withdrawal Methods for UAE Clients

- Tradable Instruments: Forex, Indices, Commodities, and More

- Leverage and Margin Requirements

- Customer Support and Service Quality

- IC Markets Demo Account: Practice Trading Risk-Free

- Educational Resources and Trading Tools

- Comparing IC Markets with Other Brokers in the UAE

- Pros and Cons of Trading with IC Markets

- Pros

- Cons

- Final Verdict: Our IC Markets UAE Review Summary

- Frequently Asked Questions

Is IC Markets a Good Broker for UAE Residents?

Absolutely. IC Markets stands out as an excellent choice for anyone involved in forex UAE trading. The broker has built a global reputation for reliability, transparency, and performance, all of which are critical for traders in a sophisticated market like the United Arab Emirates. They understand the needs of local traders by offering a seamless account opening process and trusted funding methods. Their core strengths—tight spreads, low latency execution, and access to deep liquidity—directly translate into better trading conditions. For a UAE trader looking for a serious, no-nonsense broker, IC Markets provides a professional-grade environment that supports ambitious trading goals.

Understanding IC Markets Regulation in the UAE

When you trade, your security is paramount. IC Markets operates under the oversight of some of the world’s most respected financial regulators. For traders in the UAE, this means you are partnering with a broker that adheres to strict international standards. These regulations mandate crucial protections that safeguard your capital.

- Segregated Client Funds: Your money is held in separate bank accounts from the company’s operational funds. This ensures your capital is protected.

- Fair Trading Practices: Regulators enforce rules that promote transparency in pricing and execution, preventing any manipulation.

- Regular Audits: The broker is subject to frequent financial and procedural audits to ensure compliance and solvency.

Choosing a well-regulated broker like IC Markets is the first and most important step in securing your trading journey.

Account Types Explained: Raw Spread vs. Standard

IC Markets simplifies its offerings by focusing on two main account types, catering to different trading styles. The choice between them comes down to one simple question: do you prefer to pay a small commission on top of ultra-tight spreads, or have all costs bundled into the spread itself? The Raw Spread account is designed for purists and automated systems, while the Standard account offers simplicity. Both provide access to the same powerful technology and deep liquidity, ensuring a high-quality experience for every UAE trading enthusiast.

Raw Spread Account Features

The Raw Spread account is built for performance. It’s the preferred choice for scalpers, day traders, and those who use automated trading systems (Expert Advisors). This account connects you directly to the broker’s pool of liquidity providers, giving you access to institutional-grade pricing. The result is some of the tightest spreads in the industry, often starting from 0.0 pips on major forex pairs.

- Spreads from 0.0 pips

- Low, fixed commission per trade

- Ideal for high-volume and algorithmic trading

- Available on MT4, MT5, and cTrader platforms

- Deep liquidity with minimal slippage

Standard Account Features

The Standard account is all about simplicity and convenience. It eliminates the separate commission fee by incorporating the trading cost directly into the spread. This makes it incredibly straightforward to calculate your potential profit and loss on any given trade. It is an excellent starting point for new traders or discretionary traders who value an all-in-one pricing model without sacrificing execution quality.

- No separate commission fees

- Spreads from 0.6 pips

- Perfect for beginners and discretionary traders

- Simple and transparent cost structure

- Access to all trading platforms and instruments

A Deep Dive into IC Markets Spreads and Commissions

One of the biggest advantages of trading with IC Markets UAE is its highly competitive cost structure. In a market where every pip counts, minimizing your trading costs can significantly impact your bottom line. IC Markets achieves this by sourcing prices from a diverse mix of liquidity providers, ensuring that you receive the best possible bid and ask prices. This commitment to low spreads and transparent commissions is a core reason why it is a leading broker in the UAE.

Forex Trading Fees

When trading forex, costs are a primary concern. IC Markets excels by offering exceptionally low fees. The table below illustrates the typical cost structure for major currency pairs, helping you see the clear advantage this broker provides for forex UAE traders.

| Currency Pair | Raw Spread Account (Spread + Commission) | Standard Account (All-in Spread) |

|---|---|---|

| EUR/USD | 0.0 pips + Commission | From 0.6 pips |

| GBP/USD | 0.2 pips + Commission | From 0.8 pips |

| USD/JPY | 0.1 pips + Commission | From 0.7 pips |

The commission on the Raw Spread account is a small, fixed amount per lot traded, making it a very cost-effective option for active traders.

CFD Trading Costs

Beyond forex, IC Markets maintains its low-cost philosophy across all CFD instruments. Whether you are trading major global indices, commodities like gold and oil, or even cryptocurrencies, you benefit from tight spreads and transparent pricing. There are no hidden markups. For index and commodity CFDs, the trading cost is built into the spread, with no additional commissions. This makes diversifying your portfolio simple and affordable for any trader in the UAE.

Non-Trading Fees to Be Aware Of

IC Markets shines when it comes to non-trading fees, or more accurately, the lack of them. This is a huge benefit for traders who want to manage their capital without worrying about surprise charges. This transparency builds trust and makes it a highly attractive broker for UAE traders.

- No Deposit Fees: IC Markets does not charge any fees for funding your account.

- No Withdrawal Fees: You can withdraw your profits without incurring charges from the broker’s side. (Note: Your bank or payment provider may have their own fees).

- No Inactivity Fees: Your account will not be charged for periods of inactivity, giving you the flexibility to trade on your own schedule.

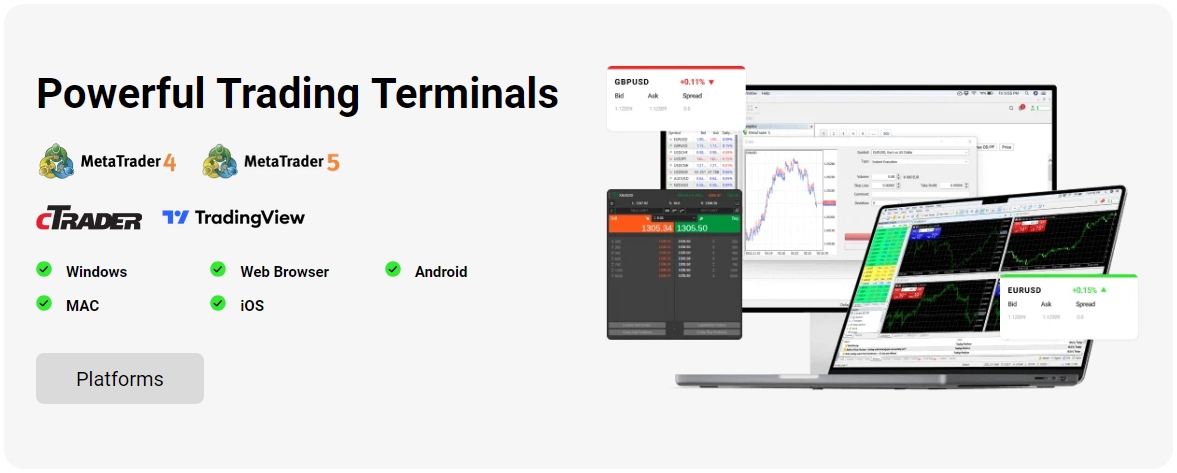

Trading Platforms: MetaTrader 4, MetaTrader 5, and cTrader

Choice is power. IC Markets understands that every trader has a unique style and preference, which is why they offer three of the industry’s most powerful and popular trading platforms. Whether you are a long-time fan of the classic MetaTrader environment or prefer the sleek, modern interface of cTrader, you have access to the best tools for the job. This flexibility ensures that every UAE trader can find a platform that perfectly matches their strategy and workflow.

Key Features of MT4/MT5

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are the undisputed titans of the trading world. They are renowned for their powerful analytical capabilities, robust performance, and extensive customization options. These platforms are the go-to choice for traders who rely on technical analysis and automated strategies.

- Advanced charting tools with dozens of built-in technical indicators.

- Support for Expert Advisors (EAs) for fully automated trading.

- Access to the huge MQL5 marketplace for custom indicators and bots.

- One-click trading for rapid order execution.

- Available on desktop, web, and mobile devices for trading on the go.

Exploring the cTrader Platform

cTrader is a modern and intuitive platform designed for the discerning trader. It boasts a clean user interface and is packed with advanced features that provide a deeper view of the market. cTrader is particularly favored by traders who appreciate transparency and advanced order management, making it an excellent alternative for your UAE trading activities.

- Sleek and user-friendly interface that is easy to navigate.

- Advanced order types, including advanced stop loss and take profit options.

- Level II Pricing (Depth of Market) shows the full range of executable prices.

- cAlgo integration for developing and running automated trading robots.

- Detachable charts and a highly customizable workspace.

How to Open an IC Markets Account from the UAE

Getting started with IC Markets from the UAE is a quick and straightforward digital process. The entire application can be completed online in just a few minutes, allowing you to focus on the markets. Follow these simple steps to begin your trading journey.

- Complete the Online Form: Visit the IC Markets website and fill out the simple application form with your basic personal information.

- Configure Your Account: Choose your preferred trading platform (MT4, MT5, or cTrader) and account type (Raw Spread or Standard).

- Verify Your Identity: Upload clear copies of your identification document (like a passport or Emirates ID) and proof of residence (such as a utility bill or bank statement). This is a standard regulatory requirement.

- Fund and Trade: Once your account is approved, you can fund it using one of the many convenient methods and start trading immediately.

Funding and Withdrawal Methods for UAE Clients

IC Markets offers a wide range of secure and convenient payment options, making it easy for UAE-based clients to manage their funds. The broker prioritizes fast processing times for both deposits and withdrawals, ensuring you have quick access to your capital. All transactions are protected with high-level encryption for your peace of mind.

| Method | Deposit Time | Withdrawal Time | Fees (from IC Markets) |

|---|---|---|---|

| Credit/Debit Card (Visa, Mastercard) | Instant | 1-3 Business Days | None |

| Bank Wire Transfer | 2-5 Business Days | 2-5 Business Days | None |

| Skrill / Neteller | Instant | Instant / 1 Business Day | None |

| PayPal | Instant | Instant / 1 Business Day | None |

Tradable Instruments: Forex, Indices, Commodities, and More

Diversification is key to a robust trading strategy, and IC Markets provides an impressive array of instruments to build your portfolio. You can trade on global markets from a single account, opening up a world of opportunities. The extensive product range ensures that whether you follow trends in currencies, equities, or raw materials, you will always find a market to trade.

- Forex: Access over 60 currency pairs, including majors, minors, and exotics.

- Indices: Trade on the direction of major global stock markets like the S&P 500, DAX, and FTSE.

- Commodities: Speculate on the prices of energy products like WTI Oil and Brent, as well as precious metals like Gold and Silver.

- Stocks: Trade CFDs on hundreds of top global companies from the ASX, NASDAQ, and NYSE.

- Bonds & Futures: Gain exposure to government debt instruments and futures contracts.

- Cryptocurrencies: Trade popular digital currencies like Bitcoin, Ethereum, and Ripple against major fiat currencies.

Leverage and Margin Requirements

Leverage is a powerful tool that allows you to control a larger position with a smaller amount of capital. It can significantly amplify your potential profits, but it is essential to remember that it also increases your risk. IC Markets offers flexible leverage options, allowing you to choose a level that matches your risk tolerance and trading strategy.

Margin is the amount of money required in your account to open a leveraged trade. It acts as collateral for the position. Always monitor your margin levels and use leverage responsibly to protect your capital. A smart UAE trading approach involves understanding and respecting the power of leverage.

The maximum leverage offered depends on the asset class and regulatory guidelines. It is typically higher for major forex pairs and lower for more volatile instruments like cryptocurrencies.

Customer Support and Service Quality

Excellent customer support is non-negotiable, and IC Markets delivers. Their global support team is available 24 hours a day, 7 days a week, ensuring that help is always on hand, no matter the time zone. This is particularly beneficial for traders in the UAE who need assistance outside of standard European or American business hours. The support staff are known for being knowledgeable, professional, and quick to resolve issues.

You can reach the team through several channels:

- Live Chat: For instant assistance directly from the website.

- Email: For detailed inquiries that may require documentation.

- Phone: For speaking directly with a support representative.

IC Markets Demo Account: Practice Trading Risk-Free

Before you commit real money, it is crucial to test the waters. IC Markets offers a free and unlimited demo account that perfectly mirrors the live trading environment. This is an invaluable tool for both beginners and experienced traders in the UAE. You can use it to get comfortable with the trading platform, test new strategies, and experience the broker’s execution speed and spreads without any financial risk. We strongly recommend every new user starts with a demo account to build confidence and refine their approach to the market.

Educational Resources and Trading Tools

IC Markets supports its clients’ growth by providing a solid selection of educational materials and powerful trading tools. While not the most extensive library, the resources are high-quality and focus on practical knowledge. The “Information Hub” blog features regular market analysis, trading ideas, and fundamental news updates. Additionally, all clients get free access to advanced third-party tools that provide a significant analytical edge. These resources help traders make more informed decisions, which is a key component of successful UAE trading.

Comparing IC Markets with Other Brokers in the UAE

How does IC Markets stack up against the competition? When it comes to the factors that matter most to serious traders—cost, speed, and reliability—it consistently comes out on top. The table below provides a quick comparison against a typical broker available in the region.

| Feature | IC Markets | Typical UAE Broker |

|---|---|---|

| EUR/USD Spread | From 0.0 pips + commission | 1.5 pips+ |

| Execution Speed | Ultra-fast, low latency | Standard |

| Platforms | MT4, MT5, cTrader | MT4, Proprietary |

| Commissions | Transparent and low | Often hidden in spreads |

| Trading Style Focus | Scalping, EAs, Day Trading | General, long-term |

Pros and Cons of Trading with IC Markets

To provide a balanced view, it’s important to look at both the strengths and potential drawbacks. No broker is perfect for everyone, but IC Markets’ advantages strongly align with the needs of active traders.

Pros

- Extremely low spreads and commissions, reducing trading costs.

- Superior execution speed thanks to its high-performance infrastructure.

- Excellent choice of world-class trading platforms (MT4, MT5, cTrader).

- Strong regulation providing a secure trading environment.

- No restrictions on trading strategies, including scalping and news trading.

Cons

- The educational section is more suited for intermediate traders than absolute beginners.

- Customer support does not offer Arabic language assistance.

Final Verdict: Our IC Markets UAE Review Summary

After a thorough analysis, our verdict is clear: IC Markets is an outstanding broker for traders in the UAE. Its core offering of razor-thin spreads, rapid execution, and a choice of elite platforms makes it a formidable player in the forex and CFD industry. It is an ideal environment for traders who are serious about performance and want to minimize costs. Whether you are an experienced professional running complex algorithms or a discretionary trader who demands reliability, IC Markets provides the professional-grade infrastructure you need to succeed. For anyone in the UAE looking for a top-tier broker, IC Markets is a highly recommended choice.

Frequently Asked Questions

What account types does IC Markets offer for UAE traders?

IC Markets provides two main account types: the Raw Spread account, which is ideal for high-volume and algorithmic traders with spreads from 0.0 pips plus a small commission, and the Standard account, which is great for beginners as it bundles all costs into the spread (from 0.6 pips) with no separate commission.

What trading platforms can I use with IC Markets in the UAE?

You have access to three top-tier platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Each platform is available on desktop, web, and mobile, catering to different trading styles and preferences.

Are there any hidden fees for deposits, withdrawals, or inactivity?

No, IC Markets is transparent with its fee structure. There are no deposit fees, no withdrawal fees from the broker’s side, and no inactivity fees, allowing you to manage your funds without unexpected charges.

How can I start trading with IC Markets from the UAE?

The process is fully digital. You need to complete an online application form, choose your account type and platform, verify your identity by uploading required documents (like an Emirates ID and proof of residence), and then fund your account to begin trading.

Can I practice trading before using real money?

Absolutely. IC Markets offers a free and unlimited demo account that replicates the live trading environment. This allows you to test your strategies, familiarize yourself with the platform, and experience the broker’s conditions without any financial risk.