Welcome to your complete guide to IC Markets Vietnam. If you are exploring the world of forex and CFD trading, you have come to the right place. We created this resource to give you a clear, honest, and in-depth look at one of the world’s leading brokerage firms. Discover how IC Markets provides Vietnamese traders with exceptional tools, low costs, and a secure trading environment. Join us as we explore account types, platforms, and regulations, and see why so many choose this broker for their Vietnam trading journey.

- What is IC Markets? An Overview for Vietnamese Traders

- Is IC Markets a Safe and Regulated Broker in Vietnam?

- How to Open an Account with IC Markets from Vietnam

- Step-by-Step Registration Process

- Required Documents for Verification

- Exploring IC Markets Account Types: Raw Spread vs. Standard

- Benefits of the Raw Spread Account

- Who is the Standard Account For?

- Trading Platforms: MT4, MT5, and cTrader Compared

- Spreads, Commissions, and Trading Costs

- Understanding Leverage and Margin

- Range of Tradable Instruments

- Deposit and Withdrawal Options for Vietnamese Clients

- Local Bank Transfers and E-wallet Solutions

- Processing Times and Associated Fees

- Customer Support for the Vietnam Market

- Educational Resources and Trading Tools

- Advantages of Trading with IC Markets in Vietnam

- Potential Drawbacks and Considerations

- IC Markets vs. Other Popular Brokers

- Frequently Asked Questions

What is IC Markets? An Overview for Vietnamese Traders

IC Markets is a global forex and CFD broker renowned for its exceptional trading conditions. The company’s core mission is to create the best and most transparent trading experience for retail and institutional clients alike. For traders in Vietnam, this means access to a true ECN (Electronic Communication Network) environment. This model connects you directly to a deep pool of liquidity providers, which includes leading global banks and financial institutions. The result? You get lightning-fast execution speeds and some of the tightest spreads available on the market. IC Markets empowers the Vietnam trading community by providing institutional-grade conditions that were once only available to investment banks and high-net-worth individuals. They focus on technology, speed, and fairness, making them a top choice for serious traders.

Is IC Markets a Safe and Regulated Broker in Vietnam?

Security is the number one priority for any trader. IC Markets operates under the supervision of some of the world’s most respected financial regulatory bodies. This oversight ensures the broker adheres to strict standards of conduct and financial transparency. For you, the Vietnamese trader, this means several layers of protection.

- Segregated Client Funds: Your money is held in separate trust accounts with top-tier banking institutions. This means the broker cannot use your funds for its own operational purposes.

- Strict Compliance: Regulators require IC Markets to maintain sufficient capital reserves and follow rigorous anti-money laundering (AML) and counter-terrorism financing (CTF) policies.

- Fair Trading Practices: Audits and oversight guarantee that the trading environment is fair and that price execution is transparent, without manipulation.

Choosing a regulated broker like IC Markets provides peace of mind, allowing you to focus on your trading strategy without worrying about the safety of your capital.

How to Open an Account with IC Markets from Vietnam

Getting started with IC Markets from Vietnam is a quick and secure online process. The entire journey is designed to be user-friendly, allowing you to move from registration to your first trade with minimal hassle. The process involves three main stages: completing the application form, verifying your identity, and funding your account. Below, we break down each step so you know exactly what to expect and can prepare everything you need in advance. This ensures a smooth and efficient start to your Vietnam trading adventure.

Step-by-Step Registration Process

Follow these simple steps to create your live trading account. The whole process usually takes just a few minutes.

- Visit the Official Website: Navigate to the IC Markets homepage and find the “Create a Live Account” button.

- Complete the Application Form: Fill in your personal details, including your name, email address, and phone number. Ensure this information is accurate as it will be used for verification.

- Provide More Details: You will be asked for additional information, such as your date of birth and residential address in Vietnam.

- Configure Your Trading Account: Choose your preferred trading platform (MetaTrader 4, MetaTrader 5, or cTrader), select your account type (Raw Spread or Standard), and set your base currency.

- Answer a Trading Questionnaire: Complete a brief survey about your trading knowledge and experience. This is a standard regulatory requirement.

- Submit Your Application: Review all the information you provided and submit the form. You will then be prompted to begin the verification process.

Required Documents for Verification

To comply with global financial regulations and ensure the security of your account, IC Markets requires you to verify your identity and address. Having these documents ready will speed up the approval process. You will need to upload clear, legible copies of the following:

- Proof of Identity (POI): A valid, government-issued photo ID. This can be one of the following:

- National ID Card (Căn cước công dân)

- Passport

- Driver’s License

- Proof of Residence (POR): A document dated within the last few months that clearly shows your name and full residential address. This can be one of the following:

- Utility Bill (electricity, water, internet)

- Bank Statement or Credit Card Statement

- Residency Certificate

Make sure the name and address on your POR document match the details you provided during registration.

Exploring IC Markets Account Types: Raw Spread vs. Standard

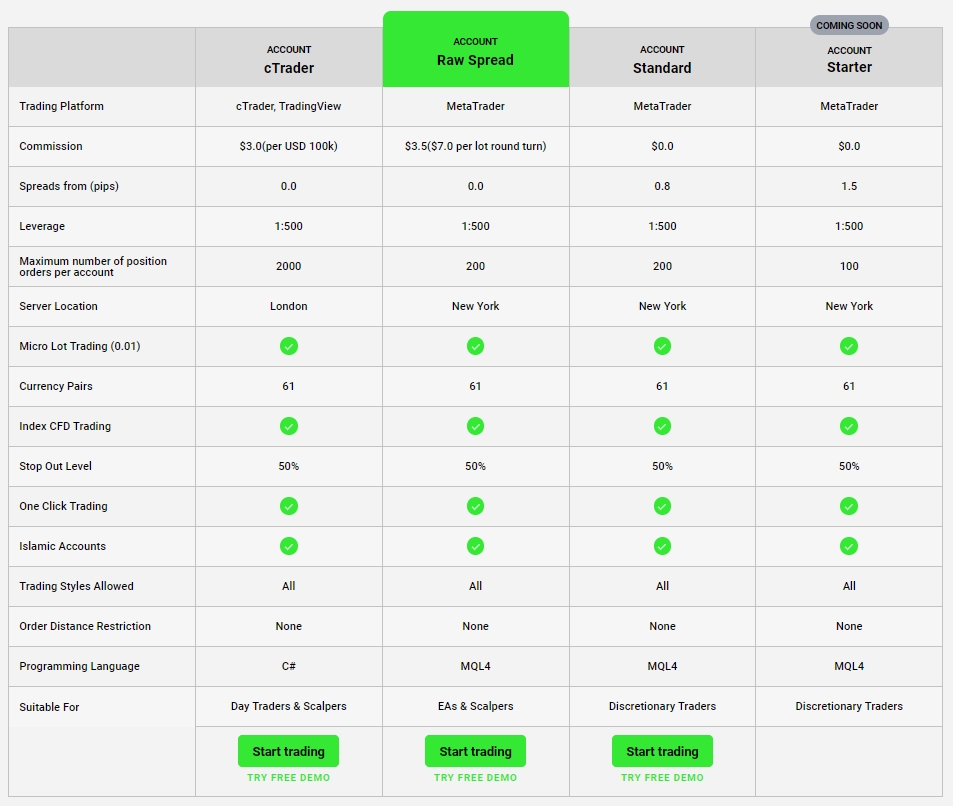

IC Markets offers two primary account types to cater to different trading styles and preferences. The main distinction lies in their pricing structure. Your choice will depend on whether you prefer to pay a small, fixed commission on a trade with razor-thin spreads or have all costs built into a slightly wider spread. Both accounts provide access to the same deep liquidity and fast execution. Understanding the core difference is key to selecting the perfect account for your Vietnam trading strategy. Let’s explore which one might be the right fit for you.

Benefits of the Raw Spread Account

The Raw Spread account is the flagship offering and is extremely popular with experienced and high-volume traders. It is designed for maximum transparency and the lowest possible trading costs.

- Ultra-Low Spreads: Spreads start from 0.0 pips on major currency pairs because you are getting raw pricing directly from liquidity providers.

- Transparent Costs: The pricing is straightforward. You pay the raw spread plus a small, fixed round-turn commission per lot traded. This makes it easy to calculate your trading costs.

- Ideal for Scalpers and EAs: Traders who enter and exit the market frequently (scalpers) and those using automated trading systems (Expert Advisors) benefit greatly from the tightest possible spreads.

- Deep Liquidity: This account gives you direct access to the broker’s ECN environment, ensuring minimal slippage and excellent order fill rates.

Who is the Standard Account For?

The Standard account offers simplicity and convenience, making it an excellent choice for certain types of traders. It removes the commission from the equation, bundling all costs directly into the spread.

- Beginner-Friendly: New traders often find the Standard account easier to understand. With no separate commission to calculate, profit and loss are simpler to track.

- Zero Commission: The primary appeal is that you do not pay a separate commission on your trades. The broker’s fee is included in the spread, which is slightly wider than on the Raw Spread account.

- Discretionary Traders: Traders who hold positions for longer periods and do not trade with high frequency may prefer the all-inclusive spread structure.

- Simplicity: It offers a hassle-free trading experience for those who value straightforwardness over the lowest possible cost structure.

Trading Platforms: MT4, MT5, and cTrader Compared

IC Markets provides Vietnamese traders with a choice of three powerful, industry-leading trading platforms. Each platform offers unique features tailored to different trading styles. Choosing the right one can significantly enhance your trading efficiency and overall experience.

| Platform | Best For | Key Features |

|---|---|---|

| MetaTrader 4 (MT4) | Forex traders and users of automated systems (EAs). | Huge library of custom indicators and EAs, user-friendly interface, high stability. The global standard for forex trading. |

| MetaTrader 5 (MT5) | Multi-asset traders who want access to stocks and more advanced tools. | More timeframes, advanced charting tools, built-in economic calendar, access to CFD stocks. A powerful upgrade to MT4. |

| cTrader | Discretionary traders who value an intuitive interface and advanced order types. | Modern design, Level II pricing (Depth of Market), advanced risk management tools, and a focus on transparency. |

Spreads, Commissions, and Trading Costs

One of the most significant advantages of IC Markets Vietnam is its commitment to providing a low-cost trading environment. The broker achieves this by connecting traders to a diverse mix of up to 25 different liquidity providers. This competition ensures that you receive the best possible price at any given moment.

A “spread” is simply the small difference between the buy (ask) price and the sell (bid) price of a financial instrument. IC Markets is known for its exceptionally tight spreads, which can go as low as 0.0 pips on the Raw Spread account during times of high liquidity.

“By keeping trading costs low, we empower traders to maximize their potential profits. Our ECN model is built on transparency, not on marking up spreads.”

On the Raw Spread account, a small, fixed commission is charged per trade, which is a transparent way of covering brokerage costs. The Standard account, on the other hand, has no separate commission, as the cost is already incorporated into a slightly wider spread. This low-cost structure is a cornerstone of the IC Markets offering for Forex Vietnam traders.

Understanding Leverage and Margin

Leverage is a powerful tool that allows you to control a large position in the market with a relatively small amount of capital. It is expressed as a ratio, such as 100:1 or 500:1. For example, with 500:1 leverage, you can control a $100,000 position with just $200 of your own money.

The amount of your own money required to open and maintain a leveraged trade is called “margin.” Think of it as a good-faith deposit.

While leverage can significantly amplify your potential profits, it is crucial to remember that it also amplifies potential losses. A small market movement against your position can lead to substantial losses if you are not careful.

IC Markets provides flexible leverage options, but we encourage all Vietnamese traders to use it wisely. Always implement a solid risk management strategy, such as using stop-loss orders, to protect your capital. Understanding and respecting the power of leverage is a key step in becoming a successful trader.

Range of Tradable Instruments

IC Markets provides Vietnamese traders with access to a vast and diverse selection of financial markets. This allows you to build a diversified portfolio and take advantage of opportunities across different asset classes, all from a single trading account. The extensive product range ensures that you are not limited to just one market.

- Forex: Trade over 60 currency pairs, including majors, minors, and exotics, with some of the tightest spreads in the industry.

- Indices: Access major global stock indices from Asia, Europe, and the Americas, allowing you to speculate on the performance of entire economies.

- Commodities: Trade popular hard and soft commodities like Gold, Silver, Oil, and Natural Gas without needing to own the physical asset.

- Stocks: Gain exposure to hundreds of top companies from major exchanges like the NYSE and NASDAQ through stock CFDs.

- Bonds: Diversify your strategy by trading government bonds, which are often used as a safe-haven asset during times of market uncertainty.

- Cryptocurrencies: Participate in the dynamic crypto market by trading popular digital currencies like Bitcoin, Ethereum, and Ripple against major fiat currencies.

Deposit and Withdrawal Options for Vietnamese Clients

Funding your account and accessing your profits should be a seamless experience. IC Markets understands the specific needs of its clients in Vietnam and provides a range of convenient and efficient payment methods. The focus is on offering secure, fast, and low-cost solutions, including popular local options. This makes managing your funds straightforward, so you can concentrate on your trading activities without worrying about payment logistics.

Local Bank Transfers and E-wallet Solutions

To make the funding process as easy as possible for traders in Vietnam, IC Markets offers localized payment solutions. This removes the complexities often associated with international wire transfers and currency conversions.

- Vietnamese Internet Banking: You can fund your account directly from your local bank account using familiar online banking portals. This is one of the most popular and straightforward methods available.

- Popular E-wallets: The platform supports deposits and withdrawals through various digital wallets that are widely used in Vietnam. These methods are known for their speed and convenience.

- Global Methods: In addition to local options, you can also use internationally recognized methods such as Visa, Mastercard, and other global payment solutions.

This variety ensures that every Vietnamese client can find a payment method that suits their personal preference and banking habits.

Processing Times and Associated Fees

IC Markets is committed to transparency when it comes to processing your funds. Here is what you can generally expect:

Deposits:

Most deposit methods, especially local bank transfers and e-wallets, are processed nearly instantly. This allows you to capitalize on trading opportunities without delay. IC Markets does not charge any internal fees for deposits.

Withdrawals:

Withdrawal requests are typically processed by the broker’s accounts team on the same business day if submitted during business hours. The time it takes for the funds to appear in your account depends on the method used. E-wallet withdrawals are often the fastest. Importantly, IC Markets does not charge any withdrawal fees. However, please be aware that your own bank or a third-party payment provider may impose their own fees, which are outside of the broker’s control.

Customer Support for the Vietnam Market

Excellent customer support is essential for a smooth trading experience. IC Markets excels in this area by offering responsive, knowledgeable, and accessible assistance around the clock. This is particularly valuable for forex traders, as the market operates 24 hours a day, five days a week.

Vietnamese traders can reach the global support team through several channels:

- Live Chat: Get instant answers to your questions directly through the website. This is the fastest way to resolve most queries.

- Email: For more detailed inquiries or for submitting documents, email support is a reliable option with prompt response times.

- Phone: You can speak directly to a support representative for urgent or complex issues.

The support team is well-trained to handle a wide range of issues, from technical problems with trading platforms to questions about account funding. Their 24/7 availability ensures that help is always just a click or a call away, no matter what time zone you are trading in.

Educational Resources and Trading Tools

IC Markets supports its clients’ growth by providing a wealth of free educational materials and powerful trading tools. These resources are designed to help both new and experienced traders sharpen their skills and make more informed decisions. They demonstrate the broker’s investment in your success.

Key resources available to all clients include:

- Market Analysis Blog: Stay up-to-date with daily fundamental and technical analysis from market experts.

- Video Tutorials: Access a library of videos covering topics from platform basics to advanced trading strategies.

- Economic Calendar: Plan your trades around major economic events that can impact market volatility.

- Trading Calculators: Use helpful tools to calculate pip values, margins, and potential profit or loss before entering a trade.

- Glossary: A comprehensive dictionary of trading terms to help you understand market jargon.

- Free VPS: Eligible high-volume traders can get access to a free Virtual Private Server (VPS) to run their automated strategies 24/7 with low latency.

Advantages of Trading with IC Markets in Vietnam

When you choose a broker, you are looking for a partner that gives you a competitive edge. IC Markets offers several distinct advantages that make it a top choice for traders in the Vietnam trading community.

- Exceptional Spreads and Low Commissions: The true ECN pricing model leads to some of the lowest trading costs in the industry, maximizing your potential returns.

- Lightning-Fast Execution: Orders are executed with incredible speed, minimizing slippage and ensuring you get the price you want. This is critical for fast-moving markets.

- Strong Regulation and Security: Operate with confidence, knowing your funds are safe and the broker adheres to the highest standards of financial conduct.

- Superior Technology: Gain access to world-class trading platforms (MT4, MT5, cTrader) and a robust server infrastructure.

- Wide Range of Markets: Diversify your portfolio with a huge selection of instruments, from Forex to stocks and cryptocurrencies.

- Convenient Local Payments: Easily fund and withdraw from your account using Vietnamese internet banking and other local methods.

Potential Drawbacks and Considerations

To provide a balanced and honest review, it is important to consider some potential drawbacks. While IC Markets is an excellent broker, no platform is perfect for everyone. Here are a few points to keep in mind:

- Advanced Focus: The platform’s professional-grade tools and ECN environment are geared towards serious traders. Absolute beginners might find the educational resources less comprehensive than those offered by brokers specializing solely in beginner education.

- No Proprietary Platform: IC Markets offers the best third-party platforms (MT4, MT5, cTrader) but does not have its own unique, proprietary trading software. This may be a downside for traders who prefer a platform exclusive to their broker.

- Standard Account Spreads: While the Standard account is great for its simplicity, its spreads are naturally wider than the Raw Spread account. Cost-conscious traders will almost always find better value in the Raw Spread option.

These points are minor for most traders but are worth considering to ensure this broker is the right fit for your specific needs.

IC Markets vs. Other Popular Brokers

When searching for a broker in Vietnam, you will encounter many options. So, what makes IC Markets different? While many brokers offer standard trading services, IC Markets distinguishes itself by focusing on the core elements that matter most to serious traders: speed, cost, and technology.

Many competitors operate on a “dealing desk” model where they may take the other side of your trades. IC Markets, with its true ECN model, simply connects you to the market. This eliminates any potential conflict of interest and ensures pricing is fair and transparent. Furthermore, the investment in server infrastructure located in major financial data centers results in lower latency and faster execution than many other brokers can provide.

For any trader in the Forex Vietnam scene, the choice often comes down to this: Do you want a standard experience, or do you want access to institutional-grade conditions? IC Markets firmly provides the latter, making it a preferred choice for those who are serious about their trading performance.

Frequently Asked Questions

What is the minimum deposit required to open an IC Markets account in Vietnam?

The minimum initial deposit to start trading with IC Markets is $200 USD or the equivalent in another currency. This gives you full access to a live trading account.

Which account type is better for beginners, Raw Spread or Standard?

The Standard account is often recommended for beginners. It has a simpler pricing structure with zero commission, as all costs are included in the spread, making it easier to calculate profit and loss.

What documents are needed to verify an IC Markets account from Vietnam?

You will need a Proof of Identity (like a National ID Card, Passport, or Driver’s License) and a Proof of Residence (like a recent utility bill or bank statement) to verify your account.

Can I trade cryptocurrencies with IC Markets?

Yes, IC Markets offers a range of popular cryptocurrencies for trading. You can trade digital currencies like Bitcoin, Ethereum, and Ripple against major fiat currencies.

What trading platforms does IC Markets offer?

IC Markets provides access to three leading trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Each platform is available for desktop, web, and mobile devices.